The OKPAY electronic payment system appeared relatively recently; it is available to users in foreign and Russian languages. OKPAY Inc. is an offshore company registered in the British Virgin Islands in 2009. If we compare the system with existing analogs, it is something between AlertPay and LibertyReserve. The advantage of OKPAY is that it can be used for almost any type of business, with the exception of industries related to child pornography. Actions related to investment projects, gambling and MLM are acceptable. Thanks to such a diverse range of services, experts predict a great future for the site www.okpay.com, about which there are many reviews.

The main advantages of OKPAY

This payment system has a number of advantages:

- Low commission percentage - in some cases it is 0%.

- A variety of methods for depositing and withdrawing funds.

- Instant and secure transactions.

- Ability to send money to the user by email.

- Simple exchange of electronic funds from different payment systems (LibertyReserve - 4%, AlertPay - 7%+0.25, Liqpay - 4%).

- Receiving payments from legal entities via the Internet.

- Pay regular bills online.

- Possibility of making mass payments.

- Receiving interest on funds stored in electronic accounts.

- Payment for goods and services in online stores.

- Online purchase/sale of currency.

- Easy integration into existing store systems.

- One agreement for all payment options.

In a word, the resource has an extensive list of capabilities, and positive reviews about the OKPAY wallet confirm this.

OkPay wallet functionality

The functions of the OkPay wallet, in principle, do not differ from the functions of Yandex-money, international PayPal and other systems, but we should familiarize ourselves with them at least briefly.

Of course, users can deposit and withdraw currency. There are extremely many directions for transactions, it is even possible to carry out transactions with bitcoins, which we wrote about earlier (read the article about a bitcoin wallet). Regarding the withdrawal of funds, there is a similar variety.

By the way, if to transfer money from WebMoney to Yandex you need to link one wallet to another, then in OkPay this is not necessary: the transaction is made through a third-party exchanger (I advise you to look for favorable exchange rates through the free exchanger monitoring system BestChange):

We have the opportunity to send money to other participants in the OkPay system , and to make a payment you can use the recipient’s email address, rather than his wallet number (sometimes it’s easier to remember the address than the number):

A unique feature of the OkPay payment system is the ability to make mass payments . For example, if you want to send varying amounts of money to a hundred people, you'll have to fill out everyone's details on a form, which is very time-consuming.

If you create a Word document or a table in Excel indicating payment details, administrators will do everything themselves, and much faster. The requirements for the table are outlined in the screenshot below:

If we need to receive money from any user of the system , select the “Request money” function. Fill in all text fields and submit the form. The user we contacted can make a payment, or he can ignore the request:

Ordering a payment card linked to your wallet in this system is not as cheap and hassle-free as, say, in Yandex Money or Qiwi. Everything here is significantly more expensive (issue and delivery), but in some cases this can be justified by the subsequent ease of use and savings on withdrawing funds from the system.

The process of issuing an OkPay card is described (in Russian subtitles) in this video:

The last important function is currency exchange within the OkPay payment system . Of course, it is very convenient to exchange money without withdrawing it from your wallet anywhere, but the exchange rates are far from the most favorable:

If you have more promising options in mind, be sure to use them so as not to lose an extra penny.

Registration in the payment system

The registration process in the OKPAY system is extremely simple and straightforward. All that is required from the user is to go to the main page of the site, then go to the “Registration” section. After this, a registration form will open in which you need to enter some data:

- initials;

- age;

- gender;

- Email;

- indicate the reason for creating the account (personal use or business).

The resource interface is very simple; it contains many convenient widgets, one of which, for example, is the exchange rate. This is very convenient, since up-to-date data is always in front of your eyes and there is no need to run around different sites. The interface contains two consoles: the left one displays information, and the right one is functional.

Review of the OKPAY payment system - features of using an electronic wallet

Before we begin the review of the OKPAY e-wallet, let me make a small digression.

A little history:

Electronic payment system OKPAY

appeared in 2009 (registration in the British Virgin Islands) with the aim of serving both individuals and people who do business on the Internet.

Confirmation of what was written above is that the OKPEY system is actively used for settlements between companies in more than 200 countries around the world.

