Scalping allows you to make money on the exchange using transactions lasting from a few seconds to several minutes. Financial analyst of the closed investor club Invest Future Dina Gilmiyarova talks about the advantages and disadvantages of this method, as well as methods and software for scalping.

Dina Gilmiyarova

Financial analyst of the closed investor club Invest Future

There are two ways to make money in the stock market: trading and investing. IF Club stands for smart long-term investing. However, the topic of today's discussion will be speculation, namely one of its variations - scalping. What is it and how to make money on it?

General information: pros and cons

If we talk in general about speculative styles, there are only three of them: scalping, day trading and swing. The difference lies in the holding time of positions. Scalping transactions are the shortest: from a few seconds to several minutes. The criteria inherent in this type of trading: a large number of transactions, low profitability and all this, as already mentioned, in a short period of time. The work of a scalper (trader engaged in scalping) requires constant concentration, quick reactions and professionalism. The outcome of the transaction depends on these qualities. Beginners should stay away from this aggressive type of speculation.

Scalping can be attractive for the following reasons. Firstly, this is the period during which you can make a profit. The scalper makes money here and now. Secondly, with competent trading, the return on investment can be much higher than that of long-term investors. Thirdly, you can make money on almost any liquid asset. And fourthly, scalping makes it possible to develop a purely mechanical strategy, which in the future can be automated using a trading robot.

The main disadvantage of scalping is the large commissions of brokers. For each transaction you will have to pay a percentage. Therefore, commission fees must be taken into account in profits. And, of course, one cannot help but note the laboriousness of the process, which can be accompanied by severe nervous tension. Scalping is an activity for professionals that requires concentration and discipline.

This is all an outline. What's the reality?

Definition

Scalping or pipsing/pipsing (from the word “pips” - percent in point) is a short-term holding of a position with the closure of the transaction immediately after receiving a minimum profit. Each such transaction usually lasts several minutes or even seconds.

The method first began to be used shortly after the appearance of the first electronic exchanges. It has found its greatest application in the highly volatile financial market.

Scalping is not just a strategy, it is a trading style, a technique that is significantly different from other methods.

In the cryptocurrency market, the method began to be used when digital assets began to function as a full-fledged structural element of economic relations.

The concept of “scalping” can be compared to the work of a surgeon who carefully wields a scalpel. Using the same system, the trader “cuts off” pieces from the market.

There is also a scalping version, although this version actually has nothing to do with the technique. Trading techniques require maximum control, concentration and speed of decision-making, which is in no way associated with the custom of the Indians.

Pros of scalping:

- The ability to conduct active trading with minimal investment and experience, which makes it incredibly popular for beginners. Any training, courses or other manuals on the use of scalping are marketing ploys. To get started, it is enough to understand the basics, study the basic concepts, key features and risky situations, after which - only practice and personal experience.

- Minimal risks of losing your deposit - even with failures and shortcomings in the strategy/application of scalping, it will not lead to a complete emptying of the account.

- Increased trader experience and improved understanding of the market - in fact, this is the most valuable advantage of the technique for those who want to master trading and understand how trading works, market analysis and other important nuances.

- Full control of the situation (not to be confused with the market). You trade only when there is time for it. No pending orders, long-term trend trading and other “difficulties”.

- Potentially high returns in a short period.

In general, scalping is the fastest type of trading. It is great for those who prefer to make profits “here and now.” This style of trading is also in demand among beginners who have not yet developed the ability to maintain positions, especially when it comes to unprofitable orders that cause panic.

For professional traders, scalping is one of the trading methods that is used no less often than other strategies, although the minimal impact of analysis (to successfully scalp the market you do not need to conduct a lengthy analysis of the traded pair) does not make it the most popular option.

Scalping: how it works, basic methods

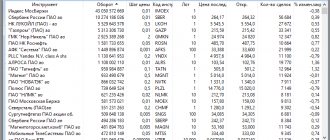

To begin with, the scalper trader must determine the asset with which he will work. In Russia, the largest volume of such transactions occurs in RTSI futures (RTS index) and blue chips (Gazprom, Sberbank, Lukoil). Afterwards, it is important to analyze the general trend in the market, or search for mini-trends using scalping strategies. Further, in the direction of the main trend, a transaction is opened and a stop loss is placed (this is an exchange order in the trading terminal to limit losses when the price reaches a certain level). Limiting losses is a prerequisite for scalping. Only by minimizing losses can scalping be profitable. As soon as a small profit appears, the trader must close the trade.

The choice of scalping strategies in the stock market is huge. Every day traders are developing new ways of scalping trading.

Let's highlight 5 methods:

- “By order book”

(the order book is a table in which there are orders from both sellers and buyers at a certain price). This method is typically used when trading stock futures. - Impulse scalping.

