Portfolio investing is a modern passive income tool that is available to everyone, unlike some other investment methods. This tool is convenient because the investor can act very flexibly when choosing the degree of risk and the resulting profitability. In addition, portfolio investments are an instrument that does not require millions of dollars and you can start investing even without having a lot of capital.

In this article we will take a detailed look at what portfolio investments are, what they are, how they differ from direct investments, and how to become a portfolio investor.

- What is portfolio investment

- Concept and examples of an investment portfolio

- How to become a portfolio investor

- Portfolio foreign investments

- Direct and portfolio investments - similarities and differences

Portfolio investments: legislative definition

In accordance with clause 14 of the Order of the Federal State Statistics Service dated October 24, 2012 N 563: Portfolio investments include the purchase (sale) of shares and shares that do not give investors the right to influence the functioning of the organization and constitute less than 10% of the authorized (share) capital organizations, as well as bonds, bills and other debt securities.

Portfolio investments include :

- shares and shares;

- debt securities: bills;

- bonds and other securities: short-term;

- long-term;

The Methodological Recommendations for assessing the effectiveness of investment projects and their selection for financing dated March 31, 1994 N 7-12/47 differ portfolio investment as placing funds in financial assets. In addition to portfolio investments, the document also defines capital-forming investments that ensure the creation and reproduction of funds.

The Methodological Provisions for the Organization of Statistical Observation of the Movement of Foreign Investments in accordance with the Balance of Payments Guidelines dated October 28, 2002 N 204 provides a detailed description of the essence of portfolio investments. Portfolio investments - securities that provide participation in capital (except for those included in direct investments), debt obligations in the form of bonds and other long-term securities, short-term money market instruments. This group does not include instruments already included in direct investment and reserve assets, nor derivative products.

In the balance of payments, portfolio investment is defined as international investment in enterprise capital and debt securities (excluding direct investment). Foreign portfolio investment is a standard item in the capital and financial account, which includes financial assets and liabilities.

Portfolio investments are the purchase (sale) of shares and shares that do not give investors the right to influence the functioning of enterprises and constitute less than 10% of the authorized (share) capital of the enterprise, as well as bonds, bills and other debt securities.

Registration of transactions with portfolio investments is carried out at market prices.

The primary classification of portfolio investments is based on the type of financial instrument (equity securities, debt securities). Debt securities (or debentures) are further divided into promissory notes, bonds and other debentures.

Article 1 of the Law of the Russian Federation “On Currency Regulation and Currency Control” dated October 9, 1992 N 3615-1 in its original edition previously determined that portfolio investment is the acquisition of securities. In the current version of the Law, there is no definition of portfolio investment.

Article 5 of the CIS Model Law “On Currency Regulation and Currency Control” dated March 26, 2002 provides a similar definition of portfolio investment. Portfolio investments are investments aimed at purchasing securities. Portfolio investments in the law are defined as opposed to direct investments; direct investments are investments in the authorized capital of an enterprise in order to generate income and obtain rights to participate in the management of the enterprise.

What is direct investment

Direct investment refers to funds that are invested in the authorized capital of an enterprise. The purpose of direct investment is direct control and management of the investment object. Direct investment involves both generating income and increasing the sphere of influence and guaranteeing future financial interests.

Direct investments are types of investments that affect material production, when the investor has the right to take part in the management of the enterprise in which he has invested. An investor may own both a controlling stake and a certain part of the authorized capital (usually 10%).

You can invest in the state where the parties to the transaction live or in different countries. In the context of economic globalization, foreign direct investment is increasingly being made.

Classification of direct investments

TypeCharacteristics

| Outgoing attachments | Produced by citizens of a certain state abroad. The dynamics of such investments from developed countries increases every year and reaches a record level |

| Incoming attachments | Implemented by foreign investors in a specific country |

Foreign direct investment is the injection of capital into the economy of an individual company from a source located in another country. In return, the investor gets the opportunity to manage the enterprise in which the funds were invested. This method of assistance is applicable to a developing economy, both the state and a specific company.