Payments are possible in all popular currencies: US dollar, Euro, rubles, Swiss franc, etc.

Account verification

To get the maximum benefit from the OKPAY website, you need to go through the verification procedure, because otherwise the following restrictions will be imposed on your account:

- The maximum limit for sending funds through the OKPAY system is 300 euros.

- It is impossible to withdraw funds from the account; they can only be exchanged for another currency through exchange sites.

In order to remove these restrictions, you need to take a few simple steps:

- Confirm your identity. To do this, in your personal account you need to indicate your passport details and attach a photocopy/scan (just take a photo of the second page of your passport with your phone or digital camera).

- Confirm address. To do this, you must indicate at least one address in the user profile and attest to it with some document. This could be a registration stamp in your passport, a receipt for utilities, etc.

- Confirm mobile phone. Phone number confirmation is a paid service, the cost is 0.70 euros (you need to buy an SMS package of 10 pieces). Please note that this item is not mandatory.

- Confirm email. Email confirmation is carried out in the standard way, i.e. a message is sent to the address specified during registration with a link that you need to follow.

The account is verified using the data provided by the system within three days.

What attracts users to OkPay?

This payment system is quite young (2009) and is registered in the British Virgin Islands (now it seems to be based in Cyprus). However, it also actively works in RuNet (it has a Russian-language interface and even provides telephone support in Russian, which is good).

As in PayPal, in OkPay the wallet is linked to a mailbox, and therefore you need to take care of its security (the best option would probably be Google mail with two-step authentication enabled).

Since OkPay appeared later than all its main competitors, it seems quite logical that its owners tried to take the best (if possible) from other payment systems:

- Transferring money from your wallet can be done directly via email. If the user to whom you sent money is already registered in OkPay, then after clicking on the link from the letter, the payment will be automatically made.

- The commission for non-cash deposits of money in the system is zero, which is good news. And they won’t charge you much (percentage) for transferring funds within the payment system.

The payments themselves occur instantly and almost all over the world, which is good (suitable, for example, for receiving payment for freelance services). - It is possible to link a plastic card to your account, and you can use it to make purchases both online and in real stores around the world.

Personally, I prefer this method in most cases, because no commission is charged for this “withdrawal of funds from the account” (if you do not cash out funds through an ATM, but simply spend them on real needs). - Money from OkPay can also be withdrawn to bank accounts or exchanged (for example, in the same wonderful BestChange) for other electronic currencies, or transferred to an Alfabank or VTB account.

- You can work with the system anonymously (albeit with a limit on transfer volumes of three hundred euros or dollars). If you verify your wallet, there will be no restrictions on volumes at all. Who cares what.

- The number of wallets created under one account is not limited and they can be denominated in dozens of different currencies (including the ruble).

- OkPay also has a fairly decent affiliate program in terms of profitability:

It will allow you not only to spend money in this system, but also to earn money (I have a separate article about the principles of earning money from referral programs).

Depositing funds to OKPAY

You can top up your personal account in different ways:

- Bank transfer. If you deposit money into your account in small amounts, it turns out to be very unprofitable due to the large commission. The bank charges 1% of the amount, but not less than $12 or €10. But judging by the reviews about OKPAY, this does not bother users.

- Transfers using the Contact system - this method is available only to verified accounts.

- Using other payment systems - LibertyReserve - 4%, AlertPay - 7%+0.25, Liqpay - 4%, etc. Most often, replenishment through payment resources is carried out instantly, but if they have doubts about the validity of the transaction, additional documents may be required, and the payment will be frozen.

- Certified exchangers.

Reviews about the OKPAY payment system indicate that replenishing an account is a fairly simple operation, and any client can choose a method convenient for him.

