- Binance: training - all about the Binance Coin (BNB) token

- How to work on the Binance exchange in classic mode

- How to trade correctly on Binance: use perpetual futures

- How to trade cryptocurrency on Binance: additional opportunities on the exchange

It often happens that competitors have been working hard for years, vying for a place at the top, but a newcomer comes along and easily surpasses the veterans. The fate of commercial projects largely depends on the ability of the creators to correctly determine the priority direction of activity.

The Binance cryptocurrency exchange is one example of the fact that you can achieve stunning success, despite fierce competition, and not only achieve, but also maintain a leading position. It is important to clearly understand what is needed for this, to competently organize the work process and not to get caught up in trifles. Let's figure out how to trade on Binance from scratch.

How to work on the Binance exchange for dummies: what is the Binance exchange

The official website of the exchange is https://www.binance.com/

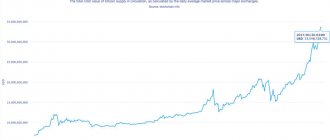

Binance is a virtual cryptocurrency trading platform. Created in July 2022, the Binance exchange found itself in first place in the Coinmarketcap ranking within a few months and remains there to this day. Because here is everything you need for successful trading:

- Large selection of cryptocurrency pairs;

- Decent depth of the order book;

- Extensive set of tools for market analysis;

- User-friendly interface, in 14 languages;

- And most importantly, very low commissions for trading operations;

The Binance exchange supports exchange pairs with the euro, Russian ruble, Turkish lira and other national currencies. Replenishment and withdrawal of traditional money is carried out through payment systems:

- Advanced Cash;

- Bank Card (Visa/MC/Mir);

- Perfect Money;

- Payeer;

- Epay;

- Okaypay.

Many newcomers to the cryptosphere are interested in how to buy and sell on the Binance exchange. What opportunities does the site offer? Binance offers leveraged trading and supports futures derivatives and P2P exchanges. You can order a Binance debit card, with the ability to top up in cryptocurrency, and use it to pay for goods and services anywhere in the world.

With Binance Earn you can earn digital coins 24/7. Put your cryptocurrency in storage and do whatever you want. It doesn’t matter what you are doing: walking the dog, watching TV or sleeping, the exchange works for you. Floating and fixed rate deposits are available, as well as fixed staking, DeFi staking and the new ETH 2.0 Staking service. So, if you don't have enough ETH crypto coins to become a validator on the updated Ethereum network, earn ETH 2.0 tokens on Binance. By the way, for this it is not at all necessary to buy the Ethereum cryptocurrency for fiat money. ETH 1.0 mining is now available on Binance Pool. Owners of gpu rigs can earn ETH on the exchange service and immediately transfer them to ETH 2.0 Staking. As a character in one old comedy movie said: “Strike iron without leaving the cash register!”

Gamblers can take part in trader battles on Binance Batl. Place a bet on a decrease or increase, wait for your opponent and if your prediction is correct, then you have hit the jackpot.

Having one of the top cryptocurrencies on the exchange deposit, you can get a crypto loan in stablecoins USDT or BUSD. The following are accepted as collateral:

- BTC;

- BCH;

- ETH;

- XRP;

- EOS;

- LTC.

The updated Binance platform provides traders with greater trading opportunities and is worth registering for.

How to trade on Binance? To get started, please register

Registration on the Binance exchange begins by clicking the corresponding button on the main page of the official website. A window with a registration form will pop up in front of you, where you will have to select the option to create an account:

- Via email.

- By phone.

Decide what suits you best and fill out the form, indicating your email address/mobile number and password, which should include:

- Minimum 8 characters in any layout;

- At least 1 capital character;

- At least one digit.

In general, the more complex the better, but be sure to save the code you come up with in a safe place. After filling out the form, click create an account and a 6-digit confirmation password will be sent to your mailbox or phone, depending on which method of registration on Binance you chose.

Enter it in the pop-up email address (mobile number) verification window and the system will redirect you to the Binance website.

Trading on Binance for dummies: entrance to the exchange

Here you will immediately be offered options for replenishing your deposit with virtual coins or fiat, and will also be reminded of additional account protection measures. Be sure to enable 2FA; detailed instructions for activating the exchange’s two-factor authentication are available on the exchange’s website. As an alternative or as a method of additional protection of funds used in parallel with Google Authenticator, you can use SMS confirmation.

