- home

- Investments

Evgeny Smirnov

Updated: February 3, 2021

0

Article navigation

- What is real investment

- Types of real investments, classification, example

- Forms of real investments and features of their management

- Risk management in real investing

- Objects of real investment

- Investments in the real sector of the economy, assets and businesses

- Investment projects for a portfolio of real investments

- Leasing as a method of financing real investments

- Methods for assessing the effectiveness of real investments

A person who is far from the world of finance and business has a very vague idea of what investment is. Usually by this concept people understand financial investments in the purchase of various securities, the Forex market or the purchase of real estate. But in addition to financial investments, there are also investments in the real sector or, as they are also called, real investments.

Definition

Financial investments are usually understood as investments of monetary capital in various financial instruments - stocks, bonds, commodity futures, etc.

In essence, this is the purchase of speculative assets with the aim of their further resale at a more favorable price. What investments are called real? Real investments are investments in the real sector of the economy, that is, in production and the service sector, in the creation of tangible and intangible assets. If we look at investments from the point of view of macroeconomics, then these are investments in the general improvement of the material well-being of society.

Thus, real investments are investments in maintaining the economic complex, as well as in its modernization and expansion. In this case, investments can be aimed at acquiring or creating both tangible and intangible assets (intellectual property objects - production licenses, artistic works, software, etc.).

Real investment is, in most cases, financing large, expensive projects. If, when making financial investments, you can buy securities in small quantities for literally a few thousand or even a few hundred dollars, in the real sector any investments almost always represent fairly large amounts.

For this reason, real investors are either wealthy individuals or legal entities with large capital. Only they are wealthy enough to provide financing for projects for the construction, modernization and expansion of production complexes of various sizes.

Acquisition of property complexes

This is one of the areas in which real investments are made. The acquisition of property (entire) complexes is an operation of large companies, through which regional, product or industry diversification of activities is ensured. The result of this form of investment, as a rule, is the “synergy effect”. It consists of increasing the total price of assets of both companies (relative to their book value) due to the ability to more effectively use the overall financial potential and reduce operating costs, mutual complementarity of the range and technology of manufactured products, joint use of the sales network on different regional trading platforms and other similar factors .

Characteristic

Real investments are investments in real assets of an enterprise, which can be divided into two subgroups: tangible and intangible. In textbooks devoted to the study of economics, real investments may be called capital investments, since they can exaggerate the amount of capital in the future.

Financial investments are a combination of monetary investments in securities, deposits and equity participations. Financial investments are investments in long-term financial instruments that can generate additional income in the future. Also, the purpose of such investments may be to protect them from various financial risks: inflation, crisis, theft. In fact, monetary investments are considered a rather complex category that needs to be considered in detail.

Tasks

In some cases, actual investment is made when the situation or legislation requires it. For example, the state may legally require an enterprise to improve environmental safety or reduce the toxicity of waste. Failure to comply with these requirements may result in heavy fines or closure of the business.

Therefore, such investments are mandatory and necessary. Such investments also include improving working conditions at the enterprise, if this is required by law by the state.

Some real investment challenges:

| Tasks | Actions |

| Increase the efficiency of the enterprise | To increase the competitiveness of the enterprise, equipment is changed and improved, technological processes are modernized, working conditions and work procedures for employees are improved. |

| Expand production volumes | To expand sales markets and increase the enterprise’s share in the current market, it will be necessary to increase production volumes. If a company produces tangible products, this is a necessity for such a business |

| Create a new production | To create a completely new product or new service, you will need to create a new company and invest in creating a new production facility |

Kinds

The concept of “real investment” includes the following areas of capital investment, attracted from outside or sourced from internal reserves for a certain time interval:

| Type of real investment | Special purpose |

| Gross | Modernization of production, increasing competitiveness or increasing productivity |

| Innovative | Updating means of production, improving technologies |

| Expansion | Extensive development |

The fact that real investments can be directed to the acquisition of fixed assets means their relative safety. Equipment has a stable value over a long period of time, and in case of failure or bankruptcy, it is subject to sale.