Investments include both financial resources and specialists, the latest techniques and technological processes, management and operational experience. Such an injection has a positive effect on the recipient company and the country where this company is located.

There are several types of direct investment:

- A completely new enterprise is created, which is completely subordinate to the investor (sometimes it is a branch of an existing foreign corporation);

- An existing company is purchased or acquired;

- An existing enterprise is improved in exchange for participation in management;

- Useful technologies are provided for use;

- Company shares are purchased.

Its attractiveness to foreign investors depends on the company's prospects. In addition, the prospects of the economy of the country where the company is located are also important.

Citizenship of Antigua and Barbuda

The cost of Antigua citizenship varies from $100 thousand (donation) to $400 thousand purchase of real estate. Registration of an Antigua passport takes 3–5 months, and the passport itself allows you to travel without visas to more than 130 countries of the world, including the entire EU, Great Britain, etc.

Not long ago, this country opened up the opportunity to obtain tax resident status. True, there are conditions: you need to have permanent residence in Antigua (buy or rent real estate), stay in the country for at least 30 days a year, confirm an income of $100 thousand per year and pay a fixed annual tax of $20 thousand. After which you can receive Certificate of Permanent Resident of Antigua and Tax Identification Number, which provides extensive tax advantages. Antigua is the only country with such an offer in the Caribbean. You can also get a driver's license in Antigua.

[[{"fid":"233083","view_mode":"default","fields":{"format":"default","field_file_image_alt_text[und][0[0][value]:false,"field_file_image_title_text [u[und][0][value]:false},"type":"media","field_deltas":{"6":{"format":"default","field_file_image_alt_text[u[und][0 ][value]:false,"field_file_image_title_text[u[und][0][value]:false}},"attributes":{"style":"height: 797px; width: 600px; margin-left: 400px; margin -right: 400px;”,”class”:”media-element file-default”,”data-delta”:”6″}}]]

Direct and portfolio investments

You can take specialized business courses or ask your own consultants about the difference between direct and portfolio investments. Yes, of course, they have fundamental differences, but there are many more common points of contact, namely:

- Profit orientation;

- Provide consistently high rates of capital growth;

- Minimize risks;

- Increase the liquidity of the investment portfolio.

The main difference is that straight lines are voluminous and longer in time; For convenience, investments use trading on the stock exchange. At the same time, direct investments are sometimes not even distinguished as an independent concept, saying that portfolio and direct are related concepts. Domestic investments are characterized by direct investments, but in the case of international investments they are still portfolio investments, occupying up to 90% of the total market.

Direct investments

The main aspect is that the investor cannot influence market conditions in any way, and therefore faces increased risks. For example, having bought portfolio shares in a company that specializes in making tables, a crisis occurred within a month or two. Changes in the market and a decline in consumer power led to it, but it is no longer possible to withdraw funds from capital.

At the same time, the security of the exchange market depends on the direct type of investment: imagine, if all investors withdraw their share from the capital of furniture factories on the same day, then the probability of a market fall will be 100%. With the help of direct investments, you control the market situation in a certain segment.

At the same time, private investments, with a competent approach, can do without selling securities, and work in the usual regime of stable profits, if you initially rely on various forms of diversification.

Securities for portfolio investments

It's simple: you invest money in a business and receive your share of the capital in the form of securities. Today we most often talk about:

- Shares - up to 70% of all market transactions are related to them;

- Bills of exchange;

- Bonds of financial institutions;

- Municipal loan bonds.

The last two, let's be honest, have long lost their potential audience due to low liquidity and huge problems with bureaucracy, which venture capital investments that took leading positions managed to take advantage of. Not only are transparent conditions, but also minimized risks, and a huge range of segments for investment - a clear advantage.

Liquidity of portfolio investments

When starting a financial transaction, it is wise to weigh all the pros and cons, real and potential “income and expenses”. If you choose financial investments, you will have to work a little to study the market position of the company you are interested in and assess its development in the near future. As a rule, the emphasis is placed on negotiations with personal consultants who constantly delve into the intricacies of the process and understand the nuances of liquidity:

- In what currency will the injections be made?