Address management. This option allows you to save and record notes for each of your withdrawal addresses.

Device management. In this section, you can create a list of devices from which you are allowed to log into your account. Don't neglect safety measures.

Trading on Binance: we go through account verification

On the Binance exchange, identity verification is not required, but for unverified accounts the maximum withdrawal amount is equivalent to 2 BTC per day. After successfully completing the first stage of verification, your limit will be raised to 100 BTC per day, and input limits will be increased for selected local currencies. At the first stage of verification:

- You indicate your passport details and taxpayer identification code number.

- Upload a scanned copy of your ID and a photo of you with the document in your hand near your face.

Upon completion of the verification, the daily limit will be increased to 100BTC.

In the second step, you confirm your residential address to increase the deposit limit for some fiat channels. A copy of your utility bill for the last month will do. Legal entities indicate their personal data as a representative of the company and company details. The process lasts on average 8 hours and after successful completion of Binance verification, your withdrawal limits will be increased. The preparation is complete, and now let’s figure out how to trade bitcoins on Binance.

Trading on the Binance exchange begins with replenishing your balance

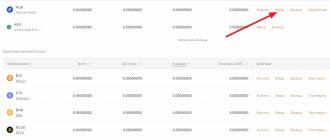

Let's move on to the next point, how to top up your Binance personal account. In order to deposit money to the exchange, in the “Wallet” tab, click on the “Spot Wallet” values and go to the list of cryptocurrencies available for replenishment.

We select the coin we are interested in and get the public address.

If you already have virtual money in your personal wallet or on deposit at another exchange, you can transfer it to your Binance wallet. How to purchase cryptocurrency on Binance using VISA/MasterCard will be discussed a little later.

When you send assets to Binance, you fund your spot wallet. Each verified user, in addition to the standard exchange deposit, is provided with wallets for:

- Margin trading (margin trading on Binance for dummies will be discussed below);

- Futures transactions;

- P2P exchange;

- Perpetual and fixed savings;

- Bitcoin cryptocurrency mining on Binance pool.

The Binance platform has forever gone down in the history of the crypto industry as the first exchange service to launch its own mining pool. 4 coins are mined here: BTC, BCH, BSV, ETH. Payments are made daily to your pool account, you can immediately transfer your earned money to a spot wallet for free or activate staking.

The exchange supports staking of 23 coins, including NEO, EOS and TRON. The full list is available in the corresponding section of your personal account. Staking is the extraction of coins by freezing a certain amount in a separate account. At the end of the period (minimum 1 month), you receive a reward from the project administration and can withdraw coins for sale or start the process again.

The Binance exchange accepts money for safekeeping at interest. Perpetual subscription is open for BTC, BUSD and USDT coins. Your money is not blocked; you can use it at any time, and for the period while it was on deposit, you will be accrued a certain percentage per annum.

Fixed savings involve freezing a certain number of coins for a period of 7 to 90 days. Essentially, this is the same staking, but it’s not the developers who pay you, but the exchange itself.

BNB Vault

BNB Vault

This method of earning allows you to receive passive income from staking the native cryptocurrency BNB (Binance Coin). At the same time, one or another additional asset can also be distributed within the Launchpool - for example, at the time of writing this is ALICE of the My Neighbor Alice project. Thus, BNB Vault is an aggregator of BNB yields. By depositing an asset, the user at the same time takes part in Launchpool, Deposits, DeFi staking, receiving standard and additional rewards.

You need to click the “Start Staking” button and enter the amount of BNB you want to use. You can also set up an automatic transfer so that all BNB in your spot account is deposited.

How to use Binance: withdraw money from the exchange

To start withdrawing funds from the trading platform:

- Go to the appropriate section (Output).

- Select the desired cryptocurrency.

- We indicate the amount and address to which funds are withdrawn.

- Click the “Send” button.

- We confirm our intentions by email.

If you have both two-factor authentication options activated (Google Authenticator/SMS), you will have to enter three codes in 30 seconds:

- Confirmation code by email.

- Verification code via SMS.

- Google Authenticator code.

This confirmation option is very secure, but not entirely convenient. However, let everyone decide for themselves. Enter the verification codes and click "Submit". Done, Binance withdrawal is complete. The progress of processing withdrawals from your Binance wallet can be seen in the Transaction History section.