Financial investment is investment in shares and other securities issued (put into circulation) by an enterprise. In case of bankruptcy, they may partially or even completely lose their value. At the same time, there is a possibility of their rapid and significant growth. For example, the rapid growth of cryptocurrency or Microsoft shares.

Let's look at the advantages and disadvantages of the two main types of investments.

| Comparison criterion/Type of investment | Real | Financial |

| Entry threshold for business | High | Low (from one share) |

| Risk level | Short | High |

| Entry method | There are difficulties associated with the need for deep awareness | Simply, through the exchange operator |

| Possible profitability | High | Average (up to 20% per annum) |

| Liquidity (possibility of exiting the business) | Low | High – shares can be sold quickly |

Financial investments have another advantage, which is expressed in the variety of forms available. They can be carried out in three markets: stock, foreign exchange and credit and deposit (by placing funds in bank accounts). All of them are equipped with electronic platforms, which simplifies their management.

Long-term security

Such investments are made for a period of 3 or more years. Effective regulation of the company's activities ensures its successful development in a competitive environment. This directly relates to the complex process of long-term investing. Quick and correct implementation of activities in this area allows the company not only not to lose its main advantages in the competitive struggle to retain the market for the sale of its products, but also to improve existing production technologies. This, in turn, contributes to further efficient operation and increased profits.

All main regulatory functions are carried out within the framework of the developed strategic plan, which ensures the implementation of the main concept. Distribution of resources, coordination of the work of different departments, organization of structure, relations with the market allow the company to achieve its goals, making optimal use of available funds. Developing a long-term investment strategy is a rather complex process. This is due to the impact of many external and internal factors on the financial and economic position of the company.

Recently, models that help assess the investment prospects of enterprises have become increasingly popular. The main tasks in this area are the selection of solution options, forecasting priority targets and identifying reserves for increasing the profitability of the company as a whole. The use of various types of matrices, the formation and analysis of models of initial system factors, is quite popular. Each specific situation will determine one or another line of behavior for long-term investments.

Forms

When you have capital and your goals are clear, you can move on to choosing a form; investments in real assets are varied. Among the main forms the following list can be distinguished:

- Acquisition of finished production or property . Of course, you can do everything yourself, that is, build everything from scratch, but sometimes it is easier to buy out an already functioning enterprise, or at least one that is equipped and for some reason not working. The simplest and most typical example is the purchase of a bankrupt. The question arises - how not to continue this unprofitable path. But this is a question for the investor. If he buys, it means he knows what he is doing. It is especially common in entire sectors of the economy - mergers and purchases of small competitors.

- Capital investment in the form of construction . Here we invest in real assets - real estate or any infrastructure facilities. For example, you can invest in the construction of a cottage community or fulfill orders for equipment of a certain area for special needs. In general, many people engage in such investing, although, at first glance, it does not look like an investment in construction - they buy apartments at the construction stage, receiving a discount. Simply put, equity participation.

- Reconstruction, repurposing and modernization as investments in a real sectorR. They are all related to construction to one degree or another. Reconstruction allows you to save money because you don’t have to buy a new and expensive object, but you can reconstruct the old one (and then sell it, as an option). The same is true with repurposing - this is often done with industrial real estate, this is due to the fact that they usually have all the necessary communications. Example – high energy consumption requires a special electricity supply. It's easier when it's already in the building.

With modernization, everything is a little simpler - this can be called the usual improvement of any link in production, or the production itself as a whole. That is, for example, there is a weak point in the production chain that prevents performance from improving. This situation is far from uncommon, which is why such attention is paid to optimization, and this, in turn, implies the removal of ineffective elements and improvement (modernization) of simply weak ones. Investments in the form of modernization can have an excellent effect on the entire production as a whole.

