All foreign investments can be divided into portfolio and direct

according to the degree of control over the company.

Direct

investments include investments whose purpose is direct participation in the management and distribution of income . The following investment methods fall into this category:

- · Investing funds from scratch by creating a representative office or branch of a foreign company in Russia. In this case, the investor is its sole owner;

- · Takeover or purchase of a Russian company by a foreign investor;

- · Providing credits and loans to branches by the parent company located abroad;

- · Granting Russian enterprises the rights to use innovative technologies developed by foreign investors;

- · Purchase of shares or shares in a domestic company, giving the investor the right to control its work (majority participation);

- · Reinvestment of the income of a foreign investor in Russia.

Portfolio investment

, unlike direct ones, provide the opportunity to participate only in the distribution of profits, but not in the management of the company (minority participation).

One of the most important problems in reforming and modernizing the Russian economy is attracting foreign investment. Considering the serious technological lag of the Russian economy in most respects, Russia needs foreign capital, which could bring new (for Russia) technologies and modern management methods, as well as contribute to the development of domestic investment. The experience of many developing countries shows that an investment boom in the economy begins with the arrival of foreign capital. The creation of their own advanced technologies in a number of countries began with the development of technologies brought by foreign capital.

The relevance of this topic is due to the fact that a significant number of researchers see a way out of the difficult situation in the Russian economy, first of all, in foreign investment. Attracting foreign investment into the Russian economy on a large scale pursues long-term strategic goals of creating a civilized, socially oriented society, characterized by a high quality of life for the population, based on an economy that involves not only the joint effective functioning of various forms of ownership, but also the internationalization of the goods market and labor force and capital. At the same time, foreign investors focus, first of all, on the investment climate of Russia, which is determined by independent experts and serves to indicate the effectiveness of investments in a particular country.

Foreign investment is the investment of foreign capital in a business entity on the territory of the Russian Federation in the form of objects of civil rights owned by a foreign investor, if such objects of civil rights are not withdrawn from circulation or are not limited in circulation in the Russian Federation in accordance with federal laws, including money, securities, other property, property and non-property rights, as well as services and information.

23 Apr

Hello! In this article we will talk about the basics of direct and portfolio investing.

Today you will learn:

- What is the difference between direct and portfolio;

- How to become a portfolio investor;

- What risks await investors?

Real and financial investments: what's the difference?

Classic – . If you contact a credit institution as a depositor, then you are making a financial investment.

This type of investment implies that funds are invested in:

- Bonds;

- Bills of exchange;

- Deposits and other financial assets.

Thus, you become a participant in the purchase and sale of securities or any certificate. This is the essence of financial investing.

If the investor decides, he will become a participant. He is pouring money into large projects.

Real investment requires the presence of the following objects:

- Equipment;

- Buildings, structures;

- Current and non-current assets of the enterprise;

- Fixed capital and so on.

The second type of investment requires a large amount from the owner and a long process period. If an account is opened, for example, in, then the investor’s share will be small due to the large number of participants. Financial investments do not require large investments, unless at the personal request of the investor.

Attracting investments

Attracting investment is a necessary element of the dynamic development of a company. At the first stages, deposits provide advantages to organizations: they increase the amount of capital and improve the quality of management. Investing allows you to reach a new level of work.

To attract deposits, the company must have a list of positive characteristics. A proven and promising action plan, a good reputation, and transparent activities are the main factors influencing the effective search for investors. The terms of cooperation between the investor and the fund owner are based on the listed factors.

We separate direct and portfolio investments

There is a concept of direct investment. The name comes from the fact that they target a single object. For example, you want to buy a controlling stake in one company in order to further manage it. In this case, you do not pay attention to other investment tools. You have a specific course of action that you follow throughout the investment process.

Direct investments set a goal - to acquire some object. There is no talk of income received here. Their calculation will be taken into account only after a positive investment result.

Portfolio investing means dividing your funds between several sources of income. not into a specific large object, but into several different lobes at once.

For example, 30% in stocks, 70% in bonds. The main goal of the investor in this case will be to obtain maximum income from transactions. The number of investment instruments is a kind of portfolio consisting of different parts.