Its use involves the study and assessment of external parameters: markets and instruments. For example, oil prices, political events, movements of American and European futures, interest rates, the dollar and even natural disasters. This trading method is most often used when trading stock index futures. - Hybrid scalping

combines the features of the first two methods. - Scalping on graphic patterns

(these are characteristic, repeating areas on the price chart). It involves the use of figures (shoulders, triangles, flags) in scalping intervals. Requires the ability to compare the range of figures with a changing timeframe scale (or trading period - a time interval used to group quotes when constructing elements of a price chart). - Scalping on indicators

.

Moving Average + William's Percent Range

Just by the name it is clear that for trading you will need only 2 standard indicators. We are talking about a simple moving average and WPR:

• We apply SMA to the Close price, we will need a period of 105;

• WPR will be used with levels -5 and -95.

The rules for working with the strategy are extremely simple; the author recommends working on the m15 timeframe:

• the moving average is needed to determine in which direction to trade. If, for example, the price is located above the moving average, then we will consider only purchases; if below, we will consider sales;

• WPR will point directly to market entry points. The transaction is concluded at the moment when the price touches one of the two specified levels;

• the strategy uses fixed stop and take profit. Thus, it is recommended to set the stop loss at 20 points, and the TP at 10 points. The not-so-favorable stop/TP ratio is compensated by the fact that most trades are closed with a profit.

Although the strategy is scalping, there are not very many transactions using it (if, of course, you strictly follow the rules of the TS). Below are a couple of such market entries.

In the first example, you can see that the price was below the moving average level for a long time, but was gradually approaching it. We are only interested in the fact that it is below it, that is, we can only enter the market in the downward direction. On the candle where the WPR indicator touched the -5 level, we conclude a sell deal.

The next candle on the chart is a reversal candle, that is, the signal was simply perfect. A stop of 20 pips allowed us to easily sit out a small price movement in a losing direction, so we would have taken our 10 pips from this trade without any problems.

The next example is again a short position, but the difference from the previous one is that the price at the time the trading signal is received is very far from the moving average. All the conditions of the strategy are met, we enter again as soon as the candle closes, at which the WPR touches the -5 level and we make a profit.

I would like to draw your attention to the fact that the downward movement after entry was very uncertain. We can say that the fact that the take profit worked was a happy coincidence.

In this regard, it is logical to introduce an additional filter - do not trade (or enter the market with a reduced lot) in cases where the price is far from the SMA at the time the Forex signal is received. Remember, a heavy moving average acts like a magnet, attracting price to itself. Therefore, the further the price moves away from it, the lower the likelihood that it will continue to move away from it. This way you can slightly increase the ratio of profitable to losing trades, and if you miss a few successful entries, then consider this a price to pay for the reliability of trading.

Scalping by order book

Let’s look at scalping “by glass” in detail. First you need to determine what exceeds supply or demand. Next, we find the biggest player. The main task of this method is to follow the plan of the big player. After this, we place an order in front of this player, so as not to simply copy his movement, but to play ahead of the curve.

The question arises: why stands in front of a major player? The answer is simple: the bets in front of him have some kind of support. The price, in case of a change in direction, will rebound from the largest order in the desired direction.

It is worth noting that it is possible for large players to submit false orders. After which they are quickly removed. This is done in order to deceive the “crowd”. Therefore, it is necessary to monitor such situations very clearly and not “jump” into the market at the sight of every major investor.

Tools for scalpers

Scalping trading can be carried out using tools such as:

stock;- currency pairs;

- indexes;

- metals;

- raw materials.

Experienced stock traders recommend studying all the instruments and choosing the right one. There is no need to take on all the options offered, as this will not bring profit.

- Example strategy - “Infinity”:

Scalping on graphic patterns

Graphic price patterns used in calm markets most often include the simplest ones - flags and triangles. Let's consider an example of using one of the figures, the flag, on an upward (bullish) and downward (bearish) trend.

Let us briefly outline the rules:

- select the timeframe where the pattern is best viewed;

- determine the type of pattern (bullish or bearish);

- if the trend is upward, then wait for the downward channel to break through;

- set a stop loss below the local minimum;

- The take profit (limiter on the amount of profit) is set along the length of the flagpole (see figure).

If bearish:

- wait for the ascending channel to break through;

- set a stop loss above the local maximum;

- We set take profit in the same way.

Scalping on indicators

Technical indicators are functions constructed using mathematical methods that allow you to track the further development of the price of an asset. They are used less frequently than technical figures due to the fact that the main mechanism of their action is averaging, that is, indicators signal changes in price movements with a delay. And scalping is trading from several seconds to several minutes, and while the indicator has time to “catch” the opportunity, the price may change.

It is important to note that indicators in scalping perform the function of identifying ranges where buy signals may appear, but do not show a specific entry point.

Indicators are divided into trend and counter-trend. The main trend indicators include:

- Moving Average.

- MACD.

- Bollinger Bands.

- Parabolic SAR.

The second group of indicators are countertrend or oscillators. They work well in conditions where there is no clear trend. The most famous oscillators are Stochastic and Relative Strength Index.

What requirements must a broker meet when working with scalping?

