Basic formula for calculating bond yields

The main formula for calculating the yield of bonds, like any other type of investment, is considered to be this:

Profitability = (Total amount received - Investment amount) / Investment amount * 100%.

Let's say we invested 100 rubles in something and received an income of 10 rubles. That is, at the end of the term our income amounted to 110 rubles. We count:

We take 110, subtract 100 equals 10, divide ten by the invested 100 and multiply by 100% equals 10% per annum.

This is the universal simple interest formula. Next, we will consider the details and features of its use in different situations.

Debt and equity securities

The main difference between a stock and a bond is that it assigns the owner a share of ownership in the organization.

The promotion certifies the right:

- for a share in a joint stock company;

- to receive part of the profit;

- on the property of the company in the event of liquidation.

The bond confirms the owner's right to receive money back in the future with a premium in the form of interest or a discount.

They differ in essence: shares are equity securities, and bonds are debt. The former certify the share, and the latter – the debt.

Calculation of coupon bond yield

Let's complicate our example. Let's say a security comes with a 5% coupon. That is, payments will no longer be 1000 rubles, but with a coupon of 50 rubles.

We calculate the total amount of what will be paid in a year. We take 1000 rubles of face value and add 50 rubles for a total of 1050 rubles.

We insert the result into our basic formula and get:

The resulting amount is 1050 rubles minus what was invested 950 rubles equals 100 rubles, divided by what was invested, that is, by 950 rubles and multiplied by 100% equals 10.52%.

Fundamental differences

Participation in management

Equity securities allow you to directly participate in the management of the company, but debt securities do not; the owner acts as a creditor. An exception is preferred shares, for which the owner receives priority rights to dividends, but he does not participate in management.

Profitability

Another difference is the amount of income from ownership. As a rule, the interest on debt obligations is fixed, while dividends to shareholders are constantly changing depending on the performance of the issuing company. If the company incurs losses, there may be no dividends at all.

Risk

The differences between stocks and bonds are also expressed in the fact that they have different degrees of risk. Debt securities are considered the safest investment option because the face value and maturity are known in advance. At the end of the period, the holder receives a certain amount.

Dividends to shareholders directly depend on the company's income. If an organization declares itself bankrupt, it will pay debt to bondholders from the reserve fund, and only then to shareholders. The latter risk getting nothing at all.

Stock prices change with greater amplitude compared to bonds.

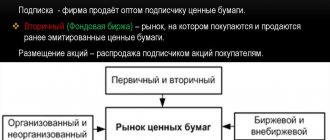

Accommodation

Both of these types of securities are placed using two methods:

- subscription (completion of purchase/sale transactions);

- conversion (exchange of one security for another from the same issuer).

The difference is as follows:

- when creating a joint stock company, shares are distributed among the founders, but debt securities are not issued in this way;

- When placing equity securities, they must be paid at their full price, at their nominal value, and debt securities may be placed at a discount (discount) from their nominal value.

Bonds

Definition 2

A bond is a debt security that gives the owner the right to resell it back at a specified time, as well as receive a certain income.

Finished works on a similar topic

Coursework Types of stocks and bonds 480 ₽ Abstract Types of stocks and bonds 250 ₽ Test work Types of stocks and bonds 210 ₽

Receive completed work or specialist advice on your educational project Find out the cost

The classification of bonds is very broad. Let's look at it in more detail.

Bonds or the basic intricacies of a debt security

Anyone can become an owner of securities, but do not forget that the bond market has its own rules that novice investors need to know about.

In the context of the economic downturn of the coronavirus pandemic, Russian regions and municipalities, along with Russian companies, are actively using borrowings by placing bonds on the stock market in order to attract funds.

So what are bonds? Current Russian legislation defines a bond as “an emission security that secures the right of its owner to receive from the issuer of the bond its nominal value and the percentage of the nominal value or other property equivalent fixed in it within a specified period.” In other words, an organization or state receives borrowed funds and undertakes to return them within a specified period, giving investors the opportunity to earn money as a percentage of the invested amount. The right to issue bonds has the state, municipal and regional authorities, as well as commercial companies.

There are different types of bonds

Before you invest in debt securities, you need to understand what types of debt securities exist.

Bonds issued by Russian commercial organizations are called corporate, and if the issue is carried out by the Russian Federation, its constituent entities or municipalities - state (municipal) bonds.

Bonds can also be classified according to a number of other criteria, for example:

— by maturity: short-term (up to 5 years), medium-term (from 5 to 10 years), long-term (from 10 to 30 years), perpetual. The face value of perpetual bonds (principal) will never be repaid by the issuer, but coupons can be paid indefinitely;

— with debt amortization (the par value of the bond is paid in stages during its circulation period on the dates set by the issuer) and without debt amortization (the par value is paid in one payment at the end of the circulation period);

— by type of income: coupon or discount;

— by the method of payment of income: with a fixed, constant or variable interest rate;

- according to the form of security: unsecured or secured. The latter can be issued by the issuer to increase reliability. The collateral includes real estate, a mortgage pool, sureties, guarantees, etc.;

— by intended purpose: ordinary and target funds, the funds of which are used to finance environmental, social, infrastructure and other projects determined by the issuer.