OKPAY: advantages and disadvantages

Advantages of the OKPAY payment system:

- availability of a savings system: users can receive dividends from funds placed on their electronic accounts;

- payments are accepted in the electronic currency bitcoin, and then automatically credited in the base currency to the recipient’s account;

- any user of the system can set up recurring payments;

- the user can subscribe to OKPAY merchant services and make payments according to a specific schedule;

- you can pay for services and goods online;

- you can receive commercial payments online and make mass payments;

- possibility of currency exchange;

- You can transfer money to any person if you know their email address;

- money transfers are carried out instantly;

- choosing methods for withdrawing and depositing money;

- high quality of service at low tariff rates;

- reliability: users are protected from unauthorized access to their accounts;

- convenient and intuitive interface: anyone can figure out how to use the electronic system;

- the ability to create a multi-business account: this makes financial accounting simple and convenient, because you can create several wallets for different needs;

- flexible options for depositing/withdrawing funds;

- a large set of special financial utilities for integrating electronic invoices, which allows you to set up payments for an online store almost instantly.

Flaws:

- complex verification procedure;

- inability to revoke the payment by the user.

However, the disadvantages are not such, if you think about it: after all, it is a thorough verification of the user that makes it possible to ensure high reliability of financial transactions. And non-refundable payments eliminate the possibility of fraudulent activities.

To summarize: OKPAY is a unique payment system that combines many functions. The OKPAY e-wallet is convenient to use for both individuals and large organizations. A flexible system for depositing/withdrawing funds allows you to choose the most convenient way to manage funds, and a high level of reliability prevents you from worrying about the fate of finances stored in the system.

Withdrawing funds from OKPAY

The service is available only for verified wallets. You can withdraw money in different ways:

- Transfer to any bank account. The minimum withdrawal amount is 5 thousand rubles/150 euros/150 dollars. The transaction fee is 1%.

- To an OKPAY debit card.

- Through other payment systems. Reviews about OKPAY lead to the conclusion that this is the most common method among users.

- Cashing out funds using certified exchangers. The minimum withdrawal amount is $10.

The time it takes to complete the operation depends on many factors, but most often the money arrives within a few minutes. Reviews about withdrawing money from OKPAY confirm this.

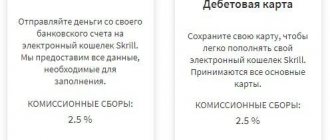

Replenishment methods

Current fees for deposits and withdrawals are listed on the website https://www.okpay.com/ru/personal/fees/ .

- Bank transfer is an expensive method when dealing with small amounts. In this case, the bank will take 1% (minimum 12, maximum 20 in dollars or minimum 10, maximum 14 in euros) of all incoming receipts;

- From a mobile phone.

A very convenient, but extremely expensive method , the minimum commission is 15% of the replenishment amount; - Through other EPS . There are options with zero commission for systems such as bitcoin, litecoin;

- Through exchangers cooperating with OKPAY.

Advice : First study independent monitoring of exchangers. There you can compare transfer fees from the desired bank or existing EPS and choose the best option for you.

OKPAY bank card

Most payment systems today offer their clients to issue an electronic wallet in the form of a plastic card, OKPAY is no exception. The OKPAY bank card is no different from a regular credit card. It was released on the basis of MasterCard, which, according to the company itself, is the most convenient “plastic”.

To receive a card you need to go through a verification process and pay $15. The card takes 21 to 27 days to produce, after which it will be delivered to the user's home. If desired, the production time can be reduced to 5 days, however, in this case you will have to pay $70. In addition to the physical card, you can issue a virtual credit card in the system, the cost of which is $15. The validity period of a bank card is 2 years, virtual - 1 year.

The OKPAY bank card is a full-fledged product; you can use it to pay at store checkouts, in cafes and restaurants, withdraw cash and top up your account, the main thing is not to forget about existing commissions.

Reviews from OKPAY clients who have already used it are very different. Some are completely satisfied with the conditions, while others are confused by the commission fees. But if you study the information, you can see that all payment systems have them.

Referral program

Details about the referral program are written on the page https://www.okpay.com/ru/partners/referral-program/ . You can read about proposals for making money on electronic money exchangers related to exchange in the OKPAY system in my article. Of course, the amounts are not cosmic, but they are a pleasant addition to the ease of using this payment.

Leave comments, share your experience and tips for using this system. Subscribe to updates, there is still a lot of new things to come!

If you find an error in the text, please select a piece of text and press Ctrl+Enter. Thanks for helping my blog get better!

