The ADX indicator is an index of average directional movement. Using the ADX indicator, you can determine the current trend and determine its strength. The ADX indicator was invented by J.W. Wilder Jr. The full name of the indicator is Average Directional Movement Index, which means “Average Directional Movement Index”. The principle of operation of the indicator was first described in detail in the book “New Concepts in Technical Trading” in 1978. The ADX indicator itself belongs to the class of leading indicators - it shows in advance what strength the current trend has, and also shows what kind of trend is present in the market (upward or downward).

ADX indicator in MT4 terminal

In order to add the ADX indicator to the chart in the MT4 terminal, you need to go to the “ Insert ” tab and select “ Indicators/Trend/Average Directional Movement Index ”

Then you need to specify the colors for the DI+ and DI- lines in the settings in the “ Colors ” tab:

And set the levels “25” and “50” in the “ Levels ” tab:

At this point, you can complete the ADX indicator settings and click on the “OK” button, after which the indicator will appear on the price chart of the selected asset.

i-Daniella: volatility arrow indicator

The indicator is based on the standard ATR and is suitable for medium-term transactions from H4 to several days. The signal occurs when volatility increases sharply, and the direction of the transaction is determined by volume analysis.

i-Daniella indicator signals.

At one time, this indicator without redrawing appeared as the basis of the trading strategy of the same name, but it, like any volatility indicator, must be combined with trend control. The most profitable combinations are with Ichimoku and moving averages - arrows are used as a confirmation signal.

Using the ADX indicator

The ADX indicator is used to determine the current trend and to determine its strength. If the ADX line is above the “25” level, then there is a trend in the market. Moreover, the higher this line is, the stronger the trend.

If the ADX line is below the “25” level, then there is a sideways movement or flat.

The lower the ADX line is, the weaker the movement. The DI+ and DI- lines are used to determine the current trend. Their intersection indicates that the market is dominated by upward or downward movement. An upward movement is present after the following conditions have been met:

- The DI+ line crossed the DI- line from bottom to top

- The ADX line is above the “25” level

A downtrend is present after the following conditions have been met:

- The DI- line crossed the DI+ line from bottom to top

- The ADX line is above the “25” level

The farther the DI+ and DI- lines diverge, the stronger the trend. When crossing back, at the moment when the ADX line has not returned to the range from “0” to “25”, a trend change most often occurs:

At moments when the DI+ or DI- line is higher than the ADX line, there is a strong trend:

Example of a trading strategy

As an example of the fact that strategies based on this indicator can bring profit , I will analyze a vehicle designed to work in a flat. The author of the trading system works on the GBP/JPY ; other currency pairs have not been studied for effectiveness.

To work you will need:

- Set period ADX 30 ;

- Add level 15 .

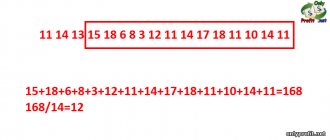

The idea of the TS is that as long as the indicator line is below the level of 15 a flat in the market . On the chart at this time we will be interested in the unsuccessful attempt exit this corridor . If we receive confirmation in the form of reversal pattern, then we enter the market with modest goals. For those who have not yet become familiar with candlestick patterns, an article about analyzing combinations of Japanese candlesticks will be useful.

Rules for shopping

- ADX below level 15;

- The price should approach the level of the last local minimum ;

- A rebound candle is forming on the chart . In the example in the screenshot below, this is indicated by a large lower shadow. At its closure, buy deal is concluded ;

- TR you can put it on the last local one maximum (significant resistance).

For short positions, the rules are the same, only you need to take into account the price rebound from the level of the recent high . Trading using this strategy is not particularly intensive, and the goals are small, but the profit is stable + the risks are low. Before you start inventing and testing your trading system, you need to decide on a broker. The table below will help in this difficult matter.

| Company | Just2trade | United Traders | BKS | Tinkoff investments |

| Minimum deposit | From $100 | $300 | from 50,000 rub. | Unlimited, you can even buy 1 share, they recommend starting from RUB 30,000. |

| Commission per cycle (buy + sell trade) | 0.006 USD per share (min. 1.5 USD), 0.25 USD for each application. that is, per lap – $3.50 | “Beginner” tariff – $0.02 per share Average $4 per round | At the “Investor” tariff – 0.1% of the transaction amount, at the “Trader” tariff it is reduced to 0.015% | 0.3% for the “Investor” tariff |