How to distinguish portfolio investments from direct ones

There are several criteria by which you can determine what type of investment a type of investment belongs to:

- Amount of investment

. Most often, the volume of direct investment involves large infusions; - Tool

. Portfolio investment is an investment in a set of securities, while direct investment is aimed at various sources of income, including shares of a company; - Profit

. Its value in portfolio investments is inferior to direct ones; - Term

. Portfolio investments can be short-term; even a small number of transactions can generate income, after which you will sell yours. Direct investments can pay off only after a few years and only after the completion of the intended project. The second type of investment is a longer and more difficult process, the result of the transaction cannot manifest itself in a short time; - Liquidity

. In the case of a portfolio, it can be immediately sold to any other investor or several. This happens in a matter of minutes. In exchange for the funds received, you will be able to form a new package of investments. Direct investment does not imply a change of ownership. While the project is in effect, you are responsible for your own mistakes and... Attracting direct investment is a long process that does not always lead to success; - Avoiding work processes

. An investor who invests in a portfolio can calmly go about his business and not delve into the specifics of the operation of the exchange. He can suspend some transaction and postpone it until a more successful opportunity. It is also possible to monitor transactions through a financial intermediary. In this case, you don’t need to look at the exchange at all; your personal manager will do everything for you. A direct investor cannot tear himself away from the project at any time. He controls every stage of the process, actively participates in it and develops some improvements himself. Lack of attention on his part may lead to the inability to realize his plans; - Company management

. The share of a portfolio investor in the securities of a company is so small that it does not give him the right to participate in management activities. The purpose of portfolio investment is to generate income. Due to a large share, a direct investor can become a participant in the management process.

Who can afford direct investment?

Direct investing requires investors to invest large amounts of money and have big goals. By pouring funds into some large project, you will not receive income in the first few years. At this time, additional capital investments may be required.

Only a person with extensive savings, a large enterprise or the state can afford such expenses by making direct investments in the economy.

Most often, a company becomes a participant in direct investment. For example, its goal is to absorb another smaller enterprise. By purchasing a controlling stake over a certain period, the investor receives the right to participate in company meetings and propose his ideas or directions for further development of the company.

If such an investor invests in real estate at the project stage, he also becomes the owner of the future building and will be able to sell premises and offices in the building at independently set prices. If at the initial stage the investor lacks savings, the process will drag on for a long time. The first profit may appear only after ten years.

In addition, only an experienced manager who already has experience with previous investments and knows what difficulties he will have to face can become a direct investor. If he has already implemented several large projects, then implementing a new one will not be some kind of innovation for him.

Who owns the investment portfolio

Those who cannot afford direct investing resort to portfolio investing. It is much simpler and does not require large expenditures from the capital owner. The presence of intermediaries makes this process even more attractive.

Both an individual and a company can become the owner of an investment portfolio. There are no restrictions in this regard, as well as in terms of the amount. With even a small capital, you can become an investor.

If you have broad knowledge regarding investment, you can invest on your own. Various graphs, formulas, analysis of the economic and political situation in the country - all this should be at the disposal of the investor.

Ignorance of such trading features does not prohibit you from being an investor. You can hire your own consultant representing one of the brokerage companies. He will cope with the task without your participation and will probably bring you a stable income for the duration of the contract.

A small amount of entry into the market allows you to invest with minimal investment. By distributing your own funds between several securities, you will be able to receive income from each share of the collected portfolio. You can collect the number of trading instruments yourself, or based on the consultant’s preferences.

Benefits of portfolio investing

Combining all the above information, we can highlight a lot of advantages of portfolio investing for an investor who does not have large sums:

- Passive investing.

You don’t need to track transaction statistics on a daily basis—this is done by a specialist. You only give your funds, and at the end of the designated period, you take them back. In this case, examples of portfolio investments for independent investment may include packages from a deposit, mutual fund and government bonds, or transferring your account to a consultant; - There is no need to deal with the affairs of the company that issued the securities.

This is of no use to the average person. You will be able to receive your income, and the company will be managed by the controlling shareholder; - The risk of losing invested funds is reduced to zero.

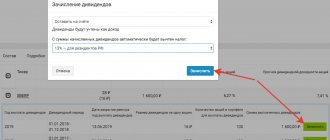

Your portfolio is diversified, that is, distributed between securities of different issuers. Direct investments have a high risk of losing large sums in the event of an unsuccessful start to the project. An organization's portfolio investments help minimize the risk of loss of capital by the company; - Ease of paying taxes

. If you do not withdraw funds from the brokerage account, but use them for further investment, then you do not need to make any payments to the tax office. Mandatory payment is provided only in case of final withdrawal of part of the funds or the entire amount. If you used the services of a management company, then it will be the tax agent.

How are international investments regulated around the world?

To understand how international investments are regulated in the Russian Federation, you can go in two ways: studying internal documents or considering external legal acts. It should be noted that Russian legislation in this regard attaches paramount importance to international agreements, so it is better to start with the issue of regulating international investments.

International investments are regulated by many conventions, but only two of them are important for the Russian Federation. The first is Seoul, also known as MIGA. And the second is the Washington one, which, by the way, has not yet passed the ratification procedure. Of course, with regard to international investments, there are many more acts and agreements in force between the Russian Federation and other states, but they do not have a general meaning, but consider particular cases of interaction between two countries in relation to foreign investments. We will focus on considering the main international treaties.

