Author:

Alexander Borskikh

Among the large number of different technical analysis patterns on the Forex market, there are some that are not very popular, but still work great. Some traders are surprised to hear the name Cup and Handle, but when they look at the chart and the designated pattern, they immediately realize that they have definitely seen this before. In principle, this is not surprising, because they usually know well what is common. The shape of this pattern is quite specific, but this makes it relatively easy to identify.

You can sign up for the Sniper for Beginners course here

Logic of pattern formation Cup with handle

In 1988, the principles of the formation of this model were described by William J. O'Neill. In the book “How to Make Money in Stocks,” he gave examples and described the rules for trading designs. Also, the theory and practice of working with the cup & handle pattern was described in Investor's Business Daily.

The Cup with Handle pattern is formed according to the following logic:

- During the upward movement, the bulls cannot push through the next resistance level, and a correction begins. It is undesirable for there to be impulses during the pullback; a moderate downward movement should be observed;

- according to the basic rules, the base of the cup should form around the correction levels of 38.2% -50.0%. In modified models, a deeper rollback is allowed up to 70-80%. In the event of a deep correction after entering the market, the position is transferred to breakeven as soon as possible, the probability of the trend continuing is lower, it is better to hedge your bets;

- when shaping the handle, the correction should be no deeper than 50% of the size of the main part of the cup.

When working out cup & handle, a breakdown of the resistance level occurs with an impulse. This is followed by a rollback, testing the broken level and development of an upward movement.

When forming a cup with handle pattern, there are a number of tolerances:

- The 1st and 2nd points (cup maxima) may not be at the same level. If a long shadow is formed when the first point of the pattern is formed, then a zone can be constructed instead of a level. The second point can form when touching the border of this price range;

- Pulse movements are allowed when forming the body of the cup and handle. To increase reliability, the lot size is reduced when concluding a transaction.

cup and handle pattern

Above is an example of the formation of a bullish cup and handle pattern on the Tape stock chart. So far, the model meets all the requirements, there is a possibility that in the coming weeks it will be tested and the company’s shares will begin to rise in price.

Pay attention to the timing of the formation of the Cup with Handle figure. O'Neill said that the formation of structures of this type takes from one month to a year . In the case of Lenta, the formation of the pattern began at the end of July, and the development will most likely take place in November-December. It has already taken about 3 months to form a cup & handle on the daily timeframe and there is still no progress.

Patterns of this type also appear on intraday time frames. Even on H1 you can find these formations, they also work, but the reliability is lower compared to higher timeframes.

At W1-W2, the formation of the HR takes about 2-3 weeks, but at such time intervals ideal patterns appear very rarely. The model itself often turns out to be deformed, without a clearly defined base with visible distortions of the cup walls. Volume requirements may not be met.

Such patterns can be traded, but it is advisable to reduce the risk. The probability of working out is lower compared to higher timeframes.

I also recommend reading:

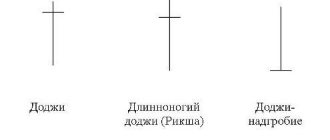

Doji Candle in Trading - Review

Typically, candlestick patterns imply some direction of movement. This could be a reversal or, conversely, a prerequisite for continuation of the previous direction. […]

Avoid deep bottom

Try to limit your choice of “bowls”

no more than 30% or 33% deep, excluding those formed during a bear market. In such a situation, in exceptional cases, growth stocks can fall by 40%, 50% or more and still make a successful breakout.

However, less is more. This shows that big hands are catching the stock.

Notice that the volumes along the lows of the bottom of the bowl have dried up. Also, the volumes should be small in the “handle”.

Narrower pricing behavior is better. This is true for almost all technical bottom patterns. A loose, choppy bottom indicates that the stock has a long way to go to find a price bottom. If institutional investors hold on to a stock, the stock price won't fall too low.

Inverted Cup with Handle

This pattern was not used by the author of a regular cup with a handle; it was added later when the model migrated from the stock market to Forex and began to be used in trading everywhere. Compared to the regular bullish Cup with handle, the inverted CHR is much less common.

The formation rules are mirrored in relation to the bullish pattern. That is, you need a confident downward trend, a smooth upward correction, an unsuccessful attempt to continue the bearish trend, and a breakdown of support after the formation of the handle.

This trend continuation model is used mainly in Forex, the cryptocurrency market and when working with CFDs on commodity market instruments. When working with stocks and stock indices, the inverted NHR is practically not used.

inverted cup with handle

How to trade Cup with handle?

