October 28, 2022 Anton Khmelenko All authors

There are many similarities between mutual funds and ETFs, but there are also important differences.

It is similar, for example, that shares of mutual funds and exchange-traded funds (ETFs) can be sold and bought on the stock market like any other securities. Thus, for several years now you can buy shares of some mutual funds on the Moscow Exchange. They are called exchange-traded mutual investment funds (MUIF).

What differences are there?

Purchase and redemption in the office

One of the key differences between ETFs and mutual funds is the inability to purchase and redeem ETF shares at the office of the management company (MC). Mutual funds and ETFs are present on the stock exchange, but only mutual funds can be redeemed by receiving money for it at the company’s office. For ETFs, there is only one option - selling on the stock market.

It would seem that what is good for ETF owners? The fact is that management companies - providers of mutual funds are forced to keep a significant part of the funds in cash in order to be able to satisfy the requirements of investors for the redemption of shares. This reduces the fund's profitability and worsens the accuracy of following the benchmark (stock index).

Thus, the ETF provider has the opportunity to invest all funds in core assets (for example, shares).

General meaning of ETFs and mutual funds

Both funds are collective investment vehicles. All money of shareholders or shareholders is collected into a common pot. Funds are invested in various assets: stocks, bonds, real estate. Each investor has his share of this pie, in proportion to the funds contributed.

The minimum entry threshold is quite democratic: the minimum share (share or share) will cost within a few thousand rubles (on average 2,000 - 5,000).

The activities of the funds are controlled at the legislative level.

By buying an ETF or mutual fund, you solve several problems at once:

- Wide diversification. For little money you get dozens or hundreds of company shares in your portfolio.

- Investments are based on the “buy and forget” principle - you don’t need to analyze and select papers yourself.

- Nothing is required from you except money. Funds will continue to work.

Let's conduct a small battle and find out the difference and profitability of ETFs and mutual funds.

Buying and selling commissions

When purchasing mutual fund shares, a premium is withheld (according to the legislation of the Russian Federation, no more than 1.5%), and when selling, a discount is deducted (according to the legislation of the Russian Federation, no more than 3%). Under certain circumstances, the premium and discount may be zero.

When trading with ETFs, a brokerage commission is withheld. Some brokers have a selection of ETFs that you can buy/sell without paying a commission.

In addition, an investor purchasing an ETF may incur additional costs associated with spreads (the difference between the purchase price and the sale price of a security on the exchange). If a mutual fund is purchased on an exchange, similar rules apply.

Expenses and other charges

The pleasure of owning funds is not free. Investors bear annual costs.

For ETFs, this is an annual holding fee. From the amount of the investor's assets.

In Russia, on average, this is tenths of a percent: 0.45 - 0.9%. For every 100 thousand rubles invested in ETFs, the commission will be 450-900 rubles. In year.

Plus brokerage expenses: transaction commissions, custodian fees and activity fees. Expenses can vary from 100-200 rubles to 2-3 thousand per year. Depending on the chosen broker and tariff.

Save money: Choose a reliable broker with minimal fees.

Mutual fund commissions can consist of 3 components:

- annual management fee - on average 4-5%;

- commission for the purchase of a share - 0.5 - 1.5% (surcharge);

- sales fee - 0 - 1.5% (discount).

Discounts and premiums may not be taken under certain conditions (purchase directly at the management company’s office, and not from intermediaries, ownership of shares for more than a certain period of time - 1-3 years).

The biggest hit is the annual fee. There are mutual funds that charge a management fee of 7-8% per year!!!

In general, commissions for ETFs are several times lower than for mutual funds.

Liquidity

You can buy or sell ETFs at any time during the trading session.

Trading in ETF securities is usually quite liquid. This is due to the work of market makers, who are required to maintain liquidity at a pre-agreed level and regulate spreads.

When trading mutual funds on the exchange, there is often no liquidity due to the absence of market makers.

You will be able to receive money after redeeming a mutual fund share at the management company’s office only in a few days (by law - up to 10 days).

