Greetings, dear readers of the Tyulyagin project! In addition to such familiar company indicators as income, profit, expenses, there are a number of specialized financial indicators that investors need to make successful transactions and choose attractive shares in the stock market. One such indispensable fundamental analysis indicator is earnings per share or EPS . What is earnings per share, how is it calculated, what are the main types and nuances associated with the calculation of this indicator in today’s article.

Formula and calculation of earnings per share EPS

Earnings per share (EPS) is calculated as net income divided by the number of company shares available . A more precise calculation adjusts the numerator and denominator for shares that may be created through options, convertible notes, or warrants. The numerator of the equation can also be changed if it is adjusted for discontinued/continuing operations. But we’ll talk about more complex calculations and formulas later in the article, but now the simplest formula for calculating EPS:

Earnings per share (EPS) = (NP - Dp) / Weighted average ordinary shares

where: PE - net profit DP - dividends of preferred shares

To calculate a company's earnings per share (EPS), its balance sheet and income statement are used. They are necessary to determine the number of common shares at the end of the period, dividends paid on preferred shares (if any), and net income. For a more accurate calculation, you should use the weighted average number of ordinary shares for the reporting period, since the number of shares may change over time.

Any stock dividends or stock splits must be reflected in the calculation of the weighted average number of shares outstanding. Some data sources on popular financial sites simplify the calculation by using the number of shares outstanding at the end of the period.

Why do you need a net profit indicator?

In our country, it has long been customary to divide earnings into two types: “clean” and “dirty” money. The second type will be considered the official salary specified in the employment contract, and the first will be the amount that the specialist actually receives in person minus personal income tax and other contributions. This principle seems ambiguous, but it works with all financial business realities, including in our case.

Net profit is one of the key indicators indicating the success of a company. This is sales revenue and other income of the enterprise minus all expenses, including taxes. It is quite logical that any management wants to extract maximum benefit from the activities of their company. This result is needed both by owners and senior managers, and by ordinary specialists, because it is this indicator that most strongly affects the likelihood of issuing bonuses to staff.

Let us repeat that the size of this indicator is the most accurate evidence of the efficiency of the enterprise. If this amount increases compared to the previous period, we can talk about the high-quality work of the company, while its decrease indicates errors in the chosen management policy.

There are a number of people who use the net profit indicator for their needs, as well as a calculation formula with examples:

- Owners, shareholders.

The owner needs the data to understand how successful the company is and what results the chosen management system brings. In addition, this indicator is required when calculating dividends and the share of individuals as investors in the authorized capital. - Director.

The calculation formula allows this person to understand how stable the company is from a financial point of view, whether management decisions are being made correctly, and what new development strategies to introduce. This indicator directly affects profitability, so analysis of the balance of available funds plays an important role. - Suppliers.

The main question for them is whether the company is able to pay for raw materials. The indicator we are discussing allows us to answer it. If the company cannot boast of a high level of net profit, some suppliers will definitely not agree to sign the contract, fearing late payments. - Investors.

They evaluate the profitability of investing in an enterprise, so the higher the level of free income, the more attractive the company is from an investment point of view. After all, everyone, when investing money, strives to receive additional income from shares. - Creditors.

It is important for them to understand the solvency of the company. It is generally accepted that money has the highest liquidity. The more funds a company has after paying taxes and other charges, the faster it will pay off its debts. That is, this is a necessary condition for obtaining a loan from a bank.

There are several reasons for calculating net profit using the calculation formula:

- Profits from any business are distributed among all participants, but it is impossible to do this in the required shares without calculating using a formula.

- This indicator is calculated, for example, if it is necessary to calculate the amount of taxes payable for the reporting period.

- If a business suffers losses, it is important to know how much will have to be compensated.

- In this way, the results of business activities are assessed - this is required for further rationalization of processes, for example, reducing production costs.

- This is evidence of the profitability of sales and the effectiveness of the pricing policy chosen by the enterprise.

Thanks to the indicator under discussion, companies are able to develop their material base, invest in expanding production, improving technology and mastering the most modern methods in their work.