- What average profit percentage does the company promise?

- How important is money at this point in the company's development?

- Will they be used in business activities?

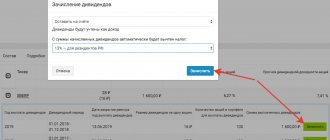

Plus, the company itself is responsible for liquidity and relies on cash injections. As a rule, to maintain it at a high level, 2 strategies for attracting customers are chosen:

- Regular payment of dividends from profits;

- Gradual increase in the price of securities on the stock exchange.

A variety of tools is a trump card for those who are thinking about starting to earn passive income.

Residence permit for investments in South America

Things are even more interesting with Latin American countries. For example, in Chile you can get a residence permit if you bring a working business plan and $10,000 . The business plan, however, must be approved by the Chilean Foreign Ministry.

Using the same scheme, but a little more expensive, you can apply for an investor residence permit in Argentina . The business project is submitted to the National Migration Directorate of Argentina, and an amount equivalent to 85,000 US dollars . The legality of the funds will have to be proven. The business plan may be approved and then you will receive a residence permit for one year with the possibility of extension. Or they may refuse, and then you will have to leave the country. However, you will not lose your deposit, but the money spent on all registration procedures will.

Uruguay will welcome even small businesses. You can apply for permanent residence by arriving in this country and registering a company there with a monthly income of $1,800 for a family of three . The requirement to open a company is not necessary, but in fact it is almost impossible to find hired work in this country, and to obtain a residence permit you must confirm the legality of your source of income.

Hot Mexico offers several options for obtaining a residence permit. Option one - real estate priced over $200,000 . Option two is purchasing a share in an existing business in Mexico from $107,000 . Option three, perhaps the most interesting, is a rentier visa. It is issued to those who have a monthly income of at least $2,000 per person and receive it outside of Mexico. Those. you can rent out an apartment, receive interest on deposits, or work as a freelancer. The main thing is that you receive money outside of Mexico and spend it in it. You cannot get a job with such a visa, but you can get a residence permit

Subscribe to Migranta Rus: Yandex News.

Benefits of portfolio investing

Investors consider this type of investment the most promising, since it combines legal protection and high liquidity, which allows you to quickly convert securities into currency.

Portfolio investments are a package of securities of one investor, which he invests in any type of business activity, wanting to make a profit through dividends or an increase in the value of acquired assets. The practice of recent years shows that foreign financial investments influence the formation of a positive investment climate in any country.

Investors and portfolio

Investors are also divided into:

- conservative;

- moderately aggressive;

- aggressive.

If an investor is an individual, his character is often reflected in his portfolio.

If the investor is a legal entity, the portfolio is formed by the tasks facing the company. The ratio of profitability and risk are the general principles in the formation of an investment portfolio:

- low return without risk;

- guaranteed profitability - moderate risk;

- maximum profitability - high risk;

Kinds

Based on the results of this approach, portfolios are divided:

- to conservative;

- moderate;

- aggressive.

Conservative is compiled using government documents, shares of very large enterprises, so-called blue chips and gold. It provides increased security for the entire portfolio and its individual components. Profitability is consistently maintained at the level desired by the investor.

Moderate is the most balanced. Its inherent feature is the optimized degree of risk and return of the portfolio. Such a portfolio contains both securities with high returns and high risk, as well as securities with low returns and low risk, such as government bonds.

Aggressive is filled with high-yield securities. These are characterized by a fairly high level of risk. For this reason, the investor regularly contacts the broker who manages the portfolio, or manages it independently.

Types

The purpose of education affects the types of portfolios:

- A growth portfolio is formed to quickly multiply capital.

- The liquidity portfolio serves for a quick return on investment.

- An income portfolio made up of shares of large enterprises - for guaranteed stable profits.

Reference!

Portfolios may consist of shares of companies in a particular industry or securities of a particular region. Accordingly, the formation takes place from foreign documents.