Investment strategies

Most ETFs are aimed at passive investing. The basis is any country (RTS, S&P 500) or industry (IT, oil and gas, metals, finance) index. And securities in the portfolio are purchased in exact accordance with their shares in this index.

The main goal of an ETF is to closely track an index.

The mutual fund strategy can be aimed at index investing or active management.

When active, the manager strives to show greater profitability than the market as a whole provides. Selecting and investing money in individual promising or undervalued securities.

Useful tips and advice for novice investors

Investing in funds solves several problems:

- capital is diversified;

- investments for the investor become passive, since the management company is engaged in the analysis and selection of securities.

The most important advantage of the mutual fund is the maneuverability of the instrument. ETF strategies involve closely following an index. If the stock market falls, the price of the share falls along with it. The securities cannot be sold before the expiration date. Active mutual funds can wait out a bond crisis, thereby minimizing investor losses.

Bond ETFs: What's the Benefit?

ETF (Exchange Traded Funds)

- these are funds whose investment units can be bought and sold on the stock exchange. They are formed from securities in maximum compliance with a particular stock index.

How it works?

An investor, by purchasing a share in an investment fund, acquires a proportional share in the index, that is, in fact, he buys the entire market. According to the investment mandate, ETFs are required to follow the selected index or asset, in other words, to maintain a portfolio structure that is as close as possible to the index basket (we talked in detail about what bond indices are and what they are needed for here). Since this process occurs without the participation of the investor, such investing is called passive. If the index rises or falls, then the value of the ETF follows it proportionally increases or decreases.

When did ETFs come into being?

The first traded exchange-traded fund appeared in 1990 on the Toronto Stock Exchange. Today, according to ETFGI, there are more than 7.7 thousand passively managed funds in the world. The global ETF market size at the end of 2022 was about $5.3 trillion. Passive strategies are most popular in the American market, where the share of ETFs in total fund assets is about 15%. In total, the US market accounts for more than 70% of the volume of assets of all ETFs in the world. Stock ETFs lead the way in terms of assets with $4.1 trillion. Bond ETFs are in second place with $940 billion in assets.

According to Oleg Yankelev , senior partner at FinEx Investment Management LLP, unlike stock ETFs, bond ETFs appeared only in the early 2000s, but attracted the attention of investors only after the crisis of 2008–2009. In recent years, interest in bond ETFs has been growing, while active managers of traditional trust funds have seen significant losses in assets under management. At the moment, bond ETFs already account for 17.4% of the volume of all ETFs on the global market.

What about in Russia?

In Russia, the first foreign ETFs (registered under the UCITS Collective Investment Directive) were listed on the Moscow Exchange in 2013. Only five years later, in 2022, Russian professional participants had the opportunity to create exchange-traded funds (ETIF) under Russian law. Formally, BPIF is considered the Russian analogue of ETF, although not all market participants agree with such a direct comparison: there are still some important differences between these instruments.

Currently, a total of 16 foreign ETFs and 7 mutual investment funds are traded on the Moscow Exchange, eight of them are bond ones, Natalia Suslennikova, director of the indexes and exchange information department of the Moscow Exchange, said at the Investfunds Forum X conference.

In 2022, the trading volume of bond ETFs and BPIFs on the Moscow Exchange amounted to RUB 9.5 billion. Source: Moscow Exchange

The largest ETF provider in Russia is FinEx. The total investments of Russian private investors in ETF FinEx are, according to the company itself, about 15 billion rubles. Now the FinEx line includes 14 funds, but only four of them are bond funds: two ETFs for US Treasury bills and two funds for the Bloomberg Barclays Russian Eurobond Index. There are virtually no full-fledged ETFs for local ruble bonds on the Russian market.

According to Alexey Tretyakov

, CEO of Arikapital Management Company, this is primarily due to the insufficient development of legislation and representative indices on the basis of which ETFs could be created. “If you asked me what Russian index we could create an ETF for, off the top of my head, apart from the Moscow Exchange stock index, I wouldn’t name a single one,” he noted.

Alexander Abramov also agrees that the main obstacle to the development of index ETFs in Russia for bonds of Russian issuers is the limited indices of ruble bonds that are actually adapted for use by index funds.

