The rules of any security are written in blood; if a turner paid for the lesson with his finger, then the trader, making one of the 15 most fatal mistakes of any trader , risks giving away part of his portfolio, rather than an experienced trader, and losing it all in one evening.

We attract traders to write useful articles on crypto trading so that other novice traders stop tumbling over their own mistakes.

The rest of the articles from the series on crypto trading are available here: Cryptocurrency trading: First things first

Every transaction must be conscious

Start trading only when you know exactly for what purpose you are doing this and you have a clear strategy and action plan for each scenario.

Absolutely all your trades cannot be profitable, since trading is a zero-sum game (if you make a profit, then someone else takes a loss). Yes, and you must understand that it is the big whales who control the altcoin market, and they are also responsible for placing huge orders for hundreds of bitcoins in the order book.

Whales wait patiently until carefree little fish like us - traders with small capitals - make trading mistakes en masse. Even if your goal is daily trading, sometimes it is better to do nothing at all rather than jump into troubled waters and expose yourself to significant losses. On such days, it is better to save your previously earned profits and stay away from the market. Especially when you do not have a clear understanding of the current market situation.

What are the secrets of successful intraday trading from Larry Williams?

According to Williams, the secrets to successful trading lie in comprehensive observations, correct logic and correct conclusions that are based on the data at our fingertips.

The main idea of Larry Williams' methods is to find trading days with wide ranges, that is, days when the market opens at one end of the trading range and closes at the opposite end.

And successful trading can develop according to one of the following scenarios:

- days with a small range, bringing both small profits and small losses;

- days when the market trend turns against our expectations and placed stop orders throw us out of the market;

- the days we need with a wide range, when the positions we open are taken correctly, and we can keep them open for as long as necessary.

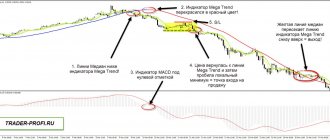

Planning trades with clear stops and goals

For each transaction, it is necessary to set in advance a clear level at which profit will be taken and, more importantly, a stop loss level at which losses will be limited. Choosing the level of a stop loss order involves preliminary calculation of the maximum amount of loss that you can afford for each position. Trading without stop orders at all will very quickly lead to colossal losses, but to correctly select the distance from the trade entry level to the stop, you must take into account many factors - from the volatility of a particular currency pair to the purely psychological aspects of trading.

Most novice traders suffer significant losses and are permanently “out of the game” when they overestimate the prospects of a particular trade or coin. When the market situation develops negatively (and, of course, without setting a stop), they often say to themselves: “things will change, and I will exit this trade with minimal losses, I’m sure.” As a result, they give up control over the situation to unmotivated confidence in success, which almost always ends in a loss amounting to a large part of the deposit.

We must not forget that compared to the traditional stock market, where price changes of 2-3% are considered extreme volatility, cryptocurrency trading is much riskier. It is not uncommon in this market for assets that can lose even 80% of their value in just a few hours. Of course, at such moments, no one wants to be in the place of holders of such coins, and especially in the absence of stops.

Get a 10% discount on trading fees on Binance using the code “ CRYPTOSLIVA ” or by registering using this link

Secret 3

Power reserve according to ATR. It must be in a ratio of 3 to 1 or 4 to 1 for us to enter the trade. This is an indicator of your risk and determining the potential profit in this operation. Before entering, you should always know how much you are getting and what you are risking. The simplest and most effective way is to calculate the average price fluctuation range manually. But you can use both the formula and a ready-made art indicator. The subtleties of using this tool should be tested through personal experience or “snooped” by professionals.

Fear of missed opportunities

Fear of missing out on something important. Surely you have watched with disappointment more than once when this or that coin is “pumped up” like crazy by tens of percent in just a few minutes. Everyone thinks at such moments: if I had entered earlier, I would have made a significant profit right now.

Not much life

The huge green candle on the price chart of this coin seems to shout to you: “You are the only one who did not buy me.” Of course, in parallel with this, dozens and sometimes even hundreds of people in Reddit thematic groups, Telegram channels, and exchange chats are playing on your nerves. And they all simultaneously talk about the still ongoing unprecedented pump.

What to do in such a situation?