The beginning of the development of the Cup with Handle pattern is considered to be the moment when the chart breaks through the resistance and becomes attached to it.

Depending on your trading style, two types of entry points are possible:

- pending order Buy Stop (Sell Stop for inverted NHR). The good thing about this method is that the trader is guaranteed to be in the market if the trend continues. A pending order is placed several points beyond the extremum, and a stop loss is placed below the handle level. The disadvantage of this approach is that if the pattern does not work out and there is no confirmation of the breakout, the trader will still receive a loss;

- according to the market after a retest of the broken resistance. After the breakout, you need to wait for a rollback to the broken level and, after a retest, open a deal. Candlestick patterns are used as additional filters. This is a more conservative trading scheme; in case of sudden movements after the NSR has been worked out, an entry point of this type is not formed. Below is an example of working out the NIR on NIO Inc. shares; after a retest of the broken resistance, a pin bar was formed, which strengthens the Cup and Handle pattern.

Take profit is always equal to the height of the cup. The distance in points from its maximum to the bottom is measured and then it is plotted from the breakout point in the direction of the trend.

The work must be confident. If, after breaking through the NSR level, the chart moves in the corridor, it is better to close trades manually or at least move the stop to breakeven.

It is also recommended to evaluate the ratio of stop and take profit when entering the market. If the risk exceeds the potential earnings, the advisability of trading is questionable.

I also recommend reading:

Broker Roboforex - full review + reviews from traders 2022

The broker entered the market in 2009, and over the past decade has managed to increase its client base to 800,000 active traders. Company […]

Reversal saucer pattern in technical analysis

The saucer, by its name, represents a classic technical analysis pattern, but without a handle . The most important difference from the circle is the subsequent trend reversal after the formation appears.

The saucer has a number of features:

- Large stop loss value. Due to the possibility of a rollback to the middle of the figure, the stop is placed beyond the extremum.

- Appears at the top, bottom of the market. Found on all assets.

- The best work occurs with the use of volumes. There should be a surge in volume at the beginning, middle and end of the structure.

- Smooth acceleration of the graph curve upon exit.

Recommendations for work from the author of ChsR, automation of pattern search

O'Neill noted that cup and handle patterns work better in which:

- the bottom is closer to a U-shape with a clearly defined bottom. The cup should be stable, patterns reminiscent of the Latin V also work, but the likelihood of a stable continuation of the trend is lower;

- the handle should be small both in terms of the duration of formation and the depth of correction;

- When forming the first half of the cup, the volume should decrease, based on the volume should be below average. The growth of this indicator should occur when the second half of the pattern is formed and the resistance is broken. In Forex you can use tick volumes, in the stock market you can work with real data;

- the period of formation of a handle is several times shorter compared to the formation of a cup;

- a breakdown of the cup & handle resistance occurs on an impulse with an increase in volumes. The deeper the correction was when the handle formed, the more confident the breakdown of the resistance level should be.

The technical analysis figure of a cup with a handle is quite simple . There are no complex dependencies in it, and those that exist are easily described by the ratios of Fibonacci levels. This led to the emergence of several indicators that automate the marking of the chart and the identification of the ChsR and the inverted cup with handle.

An example of such an indicator is PZ Cup & Handle . This tool is available in the built-in MT4 market, there is a demo version for testing in the trading terminal tester.

In general, the markup is done adequately. In this case, PZ Cup & Handle marks the breakout candle with an arrow and, during testing, automatically collects statistics on worked patterns. In addition to the ChsR, it can also detect an inverted ChsR. Based on statistics, one can judge the effectiveness of this model; the results are not bad, for example, over 9.5 months in 2022, 5 out of 6 patterns worked out on Brent oil.

It will not be possible to completely automate the work; manual filtering of signals is required. The indicator is unable to reject designs in which additional conditions for cup formation are not met. The code contains only the key relationships between the elements of the graphic design.

Entry point for buying shares

This is, of course, where all the above parameters lead if they are displayed correctly on the price chart. The buy point from the bottom of the cup and handle appears at the highest point of the handle plus 10 cents. In the case of former big winner Baidu, the correct buy point during its breakout on May 14, 2007 was $132.90, a dime above the handle's intraday high of $132.80.

In less than six months, China's leading search engine soared to $428, an increase of 222%.