, Head of the Laboratory of Analysis of Institutions and Financial Markets at RANEPA.

As Oleg Yankelev clarified, FinEx does not yet plan to launch ETFs for local bonds. He explains this by the fact that ETFs for Russian Eurobonds in the line are quite sufficient, since they provide the level of liquidity and diversification necessary for investors, as well as higher returns with a similar risk in relation to local Russian bonds.

However, if you really want to, you can still invest in Russian bond indices, and even now, although not with the help of an ETF, but by purchasing shares of the BPIF on the Moscow Exchange. At the beginning of the year, Sberbank Management Company launched a mutual fund for the Moscow Exchange OFZ index, and VTB Capital Asset Management offered investors a mutual fund for the exchange index of Russian corporate bonds.

What are the advantages

- Low entry threshold, including the global bond market and the Russian Eurobond market.

- High level of diversification: portfolios of individual ETF funds can include several thousand positions, that is, by purchasing just a few shares of an ETF fund, an investor immediately receives a diversified portfolio, which in theory reduces his risks. In addition, you do not need to waste time analyzing each issuer in your portfolio; the index providers have already done this for you, selecting the most liquid and reliable securities for the basket.

- Low costs: the total annual costs of an investor when investing in ETFs are 0.2–0.95% of investments (for Russian ETFs). In the global market, the commissions of the largest index funds are even lower and amount to hundredths of a percent. Some global ETF providers are even eliminating commissions altogether in the fight for investor funds.

- Possibility of investing through an IIS: by purchasing ETFs traded on the Moscow Exchange using an IIS, you get the opportunity to earn an additional 13% on your investments by deducting the contribution.

What are the disadvantages

- You do not receive a regular "rent" in the form of a fixed coupon that is paid to holders of individual bonds by the issuers of the bonds.

- You can't lock in a guaranteed return at the entrance: when you buy an ETF, you don't know what kind of return this investment will bring you in 3, 5 or 10 years.

- You do not have the opportunity to manage the duration of your portfolio yourself, that is, to choose securities with maturities that correspond specifically to your goals. For example, if the market (and therefore the index) falls for 10 years, then you are in the red all this time and are forced to wait until the value of your assets recovers, or sell them at a loss if you need money urgently.

- By buying an ETF, you agree to simply follow the market, which means you automatically lose the opportunity to beat the index by earning more than the market (although this is quite rarely possible even for professional managers, but this possibility still exists, especially during periods of market decline).

- With the help of ETFs, it is now actually possible to invest only in the global bond market and Russian Eurobonds, but it is no longer possible to assemble a diversified portfolio of local ruble bonds that provides a stable fixed income in rubles using this instrument.

EXPERT OPINION

Oleg Yankelev , senior partner at FinEx Investment Management LLP:

— Firstly, bond ETFs solve the problem of effective diversification at minimal cost.

Secondly, they provide investors with maximum liquidity even during periods of market turbulence - they have the opportunity to get a fair market price for the assets they own at the moment when they really need it.

Third, ETF liquidity is concentrated on exchanges, allowing buyers and sellers to quickly and efficiently access bond exposure without having to trade in the underlying asset market (the secondary market accounts for about 80% of bond ETF transactions). In contrast, the liquidity of individual bonds is fragmented: it is often not possible to obtain quotes for individual bonds at every point in time.

Fourth, ETFs provide an unprecedented level of transparency and fair execution of transactions.

Fifth, using ETFs makes it easier to manage liquidity and rebalance a global investment portfolio.

And sixth, bond indices, like stock indices, beat most active managers - which means a reasonable question arises: why pay more for a classic industry product if you are almost guaranteed to get a mediocre result.

Sergey Grigoryan , private investment management expert, author of the Capital Tg channel:

— In my opinion, the main advantage of an ETF is that this instrument allows the investor to control what is controllable: costs, risks and tax consequences. If we talk about global markets, this is also an opportunity to quickly and inexpensively enter the largest asset class.

If independently compiling a global bond portfolio, in order to achieve the required level of diversification that reduces non-market risks, a private investor would have to buy at least 20-30 securities, each of which requires separate analysis and a minimum investment of 100-200 thousand dollars.

