How is a reversal candlestick pattern – hammer and inverted hammer – formed and what does it mean?

The psychology of the formation of this pattern is quite simple - the lower long shadow is nothing more than a signal that the price was pulled down by sellers with enormous force, but at the moment a turning point occurred, in which the advantage passed to buyers, who pulled the price of the traded instrument higher.

And this causes the formation of a short body and a long shadow of the Hammer formation. No matter how strange it may look, the Inverted Hammer candlestick pattern has the same properties as the Hammer pattern. On the price chart, our Inverted Hammer is also a bullish formation on a downtrend.

The conditions for the formation of the Inverted Hammer candlestick pattern are almost similar to the conditions for the formation of the Hammer pattern. The only difference is in the location of the long shadow - in the Inverted Hammer figure the shadow is located higher relative to the candlestick body. The color of this formation, as in the case of the Hammer figure, does not carry any meaning.

As a conclusion: it is quite easy to identify these reversal formations that indicate a support level and reverse the price on trading charts.

Important points when trading patterns: Hammer and Inverted Hammer on candlestick charts

These candlestick patterns are a sign of a reversal of the downward market trend in the opposite direction, that is, upward, and for this reason you should look for an opportunity to open buy orders.

In other words, if you found on the chart that a Hammer figure had formed, received confirmation that the trend had begun to reverse (the formation of a new long candle with a white body and an elongated lower shadow, a fairly large price spread was observed throughout the day), then you can safely open trades to purchase.

But there is one feature - the reliability and strength that our patterns have. The smaller the body of such a candle and the longer their shadow, the more significant the signal emanating from them.

It should be taken into account that the excessive length of the lower shadow of the Hammer formation or the upper shadow of the Inverted Hammer pattern (more than 3 times) may indicate panicky “throwing” of market participants.

Also, you should pay attention to the presence of strong bearish figures in front of the formations we are considering, and especially the “Maribozu Closing”. In such cases, it is better to refuse purchases. Also, it will be completely bad if our figure breaks through the support line with its candle.

As mentioned above, the color of the candle body in our formations does not matter, but it is an additional reversal signal. To put it simply, a white candle in these formations is a stronger signal in contrast to a candle with a black body.

We also note that if, during market analysis, in addition to the Hammer or Inverted Hammer pattern, no other figures are observed, then most experienced traders try to determine the occurrence of a moment of oversoldness of the assets being traded.

Hammer pattern trading

Market entry options:

- at the closing price of the reversal candle. Applicable only for ideal patterns, but even in this case the risk is high;

- a Buy Stop order located at the High level of the hammer + spread + 4-5 points for insurance. This technique insures the trader against situations when the trend resumes immediately after the hammer candle. There may be a false breakout of the level; a pending order saves you from losses in such cases;

- the same Buy Stop, but located above the High of the confirmation candle. We wait for the hammer pattern to appear, then a candle should form in the direction of the expected movement. The Buy Stop is located above its maximum, you can enter into a deal at the closing price of the confirmation candle, the risk is acceptable;

- The option of entering with a limit order with an expected correction to the 50.00% hammer level reduces the stop, but there is a risk of missing a reversal.

Hammer candle and market entry options

Let's compare the ratio of stop and take profit:

- option with a confirmation candle – 1 to 1.095;

- entry at Buy Stop immediately after the pattern – 1 to 1.947;

- the Buy limit entry was 1 to 4.919, but there was a risk that the order would not work.

The goal in the figure above was set with the expectation of closing the gap, which was done.

Description of reversal candlestick patterns “Hammer” and “Hangman”

The Hammer and Hanging Man candlestick patterns consist of one candle. They have long lower shadows and small bodies that are at or very close to the top of the daily trading range.

The Hammer candlestick pattern occurs in a downtrend and is so named because it forges a bottom, and the Japanese word for this pattern, tonkachi, translates to “earth.”

Hammer reversal candlestick pattern (Kanazuchi/Tonkachi)

The Hanging Man candlestick pattern appears at the top of a trend or during an uptrend. This name comes from the Japanese “kubitsuri” and arose due to the fact that this candle resembles a hanging man.