As a result, firms enter new markets, increase sales volumes, and therefore increase income. See also:

Automation of regulated and management accounting

Examples of calculating earnings per share EPS

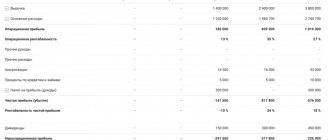

The earnings per share (EPS) calculation for the three companies at the end of 2020 is as follows:

| Company | Net profit | Dividends of preferred shares | Weighted ordinary shares | Basic EPS |

| NVIDIA | $4.33 billion | 0 | 0.617 | 4,33/0,617= 7.02$ |

| Apple | $57.411 billion | 0 | 17.344 billion | 57,411/17.344= 3.31$ |

| Tesla | $0.721 billion | 0 | 0.933 billion | 0,721/0.933= 0.77$ |

The essence of earnings per share (EPS) in simple words

Earnings per share (EPS) is one of the most important variables in determining a stock's price. It is also the main component used to calculate the price-to-earnings (P/E) ratio, where the E in P/E is earnings per share (EPS). By dividing a company's stock price by its earnings per share, an investor can see the stock's value in terms of what the market is willing to pay for each dollar of earnings.

EPS is one of many indicators you can use to select stocks. If you are interested in stock trading or investing, your next step is to choose a broker that suits your investment profile.

Comparing EPS in absolute terms doesn't mean much to investors because common shareholders don't have direct access to earnings. Instead, investors compare EPS to the share price to determine the amount of earnings and how investors generally feel about the future growth of the company and its stock.

THE PLACE OF PROFITABILITY INDICATORS IN THE FINANCIAL ANALYSIS OF AN ENTERPRISE

Profitability assessment is one of the areas of financial analysis of an enterprise.

The set of areas of financial analysis and the order of their implementation depend on the goals of the analysis. In any case, financial analysis is the calculation and analysis of a set of financial indicators (ratios), interpretation and preparation of conclusions about the financial condition of the company. There are different approaches to classifying areas of financial analysis, but most often financial indicators are calculated using the following blocks (Fig. 1).

Financial analysis can be carried out by both internal users (enterprise managers) and external users (creditors, investors, counterparties, etc.). This analysis is carried out on the basis of open financial statements.

The management of the enterprise evaluates the financial condition in order to identify key problems and find ways to solve them to improve the efficiency of the company and increase its value.

External users analyze the financial statements of a particular enterprise to compare its performance with standard or indicators of an alternative enterprise (for example, when choosing an investment object).

Financial analysis for each area can be carried out with a different set of indicators and varying degrees of detail. Thus, profitability analysis can be carried out for the entire enterprise in the context of various analytics: product or type of product, company division, region, etc.

Basic and diluted earnings per share

The formula used in the table and examples above calculates the underlying EPS of each of these three companies. Basic earnings per share do not take into account the dilutive effect of shares that the company may issue. When a company's capital structure includes elements such as stock options, warrants, and restricted stock units (RSUs), these investments, if exercised, can increase the total number of shares outstanding in the market.

To better illustrate the impact of additional securities on EPS, companies also report diluted earnings per share (diluted EPS), which assumes that all shares that could have been outstanding have already been issued.

For example, the total number of shares that can be created and issued using NVIDIA convertible instruments at the end of 2020 was 10 million. If this number is added to the total number of shares outstanding, its diluted weighted average number of shares outstanding is 617 million + 10 million = 627 million shares. Thus, the company's diluted earnings per share at the end of 2022 were $4.33 billion / 627 million = $4.90.

Sometimes an adjustment to the numerator is required when calculating fully diluted earnings per share. For example, sometimes a lender will provide a loan that allows them to convert debt into equity under certain conditions. The shares that would be created by the convertible debt must be included in the denominator of the diluted EPS calculation, but if that were to happen, the company would not pay interest on the debt. In this case, the company or financial analyst will add the interest paid on the convertible debt back into the numerator of the EPS calculation so that the result is not skewed.

