The goal of any commercial company is to make a profit. One of the tools for extracting funds is investments. They are divided into many varieties.

Question: How to reflect in the accounting of a joint-stock company the receipt of budget investments for the reconstruction of a property accounted for as part of fixed assets (fixed assets) (the amount of investment is recognized as a state contribution to the authorized capital of the joint-stock company)? The reconstruction is being carried out by contract. The total amount of budget investments is 90,000,000 rubles. For this amount, the joint-stock company transfers into the ownership of the Russian Federation shares of an additional issue at market value. An agreement on the participation of the Russian Federation in the property of the investment subject was concluded with the authorized federal executive body. The total par value of the transferred shares is RUB 50,000,000. This month, part of the funds received was used to pay for reconstruction work performed this month by the contractor at a cost of 1,200,000 rubles, including VAT of 200,000 rubles. As a result of reconstruction, the initial cost of the fixed asset increases. An increase in the initial cost of a reconstructed fixed asset and the accrual of depreciation on it are not considered in this consultation. View answer

Investments are a popular financial instrument

Investments are a convenient and simple way to get rich.

There are several types of investments:

- financial instruments;

- property;

- intellectual values;

- resources.

In addition, investments can be direct (investing in a specific object) or indirect (investing in the stock market).

Choose popular financial investments and receive a fixed monthly reward. There may be loans to other enterprises, purchase of securities, participation in shared construction.

Division by origin of capital

Depending on the origin of the funds used, the types of investments are:

- primary – initial investments that were formed from own or borrowed funds;

- repeated or reinvestment - this money is formed directly from the profits received from the primary investment process;

- disinvestment – or investment on the contrary. They represent the withdrawal of capital from an investment project. In turn, they can be partial or complete.

Let's take a closer look at disinvestment. The question arises: “In what case can an investor take such a decisive step?” As a rule, we can talk about two situations. Firstly, the investor withdraws money from an unsuccessful investment project when he is finally convinced of its futility.

Secondly, disinvestment can be carried out with the aim of investing money in more interesting investment objects. They are necessary when the investor does not have enough other available funds for this.

Investment activities

Investment activity is the investment of savings (capital) for subsequent growth. By investing money today, you make a profit tomorrow.

Investment activity contributes to:

- safety of capital;

- increasing profitability;

- balance sheet liquidity;

- support of secondary reserves.

It’s easy to start investing even for a beginner by buying shares (it’s enough to spend a small amount). Among other things, investments help to insure the risks associated with daily operations.

Investment analysis

Investment analysis is a set of methods for substantiating investment activities. The goal is to determine the level of investment value and the expected effect of profit growth.

Analysis is expected:

- dynamics of the investment climate;

- investment structures;

- profitability of the project.

Methods:

- Discount flow analysis – bringing cash flows excluding tax accounting to current value.

- Comparative analysis is a comprehensive assessment of the purchased value against the background of others.

- Replacement value analysis – takes into account the value of an object in the future to its current value.

Basic Investments

The most accessible investment instrument is shares - the main investment.

Their advantages:

- low price;

- high potential profitability;

- dividend payment;

- excellent liquidity;

- ease of purchase, implementation;

- security, transparency of the transaction.

The best tools for increasing revenue are:

- Opening a brokerage account allows you to become a trader or entrust capital to professionals.

- Buying real estate - purchasing for the purpose of renting out, playing on the difference from the sale, buying with a loan to receive rent. Particular effectiveness is revealed when purchasing several objects.

- Creating a financial reserve in the form of bank deposits is less expensive, but carries no less risks.

Where to invest money

Once the investment goals have been determined, specific objects can be selected. There are many investment options available to individual investors, but some of them should be immediately discarded if one does not have the relevant knowledge. Investments in antiques, philately or some even more original methods can bring benefits, but only if the person is truly a specialist and understands the subject. Otherwise, the money will be wasted. Therefore, in the first stages it is better to choose something that is time-tested and available to everyone who wants to invest money.

Savings accounts and bank deposits

The classic method of generating income. Bank deposits are the least risky asset. Deposits are reliable, but their annual rate for a long time is almost equal to or slightly exceeds the inflation rate. Therefore, they can only be considered as a way of preserving, and not increasing capital. If this indicator offered by the bank is higher than in other financial institutions, the position of the bank itself should be considered, perhaps by attracting new depositors it is trying to improve its position. Second-tier banks may offer higher rates, but in this case there is a risk of reorganization of the Central Bank and revocation of the license. In this case, depositors receive a refund of the amount of deposits, but not more than 1.4 million rubles.

