01/27/2020 Updated: 12/30/2021

Almost all standard indicators that are available in trading terminals were developed back in the 70s and 80s. At that time, computer chart analysis did not yet exist. Candlesticks were drawn by traders themselves.

- Briefly about the tool

- Changing indicator parameters

- How to change the indicator period

- Checking the effectiveness of signals

Of course, under such conditions it was possible to accurately draw only daily and weekly charts. Therefore, indicators were developed only for daily and weekly charts. The RSI we will talk about today is no exception. The standard period is 14. However, this is the optimal setting for the daily chart.

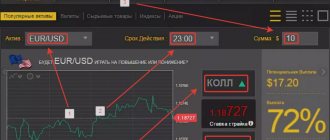

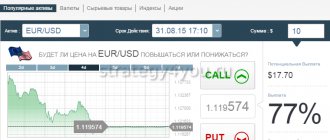

Binary options are a faster trading option than others. Almost no one trades here on the daily chart. But short-term TFs are in great demand. Therefore, today we will tell you how to set up RSI for 5 minutes.

RSI indicator settings

RSI has the following standard settings:

Standard period: 14 The period is the number of last candles (bars) on which the RSI line will be constructed. The larger this value, the more accurate the RSI, but it also takes longer to react to changes. If you shorten the period, the RSI line will react faster to price changes, but there will also be more false signals. I suggest you take a look at the difference in RSI settings:

The first window with the indicator (blue) has standard settings (14), the second window (green) with a reduced period (5), the third window (red) with an increased period (20). As you can see, when you set a larger period, the RSI line becomes smoother, while for RSI with a small period, the line jumps across the entire scale. In addition, you should also pay attention to the “Levels” tab:

To work with standard settings, the following levels are important: 30, 50 and 70. Depending on the change in the RSI period, it makes sense to additionally use the levels 80 and 20, or 90 and 10.

Briefly about the tool

First, let's remember what this instrument is and what it is used for by traders. The relative strength index shows the ratio of upward and downward candles over a certain period of time.

The default value is 14, that is, the tool takes into account the last 14 candles when drawing a line. Let’s say that bullish and bearish candles moved approximately 100 points each during this period. This means that the line will be approximately at level 50. And the greater the difference between the bars, the further the oscillator line will go to one side.

RSI gives several entry signals. And we will also consider them, but after we adjust the RSI for 5 minutes.

Subscribe

New telegram channel to help the novice trader! All the most useful things - every day!

Telegram

Application of the RSI indicator

RSI is a multifunctional indicator. It will show you a lot if you understand it correctly. And now we will analyze all the aspects and put everything in order.

Overbought and oversold

Most of the time, the RSI indicator is in a “calm” state - the indicator line is between levels 30 and 70. But during strong trends, the line breaks through these levels. It is these moments that interest us. A trend cannot last forever; there will still be rollbacks, corrections and price reversals. RSI will show us the most likely points at which the trend is most likely to fizzle out - a reversal or rollback will occur. The range below the level of 30 and the range above the level of 70 is precisely the price reversal zone. The RSI line itself indicates a weakening trend: the closer this line is to the value “0”, the weaker the downward trend (downtrend), and the closer this line is to the value “100”, the weaker the upward trend (uptrend). The area above the 70 level is called the overbought zone, and the area below the 30 level is called the overbought zone.

It is in these zones that a trend reversal most often occurs.

Here it is worth paying special attention to the price movement itself. Let's take the following example:

In this case, an uptrend is represented. Please note that after the RSI indicator line entered the overbought zone (the zone above the “70” level), there were pullbacks, but not price reversals - the trend continued later. The thing is that a trend consists of impulses (hence the wave-like price movement). The impulse cannot last forever, and a rollback is a way to gain strength before the next jerk (impulse). RSI shows us the moments when these pullbacks are most likely to occur, but a rollback may not always lead to a change in trend. This needs to be understood! In addition, the stronger and longer the trend, the less often the RSI line will fall into overbought or oversold zones.

RSI trading strategy

Step One: Find the currency pair that is showing a high in the last 50 candles. (OR minimum, depending on trade)

The 80-20 trading strategy can be used on any period. This is due to the fact that trend reversals occur in each period. This could be swing trading, day trading or scalping. As long as it follows the rules, it is a correct trade. At this stage we only need to make sure that this is the minimum or maximum of the last 50 candles.

