Bitcoin Cash cryptocurrency Bitcoin

Cash cryptocurrency was created as a hard fork of Bitcoin. This happened in the summer of 2022, and this event became one of the most scandalous and memorable in the world of cryptocurrencies, as the community was divided into two camps. The main disagreements concerned the block size - in Bitcoin Cash up to 8 MB versus 1 MB for Bitcoin.

In this article we will tell the whole truth about the reasons for the appearance and technical features of the coin, why it is called the “true Bitcoin” and what role Roger Ver played in the fate of the project. You will also find out what caused the discord in the Bitcoin Cash team and what the current state of affairs is.

- What is Bitcoin Cash

- Technology and features of Bitcoin Cash

- Jesus or Judas? What did Roger Ver do?

- Another split?

- How to buy Bitcoin Cash

- Where to store

- Bitcoin Cash rate and capitalization

- Bitcoin Cash Problems

- Advantages and disadvantages

Is Bitcoin Cash the real Bitcoin?

The new cryptocurrency was a modernized version of the original Bitcoin, which was based on its blockchain code, but with some changes that eliminated the scalability problems of the system. Major Bitcoin Cash Updates:

- increased block size

- new principle for changing mining difficulty

- additional transaction protection mechanisms

This technology immediately attracted many investors in the market, and the aggressive promotion policy on the part of the founder of the digital currency only further promoted the BCH project.

Today Bitcoin Cash is confidently among the TOP 5 best cryptocurrencies, having a huge capitalization and a high price. However, is Bitcoin Cash really better than the original Bitcoin? What are its specific advantages? Should you buy or mine BCH today?

We will try to answer all these questions in today’s article, where we will make a complete review of the Bitcoin Cash cryptocurrency. From it you will learn the history of the creation of Bitcoin Cash, the operating principle of its blockchain system, what are the advantages/disadvantages of BCH, how this digital coin is mined, what prospects does Bitcoin Cash have for the near future and whether it can generally resist its progenitor Bitcoin.

Technical support

Technical support service from 8 to 24 helps with resolving issues

Crypto wallet has been tested by time and hundreds of thousands of clients

The Matbi cryptocurrency exchange wallet has been on the market since 2014. Over 6 years of operation, it has earned a reputation as a reliable and safe service. The mission of our company is to provide users with an accessible, comfortable and secure way to purchase and exchange Bitcoin and other cryptocurrencies. We are proud and grateful for the trust of thousands of customers. Create a Bitcoin wallet and join our community!

Bitcoin Cash Review

In 2022, the Bitcoin Cash cryptocurrency occupies a stable 4th place in the list of the best cryptocurrencies. The project capitalization is more than 7.89 billion US dollars, the price of one coin is about 454 US dollars, the daily volume of currency trading reaches more than 404 million US dollars. The total coin supply is 21,000,000 BCH, with 17,367,038 BCH currently available in free circulation on the market.

It is noted that Bitcoin Cash has the possibility of traditional mining. Coin ticker: BCH. Official website: https://www.bitcoincash.org Twitter: https://twitter.com/bitcolncash BCH blog on Reddit: https://www.reddit.com/r/Bitcoincash/ Bitcoin Cash thread on the Bitcointalk.org forum : https://bitcointalk.org/index.php?topic=2040221.0 Open source on GitHub: https://github.com/bitcoincashorg/

The history of Bitcoin Cash. Bitcoin Split

The Bitcoin Cash coin appeared during the well-known conflict in the community of the original Bitcoin currency. Sometime in 2022, when the positive trend of the digital asset market began, the original BTC faced the problem of scalability of its own system. The cost of transactions has been constantly growing, and the speed of financial transactions has dropped significantly due to the rapid increase in demand.

In order to solve the problem, part of the BTC community proposed improving the system protocol, as well as introducing SegWit2x (Segregated Witness) . With these innovations, part of the signatures in the blocks of the Blockchain chain, as well as other secondary information, would be deleted. This would increase the throughput of the Bitcoin network. Thus, its effectiveness would increase significantly, and the coin would receive a new life.

This decision to change Bitcoin for the better and implement the SegWit2x system was supported by the majority of miners distributed throughout China. This would significantly increase their profitability from cryptocurrency mining. Also, other small investors and single miners voted positively for the improvement of BTC.

However, the largest mining pools and part of the development team insisted on an exclusive division - a Bitcoin hard fork. As a result, the community was unable to reach a consensus and a split occurred. Thus, on August 1, 2022, the digital market saw a new cryptocurrency based on the BTC blockchain, which was called Bitcoin Cash. This fork occurred at block number 478558 of Bitcoin. This is why there are so many similarities between the original BTC and BCH, including all the transactions that are stored in their distributed databases.