The Seoul Convention was created to protect international investments from possible risks of a non-commercial nature. For example, wars, riots and any other similar situations. The Seoul Convention insures international investments, and this is monitored by a specially created organization - MIGA (International Investment Guarantee Agency). In 2013, it already had over 170 participants.

The Washington Convention was created to deal with disputes between the recipient state and private investors. For these purposes, there is a special body that ensures that any disagreements related to international investments are subject to general rules, and, in addition, guarantees fair decisions in the event of disagreements.

The Convention on the Protection of Investor Rights is a document that is valid in the CIS. It contains, among other things, the combined principles of both conventions related to issues of international investment. But it should be noted that the Russian Federation has not used it since 2007, preferring to rely on bilateral agreements for relations with each country separately.

Of course, this approach to the legal regulation of international investments looks cumbersome and overly complicated, but in reality, in each agreement it is possible to identify general principles that form the features of the legal regulation of this issue. Despite the existence of many agreements, almost all of them emphasize that losses in international investments have insurance protection, and double taxation is impossible, which, in turn, allows for a significant increase in international investments.

What types of investment exist according to timeframes?

All investments of funds imply a certain period during which their owner will not withdraw money from circulation. Depending on this, there are short-, medium- and long-term investments.

The shortest lifespan of an investment is a few hours. This is possible with portfolio investing. Share purchase and sale transactions can take place every second. By monitoring the volatility process, you can choose the most opportune moment to sell securities. This process only takes a couple of hours. usually last more than six months.

The next period for placing your funds for investment purposes exceeds six months and ends at the annual value. If you sell your package after 8 months, then you are a participant in medium-term investments. This method of investment is most common among portfolio investors. Most often, brokerage companies enter into an agreement with a new client for a period of one year. This is no different from investing in a bank deposit.

The longest investment period is unlimited in time. You can make your first profit in a year, or maybe in several decades. The last option is more relevant to investments by government agencies. All types of direct investments are examples of long-term investments, when the project pays off only after a few years.

How else are the types of investment divided?

Depending on how much income you want to receive from your own investments, your investments can become:

- Conservative.

The most common type of investment. It means minimal risk and low return. These are investments in a bank deposit or government securities - bonds. The risk of losing invested funds here is so minimal that the investor does not even take it into account. For example, the loss of money on a bank deposit threatens if the bank goes bankrupt. Therefore, it is better to choose an organization for storing your savings wisely and carefully. The return on such investments is minimal, since it does not imply investing in risky projects; - Moderate.

Average risk and increased income. This type includes an investment portfolio consisting of a percentage of risky and reliable securities. For example, part of the money is invested in government bonds, and the other in blue chip stocks. Here the income is higher due to transactions with shares; - Aggressive.

Most of the portfolio is invested in risky projects. At the same time, the investor often changes investment instruments in order to obtain maximum income. This type of investment involves the possibility of losing all invested funds or making a high profit.

Methodological commentary on the international investment position of the Russian Federation

The conceptual and methodological basis is the sixth edition of the Balance of Payments and International Investment Position Manual

International Monetary Fund

(BPM6)

.

General concepts of international investment position statistics

The International Investment Position (IIP) is a statistical statement that reflects, at a given point in time, the value of financial claims of residents on non-residents, as well as gold bullion, which serves as a reserve asset, and obligations of residents to non-residents.

IIP reflects the balances of assets and liabilities at the reporting date, as well as changes during the period that occurred as a result of transactions, cost changes (revaluation) and other changes.

Changes in transactions show the net changes in foreign assets/liabilities that result from financial transactions between residents and nonresidents in those assets/liabilities. These transactions are reflected in the financial account of the balance of payments.

Revaluation changes and other changes reflect changes not related to financial transactions between residents and non-residents. Changes as a result of revaluation take into account net changes in the volume of assets/liabilities as a result of changes in exchange rates and the price level of financial instruments. Other changes include all other changes in the volume of assets/liabilities. These include: changes resulting from write-offs of assets or liabilities; reclassification (redistribution) between institutional sectors or functional categories; changes caused by a change of residence of an institutional unit.

The difference between external financial assets and liabilities represents the net investment position, which can be positive—the country is a net lender relative to the rest of the world—or negative—the country is a net borrower.

Structure and characteristics of the international investment position of the Russian Federation

The data of the International IP of the Russian Federation are disseminated (published) in several presentations with different data groups and levels of detail.

Main units

. The presentation is a collection of the main components of an international investment position.

Standard Components

. The list of components for this presentation is defined by the International Monetary Fund (IMF) and is standard for all countries reporting data to the IMF under the Special Data Dissemination Standard (SDDS). It is the most detailed and includes the actual standard components and additional articles. Standard components are integral components of the system that are taken into account when calculating the resulting indicators.