D/E Ratio

D/E Ratio – a ratio indicating the ratio of borrowed funds to equity. Talks about the financial risks associated with the company. In English, debt to equity, which is where the letters in the name come from.

Coefficient formula:

D/E Ratio = Company Debt / Equity

The higher the value of this multiplier, the greater the chance that the company may encounter financial difficulties and, in the worst case scenario, default.

In fact, not only businesses, but also private traders in the securities market who use leveraged lending to buy shares can be valued in much the same way. And you can even calculate the coefficient: divide the borrowed funds by your own money in the account.

EPS, excluding results of extraordinary circumstances

EPS can be distorted, either intentionally or unintentionally, by several factors. Analysts use variations on the basic EPS formula to avoid the most common ways of inflating EPS.

Imagine a company that owns two factories for the production of smartphone screens. The land on which one of the factories is located has become very expensive as new startups have surrounded it over the past few years. The company's management decides to sell the plant and build another one on less expensive land. This deal brings a windfall to the firm.

Although this sale of land resulted in an actual profit for the company and its shareholders, it is considered a “result of extraordinary circumstances” since there is no reason to believe that the company will be able to repeat this transaction in the future. Shareholders may be misled if windfalls are included in the numerator of the EPS equation, so they are excluded for a more accurate estimate.

A similar argument could be made if a company were to suffer an unexpected loss (such as a factory burning down) that would temporarily reduce earnings per share, that loss should be excluded from the calculation for the same reason. Calculation of earnings per share without taking into account the results of extraordinary circumstances:

EPS = (NP - DP ± RPO) / Weighted average ordinary shares

where: PE - net profit DP - dividends of preferred shares RCHO - results of emergency circumstances

EPS from continuing/discontinued operations

Let's imagine that the company started the year with 600 stores and had EPS of $6. However, let's say that this company closed 100 stores during this period and ended the year with 500 stores. A financial analyst will want to know what the earnings per share were for just the 500 stores the company plans to open in the next period.

In this example, it could have increased earnings per share because the 100 closed stores may have been operating at a loss. By estimating earnings per share from continuing operations, the analyst can better compare past performance with current performance.

Calculation of earnings per share (EPS) from continuing/discontinued operations:

EPS = (NH-Dp ± RChO ± PD) / Weighted average ordinary shares

where: PE - net profit DP - dividends of preferred shares RCHO - results of emergency circumstances PD - discontinued/continuing operations

Earnings per share and equity

An important aspect of earnings per share that is often ignored in calculations is the capital required to generate earnings (net income). Two companies may generate the same earnings per share, but one may do so with fewer net assets; this company will use its capital more efficiently to generate income and, all other things being equal, will be a “better” company for the investor in terms of efficiency. A metric that can be used to identify better performing companies is return on equity (ROE).

How can profitability be increased?

If we see negative dynamics in profitability, then it is necessary to take measures to prevent a loss or get out of it.

There are two key indicators that determine profitability. This is the level of markup and the intensity of asset turnover of the enterprise. Unfortunately, there is no universal recipe for a profitable business: it is impossible to rely on either a high markup or a high turnover. Each of these indicators can “let you down” and deprive you of the expected profit. An entrepreneur has to analyze the situation of his own business and develop a management strategy. He can increase the markup while maintaining turnover, or lower the markup, but at the same time increase turnover and make more profit. Another option is to divide the business into several segments and in one segment rely on margins, and in the other on turnover. This is how we try to increase the number of kopecks of profit per ruble of sales.

Another way to influence profits is to reduce and plan expenses. By reducing expenses in core activities, we reduce production costs and reduce the burden on gross profit. By reducing operating costs, we increase sales profits.

Earnings per share and dividends

Although earnings per share are widely used to track a company's performance, shareholders do not have direct access to these earnings. Some of the profits may be distributed as dividends, but all or part of the earnings per share may be retained by the company. Shareholders, through their representatives on the board of directors, must change the percentage of earnings per share that is distributed through dividends in order to gain access to a larger portion of those earnings.