Bitcoin Cash. Way to the top

From the very beginning, Bitcoin Cash has been a significant success. This was influenced by the serious support of the project from various large organizations, as well as the aggressive promotion of the BCH cryptocurrency in various media.

Immediately after entering the digital market, this asset was supported by many popular exchange platforms like Bittrex, and the following blockchain projects openly announced cooperation with BCH: BTC, Top, ViaBTC, BiXin, BW, 1Hash, Canoe, BATPool, Bitkan, OKCoin, Huobi, BTCCPool , Bitmain, F2Pool.

There were, of course, opponents of the Bitcoin Cash cryptocurrency (for example, the Coinbase exchange, Kraken), who did not want to have relations with this coin, justifying that they had enough cooperation with the original Bitcoin. However, their feedback did not have much impact on the future success of BCH.

The next important factor in the initial development of Bitcoin Cash was the support of the BCH currency from many multi-currency online wallets, as well as provocative announcements from developers about the emergence of a new, more advanced cryptocurrency based on BTC.

Moreover, information was disseminated as much as possible that every user who owns at least some amount of Bitcoin has the opportunity to receive a completely free Bitcoin Cash coin to their critical account. BCH accruals occurred in a 1:1 ratio. Thus, if you had 1 Bitcoin in your account, then you would receive 1 Bitcoin Cash coin completely free of charge.

Of course, most investors decided to take advantage of this event, especially those who decided to support the fork. In general, the demand for BTC before the release of BCH simply went through the roof. Everyone wanted their share of Bitcoin Cash coins. So, on August 1, 2017, the BCH coin appeared in free sales on many exchanges, its cost fluctuated around $300.

Everyone assumed that this asset would be in great demand at first, but no one could have imagined that already on August 2, the price of one Bitcoin Cash coin was able to reach $1,300, and its position in the ranking changed to 3rd place, leaving such popular assets like Ripple and Litecoin are behind.

This growing Bitcoin Cash trend did not last long, until the moment when exchanges established the ability to withdraw this asset from their services. Investors and traders decided to withdraw funds from trading platforms and after a very short time the cost of BCH became only 250 US dollars.

After this, the price of Bitcoin Cash grew steadily for a long time and did not have such rapid growth spurts until the moment when at the end of December the developers themselves began to actively pump this asset, briefly accelerating the BCH rate several times.

Thus, in a short period of time (about 10 days of active pumping), the maximum Bitcoin Cash price of $4,000 was reached. And this is provided that the initial cost of one Bitcoin Cash coin was less than $1,500.

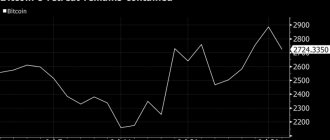

History of the Bitcoin Cash pump

Soon after these events, a global market correction began and the price of BCH began to gradually fall.

Future trends

In fact, to predict the price trend of any cryptocurrency means to instantly expose yourself as narrow-minded. After all, changes occur so frequently and unpredictably that no theory can help predict the approximate cost.

But this is only the case when it comes to immediate changes. Many are confident that they can find out the approximate price in the distant future. To do this, you need to operate with the following data:

- course history;

- news background;

- miner activity;

- trading volume;

- reviews;

- team activity;

- difference between opponents and supporters.

You know the history of the exchange rate and it may seem that the cryptocurrency has a chance to grow. In fact, 3 situations of a sharp increase in value were provoked by a pump. At the same time, the first pump coincided with the general situation on the crypto market, which led to an increase to 4 thousand. The remaining massive buying of BCH did not allow the rate to rise above $1,600.

The news background depends on the activity of opponents and supporters. Therefore, if you are interested in this cryptocurrency, you should pay attention to their statements and actions. User reviews are mostly positive, as the hard fork was able to provide better conditions than Bitcoin itself. Well, the trading volume of cryptocurrency is quite high. According to Coinmarketcap, it is in 5th place in this indicator.

How to determine future prospects? Some experts, even after “Grey Friday,” predicted its cost would be 3,000 in the spring of 2018, and by the end of the year - at least 5 thousand. As you can see, the first forecast did not come true. Who knows what will happen to the second one.

Development prospects are also not the most optimistic. Many are confident that Bitcoin will develop at its usual pace, but the fork can no longer bypass the so-called “big brother”.

But traders, crypto exchanges and miners can change the situation. The latter will have the greatest impact; accordingly, the largest percentage of contribution to development depends on them. Traders, in essence, regulate the rate and trading volume. These two indicators are very important for any cryptocurrency. Therefore, the more activity on the part of traders on the exchange, the greater the likelihood of an improvement in Bitcoin Cash’s position.