Deposits in foreign currency bring even less interest, and in European banks these figures are even lower. Therefore, this type of investment should not be considered as an investment at all.

A similar type of deposit is savings accounts. Depending on the conditions (amount of investment, options for closing the account, the ability to withdraw money), the interest rate fluctuates, but also rarely exceeds inflationary processes. Nowadays, savings accounts are offered not only by banks, but also by insurance companies. In each case, it is necessary to consider the specific situation.

Real estate

The second most popular investment method in Russia. Such investments are inferior to banks in terms of reliability, but can bring greater profits. However, the high level of entry into the market is an obstacle for the majority of those wishing to purchase such assets.

The convenience of such investments is that they can generate passive income if the property is rented out. The second option is suitable for short-term investments with high returns and consists of purchasing an apartment at the foundation pit stage and resale the property after completion of construction. However, both options have their drawbacks.

In the first case, you will need to prepare the apartment for rent: purchase furniture, household appliances, and make repairs. After this, you need to find tenants, and then monitor both the condition of the apartment and the timeliness of payments. If the rent exceeds the amount paid on the mortgage, real estate can be purchased with a minimum investment in the down payment through a bank loan. This method is good because in addition to monthly income, the asset itself will also bring potential profit, gradually rising in price.

In the second option, the risk is that the object will not be completed if the development company does not have enough financial or material resources for this. Therefore, this option will require a thorough check of the developer’s history and financial statements.

Another option for investing in real estate that is still not very common in Russia is buying a room in an apart-hotel. It is suitable for those who do not want to take on the management of real estate. Apart-hotels operate as hotels, managed by specialized companies, and the owners of each room are private or legal entities. They are responsible for the occupancy of rooms, advertising, building repairs, etc. Investors are offered several programs with a certain percentage of profitability.

In the latter case, the risks are not too great, and the profitability exceeds the level of deposits. In addition, apart-hotels are built in areas with high traffic and developed infrastructure, both social and transport. Therefore, over time, an increase in the value of such an asset is required.

Bonds

Bonds are securities issued by companies or governments in which the issuer (the one who issued them) undertakes to repay, over a specified time, the amount spent by the investor, along with certain interest. Issuing bonds can be compared to borrowing money against a receipt, where a bond is an analogue of such a receipt.

There are several types of bonds:

- state - the safest non-payment of obligations can occur only when a default is declared or in other crisis circumstances;

- municipal - issued by local governments, funds go to the local budget;

- corporate - bonds of commercial companies, terms of issue depend on the rating and position of the enterprise;

- Eurobonds are securities issued abroad, paid in euros or dollars and used as an alternative to bank foreign currency deposits.

Secured and unsecured bonds are issued. The former are more reliable; when purchasing the latter, the risk of repayment is borne by the investor; he needs to check the reputation and credit rating of the borrower.

The amount of investor income depends on the coupon - the amount of payments on bonds, and changes in the value of the security. The coupon is paid either quarterly or semi-annually. If no payments were made, the coupon amount is accumulated and issued to the investor when the bond is sold to the issuer.

The amount received from the coupon is tied to the face value of the security. The price of a bond after issue gradually changes and it can be sold either more or less than its original cost. The loan is repaid on the day specified at issue.

Bonds are attractive due to their fixed income, which exceeds the profit from bank deposits. Government securities and bonds of blue chips (companies included in the list of especially reliable ones) are especially reliable.

Securities of other issuers can bring greater profits, but they are also riskier. Bonds that earn tens of interest are called “junk” and have a low rating.

This investment method is suitable for those who want to have a guarantee of return on investment and an average income. You can purchase them by opening a brokerage account or an individual investment account.

Stock

Investments in securities are made to obtain income above the market average. They carry a greater degree of risk than bonds or bank deposits.

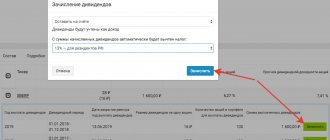

Owners of shares can count on both their resale when their value increases, and the payment of dividends. The size (and the possibility of receiving) depend on the financial condition of the enterprise, the issuer and the decision of the meeting of shareholders. The meeting may decide not to pay dividends, in which case the owner of the securities does not receive profit for a certain period.