Because shareholders cannot access the EPS associated with their shares, it can be difficult to determine the relationship between EPS and the share price. This is especially difficult for companies that do not pay dividends. For example, technology companies often disclose in their prospectuses and initial public offering (IPO) documents that the company does not pay dividends and has no plans to do so in the future. At first glance, it's difficult to explain why these shares have any value to shareholders.

The actual par value of EPS also has a relatively indirect relationship with the share price. For example, the EPS for two stocks may be the same, but the stock prices may be very different. For example, in October 2022, Southwestern Energy Company (SWN) earned $1.06 per share in diluted earnings from continuing operations at a share price of $5.56. However, Mellanox Technologies (MLNX) had earnings per share of $1.02 from continuing operations with a share price of $70.58.

At first glance, SWN appears to be the better deal because the investor is paying only $5.25 per dollar of earnings ($5.56 share price / $1.06 per share = $5.25). Investors in MLNX are paying $69.20 per dollar of earnings ($70.58 per share / $1.02 per share = $69.20). This ratio is also known as the ratio or price/earnings ratio (P/E).

While the comparison between MLNX and SWN is extreme, it is generally difficult for investors to compare EPS and share prices between industry groups. Stocks that are expected to grow (e.g., technology, retail, industrials) will have a higher price-to-EPS (P/E) ratio than those that are not expected to grow (e.g., utilities, consumer staples).

EFFECTIVENESS OF MARKETING ACTIONS

By marketing promotion we mean a fixed percentage discount on a group of products.

In our opinion, the goal of a marketing campaign is one - to increase profits, and there may be several reasons for its implementation:

- sale of illiquid goods. A good example is sales of old collections by clothing stores. The sale is needed to free up part of the sales floor for a new collection and not write off old goods;

- reduction of losses. An example is discounts on goods with a low remaining shelf life in grocery chains. If we accept the fact that the trade margin on a product is on average 25%, then the loss of one unit at cost is equal to the marginal profit received from four units of the product. Therefore, selling part of a product for which there is a high risk of loss at cost may be a more profitable solution than maintaining a regular price for it;

- increase in sales. This type of promotion means that we have no problems with promotional items. By launching a promotion, we want to increase sales and make additional profits.

Let's dwell on the last point and consider the option of providing a discount on the entire range. For example, let's take the following conditions:

- product price without discount - 1000 rubles;

- sales - 1000 pcs.;

- variable costs - 80% of the price;

- discount - 15%.

Revenue:

- before the promotion:

1000 rub. × 1000 pcs. = 1 million rubles;

- during the promotion period:

1000 rub. × (100% – 15%) × 1000 pcs. + (100% + sales increase in units/%).

In order for revenue during the promotion period to be no less than before the promotion, you need to ensure an increase of 17.6% of sales in units:

1000 rub. × (100% – 15%) × 1000 pcs. × (100% + increase in sales in units/%) = 1 million rubles.

1000 pcs. × (100% + increase in sales in units/%) = 1 million rubles. / 850

100% + increase in sales in units/% = 1000 / 850

Increase in sales in units ≈ 17,6 %.

Let's consider what increase in sales in units is necessary for the promotion to pay off in terms of marginal profit.

Marginal profit:

- before the promotion:

(1000 rub. – 800 rub.) × 1000 pcs. = 200 thousand rubles;

- during the promotion period:

(1000 rub. × (100% – 15%) – 800 rub.) × 1000 pcs. (100% + increase in sales in units/%).

Let us equate to the marginal profit before the promotion, simplifying the left side of the equation:

50 rub. × 1000 pcs. (100% + increase in sales in units/%) = 200 thousand rubles.

100% + increase in sales in units/% = 4

Increase in sales in units/% = 3 units. = 300%.

Figure 1 shows the relationship between the increase in sales in units and the increase in revenue and marginal profit as a percentage for a given discount amount and the share of variable costs in the original price.

Let's compare how the break-even point of a stock changes with changing parameters of the discount percentage and margin (Fig. 2). Calculations for other discount parameters and the share of variable costs in the price are similar to the calculations given above.