What do the statistics say? BCH is gaining momentum. When the fork appeared, only 3% of cryptocurrency users trusted it. However, several pumps and world events have led to the fact that today this figure has already reached 10%. When it comes to cryptocurrencies, numbers speak volumes. In this case, they only show development.

Differences between the Bitcoin Cash blockchain and Bitcoin

The Bitcoin Cash system has almost the same structure as the original Bitcoin. These coins are based on the same blockchain code. SHA-256 mining algorithm, Proof of Work consensus, ten-minute block formation. Even the issue of BTC and BCH assets is the same - 21 million coins. However, BCH does have some changes.

The main distinguishing feature of Bitcoin Cash is the increased block size of the system. In BTC, the block size is only 2 MB. This, in turn, allows the system to maintain complete decentralization and security, however, during times of network congestion with multiple transactions, one operation can take 1-2 days to process.

That is why initially in Bitcoin Cash the block size was changed to 8 MB, and in 2022 the developers increased this volume even more - to 32 MB. Thus, the BCH cryptocurrency is trying to solve the problem of long transactions. I would also like to note the cost of financial transactions in the Bitcoin Cash system. Here they are much cheaper than on the BTC network.

In general, the developers of Bitcoin Cash decided to take the basis of the original Bitcoin and improve it. As a result, we received a decentralized payment system in which all financial transactions are much cheaper and their speed is an order of magnitude higher. It is for these qualities that investors fell in love with Bitcoin Cash as it is now.

Probability of collapse

Today it is small. And while Bitcoin cannot solve the problem with scalability, high fees and transaction speed, there will most likely not be a collapse of Bitcoin Cash. After all, he has already solved these problems.

However, Bitcoin is still trusted by many users. The Lightning Network is planned to be introduced soon, which can correct many of the shortcomings of BTC. If this is implemented successfully, then BCH will lose its current position.

In general, the prospects for the development of Bitcoin Cash completely depend on the state of affairs of Bitcoin. As soon as it gains new momentum, its fork will gradually fade into oblivion. To avoid this, the BCH team needs to come up with something revolutionary as quickly as possible.

Mining Bitcoin Cash. Is it worth mining BCH now?

Mining the Bitcoin Cash cryptocurrency is slightly different from mining the original BTC, although it is carried out using the same calculation algorithm. The fundamental difference between BCH mining is the difficulty change scheme: here it changes not every 2016 blocks, like BTC, but every 6.

Also, the Bitcoin Cash developers have added a new feature - a “slow reduction in mining difficulty algorithm”, which is automatically activated if there is a serious lack of hashrate in the network. Thus, depending on the size of this hashrate, the difficulty of mining will either grow or increase. Otherwise, mining BCH is no different from mining the original BTC.

Now, due to the increased demand for these digital coins, users have the opportunity to mine cryptocurrencies exclusively on expensive ASIC chips or participate in the largest mining pools. At the same time, the difficulty of mining BTC and BCH will be approximately the same (mining bitcoins is a little more difficult).

!Accordingly, based on this, we can draw the following conclusion - mining the Bitcoin Cash cryptocurrency is less profitable in 2022 than the original Bitcoin, since the difficulty of mining is almost the same, but the final profit will be less. BCH is currently worth less than $500, and one BTC is over $6,600.

The difference is obvious, so if you are only looking for profit, and not for the fundamental support of the Bitcoin Cash cryptocurrency, you should consider mining Bitcoin coin.

Blockchain technology and cryptocurrencies. Fast start

Get the book and learn all the basics of blockchain technology and cryptocurrency in one evening

The second advantage is the size of the transaction processing fee. Since we managed to unload the network and transfers are faster, they have become cheaper. Thus, this cryptocurrency can be used for micropayments.

The third significant difference is simplified mining. This fork implements the MTP protocol. This is a certain median of the last eleven blocks. If it exceeds 12 hours, the mining difficulty is reduced by 20%. Also, if the overall network hashrate drops, the difficulty also decreases.

Advantages and Disadvantages of Bitcoin Cash

Having studied the Bitcoin Cash currency in detail, the following advantages can be highlighted:

- Increased block size. Initially, the block in the Bitcoin Cash system was increased to 8 MB. This made it possible to carry out financial transactions much faster than on the Bitcoin network. Relatively recently, BCH developers increased the system blocks to 32 MB. If necessary, they will repeat this procedure and increase the network capacity. Thus, the Bitcoin Cash currency will never suffer from slow transactions.