Now compare that to buying a piece of the pie (that is, an ETF covering a broad asset class: US bonds, non-US bonds, and emerging market bonds).

Source: SGCapital Telegram Channel

With a brokerage account with access to the NYSE and a few hundred dollars, a private investor can gain “exposure” to an entire market, and his only concern will be managing the share of that asset class in his portfolio, while all the work is done directly for managing the bond portfolio will remain on the side of the largest management companies for a symbolic commission. Equally important is high (almost instantaneous) liquidity, since if necessary, a position can be sold to the market with a minimum spread in a few seconds. When dealing with individual securities, liquidity often disappears at the most inopportune moment, when it is most needed, for example, during periods of crisis sales.

One downside to ETFs for some may be the fact that some index funds do not pay regular dividends, unlike coupons on specific bonds. In fact, this is a rather illusory disadvantage, since the coupons from the bonds included in the ETF do not go anywhere, but accumulate in the portfolio and are reinvested, increasing the final return. If an investor needs to periodically withdraw income from the portfolio, he can do this by selling his position in small parts (for example, equal in size to the coupon income).

Personally, I see no downside to ETFs over buying individual bonds for the vast majority of retail investors. The exception, perhaps, is investors - market professionals who know a specific industry/company very well and are able to assess the quality of the issuer at the level of an insider or an experienced buy-side analyst. Perhaps in this case, an attempt to earn additional profitability compared to the market average will be justified. For everyone else, the pursuit of excess profitability can result in increased risks that do not lie on the surface, but are highly likely to appear during periods of turbulence, for example, in the 4th quarter of 2014.

Alexander Abramov , head of the laboratory for analysis of institutions and financial markets at RANEPA:

— If we talk about investments by Russian private investors in the global market, then, in my opinion, the most preferable are ETFs of large American companies traded on American exchanges. ETFs for “foreign” indices presented on the Moscow Exchange are unlikely to be able to compete with American ones in the field of diversified portfolios; this is simply not their niche.

Building a well-diversified global portfolio from several ETFs from Vanguard, BlackRock, Fidelity Investments, PIMCO and other major US companies is quite simple. The advantage of this solution: relatively low costs for the investor, protection from the risk of ruble devaluation, acquisition of instruments from large companies with a high level of reputation. You can also buy such ETFs on American exchanges through Russian brokers, and this does not involve high transaction costs. However, this is only possible if you have the status of a qualified investor. I consider this limitation of our legislation to be largely artificial, but it exists. It is also impossible to purchase such instruments on foreign exchanges through IIS. Additionally, I would highlight the operational risk associated with the storage of these securities by Russian intermediaries through a chain of foreign depositories.

Making a choice

On the same side of the scale is the ETF, with its low costs, index strategy, high liquidity and ease of buying and selling. Plus the ability to use it in conjunction with IIS.

With passive management (index strategy), it is definitely more profitable to invest money in ETFs. The point with mutual funds is the same, but the costs are several times lower.

To another mutual fund. With the exchange of shares without taxes. Opportunities to get more money with active management. But here we come up against the art of the manager. His professionalism and consistency of results.

So to speak. By investing in active mutual funds, you get the opportunity to earn more than the market provides with an index strategy (ETF). But at the same time, there is a risk of not even getting this average market return.

Direct investment in bonds: when and why is it profitable?

Over the past couple of years, private investors have become increasingly active in independent investing, choosing direct investments in bonds or stocks instead of funds.

Last year, an absolute record was set for the influx of funds from individuals into the Russian stock market. In total, over 700 thousand new Russian citizens entered the exchange market in 2022, the Moscow Exchange calculated. Source: Moscow Exchange *New unique individuals not previously registered on the exchange.

**Clients who made at least one transaction per year According to the annual review of NAUFOR, the volume of funds received from citizens into brokerage accounts (without IIS) in 2022 exceeded 1 trillion rubles.