Preferred and ordinary shares are issued. The main difference between them is in the order in which dividends are received. In addition, owning shares allows you to participate in shareholder meetings.

Stocks are considered as one of the ways of long-term investment, but they can also be used for short-term investments. In the latter case, the calculation is not to receive dividends, but to sell securities at a higher price than they were purchased.

Mutual funds and ETFs

Mutual investment funds (or mutual funds) are financial organizations that purchase bonds or shares at the expense of investors. Each of the mutual funds composes different portfolios, which are distinguished by certain parameters. For example, a portfolio may contain only blue chips or representatives of a particular industry.

Income from participation in mutual funds is one of the ways to invest with the expectation of greater than average income. This is an instrument (in the case of open-end funds) of high liquidity that can be sold at any time. You can sell shares of closed-end funds only after the end of the investment period. There are also interval funds, whose shares are sold during periods specified at the conclusion of the contract.

The profitability of a share is determined by the success of the mutual fund and the profitability of the selected portfolio. It is impossible to determine the profitability of such investments in advance.

ETFs are similar to mutual funds in the way they work - here you can also invest in a group of companies or industries. But they are more profitable due to the fact that their commission is lower.

Precious metals

Investing in precious metals is not actually buying them, but investing in “metal” accounts. Purchasing real bars, coins or products is unprofitable, as it requires paying VAT and paying for metal storage. Anonymized metal accounts do not have these disadvantages.

The profit from such investments depends on the increase in the value of gold, palladium, platinum, silver or other selected metal. Over time, their price invariably increases, but it is quite difficult to predict exactly when and how much the cost will change. This instrument is not suitable for short-term investments, but for long-term investments it is beneficial to have it in the investment portfolio.

Venture funds and startups

Options suitable for those. who are interested in high-risk projects with potentially equally high profits. You can invest money either in a startup that promises high interest rates or in a fund that supports similar areas. Theoretically, such investments can bring 100 percent or more profit. However, there is no guarantee that the money invested will not be lost. According to analysts, no more than 2-3 out of a dozen such projects are profitable.

There are other ways to invest money, but they are either less accessible to novice investors or require special knowledge. And the listed methods are available to anyone, so they should be included in your first investment portfolios.

URGENT MASTER CLASS ON VAT

Only this Friday (January 14) a large master class on VAT from Elvira Mityukova “Declaration for the 4th quarter and work in 2022”. Price for “Clerk.Premium” subscribers – 8,990 RUR , without subscription – 12,990 RUR. Check out the program here

Investment development

Investment development is the acquisition of various investment instruments, the study of innovative trends to identify the most prestigious areas. The stock market, which is at the level of development, offers a wide range of ways to increase the money supply.

To preserve investment capital, follow the rules:

- withdraw interest on time;

- withdraw part of the deposit, increasing it at the expense of interest.

- don’t be afraid to earn less than you planned.

Investment principles

Investing is essentially a science. And as in any science, here it is necessary to move from simple to complex. Here are a few rules that every novice investor should follow:

- You should invest only free money, that is, savings and savings that will not be needed in the near future.

- Before investing, it is advisable to create a financial cushion, otherwise a sudden need for free money may push you into unprofitable asset sales or unwanted loans.

- Money should be distributed among different investment vehicles. If you make a loss on any asset, it can be offset by profits from other instruments.

- It is necessary to evaluate not only profitability, but also risks. For example, if you invest in stocks, there is a possibility that prices will fall due to a worsening economic situation, weak company reporting, or the emergence of strong competitors.

Investment management

Every investor should be able to diversify risks.

High-quality investment management will help reduce losses by:

- combinations of high-profit and low-profit (but more reliable) investments;

- drawing up a plan for reorganizing the investment portfolio, monitoring the profitability of investments;

- choosing only those tools you trust;

- observing more “adult” players;

- obtaining education/certificate in the field of risk management.

You can delegate authority to professionals at any time. The main thing is to start.

How to become an investor?

Anyone can try their luck in investing, but not everyone is destined to become successful investors. First of all, an investor is an analyst, strategist, forecaster and financier rolled into one; he must:

- be quite knowledgeable in the area you have chosen to invest in;

- navigate the pricing of this market segment (if we are talking about speculative investment);

- be able to analyze the situation, have the qualities of a forecaster and strategist;

- have specific goals, clearly understand why he is doing this business and what is expected from him.