These and other characteristics of bonds are the most important information for an investor who plans to purchase them. The key documents containing information about a specific bond issue are the securities prospectus (i.e., the terms of the issue) and the decision to issue bonds .

Before making a purchase decision, an investor must carefully analyze the parameters of the bonds being purchased.

One of the main parameters is the bond's term to maturity. In generally accepted practice, the maturity date is a clearly defined date upon which the issuer is obliged to pay the bondholder its face value and the coupon income for the last coupon period.

Another important parameter is the type of coupon income . Both discount and coupon bonds are traded on the market. Discount bonds are placed on the stock exchange at a price below par and are redeemed at par. In this case, the investor's return is the difference between the purchase price and the face value of the security paid at maturity. However, in practice, most often bonds are coupon. They provide for payments of a certain percentage of the face value of the bond either once a quarter, or once every six months or year, as well as payment of the face value at the end of the bond's circulation period. Coupon interest accrues daily but is paid either on the coupon payment date, which is known in advance, or when the debt security is sold before its maturity date. The coupon rate is expressed as a percentage per annum.

Currently, bonds with the following types of coupon income :

- constant coupon income - the coupon income rate is the same throughout the entire circulation period of the securities. For example, 8% for all coupon periods throughout the entire life of the bonds;

- fixed coupon income - the coupon income rate is not the same throughout the entire circulation period of the securities, but its value is fixed in the decision to issue bonds. For example, 8% for the first two coupon periods, 7% for the next two coupon periods, 6% for the remaining coupon periods until the end of the bonds' circulation period;

- variable coupon income - the coupon income rate changes depending on a certain base value (for example, the interest rate on the money market) and is calculated using a special formula (for example, in relation to the inflation rate, other indicators that make up official statistical information).

A worthy alternative

Bonds issued by issuers with a high credit rating are a tool aimed at preserving funds and generating moderate income. Compared to other financial instruments, bonds of reliable issuers (primarily federal loan bonds, bonds of economically stable constituent entities of the Russian Federation, bonds of major corporations) are less risky investments, since their price fluctuations are much less than, for example, stocks.

At the same time, bonds of reliable issuers are a worthy alternative to a bank deposit. Unlike deposits, the interest rate of which can be changed by the bank unilaterally, the coupon rate on bonds is set by the issuer for the entire circulation period of the issue. In addition, the bulk of debt securities are traded on the stock market; they can be bought and sold by contacting a broker without losing the accumulated coupon income.

Advantages of bonds over bank deposits:

— yield on bonds, as a rule, exceeds interest on bank deposits;

— the possibility of diversifying savings: depending on the situation on the financial market, you can purchase bonds of different issuers with different characteristics;

— long-term investments: the term of a bank deposit varies from 1 month to 5 years. Investors who invest in bonds can lock in returns over longer periods - up to 30 years;

— wide choice in terms of risk/return ratio. Among Russian bonds, the most reliable are bonds of issuers with high credit ratings. For risk-averse investors, there are options in the form of corporate bonds, which have the potential to provide higher returns;

— minimum investment period: liquid bonds are freely traded on the market and can be sold at any time. A competent, experienced investor is able to earn money by placing funds for a month, a week, or even for 1 day.

It is worth noting that the total interest income on bank deposits from January 1, 2022 is subject to personal income tax only if it exceeds the legally established minimum for interest income on deposits. In 2022, this amount is 42.5 thousand rubles. At the same time, coupon income on bonds is taxed (at a rate of 13% for residents of the Russian Federation and 30% for non-residents) regardless of the amount of income.

There are no perfect ones

Investing always involves risks. There is an economic rule that also applies to the bond market: the higher the yield, the higher the risk of losing an investment, and vice versa - the more reliable the bond issuer, the lower the yield it offers its investors. If the probability of problems with the solvency of the issuer is high, then it has to offer a higher coupon on its debt securities or place them at a lower price in order to interest market participants.

In any case, it is important for an investor to know about existing risks:

— risk of default of the bond issuer. Default is the inability or refusal of the issuer to pay coupon income to the bondholder and/or repay bonds at par within the specified time. This risk can be assessed based on the credit rating assigned to the issuer by a rating agency, but even in this case there is a possibility of error. It must be remembered that investments in bonds are not insured by the state, unlike bank deposits up to 1.4 million rubles;

— the risk of rising interest rates in the market. The yield of bonds on the secondary market is completely determined by the law of supply and demand. This risk occurs if money market interest rates rise, causing the bond's current market price to be lower than its purchase price. And if you wait until maturity, the bond will be redeemed at par;

— risk of inflation. If inflation turns out to be higher than the bond's yield, then the real investment rate in such a security will be negative, i.e. investments will depreciate;

— risk of lack of liquidity. This is possible when no one trades the issuer's paper or trades very little. The secondary market itself is volatile: at some point there is supply and demand for a particular security, at another moment there may not be. Therefore, the owner may simply not be able to sell the bond at the desired price. To avoid getting into a situation of lack of liquidity, you should avoid buying bonds of little-known companies.

