What are portfolio and direct investments? When investing in real estate, companies, your business or PAMM accounts, you strive to achieve a specific goal each time. Direct and portfolio investments are the main investment categories. Let's see what their difference is.

Direct investment is control of the business. You invest finances in the growth and operation of any enterprise, and in return receive a percentage of the authorized capital, for example 20% - the specific share depends on the amount you invested. From this moment on, you have direct influence on the decisions made by the owners and, thus, participation in the management of the company, especially if you own a controlling stake. At the same time, you have the opportunity to send your person to the board of directors. This is called direct investment.

Reference!

In other words, such investments are the investment of finances in the production or sale of a product, while the investor receives at least 10% of the company’s authorized capital.

It is assumed that with such an investment you are interested in the profitable growth of the company. For this reason, owners have the right to expect not only financial support from the investor, but also count on his experience in this matter, connections and knowledge. A direct investor turns into a full-fledged business partner.

Typically, companies use direct investment when they see advantages for the active growth of the enterprise in the future, but their own finances are not enough to achieve this. The convenience of using direct investment lies in the fact that control over the company is retained while receiving the necessary funds for the growth of the enterprise and investing them, say, in the acquisition of the necessary equipment or the development of a commercial network.

Investors who invest in businesses at the idea stage are called business angels. This nickname captures the essence well, because getting money at such an early stage is the stuff of science fiction. They usually prefer to invest in companies with already well-regulated work processes.

When an investor decides to invest in any business, he calculates and analyzes the following list of factors:

- Prospects for the company's growth and its advantages over competitors.

- The structure of the property, as well as the degree of business processes.

- Level of experience and qualifications of managers, level of corporate culture.

- Relations with authorities, especially conflicts with tax authorities.

Direct investments are:

- Incoming - finances come from foreign investors.

- Weekends - citizens of the state invest funds in foreign enterprises.

Investors can be individual companies or individuals who have sufficient funds to invest. Investments can be made independently or through a Private Equity Fund. Typically, these are long-term investments, the income from which can be received only after a few years. To increase security, funds distribute accumulated funds simultaneously to various enterprises.

Reference!

There are universal funds that invest in companies from different economic sectors, as well as specialized ones, the task of which is to invest in enterprises in a particular field, for example, information technology.

How does the process of returning money and receiving income proceed:

- Purchase of your percentage by the owners of a company that is already firmly on its feet.

- Acquisition of your interest in the authorized capital by a strategic investor.

- Entering the company on the stock exchange and conducting an IPO.

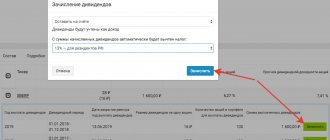

Tools for portfolio investments

Portfolio investments can consist of equity instruments - ordinary and preferred shares, as well as debt securities - government and corporate bonds. That is, securities that have passed the registration of the issue and are admitted for sale to an unlimited number of persons. This allows investors to open positions as easily as possible and, when necessary, close them, making a profit or limiting possible losses.

In addition, it is also possible to participate in portfolio investments in bills of exchange and bank savings certificates, however, these securities meet to a lesser extent one of the main requirements for instruments for portfolio investments - liquidity.

Definition

Portfolio investments are investments that are made up of several different investment products, including stocks, bonds and other investment instruments. An important feature is the investor’s lack of desire or desire to participate in the management of the companies whose securities he acquires. The portfolio investor receives the main income in the form of dividends, coupon income, and the difference between the purchase and sale prices. The combination of several sources of profit and different areas of investment ensures both optimal risk insurance and achievement of the required level of profitability.

Diversification of portfolio investments

When an investment portfolio is formed, probably everyone knows that it should be diversified, that is, the risks should be divided between the securities included in it.

Unfortunately, many people approach this issue - let's say, in a simplified way. In fact, real portfolio diversification is the analysis and division of risks into components and a mathematical assessment of the correlation of certain instruments, the calculation of special coefficients, and so on.

Diversification is a really complex topic, but let's try to explain it simply in at least a very short version. For example, buying two securities from the oil and gas sector can protect against the problems of one company, but it will not save you in the event of a crisis in the entire industry, for example, as a result of falling energy prices. Or the purchase of Eurobonds of two countries, even if they are on different continents, can save from the problems of an individual state, but not the whole, for example, the bond market of developing countries as a whole.

Classification

Different criteria are used to classify portfolio investments. Among them:

- level of potential risk;

- source of income;

- investment period, etc.

Various combinations of investment assets different according to the listed criteria ensure the formation of a portfolio focused on the personal goals of a particular investor. They are usually divided into three basic types:

- With high reliability and low profitability.

- Balanced – with average performance in both directions.

- Simultaneously with a high level of both risk and income.

Goals and features of strategic investment

A strategic investor is interested in obtaining a controlling stake in a particular joint stock company and expects to acquire ownership of it in the future. His main goal is to become the owner of an investment object and receive income from the use of this property, since the income from owning property is much greater than the income from simply owning securities. First, he can buy out more than 30% of the shares, and ultimately become the sole owner of a controlling stake.

