The Investopedia portal talks about what indicators are used by traders whose strategies are built around following trends. We have prepared an adapted version of this material.

Note

: indicators are just one of the auxiliary tools for working with exchange assets; they do not guarantee positive trading results. In order to understand the use of indicators, you will need a trading terminal (for example, SMARTx), as well as a brokerage account - you can open it online. You can practice using a test account with virtual money.

Moving averages

I think it would be stupid not to start the top with this indicator. As mentioned above, most indicators consist of it and it is truly the simplest indicator available.

The method of trading using this indicator is simple:

- If the price is above the moving average, then you only need to consider buying;

- If the price is below the moving average, then you only need to consider selling.

It is also not uncommon for traders to use two moving averages together. One with a smaller interval, the other with a larger one. For example, 50 and 100. When a short moving average crosses a long moving average, you need to open a trade in the direction of the intersection.

How to determine a trend using an indicator

The reversal of the trend for this index is accompanied by difficult moments. The main task of the indicator is to display the speed of price movement. If the RSI is 50 or higher and the moving average has a positive slope, the trend is strengthening. The reverse is also true: when the price declines and the index curve falls below the 50 line, the trend will fade.

Volume

Also the simplest and one of the most popular is Volume, or in other words, volume.

There is no specific trading method for this indicator, but it helps a lot with the concept of the overall picture of supply and demand. Based on it, you can understand what the mood of the market is today and in which direction it is necessary to open transactions.

Fibonacci extensions

Continuing with the example above, you now bought the stock at $31 and are trying to determine a profit target to sell. To do this, you can look at Fibonacci extensions, which show how much the price might rise if the overall uptrend resumes. Fibonacci extension levels are tied to prices that represent the 126%, 138%, 162% and 176% of the initial uptrend move calculated from the retracement low. So, if the 38% retracement of the initial move from $10 to $40 turns out to be the retracement low, then from that price ($31) you will find the first Fibonacci extension level and potential take profit target, adding 126% of the original $30 moving up. The calculation goes as follows: 126% Fibonacci Extension Level = $31 (30 x $1.26) = $68, giving a target price of $68.

Once again, you will never have to do any of these calculations. You simply plug the Fibonacci indicator into your charting software and it will display all the different Fibonacci levels.

Pivot and Fibonacci levels are worth tracking even if you don't personally use them as indicators in your own trading strategy. Because so many traders make basic buys and sells at reversal and Fibonacci levels. Therefore, there will likely not be significant trading activity around these price points. Activity can help you better determine likely future price movements.

Relative Strength Index RSI

The relative strength index is also very popular among traders, the point is its versatility and simplicity. The indicator can be used in almost any trading strategy, both in trend trading and scalping.

The key features when using it are the levels of oversold, overbought, and the average value. Based on the intersection of these lines, buy or sell transactions are opened. The indicator is also great for trading divergences.

Momentum

Due to its simplicity and ease of interpretation, the momentum indicator has become widely used among traders. Momentum is calculated as the difference between the current price of the financial instrument in question and the price of the former price a certain period of time ago. This period of time is called the period of the momentum indicator. In fact, momentum is equal to the profit (or loss) received over a given period of time for the purchase of one unit of the financial instrument in question.

Momentum indicator on the price chart

Technically, this indicator shows the presence or absence of a trend, as well as the direction of this trend. Positive values of the indicator indicate an upward trend, negative values indicate a downward trend. A change in the indicator sign indicates a change in trend.

The main signals of this indicator are when it crosses the zero mark. That is, when momentum changes its sign, thereby indicating a change in the prevailing trend at a given moment in time. When the sign changes from plus to minus (the trend changes from upward to downward) it is a signal to sell, and when, on the contrary, from minus to plus (the trend changes from downward to upward) it is a signal to buy.

Read more about the momentum indicator in this article.

MACD

This indicator consists of two moving averages and a histogram with a zero level. It combines the ability to trade with a trend, like moving averages, and the ability to trade with divergences, like RSI.

The trading method is no different from similar indicators described above; it only combines their best functions.

