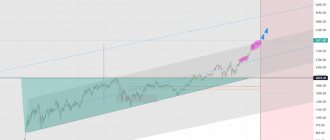

Did you know that in the spring of 2022, the price of Bitcoin will finally reach $100,000 because market cycles tend to lengthen? Are the best altcoins already preparing to enter the new altcoin season and show profits early next year?

You may ask, where does so much positivity come from? We have nothing to do with it, and the positivity comes from completely different market participants, these are traders, analysts and famous billionaires. And the initial reason for everything was the closing of the BTC weekly candle above 50 WMA and at the same time above $50,000.

This is indeed a very good sign, and the forecasts that we will present below also indicate the chances of seeing cryptocurrencies rise in January. We will tell you how this can happen in this article.

- BTC

- Ben

Will the price of Bitcoin go up?

The block reward will be reduced over the next two years. It will decrease by twelve and a half bitcoins. Today, successful miners receive twenty-five bitcoins. According to the protocol, this remuneration is being reduced. According to forecasts, it will decrease in two thousand and seventeen. Maybe even this moment will happen in two thousand and sixteen.

Perhaps by reaching a high level, people will have a reduced opportunity to receive a large number of coins. You might think that the electronic payment industry will grow very quickly, demand for it will increase, and prices will begin to rise.

Along with this, there will be an increase in Bitcoin production and an increase in the cost of rewards. Thus, Bitcoin will rise in price. The course will still change frequently.

If you look at the technical side, it is possible to mine bitcoins in the amount of only twenty-one million, because the rest is spinning. Thus, the growing community can only cope with seven million. Compared to regular money, new Bitcoins cannot be printed. Temporary shocks may occur.

Regular user surveys

Below is a graph of the most popular answers to the question about the Bitcoin exchange rate forecast, which was asked by ordinary network users when asking about 2016. As you can see, many people made a mistake back then; they didn’t expect the high growth of Bitcoin, but the same thing could happen again in 2017.

Bottom line: Based on the above, Bitcoin will become increasingly stable as the market develops and new applications emerge. Therefore, in 2017 the average rate will be $900-$1400 . At the same time, some experts believe that Bitcoin can rise to $2,000 . And in order not to oversleep this moment, find out 5 ways to earn bitcoins without additional investments. Please share your predictions regarding the Bitcoin price in 2022 in the comments.

Forecasts can be wrong

Many critics compare the Bitcoin rate to Dutch tulips. During the tulip crisis, importing tulip bulbs became a profitable investment. There was a rapid rise in their prices. After people cashed out tulips, the business collapsed. Less than a month has passed since the cost of expensive tulip bulbs dropped by almost one hundred percent. There is no need to make such comparisons because these are flowers and they have only beauty. Bitcoin's price trend can be compared to real estate.

When the economic boom reached its peak, critics declared that digital currency would disappear. Only as a result of this a reasonable price appeared. Bitcoin's real price has been determined.

Perhaps in two thousand and twenty-five, bitcoins will be able to account for ten percent of all payments on the Internet. According to critics, you should not rely on diagrams. The Bitcoin market is similar to the real estate market. It has a very high rate and will always be in circulation.

What's happening to the value of Bitcoin?

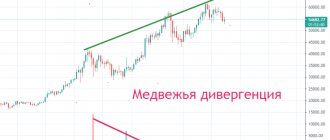

Many professional analysts agree that a classic bubble has formed in the cryptocurrency market, which with a high level of probability will burst soon.

The famous trader D. Kemala claims that a serious collapse in the Bitcoin rate is expected in the near future. He came to this conclusion through the use of technical analysis techniques, which make it possible to predict changes in quotes for a selected instrument based on an assessment of past price movements.

This trader claims that the current charts showing the ratio of Bitcoin to currencies such as the US dollar, Australian dollar, New Zealand dollar and Swiss franc have formed an arcing upward curve, which is one of the signs of a financial bubble.

Similar patterns appeared on the charts of the popular Shanghai Composite and Nasdaq indices in 2007 and 2000. After the formation of these figures on the charts of the above-mentioned indices, their quotes seriously collapsed.

In the first two months of 2000, the Nasdaq index increased by more than 30%. After this, the quotes of this index began to fall, and as a result, its value decreased by more than 34%. The fall in quotations continued until the fall of 2002. Due to the burst of the bubble, the initial value of the Nasdaq index fell by almost four times.

In the first nine months of 2007, the value of the Shanghai Composite Index increased by more than 113%. After which there was a sharp drop in the price of this index, which continued until the fall of 2008. Due to this decline, the value of the Shanghai Composite Index fell by more than 71%.

The above-mentioned situations with indices are considered to be a classic bubble. Currently, the Bitcoin market is experiencing a similar situation that preceded the fall in indices. This is what allows many experts to claim that in the fall of 2022 there will be a fall in the value of Bitcoin.

What does the future hold for Bitcoin in 2022?

According to investor and activist in the cryptocurrency industry Roger Ver, the forecasts will be very optimistic. This year this unit will have a high rate. According to his comments on Twitter, the world is a better place because of Bitcoin. And for this they use not tanks and weapons, not votes, but cryptographic encryption, unmanned aerial vehicles, bitcoins, drones and 3D printing.

According to Matthew Rozak, a founding partner at Teily Capital, Bitcoin is the most undervalued asset it has ever been his entire career. In addition, thanks to the growth of enterprises using this currency, it began to have great opportunities that are necessary for a modern investor and entrepreneur.

Considering cryptocurrency as an investment instrument, American venture investor Tim Draper made a prediction that soon everyone will want to own this currency. According to Draper, the main reason that prices are falling is hidden in the miners who sell cryptocurrency to pay electricity bills. In general, the popularity of Bitcoin is increasing, so it will soon be possible to pay various bills with it.

Regular users don't expect change. They don't think that sudden changes can occur. Based on the above, it is clear that this currency gains stability through market development. With a steady increase in the rate and some major declines for two or three months, regardless of how events go, bitcoins will have a value of around six hundred dollars.

When 2022 comes, it could reach a rate of $1000-1500. This important information can help all Bitcoiners get a good income without even having to make additional investments.

Want to know how to earn over 450% per annum in the stock market?

Get a free course on investing in high-yield instruments that brought in more than $1 million in 2022.

I, Andrey Abrechko, an investment expert with 12 years of experience and the founder of the Academy of High Profit Investments, invite you to take part in my free course, where you will learn:

— which instruments are the most profitable in 2021;

— what are IPOs and SPACs and how to start making money on them from 100% per annum;

I will analyze my real case, where I will show with a clear example how I managed to make more than 450% per annum for 2020.

The course consists of 5 small lessons that will be sent to you via Telegram and you can watch them at any convenient time.

Follow the link and start free training