Below is an example:

Note** We will use the same example to explain this strategy. This is the USDCHF currency pair and this will be a buy trade.

Once we determine this minimum or maximum, we can move on to the next step. Vertical lines are drawn on the price chart so that you can see the minimum 50 candle that has been identified. If you need to use horizontal lines on the chart to make sure that the candle closed at the lowest level of the last 50, you can do so. This is not necessary, but can be helpful for you to see how strong the trend is.

Step two Using the RSI trading indicator:

When we find a low at the 50 candle, it needs to be combined with an RSI reading of 20 or lower. (If it is high, it should be combined with an RSI reading of 80 or higher). Below we see the readings that reached the 20 line on the RSI and were the low of the last 50 candles.

Once we see that we have had a low in the last 50 candles and the RSI is BELOW 20, we can move on to the next step. Remember that this strategy is a reversal strategy. It involves breaking the current trend and moving in the other direction.

Step 3: Wait for the second price (low) candle after the first one, which we have already identified, to close.

The second price low must be lower than the first low. In this case, the RSI trading indicator should give a higher signal than the first one. Remember that divergence can be seen by comparing the price movement and the indicator movement. If the price makes higher highs, the oscillator should also make higher highs. If price makes lower lows, the oscillator should also make lower lows. If this is not the case, then the price and the oscillator are at odds with each other. That's why it's called "divergence."

At the end of the description you can download the RSI indicator, which automatically detects divergence.

Just because you see a bullish or bearish divergence does not mean you should automatically enter a position. We have rules that will allow you to use this divergence to make significant profits. Keep in mind that this stage may take time to develop. It is very important to wait for the second low because this will put you in a better trading position.

It sounds a little complicated, but think of it this way:

The price is going down/RSI is going up. This is divergence. Remember that our example is a current downtrend that is looking to break out to the upside. If it were a maximum of 50 candles, we would have observed exactly the opposite result. With that said, let's look at our chart.

Once this criterion is met, we can begin searching for an entry. This is because the charts are showing us that a reversal is coming soon.

Step four: how to enter a trade using the RSI trading strategy.

The method of entering a trade is very simple. You wait for price to move in the direction of the trade and wait for the candle to close above the first candle you identified, which was previously the low of the 50 candle.

If you have difficulty with this step, save the photo for reference. This will help you navigate your search for a deal.

Determining the trend using the RSI indicator

RSI is capable of determining not only moments of price reversal, but also the current trend. If the RSI indicator line is higher than the “50” level, then there is an upward trend, if below the “50” level, then there is a downward trend. The “50” level itself is partly a support and resistance level - very often you can notice that having reached this value, the RSI line reverses, because the price also turned around.

The direction of the RSI indicator line itself indicates what kind of movement is taking place in the market in a given period of time: the line is directed upward - the price is increasing, the line is directed down - the price of the asset is decreasing.

Calculation

The indicator is calculated based on the price change of the current trading day compared to the previous one.

If today the quotes of an asset close higher than yesterday, the day is called an up day. In case of reverse dynamics, the trading session is considered to be downward. The sum of the values of ascending days for the selected period is smoothed using an exponential moving average. A similar operation is performed with descending days.

Based on this data, Relative Strength is calculated - an indicator of relative strength. It is a fraction where the numerator is the sum of the values of the ascending days, smoothed using a modified moving average, and the denominator is the same indicator for the descending days.

The main indicator is calculated using RS:

RSI = 100 - 100 / (1 + RS).

If the price has been constantly growing over the selected period, it is possible that the denominator in this formula will be equal to 0. In this case, it is recommended to take the RSI value as 100.

Convergence and divergence

The RSI indicator is also capable of determining convergence and divergence. The principle is the same as that of the MACD indicator. Convergence (convergence) on the RSI indicator looks like this:

As can be seen on the chart, there is a downward trend (each new depression is lower than the previous one), but the RSI speaks of growth - a clear sign of a change in the trend to an upward one, which subsequently happened. Divergence (divergence) is also a sign of an imminent trend change, but already a change from an upward trend to a downward one. On the chart, the divergence looks like this:

As can be seen on the chart, there is an upward trend (each new peak is higher than the previous one), but in the RSI window the new peak is lower than the previous one - a clear sign of a change in the trend to the opposite (downward), which subsequently happened.