- Partial real investment . The simplest example is that we sell worn-out equipment and buy new, more efficient one. The reasons for selling or simply getting rid of equipment can be different - non-compliance with the requirements of supervisory authorities, changes in legislation in certain areas or in general, the need to change the production cycle or renewal due to market conditions. There can be many reasons; there is also such a thing as a planned update, not only of equipment, but also, for example, of raw materials.

- Real investment in intellectual property or permitting documentation. You can’t just go ahead and start producing medical products. To do this, it is necessary to meet special requirements; sometimes it is easier to buy out a production facility that already has everything necessary. This is a combination of the first form and an intangible asset. Even your own development as a manager or just a specialist will cost money - and this is also an investment, and quite a real one at that.

This also includes technologies and innovative solutions. What was relevant yesterday may no longer be of use to anyone today. A typical example is the electronics industry. Of course, few people own enterprises that produce high-tech electronic equipment. Then you can look at simpler options - the same field of cosmetic medicine. Every year something new appears, and, oddly enough, it requires new equipment and staff training. Now there are two to three dozen different procedures offered, and the range is constantly growing.

Reconstruction

This form of investment involves a significant transformation of the entire production process based on modern scientific and technological advances. The reconstruction is carried out according to a comprehensive plan to radically increase the production potential of the company, introduce resource-saving advanced technologies, significantly improve the quality of manufactured products, and so on. During this process, individual buildings and premises may be expanded (if new equipment cannot be installed in existing ones), structures and buildings of the same purpose may be constructed on the site of those liquidated on the company’s territory, the operation of which is not practical in the future for economic and technological reasons.

Selecting an object

When choosing a production facility where funds will be invested, some significant factors should be assessed. These include the following:

- the investment project is carefully studied;

- the market is analyzed to make sure that the goods produced are promising and in demand;

- possible distribution channels are located;

- customer reaction to products is assessed;

- all competitors and their proposals are identified;

- the estimated profitability of the project is calculated.

The risks and potential profits from work depend on the correct choice of investment object. If an investor does not have the necessary knowledge and capabilities, then he can use the help of specialists who, in a short period of time, will study a specific area of \u200b\u200bthe company's activities, after which they will transmit a detailed report to the customer.

Analysis

First of all, a detailed analysis of financing is carried out. The real state of investment for a certain previous period of work is analyzed. The policy of managing real investments involves a thorough study of existing experience. It is important to assess the degree of investment activity of the company, as well as determine the degree of efficiency and effectiveness of programs that have already been started and completed at the previous stage of work. The analysis takes place in several stages. Real investment management should be based on objectivity:

- First, they examine the dynamics of financing in the growth of real assets, as well as the percentage of real financing in the volume of total investments of the enterprise.

- Then the level of effectiveness of individual financing programs and the degree of their successful implementation are examined.

- Then it is important to find out how successful past investment programs have been. It is necessary to determine the exact amount of investment that is required to complete the programs.

- At the fourth stage, the final stage, an analysis of the effectiveness of financing programs that have already been completed is carried out. It is determined to what extent they correspond to the planned indicators at the operational stage.

Strategy

One of the key conditions for sustainable economic growth is the activation of the state’s investment policy. This strategy involves a system of measures that determines the structure, volume and directions of capital investments, an increase in fixed assets, as well as their renewal in accordance with the latest achievements of technology and science. Investment policy regulates and stimulates the financing process, creates conditions for the sustainable development of the socio-economic sector of the country, region, a certain industry, and entrepreneurship in general. The most important areas provided for in the strategy include:

- Strengthening government support in the development of priority areas of the economy.

- Formation of an institutional and legal environment conducive to stimulating investment in the real sector.

- Coordination of regional and federal strategies src=»https://uspeshnick.ru/images/static/img/a/20380/203417/16067.jpeg» class=»aligncenter» width=»500″ height=»333″[/img ]

Main functions

Investment is an exchange of a certain current value for a possible uncertain future value. In the field of training economists, the study of this phenomenon is one of the most important stages. Considering the role of investments in a broad sense, it should be noted that they provide economic development and financing for the growth of the country’s economic sphere. The intensity of these processes largely depends on how quickly financial resources will be mobilized to meet the increasing needs of the state itself and the companies operating within its borders, as well as individuals. Thus, investment activity and economic growth are interdependent phenomena.