Reversal candlestick pattern “Hangman” (Kubitsuri)

Lower shadow

Let's dwell on the problem of the lower shadow of the inverted hammer - the larger it is, the less chance that the inverted hammer will work. The lower shadow indicates that the bears not only took the situation into their own hands after the bulls tried to reverse the market, but also made an attempt to continue the downward movement. The first requirement for the lower shadow is that it should not be larger than the body

. If it is higher, then there is no inverted hammer on the market.

Figure 9.7 Candlestick analysis of the Forex market - requirements for the size of the lower shadow of the inverted hammer

Sometimes we can come across a situation in the market when a candle very similar to an inverted hammer has not only a relatively large lower shadow (smaller than the size of the candle body), but also an upper shadow that is not very large. The combination of such circumstances further complicates the solution to the problem of identifying an inverted hammer. In this case, you should do the following:

- take the length of the upper shadow and divide it by the sum of the length of the body and the lower shadow. If the result is more than two, then it is most likely an inverted hammer.

Figure 9.8 Candlestick analysis of the Forex market - identifying an inverted hammer in the case of a not very large upper shadow and the presence of a relatively large lower one

Inverted hammer

“It happens that a leaf sinks, but a stone floats”

Good day to all readers. It’s already spring on the calendar, but it’s not noticeable outside, it’s just as cold as in winter, but you already want warmth and sun. It's probably time to buy yourself a hot ticket to the South. As the old saying goes:

- If the mountain does not come to Magomed, then Magomed goes to the mountain.

We'll meet there.

Signal improvement

- The longer the lower shadow of the pattern, the higher the reversal potential

- High volume during the Hammer formation increases the likelihood of a successful trade

What does Hammer mean in Japanese candlesticks?

In technical analysis, the Hammer figure means a probable trend reversal. Its origin is explained by the fact that in the midst of a downtrend, bears reign. The price opens and starts to go further down, the bears are still in control of the situation. Then the bulls enter. They begin to push the price up, this creates a Japanese candlestick with a small body and a large lower shadow. The appearance of such a figure means that the bears were unable to maintain control. The long lower shadow is now making bears question whether the downtrend will continue. A strong bullish candle following the Hammer will dispel their doubts, the trend has changed to bullish and buying begins.

Psychology and fundamental factors.

After a strong downward trend, the atmosphere in the market is purely bearish. On the signal candle, the price opens and begins to trade higher. Buyers are entering the game, but they do not yet have sufficient power. Sellers still dominate the market and they are pushing the price back down. As a result, the price closes near the opening price. This creates a small body and a long upper shadow of the candle. On the next candle, buyers take control of the market without much resistance from sellers.

The Inverted Hammer candlestick pattern forms at the bottom of the price movement. There are two possible scenarios here:

- This can occur at the end of a long-term downward price movement that depletes sellers' supply and attracts buyers into the market at significantly reduced prices. At this stage, buyers will be inclined to enter the market at relatively cheap levels. At the same time, sellers begin to exit the market, realizing that the downward price movement cannot last forever and fixing profits.

- The Inverted Hammer candlestick pattern can form in an uptrend when price temporarily pulls back, preferably to a support level. This temporary downward movement may be due to profit-taking by some buyers, the arrival of sellers at relatively high price levels, or the usual cyclical decline in buy orders. Consequently, the price moves down towards the support level, where buyers are ready to start buying again, pushing prices up.

Using the Hammer Candlestick in Technical Analysis

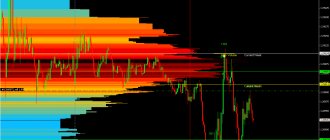

The weekly EUR/USD chart shows a hammer candle:

Hammer candle on the weekly EUR/USD chart

If we look at a longer section of the chart, we can see that the price had previously bounced off the recent lows before the trend finally reversed upward. The area combining the lows acts as support and reinforces the reversal signal provided by the hammer candle.

Stops can be placed just below the support zone, and take profit levels can coincide with the latest resistance levels (as long as a positive risk-to-reward ratio is maintained).