Additional articles are components that are compiled depending on specific economic conditions. In the presentation of standard components, additional entries are shown in italics.

Financial assets and liabilities in the standard IIP presentation are classified as follows:

- by functional categories - direct investments, portfolio investments, derivative financial instruments, other investments, international reserves (reserve assets);

- for financial instruments - equity instruments and shares of investment funds, debt securities, options, forward contracts, other financial assets and liabilities;

— by institutional sectors and subsectors — central bank; banks; government bodies; other sectors, which include other financial institutions (except banks), non-financial institutions, households and non-profit organizations serving households;

- by maturity (in the case of debt instruments): long-term (with an original maturity of more than one year) and short-term (with an original maturity of one year or less or payable on demand).

Additionally, the main aggregates of the IIP are developed in the distribution of positions in national currency and in foreign currency, as well as the currency structure of external debt claims and external debt obligations, which includes classification by sector, maturity and type of currency (Russian ruble, US dollar and euro). In addition, the IIP is being developed in the context of financial instruments and institutional sectors, highlighting the sector of non-financial organizations.

Functional categories and financial instruments

Foreign investments are classified in the IIP into assets and liabilities, distributed in accordance with the economic model of investor behavior into functional categories (direct, portfolio and other investments, derivative financial instruments, reserve assets), which, in turn, are detailed by type of financial instrument, covering a full list of financial relationships with non-residents.

Direct investments

Direct investment is a category of foreign investment that is made by an institutional unit resident in one country for the purpose of exercising control or gaining lasting influence over the management of an enterprise located in another country.

A direct direct investment relationship occurs when a direct investor directly owns equity instruments that give it 10 percent or more of the voting power in the management of the direct investment enterprise.

Direct investments are accounted for in the form of participation in capital (quoted and unquoted shares, interests, shares, real estate), reinvestment of income and debt instruments (securities, loans and borrowings), excluding transactions with debt instruments between financial intermediaries associated with direct investment relationships.

Direct investments include transactions where a direct investment enterprise acquires equity and debt instruments of its direct investor (reverse investment) and transactions between sister enterprises. Sister enterprises are those enterprises that are controlled or influenced by the same direct or indirect investor, but do not have any control or influence over each other.

Portfolio investment

Portfolio investment is a category of foreign investment in marketable debt and equity securities other than those included in direct investment and reserve assets.

Derivatives

Derivative financial instruments are financial instruments that are linked to other specific instruments, indicators or exchange commodities and with the help of which financial risks can be resold in financial markets regardless of the underlying instrument. There are two categories of derivative financial instruments: options and forward contracts.

Other investments

Other investments represent the residual category of financial instruments that are not included in the categories of direct and portfolio investments, financial derivatives and reserve assets. They include: other equity participation, cash and deposits, loans and borrowings, insurance and pension programs, standard guarantee programs, trade loans and advances, special drawing rights (SDR) in terms of obligations, other receivables/payables (including debt on declared but unpaid dividends on shares of Russian enterprises owned by foreign portfolio investors).

Reserve assets

Reserve assets are highly liquid foreign assets that are held and controlled by the Bank of Russia and the Government of the Russian Federation to meet balance of payments financing needs, intervene in foreign exchange markets to influence the exchange rate, and for other relevant purposes. Reserve assets include: monetary gold, SDRs, reserve position in the IMF and other reserve assets (currency and deposits, securities, other claims).

Institutional sectors

Institutional sectors and subsectors in the international investment position correspond to the sector (subsector) of residents, and not to the sector of counterparties, that is, in the case of assets, this is the sector (subsector) of the Russian investor or lender, and in the case of liabilities, the sector (subsector) of the Russian issuer or borrower.

central bank

presented by the Central Bank of the Russian Federation.

Banks

— credit organizations (except for non-bank credit organizations) and the state corporation “Bank for Development and Foreign Economic Affairs (Vnesheconombank)” without taking into account its activities as an agent of the Government of the Russian Federation.

Government bodies

— state authorities of the Russian Federation, state authorities of the constituent entities of the Russian Federation, local authorities.

Other sectors

— analytical grouping, including other financial organizations (except banks), non-financial organizations, households and non-profit organizations serving households (NPISH):

— other financial organizations

— non-bank credit organizations and other organizations whose main activity is the provision of financial services;

— non-financial organizations

- enterprises whose main activity is the production of goods or non-financial services. Non-financial organizations include legal entities, as well as quasi-corporations - organizations operating without forming a legal entity (branches and representative offices of non-resident organizations, conventional resident units owning real estate);

- households

— institutional units consisting of one individual or group of individuals, including individual entrepreneurs;

— non-profit organizations serving households (NPISH)

- institutional units that are non-market producers, created to provide social services to households. These include charitable societies, trade unions, professional and scientific societies, religious institutions, etc.