Control

It is carried out by specialists who have the necessary knowledge and investment experience, and includes several stages:

- analysis of the past investment experience of the company and its competitors;

- determining the required amount of investment;

- choosing the form of real investment that needs to be implemented in production;

- search and identification of profitable investment projects;

- analysis of selected options for their effectiveness;

- creation of a real investment program;

- implementation of the selected investment program.

Among the numerous examples of financial investments, one can highlight Yandex, whose dividend quotes are constantly growing; one share of the company costs about 2 thousand rubles.

A simple example of real investment is the purchase of equipment for a furniture workshop, when you, as an investor, purchase a format-cutting machine and receive part of the profit, according to the agreement, from the sale of products that are produced using this equipment.

Real investing is an excellent alternative to passive income, and for large enterprises it is impossible to stay afloat and develop without them.

Specifics

Any form of real investment is typically long-term, large-scale financing. Investment of assets in equipment and land, construction of new structures or buildings has a fairly long payback period. But no production will exist without real investment. In order to attract funds, in addition to the company’s own proposal, their need should be justified and technical and economic calculations should be submitted. The effectiveness of real investments is ensured through constant monitoring of the developed financial project. This process is key to the effectiveness of the company's strategy. During monitoring, the effectiveness of real investments is assessed and the achieved results are compared with the planned ones. Depending on the results, the project is adjusted.

Grade

The economic assessment of material investments is carried out according to the classical scheme: indicators of return on investment, the payback period of investments in an investment project, the present net value and the internal rate of return of the project are determined. The main thing for an investor is the internal rate of return indicator. If this indicator is lower than the refinancing rate of the Central Bank, the investor will prefer to invest his funds in more efficient assets or even in financial assets with a higher yield.

Risks

Investments in real assets are potentially more profitable than portfolio investments, but usually less profitable than venture or private equity investments. Obtaining returns from real investments involves certain risks:

- financial – lack of funds to implement the project;

- marketing – incorrect calculation of profit from investments;

- inflationary – depreciation of asset values;

- human - inexperienced specialists can harm the project

There are other types of risks that do not depend on the enterprise. For example, the collapse of the country's economy, war, the introduction of new taxes, etc. To minimize risks, real investment management should be carried out by highly qualified specialists who have experience in identifying common problems at the planning stage and eliminating them during project implementation.

Implementation Features

Real investments act as the main tool for implementing the developed company development strategy. The main goal of this process is achieved through the implementation of effective financial projects. At the same time, strategic development itself is directly a complex of implemented plans. An analysis of real investments shows that it is precisely this type of investment that ensures the company’s successful entry into new regional and product markets and a constant increase in its value. This method of financing is closely related to the operating activities of the company.

Solving the problems of increasing production and sales volume, expanding the range of products, improving their quality, and reducing current costs allows competent management of real investments. At the same time, the indicators of the upcoming operational process, as well as the potential for expanding activities, will largely depend on the financial projects implemented by the company. Real investments lead to higher levels of profitability.

The ability to generate a significant rate of profit acts as one of the incentives to continue entrepreneurial activity. Realized investments provide the company with a steady flow of net cash. It is formed from intangible assets and depreciation charges from fixed assets even when the operation of projects does not generate income. The assets under consideration are distinguished by a high level of anti-inflation protection. As practice shows, in conditions of inflation, the intensity of price growth for real investment objects not only corresponds to, but often exceeds its rate.

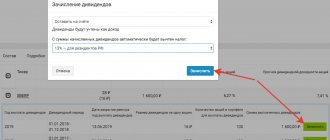

Stock

Shares are equity securities. By purchasing a share, an investor invests funds in the authorized capital of the issuing joint stock company and automatically becomes a co-owner of the joint-stock company, acquiring the right to receive part of the profit - dividends.