Card fees

After receiving an OKPAY bank card, you must activate it by following the attached instructions, or on the receipt of okpay payment website (according to reviews found on the network, it is better to use the second option). This service is paid, $10 will be debited from your account.

The commission for replenishing a card account from a wallet is 3% of the amount, in the opposite direction also 3%. When withdrawing cash (the operation can be performed at any ATM), the commission is 2% of the amount, but not less than $3. When paying through POS terminals, for example, in stores, restaurants, etc., no commission is charged. But if the transaction is performed in a currency other than the dollar, then automatic conversion occurs at the rate set by MasterCard.

There must always be funds on the OKPAY card, the minimum amount is $10. As soon as the money is credited to the account, the system blocks this amount as a fee for closing the card account.

Payment cards

OKPAY system members can order a debit card. With it, you can access your account and make offline purchases or withdraw money from an ATM. So far the system offers two types of cards.

| Map type | MasterCard | VISA |

| Currency | USD | USD, EUR, GBP |

| Release | from 15$ | 15$, 19.99€, 9.99£ |

| Payment by card | No commission | 0.72$, 0.54€, 0.45£ |

| ATM | 2% (min. 3$, max. 15$) | 3.60$, 2.70€, 2.25£ |

How to earn money with OKPAY

The OKPAY payment system can be used not only to store funds and pay bills, but also to receive additional income from it. Moreover, this fact is confirmed by reviews about OKPAY found on the Internet. There are several ways to earn money:

1. Daily bonus from the online exchanger Ok-change. To make a profit, you need to register on the resource and click on the “Bonus” button located in the header. In the window that appears, you need to enter the current exchange rates for the euro and dollar (you can see it on the main page if you hover your mouse over the EUR icon), your email address, the symbols in the box below - confirmation that you are not a robot, and click the Get Bonus button. After this, the user’s dollar wallet will be credited with $0.01-0.02. You can repeat this operation once a day.

2. Affiliate program. The okpay.com portal (reviews of which are very positive) has a two-level referral program:

- Level 1 referrals – the user receives a bonus in the amount of 20% of the amounts spent by all attracted referrals. In addition, bonuses are awarded: a) For issuing a debit card - 1 dollar for regular delivery, 3 dollars for express delivery.

- b) For account replenishment – $0.20 for each transaction.

- c) Deposits – 0.5%.

- d) Cash out – $1 per transaction.

- a) For ordering a card – $0.25 (regular delivery); $1 for express delivery.

3. Promotion of OKPAY on your own website. In order to receive additional income, the site owner needs to create a special page with information about the OKPAY payment system. Every person who comes from this resource, regardless of who posted the text, automatically becomes your referral. To participate in the program, fill out a special form on the official OKPAY page.

4. Bonus for those sites that accept payment through the OKPAY service. Each of your new clients who pay for their first purchase is included in the list of your referrals (if they do not have another referral).

5. Online exchangers. You can receive additional income if you exchange different electronic currencies. Additional conditions are provided for this category of users on okpay.com - they have the opportunity to obtain the status of a certified OKPAY partner. Each new user who performs an exchange operation automatically becomes a referral.

What do its clients think about Okpay?

Almost every payment system says everything is fine. The site has an attractive design, everywhere the attention is focused on the advantages and benefits, and the disadvantages are bashfully silent. But as soon as you register and start using it, all the disadvantages are immediately revealed. The best way to identify all the shortcomings is to read independent reviews on the Internet.

Okpay, although not perfect, is a well-made payment system. We are pleased with the small commissions for internal transactions and transfers to accounts in foreign electronic payment systems, such as Payza. For this reason, I chose Okpay - I used it to transfer bitcoins to various exchanges where there was no direct BTC deposit. On the other hand, cashing using checks with a 2.5% commission is a natural rip-off, as is the $10 account restoration fee that I had to pay once.

Pavel, 33 years old, Kazan.

I have been holding an Okpay account for more than two years and actively using the account. I would like to note the poor implementation of technical support. Not only do specialists not work 24 hours a day (as in most other payment services), but only from 8 a.m. to 2 p.m. London time, but also the level of their responses leaves much to be desired. I asked them a question about exchanging funds and received two identical answers. It seems that they ignored my comment after the first answer.