Page last updated: 08/23/2019

Portfolio investments and investment objects

Depending on what instruments the investor uses to generate income, types of portfolio investments are divided based on investments in:

- Money market.

Here you select several currency pairs of interest, the difference in price of which can be used to generate income. This type of investment is often short-term in nature; - Government securities.

These are bonds of various issues, with low yield and long-term nature; - Private securities or financial portfolio investments.

The funds are invested in shares of various issuers and are intended to be short-term in nature with high income. If you invest in blue chips (the largest and most famous companies), you can get a stable income. Investing in shares initially issued by new companies is fraught with high risks and an uncertain level of income. If one of these companies becomes successful in the market, its shares will greatly increase in price in a short period of time.

Basic Investments

The most accessible investment instrument is shares - the main investment.

Their advantages:

- low price;

- high potential profitability;

- dividend payment;

- excellent liquidity;

- ease of purchase, implementation;

- security, transparency of the transaction.

The best tools for increasing revenue are:

- Opening a brokerage account allows you to become a trader or entrust capital to professionals.

- Buying real estate - purchasing for the purpose of renting out, playing on the difference from the sale, buying with a loan to receive rent. Particular effectiveness is revealed when purchasing several objects.

- Creating a financial reserve in the form of bank deposits is less expensive, but carries no less risks.

Growth and Income Portfolios

Depending on the investor’s goals, there are three forms of portfolio investment:

- Focused on growth.

These investments are inherent in the direct form of investments. The main purpose of the infusion of funds is considered to be to increase one’s own share in a particular company. You gradually increase your capital, which increases the initial part of the acquired assets. The larger this share, the faster you can take control of the company you are interested in; - Income-oriented.

These are portfolio investments whose main goal is to obtain maximum profits with minimal risks. You buy, for example, shares in order to sell them more profitably in the future. The expectation of an increase in the value of securities or other instruments is the essence of investing in a portfolio; - Focused on growth and income.

This is a combination of the above two types. This type of investment is most acceptable from the point of view of the inadmissibility of loss of funds during direct investment. The investor pours money into the purchase of equipment for the company, which will further automate the work process. In order to have at least some income, an investor prefers to form a portfolio of securities in order to receive a stable income.

Investment analysis

Investment analysis is a set of methods for substantiating investment activities. The goal is to determine the level of investment value and the expected effect of profit growth.

Analysis is expected:

- dynamics of the investment climate;

- investment structures;

- profitability of the project.

Methods:

- Discount flow analysis – bringing cash flows excluding tax accounting to current value.

- Comparative analysis is a comprehensive assessment of the purchased value against the background of others.

- Replacement value analysis – takes into account the value of an object in the future to its current value.

Principles of forming an investment portfolio

In order for investments to pay off and bring high income, when compiling an investment portfolio you need to pay attention to the following indicators:

- Quality.

When choosing investment instruments, pay attention to the essence of the project or the issuer of securities. They must correspond to reality, that is, the project must have a real basis, and not fiction that is not destined to come true, and the issuer must be studied by you carefully (including the history of its formation and the number of issued securities); - Reliability.

Choose only well-known companies in which you are confident. It’s good if they have been on the market for more than five years and are developing at a steady pace; - Trust a professional consultant.

If you don't understand investing, then you shouldn't do it yourself. You will only lose your invested assets; - Initial small income.

Start with a conservative type of investing. If you complete this step successfully, you can move on to moderate investing; - Consistency.

It is better if the income is stable and not irregular. This will help you conduct further activities correctly and will not leave you without money; - Liquidity.

Choose those assets that you can get rid of at any time. Portfolio investing in stocks is a great example of this.

Investment management

Every investor should be able to diversify risks.

High-quality investment management will help reduce losses by:

- combinations of high-profit and low-profit (but more reliable) investments;

- drawing up a plan for reorganizing the investment portfolio, monitoring the profitability of investments;

- choosing only those tools you trust;

- observing more “adult” players;

- obtaining education/certificate in the field of risk management.

You can delegate authority to professionals at any time. The main thing is to start.

Investment portfolio management strategies

Depending on your time and desire to get maximum income, you can use one of the investment techniques:

- Passive.

In this case, there is no need to monitor the accumulation process daily. You deposited money into the account and took it back at the end of the term. This kind of investment involves receiving a small income due to the fact that you do not control the transactions. You can open a bank deposit or entrust account management to a qualified consultant; - Active.