Promotion

There are three ways to make a profit by investing in stocks:

- making a profit based on an increase in the exchange rate, for example, an investor buys a share at a cheaper price and sells it at a more expensive price;

- making a profit based on a decrease in the rate, for example, an investor can take shares from a financial intermediary - a broker, sell them at a high price, and when the rate decreases, can buy back the shares at a lower price, after which he returns the shares to the broker, and the profit received from the difference the buying and selling rate goes to the investor;

- receiving dividends, usually once a year or once a quarter.

There are two types of promotions:

- ordinary - their owners have the right to directly manage a joint-stock company, to develop a dividend policy, their liquidity on the stock market is higher than that of preferred ones, and profitability directly depends on the rate of inflation in the state.

- privileged - their owners have the right to priority payment of established interest on the profit of the joint-stock company, payment is carried out within a strictly designated period, regardless of the financial results of the joint-stock company.

The advantages of investing in shares are: high profitability of assets, minimal starting investments (you can purchase a small share of shares in a joint stock company, and later, as they are issued, expand your stake). There is also a downside - disadvantages, including: high risks, commission fees if an investor purchases shares through a broker.

Leasing as a method of financing real investments

Leasing as a method of financing long-term investment projects is an excellent alternative tool for raising funds. In a stagnant economy with high inflation and high rates on bank loans, leasing allows you to successfully implement expensive investment projects with a long payback period. How it works?

Inflation can eat up all the profits from long-term investments, so an outside investor is not interested in a real investment project designed for a long term. If the enterprise does not have enough of its own working capital for such a project, it only has a bank loan. But due to high interest rates, investments in real assets may turn out to be unprofitable.

The solution to this situation is leasing. A third-party investor purchases the relevant property (for example, industrial machines) and leases them to the industrial enterprise. As a result, the investor receives a rental profit that covers the level of inflation, and at the same time remains the owner of the property, which can be sold after the lease agreement expires.

In turn, the enterprise receives for use the property it needs, the rent of which is covered from the profit generated by this property. Moreover, the cost of rent is lower than payments on a bank loan.

One more fundamental point should also be noted regarding this source of investment financing. A bank loan can only be taken out from a bank in the country in which the enterprise is located. The law prohibits direct lending from foreign banks with lower interest rates. But a leasing agreement can be concluded with non-residents, that is, you can rent property from companies and individuals registered in another country.

By the way, the decisive prerequisite for the influx of real foreign investment is precisely the high cost of bank loans in our country. Foreign investors are willing to participate in leasing schemes, which are quite safe and at the same time provide all parties with excellent conditions for making a profit.

Bonds

To make money on the stock market, but with less risk, investors prefer to invest at least part of their money in bonds. Their advantage over stocks is their more stable and predictable price. In this respect, bonds are similar to bank deposits, but they bring higher income - on average, 20% higher than deposits. In times of crisis, bonds are considered the main protective asset.

Pros. Higher yield than on deposits. At the same time, bonds provide a clearly predicted and fixed income - this makes them easier to manage than shares. Bonds are also highly liquid: they can be easily sold on the market without losing profit.

Minuses. There is a risk that the issuer will go bankrupt. Yes, for large players such a probability is low: blue chips rarely burn out, and federal, subfederal and municipal bonds will almost certainly remain in price. But smaller companies may suffer from the crisis, which will have a detrimental effect on investor income.

Domestic tourism

In the near future, domestic tourism and everything connected with it will develop especially actively: hotels, theme parks and entertainment.