Stanislav, 42 years old, Dnepropetrovsk.

The system has a lot of interesting features - multi-currency accounts, interest calculation similar to a bank deposit (3%) and, best of all, your own debit card. I tried to use it to pay in the online stores Aliexpress and TaoBao - all payments went through without problems. I'm also glad that the system is well protected. You can top up with a larger amount for future purchases in advance, without fear of break-ins and theft.

Kristina, 24 years old, Moscow.

It is difficult to find devastating reviews about the Okpay payment system. Almost all clients evaluate it as a truly high-quality project, although not without certain shortcomings. The main dissatisfaction is caused by high commissions in some areas and the lack of round-the-clock support.

Summarizing

After studying all the reviews about OKPAY, we can conclude: the new payment system has started well, but for now that’s all that can be said. The developers and owners of the resource take care of Russian-speaking users, do not forget to expand functionality, improve the interface, but all these changes have a bad impact on the tariffs, which are increasing. In the future, OKPAY has all the prerequisites for a strong foundation in the world of electronic payment systems, but until this happens, it is better to use the resource as an alternative option when there is no other option. Despite the growing tariffs, they still remain minimal, which undoubtedly attracts users. In the future, OKPAY has every chance to take a leading position, because only here it is possible to work in parallel with three different currencies.

Payment system Okpay

As already mentioned, the system both developed some of its own functions and adopted selected capabilities of competitors. One of the interesting features of the system is the internal currency. There is no specific unit here, but money between users of the system is transferred in bitcoin, after which it is automatically converted into the necessary virtual tokens, which are credited to the recipient’s account. In addition, the system, for its part, rewards users. This is expressed in the accrual of dividends on amounts placed in accounts. This way, you can earn extra money by simply transferring all virtual funds to your Okpay wallet. The agreement with MasterCard, which was written about above, allows users to use this payment system for offline payments. Other features include automatically recurring payments, the possibility of mass payments, a built-in exchanger and many others. Separately, it can be noted that the system does not support payment revocation. The buyer can receive money back only by agreement with the seller.

Okpay official website

In most cases, any online business opens a website of the same name in the *.com domain zone, where it talks about its capabilities. Okpay was no exception. The payment system, whose official website is located at okpay.com, offers the user communication in several languages. In addition to English, the supported languages include Russian and Ukrainian. Not all pages have been translated, but according to the developers, the translation will be completed in the near future, and then it will be the turn of other languages of the Soviet bloc countries. The choice of language is in the upper right corner in the form of a drop-down list. There you can select “Russian” if the English version suddenly opens. The main page has been translated almost completely, so a new person should not have any special problems. It consists of several blocks. The top panel contains several links to the most frequently used system features. This is a description of the opportunities for ordinary users (drop-down menu “Private Clients”), for businesses (drop-down menu “Business”) and several links - to the knowledge base, to the developer center, and login.

Below is a large animated banner inviting you to register in the system. Even lower, the page is divided into two parts, each of which lists the key features that the Okpay wallet offers to different users. An interesting feature is the image of a young man in the center between the options - moving the mouse to one side changes his appearance accordingly. A funny feature that draws attention to the possibilities. Below, in the form of a kind of creeping line, other key features for the user are presented. Finally, the footer contains several links to social networks, copyright, and news feed. If you choose the Russian option, then all blocks, including news, are translated. It’s interesting that among the social networks there is Russian VK. The group in Russian is quite large and has answers to almost any question that a new user of the Okpay system might have.

How can I withdraw, exchange or top up Okpay?

The “Tariffs” page, hidden in the “Private Clients” menu, is interestingly designed. Here you are asked to choose in which currency you want to receive money. The list includes more than 20 currencies, including Russian rubles. Moreover, below the selection, the user can immediately see the interest rates for both depositing money into the payment system and withdrawing it. You can top up Okpay in many ways, which are divided into categories for the convenience of the user - from electronic currencies to banking and money transfer systems. There is even the option to use mobile payments. True, so far only Megafon is supported. If you scroll down this page, you can see the exchange rates for the most commonly used currencies in the system. Rates may differ from bank ones, but it’s worth remembering that the system has its own exchanger and its offers are listed here.