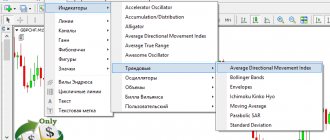

Best asset for the inexperienced

On balance volume indicator, simply put, Volumes is the most successful asset for beginners. It allows you to obtain information about current market volumes in a convenient graphical form. Below it is shown for MT4. Also available for Quik, another popular trading program. This instrument is displayed with standard settings on the five-minute USD/CHF chart.

The Volumes indicator consists of many multi-colored columns following each other. As standard, the posts are red and green. Flexible settings allow you to choose any other colors as primary colors. In this article we will look at the default colors. If the next column being formed has a larger scale than the previous one, it is colored green. Otherwise, go to red.

The formula is extremely simple - it takes into account all transactions carried out in a single unit of time. An important point is that it is the total number of open transactions that is counted, without adjustment for the amount of funds invested in these transactions. On the one hand, this does not quite objectively show the current situation. Because often large exchange players enter the market with one large order, taking many orders from the exchange order book. But for volatile assets, where the opinion of the majority of participants is necessarily taken into account, a technical asset cannot be found more useful.

You can see this in the chart shown earlier. It graphically marks the strongest trend bars, which perfectly correlate with the increase in the number of transactions.

A movement that is confirmed by volumes has the greatest potential even in a sideways trend. Using volume indicator data as a signal indicator, you can use just one tool to build high-quality trading with an alert on a decrease or increase in the indicators of the previous time interval in relation to the next one.

Stochastic Oscillator

This indicator belongs to the type of oscillator and can only be effective in flat market conditions, that is, it is unacceptable for trend trading.

It consists, like RSI, of two zones, namely overbought and oversold, but has two moving averages instead of one, which adds another type of signal to it.

Possible trading methods: entering a deal at overbought and oversold levels, entering when crossing moving averages and going beyond the middle line of the indicator, entering based on divergences.

Why is it stupid to look for a “magic” indicator?

We are dealing with a limited number of variables: price, time, sometimes volumes.

That is, any indicator, if it is not informational, receiving data from external sources, does not carry any “new” information, but only passes the same data through another formula.

So how can the indicator show you something that is not on the chart?

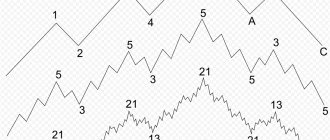

ZigZag

The ZigZag indicator is an excellent assistant for building Fibonacci levels and reversal patterns. It is used in many strategies and helps to correctly identify such figures as Double Top, Double Bottom, HHLL and others.

It’s easy to use, you just need to put the indicator on the chart and look at it, ignoring the candles, so unnecessary noise will disappear and you can see the patterns more clearly.

What are indicators?

An indicator is a price chart passed through a formula, or additional trading information, from the size of the spread to the display of upcoming news.

The resulting curve or histogram greatly simplifies the “chaos” of quote movements.

Price conversion helps in searching for trading signals, but sometimes traders use non-trading indicators that provide additional information: the size of the spread, swap, time until the end of the session, the closure of the candle, the release of fundamental news, etc.

The purpose of trading indicators is to summarize historical price data on a chart to make it easier for a trader to interpret market behavior.

The result of using the indicator can be compared to points. For a beginner, fluctuations in quotes are similar to a blurry picture of vague outlines of objects, observed with the naked eye of a nearsighted or farsighted person. Only by wearing glasses will he be able to read text or see an obstacle in the distance.

Depending on the type of indicator, the trader can easily determine the trend, postpone the transaction due to the proximity of the overbought/oversold zone, and wait for a correction or confirmation of further growth. The type and purpose of each specific tool is determined by the formula embedded in it.

All calculations are carried out using simple addition, subtraction and/or division of four parameters: closing price, opening price, high and low on a certain time interval. It is specified by a standard series of time values from 1 minute to a month and is displayed in the trading terminal in the form of a candle.

Chaikin Oscillator

Like other oscillators, the Chaikin oscillator works using an identical technique. What distinguishes it from others is its more accurate construction method and the ability to use it on local trend movements.