As can be seen in Fig. 2, when the share of variable costs in the price changes from 80 to 50% and a discount of 15%, the promotion becomes profitable with an increase in sales in units from 40 to 50%.

With a similar share of variable costs and an increase in the depth of the discount to 30%, an increase in sales in units is required by 150%, or 2.5 times.

Conclusion: the higher the share of variable costs in the price, the greater the increase in sales in units required to pay off the promotion. From this point of view, this mechanic is more suitable for the service industry, where the share of variable costs is lower than for a business with a high share of product costs.

An important point: when analyzing stock performance, two additional points must be taken into account:

- Attraction of new clients;

- purchase of related products.

EPS and Price Earnings P/E Ratio

Comparing P/E ratios within an industry group can be helpful. Stocks that are expensive in terms of their EPS compared to similar stocks in the market, and the opposite will also be true. Investors are willing to pay more for a stock, regardless of its historical EPS, if it is expected to grow or outperform its peers. In a bull market, it is not unusual for stocks with high P/E ratios in a stock index to outperform the average of other stocks in the index.

PROFITABILITY INDICATORS AS AN OBJECT OF TAX CONTROL

The Federal Tax Service of Russia systematically analyzes the profitability indicators of enterprises. The fact is that domestic tax authorities use a risk-based approach to carry out tax control activities, in particular, on-site tax audits. This means that on-site tax audits are carried out when financial and tax reporting data indicate possible violations.

One of the criteria that the tax service analyzes is the profitability of enterprises according to two documents - the Balance Sheet and the Statement of Financial Results. If the company's profitability according to its financial statements differs significantly from the industry average, this increases the risk of a fiscal audit.

Considering the above, it is advisable for enterprises to:

- know the methodology for calculating profitability indicators used by the Russian tax authorities;

- annually calculate the level of profitability and compare it with industry average values to assess tax risks and reduce them.

Tax authorities calculate two profitability indicators:

- profitability of goods, products (works, services) sold;

- return on assets.

The methodology used by the tax service for calculating these indicators differs from the generally accepted one.

Profitability of goods, products (works, services) sold

The profitability of goods sold, products (works, services) (hereinafter referred to as product profitability) is the ratio of profit from the sale of goods (products, works, services) and the cost of goods sold (products, works, services), taking into account commercial and administrative expenses. The calculation formula looks like this:

Rpr = OP / (Sp + KR + UR),

where Rpr is the profitability of products;

OP - operating profit (line 2200 f. 2);

Sp - cost of sales (line 2120 f. 2);

KR - commercial expenses (line 2210 f. 2);

UR - administrative expenses (line 2210 f. 2).

Return on assets

Return on assets is calculated as the ratio of profit from the sale of goods (products, works, services) and the value of the enterprise's assets in an average annual value. For calculation use the following formula:

RA = OP / ((Ana beginning of period + Ana end of period) / 2),

where RA is return on assets;

OP - operating profit (line 2200 f. 2);

A - assets (line 1600 f. 1).

Every year, updated industry average values of profitability indicators for the previous year are published on the official website of the Federal Tax Service of Russia. As an example, we present sample data for 2022 (Table 4).

| Table 4. Industry average values of profitability indicators for 2022 (selected) | ||

| Type of economic activity (according to OKVED-2) | Profitability of sold goods, products (works, services), % | Return on assets, % |

| Total | 9,9 | 4,5 |

| agriculture, forestry, hunting, fishing and fish farming | 22,9 | 8,5 |

| crop and livestock farming, hunting and provision of related services in these areas | 20,8 | 7,8 |

| fishing and fish farming | 52,2 | 15,6 |

| mining | 23,0 | 8,3 |

| production of crude oil and natural gas | 19,8 | 9,6 |

| metal ore mining | 81,4 | 27,9 |

| mining of other minerals | 32,8 | 6,6 |

| manufacturing industries | 12,2 | 5,8 |

| food production | 9,5 | 8,7 |

EXAMPLE 3

Let’s compare the group’s profitability indicators with industry averages (Table 5) and assess tax risks, taking into account that the company’s type of economic activity is food production.