Don’t lose your mind and continue to deal with the assets you were doing before (after all, most likely, it’s not your “regular” coin that is being pumped).

Yes, people who bought early “caught the rise” and, yes, the value of the coin may continue to rise. But keep in mind that the whales are simply waiting for more small buyers willing to buy an increasingly expensive asset in order to sell them the coins they once bought at lower prices. The price has risen very quickly, but the new “lucky” owners of digital coins are just those same small fish, and now their money is at the mercy of the whales. Moreover, with a very high probability, very soon they will see a big red candle, which will just as quickly cross out all their hopes.

Risk management: not only for crypto trading

The amount of income received from trading is never determined by a single transaction, which at once “covers” all past losses.

Truly successful traders never wait for the next uptrend to begin or continue before exiting a trade that has already reached its profit target. The secret of success is this. that a relatively small income from each transaction gradually forms the overall level of profit for a specific time interval, for example, a month. Expecting continued growth after reaching a goal is a completely unnecessary risk.

Manage risk in your portfolio wisely. For example, you should not invest a significant share of your funds in instruments of an illiquid (very risky) market (limit yourself to a few percent). But it is precisely for high-risk assets that it is quite possible to assign targets and stop orders at a significant distance from the purchase level.

Cryptocurrencies are trading against Bitcoin

To begin to understand the market, it is necessary to understand that the underlying asset in a particular currency pair is more likely to create volatility. Considering that most altcoins are primarily traded against Bitcoin rather than fiat, it turns out that volatility in the value of altcoins is very often caused by changes in the price of BTC. Compared to any fiat currency, Bitcoin is a highly volatile asset and this fact should be taken into account, especially when there are significant changes in its price.

In past years, Bitcoin and altcoins typically showed an inverse correlation, meaning that when Bitcoin rose against fiat, altcoin prices fell against Bitcoin, and vice versa. However, starting from 2022, this correlation is no longer so relevant and it is not worth building trading strategies on its basis (especially without regard to other factors). When Bitcoin is volatile, trading conditions are a bit murky.

During fog, we cannot see very far ahead, so it is better to have close targets and stop losses, or not to trade at all.

Let the market take its first step

If you are a technical analyst, never trade during news releases. Instead, wait for the price to react to the news. In other words, use price action to study the subsequent market reaction. Let the market take its first step. Trying to anticipate news events will most often lead you to a loss.

Many traders open their trades even before the news comes out, because they are afraid of missing out on a profitable trade. However, the main thing that a trader should be concerned about is not the fear of missing out on the opportunity to make money, but the protection of his capital. Therefore, always start by considering possible risks when analyzing any entry point.

Important Tips for Profitable Altcoin Trading

Most altcoins lose value over time. This process happens at different speeds, but look at the list of Top 20 coins by capitalization: there have been big changes in it over the past few years, and that says a lot. When storing large volumes of altcoins for the medium to long term, be aware of the fact that they will depreciate and choose them wisely.

If you are considering holding altcoins for the long term or planning to create a long-term crypto portfolio, then take a closer look at coins that have already achieved high daily turnover on trading platforms and have become widely known in the crypto community. For such assets, the risk of depreciation is significantly lower.

It is important to monitor changes in the coin price chart and learn to identify periods of decline and consolidation. At such moments, there is likely a process of accumulation on the part of the whales, and you too can take part in it. At the right time, for example, after the appearance of new positive news related to the development of the project, the pump process will be launched again and the whales will begin to sell previously purchased coins at a profit. Don't be left out.

Masterforex-V tips for trading on the stock market

A tip for novice traders from MF for trading on the stock exchange : the trend of all financial instruments is determined by the S&P 500 stock index on the world's largest New York Stock Exchange NYSE:

- the bull market lasts 10-12 years in between global economic crises (1987 / 1998 / 2008 / ...);

- bear market - a strong short-term decline during a global crisis

All financial trading instruments (stocks, warrants, derivatives, etc.) move following the specified trend . See the online chart of this S&P 500 stock index. It de facto forms a trend for the shares of Gazprom, Apple, Google, Yandex, Sberbank and many others.

Task for novice traders : using the table below of the main stock exchanges of the world, determine which stock indices (and the stocks included in them) are “on par” and which ones are clearly lagging behind the S&P 500 in order to gain a general understanding of trading on the stock exchange.