Basically, all transactions are carried out when the zero mark is passed. Crossing from bottom to top means buying, and crossing from top to bottom means selling.

RSI on different timeframes

By default, the tool settings set the period to 14 days. But sometimes you need to discard false signals and look at other time periods. For example, with the M1 time frame, the currency pair will be in the oversold zone, and changing the period to H4 will signal overbought.

The main task of a trader is to choose a time period, filter out small fluctuations well and leave only important price movements.

Keltner channel

The Keltner Channel is a trend indicator and has proven itself well. Many strategies have been built on its basis, but the main essence of its use is that when the price is pressed against one of the sides, you should trade only in the direction where the price is going. A deal may be fixed or a possible price reversal may occur when the price approaches the middle of the channel.

Signal interpretation

For beginners, a combined analysis of volumes and quotes can be misleading. But it is enough to understand all its intricacies once in order to subsequently correctly interpret market patterns.

- If the price goes up or down, and the number of orders increases, the trend will most likely continue for a certain period of time. Until it is time to take profits or the chart approaches strong long-term resistance or support levels.

- If there is a price movement and a low number of transactions, we have a signal that a large position is being sold and most likely the existing trend will soon end. The exception is when trading on important news, when the publication of unexpected data will trigger a powerful change in quotes without a simultaneous increase in the number of orders entering the market.

- The lack of a clear direction with increasing volumes suggests that there is a fierce struggle between bulls and bears and it is necessary to resort to additional funds to make a decision.

In case of uncertainty, it makes sense to analyze the situation on a different time interval. It is quite possible that over longer periods the trader will be able to receive a clearer signal for action.

Bollinger Bands

The Bollinger Band indicator also acts as a channel and is very similar to the Keltner channel, except for its multifunctionality. Bollinger is perfectly used both in scalping and trend trading.

It combines the principle of trading according to Keltner, but also adds the feature of trading based on channel exits. The scalper strategy involves catching small knives, and Bollinger will tell you where exactly to catch.

Definition and main features

Indicators in technical analysis are tools that carry out specific calculations using formulas based on the values of the value chart, and then automatically produce the result. Basically, they look like an indicator that draws figures that are automatically overlaid on the chart.

Each of them is based on formulas. The variable values in them are schedule or cost indicators. Values can be configured by the user. After determining all the values and indicators, the indicator is plotted on the chart, and the exchange trading participant receives a signal to enter or exit a transaction.

Automatic calculation is the main property of these indicators, due to which the most complex constructions are immediately superimposed on the chart. Thanks to the emergence of computer analysis, it is possible to automatically create trading systems, robots and assistants.

Cloud Ichimoku

The indicator is predominantly trend-based and is not suitable for flat trading.

The key features of the Ichimoku Cloud are its diversity. It combines 5 moving averages with very interesting parameters. It also shows support and resistance zones, trend direction and gives signals to enter and exit a position, in general, a dream.

Top 10 best indicators for binary options

We've dealt with standard indicators, now it's time for indicators that can significantly brighten up your trading routine.

I suggest you familiarize yourself with the rating of the 10 best indicators that you should try to use in your trading. Of course, this top of the best indicators is compiled in my personal opinion, as well as in the opinion of some profitable traders. In fact, there are many more interesting indicators and all of them could not fit within the framework of this article.

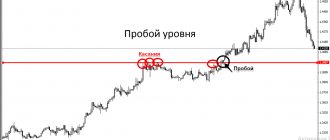

Indicator for binary options SR Pro or Support and Resistance TLB OC

Probably the best indicator of support and resistance levels for binary options. The indicator can build PS levels at several points (the number of points can be specified in the indicator settings):

Another important advantage of the Support and Resistance TLB OC indicator is that it builds levels on different time frames. True, only the closest levels from each time frame appear on the chart, but in practice this is enough.

If you don’t need any levels, you can disable them in the settings. This indicator is used in a number of very profitable trading systems and has proven itself only from the best side.