| Additional charges | The ROX platform will cost at least $39/month. (for the American market), for an additional $34.50 they connect Canada/TSE, Level II On the over-the-counter market, the additional fee is 0.75% of the transaction volume (minimum $30), in the case of dividends - 3% from the issuer (minimum $3) | On the Day Trader tariff, they charge $60/month for the Aurora platform, free on other plans | If the account has less than 30,000 rubles - 300 rubles/month. for access to QUIK and 200 rub./month. for access to the mobile version of QUIK, | — |

| Account maintenance cost | $5/€5/350 rub. reduced by the amount of the commission paid | — | 0 RUR/ month on the “Investor” tariff. On other tariffs, funds are debited only if there was activity on the account this month | Free for the "Investor" tariff |

| Leverage | for Forex Up to 1 to 500 for stocks up to 1 to 20 (day) to 1 to 5 (night) | 1 to 20 on the Day Trader tariff, this is the maximum leverage (daily) | Calculated for each share, within the range of 1 to 2 – 1 to 5 | Calculated for different instruments, the calculation is linked to the risk rate |

| Margin call | -90% | Standard -30% of the deposit, in technical terms. support can be set -80% | Calculated based on the risk for each security | Depends on the asset |

| Trading terminals | MetaTrader5, ROX | Aurora, Sterling Trader, Fusion, Laser Trader, Volfix.Net, Pair Trader | My broker, QUIK, WebQUIK, mobile QUIK, MetaTrader5 | The purchase of shares is implemented like an online store, professional software is not used |

| Available markets for trading | Forex, American, European and other stock markets, cryptocurrency | American and other stock markets, more than 10,000 assets in total, cryptocurrency | Foreign exchange, stock, commodity markets, there is access to foreign exchanges | American and Russian stock markets |

| License | CySEC | Lightweight license from the Central Bank of the Russian Federation | TSB RF | TSB RF |

| Open an account | Open an account | Open an account | Open an account |

Changing the period of the ADX indicator

Changing the period of the ADX indicator can significantly affect the data received from the indicator. If you reduce the period of the ADX indicator, it will begin to react to all price movements - its “response” time to price changes will decrease, which is not always good, because many false signals will appear. ADX with period 8:

If you increase the period of the ADX indicator, then the indicator’s reaction to price changes will be slightly delayed, but at the same time there will be fewer false signals. ADX with period 20:

conclusions

To summarize, let's briefly look at the strengths and weaknesses of the ADX indicator.

Advantages:

- Simplicity - if you do not use any additional lines, but only the ADX itself, you will get a simple tool for measuring the strength of a trend.

- Minimum settings - there is no need to change the user settings for the period, which by default is 14, and it is suitable for all trading instruments.

- Invisibility - If you use ADX for automatic stock selection, as described in this article, then there is absolutely no need to put it under the chart and burden your workspace.

- Reliability – has proven itself well for searching for securities that are trending or consolidating.

Flaws:

- A trend indicator, by definition in technical analysis, is a lagging indicator. You should not hope that a consolidation breakout or similar things should necessarily occur at the level of 25-30. First, the price will take action, and then ADX will display them - it won’t work without a delay.

- A lot of noise - different parameters, additional lines, modifications and analogues - all this only distracts the trader from the main thing - the chart and price dynamics.

There were more pros than cons - it turned out to be a super indicator. Maybe you have your own thoughts - write them in the comments. Thank you for your attention and stay tuned to the trading blog. Profit and prosperity!

Using the ADX indicator with other indicators

The ADX indicator does not show entry points into the market - it is a filtering indicator that shows both the strength of the trend and what kind of trend is currently present in the market. Therefore, the ADX indicator simply must be used in conjunction with other indicators.

ADX indicator and CCI indicator

The combination of the ADX indicator and the CCI indicator shows itself very well in trading. As mentioned earlier, ADX acts as a filter indicator, and CCI shows entry points into the market. For an entry point to appear, the following conditions are necessary:

- The ADX line is above the “25” level (there is a trend)

- The prevailing trend is determined using the DI+ and DI- lines

- Entry point – exit of the CCI indicator line beyond the level of “100” or “-100”

These indicators complement each other perfectly and allow you to find very confident entry points into the market.

ADX indicator and RSI indicator

The ADX indicator can also be used in conjunction with the RSI indicator. In this case, we will be interested in moments when the following conditions coincide:

- The ADX line is above the “25” level (there is a trend)

- The DI+ and DI- lines intersected (a trend change occurred)

- The RSI indicator line has crossed the level of “50”

Stop losses

Wilder placed a stop behind the extremum of the candle where the ±DI lines intersected . Nowadays, this approach does not always , so if signals of this type are used in work, then the stop should be placed, for example, beyond a local extremum or a fixed SL depending on the rules of the vehicle.