Moreover, private investors have not only become more active in buying and selling bonds directly through a broker on the secondary market, but are also increasingly becoming active participants in initial bond offerings. For example, in 2022 they purchased new corporate bonds worth RUB 251 billion. (over 10.9% of the total volume) and OFZ for 74.2 billion rubles. (7.2% of the total). Source: NAUFOR

In many ways, the popularity of securities among the population has grown greatly in recent years thanks to the instrument of individual investment accounts: they allow a private investor to receive not only income from investments, but also a bonus from the state in the form of a tax deduction. In addition, technology has helped: today, almost all major professional participants offer the opportunity to remotely open brokerage and depository accounts. And thanks to mobile investment applications, buying bonds directly from your smartphone today is no more difficult than making a purchase in any online store. Moreover, a number of services (for example, the Yango.Investments application) allow you to perform any operations with your portfolio 24/7.

Of course, in order to independently decide what to buy or sell, you need to be in the market. But even this has become much easier today: investors have access to all information online; they just need to subscribe to several reputable specialized telegram channels to receive news, financial analytics and free investment advice delivered to their smartphone around the clock.

By the way, the Moscow Exchange, NAUFOR and the Bank of Russia promise that by the end of 2022, “physicists” will also have the opportunity to instantly replenish brokerage accounts using the Fast Payment System (SBP), using the invoicing system in their Internet bank.

What are the advantages

- Individual bonds in Russia, unlike funds, allow you to receive regular annuity in the form of a coupon - therefore this is one of the main instruments of annuity and pension portfolios.

- You decide for yourself which securities and in what proportion to buy, clearly understanding the credit, market and other types of risks that you incur.

- When purchasing individual bonds, you clearly record the profitability of your investment, which is determined at the time of purchase of the security by its price. Thus, you always know at the entrance how much you will ultimately earn.

- You can manage the duration of your portfolio by choosing maturities that suit your investment goals. It is impossible to predict what the price of an ETF share or mutual fund unit will be in 3 years. But if you buy an individual bond that matures in three years, you know exactly what price you'll get out of that investment at.

- By using individual bonds, you can manage your expectations for rate changes: if investors believe that rates will rise soon, then it makes sense for them to invest in short-term securities; if investors are waiting for rates to fall, they can invest in long bonds, locking in higher returns.

- By investing in individual securities, you can make the most of all types of tax benefits that the state has provided for a private investor: this is an incentive for long-term ownership of securities, and an exemption from paying personal income tax on coupons for bonds issued after 01/01/2017, and the opportunity to receive an additional 13% on your investments annually in the form of a deduction for the IIS contribution.

- Low costs. Even after taking into account all the expenses that include broker commissions, exchange commissions and custodian fees, the total trading costs of direct investing are much lower than investing in funds where you are required to pay management fees to the management company every year, regardless of whether the fund showed profit or loss.

What are the disadvantages

- Low liquidity: The Russian bond market has historically had fairly low liquidity. This means that you will not always be able to quickly and without losses get out of the papers (by finding good quotes in the glass), if such a need urgently arises. As a rule, the lack of liquidity turns out to be especially critical during periods of severe market drawdown.

- Low diversification: to assemble a full-fledged and well-diversified bond portfolio yourself will require more time, expertise and significant investments. Achieving high diversification if you entered the market with small amounts will be problematic.

- Higher time costs for maintaining a portfolio: although the process of buying and selling bonds for a private investor today looks as simple as possible, you, as an independent investor, will still have to regularly spend time on your portfolio: you need to follow financial news in order to control market risks, track information about issuing companies, look for new interesting ideas for investment, and so on. This requires time and high financial literacy.

- Difficulties with investing in the global market and the Eurobond market. Due to the high entry threshold, it is unlikely that you will be able to independently form a diversified portfolio of foreign currency assets with a small starting capital (for example, in the Eurobond market, the minimum lot size, as a rule, starts from $100 thousand). In addition, you will also have to search for information and deal with interesting foreign credit histories, analyze the risks of foreign issuers, their business, reporting and the markets in which they operate.

