Whether you're investing in stocks or cryptocurrencies, this guide will explain what fundamental and technical analysis are and which one to choose.

The debate between traders and investors over which method of analysis is best has been going on for quite some time. On the one hand, fundamental analysis has proven to be especially effective for sophisticated investors such as Warren Buffett and Ralph Seger.

On the other hand, technical analysis has its merits. In several markets around the world, traders have made millions using technical analysis.

In reality, however, a combination of both produces the best results , especially in the crypto space where nothing is easily predictable.

Here's a detailed overview of both methods, with comparisons to help you make an informed choice.

What is fundamental analysis?

Investing and trading in any market is about assessing the value of an asset to determine whether the asset is worth it in the short or long term. Fundamental analysis is the process of measuring the value of an asset based on related economic or financial factors.

In the case of the stock market, a fundamental analyst will look at the intrinsic value of a company by looking at that company's balance sheets, general economic trends that are bound to impact the industry, and an overall view of the company's internal workings.

This type of analysis is generally considered ideal for long-term investors. At its core, fundamental analysis measures the intrinsic value of an asset by evaluating all tangible and intangible aspects of a company or investment using publicly available information. The goal is to best determine whether an asset is undervalued or overvalued.

Research of the internal environment of the enterprise

An important point in the fundamental assessment is the analysis of the internal situation at the enterprise that has assets of interest to the trader - shares, currency, any goods. And although most often a simple financial and investment analysis is enough to decide whether to purchase shares, these will only be superficial averages that are considered in the reviews of any investment analysts. In the Russian market, such companies include Surgutneftegaz, Fosargo, Norilsk Nickel. These companies are distinguished by high financial performance, stable growth and a strong position in the global market.

But such shares are not capable of bringing ultra-high profits for one simple reason - popularity. They are noticed by absolutely all even slightly experienced investors, which means that the income from such assets is unlikely to rise above 30 percent per year.

Technical analysis of the foreign exchange market is the basis for success

To find more promising investment ideas, a deeper study of companies is necessary. And in this case, some official data sources may be suitable, which, however, are not often considered by traders and analysts:

- Presentations intended for investors . Allows you to obtain information about the company’s plans, natural indicators, as well as how the company evaluates itself and its competitors. Of course, when preparing such presentations, almost always only positive aspects are presented, which is also worth taking into account;

- Consolidated financial reports . The main advantage is that such reports are prepared according to the regulated international standards IFRS, which takes into account all enterprises subordinate to the main company, which means it is possible to create a holistic financial picture of the entire group. The only disadvantage of such reports is that they are prepared only once a year, but in their absence, disclosure reports can be used;

- The results of shareholder meetings contain information about dividends, changes in management, completed and planned major transactions, issues, etc.;

- Information disclosure reports (quarterly reports, etc.) are prepared in accordance with the law on the securities market. They are prepared by all enterprises of the Moscow Exchange on a quarterly basis, and this is the main advantage over the consolidated ones. The biggest disadvantage is Russian accounting standards, according to which all similar documents in the Russian Federation are drawn up.

Assessing fundamentals is not easy because the same factors can behave differently in different situations. Having one or another impact on the market, events can, when conditions change, radically change the degree of importance, turning from uninteresting news into decisive ones in the current trend. Nevertheless, it is this method of study that is indispensable when making long-term forecasts.

Fundamental analysis of securities: stages and methods

What is technical analysis?

On the other hand, technical analysis is a trading method that estimates the value of an investment based on the statistics and trends of that asset's price movement and trading volume.

Technical analysis is based on the belief that the past price movements and market activity of a given asset can be used as a valuable source of information to determine the future price path of that asset.

While a fundamental analyst focuses on the intrinsic value of a company and measures its ability to grow earnings as well as that company's assets, a technical analyst will only look at the price history and trading volume of an asset.