- New generation transactions. Here, all financial transactions occur at a more secure level, using input value signing functions for improved wallet security, as well as eliminating the problem of quadratic hashing. The user is also given the opportunity to sign separately the transfer amounts.

- System security. Bitcoin Cash is protected from replay and wipeout protection. The difficulty of the BCH network changes much faster than the original.

Block size problem

It would seem that if it’s so easy to increase the block size, why wasn’t this done in the original network instead of a hard fork? 1MB was logically justified when Bitcoin was created. The main argument is aimed at protecting against DDoS attacks on the network.

The second problem is the size of the blockchain. The Bitcoin network today is already more than 200GB. And if you increase the block size, the total volume of the blockchain will also become larger. Thus, you will have to buy billions of SSDs in order to safely use Bitcoin Core. Or you will have to sacrifice security and use wallets that contact an external server to confirm transactions.

Bitcoin Cash Development Team

Amaury Sechet

The main developer of the new coin is former Facebook programmer Amaury Sechet. It was he who initiated the Bitcoin hard fork, proposing his idea for a solution to the scalability of the cryptocurrency. Most of the Bitcoin Cash developers come from the 2 largest Bitcoin Cash mining pools viaBTC and Bitmain.

Hypo Yang

The most prominent member of the viaBTC team is Hypo Yang (Twitter), the director of this mining pool. Yang is a mathematician with very deep knowledge of blockchain development. At the beginning of 2016, he decided to create the company ViaBTC, which continues to operate to this day.

Jihan Wu

From the mining pool company Bitmain, I would like to highlight Jihan Wu (Twitter), who is the co-founder of Bitmain. Bitmain is also the owner of the largest mining farm in the world today.

Roger Ver

Of the Bitcoin Cash partners, of course, it is worth highlighting Roger Ver, the famous Bitcoin evangelist, who is very often called “Bitcoin Jesus” on the Internet. Roger today continues to lobby for the Bitcoin Cash project, and he is considered the owner of one of the largest Bitcoin accounts in the world.

Confrontation with Bitcoin by Satoshi Nakamoto and the success of BCH

One of the factors behind the success of the Bitcoin Cash cryptocurrency is the policy of the crypto community led by Roger Ver, who ardently supports BCH to this day. On social networks and various media sources, you can often see news where Roger Ver openly states that the Bitcoin Cash cryptocurrency is the true Bitcoin, reflecting the legacy of Satoshi Nakamoto. First of all, this is due to the fact that the information in the White Paper left by the creator of Bitcoin completely contradicts the decision to introduce the SegWit system into BTC.

Increasing the size of blocks in Bitcoin Cash, according to Roger, is the only correct solution to the scalability of cryptocurrencies. This is the only way to create a true p2p platform for cheap and fast transactions.

This is exactly the aggressive policy Roger Ver is trying to impose on the crypto community. Moreover, it is worth noting that he is not bad at it. The website bitcoin.com about the Bitcoin Cash cryptocurrency, owned by Roger Ver, the Twitter account @Bitcoin, which has nothing to do with BTC, even similar logos of the BTC and BCH systems.

BTC vs BCH

All this, in one case or another, greatly confuses novice investors in the digital market, and it is possible that some of the investments in the Bitcoin Cash cryptocurrency were made solely by user error.

In general, we can assume that the success of Bitcoin Cash was ensured by “copying” the Bitcoin brand, which almost every user in the world knows about. Without the popularity of the original BTC, Bitcoin Cash would hardly have achieved such an impressive result. But, nevertheless, BCH is now a very popular digital coin in which investors continue to invest their money.

Bitcoin Cash Wallet

The most common and convenient way to store BCH cryptocurrency is directly on the exchange where you purchased it. However, this option is very unsafe, so if you have a lot of Bitcoin Cash cryptocurrency, then you should consider safer and more reliable options for storing it.

The safest option is to use cold storage hardware wallets, which are called Ledger Nano S and Trezor. They are small devices in the form of a USB flash drive that connect to your computer. It is through these devices that secure access to your crypto account will occur. Using them is not free, hardware wallets cost money - on average $100 and up. They are best suited for those investors who want to protect their large cryptocurrency savings as much as possible by any means, and are even willing to pay extra money for it.

For all other users who do not have many BCH coins in their account, but also prefer to store them safely and securely, it is best to use the official desktop wallets from the developers of the Bitcoin Cash cryptocurrency. This wallet is an application for your PC, through which secure access to your crypto account will be provided. You can download it from this link https://wallet.bitcoin.com.

There are several more alternative options for storing the Bitcoin Cash cryptocurrency; you can find a complete list of various wallets for BCH on the official website of the project in the special Wallet