It all depends on your personal intervention in the process of asset price movements. By constantly selling or buying different assets, you can achieve quick results. High income on successful transactions is guaranteed. This method of investing is more suitable for competent specialists who know all the intricacies of the market. Direct investing can also become active in the sense that the owner of the capital is constantly involved in the life of the launched project. He is constantly interested in the ongoing activities and makes adjustments at different stages.

What can affect changes in the price of investment instruments

By investing in a particular asset (and more often in securities), you can see a price decline or increase. This may be due to market volatility. The indicator characterizes the normal course of development of the process of buying and selling securities by market participants.

There are other factors that contribute to price changes:

- Portfolio investment objects.

Stocks, bonds, futures, options - all these assets and many others function differently in the market and change their value depending on the issuer, the number of issues or pieces in circulation; - Activities of the issuer.

Different areas are perceived differently by market participants. Many are ready to invest in securities of oil producing companies, but not everyone likes to support agriculture; - The situation in the country.

The crisis is driving down prices for most assets. Conversely, when a company's business improves due to economic growth, the value of its assets increases; - Internal position of the company

. If a company experiences some difficulties, this could harm the price of its assets. This situation arises in the case of unsuccessfully concluded contracts with partners and, as a result, a decrease in the company’s reputation. This contributes to the outflow of stock buyers and a decrease in their value.

How to invest in an investment portfolio

If you want to become a portfolio investor, then completing the following steps will be mandatory:

- Setting investment goals.

You must decide which investments you will be dealing with - low-yield or high-risk. Your future profit depends on this. If you want to have a small stable return on portfolio investments, then this is one goal, and getting the maximum amount in a few hours is another; - Choosing a strategic direction (passive or active investing)

. If you want to control transactions yourself, you will become a participant in active investments. When you transfer funds under the management of another company, this type of investment is passive; - Studying the features of the stock market.

Even if a specialist carries out all the operations for you, it will not be superfluous to know some important components of this process. This way you can bring your own idea into the portfolio formation for approval by the consultant; - Assessing portfolio profitability.

You must understand how effective the created package of securities is. If some tools can be replaced in order to obtain greater benefits, then this should not be neglected; - Exploring the feasibility of the tool.

During the investment process, some instruments may become unprofitable; they need to be excluded from the list of income-generating objects. To this end, you need to regularly review the composition of your portfolio.

Risks of portfolio investments

Portfolio investing is considered the most profitable for obtaining average income. Risks are minimized due to a large number of investment objects. In case of losses from one instrument, others will allow you to maintain income.

However, even this is characterized by some risks:

- The briefcase is not assembled correctly

. If you invest only in risky securities, you may not receive any income at all. It is necessary to combine investment objects so that the risk of losing funds is minimal; - Time to enter the market.

If you bought shares at their maximum price, then it is unlikely that you will be able to sell them without a loss. The main rule of investing in the stock market is to buy securities at the moment when others are selling. This will allow you to purchase assets at the lowest price; - Inflation rate.

If you have chosen a conservative type of investment, then rising prices in the country may mean that you won’t win anything; - Activities within the issuer.

Some companies issuing securities may merge into one, or, conversely, leave the company as an independent entity. In this case, the price of shares may change sharply and not for the better, and therefore choose only proven corporations to create a portfolio; - Excessive emotionality of the investor

. An investor who is actively involved in the investment process must rely on cold calculations from each transaction, and not on his own experiences. The latter most often become the cause of loss of funds, resulting in a negative impression of the stock or.

Investment development

Investment development is the acquisition of various investment instruments, the study of innovative trends to identify the most prestigious areas. The stock market, which is at the level of development, offers a wide range of ways to increase the money supply.

To preserve investment capital, follow the rules:

- withdraw interest on time;

- withdraw part of the deposit, increasing it at the expense of interest.

- don’t be afraid to earn less than you planned.

Foreign Portfolio Investments

You can use not only foreign ones for investment purposes.

The owner of capital must be extremely careful and rely on the following principles:

- Awareness of the activities of a foreign corporation.

Typically, such companies are less susceptible to economic events and often provide guaranteed income. It is important to understand how the enterprise operates and evaluate forecasts for its further development. The success of foreign direct investment depends entirely on this point; - Choosing the right country for investment.

It is necessary to realize that not all countries occupy a stable position in the world. The domestic economy and production depend on this; - Knowledge of the functioning of the market itself.

Its volatility may differ from that in Russia. The operating principle also has its own characteristics that you need to get used to.

For a long time, loans were the main method of investment.

Probably the simplest way of investing in the era of exchange (before the invention of money by mankind) was “selfish charity”. A successful food producer could feed strong people experiencing hunger due to temporary difficulties (weather, war). The survivor would later become their farmhand or help out during difficult times. During the Renaissance, Florentine Medici merchants, tired of trading, became “money changers,” investing money in properties under construction and young businesses. Even during that period, it became “fashionable” to buy monopolies - securities that allow you to engage in any industry without interference from competitors.