However, not everything is so rosy with scalping. There are some features of working with this system:

Interesting: What are bitcoins and how to earn them

- Not every broker encourages or allows scalping trading. Many DCs impose restrictions on the duration of the transaction. For example, if you opened and closed a transaction within 5 minutes, there is a chance that the broker will not count it, even though it made a profit.

- In order not to get burned by scalping, you must take into account the size of the spread for each open trade. An excessively large spread can easily eat up all your earnings. Therefore, it is important to choose a broker who charges a fair spread. It’s even better if the spread is floating. The profit should at least cover the spread.

- When a signal appears, you need to open a deal as quickly as possible - without requotes, because any slowdown can negatively affect its profitability.

Well, the basic rules for choosing brokers also play an important role. The broker must have a long-term positive reputation and must pay earned money on demand.

Automation of the scalping process

Speaking about scalping, it is worth touching on the topic of trading robots or bots. They are a computer program that completely or partially replaces a broker in stock trading. They provide the ability to implement algorithms that copy the actions of the trader. Robots are able to independently make decisions about making transactions, taking into account price movement charts, various company indicators, and so on - everything that is included in their algorithm.

The types of trading robots depend on the degree of automation:

- Semi-automatic robots (advisers) analyze the market situation, calculate various options for price movements and give a signal for a transaction.

- The automatic robot is completely autonomous. Connects to a trading account and organizes the process of buying and selling assets. It also calculates the level of risk and to a certain extent takes into account force majeure situations.

The advantages of trading bots include the ability to process large volumes of information at high speed. The disadvantages include the inability to take into account macroeconomic, political and other news factors. Deviation of the situation from the given standard will not prevent the algorithm from continuing to operate, regardless of the changed circumstances. He does not have mental flexibility and may react incorrectly to a sudden change in trend. In addition, when using the robot you must pay a subscription fee. This is in addition to the brokerage fee.

For inexperienced traders, robotic trading can be a trap because all parameters must be taken into account when setting up. It is worth noting that to increase efficiency, trading robots require considerable initial amounts, at least half a million rubles.

Experienced scalpers do not recommend shifting the responsibility entirely to the bot. It is better to use it as a reliable assistant.

Other names

This strategy is sometimes called pipsing. True, among professional traders there is no consensus on the relationship between pipsing and scalping. Some financiers believe that trading small pips is actually pipsing, while scalping is trading at local highs or lows. But most often the concepts are equated with each other.

Scalping Software

There are a large number of scalping programs, some of which are paid. They differ in interface, but have similar functionality. Some of the most popular:

- Bondar drive;

- Moroshkin drive;

- Alor-fast;

- Tfast.

Bondar drive

opens access to trading using the Moscow Exchange and FORTS instruments (Futures & Options of RTS, futures and Options of the Russian Trading System), and provides access to the world market. In particular, you can trade on the Chicago Mercantile Exchange (CME) or on the European Exchange (EUREX). The program provides the trader with comprehensive information about the current market situation, conveniently structuring it and allowing you to conclude transactions literally in one click. The capabilities of the QScalp system include: market sentiment indicator, cluster analysis, trading recording function, and so on. This service is absolutely free.

Moroshkin drive (QScalp)

is a tool for analyzing and quickly performing operations on the market during short-term and high-frequency exchange trading. The service is paid. Has a wider range of tools than the previous one. Widely used among traders and investment companies.

Alor-fast

is a full-featured trading terminal with a wide range of tools, famous among scalpers. The service is free. The only downside is that it is only available to Alor-broker clients. Does not provide the opportunity to trade on foreign exchanges.

Tfast

— special software for scalping, also provided by Zerich. It has a large number of interesting functions in its arsenal. You can only trade on Moscow Exchange and FORTS. If you want all the features of the program to be available to you, you must pay a subscription fee.

1 Minute Forex Scalping Strategy Guide

✴️ The 1 Minute Scalping Strategy is a good starting point for new Forex traders. However, you should know that this strategy requires a certain amount of time and concentration.

. If you are unable or unwilling to put in the effort for at least a few hours a day, then 1 minute FX scalping may not be the best strategy for you.

1 Minute Forex Scalping Strategy

is an intraday trading approach and one of the simplest trading strategies.

| ✍ The main aspect of Forex scalping is amount of deals . Sometimes traders open more than 100 trades a day. For this reason, it is important to choose a broker with the lowest spreads as well as the lowest commissions. |

Let's look at the key elements of the strategy:

- Applies to currency pairs (EURUSD).

- Timeframe – M1.

- Required indicators: Stochastic (5, 3, 3) and EMA (50), EMA (100) * (available in the MetaTrader 4 trading platform).

- Preferred trading time: European and American trading sessions due to high volatility.

*EMA stands for Exponential Moving Average. This is the second most popular type of moving average after the Simple Moving Average (SMA). EMA is used when calculating the moving average it is necessary to give special importance to the most recent data.

We recommend studying the entry points and required levels