Do not withdraw from Binance directly to a Crowdfund or ICO address. To make donations and purchase tokens, you must first transfer funds to your personal cryptocurrency wallet.

How secure is Binance?

Binance is a generally secure exchange, although it suffered a major hack in 2022 in which 7,000 bitcoins worth $40 million were stolen from the exchange . Binance has since strengthened its security and promised that all losses will be reimbursed through its insurance fund. The exchange uses two-factor authentication (2FA) to protect user accounts.

Binance has also previously worked with authorities to freeze hacked assets or criminal accounts.

Trading on Binance: service commission for transaction processing

Let's move on directly to how to sell on Binance, but first, a little about commissions. The Binance exchange has set a fixed commission fee for trading operations of 0.1% of each transaction. The tariff is one of the minimum among all crypto exchanges. Traders, paying the commission with BNB tokens, receive a 25% discount, and the payment for withdrawing crypto is also low.

- Bitcoin - 0.001%;

- Ethereum - 0.01%;

- Ripple - 0.25%;

This allows us to call Binance a trading platform with minimal trading fees.

Binance: training - all about the Binance Coin (BNB) token

BNB is the internal token of the Binance ecosystem. The digital asset can be used to pay fees and make online payments. BNB cryptocurrency is accepted at merchants using Pundi X's XPOS device and Monetha merchants. BNB is supported by the Crypto.com and NOWPayments payment networks. Using this token you can book hotel rooms and hire a freelancer on the service

CanYa.

The exchange also released its own stablecoin BUSD and an updated version of the Binance Chain network, called Binance Smart Chain, compatible with the Ethereum virtual machine. Now clients can not only issue Wrapped tokens of Ethereum and other top coins for quick exchange with a minimum commission, but also invest in the defi sector or participate in referendums on the blockchain.

Launchpool

Earning money on Binance Launchpool (farming DeFi tokens)

The Binance Launchpool platform creates additional incentives for stakers, allowing them to receive tokens of new promising projects by investing in certain assets. For example, at the time of writing this article, all stakers in the BNB, BUSD and CHR pools will additionally receive some ALICE tokens. This is already the 16th such event.

One of the main advantages of receiving new tokens is that they sometimes show incredible price growth in the first days or even hours after listing. This is a good opportunity to earn additional income.

How to trade on the Binance exchange: guide, instructions

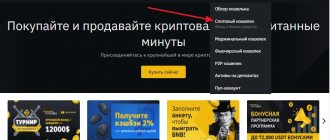

How to trade on Binance for a beginner? Let's look at the process in detail. So, let's start trading operations. You need to click on the “Trade” button and select the operating mode:

- Basic . Simple conversion of one currency to another according to the market.

- Classical. A mode with a simple and intuitive interface.

- Advanced. All trading instruments are available in one window.

- P2P. Transactions are made directly with other traders.

- OTC . Designed for large volumes.

Before working on the Binance exchange, you need to decide on a trading pair. How to choose a pair on Binance? Coins available to users:

- Binancecoin (BNB);

- Bitcoin (BTC);

- Ethereum (ETH);

- Ripple (XRP);

- Fiat currencies and stablecoins (USDT, USDC, TUSD, PAX).

For compactness and ease of use, ETH and XPR coins are located in the ALTS department, and “dollar” cryptocurrencies (USDS Binance) and traditional money are located under the FIAT button.

After you decide on the market and select a currency pair, you will see detailed data on quotes, price depth and other information important for a trader. If you are new to cryptocurrency trading and don't know how to sell on Binance, use the Market order. Orders of this type are executed immediately after creation, at the current price of the cryptocurrency on the site. Basic trading mode and OTC mode have a very simple interface that even a beginner can easily understand. On the P2P site you need to select a currency, indicate a payment method and select a suitable ad. Basic trading, including leverage, occurs in classic and advanced modes.

The basic trading mode has a very simple interface that even a beginner can easily understand.

To get started:

- Hover your mouse over the “Trade” button.

- Select the "Basic" section from the drop-down menu.

A window with two columns will pop up in front of you. In the first, you need to select from the list of available coins the one you want to sell and enter the amount. And at the bottom indicate the cryptocurrency you want to buy. The system will calculate how many tokens you will receive. If you are satisfied with the result, carry out the operation and the money will be credited to your account.