Today's market consists of millions of trades per day. Thousands of businesses are created and go bankrupt every day. The shares of many of them, as well as securities of countries and industries, are listed (have a single price) on the stock exchange.

Direct investments

Direct bonds are fundamentally used by the world's leading investors. There are different types of investors. Venture capitalists invest money in “startups” - the most fragile companies consisting of 1-2 entrepreneurs, 0-5 employees and one “super idea”. They estimate the likelihood of success and take most of the company for next to nothing. However, their risk is up to 90 percent. In other words, nine out of ten startups don't survive. The profitability of a venture investor is determined by the success of 10% of selected companies.

Investment activities

Investment activity is the investment of savings (capital) for subsequent growth. By investing money today, you make a profit tomorrow.

Investment activity contributes to:

- safety of capital;

- increasing profitability;

- balance sheet liquidity;

- support of secondary reserves.

It’s easy to start investing even for a beginner by buying shares (it’s enough to spend a small amount). Among other things, investments help to insure the risks associated with daily operations.

Financial "bar"

The "Barbell Principle" advises keeping 80%-90% in the safest instruments (money, precious metals, real estate), while 20%-10% should be "working hard."

The riskiest “small interest” can be placed in income bonds of developing countries, complex derivatives (credit instruments), etc. Many experienced investors use it, keeping up to 90% of their “budget” in cash and government bonds. A small part of savings is stored in the riskiest instruments, shares of developing companies and their shares.

There are two main types of investments - direct and portfolio. What are the features of both?

What laws govern international investment in Russia?

Domestic legislative regulation of international investment in our country has a fairly long history, in which it is customary to distinguish three stages of development:

Stage 1. This is the period from 1980 to 1990 when economic reform took place. At that time, a base was created that subsequently helped the development of a more developed legislative framework for regulating this area of relationships. We can say that the first stage consists of sketches and is preparatory.

Stage 2. This is the period from 1990 to 1999 when the first laws regarding international investment were created. Actually, this is the very beginning when investments became a legal term in Russia.

Stage 3. From 1999 to present. This stage is another milestone in the creation of laws regulating foreign investment. The emphasis is on ensuring that Russian laws fit into the context of the international economy. It cannot be said that the work is completed today, but the tasks that need to be solved along this path have already been clearly identified.

Of course, the conversation about the existence of legislation regulating international investment became relevant only after the opportunity arose to attract investment from capitalist and developing countries. During the second stage, there is regulation of Russian legislation, the introduction of private property, entrepreneurship opportunities and the organization of joint-stock companies. Without this base, there could be no talk of international investment: there were no important concepts with which lawyers should operate in this area.

The first thing that was discussed within the investment bills was encouraging production, providing both tax and customs benefits in order to stimulate these areas and promote their development.

An important milestone in this entire process was 1999, when a number of bills were introduced regulating foreign investment issues: Federal Law No. 160 (“On foreign investment in the RSFSR”) and Federal Law No. 39 (“On investment activities in the Russian Federation carried out in the form of capital investments"), while they did not completely exclude previous laws, but retained those parts of them where there were no contradictions with innovations. It should be separately emphasized that special emphasis is placed on the dependence of subjects of investment activity on the will of the state.

The state has a variety of ways to influence investment activity.

Indirect methods of influencing investment activity are those actions that create certain conditions for investment. This may include the right to create their own investment funds, granted to subjects of investment activities, changing tax rules, creating sources of financing, and much more. At the same time, indirect methods, according to the law, are considered a priority for the state.

Direct methods of influencing investment activity are the creation by the state of guarantees for subjects of investment activity, the development of a list of potential investment projects, financing from the budget, the conclusion of concession agreements, etc.

Let's move on to consider the laws. What do they say about investment activities? Federal Law No. 39 of 1999 indicates that such relations can only be carried out if there is an official written agreement - an agreement or contract, which is drawn up in accordance with the requirements imposed on such documents by the Civil Code of the Russian Federation.

We should also talk about government contracts. This is also a form of contracts, but their distinctive feature is that one of the parties is a government agency or the state itself. These are, for example, contracts regulated by special legislation for the supply of goods, provision of services, etc., we are talking about the needs of the state. In other words, such an agreement must involve some kind of state interest. In some cases, a concession agreement can also be regarded as a government contract.

In addition, it is necessary to mention that the concept of “investment agreement” is often used in the field of capital construction, where it implies mixed contracts. It is typical for this area that investors have equal rights within the framework of investment activities. They can decide for themselves where to direct funds, with whom to enter into agreements, how to dispose of capital investment objects, etc. This norm allows them to maintain an antimonopoly position, but does not apply to norms that ensure national treatment. To date, this area has not yet been fully developed, and its potential has not yet been sufficiently used. But the foundations have already been laid to protect the interests of investors.