In addition to the above, it is simply necessary to have funds for investment, and this should not be your monthly salary, on which you are going to live as a family of five. You must create your individual investment account from available funds that you can afford to lose. And, of course, don’t put all your eggs in one basket - remember to diversify your funds, that is, distribute capital across several projects, or better yet, across different types of investment. Investing is an excellent opportunity for almost passive income, in which money makes money itself. Visit any investor blog, and you will understand that it is not enough to find the answer to the question “how to become an investor”; it is important to understand that before rushing into battle, you need to be sufficiently savvy and aware of what you are doing, soberly assessing the risks.

Author Ganesa K.

A professional investor with 5 years of experience working with various financial instruments, runs his own blog and advises investors. Own effective methods and information support for investments.

Attracting investments

Attracting investment is a necessary element of the dynamic development of a company. At the first stages, deposits provide advantages to organizations: they increase the amount of capital and improve the quality of management. Investing allows you to reach a new level of work.

To attract deposits, the company must have a list of positive characteristics. A proven and promising action plan, a good reputation, and transparent activities are the main factors influencing the effective search for investors. The terms of cooperation between the investor and the fund owner are based on the listed factors.

Types of investments

There are direct and portfolio investments. Direct investment is carried out in tangible and intangible assets. Portfolio investing is aimed at generating income. Types of investments are divided into 4 groups based on profitability: high-yield, medium-yield, low-yield and no-yield.

Classification by terms: short-term (less than a year), medium-term (1-5 years), long-term (more than 5 years). Investments are divided by liquidity, risk level, and nature of use. There are external and internal investments.

Existing classifications

If you talk to several different investors and each of them is asked the question: “What are the types or forms of investments?”, the variety of answers may confuse you. Indeed, they can tell you about direct, portfolio, gross, long-term and primary investments of funds. Moreover, this list can be continued for a long time.

All these types of investments exist. The only question is on the basis of what criteria they are classified in each individual case. It is also necessary to take into account that there is no right and wrong division. All of the following gradations have the right to exist.

Investment classification may be based on the following characteristics:

- object;

- investment goals;

- forms of ownership of investment resources;

- profitability factor;

- origin of the capital used;

- degree of risk;

- liquidity level;

- by urgency;

- accounting forms.

Let's look at the listed types of investment in more detail.

Investment structure

The structure of investments is its constituent elements, characterized by types and direction of use. Structure in this case is the interaction of elements of a single system, the characteristics of the whole by its components. There are three main types of structures: consumer investments, capital investments, financial investments.

Consumer investing means allowing customers to purchase products. Capital investments – contributions for modernization work. Financial deposits allow you to purchase assets.

Difference between financial and real investments

Financial investments are the acquisition of securities, real investments are investments in industry, construction, farming, education, etc. The difference between financial and real investments lies in the conditions for achieving the goals. With real investments, non-current assets are used to manufacture products and sell them. In financial investing, investments are made in investment instruments.

The investment program includes the selection of effective instruments and maintaining a balance in the number of instruments. Financial contributions allow you to expand the company’s sphere of influence and increase market share.

Investments for individuals

With sufficient savings, an individual can invest monetary values. The main obstacle for individuals when choosing a suitable investment object is the lack of financial education. Today, brokers offer services to find an effective investment object.

Advice from Sravni.ru: When choosing a broker, focus on customer reviews and the experience of the company for which he works. At the initial stage, choose investment strategies with the lowest risk.

Division by resource ownership form

In this case, ownership of the invested resources is of paramount importance. In other words, we start from who actually owns the invested funds or from the sources of financing. Based on this principle, the following forms of investment can be distinguished:

- private – investments of individuals and legal entities;

- state - investment of funds from the budget of a particular country, which is carried out by specific participants in economic activity (for example, the Central Bank or the Federal Ministry);

- foreign - deposits of capital owners who are citizens or subjects of another state;

- mixed – simultaneous investments of several of the above-mentioned entities.

These forms of investment are best understood through a concrete example. Let’s say the Government of the Moscow Region put up a certain number of land plots in the Stupinsky and Ozersky districts for open auction. Thus, any interested owner of capital can invest money in their acquisition. If the winner of the auction is an individual or legal entity, then such investments will be considered private. If an American or Chinese company wins, such investments will be recognized as foreign. And so on.