How to work on the Binance exchange in classic mode

To create a Market order, go to the “Market” tab from the page of your currency pair, enter the required amount, and click on the button below. Buying and selling prices can be seen on the display to the left of the order. After completing the application, you will immediately receive funds into your account.

Nearby, in the Limit section, limit orders are created. You must indicate the price at which you are willing to sell or buy the coin you are interested in. Using limit orders (Binance limits), they make transactions at more favorable prices, and there is no need to constantly monitor the market.

Let’s say you have an assumption that some cryptocurrency will fall in price, which means you need to create an order to purchase it at a price below the market price. When you see signs of an imminent rise in quotes, create a sell order at a price higher than the current one. When the marks you specified are reached, the applications are completed and you will receive money for your deposit.

To use Binance stops, go to the Stop Limit tab, this order form has three columns:

- Stop — determines the price upon reaching which the order will be put up for auction;

- Limit — the sale (purchase) price of the coin;

- Amount — the amount of cryptocurrency being sold or purchased;

- Total - how much you will receive (give) for everything as a result;

For example, we purchased EOS for USDT at 3.1, while we expect the price to rise, but we insure ourselves against loss of funds if a decline occurs. This means that in the Stop column we write the price 2.9, and set the Limit to 2.7. Click Sell NEO and the order will be created immediately. Let's consider purchasing options. When you expect the value of a coin to increase, for example, if it rises above the 4 mark, set:

- Stop - 4;

- Limit - 4.2.

When the cryptocurrency rises in price to 4 USDT, you will be able to purchase it at prices from 4.2 to 4.2. And when it rises in price even more, you will be able to sell the coins for a profit. Of course, only if your prediction turns out to be correct.

Advanced trading training on Binance

This market is suitable for professional traders who know how to do deep technical analysis. If you have recently started trading, it will not be suitable for you. It will take a lot of time and effort to master the trading tools available here.

If you are using a bot to trade on Binance, please be aware that there are API restrictions on the number of transactions per minute. When the limits are exceeded, the exchange issues an IP ban for 2 minutes, so the bot constantly monitors the current API load. When you approach the limit, operations will be delayed. Current API usage is indicated in the status bar (API loading).

Generally, you don't need to worry until the indicator is half full; if it turns red, you are approaching the limit and the bot will start pausing. The most complex operation is downloading the full order book (1000), so when working with Binance, the bot downloads the full book only for a full-frame chart. Do not run two or more Binance bots on the same network (same IP). API requests made from the same IP will be summed up, resulting in an instant ban for 2 minutes.

Binance: Margin Trading

Margin trading is the use of borrowed funds to conduct transactions in digital assets. Just a year ago, this type of trading was extremely rare; now quite a few platforms support trading with leverage. To open a margin trading account on Binance, you will need to complete full identity verification (KYC) and enable 2FA. Once activated, transfer money from your Binance spot wallet to your margin trading wallet.

You will now be able to use these coins as collateral to borrow funds. Your margin wallet balance determines the amount of funds you can borrow, following a fixed 5:1 (5x) rate. For example, if you have 1 BTC, you can borrow 4 more. To borrow money:

- Select a borrowed asset;

- Enter the amount;

- Click the “Confirm Borrowing” button.

Please note that money is lent in growth and the interest rate is updated every hour. You can view the available pairs, as well as their rates, on the margin commission page. You can check the current status of your margin account in the “Margin” tab of your deposit.

The level of risk changes depending on market movements; if prices move against your forecast, your assets may be liquidated. In the event of liquidation, the trader will be subject to additional fees.

How to trade profitably on Binance: OTC

The abbreviation OTC is derived from the English phrase Over-the-Counter, which literally translates as “Bypassing the counter.” The term OTC refers to an over-the-counter transaction between a client and a market maker facilitated by a third party.

On the OTC platform, one large transaction is carried out for a specific amount and at a pre-agreed price. This transaction is not recorded in the site's order book and is not publicly displayed.

Binance OTC helps you trade large amounts (usually over 10 BTC) quickly and securely. Any pairs are supported, even those that are not on the traditional site.

How to start trading on Binance on the P2P platform

On a P2P platform, users negotiate among themselves, without the participation of the exchange, which acts as the organizer of trade, providing clients with a website for publishing their offers.

The online escrow service guarantees the security and timely delivery of the digital asset. To work on P2P, you need to pass KYC and add a payment method in your account settings. Then you find a suitable offer, and if you don’t have one, publish yours and wait for the client.

