On the question of how to make money on Olymp Trade, there are more secrets than successful traders. Moreover, even notorious beginners who are unable to understand the driving forces of trends supposedly possess them. As a result, the number of articles about making money and videos showing these same earnings is increasing on the Internet. But, having pretty much littered Internet portals with the same type of content about trading using the doubling system, no one has ever taught a Russian how to trade successfully. Of course, this publication will not turn the reader into a trader, but it will reveal the fundamental secret of options trading.

The main secret of options

When understanding the question of how to make money on Olymp Trade, you should not find secrets and universal recipes. You just need to understand that a successful strategy is based on a mathematically profitable idea, and therefore the doubling system, widely advertised by bloggers, will not be successful. Profit will come from tactics that provide at least a 70% probability of profit. And, of course, to build it, you need to learn to understand market processes and understand who is buying a given asset and who is selling.

Understanding who wins in this confrontation between sellers and buyers will allow you to look for good points to buy options. Of course, a beginner will be disappointed here, because it is impossible to make money on Olymp Trade from scratch. To make money, you need to be a balanced trader, and not a fool who hopes that mathematics will pull out all the money management instead of looking for competent entry points. This should be learned right now and remembered forever.

For successful training, a beginner should not be shy about merging demo accounts and first learn how to trade on Forex. This will provide valuable experience and, perhaps, distract you from binary options. Because in the trading tactics of a successful trader they are assigned only the role of instruments for hedging medium-term positions.

Trio

“TriO” is a strategy for OlympTrade, which is used when you need to find the most favorable points and enter the market in order to make money on a trend reversal. This is not easy to do, so you will have to use 3 oscillators RSI, Williams %R and CCI at once. With their help, you can receive the most accurate signals to buy or sell options.

First, you will need to select 3 oscillators in the “Technical Analysis” section and add them to the chart. Then you need to configure them. For RSI, you should select 7 candles, then the overbought and oversold levels will be at 30 and 70. On the Williams %R indicator, coordinates of -20 and -80 are set and levels are added. To do this, use the “Line” tool located in the console on the left. The coordinates on the CCI oscillator are 100 and -100.

Now you can start analyzing the data. It must be remembered that to open a contract, the signals from all oscillators must match. It is recommended to open a bullish trade when their lines return from the overbought zone, and to open a bullish trade when the price returns from the oversold zone.

Trading using an algorithmic strategy

One of the most reliable options trading strategies is algorithmic, which boils down to the formation of a set of rules on the basis of which an option is purchased. And the most competent tactic, but quite difficult to understand, is “Sniper 3.2”. More precisely, its adaptation should be applied to options with only one difference: instead of entering a trade, an option is bought after the appearance of a reversal level or exit from a cumulative flat. This is the only difference with the Sniper tactic used in Forex.

For such trading, it is better to use the M5-M15 time frame and set the option expiration period to at least 30 minutes. Minute charts, so widely advertised on the Internet, cannot be successfully used for trading, because they are the result of the activity of HFT robots. Therefore, it is not possible to predict high-frequency operations.

It is worth remembering that the rules are the main successful strategy, since it is impossible to trade on Olymp Trade and make a profit without an analysis algorithm. It is the rules that can eliminate psychological influence and will allow you to protect your deposit from yourself. And there are no secrets in this activity: you need to understand the instrument and see its participants by analyzing charts on large timeframes.

https://youtu.be/https://www.youtube.com/watch?v=AzBG9kf4n98

_

Reflection

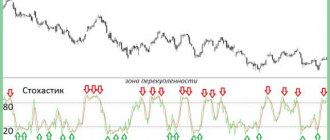

This strategy for Olymp Trade is suitable for experienced traders. Analysts advise using it when you want to trade against the current trend in anticipation of an imminent price reversal. The risk is high, so to obtain more accurate data, take into account 3 signals from the Slow Stochastic indicator, price levels and Japanese candlestick patterns. Working with them is difficult; first you will need to make a number of settings.

First of all, a time frame of 1 minute is set on the Japanese Candlestick chart. Then the Slow Stohastic oscillator is superimposed on it, and its parameter changes to 5. When the indicator appears under the chart, you will need to mark the levels of the overbought and oversold zones, creating 2 horizontal lines. Then the coordinates are set. For the top line - “80”, for the bottom - “20”.

Now you can move on to trading. You can enter the market when the value of an asset increases when the Slow Stohastic lines rise above 20 and the candles create a reversal pattern for an increase. The duration of the contract should be 4-5 minutes.

Downside options are purchased in a similar way. However, in this case, the Slow Stohastic lines should be below 80, and the candles should form a downward reversal pattern.

Overnight binary options strategy

Among algorithmic strategies, there are those that are based on the peculiarities of quote behavior at a certain point in time. For example, the pairs EURGBP, EURCHF, GBPJPY, NZDCHF, AUDCHF are in a narrow corridor at night and move between its boundaries. Due to the spread on Forex, it is impossible to make money at this time, but it is possible with options.