Do you want to make money on crypto? Subscribe to our Telegram channels!

0 comments1

Errors in identification

Using Japanese candlestick analysis, errors can be made when identifying reversal patterns; in particular, an inverted hammer may differ from the classic description if there is a strong support level. You can see this in a few examples below.

Figure 9.11 shows an inverted hammer that formed at the lower border of the trading range (weekly chart of EUR/JPY). As you can see, the hammer is far from ideal - there is also a relatively long lower shadow, as well as a rather large bearish body. The inverted hammer signaled a rebound from the lower boundary of the trading range.

Figure 9.11 Candlestick analysis of the Forex market - inverted hammer at the lower border of the trading range (weekly chart EUR/JPY)

Figure 9.12 shows an inverted hammer that became a reversal signal at the support level (weekly chart of EUR/JPY). An interesting point about this reversal signal at the bottom is that after the inverted hammer, a downward window was formed instead of the expected upward one, however, this did not affect the execution of the signal.

Figure 9.12 Candlestick analysis of the Forex market - inverted hammer at the support level (weekly chart EUR/JPY)

Figure 9.13 shows an inverted hammer that formed at the support of the downward channel (daily chart of EUR/JPY). As we can see from the picture, this candle is very far from the ideal of an inverted hammer. The lower shadow is equal to the size of the candle body, but in total they are placed in the upper shadow more than twice. After the rebound, the pair not only managed to reach the upper boundary of the descending channel, but also rose higher.

Figure 9.13 Candlestick analysis of the Forex market – inverted hammer at the support of the downward channel (daily chart EUR/JPY)

Market entry and stop loss.

You can place a sell stop order 2-5 pips below the low of the confirmation candle, or you can enter with a market order if you are confident that the price will decline further. In any case, your stop loss should be set 2-5 pips above the high of the signal candle. This is only a rough guide. In volatile markets, you may want to move your stop loss higher. Also, for higher timeframes, the stop loss should be set higher, for example, for the daily timeframe, 5-20 points above the high of the signal candle.

The larger the confirmation candle, the greater the likelihood of a reversal. However, if the candle is too large, then there may be problems with the optimal risk-to-reward ratio. For example, if the signal candle and the confirmation candle together reach 100 pips, then your stop loss will be at least 100 pips. Therefore, the take profit will have to be set at a minimum of 150-200 points. If the support level is within these limits, then you will have to miss such a signal and not enter the market, no matter how obvious it is.

Candles and candlestick patterns are the pulse of the market, determining price action ( Price Action ) and the sentiment of market participants, which is the driving force behind price action.

What are the different chart models?

Using candlestick analysis models, you can easily track the highest percentage of bets being triggered and see the prerequisites for a reversal of the trend and price impulse of the cryptocurrency.

Now traders identify 6 main models in which Japanese Forex candles are used in different ways:

Triple Strike

This pattern is formed on the basis of three black candles, which are inherent in a bearish downtrend. In this case, each subsequent candle must be lower than the previous one, and it closes near the intra-candle low.

The fourth bar will be open below the third, but inside the candle there will already be growth without a shadow. That is, the candle will be white, but it is lower than in the previous trend.

In 84% of cases, the value of the cryptocurrency will increase after this.

Three black crows

Three Black Crows is another bearish downtrend. Its peculiarity is that it occurs unexpectedly when the currency is at its peak in value growth. After this, a black candle immediately appears and the price of the coin begins to constantly fall to a minimum.

This is a great trap for greedy traders who were saving cryptocurrency in their wallets and did not manage to sell it in time at its peak. In other words, a rect happened to them.

This model predicts the cryptocurrency's further decline 78% of the time.

Candle sandwich

When three different Japanese Forex candles line up in one line, this pattern is called a “sandwich”. Two black candles surround a white one on both sides. At the same time, the closed price of the candles is very close to each other in level. It is these components that indicate another common model, but this time of a bullish trend. And it lasts for about three days.