Which stock indexes would you choose?

Only by answering these questions can you then begin to learn professional trading techniques (scalping, day trading, etc. - see below).

| Exchange | Index | Exchange | Index |

| North America | Near and Middle East | ||

| NYSE (New York Stock Exchange) | Dow Jones 30, S&P 500 | BIST (Istanbul Stock Exchange) | BIST 30, BIST 100 |

| NASDAQ | NASDAQ 100, NASDAQ National Market Composite, NASDAQ Biotechnology Index | TASE (Tel Aviv Stock Exchange) | TA 35 |

| TSX (Toronto Stock Exchange) | S&P/TSX 60 | QSE (Qatar Stock Exchange) | QE index |

| BMV (Mexican Stock Exchange) | S&P/BMV IPC, S&P/BMV INMEX | ADX (Abu Dhabi Stock Exchange) | ADI |

| Tadawul (Saudi Stock Exchange) | TASI, SAR | ||

| South America | |||

| Brasil Bolsa Balcao (Sao Paulo Stock Exchange) | Ibovespa | Europe | |

| BCS (Santiago Stock Exchange) | IGPA, IPSA | LSE (London Stock Exchange) | FTSE 100 |

| Euronext | Euronext 100, CAC 40, BEL 20, AEX 25, PSI 20, ISEQ 20 | ||

| Asia | FSE (Frankfurt Stock Exchange) | DAX 30, Euro Stoxx 50, MDAX, TecDAX | |

| BSE (Bombay Stock Exchange) | BSE SENSEX 30 | BME (Madrid Stock Exchange) | IBEX 35, IGBM |

| NSE (National Stock Exchange of India) | NIFTY 50, NIFTY Next 50, NIFTY 100 | MOEX (Moscow Exchange MICEX-RTS) | IMOEX, RTS, MOEXBC |

| KLSE (Malaysian Exchange) | FTSE Bursa Malaysia KLCI | SWX (Swiss Stock Exchange) | SMI 20, SLI 30 |

| TWSE (Taiwan Stock Exchange) | TAIEX | WBAG (Vienna Stock Exchange) | ATX |

| KRX (Korea Stock Exchange) | KOSPI, KOSDAQ | OSE (Oslo Stock Exchange) | |

| HOSE (Ho Chi Minh City Stock Exchange) | VN Index | GPW (Warsaw Stock Exchange) | WIG 20, WIG |

| TSE (Tokyo Stock Exchange) | NIKKEI 225, TOPIX Core 30 | ||

| SSE (Shanghai Stock Exchange) | SSE Composite, SSE 50 | Australia | |

| SZSE (Shenzhen Stock Exchange) | SZI | NZX (New Zealand Exchange) | S&P/NZX 10, S&P/NZX 50 |

| HKE (Hong Kong Stock Exchange) | HSI | ASX (Australian Securities Exchange) | S&P/ASX 200, S&P/ASX 20 |

| SGX (Singapore Exchange) | STI | ||

| PSE (Philippine Stock Exchange) | PSEi | Africa | |

| SET (Stock Exchange of Thailand) | SET | JSE (Johannesburg Stock Exchange) | JTOPI |

Isn’t it difficult to start trading from scratch when you know, thanks to Masterforex-V, its “starting point”? Details:

- Basic Masterforex-V tactics for making a profit on Dow Jones index futures

- Masterforex-V: will the blue chip stocks of Japan (Sony, Canon, Olympus, Panasonis) go down in the coming global crisis?

ICO, IEO and Token Sales

A few words about public ICO (or IEO - a slightly more complex, but essentially similar process), which is the sale of tokens to investors. New projects prefer to raise funding through crowdselling, during which they offer everyone the opportunity to buy a share of the project’s tokens in the early stages of its development at a very reasonable price.

The main benefits for investors are that after some time the token will be listed on the secondary market, that is, on crypto exchanges, and (possibly) will bring good profits to those who bought it earlier and cheaper than everyone else. There have been many successful token sales in recent years and 10x ROI is not that uncommon.

The most striking example is the Augur ICO, which brought investors a phenomenal 15x return on investment. Okay, but what's the catch? Not all such projects reward their investors. In fact, most of the sales turned out to be scams. Some of them never raised sufficient funding, but the developers of some projects disappeared forever along with the investors' money.