Why are investment portfolios needed?

An ideal investment is an investment that provides a high, stable, secure income and the ability to monetize financial assets at any time. In real life, such a successful combination, if it occurs, is very rare and does not last long. As a rule, an investor has to choose between the main parameters of financing: profitability, reliability and liquidity. A separate type of security does not have such versatility. This can only be achieved by a complex investment composition called a portfolio.

The difference between portfolio investments and direct ones

Objectively, there is always a dilemma between direct and indirect (indirect or portfolio) investing. If the owner of available funds aims to own control over a specific business, he seeks to invest in securities (shares) of this particular enterprise. By purchasing a certain share of its assets, a direct investor receives the right to vote when making management decisions.

The differences between direct and portfolio investments are manifested primarily in the investor's ability to influence the management of the company (through the board of shareholders or other similar body). The reason for this is the proportion of shares owned by him in the controlling stake.

Real investments are also practiced. This is an investment in the development of a specific project that promises high profits and therefore has aroused interest. This type of investment cannot be indirect (that is, made on behalf of the owner of the capital in his interests by a third-party fund).

Another important difference is that direct investment is carried out in the form of transfer of equipment, technology, intangible assets, the right to use a trademark, as well as finance. Indirect and portfolio investments involve only cash.

An alternative to the direct approach is portfolio investment. What it is? Several definitions are available, each focusing on a specific aspect of a financial investment.

Functions of foreign portfolio investments

Foreign portfolio investment occupies an important place in the structure of the modern financial market. The influx of capital investments from abroad helps to increase the stock market of the importing country. Therefore, most government programs emphasize that direct and portfolio foreign investment in Russia is important for the development of the domestic economy. Attracting foreign funds is of particular importance if domestic financial savings do not satisfy the state's needs for capital investment.

Mechanisms for attracting external investment are more flexible compared to commercial lending, which allows both borrowers and investors to quickly adapt to market conditions. The influx of foreign capital into the Russian economy is constrained by a number of factors, including the lack of stability and insufficient development of infrastructure in the securities market.

The main task of a foreign financier is to place his funds in the securities of companies in that country, where they will provide maximum profits with minimal risks. Therefore, portfolio investments in the global economy are carried out between developed countries, and their growth rates are faster than direct investments.

Attracting foreign capital is required to:

- speed up the process of creating international economic ties;

- increase macroeconomic indicators;

- modernize the national economy;

- develop stock markets;

- soften credit policy;

- solve socio-economic problems.

Spheres of the economy requiring public investment

During periods of crisis, government investments help to “launch” those areas of the economy that have suffered the most severe blow. In the economic program of the government, priority areas are identified that are in dire need of support:

— environmental measures;

— increasing scientific potential (improving training conditions, organizing retraining and a base for advanced training, financing scientific projects);

— defense industry and public safety;

— formation and maintenance of a high level of social environment;

— maintaining the pace of construction of socially significant and industrial facilities, including housing, at the proper level.

Portfolio investment objects

Portfolio investments can cover a wide range of asset classes. The portfolio may include stocks, government bonds, corporate bonds, Treasury bills, real estate investment trusts, exchange-traded funds, mutual funds and certificates of deposit.

Portfolio investments may also include options, derivatives such as warrants and futures, and physical investments such as commodities, real estate, land and timber.

While direct investments are usually aimed at buying out a large part of an enterprise and further participation in its work.

Which portfolio investment objects should I use? This depends on a number of factors. The most important of them include:

Firstly, the investor’s risk tolerance. How much risk of loss can an investor take on? Bank deposits and pension accounts are considered the safest. However, they have an extremely small percentage of profits, which hardly covers inflation.

Secondly, the investment horizon. This is the period for which the investor plans to invest money. If the investment takes place within one year, then it is a short-term investment. And long-term investments are called investments for several years, or even decades.

Thirdly, the amount of investment. If a young investor is limited by funds, then mutual funds or exchange-traded funds may be suitable portfolio investments. And for large individual capital, portfolio investment objects can include stocks, bonds, commodities and rental property.