Technical analysts use mathematical equations, charts, and graphs to identify trends and patterns that support a buy or sell signal. Since the underlying business is not taken into account, technical analysts will measure these signals in comparison to other technical indicators that support a similar version. While fundamental analysis encourages an investor to look for the intrinsic value of a company, technical analysis deals with methods that predict the price behavior of an asset.

Factors Fundamental Investors Look at Before Selecting Stocks

- Economic conditions

- Exchange rate/interest rate

- Inflation rate

- Fiscal/monetary policy

- Government policy

- Price to Earnings Ratio

- Earnings per share

- Dividend yield/sequence of dividend payments

- Political stability

- Industry trends/events

- Management Competence

- Quarterly/Annual Reports/Historical Data

- Rate of return in the money market

- Direct foreign investment

While the financial strength of a company remains most important, economic factors cannot be reversed. No matter how impressive the results of a company's fundamental analysis may be, there is no guarantee of positive results in the future. Warren Buffett has been recognized as one of the best fundamental investors in the world. In conclusion, as a stock seller, it is important to invest in research for business development to maintain investor confidence, business growth and eventual success. As a stock buyer, it is necessary to establish the right guidelines to prevent you from losing money.

What are technical indicators?

Technical indicators form the basis of technical analysis . They contain pattern-based signals that are produced by the price and trading volume of an asset and allow the trader to study and predict future price movements of that particular asset.

Technical analysts use technical indicators to study and analyze historical data about an asset's price and other market movements to determine favorable entry and exit points for trades.

In general, there are four categories of technical indicators , including trend indicators, momentum indicators, volume indicators and volatility indicators.

As you would expect, trend indicators show the general direction of the market . These indicators are also called oscillators because they move between high and low values, creating a wavy pattern on charts and graphs. Examples include Moving Average Convergence Divergence (MACD), Parabolic SAR, and parts of the Ichimoku Kinko Hyo.

Momentum indicators are used to indicate the strength of a trend. They are also used to determine when a market trend is about to reverse. Most traders use these types of indicators to predict when an asset's price path is about to change. Momentum indicators include the Average Directional Index (ADX), Relative Strength Index (RSI), and Stochastic Oscillator .

The class of volume indicators consists of tools used to determine the intensity of market orders to buy or sell a particular asset . These include the On Balance Volume ( OBV ) indicator, the Volume indicator, the Klinger Volume indicator, and the Chaikin Money Flow indicator.

Finally, volatility indicators are used by traders to determine how often the price of an asset changes over a given period . The faster the price changes, the more volatile it is. Examples of such indicators include the Bollinger Band .

How to analyze cryptocurrencies?

Now that we have an understanding of what fundamental and technical analysis consists of, let’s move on to market analysis and start with cryptocurrency.

Since the cryptocurrency market is in its infancy and is just looking for its place in the global economy, it is almost impossible to conduct fundamental analysis on it. The market is still dominated by manipulators, in whose anonymous hands large cryptocurrency capitals are concentrated. The market is not regulated and is not part of any government, financial system or related markets. Accordingly, it is impossible to evaluate any statistical or macroeconomic data that would indicate the rise or fall of cryptocurrencies. At the moment, this is an exclusively speculative market. The only fundamental factor that positively influences digital money is its prospects and increased interest in it, in particular, in the blockchain technology on which it is based.

Otherwise, the cryptocurrency market can only be analyzed using technical analysis, looking for current trends, price highs and lows within which the price moves. Periodic positive or negative news and events appear suddenly and are reflected in prices for a short time. As cryptocurrencies are introduced into the global financial system, the fundamental factors influencing the price will become more tangible.

Best Technical Indicators for Crypto Assets and Stocks

Here are some of the best technical indicators that you can use to trade crypto assets as well as stocks.

- On-Balance Volume : This is a technical indicator that uses the changing trading volume of an asset to predict prices.

- Accumulation/Distribution Line : This indicator is used to measure the flow of capital into and out of the market.