But how do you know if the next ICO is worth investing in? The key factor is the amount of money the project intends to raise. Consider that insufficient funding raised will likely be the main reason the project owners fail to produce a working product. But at the same time, investing in projects that expect to raise a huge amount will also not be very profitable, even if the ICO is successful. The thing is that the number of investors who will be ready to buy tokens on the secondary market will not be too large. And of course, the most important thing is risk management. Never put all your eggs in one basket and invest a significant portion of your investment capital in one IEO or ICO - this is an excessive and unjustified risk.

Get Started Immediately: Optimize Your Trading

Here are some practical tips that can and should be used in trading right now:

Commissions, commissions, commissions...: The more transactions you make, the more commissions you pay. Remember that it is always cheaper to place a new order as a market maker rather than buying an existing order as a taker. In addition, it is wiser to make one large trade than 10 small ones.

In order not to be hostage to commissions, you need to choose a cryptocurrency exchange with the lowest commissions.

No pressure

No pressure: do not start trading if the optimal conditions for making the right decisions do not exist right now. For each trade, you must have a trading plan, which involves understanding at what levels and under what conditions the trade will be closed. Any excess pressure will negatively affect trading performance. Never rush! If the opportunity to enter is missed, wait for the next one, and you will definitely get it.

Setting goals and placing sell orders

Setting Goals and Placing Sell Orders: Always set your goals when placing sell orders. You have no way of knowing when exactly the whales will decide to pump your coin in order to clear the order book (and pay less commissions like makers).

Placing buy orders significantly below current prices

A successful trading strategy also involves placing buy orders well below current prices. On the Poloniex exchange in December 2016, there was a sudden collapse in the price of Augur - it dropped by 75%, and after some time the market completely recovered. Those traders who were not too lazy to place orders at the very bottom of the chart were able to easily double or triple their investments. But still, placing such orders requires special caution. You should constantly monitor the situation so as not to get into a real sale, when the price continues to decline after your buy order is triggered.

Buy on rumors, sell on news.

Buy on rumors, sell on news. When major publications publish news related to coins for which you have open trades, then it is the right time to say goodbye to such assets.

Lost profit, what to do with it?

The usual situation: you close a profitable trade, but you sell, and the coin flies up again. What to do? First, get to know Murphy's Law. Secondly, re-read what is written in this article and never enter a trade under pressure or pursue missed opportunities. You have taken a profit, which means everything is just fine. Stick to your trading strategy and look for a new entry point.

You don't owe anyone anything.

You don't owe anyone anything. At the very least, they should not follow the “correct” trades and be in the general trend. Your goal is to make a profit. Of course, it’s impossible to completely avoid failures and mistakes, but you shouldn’t reproach yourself for not placing that order that would have brought profit. If the number of winning trades is greater than the number of losing ones, you are a successful trader.

You can also make a profit in a bear market.

You can also make a profit in a bear market. You can also make money by reducing Bitcoin and other cryptocurrencies.

Trading plan

In my early years of trading, I was the most inconsistent trader. I used Bollinger Bands, price action, harmonic patterns and anything else that caught my eye. Of course, my trading results were inconsistent. Sometimes I made money, sometimes I lost. But I didn’t know which trading methods brought me profit and which only caused me losses.

To become a consistent trader, develop a trading plan. Write it down on a piece of paper and hang it in front of you. Follow your trading plan every day.

If you constantly break your rules and don't follow your trading plan, your trading will be ineffective. We need constant progress and results in order to achieve something. Therefore, a trading plan will help us see mistakes and constantly develop in terms of effective and profitable trading.

Ignore news and opinions of other traders

Don't waste your time reading current news. The vast majority of news reports and analyzes that are published in the traditional press are biased or promoted by a specific company or group with one agenda or another. The right strategy is to invest your time in studying long-term trends.

When reading the news, it is almost impossible to find a truly worthwhile reason to enter a trade. The opposite statement is also true: if an article about a coin appears in the news, then the positive or negative fact mentioned in it becomes generally known, which means it has already been “worked out” by the market and has no value. Buy on rumors, sell on news - this approach really works.