| Table 5. Comparison of profitability indicators with industry averages | ||||

| Index | Line code | Enterprise data | Industry average | Deviation |

| Product profitability (Ррр), % | 10,0 | 9,5 | 0,5 | |

| Profit (loss) from sales, rub. | 2200 | 26 342 | X | X |

| Cost of sales, rub. | 2120 | 253 330 | X | X |

| Selling expenses, rub. | 2210 | 9994 | X | X |

| Administrative expenses, rub. | 2220 | 1182 | X | X |

| Return on assets (RA), % | 23,2 | 8,7 | 14,5 | |

| Profit (loss) from sales, rub. | 2200 | 26 342 | X | X |

| Assets at the beginning of the period, rub. | 1600 | 168 800 | X | X |

| Assets at the end of the period, rub. | 1600 | 58 108 | X | X |

According to the data in Table. 5 product profitability and return on assets of the group of companies under consideration are above industry averages. This means that it has no tax risks, since risks arise if profitability indicators are 10% or more below the industry average.

Summary

What Earnings Per Share (EPS) is "good"?

What is considered "good" earnings per share (EPS) will depend on factors such as the company's recent performance, the performance of its competitors, and the expectations of the analysts who follow the stock. A company may report earnings per share growth, but shares may fall in price if analysts were expecting higher earnings. Likewise, a reduction in EPS could lead to higher prices if analysts were expecting an even worse result. It's important to always evaluate EPS relative to the company's share price, such as the company's price-to-earnings (P/E) ratio or earnings yield.

What is the difference between basic earnings per share and diluted earnings per share?

Analysts sometimes make a distinction between "core" and "diluted" EPS. Basic earnings per share consists of a company's net income divided by the number of shares it has outstanding. This is the number most often reported in the financial media, and it is also the simplest definition of EPS. On the other hand, diluted earnings per share will always be equal to or lower than basic earnings per share because it includes a broader definition of a company's outstanding shares. In particular, diluted earnings per share includes shares that are not currently outstanding but may become issued if stock options and other convertible securities are exercised.

What is the difference between earnings per share and adjusted earnings per share?

Adjusted EPS is a type of calculation of net earnings per share in which the financial analyst adjusts the numerator. Typically, this consists of adding or removing components of net income that are considered non-recurring. For example, if a company's net income was increased based on a one-time sale of a building, the analyst could subtract the proceeds from that sale, thereby reducing the net income. In this scenario, adjusted earnings per share would be lower than core earnings per share.

- Earnings per share (EPS) is a company's net income divided by the number of common shares outstanding.

- EPS shows how much money a company makes per share and is a widely used metric for assessing corporate value.

- A higher EPS indicates greater value, as investors will pay more for a company's shares if they think the company has higher earnings relative to its share price.

- EPS can be obtained in several forms, such as the exclusion of extraordinary circumstances or discontinued operations, or diluted EPS.

And that's all about earnings per share (EPS) for today. I hope the article was useful to you. Successful investments and see you again on the pages of the Tyulyagin !

What specific terms should you know to use IFRS 33 correctly?

To use IFRS 33 , it is necessary to know and understand some specific terms.

In practice, most problems with understanding arise around the definitions of “potential ordinary shares”, “dilution”, “anti-dilution”.

Thus, firms applying the rules and requirements of the standard under consideration should keep in mind that along with ordinary shares there may also be potential ordinary shares. This term refers to contracts or financial instruments that give the holder the right to later acquire ownership of common tradable shares.

The next problematic issue is related to dilution. As paragraph 5B of the standard explains, dilution is the possible maximum reduction in the profitability of each share as a result of:

- conversion of all convertible securities;

- that additional shares of the company were issued upon the fulfillment of specified conditions.

The opposite phenomenon is called anti-dilution. That is, this is a situation where the profit of each of the shares of the enterprise increases as a result of the same circumstances listed above.