In general stop loss is an important element of any trading strategy; it allows you to limit losses and increases trading efficiency. My post on what a stop loss is looks at this issue in more detail.

As an option, you can use a simplified version of this type of signal, taking into account only the intersection of ±DI lines.

In addition to these types of signals, you can find recommendations for using divergences on ±DI (in a growing market - along +DI, in a falling market - along -DI). very rarely on this indicator and it is better not to rely on them too much . If you are interested in working on divergences, I advise you to pay attention to the MACD . We have already discussed how to use the MACD indicator; divergences work really well on it .

Advantages and disadvantages of the ADX indicator

The ADX indicator is a very powerful tool in the hands of an experienced trader. It is always important to understand how strong the current trend is, and the ADX indicator copes with this task with ease. This indicator is very good to use in trend strategies as a filtering indicator. The disadvantages include the fact that the ADX indicator is not an independent indicator. It does not show market entry points and requires additional indicators. In addition, the indicator redraws on the emerging bar - a standard problem with most indicators.

Interesting Facts

The Average Directional Movement Index (as translated from English) was first introduced in technical analysis by its creator Welles Wilder in 1978 in the book “New Concepts in Technical Trading Systems”.

Along with the ADX indicator, this book also describes in detail several other well-known “brainchildren” of Wilder, which have found their application in stock trading: Average True Range (ATR), Parabolic SAR, RSI. Although all of these technical indicators were developed in the pre-computer era, they are incredibly detailed in their calculations and have stood the test of time.

Work with ADX took place on the Forex and futures markets, where the author himself traded. But stocks are also great for analyzing this indicator, especially those trading with high volatility.

BrainTrend2Sig: volatility+stochastic

For quite a long time it was offered as a paid arrow indicator without redrawing, although within the algorithm there is the usual combination of Stochastic+ATR. Today you can download it from the Internet without any problems. The parameters only contain the number of bars, so there is no fine tuning.

BrainTrend2Sig indicator.

It is not recommended to use it for short periods; in the medium term it catches reversal moments well, but it is better to ignore countertrend signals and trade in the direction of the global trend. On volatile assets, this indicator can show multidirectional signals on bars with a long shadow without lag, so additional filters in such a system are mandatory.

T3MA-Alarm: visual RSI+SSMA

Another version of the arrow indicator based on standard tools: the moving average and the oscillator. Clearly shows the moment of reversal of the RSI line from critical zones.

Indicator without redrawing T3MA-Alarm.

“Strelok” gives a lot, including false ones, but the presence in the parameters of the ability to specify the offset in bars (usually back from the current one) allows you to receive more correct signals. It is not recommended to use this arrow indicator without additional filters; stable options are obtained with long EMAs. By default, it rings when the arrows appear.

BBands for RSI: trend on the oscillator

An unusual pointer indicator without redrawing or delay, which completely frees up the workspace. The trend Bollinger Bands and the RSI oscillator are located in one additional window under the price chart. The original version of using overbought/oversold zones, where the source of data for Bollinger Bands is the RSI indicator data.

Dial indicator settings without redrawing BBands for RSI.

Arrows appear:

- blue - at the intersection of the lower BB band with the RSI line from bottom to top - buy;

- red - at the intersection of the upper BB band with the RSI line from top to bottom - sell.

Many settings allow you to adapt this indicator to almost any asset without redrawing, and also set which bar to take the signal from at the beginning of the calculation (1 - from the first, 0 - from zero).

WPRSI Signal: Marker for Sniper Deals

The most accurate option for intraday scalping. This indicator successfully bypasses all ambiguous situations without delay and shows the most “adequate” signals on any time frame from M5 to D1.

General view of WPRSI signals.

The arrow indicator without redrawing WPRSI has a minimum of settings, the up-down filter parameters depend on volatility: the more actively the price moves, the wider the filter is needed to get an accurate signal.

SixtySecondTrades: a tool for futures transactions

This arrow indicator without redrawing was specially developed by fans of binary options for the fastest transactions (turbo options have an expiration period from 15 seconds to 1-2 minutes), and was initially adapted only for EUR/USD.

Visual appearance of the indicator without redrawing SixtySecondTrades.

The calculation is based on standard MA and ADX. In the settings, only ADX parameters are visible, which are usually selected according to the usual criteria: the shorter the working period, the smaller the parameter should be.

Instead of an arrow, a colored dot appears in this arrow indicator without redrawing (green = buy, red = sell), but only when the probability of movement in one of the directions is more than 60%. The result is a fairly stable algorithm that works normally on major Forex currency assets on any period, and the higher the time frame, the more reliable the signal.