- View a review of the indicator for binary options Support and Resistance TLB OC

Indicator for binary options CCI nrp & mtf advanced

The indicator for binary options CCI nrp & mtf advanced is a modification of the usual CCI (Commodity Channel Index) indicator. A distinctive feature of this indicator is that it can collect data from different time frames, and is also capable of generating buy and sell signals:

Signals from this indicator are directed towards the trend. Moreover, there are signals both in the direction of a trend impulse, and there are signals indicating the end of a trend impulse and the beginning of a rollback. The indicator is very flexible to configure:

- View a review of the indicator for binary options CCI nrp & mtf advanced

Indicator for binary options Vdub Sniper Bx

The indicator for binary options Vdub Sniper Bx is a whole trading system consisting of a moving average and signal indicators. The indicator is only available on the Trading View website, so if you want to use it, you will have to use a live chart:

The indicator signals are considered confirmed if two arrows appear below or above the candle:

Indicator for binary options 5 – 15 min Binary V2

Indicator for binary options 5 – 15 min Binary V2 is another indicator-strategy that allows you to make money on trend changes. The indicator is very well thought out and is designed for M1 time frames - for this TF the expiration time is 5 minutes, and for M5 the expiration time is 15 minutes:

Mandatory conditions for using the 5 – 15 min Binary V2 indicator are:

- You must wait until the basement indicator lines intersect

- The basement indicator lines, before crossing, must be behind the upper or lower purple horizontal level

Indicator for binary options Kill Binary Signals 2 nrp

The indicator for binary options Kill Binary Signals 2 nrp is an arrow indicator that shows fairly good entry points into the market:

You won’t be able to change much in the settings, but you can adjust the frequency of signals and their quality:

- View a review of the indicator for binary options Kill Binary Signals 2 nrp

Indicator for binary options T3MA ALARM Alert

The indicator for binary options T3MA ALARM Alert is another arrow indicator that has earned its trust among binary options traders. The indicator is based on three moving averages (as is clear from the name) and gives a signal in the direction of trend price movement:

The indicator settings are not rich, so I don’t see much point in changing anything. Overall, we get a good switch:

- View a review of the indicator for binary options T3MA ALARM Alert

Indicator for binary options QQE-New

The indicator for binary options QQE-New is a mixture of a arrow indicator and a histogram that filters these signals. The mixture turned out to be very successful and the indicator is capable of giving signals in trend price movements, which will appeal to many binary options traders:

Unlike the previous “experimental”, QQE-New has an impressive range of settings, which will allow it to be used even in very difficult situations:

- View a review of the indicator for binary options QQE-New

Indicator for binary options CPI (Candle Stick Pattern Indicator) v1.5

The indicator for binary options CPI (Candle Stick Pattern Indicator) v1.5 is an indicator that identifies candlestick patterns on the price chart and issues a signal to open a transaction. It would seem, what else does a binary options trader need?!

The indicator does all the work on its own, and all candlestick patterns are included in the code, so you won’t be able to disable some formations:

- View a review of the indicator for binary options CPI (CandleStick Pattern Indicator) v1.5

Indicator for binary options Super Trend

The Super Trend Binary Options Indicator is an indicator for the Trading View live chart.

There are also options for MT4 terminals, but they are not so accurate there, so preference is given to the indicator for the live chart. The indicator determines trend change points - they can be used to open trades for 5-10 candles. In general, the Super Trend indicator is very suitable for binary options.

All signals from the indicator are directed towards the current trend. It is a little late, but it very accurately determines the trend movement that has begun:

The disadvantages of the indicator include the fact that it does not work well in lateral movements - they will need to be filtered somehow.

Indicator for binary options CM Sling Shot System

The CM Sling Shot System binary options indicator is the last indicator on our list. The indicator itself allows you to find price rollbacks during trend movements. It is made very cleverly - there are two Mashas that define the trend. The signal appears when the price has been in the zone between these Mashas and left this zone towards the current trend:

Unfortunately, the indicator is only available on the Trading View live chart and I did not come across analogues for MT4. In general, the idea of the indicator is very simple and clear - to find entry points during a price rollback: