Hello, dear friends! Not everyone, even the most seasoned trader, can answer the question of what a swap is on Forex and give a clear description of the methodology for its calculation For most, swap remains an insignificant amount that the broker debits from the account once a day. Not everyone understands how it is calculated and what it is. Today I propose to fill this gap in knowledge and understand how swap affects trading, what its value depends on and whether it should be taken into account when assessing the effectiveness of a strategy.

Forex brokers explain the presence of swaps by the difference in “delivery of currency to the trader”:

Swap is the daily accrual or withdrawal of funds from a trader’s deposit for transferring a position on open transactions to the next day. Forex swap broker automatically adds or withdraws a certain amount from your deposit every day at 0 o'clock.

a) in the interest rates of the National Banks (if the US Federal Reserve has it 0.25%, in the euro area 0.05%, the Bank of England 0.5%)

b) between the credit and deposit rate of the loan that they provide to a trader trading with a leverage of more than 1 to 1 (usually forex traders have a leverage of 1-100, 1-200).

A real-life example of an explanation of the nature of swaps. Imagine: you took out a loan from a European bank and placed it as a deposit in a US bank (selling EURUSD by a broker for your trader). What will you get? That's right, a loss. And if it’s the other way around: buy euros for dollars borrowed from the USA (purchase EURUSD). There will be... an even greater loss, because... the deposit rate in the EU is even lower than the loan in the US.

Example for moving a position to the next day on a trade:

- buy EURUSD swap – 0.4 dollars for each day with 0.1 lot

- sell EURUSD swap - $0.8 (this is $292 per year when trading only 0.1 lot or almost $3 thousand for those who trade a “standard lot”)

For mathematicians, we give the exact formula for calculating swaps, which we do not recommend for humanists to memorize or even delve into, because It will still be not you who will calculate the size of swaps, but your Forex broker.

More information about the swap calculation formula, as well as about the two types of currency swaps and their value terms can be found in the article “Currency swaps”.

As a result, a small amount per day turns into a significant amount for a trader for a month and a gigantic amount for a year or several years of trading on Forex from 3 to 12% of the deposit. For example, if you have a trading account of 10,000 US dollars, you will agree that it is much more pleasant to gain 500 dollars in a year than to lose 1 thousand during this period, only accidentally replacing the loss at the end of the year.

conclusions

Rollover is not a deception on the part of the broker and not an attempt to profit from your gullibility . Writing off this amount is a necessity due to the specifics of trading on Forex and other financial markets. For intraday trading and holding periods for a trade of several days, it can be neglected.

I recommend seriously thinking about the impact of swaps only for those who work on the long-term and curry traders . For the rest, I advise you to simply remember what a rollover is, where you can find out about it and calm down.

If you have any questions, ask them in the comments . Be sure to subscribe to my blog updates, so you will always be aware of the release of new materials. With this I say goodbye to you. All the best and see you soon!

If you find an error in the text, please select a piece of text and press Ctrl+Enter. Thanks for helping my blog get better!

Masterforex-V: currency swaps are a hidden spread of Forex brokers.

Traders, trading medium- or long-term, sometimes do not pay attention to swaps, but in vain. Losses from negative swaps can not only reduce the overall profit, but also turn the entire trade into a loss-making event.

Don't believe me? Let's just do the math together with a new investor: take $1 million, buy 250 lots of the EUR/USD currency pair at a price of 1.05 from the FxPro broker and hold the order for four years with a target of 1.25. Theoretically, the profit will be $5 million. And practically - twice as much. Why? Because the long swap for the EUR/USD currency pair with this broker is -$6.66 per day for one lot! And if we assume that the currency pair remains at 1.05 or slightly below it, then the investor will lose his million dollars!

Therefore, if a trader trades short-term intraday, he has no problems (many brokers today offer a minimum spread for the EUR/USD pair of only 0.3 points). But as soon as (for various reasons) it was not possible to close the transaction on the same day, then other rules come into play - the broker will withdraw 6 points from the trader’s account every day. In other words, in a day the difference between buying and selling will be not 0.3 points, but 6.3 points, in a month it will be 180 pips, in two - 360 points, then you can calculate it yourself. What if you have not one open order, but two, three, four?

Have you noticed that all brokers advertise “the lowest spreads” on the first page of their websites, and hide the swap table in such a way that you need to involve the website’s technical support to find it? Like, for example, brokers FxPro or XM.com, whose swaps for the same EUR/USD currency pair are -6.6 and -6.84 points, respectively. Moreover, there is no deception as such. If you close the trade on the same day, the spread will be 0.3 pips, as advertised. If not, then every day a minimum of $6.6 will be debited from your account for each lot.

Look at the chart carefully and answer your question: why don’t professional traders of the Masterforex-V Academy open accounts with XM.com or FXPro? And, according to statistics from the website pro-rebate.com, almost 2/3 of traders’ accounts are opened with NordFX:

Thus, the managing traders of Masterforex-V, knowing these features of brokers, trade limitedly on currency pairs that have negative swaps, planning to close orders on the same day and choose those brokers who have minimal swaps (for example, NordFX has a swap on EUR/USD is -0.4 points (compare with XM.com's -6.84).

Where to find out the amount of swaps

There is no point in calculating a currency swap yourself. This is a reference value and is available both in the trading terminal and on company websites in the description of trading conditions.

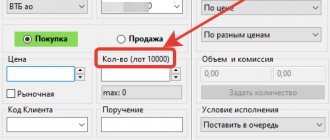

Swap in the trading terminal

In the terminal window, directly below the charts with currency pairs, the swap is also shown for each open transaction. If you accidentally closed this window, you can return it through the View - Terminal or by pressing Ctrl+T .

You can also view detailed specifications for each tool in the terminal. In the Market Watch (left side of the terminal), right-click on the instrument of interest and select Specification .

The window that opens contains not only information on the swap amount, but also the day on which it is accrued in triple size.

You will find the same information on the broker's website.

Swap on the broker's website

Information on swaps is specified in contract specifications. It is presented on the website in the section with trading conditions; there may also be a separate item Contract Specifications . Below is the appearance of these sections for different brokers.

Exness

For each available instrument, the spread, margin for leverage, Stop Level and swap in points are indicated; check its value here . There is also a calculator for calculating the swap depending on the holding period of the transaction and other initial conditions.

Open an account with broker Exness

FxPro

The Commissions and Swaps section contains a calculator that allows you to estimate the costs of spreads and swaps when trading. A detailed explanation of the methodology for calculating these values is also given here, and the broker’s commission is indicated. Information about swap is also provided in tabular form . By following the link you can read a review of the profitable broker for trading FxPro; the company is quite suitable for opening a main trading account here.

Register on FxPro

Alpari

Everything is standard; in the table, assets are classified into groups, and for each, a swap for purchases and sales, a trading schedule, and a spread are indicated.

Opening an account with Alpari

Amarkets

The same situation as other brokers. True, the assets here together, so it’s not entirely convenient to choose the right one.

Registration Amarkets

Let's compare swap for 4 currency pairs from these brokers:

| Broker | AUDCAD long | AUDCAD short | AUDCHF long | AUDCHF short | AUDJPY long | AUDJPY short |

| Exness | +0,050 | -0,160 | +0,360 | -0,560 | +0,270 | -0,550 |

| FxPro | -0,329 | -0,468 | +0,263 | -0,831 | +0,158 | -0,809 |

| Alpari | -0,161 | -0,134 | +0,309 | -0,656 | +0,204 | -0,62 |

| Amarkets | -0,061 | -0,184 | +0,407 | -0,692 | +0,3 | -0,62 |

As you can see, there are differences in swap; on some currency pairs it can vary by almost 2 times . But in terms of money these are such small amounts that most traders will not feel this difference. For it to begin to affect results, you need to work with capital of tens and hundreds of thousands of dollars.

If you want to compare brokers based on rollovers, use myfxbook.com . in the Brokers . It’s very convenient that this is not just a table . You can add any currency pair to it and arrange the search results in descending or ascending order. In a couple of clicks you can find a company with a maximum or minimum swap.

Information on interest rates of banks around the world

If you need to select a pair with the smallest negative swap or the largest positive one, it is convenient to do this by comparing interest rates of banks around the world. We have already figured out above that rollovers may differ between brokers for the same currency pairs due to the fact that the commission is different. But in general, when comparing bank rates, it is convenient to select currency pairs, and then make comparisons across brokers.

Below is a list of resources where you can monitor interest rates:

- fxstreet.com – in the section with the economic calendar there is a link Interest rates. The information is grouped by region.

- On the Alpari website In the fundamental analysis section, countries are grouped by region. In addition to the current value of the rate, the date of the next meeting regarding its revision and a brief description of what the rate means are indicated. Information is given in Russian.

- On global-rates.com There is a small table displaying the rates of countries around the world. The current and past values are indicated, as well as the date of its last change. For each of them you can get detailed information - what is the name of the body involved in its consideration, the graph shows the dynamics of changes in the rate in the past.

Information on rates is not secret and you can find it from other brokers. Just make sure that the data is updated regularly and corresponds to the latest changes. For Russian-speaking traders, I recommend using the information from Alpari - everything is implemented as conveniently as possible .

How do experienced Forex traders make money on swaps?

- The theory of making money on swaps. Using the Masterforex-V TS, find the highest and lowest interest rates of National Banks in the world to understand which swaps you can make money on, even if you open transactions by mistake.

Total: earnings on swaps will only be for currency pairs with the maximum difference in the interest rates of the National Banks.

- Testing your understanding of the nature of swaps: a trader will make money on swaps if he opens a buy deal on NZD and AUD, because their National Banks have the highest interest rates (2.75% and 2%). For example, in the brokerage company NordFx, which has the most attractive swaps for traders, the broker adds daily to the trader’s account when trading 1 lot

- buy AUDJPY = $5 per day

buy AUDCHF = 4

- buy NZDJPY = 5

- buy NZDCHF = 4 dollars per day.

- An example of conservative trading by a Masterforex-V Academy student: 3%-4% per month:

What are the benefits of conservative trading? In six months, the red and yellow lines diverged only twice, when buy AUDJPY and AUDCHF went negative. During these days, the broker calculated swaps, the trend returned to its previous course and the trader recorded a profit.

- An example of aggressive trading by a Masterforex-V Academy student on swaps: 9% per month in foreign currency:

This trader:

- has 9%-10% profit in currency, opening and leaving ten open transactions, for which the broker accrues profit to him on swaps for the same currency pairs

pay attention to the first part of trading “classically” with stops and the second part of trading without stops on currency pairs with positive swaps.

Source - service for free copying of transactions of Masterforex-V Academy students - Autotrading pro-rebate.com.

What to do if you are trading holding positions for a month or more?

In this case, swap-free accounts will come in handy. Currently, almost all brokers provide the opportunity to create such an account. When opening it, you just need to indicate that you want an account without swap. However, it is worth remembering that an increased commission for the position will be charged. Since the broker needs to compensate for his losses.

Thus, if you do not keep positions open for more than a month, then you can not pay attention to swaps. Unless, of course, you trade not exotic currency pairs, but major ones.

If you consider yourself more of an investor and keep positions open for several months, then you should take a closer look at swap-free accounts.

For those who want to delve deeper into the issue of swaps, you can look at the table of interest rates of the world's central banks on the Internet. Type this phrase into a search engine. And you are given sites that have the following information:

For example, I went to the FXSTREET website.

The table contains data from the European Central Bank, Australian, Canadian, Indonesia, etc. All the data is here. You can consider the current rate, the previous value, as well as the date on which the interest rate changed.

Swaps table for Forex brokers.

The swap table is usually hidden deep on the Forex broker’s website called “Contract Specialization” in which a professional trader, among a variety of financial instruments, always clearly identifies currency pairs

- with a positive swap (underlined in green) for which the broker daily credits the trader with the trading deposit for the amount specified by the specialization of the contract for each open transaction. According to them, Masterforex-V recommends that its traders open TREND transactions;

- with a negative swap (underlined in red). Masterforex-V traders, as a rule, do not trade with them, missing their trends, because any mistake will lead to them.

For example, at the forex broker Fort Financial Services , if you open a 1 lot trade on GBPUSD

- buy, then the Forex broker daily deducts 3.95 points or $5.01 dollar from your deposit at a rate of 1.27 (per month $150)

- sell, then the broker ADDS $2.99 points or $3.8 to your deposit daily (per month $114, per year more than 1.3 thousand dollars)

The best swaps for Forex traders, according to the Masterforex-V Academy rating, are provided by brokerage companies NordFx and Fort Financial Services.

The worst swaps are with the broker XM.COM, whose swap is on average 3 times worse than that of the listed brokers. Compare for yourself:

What is a swap line

The concept of a “swap line” appeared on international financial platforms after the 2008 crisis, which made changes to the policies of Central Banks. The new instrument is designed to solve liquidity problems with non-standard measures based on mutual currency agreements.

The formation of swap lines between two central banks guarantees the parties’ obligations to exchange national currencies at the current market rate, if necessary. At the same time, a repurchase agreement is concluded, which stipulates the terms and exchange rate.

Currency pairs with positive swap.

The best currency pairs with a positive swap are formed with the largest difference in the interest rates of National Banks. For example, if the refinancing rate of the National Bank of New Zealand is 2.75%, and the National Bank of Switzerland is 0.75%, then the swap for the NZDJPY currency pair is

- Long (buy) for NZDJPY will always be positive (you “bought” a New Zealand dollar for the Japanese yen);

- Short (sell) on NZDJPY will always be negative.

Further, as you understand, everything regarding specific swap numbers depends on the integrity of a particular Forex broker. As shown in the table above, when for the same trade to sell GBPUSD

- Fort Financial Services removes -3.13 points daily;

- NordFx -4.5 points;

- XM.COM as much as 8.81 points.

Calculate the annual difference in GBPUSD swaps of 5.68 points (3.13 and 8.81) between Fort Financial Services and XM.COM, for example, only 1 lot. It will turn out to be a gigantic amount of $26,329 , which ONE trader will lose in just ONE year for only ONE currency pair GBPUSD with this broker in comparison with another (5.68 points X 1.27 pound dollar exchange rate x 365 days X 10 dollars per lot. Are you surprised? Imagine the reaction comparable to the shock of Masterforex-V investors, who, as part of their investment portfolio, opened real trading accounts in different brokerage companies to auto-copy our traders; as a result, the profit on XM.COM trading accounts was 2-2.5 times less than on deposits from others forex brokers. “Yes, the deposit with profit, XM.COM returned in full,” one of the investors told us, but I did not receive at least $3,000 due to XM.COM swaps and the difference in quotes. Now I understand where they come from brokers have money to advertise football and basketball clubs,” he said, “from swaps that market newcomers don’t pay attention to.”

Swap ruble dollar (USDRUB)

Let’s take a separate look at the Russian currency. In theory, the positive exchange swap for USDRUB should be quite large:

- — rate in the USA — 2%;

— the rate in the Russian Federation is 7.25%.

Let's calculate how it will work out for various brokers when selling 1 lot of USDRUB:

Alpari (swap from the terminal 1.19 p.). Price per item = 0.001 * 100,000 / 67 = 1.49 USD. Swap = 1.49 * 1.19 = 1.77 USD.

Forex4you (swap from the terminal 292.6 p.). Price per item = 0.00001 * 100,000 / 67 = 0.01 USD. Swap = 0.01 * 292.6 = 2.62 USD.

However, the above table shows that not all brokers provide such conditions. In the same Alpari, a swap for USDRUB is not very different from a swap for EURUSD. If we take ZAR as an example, then in South Africa the rate is 6.5%, and the swap is much higher than for the ruble. Everything is somehow connected with broker commissions and their interests, so swap strategies for USDRUB are not appropriate in most cases.

Quick check of positive and negative swaps in MT-4.

If a trader does not remember what kind of swap a particular broker has for a currency pair, this can be easily checked in his MT-4 trading terminal. To do this, you need to select the instrument you are interested in in the quotes window by right-clicking on it and selecting “Contract Specialization”. For example, according to USDCHF

- “swap of long positions” (long, these are buy transactions), amount to 4 points x 0.987 = $3.98, the broker will ADD daily to the terminal at midnight to the trader for each day of trading when opening a buy order for USDCHF of 1 lot;

- “swap of short positions” (short, these are sell transactions), amount to 8 points x 0.987 = $7.96, the broker will REMOVE from your trading deposit daily at the same time for each day of trading when opening a sell order on USDCHF of 1 lot;

- The day of the “triple swap” (counting 2 days off on the market + the current day) is usually Wednesday, as indicated in this specialization.

Kinds

The classification of swaps depends on the type of markets and includes currency, interest rate, commodity, stock and credit swaps.

The Forex market is dominated by currency swaps, which are divided according to the principle of implementation time interval into the following types:

- Short (one-day) - direct and reverse transactions are made before the spot date (2nd business day after the day the transaction was concluded).