Perhaps this is the only opportunity to find an intelligible answer to the question of how to make money on Olymp Trade from scratch. The secrets of the strategy are as follows: after 22:00 Moscow time, on these instruments, presented in the form of candlestick charts, you should find a narrow corridor lasting more than 1.5 hours. Then you should determine its boundaries, marking them by maximums and minimums. The next step is to visually determine the channel configuration: almost straight, ascending or descending.

Technical analysis

For a novice trader, this section may seem confusing and complicated. But you need to master it, because thanks to it you can analyze the situation for the desired asset on a global scale, using a set of graphical and technical services. You will be able to analyze his past behavior and make a forecast for future movement.

Using technical analysis, you will have the opportunity to get a market picture for any asset in the desired time period, including in the long term. Also, thanks to it, you can improve your trading strategy and increase your level of profit over the long term.

Combined options trading

There is also a more reliable trading strategy, in which there is a huge amount of ambiguity for a beginner. And if the dear reader has stopped asking questions about whether it is possible to make money on Olymp Trade, how to make money with the doubling system, or has completely freed himself from the thought of instantly earning big money, then he may learn something useful.

This utility lies in the use of options as a hedging instrument for intraday Forex transactions. Their goal is to eliminate risk if the forecast for a transaction on the foreign exchange market does not come true. Then you should close the Forex transaction with the minimum possible profit and make a profit on the option opened in advance. The latter should open in the direction opposite to the currency transaction.

Perhaps this information will make it clear that in the question of how to make money on Olymp Trade, secrets mean nothing. All strategies have long been developed, because financial markets have been around for many years. And options developed long before Olymp Trade and the current supposedly super-traders who use doublings to make their earnings. Martingale is an unsuccessful tactic, but very profitable for a broker who receives income from client losses.

Volatility

If you look at the behavior of specific assets, you can come to the conclusion that it varies depending on the time of day. For example, it may move quietly in the first half of the day within a small range, but in the second half of the day there may be sharp fluctuations. These are indicators of volatility. It is very important that they are up to date. You can find them in a special analytical section.

Also here you will find a description of trading sessions and the most popular currency pairs, a list of assets with moderate and high volatility. An additional plus is separate trading recommendations for the most popular currency pairs.

In the “Volatility” section, a table of ranges in points is available. With its help, you will be able to select the most profitable currency pairs for trading by day of the week:

In the same section, charts for three main trading sessions are available:

- Asian – opening hours from 03:00 to 12:00 Moscow time;

- European - start of work from 09:00 to 18:00 Moscow time;

- American - work starts from 16:00 to 01:00 Moscow time.

Thanks to such charts, you will be able to track the start and end times of strong asset movements for each session and identify the timing of their quiet and calm dynamics, which will allow you to fully implement your trading strategy.

Disclaimer

The effectiveness and reliability of the strategies described above are also based on the expectation that the broker will fulfill its obligations absolutely honestly, that is, will withdraw the funds earned. However, this is not guaranteed due to offshore jurisdiction. The option of stopping payments for a specific reason is not excluded. A similar example can be recalled with the broker FOREX MMCIS group, bankruptcy, or, more precisely, betrayal of which no one expected. At the same time, financially, Olymp Trade is probably on stronger feet. But a broker can quickly go out of business due to possible changes in the legislation of offshore zone states.

MACD Professional

This tactic requires the use of 3 oscillators at once - MACD, Trend Line and Parabolic SAR. By combining them, you can conduct a qualitative analysis of the current trend, notice its reversal, recognize the movement, and the value of the asset. Thanks to the indicators, you can get 3 types of signals:

- Preliminary (inform about the best moments to buy contracts, notify about the appearance of the main signal).

- Reinforcing (confirms the appearance of the main signal).

- Basic (help determine the moment of opening the contract).

To use the “MACD Professional” strategy, you will need to set the MACD settings to 12, 26 and 9. Then, 3 preliminary signals are recorded on the chart - the general direction of the trend (“above” or “below”), an increase in the MACD histogram (above or below zero line) and the discrepancy between the histogram and the asset chart.

Analysts recommend paying attention to the Reinforcing Signal, which indicates the emergence of a trend. It is the 1st or 2nd Parabolic SAR point. They appear above or below the chart. However, you can purchase a contract when all 3 signals are visible on the chart. The MACD Professional tactic can be used exclusively for uptrends and downtrends.

How beginners can build a strategy on Olymp Trade

All professionals mainly use Japanese candles in their work. Candlesticks are a type of chart for trading analysis. You can determine a pattern from the candles and use this information to make the right bet. For beginners, it will be easier to use the Doji strategy. It is also based on candles.

This is a variation of charts when candles have a short body but long shadows:

Remember that before spending real money, it is better to practice on a demo account. Practice your skills and knowledge about charts. As you can see, there are a lot of Doji candles on the chart. What do they mean? Each candle indicates a price change in one direction. This price change in options trading is called a trend.

Look at the following chart, where you can see the upward trend in the euro/dollar pair. The euro is rising in value against the dollar.