- Average Directional Index (ADX): This indicator measures the supply and demand for an asset to determine the strength of existing price trends in that market.

- Aroon Indicator : This indicator is used to determine the strength of a trend as well as changes in the price movement of an asset.

- Moving Average Convergence Divergence (MACD) : Investors and traders use this indicator to determine the strength of an asset's price trend.

- Exponential Moving Average (EMA) : An exponential moving average is a variant of the moving average indicator that is used to measure the average periodic changes in price over time to generate, buy and sell signals for a trader or investor.

- Relative Strength Index (RSI) : This is a momentum indicator that determines whether an asset is overbought or oversold by assessing the magnitude of recent price changes.

- Stochastic Oscillator: Similar to the RSI, the Stochastic Oscillator is a momentum indicator that identifies overbought and oversold conditions in the market .

Models of breakout and rebound from levels

Classic level breakdown

What happens in the market at each stage of the formation of a level breakout trading model:

The first point is the approach to the level. At this moment, alerts from other participants are triggered in the market, large players begin to pay attention to the trading instrument, and aggressive players immediately enter the market.

The second point is the place where the position is accumulated. Large players usually simply do not have enough market liquidity to create their position “with one trade”; this requires a certain time. In this place they place their orders, buying up all offers on the market.

The third point is the victory of the bulls. When the market has already run out of supply, the price begins an upward movement, and between points 2 and 3 the level is broken, which is joined by both new buyers and short-sellers who run away from the market with a loss.

Point four is the last chance. When the market has calmed down after the increased excitement provoked by breaking through the level, it returns to the same level, where conservative traders are already waiting for it, who join the practically formed pattern, thereby helping the major player make a profit from an already fully accumulated position in the previous stages of this “chess game”. party."

Classic level bounce

What happens in the market at each stage of the formation of a trading model of a rebound from the level:

The first point is the approach to the level. If large market participants want to exit it, they, as in the entry situation, cannot do everything by pressing one button, since there are simply no people on the market willing to buy so many bitcoins at the offered price. At certain prices, large players place their orders, selling cryptocurrency to everyone in parts.

The second point is the place where the position is accumulated. In this case, the situation is mirror of the previous one: nothing happens, there are large orders to sell at the level price on the market.

The third point is a false victory for the bulls. In order to quickly sell the required amount of crypto, large players almost always perform a similar trick - a false breakout. At this moment, those who were waiting for a breakout begin to enter the market en masse, injecting new liquidity into the market. At this moment, a large player has a unique opportunity to sell off the remaining part of the position.

Point four is the finish line. Since the major player has already completely exited the position, there are a lot of traders left in the market “long”, and since the price has again gone below the level, they gradually begin to sell their coins, realizing that the market has “run out of fuel” or seeing losses in their account.

It is worth noting that each market situation is unique, and the actions of players are quite often unpredictable, but at the initial stage, this approach to analyzing market information really works and can bring profit.

Line of least resistance

The line of least resistance is an imaginary line against which it is difficult for the price to move up or down.

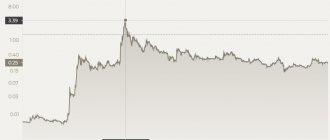

At the moment, on the EURUSD pair this is a line directed downwards:

You can call this a global trend. It is now much easier for the price to fall than to rise.

For us, this means that if there is some slightly positive news, it will be easier for the price to stay in one place or fall than to rise.

In order to lift it, it will take much more effort so as not to fall.

The same thing happens with another currency pair, only in reverse. If the line of least resistance runs from below, then it is easier for the price to rise, as is the case with USDRUB:

At the moment, some very positive news is needed for the ruble to rise in price significantly.

But at the same time, in order for this pair to continue to grow, not very strong negativity is enough.

Therefore, remember, if the general trend on the chart is downward, then even if some positive news has come out that will be slightly better than the forecast, this does not mean that you need to run and open long positions.

But if the news is bad, and the trend was already down, then it will probably continue further.