Search for technical analysis patterns

The use of elements of graphical technical analysis on the RSI indicator curve is a rather rare technique, but, nevertheless, Wallace Wilder also pointed out the possibility of this. Often these patterns will be visible on the indicator, but they will not be on the price chart, thereby we can receive a kind of leading signal to enter the market. You can consider opening trades either at the moment of the formation of “shoulder” on the Index values or when the neck line is broken.

In the presented example on the EUR/USD currency pair, we see a clearly formed “head and shoulders” model, and there are no high-quality models on the price chart. After breaking through the neckline, the pair’s quotes continue to move downwards. As can be seen from the example, the model worked very well.

As practice shows, such signals are processed strongly. However, at the moment, traders rarely use such models in their work due to the complexity of the search. To a greater extent, the quality of determining such models is based on the trader’s experience, which is acquired only as a result of practical trading.

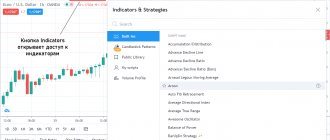

Using the RSI indicator in combination with other indicators

The RSI indicator is very “friendly” to many other indicators and works well in conjunction with them. As a rule, RSI plays an auxiliary role - the role of a signal filter.

RSI and Bollinger Bands

As you can see, the RSI and Bollinger Bands indicators perfectly complement each other and allow you to determine the most likely price reversal points.

RSI and Stochastic

When combining the RSI and Stochastic indicators, the RSI acts as a serious filter, allowing you to pay attention only to the strongest signals.

Overbought and oversold areas

When the RSI shows extremely high or extremely low values (above 70 or below 30), the price is considered oversold or overbought.

High RSI values simply mean that there were more bullish candles than bearish ones. While price cannot continue to move on bullish candles alone, it is dangerous to believe that just because the RSI is overbought, the market can reverse.

Let's look at some examples.

- The first area shows the period during which the price continued to fall for 16 days before the RSI turned above 30 and left the oversold area. And yet there was no reversal. A trader who buys one only because the RSI shows oversold conditions suffers a loss.

- During the second period, the price continued to fall for 8 days when the RSI was oversold, and even after that the price did not rise.

Advantages and disadvantages of the RSI indicator

RSI is a very useful tool in a trader's arsenal. It is easy to understand, multifunctional and works great in conjunction with other indicators. But in most cases, the RSI indicator is an auxiliary indicator - a filter of incoming signals. On the other hand, RSI copes excellently with its function of filtering out false signals. In addition, it is a classic indicator, which means that it can be found and used on trading platforms of the following binary options brokers: Binomo, ExpertOption, FinMax, Olymp Trade. The disadvantages include redrawing on a developing bar - a standard drawback of most indicators.

Trading with high jumps

The market often becomes highly volatile at times of serious impacts on it. Breaking news or large cash injections cause the price to pick up speed. But not all bidders agree to this. As a result of counteraction, price hikes begin. The RSI will help you trade these races. In the indicator settings, you need to change the periods to 95 and 5. Such wide values will help filter out unnecessary fluctuations. A buy deal opens only after reaching level 95. A sell deal opens after level 5. Everything is extremely simple. Only high volume jumps will determine these levels.

You need to work on a chart with a time frame from 1 minute to 10. The expiration time is 3–15 candles. You can trade this strategy not only in a trend, but also in a flat.

The analytical tool discussed today is an effective and reliable solution for use with a medium or fast trend. But it can be used in flat movement. To do this you need to use channel lines. Trading based solely on the readings of this indicator is not recommended. You need to select several tools to confirm the received signals. And don't forget that RSI is based on a mathematical calculation. This means that the algorithm it uses is lagging and may show market noise. But all these shortcomings are noticeable only to novice traders.

We recommend a thorough study of the analyzer and the nuances of trading with it, along with the study of graphical models. As a result, the trader will receive several tools and will be able to create a working and effective strategy based on them. We also recommend frequently using the RSI indicator for binary options as a divergence search tool. Having learned to find them on the chart, you will receive an additional strategy with a high probability of signal processing and a positive outcome.