Portfolio investments for major institutional investors such as pension funds and sovereign wealth funds include a significant portion of infrastructure assets such as bridges and toll roads.

Portfolio investments for institutional investors are generally expected to have a very long life. The duration of their assets and liabilities must match each other.

Direct investments

Residence permit for investments in Europe

Before we begin listing European countries that are ready to host wealthy citizens, it is worth clarifying that there are two types of investments that underlie residence permit programs: active and passive.

- Active investing consists of creating a new or purchasing an existing business in the country. The benefit to the state is obvious because you save or create new jobs.

- Passive investing involves purchasing shares of local companies, purchasing government bonds or investing in commercial real estate.

Greece allows you to purchase your residence permit for: investments in real estate (from 250 thousand euros ), investments in the development of the Greek economy ( from 300 thousand euros ) and simply for financially independent persons (annual income from 24 thousand euros , transferred to the accounts of a Greek bank).

Portugal offers several investment options: real estate from 350 thousand euros , creating a new business for at least 10 people, or investing 250 - 350 thousand euros in scientific research, supporting art projects or developing renewable energy projects.

Spain is satisfied with passive investments: from 2 million euros in Spanish bonds, a bank deposit in the amount of 1 million euros and real estate worth over 500 thousand euros.

France offers wealthy foreigners a long-term visa, on the basis of which they can live in this country, but cannot work. The conditions are as follows: annual income from 20,000 euros , mandatory annual rent or purchase of an apartment in France and insurance. The visa can be extended. But it is beneficial only to those who receive income in another country, since taxes in France are extremely high.

In addition, the country of the Eiffel Tower has a Talent Passport program. This is a four-year residence permit for investments of €300,000 or more in local companies.

Italy is not averse to issuing residence permits to those who make contributions to Italian innovative startups ( from half a million euros ), to socially significant projects ( from 1 million) or to government bonds ( from 2 million euros ).

The UK is famous for its love for large investors, whom it is ready to support and allow to reside on its territory. True, it is not cheap - from 2 million euros invested in British bonds or companies.

Ireland also favors wealthy citizens: for 1,000,000 euros invested in Irish enterprises for a period of 3 years, you will be given a residence permit for a period of 5 years with the possibility of extension.

How to become a portfolio investor?

Portfolio investments are the best choice not only for beginners, but also for experienced investors. Splitting capital never hurt anyone. Perhaps some security will shoot up and bring a lot, while another asset will sag, but this will not be critical. Therefore, it is worth considering the entire sequence of actions:

- The investor decides to start investing . You need to be confident in your actions so that you don’t rush to take your money when you see what’s going on in the markets.

- Decide on the amount of money to invest . The latter is not worth carrying, anything can happen - the portfolio can immediately go into a slight minus simply because of the not very well chosen time.

- Choose a direction for investment - most often it is the stock market . To do this, you need to open an account with a broker. Everything is not very complicated, the support service will help with all questions, it is quite patient and competent.

- Develop a strategy . Here you can act on your own, or contact a specialist - take different investment strategies from the broker’s employees or contact a financial consultant. At the same time, the investor decides how he will work - conservatively, moderately or aggressively. In the latter case, it is also recommended to familiarize yourself with cryptocurrency exchanges; this may be the most profitable instrument in the portfolio.

- Decide for how long or up to what amount of income to hold positions and securities, decide what to do with the profit - reinvest or withdraw. If you reinvest, then where?

Here are 5 steps that separate a person with money from a portfolio investor. Everything is simpler than it seems, you just need to start taking action. But it is also important to remember that investment capital should not consist of the latest savings or be a financial airbag; there are minimal risks even in conservative portfolios.

Citizenship of Saint Lucia

This program for obtaining citizenship by investment is one of the youngest; as of this year, restrictions on the number of passports issued have been lifted (previously 500 per year), the need to declare at least $3 million for applicants and the need to visit the state to obtain a passport have been abolished. In addition, citizenship by investment here is one of the cheapest - $100 thousand for one and $190 thousand for a family of up to 4 people. The procedure for obtaining citizenship takes no more than 3 months, and a passport allows you to enter almost 130 countries of the world without visas.