This trend is clearly visible in the results for 2022. Closed borders have increased demand for domestic holidays. In many places this caused a real collapse. For example, at the Rosa Khutor resort they even had to introduce restrictions. And the influx of tourists in the Sheregesh complex prompted the start of construction of a completely new sector D worth 1.5 billion rubles. Trips to Altai, which were previously unpopular among Russians, have also increased. In general, there is unprecedented optimism in the market and it is shared by the head of Rostourism, Zarina Doguzova, who believes that domestic tourism will grow by 10–15% in 2022. Separately, it is worth highlighting the greatly increased interest of investors in purchasing hotels. For example, demand for hotels overall increased by 20% in 2020. Most of all in such cities as: Stavropol (+59%), Voronezh (+53%), Omsk (+50%), Izhevsk (+35%), Ufa (+33%), Novosibirsk (+25%) and Sochi (+23%). In the Moscow region, the demand for former tourist centers and children's camps has sharply increased - investors are planning to convert them into hotels and spa complexes. At the moment, there are practically no such offers left on sale. This, firstly, is due to the higher potential of this market. Before the pandemic, in 2022, the Moscow region was visited by 22 million tourists, while at the same time, for comparison, the entire Crimea was 7.5 million, and Sochi was 6.5 million. And, secondly, this can be associated with the high demand for country holidays and accommodation among Muscovites. Now is a great time to go into this direction if you want to become a rentier. Hotels of this type are quickly put into operation due to ready-made infrastructure, and real estate increases in price by 2-3 times by the time of commissioning.

The World Health Organization predicts that the pandemic will last until at least early 2022. And given that vaccination in Russia is going much slower than in other countries, the opening of borders may come much later, and by this time it will be possible to return all investments.

Precious metals

Investing in precious metals is almost always popular among investors. This is due to the fact that this type of metal has always existed and will exist tomorrow and the day after tomorrow. In addition, precious metals are always in demand. This asset is often called eternal. This feature of this type of asset is used as risk diversification. It is generally accepted that the cost of precious metals cannot fall to zero like the cost of shares; therefore, investors often purchase these metals to neutralize (reduce) their risks.

You can invest in precious metals both in material form (ingots) and by purchasing metal through banks by opening metal accounts. Precious metals usually include gold, silver, palladium, and platinum. This tool is actively used in long-term investment strategies.

Modernization

An investment operation of this type is associated with improving and bringing the operating part of the main production assets to a state that corresponds to the modern level of technological processes. This is achieved through constructive changes to the main set of equipment, machines and mechanisms that are used by the company in the course of operating activities. Repurposing is considered a derivative process from modernization. During this investment operation, a complete change in production technologies is carried out to produce new products.

Deposits

Banks attract money from individuals and companies to then lend it out or trade in financial assets. They guarantee repayment of interest on the deposit, as well as a full refund of funds upon expiration of the period chosen by the client.

There are deposits in foreign currency, but practice shows that such investments are unreliable.

Two important aspects.

- In Russia, according to the law, the state will reimburse the full amount of the deposit in the event of a bank collapse, if it is less than or equal to 1,400,000 rubles.

- Now the best strategy is to choose a longer term, because the deposit rate follows the key rate, and the Central Bank intends to lower it.

Professional assistance in real investing - review of the TOP 3 service companies

If the company’s management is not able to manage investment projects on their own, they can delegate the task to professional performers.

There are companies that will help you manage your available funds wisely and with guaranteed profits.

Our expert review presents the most competent investment firms. These companies work with private and corporate depositors and are required to insure customer deposits.

1) Invest Project

The financial analyst has been working in the investment market since 2010. During this time, the company was able to achieve the status of a leading institution in Russia in the field of finance and lending. The return on key investments of the project is up to 70% per annum. The minimum investment amount is 50,000 rubles. This means that individual entrepreneurs and individuals with a small amount of initial capital can use the company’s services.

Interest on income is calculated monthly. The main areas of investment are construction, transport, agriculture, tourism and trade services. The company's employees will help clients form an investment portfolio and assist in obtaining a loan.

2) FMC

The company specializes in financial investments. The company's field of activity is consulting and real assistance to citizens and legal entities on issues of profitable financial investments. FMC clients are always aware of what they can make money on right now. The income received from investments in shares successfully moves further - they are placed in real instruments - production, business expansion.