EXPERT OPINION

Alexey Tretyakov

, General Director of Management Company "Arikapital":

— Russian ruble bonds are now trading with a very small difference in yield. For comparison, in dollar securities the difference in yield between bonds with a rating of AAA (risk-free government bonds) and securities with a rating of B (corporate bonds of high-risk issuers) reaches 5 times (2% and 10% per annum, respectively). At the same time, in the ruble bond market, OFZs provide a yield of about 8%, and corporate bonds with a B rating rarely give above 10% per annum. With such a slight difference, in my opinion, it is really not very advisable for a private investor who has the desire and time to understand the peculiarities of working in the market to overpay the management company’s commission and it is much more profitable to purchase bonds directly into a personal brokerage account.

True, not everything is so hopeless for managers of ruble mutual funds. They can achieve higher returns by choosing the right moments to buy and sell long-term bonds in order to make additional money on rising market prices, or (as we do) by including foreign currency bonds in mutual funds, hedging the risk of changes in exchange rates in the futures market.

Oleg Yankelev

, senior partner at FinEx Investment Management LLP:

— Due to the fact that ETFs are subject to tax benefits within the IIS and benefits for long-term ownership of securities, the benefits of individual bonds can only be realized with short-term investments in local corporate and government bonds, for which there is a coupon tax exemption. As for the often-cited advantages of individual bonds, such as the ability to manage duration or regular coupons, in my opinion, in fact, they are not: coupons, on the contrary, only create headaches for investors (reinvestment risk). ETFs can also pay dividends, but FinEx has made a conscious decision not to pay dividends - all income received is reinvested in the fund's portfolio). Duration management, even assuming its utility, can be achieved by re-weighting the various bond ETFs in the portfolio.

Alexander Abramov

, Head of the Laboratory for Analysis of Institutions and Financial Markets at RANEPA:

— Unlike shares, bonds are a more complex instrument for a retail investor in terms of the required minimum financial knowledge and the costs of monitoring essential information about the economy and markets. For example, according to a 2016 survey of Americans conducted by the influential research center Bipartisan Policy Center, when asked what happens to bond prices if the official interest rate rises, only 28% of respondents gave the correct answer (that prices fall). I don’t know what the percentage of correct answers to this question would be among Russian citizens, but I believe that it would be less than 28%.

However, the example from the United States shows that it is difficult for private investors to understand many aspects of the behavior of bond prices and yields. Add to this the fact that information and analytical systems that disclose information essential for bond investors in Russia are still poorly suited for use by private individuals. Perhaps for these reasons, the International Securities and Exchange Commission (IOSCO) estimates that institutional investors (banks, pension funds and mutual funds) dominate retail investors in the secondary bond market, especially in developing countries. And many retail investors still prefer to own bonds through collective investments such as mutual funds and pension funds.

Review of BPIFs on the Moscow Exchange

All exchange-traded funds are listed on the Moscow Exchange. Their list is updated almost monthly, so check the relevance of the link. At the time of writing, 68 BPIFs are trading. There are funds for:

- bonds, including Eurobonds – 17 pieces;

- money market – 1 pc.

- shares – 37 pcs.;

- goods (gold, silver) – 4 pcs.;

- mixed – 9 pcs.

The base currency can be rubles, dollars, euros and Kazakh tenge. Diversification is quite wide - into securities of Russia, the USA, Germany, China, Kazakhstan, and a number of developing countries.

More than 100 cool lessons, tests and exercises for brain development

Start developing

For investors who adhere to the principles of environmental investment (ESG), there are funds for shares of companies with the best dynamics of indicators in the field of sustainable development and corporate social responsibility (for example, ESGR from Rosselkhozbank Asset Management or SBRI from Sber).

In the wake of the frantic growth in stock prices of IT companies, mutual funds for the technology sector began to actively register (for example, MTEK from the East-West Management Company or TECH from the Tinkoff Capital Management Company).

Investors who use precious metals as a defensive part of their portfolio can choose gold and silver exchange-traded funds. So far the choice is small - only 4 mutual funds.

The first mutual funds in Russia appeared only at the end of 2022:

What's better?

Okay, we understand the differences, but which is better? Apparently it's an ETF, is it true?