In addition to this goal, a strategic investor can pursue two more goals:

- Expand your sphere of influence in the market.

- Acquire control in the distribution of various properties, including through various acquisitions and mergers.

The main feature of strategic investment is that the organization that is the object of investment receives financing, but its management, in fact, is in the hands of the strategic investor. If the investments of a strategic investor do not foretell economic benefits in the near future, they can always be obtained later.

In addition to the fixed capital of the enterprise, the object of strategic investment is the social infrastructure of the organization. The tasks of a true strategic investor include investing in the development of the social sphere of the enterprise, improving the living conditions of workers and educating their children.

Legal regulation of the procedure for acquiring large blocks of shares

The procedure for purchasing a large share of shares in an open joint-stock company is regulated by the legislation of the Russian Federation. In this case, the law provides for a number of measures:

- Create a voluntary offer to purchase shares owned by shareholders to a person wishing to acquire a stake amounting to more than 30% of the shares with voting rights.

- Create a mandatory offer to purchase shares held by shareholders to a person who owns over 30% of the voting shares.

- “Sell-Out” is the process of acquiring securities by a person who has purchased over 95% of all shares of a joint-stock company, the remaining shares and other securities convertible into shares according to the requirements of the shareholders themselves.

- “Squeeze-Out” is the process of acquiring securities by a person who owns over 95% of all shares of a joint-stock company, the remaining shares and other securities convertible into shares forcibly, in connection with the requirement of the owner of the controlling stake.

The state, as the largest investor in the securities market, owns stakes in privatized enterprises that represent federal property. First of all, the state manages the securities of organizations of national importance. This is necessary to control their activities and influence the economic situation in the country.

Attracting a strategic or portfolio investor for insurance companies

Roman Zadavysvichko, Director of Investment Banking Services at Concorde Capital

Often, shareholders and top managers of insurance companies face a choice -

to attract a strategic or portfolio investor

. The main factors to consider when choosing an investor are the short-term and long-term goals of both the owners and the company itself. Their goals do not always coincide, because... The motives of business owners are to obtain a return on investment. You can also note such factors as the existing legal and financial business model, the amount of funds required, the desired implementation time frame, the cost of the tool and the degree of likelihood of obtaining the desired result. Let's consider the key points that a strategic and portfolio investor pays attention to.

Strategic investors

– these are companies that operate in the same business, in other markets (in another region, country), whose strategic plans include expanding their business by entering the markets of other regions (countries). These are companies that operate in the same business and are planning an aggressive growth strategy through the acquisition of other companies. They are usually, especially if there are several real buyers, willing to pay a premium for control.

Investors in the securities market: strategic, portfolio and private

Investors are participants in the securities market, legal entities and individuals who invest their free capital or savings in securities.

The investor will also be the issuer if he issues his own securities. An investor can simultaneously be an issuer if he issues his own securities, and the issuer simultaneously becomes an investor if he invests his capital in securities of other issuers. He constantly acts either as a seller or as a buyer, depending on the market situation, prices and profitability of various securities. Therefore, it is incorrect to identify issuers only with sellers of securities, and investors - only with their buyers. Both issuers and investors act as both sellers and buyers in the securities market. Investors are divided into:

1. Strategic investors set their goal not to receive benefits from owning shares, but to have the opportunity to influence the activities of the joint-stock company. The degree of influence on the activities of the joint-stock company depends on the number of shares owned by the investor. Institutional or portfolio investors do not make direct capital investments in production, but buy securities in order to receive income from growth their coursework. The quality of institutional investors includes: B, investment funds and comps, insurance companies and PF.

2. private investors - individuals who purchase shares for the purpose of generating income. They constitute one of the most numerous groups of investors.

Investors can be classified by status : individual (individuals), institutional (collective) and market professionals; – and by investment purpose: strategic and portfolio. A strategic investor, through ownership of shares, gains full control over a joint stock company (or takes ownership of it), while a portfolio investor relies only on income from the securities he owns. For a portfolio investor, the most important thing is constant interaction with the exchange in order to decide what, where and when to buy. If the main issuer in the securities market is the state, then the main investor who determines the state of the stock market is the individual investor: an individual who uses his savings to purchase securities. At the same time, the number of individual investors can, to a certain extent, serve as an indicator of the well-being of citizens, since individuals begin to invest in securities only when they reach a sufficient degree of personal wealth and the issue of managing it becomes relevant. Legal entities that do not have a license to carry out professional activities in the securities market as intermediaries, but purchase securities on their own behalf and at their own expense, constitute a group of institutional investors. Investors are also professionals who carry out the entire range of operations on it, but only if they invest their own funds in securities. In the market for monetary securities, banks dominate as investors, which at the same time, as intermediaries, partially place short-term securities with their clients (for example, commercial banks of some enterprises offer to other enterprises. So-called mutual funds, or investment funds, play a major role as investors. large financial institutions. A fund is a managed portfolio of securities. Individual investors buy a share in this fund, receiving at their disposal an average asset that generates income with an average risk. According to the degree of risk, there are different types of investors and, accordingly, types of securities portfolios, from low-risk, conservative, to high-risk, aggressive. A conservative investor is an investor who seeks, first of all, to ensure the reliability of investments, the safety of capital at the expense of profitability. An aggressive investor is an investor who consciously takes on increased risk in the hope of obtaining increased profit. An aggressive investor's portfolio (aggressive portfolio) will consist primarily of common stocks.