Evening Star

The Evening Star is a bearish pattern. It comes from a long white candle. The market is gradually starting to gain momentum, but new buyers are still not appearing. Because of this, the next candle appears, but this time it is black. It is noticeably higher than the same white one. The pattern ends with the next black candle, which significantly lowers the value of the cryptocurrency.

The Evening Star model predicts a decline in the price of a virtual coin with an accuracy of 72% of cases.

Abandoned child

Abandoned Child is another bullish trend scenario. Its difference lies in the fact that it begins with the price of the cryptocurrency falling to its minimum value, and then a gap occurs, that is, a break. After this, the price of the coin will begin to rise and, as a rule, this outcome of events occurs in 70% of cases.

Falling star

The shooting star is one of the most reliable bearish trend patterns. When it occurs, it signals that this trend has reached its maximum point, and then it will decline. In the case of cryptocurrency, its rate will fall to the very bottom.

On the chart it looks like a comet flying towards the earth, leaving behind a trail of black candles lined up in a row.

In this case, the trader must go into hibernation, close all his trades even at long distances and simply prepare. After this, a powerful direction correction will occur. This is also done using a gap.

Signal improvement

- The longer the Hammer's handle (upper shadow), the higher the reversal potential

- The presence of gaps on the left and right of the Inverted Hammer significantly enhances the signal

- High volume during the formation of an Inverted Hammer indicates a greater likelihood of success

Sources

- https://InfoFx.ru/trejding/svechnaya-model-figura-molot-i-perevernutyj-molot-opredelyaem-razvorotnye-formacii/

- https://profitov.net/figura-molot-v-yaponskih-svechah/

- https://ru.wowhead.com/quest=34105/%D1%80%D0%B0%D0%B7%D1%8B%D1%81%D0%BA%D0%B8%D0%B2%D0%B0 %D0%B5%D1%82%D1%81%D1%8F-%D1%80%D0%B0%D1%82%D0%BE%D0%BA-%D0%BC%D0%BE%D0%BB %D0%BE%D1%82

- https://Forex-Invest.tv/technicheskiy-analiz-rinka/yaponskaya-svecha-molot.html

- https://profitov.net/perevernutij-molot-v-yaponskih-svechah/

[collapse]

Buy levels and Stop Loss

The key level for opening a long position is the top point of the candle body, that is, the closing price. However, to make a final decision, you must wait for confirmation - the market closing the next day above this level.

The reference point for a Stop Loss order is the minimum price level of the hammer candle. At the same time, it makes sense to record a loss in two cases:

- the market closed below this level;

- For two days in a row, the minimum prices were below this level.

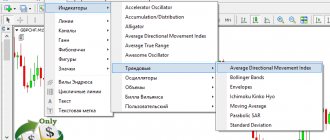

Rules for using Japanese candlestick reversal patterns

Before getting acquainted with Japanese candlestick reversal patterns, you need to remember a few rules for their use:

- Using Japanese candlestick patterns does not provide 100% profitable trades;

- The models can be used either independently or with other technical indicators (for example, Bollinger). If the signals match, then this will be an excellent entry point;

- The higher the time frame, the stronger the Japanese candlestick reversal pattern;

- The stronger the trend that preceded the appearance of the pattern, the stronger the pattern will be;

- Basic patterns can consist of one, two or three candles.

Why do you need candlestick analysis?

Candlestick analysis is a type of forecasting changes in the cryptocurrency rate using Japanese candles, the main idea of which was laid down in the 17th century by a certain Munehisa Homma.

It was Homma who first introduced the idea of an ideal analysis tool for traders. He built a system where changes in the price of a currency were simultaneously displayed, and it was possible to forecast its further movement. Thus, he wanted to create a special tool for traders with which they could minimize their losses and make more profitable bets.

In the end, he succeeded. With the help of candlestick analysis, a trader receives more than just dry facts. He can understand how changing trends affect other market players and its psychology.

However, Forex candlestick analysis does not end there. Steve Nisson wrote an entire book dedicated to the basic principles and benefits of candlestick analysis. He showed with clear examples a large number of working models that are still used by traders around the world.