Portfolio investment risk

If investments are made as part of a portfolio, then they depend on the individual characteristics of each investor. Those with a greater risk appetite may prefer to invest in stocks, real estate, international securities and options. And more conservative investors can choose government bonds and shares of large well-known companies.

Many factors influence stock prices. Every company has successes and failures. This is reflected in both the growth and decline in the value of the company's shares. Therefore, the risk for this asset is considered high. Since bonds are not subject to sudden changes in value, they have a fixed profitability. Therefore, they are considered less risky assets.

Real estate is also a very slow and stable structure, weakly susceptible to sudden price changes. Bank deposits are considered the safest. There is virtually no risk of losing money with such an investment. After all, in addition to the bank itself, the deposit is also secured by a deposit insurance agency.

The degree of risk in a portfolio should be weighed against the investor's goals and time horizon. A young person saving for retirement may have 30 years or more to live. He will want to maintain the investment rather than take on the risks of the stock market. This person may prefer a more conservative mix of portfolio investments, despite the long-term horizon.

Likewise, people with a high risk appetite may want to avoid investing heavily in riskier growth stocks as they approach retirement age. As you get closer to your investment goal, it is usually recommended to move to a portfolio of more conservative investments.

Residence permit for investments in the Caribbean

If millions of euros are putting you off, look away from old Europe and look to the Caribbean. Contributions there are 10 times lower, taxes are lower, and the climate is hotter. Take, for example, the state of Antigua and Barbuda . It offers not just a residence permit, but immediate citizenship to everyone who is able to donate $100,000 or acquire real estate for $200,000.

Grenada - $150,000 in the island development fund or $220,000 invested in real estate will provide you with the opportunity to permanently reside on a tropical island with an average temperature of +26 C.

The monarchy, located on the islands of Saint Kitts and Nevis , has been issuing permanent residence permits to foreigners who support its economy with financial injections for more than 30 years. And this program is perhaps one of the most profitable. Anyone who wants to move to this Caribbean island can buy commercial real estate worth over $200,000 , obtain a residence permit, and then citizenship, and sell this property after 7 years. The second option is a non-refundable donation to the Sustainable Development Fund ( $150,000 ).

A similar program exists in Dominica . The non-refundable payment for immediate citizenship is $100,000 for one person. If a married couple or a parent with two children is registered - $175,000 . In addition to the fee, those interested will have to pay a due diligence check in the amount of $7,500 per applicant.

The small Caribbean island of Anguilla has big appetites. The British “colony” promises to issue residence permits to those who contribute $150,000 for themselves and $50,000 for each family member to the Anguilla Capital Development Fund. The contribution to the Fund is in addition to application processing fees and due diligence fees of $3,000 and $7,500 thousand.

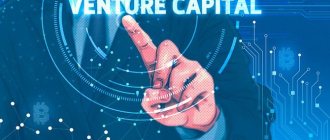

Are private equity investments different from venture capital investments?

Venture investments are high-risk investments. It follows from this that they can only be straight. Without understanding the essence of the proposed venture startup, not a single investor will invest money in it. Shares of risky projects are extremely rarely included in investment projects.

Venture investments are more often carried out by specialized funds, less often by individual financiers (their category includes the so-called business angels) or businessmen who are passionate about an idea that seems promising to them.

Summarizing this information, it can be argued that a direct investment may not be a venture investment, but a venture investment is almost certainly a direct investment.

A conditional exception is venture clubs, which are a “fair” of risky but promising startups. Their task is to interest potential investors in fresh, revolutionary business ideas.

However, they can hardly be called intermediaries in the generally accepted sense. Venture clubs do not buy startups or speculate on them. They only present commercial ideas with an unclear perspective. After a businessman agrees to finance a risky project, he becomes a direct investor.