- Standard - the time of the 1st transaction coincides with the spot date, and the 2nd transaction is concluded later than the spot date (forward conditions).

- Forward - includes two outright transactions (both concluded after the spot date).

Mandatory conditions for successful trading in swaps.

Masterforex-V Academy warns that it does not recommend that beginners trade independently to make money only on swaps, because necessary for successful trading

a) full compliance with money management, otherwise you... will lose the deposit;

b) you need to trade only... according to the trend.

What should be the minimum deposit, when a long-term trend begins, how you can receive up to 50% in foreign currency per year through swaps, as well as methods for hedging (protecting) open positions you will learn from the materials of the MasterForex-V Academy mailing list.

Swap

In economics, swap is a type of trade and financial transactions that involves the simultaneous conclusion of two transactions with one asset: the first transaction is the purchase (sale) of an asset (for example, securities or currency); the second is about the sale (purchase) of the same asset after a specified period on the same or changed conditions. In simpler terms, this is an exchange of assets for a specified period.

Such operations are used to increase the amount of assets, reduce risks, hedge, make a profit, and also as a lending tool.

The terms of swap agreements, as in the case of any other transactions, depend on the negotiations of the parties. Two organizations are developing common standards for this type of transaction:

- British Bankers Association (BBA);

- International Swaps and Derivatives Association (ISDA).

And what is the result?

It is not worth keeping the deal open for a long time just to accrue a positive swap, unless its volume is 10-100 lots. In small-volume orders, these amounts are not noticeable, and for intraday operations, any swap does not matter at all. Swaps require special attention for transactions that remain open for at least a week, and the effect of its impact can be assessed no earlier than three months. And, by the way, if your broker has swap-free accounts, then try to use them as much as possible, even if you need to somehow adapt to special conditions. The amount of swap costs must be taken into account in advance in the money management scheme when choosing an asset for any medium or long-term strategy.

Carry Trading

If there are positive swaps that are awarded to a trader simply for holding a position, then a logical question arises whether it is possible to make money on this.

Yes. And this type of trading is called carry tarding. It is typical not only for Forex, but also for other markets. It is especially widespread in the market of bonds and other debt securities.

In Forex, we can take a currency pair, open a deal on it that will result in a positive swap, and hold the position for as long as possible, receiving an increase in the form of swap every day.

When choosing a suitable pair and the direction of the trade on it, it is important that the positive swap value itself is large, at least greater than its average value for most underlying currency pairs. Typically, large swaps are for exotic pairs such as EURNOK (Euro/Norwegian krone).

It is also important that the spread for such a transaction is not large. Because for many exotic pairs, the spread can be 10 times larger than the swap, and in order to simply break even, you will need to wait 1-2 weeks.

And the result of the transaction itself is also very important. Of course, there will be no point in sitting in a deal for several months, making decent money on a swap, but on the deal itself, the result of speculation, there will be a minus that will be equal to or greater than the value of the swap. In this case, all the advantages of carry trading will come to naught.

But if you choose a suitable pair with a large swap, a low spread and the potential for a long-term trend in the direction of our trade, you can get good trading without constantly sitting at the monitor and hassle.

Interest rate swap pricing

To calculate an interest rate swap, different formulas are used.

For a fixed payment, use the following formula:

Where C is the rate; P – transaction size; t – period; T – currency base corresponding to the convention; M – number of payments; df – discount factor.

In a floating transaction, the settlement of each payment depends on the forward interest rate (f).

And the formula is as follows:

Where N is the number of payments.

At the time of conclusion of the contract, equality must be true:

That is, none of the counterparties has any benefits over the other, and no payments are made.

A change in f in a period can affect this equality.

Advantages and disadvantages

The positive aspects of the IRS are:

- meeting the needs of counterparties. They do not need to carry out additional operations with loans (repay early, re-open);

- gaining access to markets previously inaccessible for working with foreign currency;

- risk exchange + insurance against market risks.

Swaps also have disadvantages: there is no possibility of resale and no performance guarantee.

Risks

When making a traditional transaction, there may be interest rate risk associated with changes in positions. That is, payments may become unprofitable for one of the parties.

There is also a risk that the other party will not be able to fulfill its terms, since it simply does not have the money to repay the loan.