3) E3 Investment

The main area of interest of the company is direct investment in real estate. E3 Investment is a professional operator of investments in construction and ready-made objects for beginners and experienced investors. Over 7 years of operation, the company has already helped its clients earn more than 150 million rubles.

Each asset is protected by three types of insurance. Users have access to free consultations on the most profitable and safe investment of financial assets.

Currency market

Ways to invest in the foreign exchange market:

- Direct purchase of currency;

- Independent trading in the currency section of the stock market (futures on currency pairs);

- Independent trading on the FOREX foreign exchange market;

- Investing in PAMM accounts on FOREX.

A simple purchase of US dollars or Euros, as the entire recent history of the domestic economy (with its numerous crises and other Black Tuesdays) shows, is a very effective way to invest Russian rubles. Just take a look at the chart below.

Dynamics of changes in the dollar exchange rate against the Russian ruble

And this is not the whole price history, but only since 2009. Before this, as you probably remember, the dollar was even cheaper.

In addition, it is possible to invest in so-called currency pairs. This can be done both in the currency section of the stock market (through currency futures) and directly in the FOREX market. By definition, doing this through the exchange is safer. After all, exchange trading is a well-established and legally regulated mechanism, in contrast to trading on FOREX, which is carried out through the intermediary of dealing centers (many of which generally operate under a betting license).

In general, it should be noted that currency pairs are a tool for speculation rather than for investment. They can also be used to hedge risks.

Among other things, there is also the opportunity to invest in PAMM accounts of managing traders trading in the foreign exchange market. However, due to the fact that PAMM investing is carried out through the same dealing centers, this tool also cannot be called reliable.

Successful examples

Let's not reinvent the wheel and immediately turn to the powers that be for advice. As decades of proven practice has shown, the most profitable financial investments are those that are long-term in nature. The great investor F. Carret liked to say that the vast majority of fortunes were made by people who did not sell the securities they purchased for years. The basis of the long-term strategy is transactions that in the long term turn into millions in profits. As a rule, such investors work on the basis of macroeconomic indicators, study news from newspapers and market conditions. No complex mathematical calculations are needed for this type of investment.

Consider how the eminent investor Thomas Price bought shares of certain companies after careful analysis of the financial performance of an individual company and the industry as a whole. In 1954, this man invested 10 thousand dollars in securities, and 40 years later his capital amounted to 2.3 million. This may seem too long to some. But children and grandchildren will certainly remember old Thomas with gratitude.

Comparison

To summarize the above, having assessed the features and characteristics of both types of investment, a cheat sheet was compiled that takes into account their similarities and differences.

| Evaluation criterion | Real investment | Financial investments |

| Infusion size | Large - from several million rubles | Insignificant - you can start work even with 1000 rubles |

| Major Investors | Large companies and enterprises | Individuals, beginners, non-professional players |

| Risks | Less, since the money is invested in tangible assets | Above, there is a possibility of loss of funds that were used to purchase financial instruments |

| Ease of implementation | It’s difficult, you need to independently search for a company interested in attracting investors | Simple - you can contact specialized institutions, banks, the stock exchange, work via the Internet |

| Profitability | Can reach 100-150% | On average it is about 15-20% |

| Public benefit | Large, especially when investing in socially significant industries | Insignificant, largely due to the growing level of speculation |

| pros | High profit, improvement of people's welfare, low risk | Possibility of investing a small amount, simplicity of the procedure, you can balance income and risks by choosing financial instruments from an impressive list |

| Minuses | Large entry size, requires knowledge about the industry in which money is being invested, inaccessibility for the common person. | Greater risk of capital loss, low profitability. |

If you are not a millionaire, you should not consider real investments from a practical point of view, but you can invest money in financial instruments - stocks, bonds, other securities, precious metals, mutual funds.

Even though this type of investment is less profitable, and the risks here are increased, with skillful management, gaining experience and knowledge in the economic sector, you can count on increasing your own capital.