Strategic investor

It is customary to call a strategic investor whose main task is not just investing for the purpose of making a profit, but gaining control over the enterprise in which he invests his funds. They can be either an individual or a legal entity.

Typically, the role of strategic investor is played by companies from the same or related industry to the enterprise they intend to gain control over. They know well the specifics and all the intricacies of work in this field of activity, and therefore it is relatively easy for them to assess all the prospects that will open up gaining control over one or another enterprise in this sector.

Often companies themselves are interested in attracting a strategic investor. This need arises when there is a lack of funds for further development. You can, of course, go to the bank for money and get it in the form of a loan, but this is not always possible, and is not always the most optimal solution.

The bank will be interested, first of all, in the financial position of the company being financed, its development strategy (business plan) and collateral value (in case of loan default). And for a strategic investor, the prospects that cooperation with a controlled enterprise will open for him are important.

The bank only gives a loan, and a strategic investor, in addition to money, often invests in the enterprise under his control such resources as:

- Technological know-how;

- Own distribution channels;

- Your rich professional experience in this field of activity.

Portfolio investment scheme

All transactions for the purchase of securities are made on the stock market. The main participants in the stock market are:

- salesman;

- buyer;

- broker;

- exchange.

The seller is the company that issued the shares (issuer). The buyer can be an individual or legal entity. In most countries, including Russia, buyers cannot carry out transactions on the stock exchange without the help of an intermediary - a broker. He makes transactions for the client and keeps track of funds. The exchange organizes the trading process itself and analyzes the attractiveness of securities.

The interaction diagram of all participants is as follows:

- The seller contacts the broker and leaves with him an application for the placement of securities.

- The broker checks all the data, goes to the exchange and creates an offer there with the parameters specified by the client.

- The buyer contacts another broker and opens an account with him.

- After this, the client can leave a request to purchase any securities at any time.

- The exchange registers the transaction and transmits information about it to the clearing center. This is an organization that deals with non-cash payments. She checks the availability of money and shares in the brokers' accounts, and then completes the transfer.

- Transaction data is transferred to the depository. He distributes funds to broker accounts and acts as a guarantor for the owner of the shares.

Important: the time has passed when shares were issued in paper form. Transactions are made every day, so no one will send papers by mail and deal with their re-registration.

How to choose a country for international foreign investment

Why do international investments bring significant returns? Firstly, they provide a fairly wide choice of where to invest money, which means you can always find the most profitable option. Secondly, it is always possible to direct international investments to places where the risks are lower and the probability of currency growth is greater. Because different countries develop unevenly, well-targeted international investment can bring different returns, and at different speeds.

Of course, when planning international investments, it is important to understand that in this way money from the country is sent abroad, and therefore it is very important to choose a reliable option that can definitely return and increase the amount invested. In this regard, there have long been criteria that allow us to assess how reliable international investments are in a particular case.

Among such criteria for international investment, the following are common:

- optimal balance between income and risk prospects;

- high level of profitability with certain risks;

- minimal risks at a specific level of profitability.

Having studied these criteria, an international investor is already able to draw the first conclusions about how promising foreign investments are in a particular country. But to make a final decision, a more in-depth analysis will be required, where it is worth paying attention to the following:

- what is the interest rate;

- for how long will the investments be made, given that long-term projects are more profitable;

- what is the required minimum investment amount;

- what is the liquidity of assets;

- are there any risks associated with currency dynamics;

- are there any interest rate risks;

- Are there any risks in dealing with securities?

- what costs the transaction may bring;

- how much the applied tax system will affect income;

- whether international investments may suffer from government inflation.

The next step required to decide on international investment is to assess the prospects of the company itself. It is important to analyze how likely the following scenarios are:

- The "cannibalization" effect. It lies in the fact that the goods of one manufacturer begin to compete with each other. This leads to a decrease in supplies to international markets. Investments will be used to cover financial damage.

- The effect of additional sales. May be caused by additional demand arising from international investment.

- The effect of commissions and royalties. It is important to take into account here that they will be positive flows for parent organizations and negative flows for international investments. The amount of commissions and royalties should be taken into account as a positive value in the analysis.

Only by considering all these criteria can an international investor come to a conclusion about how profitable international investment is for him. But it should be borne in mind that all these factors are far from the only ones worth paying attention to.

International investments may not be profitable at all due to the difficult political situation in a particular state, and unstable currencies may collapse. Therefore, in each situation, before making international investments, it is worth taking a comprehensive look at the situation, making forecasts and deciding for yourself how profitable this activity is in this case.

Read the article: Foreign trade risks