There are two cases when it is recommended to buy shares of a Russian mutual fund:

- If for certain reasons you do not want to open a brokerage account or individual investment account to purchase an exchange-traded fund.

- If you are not eligible to invest in foreign financial instruments. Thus, some categories of citizens will not be able to invest in ETFs.

In these cases, a mutual fund will indeed serve as an alternative to an ETF. In all other cases, exchange-traded funds are a more preferable option.

If you want to invest for a period of 2-3 years, then bond funds are optimal. So, on the Moscow Exchange these are ETFs, which have the designations FXRU, FXRB, FXMM, RUSB. In addition, you can use federal loan bonds, but on their own, without ETFs. There is no exchange-traded fund for these bonds on the Moscow Exchange.

As for equity funds, investing for such a short period of time is not recommended due to the fact that the value of such shares fluctuates greatly in price.

Fund returns

In general, mutual funds lose out to ETFs in terms of profitability. The difference is especially noticeable over long periods.

Factors influencing profitability:

- commissions;

- active control.

Passive strategy

In passive index investing, both funds seek to replicate the index. But due to the higher commissions of mutual funds, the profit will always be less by this difference. The mutual fund will lag behind the ETF by an average of 2-3% annually.

For mutual funds, not all money works. Some funds have to be kept in reserve. In case of sale of shares and payment of money to shareholders.

This further reduces the yield of mutual funds and increases the gap with ETFs.

Most index mutual funds support an index strategy by purchasing foreign ETFs. As a result, we have an extra link in the form of a management company. And double expenses. The mutual fund pays a foreign provider to hold the ETF. We pay mutual fund. But several times more.

The loss of a mutual fund “only” a couple of percent annually, over long periods, very significantly reduces the overall profitability. Making the gap in the final results simply colossal.

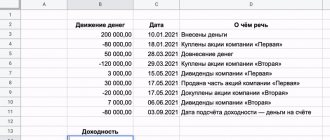

Using the example of investing in gold. Profitability at the official exchange rate of the Central Bank, ETFs and several Russian mutual funds. They have one meaning - investing in gold. But the results are completely different.

Actively managed funds

The most important advantage of mutual funds is freedom of maneuver. ETFs that blindly follow the index, when the stock market falls, begin to decline along with it. According to the strategy, securities cannot be sold. During periods of crisis, we could observe corrections of minus 20-30%.

Active funds that are not tied to an index can afford to get out of a bear market by riding out the storm in reliable instruments. For example, bonds. Thereby saving the investor’s money.

In general, according to statistics, two thirds of such funds lose to the index over an interval of 3 years. Over a period of 8-10 years, the number of successful ones is reduced to 5-10%.

Causes?

High commissions. There is a direct relationship here. The higher the management fees, the lower the percentage of successful funds. In order to receive returns above the market, the manager needs to earn additional profit in the form of management fees + something on top. Constantly. One or more mistakes can negate the entire result of past investments.

How is the price of an ETF formed?

Exchange-traded fund creators track the composition of a portfolio of assets in real time. The total value of financial assets is constantly calculated, taking into account the weights of individual issuers included in it. Thus, fund managers always know the fair price.

Each investor can independently understand the cost. If the fund is based on the MICEX index, then if it grows by 2%, the fund also grows by 2%. If we are talking about the foreign market or gold, then the ruble exchange rate is also taken into account. If the ruble strengthens against the dollar by 1%, and the foreign market grows by 2%, then the value of the ETF will grow by only 1%.

How are fund units sold to private investors? A certain number of ETFs are issued in advance to be sold through the exchange. Individual organizations are responsible for creating liquidity; they are called “market makers.”

A separate organization represented by the depository monitors that the fund's assets are backed by real securities, so it is impossible to inflate a “bubble” in the value of the ETF.

Results

Which of the two investment instruments seems more interesting to you?

I am sure that after reading this article you will be able to decide for yourself which is better for you - mutual fund or ETF. Well, I’ll tell you exactly how you can invest money in such an interesting (but so far unpopular in our country) instrument - ETFs - in one of the following articles.

Subscribe to updates so you don't miss anything and don't forget to share links to the most interesting posts with your friends on social networks! See you!