How to trade on Bnance using derivatives

Derivatives are derivative financial instruments based on some other exchange asset, including cryptocurrency. A derivative is worth nothing in itself; its price depends entirely on the value of the underlying asset. The Binance platform supports the following derivatives.

How to trade correctly on Binance: use perpetual futures

Perpetual futures contracts do not have a specific closing date. Transactions are concluded based on the underlying asset value index, which is derived based on the average price of the crypto coin and sales volume. Therefore, the value of perpetual futures is often comparable to the market value of the cryptocurrency.

How to trade on the Binance exchange: quarterly futures

The name quarterly futures speaks for itself. The contract always closes after the specified period. For example, on Binance Futures such futures are executed on the last Friday of the third month.

Trading on Binance with leverage

Credit tokens are “portfolios” filled with perpetual futures. They allow the trader to operate without collateral or margin support without worrying about the risk of liquidation.

BTCUP/USDT and BTCDOWN/USDT pairs are available on the Binance spot market. You can use a NAV leveraged token with a daily limit of 1000 tokens per account. To subscribe or redeem, simply go to the Binance Leveraged Tokens page and click “Subscribe” or “Redeem”.

How to trade on Binance from your phone

How does spot trading work on the Binance exchange? Login to the Binance app, click [Trades] to go to the spot trading page.

In front of you is the interface of the trading page.

- Market and trading pairs.

- Real-time market candlestick chart, supported cryptocurrency trading pairs, Buy Cryptocurrency section.

- Buy/Sell order book

4.Purchase/sale of cryptocurrency

- Open orders

You can use a “Limit Order” to buy BNB.

- Enter 0.002 BTC as the price.

- Select 100% as the quantity.

- Once the market price of BNB reaches 0.002 BTC, the limit order will be executed and 1 BNB will appear in your spot wallet.

You can sell BNB by following the same steps.

ATTENTION:

- The default order type is limit order. But if traders want to place an order as quickly as possible, they can select a [Market] order. By selecting a market order, traders can execute a transaction instantly at the current market price.

- If the market price of BNB/BTC is at 0.002, but you want to buy at a specific price, for example 0.001, you can place a [limit] order. When the market price reaches the price you set, the order you placed will be executed.

- The percentage listed below the BNB amount field refers to the amount of BTC you want to use to purchase BNB. Enter the amount and buy cryptocurrency.

Hodling (investing)

The purchase and long-term storage of assets with the expectation of further appreciation is called hodling. Theoretically, the Binance exchange can be used for this purpose, since it is classified as a custodial exchange and provides users with accounts for storing assets.

Experts, however, recommend choosing safer options for holding, such as hardware wallets.

If you do store investments on an exchange, then do not forget to secure your account in every possible way: enable two-factor authentication, come up with the most complex password possible. This will reduce the risk of hacking from the outside.

Trading on Binance: buying cryptocurrency

On the official website of the Binance exchange, you can buy the following cryptocurrencies using a VISA or master card credit card:

- BTC;

- XRP;

- ETH;

- LTC;

- BCH;

- BNB;

- DASH;

- EOS;

- TRX;

- XLM;

- NANO;

- ATOM;

- BUSD;

- TUSD;

- PAX;

- USDT.

The exchange takes place:

- Directly on the exchange.

- On a P2P platform.

- Through third party exchangers.

Including through the Simplex payment system, it is a reliable fintech company that provides payment processing worldwide. Simplex technology allows traders, marketplaces and crypto platforms to process online payments with full fraud protection and chargeback coverage.

The exchange accepts for payment:

- Rubles;

- American dollars;

- Ukrainian hryvnia;

- Turkish lira;

- Swedish crowns;

- Singapore dollars;

- Uruguayan pesos;

- Saudi riyals;

- Vietnamese dongs;

- Romanian lei;

- Thai baht.

As well as national money of the Republic of South Africa, Uganda and Taiwan. Partner companies and the P2P platform have a much wider choice of fiat currencies available for payment.

Working on Binance: mobile application

The trading platform has long had its own program for Android smartphones. The iPhone application was developed much later. Desktop versions of PC-Client are also available, running on Windows and Mac OS. All programs have a full set of tools for trading on the Binance exchange.