Where to invest money in Russia: TOP 5 specific profitable areas

Now that the framework and the potentially most successful algorithm have been outlined, we can list those areas of economic activity that can allow you to earn 100% profit rates already in the first year of the business’s existence. So, TOP 5:

Trade in ferrous metallurgy products

Engineering schemes here are most effective, especially when working with slabs, castings and forgings. There are several stages of processing on each product, and all this with a significant margin at each stage of processing (casting, forging, roughing; finishing).

Woodworking

A characteristic feature of engineering in this field is that the entrepreneur will need to have his own fleet of vehicles, encumbered as little as possible by any time restrictions. It’s hard to say why, but the percentage of disruptions and delays in this particular industry is off the charts.

Trade in neftorgsintez products

It is in Russian realities that NOS enterprises produce low-quality products in large quantities, but at the same time sell them cheap. As a result, it becomes profitable, for example, to purchase low-quality diesel fuel, transport it abroad, process it according to a tolling scheme at a plant, for example, in Austria, and sell ready-made high-quality fuel at an expensive price (and for foreign currency). And so on for many positions in the product line.

Food trade

The topic of processing substandard agricultural products is extremely promising. (We are not talking about defects, but about substandard products that cannot be sold off the shelves in supermarkets). The production of squash caviar, apple confiture, or even the processing of soybeans to produce oil and meal - has an overall profitability of significantly more than 100%.

Recycling of recycled paper

Paper recycling stands apart from other recyclables, firstly due to the decentralized collection mechanism for waste paper, and secondly, due to the increased interest of the global industry in composite materials. Some, in particular, are formed with the participation of cellulose. With its help, you can produce dozens of types of extremely strong and lightweight films and even entire arrays of materials that will be distinguished by a set of valuable engineering properties. As a result, from a business point of view, it is possible to implement engineering schemes with all processing formats.

In other words, the more technologically advanced the final product, the more opportunities for the use of engineering are built into the economics of its production.

Bottom line

Investing is a great way to preserve and increase your accumulated capital. The modern market provides various methods and objects of investment with differing indicators of efficiency and profitability. A novice investor must learn that the amount of income received is directly proportional to the size of the investment and the risks associated with it

.

You should not invest in projects that promise multiple returns with minimal investments and in the shortest possible time - in most cases they lead to loss of investment. Sources

- https://Delen.ru/investicii/realnye-investicii.html

- https://kudainvestiruem.ru/klassifikatsiya/finansovye-investicii.html

- https://Delen.ru/investicii/realnye-i-finansovye-investicii.html

- https://internetboss.ru/realnie-investicii/

- https://FB.ru/article/381056/investitsii-v-proizvodstvo-ponyatie-vidyi-riski-preimuschestva-i-nedostatki

- https://business-poisk.com/realnye-investicii.html

- https://BusinessMan.ru/new-realnye-investicii.html

- https://loxotrona.net/realnye-i-finansovye-investicii-chto-eto-takoe-formy-primer/

- https://kudainvestiruem.ru/klassifikatsiya/materialnye-investicii.html

- https://investprofit.info/real-investment/

- https://bank-explorer.ru/finansy/vidy-finansovyx-investicij.html

- https://bankiros.ru/wiki/term/kuda-vlozhit-dengi-chtoby-poluchat-ezhemesyachnyj-dohod

- https://Tyulyagin.ru/investicii/osnovnye-vidy-finansovyx-investicij-i-ix-sushhnost.html

- https://greedisgood.one/finansovye-investitsii

- https://www.AzbukaTreydera.ru/vidy-finansovyh-investicij.html

- https://pammtoday.com/finansovye-investicii.html

- https://goldengalaxy.ru/investitsii/realnye-i-finansovye-investitsii

- https://zen.yandex.ru/media/kompanion/investicii-poniatie-vidy-obekty-dlia-investirovaniia-5b2cae6dcb0ffb00a9d440e9

(Visited 7,676 times, 15 visits today)

Was the article helpful? Share it with your friends!