Do not complicate your own analytics by reading success stories of other traders and their analytical calculations about the development of the market situation. When making forecasts, you start from different assumptions. Competition of opinions is inappropriate here and will not bring you any benefit. Your trading skills will improve if you focus on your own understanding of the market, rather than buying coins just because a friend suggested it.

Use mean reversion

Buy at the lows and sell at the highs. This is perhaps the most common mantra among traders. Unfortunately, most people trade quite the opposite and buy at the highs and sell at the lows.

However, there is a simple way to avoid this situation. Use exponential moving averages with periods of 10 and 20 (10 EMA and 20 EMA). For example, if the price is significantly above these moving averages, avoid buying, regardless of the strength of the signal. Once the price returns to its average and moving average levels, then you can look for entry points.

Your goals should be long-term

You are engaged in trading, risking your own funds, which you can easily lose, for no immediate gain. Think more globally and set meaningful goals, which may include increasing your income, which will allow you to leave your main job, buying real estate, or accumulating “pension” capital.

Keep your short-term and long-term life goals separate and don't risk funds you'll need in the short term. Manage risks so that they do not threaten the achievement of global goals.

How to spot fraud?

Investing in altcoins is very tempting, but remember that the booming cryptocurrency market has also become a target for many scammers.

The basic idea of the crypto world: “only you are responsible for your funds, not the bank,” is truly revolutionary, but it contains a lot of threats that scammers take advantage of.

Inexperienced newcomers invest in dubious projects with supposedly “high ROI” or participate in ICOs or IEOs that will “change the world.” Remember that, unlike traditional finance, there is no risk insurance in the world of cryptocurrencies. Immediately after you send a transaction to someone, the transferred amount forever changes the owner and it depends only on him how honestly the obligations undertaken will be fulfilled.

How to identify crypto scammers? Unfortunately, there are a lot of them. Many projects want to attract funding, but not all of them work honestly. The only way is to think in terms of “why shouldn’t I invest.” This approach will help you conduct a thoughtful analysis of the prospects before you transfer your cryptocurrency to the wallets of the next project.

Results

Perhaps these are all the main recommendations for traders. I hope these tips will help you become a binary options professional faster. In any case, study new aspects of the topic, practice, get interested - gain the experience that is so necessary in this matter. And one more piece of advice for traders. Always clarify any unclear points and ask other traders for their opinions. Perhaps the answer lies on the surface... Well, you can read about my forecasts for the binary options industry in 2016 here. Well, forecasts for 2022 are also already available here.

Long-term portfolio: what you need to know about it

Assume that only a few cryptocurrencies will survive in the long term. Take a close look at the top 20 coins by market capitalization, and you will see that the list of projects in it changes from year to year (with the exception of the first place, which, of course, belongs to Bitcoin). Since many of the altcoins will not survive, you need to think carefully about which coins and how much to include in your long-term crypto portfolio. Of course, you will not be able to predict the time interval during which coins will lose value, because another crypto bubble could appear at any moment. .

Profit is what you transferred to fiat

The fiat value of your crypto portfolio is a key factor—at least until crypto gains acceptance as an official payment instrument. You should measure the total value of your portfolio in fiat currencies and nothing else.

You will not be able to cash out your cryptocurrency until you sell it for fiat and receive the money in your bank account. Even if you are a successful crypto trader, you can lose your funds if you do not follow information security rules. Many investors have lost their fiat assets despite holding them on exchanges after selling cryptocurrencies. The most famous example is the collapse of the Mt. Gox in 2014. However, the recent Quadriga CX incident also highlights the disadvantages of storing fiat on exchanges.

Crypto trader and community: more effective together

We talked about how you shouldn't read other people's analytics, but in reality, you shouldn't read other people's analytics from all traders. There is a huge amount of information related to the crypto world on the Internet and everything changes so quickly. that it becomes difficult to keep track of even important events and news. To avoid confusion, look for like-minded people who share your approach to trading and views on the market. These people will be able to evaluate your trading ideas and share theirs, together you can discuss fundamental and technical data and develop a unified approach to analysis. Even in existing Telegram or WhatsApp groups, you will be able to select those interlocutors whose opinions you should listen to, and separate them from others who do not share your approach to analysis and whose opinions should be ignored.