Read the article: Import of products to Russia

What is direct investment?

This type of investment involves concluding an agreement between the person investing money in the project and the company that implements it. According to this document, the investor will be able to participate in one way or another in the management of the company or influence the decisions made by its management.

Direct investment in a business can be expressed in the fact that the investor acquires a controlling stake in the company, after which he receives the right to appoint his own people to the governing bodies of the organization or even apply for some high-ranking position in the company.

An investor who has acquired control over a company or is authorized to participate in key decisions made by its management can make a profit not only from dividends and interest on the growth of the value of shares, but also from the distribution of the company's profits.

Direct investments, as a rule, have a clear focus: the corresponding funds are used for the purchase or modernization of fixed assets, expanding the staff of the enterprise.

An investor interacting with a company under the scheme in question usually hopes for profit in the medium and long term. Therefore, receiving direct investment is always welcomed by any entrepreneur - he can count on the fact that the funds will not be unexpectedly withdrawn by the investor if the pace of development of the enterprise slows down.

In addition, people who invest in companies through direct investment typically have the highest level of competence in a particular area of business. Therefore, the fact that an experienced investor or managers invited by him come to manage the company is usually perceived positively among the company's owners. For them, a competent person in management is perhaps a more significant factor than increasing the company’s capital through direct investment.

What is portfolio investment?

This type of investment represents the acquisition of a share of a company's shares, the size of which is insufficient to give the investor the right to influence decisions made by the company's management.

Portfolio investments are generally designed to provide the investor with income in the short term. It often happens that the corresponding financial flows are activated only at the stage of the fastest growth rates of the business. As soon as the pace of development of a company slows down, portfolio investors begin to actively withdraw capital from the company.

Profit under the business financing scheme under consideration is usually paid in the form of dividends or interest on bonds.

The funds received by the company under this scheme are used for any purpose, and this is not necessarily the replenishment or modernization of fixed assets. For example, this could be accelerated repayment of loans or an increase in salaries for certain categories of managers.

Investment structure

The structure of investments is its constituent elements, characterized by types and direction of use. Structure in this case is the interaction of elements of a single system, the characteristics of the whole by its components. There are three main types of structures: consumer investments, capital investments, financial investments.

Consumer investing means allowing customers to purchase products. Capital investments – contributions for modernization work. Financial deposits allow you to purchase assets.

Comparison

The main difference between direct investment and portfolio investment is that the former involve the creation of conditions for the investor’s participation in the company’s management making key decisions on business development issues. This is possible due to the fact that a person who invests money in a company acquires a controlling stake in its shares. This scenario is not typical for portfolio investments.

The fact that the investor is involved in the management of the business determines many other differences between direct and portfolio investments. Such as, for example, the waiting period for profit, as well as the method of obtaining it.

Having studied the fundamental differences between direct and portfolio investments, we will record the main conclusions in a small table.

How to become a portfolio investor

How to invest in portfolio investments

How to become a portfolio investor:

- Choose the optimal investment period.

- Determine the investment amount.

- Choose a broker.

- Choose the optimal strategy.

- Check your portfolio every few months and adjust it if necessary.

- Use various tools to diversify risks.

Below we will describe some nuances that will help you use your portfolio investments correctly.

Choosing a broker for portfolio investments

It’s worth saying right away that there are two ways to invest money in portfolio investments:

- Trust management is the transfer of funds to professional traders/companies who will form a portfolio and monitor its performance. When choosing a trustee, you should very carefully check all documents, especially the availability of a business license.

- Independent management of portfolio investments.

As for the term, portfolio investment is a long-term instrument.

☝️

As you probably noticed above, the recommended minimum investment period in VTB funds is a year; greater income can be obtained by holding securities for 2-3 years.

The next very important point is to choose a broker. You should pay special attention to fees and choose a tariff plan that will be beneficial for long-term investing.

The following brokers

offer good conditions for portfolio investments:

- Finam;

- Opening;

- BKS,

- Keith Finance.

After opening a brokerage account, you need to create an investment portfolio by selecting and purchasing shares. As mentioned above, there are three investment options, each of which involves the purchase of certain instruments.

The most reliable are bonds and shares of state corporations, “blue chips” are a medium-risk instrument, and the riskiest, but at the same time the most profitable, are shares of young promising companies and startups. You can diversify risks using various tools.

☝️

Read the full article: What is diversification and why is it needed?

Some investors change the selection of stocks in their portfolio almost every week, but this approach is erroneous, provided, of course, that the assets were chosen correctly. Review the contents of the portfolio no more than once every three to four months, the only exception being the bankruptcy of the issuer.