If you go to the crypto exchange as a job, we recommend downloading the Binance PC Client desktop application. When working through a browser, you risk ending up on a phishing site or missing out on a profitable deal due to insufficient request processing speed. This is excluded in the desktop program. The trader gets access to all sections of the platform and does not have to worry about the safety of personal funds.

Security is the main priority of the exchange administration. Users' money is protected by a special Security Asset Fund (SAFU). The desktop client has many convenient features. For example, you can receive alerts about changes in the rate of a trading pair you are interested in or set up regular purchases of cryptocurrency at a price you set. You can download the updated release at https://www.binance.cc/ru/download.

What other cryptocurrency can you invest in in 2022?

In addition to the coins discussed above, the following should be included in the promising category:

- Chainlink is a virtual coin ranked 21st in terms of capitalization with $9.4 billion. It is considered one of the best in terms of payback. Despite the temporary price reduction in December 2021, experts unanimously speak about the potential for next year.

- Cardano is one of the fastest blockchain assets in the cryptocurrency market. The platform focuses on smart contracts, decentralized applications and secure payments. At the end of 2021, cryptocurrency is in sixth place in terms of capitalization with $46 billion. ADA is fully compatible with other cryptocurrencies, has a low commission and high transaction speed. Has excellent chances of price growth.

- Teher is a cryptocurrency created on the basis of Ethereum, which is pegged to the dollar exchange rate. Essentially, it is a stablecoin that is invested in to preserve an investment portfolio during periods of high market volatility. In terms of capitalization, the coin is in fourth position with $75 billion.

- Polkadot is a relatively new project that has quickly gained popularity. It runs on open source code and allows you to transfer data via the blockchain. The DOT coin stands out for its good scalability, fast transactions, and ample opportunities for price growth. It ranks 10th in terms of capitalization ($28.4 billion).

- Dogecoin , a cryptocurrency that was created as a joke, has been in the TOP 20 best virtual coins for many years. It stands out for its simple transaction mechanism and low price.

For investing in 2022, you can choose other cryptocurrencies - EOS, TRON, Dash, Monero, etc. Each coin is individual in its own way, which requires a special approach.

Why trading on the Binance exchange for beginners is a great way to get acquainted with the crypto market

The main advantages of trading on Binance are:

- Lowest trading commissions.

- High liquidity.

- Fast execution of translations.

- Reliable protection system.

- A large number of trading pairs.

- Young tokens are often sold, from which you can get high profits.

- Russian language support

You can buy cryptocurrency for USD, but you cannot withdraw money from the exchange in dollars. But there are rubles, eurocurrencies and other fiat currency.

How to trade cryptocurrency on Binance: additional opportunities on the exchange

Binance provides traders with many additional earning opportunities. You can become a member of the affiliate program and receive income from each referral. Institutional clients can create a system of trading accounts with different levels of access to asset management based on the main account.

The Binance Launchpad service allows you to invest in young crypto projects that are conducting fundraising campaigns within this platform. Each verified user can apply to participate in the IEO of a new cryptocurrency in order to buy tokens at the starting price and then resell them at a higher price when the new cryptocurrency goes up for trading. All projects applying for participation in the IEO undergo a comprehensive review, which means you will definitely not invest your capital in an outright scam.

Binance Labs provides scholarships to promising blockchain startups, and Binance Charity is creating an open platform for donations to disadvantaged people. This allows people to see the benefits of innovative technology and become familiar with its use cases.

The trading platform is represented on eight social networks. If you analyze the reviews about Binance, you can sum it up. Binance is one of the leading exchanges with profitable and functional cryptocurrency trading. The project is not a scam, the site is supported by large businesses and the number of clients is growing all the time.

Pros and cons of investing in cryptocurrency

Today, there are more and more investors who are ready to invest in virtual coins. This is due to the following advantages:

- Small threshold for entry. To invest in cryptocurrencies, a few dollars are enough.

- Potentially high profitability. Due to high volatility, the price of cryptocurrency can increase by 30-60% within a year.

- Good liquidity. Cryptocurrency is easy to buy and sell due to high demand.

- Pandemic situation. The current problems with coronavirus have played into the hands of cryptocurrencies, which look more reliable than fiat money.

Investing in virtual tokens also has its risks:

- The likelihood of hacker attacks on exchanges with subsequent loss of funds.

- The risk of cryptocurrency being banned by one country or another.

- High volatility of cryptocurrency exchanges.

- Unpredictability of the exchange rate, which depends only on supply and demand.