One of the most liquid securities in Russia are federal loan bonds (OFZ), issued by the state represented by the Russian Ministry of Finance.

Today, after a long break, Moscow announced the issue of city bonds. According to experts, Moscow bonds are a reliable financial instrument and can arouse interest among both professional market participants and private investors.

Moscow has the highest credit rating among the constituent entities of the Russian Federation, corresponding to the level of Russia's sovereign credit rating. This is the unanimous assessment of the world's leading rating agencies, including the Big Three (Moody's Investors Service Limited, S&P Global Ratings, Fitch Ratings). Throughout the history of its presence in the financial market, the Moscow Government has timely and fully fulfilled its obligations to repay and service public debt.

Moscow plans to use funds, including those raised through the placement of bonds, to finance the most important urban infrastructure projects and special attention will be paid to environmental projects. Moscow is the first public legal entity in Russia planning to issue green bonds.

On April 1 of this year, the Ministry of Finance of the Russian Federation carried out state registration of the Conditions for the issue and circulation of bonds of the Moscow City Bonded (Domestic) Loan. It is planned that the capital will put the first issues of city bonds into circulation at the end of April - May 2022.

In accordance with the registered terms of the issue, Moscow has the right to issue bonds with constant, fixed and variable coupon income, as well as with debt amortization. Their possible maturity ranges from 1 year to 30 years. The bonds have a par value of 1,000 rubles.

A private investor will have the opportunity to use government securities of the city of Moscow as a reliable and highly liquid instrument for preserving and increasing their capital, while simultaneously contributing to the development of the city.

Bond classification

- By timing:

- Short-term – from 1 year to 3 years;

Medium-term – from 3 years to 5 years;

- Long-term – from 5 years to 10 years;

- Indefinite.

- By release form:

- Domestic release;

Foreign release;

- Mixed form.

- Bonds without maturity:

- Perpetual bonds;

With the possibility of recall;

- With the right of early repayment;

- With prolonged action;

- With deferred payment.

- By issuer:

- State participation;

Municipal participation;

- Corporate participation;

- Foreign participation.

- For payments:

- Payments without coupon;

Payments with a coupon;

- Zero coupon payments.

- By purpose:

- bonds with a purpose;

deprived (free).

- By characteristic features:

- Convertible bonds;

No conversion;

- By risk level:

- Low risk;

With an average degree of risk;

- High risk;

- Unreasonably risky;

- No risk.

- In priority area:

- Preferential bonds;

Subsidized bonds.

- By right of ownership:

- Registered bond;

An impersonal bond;

- By type of appeal:

- With conversion;

No conversion.

- By type of placement:

- Placed on the market;

Placed outside the market.

- By right of security:

- Secured Bonds;

Providing property;

- Support by securities;

- Providing at the expense of equipment;

- With no collateral.

- By interest rate:

- With a fixed percentage;

With a floating interest rate;

- With inverse floating interest rate;

- With zero interest rate.

- According to the form of income payment:

- Bonds at a discount;

Bonds with interest rate;

- Winning Loan Bonds.

- By type of purchase:

- Callable bond;

Bond with the right of early redemption;

- Bond with extension;

- Deferred maturity bond.

- For financing investment projects:

- Financing of new investment projects

Refinancing of debts on investment projects;

- Financing outside the investment project.

The difference between a stock and a bond

- Bonds guarantee the return of funds spent;

- Shares provide the right to manage the company;

- Stocks carry a high degree of risk;

- The share price is more dynamic;

- Investing in stocks can be more profitable;

Let's assume that the issuer has issued convertible bonds. The participant can exchange them for shares of the issuer. The shares will bring income to the owner in the form of dividends in the future. If the company goes bankrupt, the owner of the share will have the right to part of the property. Bonds without conversion do not provide such a privilege.

Get paid for your student work

Coursework, abstracts or other works

Types of shares

- Regular shares.

- Preferred shares.

Ordinary shares have public status. One share equals one vote. It is profitable to own them while being in alliance with other shareholders. They do not provide special privileges.

Preferred shares are more attractive to investors. They allow you to take part in management. In addition, the owners of such shares are responsible for the decisions made. Preferred shareholders are directly involved in eliminating the company's debt because they are among the first to receive income.

Note 1

Stocks and bonds are not identical concepts. Shareholders are responsible to other shareholders. Bond holders risk only their own funds.

Novice investors often confuse these concepts, considering them equivalent. Let's move on to consider bonds and their classification.