Intraday Volume Swings

Volume swings are defined as increasing volume and higher highs/lower lows over a minimum of three bars.

This script tracks volume fluctuations on an intraday chart and stores the latest swing low/swing high for the day. The final high and low swings are then plotted the next day as possible retracement/support and resistance levels.

Intraday levels for the current day may also be displayed, which may or may not be the final swing of the day, but can also be areas of interest.

Add to platform. https://ru.tradingview.com/script/dFY6oRQi-Intraday-Volume-Swings/

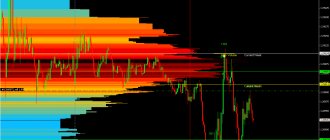

Example at Gazprom

The last example, it will be instructive to look at Gazprom on paper.

Here I think you don’t even have to say anything special, many will understand everything on their own.

We took the chart from the beginning of 2022, and all large volumes were in the range of 160 - 230 rubles. This looks logical, of course, since the paper has been here for quite a long time, but with further growth, the volumes do not increase. And this is bad, practically no one supports such a movement. How do we understand that if no one supports such a movement, then the whole thing can fall back to the range of 160 - 230 rubles quite easily.

And now perhaps the most important feature of horizontal volumes comes to light. They work very well in investments.

One more area of accumulation of volumes is still visible, this is the range of 270 - 280 rubles. This area will provide support in the near term. By the way, it was at the moment when the price was broken there, and there was still an important horizontal level there, that we gave the last investment recommendation to buy Gazprom on Instagram. By the way, don’t forget to subscribe to my instagram, there is also a lot of useful information there. Afterwards, the price actually began to look quite expensive, and as you can now see for yourself, all this movement was not supported by volumes.

If, with the horizontal volumes connected, you start going through the instruments further, you can find quite a lot of different points. But even with the experience of an investor or trader, they can be understood without horizontal volumes.

Displaying volume from small timeframes

Now we can get information from lower timeframes, thanks a lot to Pine Team. This script gets volume information from lower timeframes and issues an alert if there are extreme volumes on the last X candles of the lower timeframe (if the last X volumes are greater than the volume moving average). So, if you set alerts on various securities, then you can get alerts when there are sudden changes in volume and check the chart immediately.

Settings:

Timeframe in seconds: You can set lower timeframes in seconds. The default is 5 seconds. If you set it to 60 then it will show 1 minute volumes, if you set it to 1 then it will show 1 second volumes. MA Length: The script draws a simple moving average using this length information. Default is 20. Number of bars to check for alert: Default is 5. This means that if the last 5 candles are greater than the moving average and if you have set an alert, you will receive an "Extreme Volume" alert. Other options are colors and line width.

As you can see in the picture above, the time frame of the chart is 1 hour and the script shows the volume information of 5 second candles.

Add to platform. https://ru.tradingview.com/script/lOrlZXEq-Volume-Info-from-Lower-Time-Frames/

Trading signals by strategy

Trading using the Qstick system is quite simple, even a beginner can handle it. But signals are generated relatively rarely, since one should expect synchronous operation of all 3 elements. The maximum allowable discrepancy in this regard is 5 candles.

A downward signal is formed during a pronounced bullish trend. The purchase of a “Down” contract should be carried out subject to the coincidence of 3 factors: the cessation of growth of QStick_LB (the color of the dots changes from green to red), as well as the exit of both oscillators from the overbought zone.

A signal to increase is exactly the opposite situation. Both oscillators should leave the oversold area, and the dots in the QStick_LB window should change color from red to green. The overall situation on the chart should indicate that the long-term downward trend has stopped and an upward movement is beginning.

Volumes of major players from WallStreetTrader Pro

This indicator is still only at the stage of being added to TradingView and is only available through the MT5 terminal. But it cannot be ignored, because you can trade profitably using only the volumes of major players, which are imported into the platform from the servers of WallStreetTrader Pro. When you see where a major player enters, it will not be difficult to start following his market entries. This is one of the most effective approaches to trading.

To understand how it works, it is better to read in telegram chats dedicated to its work, or on forums. Because Sometimes it’s not easy to learn, but the indicator is worth starting to use and forget about all the others. Many people make good money in the market by analyzing only volumes:

One of the nice bonuses: with this indicator you can see volume injections even for the USDRUB (dollar/ruble) currency pair and easily analyze it.

A thread on the Millionaire forum dedicated to trading only this indicator. Telegram chat on WallStreetTrader Pro strategy.

There is a crack online, but if you don’t want to use the crack, you can buy the indicator using the link here, or open a futures trading account with an American broker and get it for free.

Settings

Getting started with Pine Script is incredibly easy. Any code we write runs on TradingViews servers, so we can access the editor and develop our scripts from the browser without additional downloads or configuration.

In this tutorial, we are going to chart the Bitcoin/Binance USD ( BTCBUSD ) currency pair. If you don't already have one, create a free account (a professional subscription is also available, but it's not necessary for this tutorial).

Follow this link and you will see a chart similar to the following:

Yours will probably be more recent.

Here we want to get a fully functional chart by clicking a button to access it. This gives us a much more detailed overview, drawing tools and options for plotting trendlines, among other things.

Fully functional chart. You can customize your time frames by clicking on the views above the highlighted tabs.

We won't discuss how to use the various tools available, but if you are serious about technical analysis, we highly recommend you check them out. In the bottom left corner (circled in the image) you will see several different tabs, click on Pine Editor .

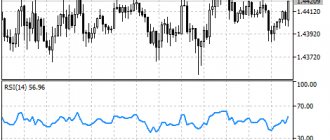

Volume Trend Meter

A nice little indicator that measures volumetric pressure over a period of time. I call it Volume Trend Meter or simply VTM. The indicator sums up the volumes of all green and red candles for a certain period of bars (which you set in the settings) and plots their values. Use this indicator to identify increasing volume with green candles (close above the open) and increasing volume with red candles (close below the open).

How the indicator is calculated

For the green column: the total volume of green candles is greater than the total volume of red candles. For the red column: the total volume of red candles is greater than the total volume of green candles.

Volume Trend Meter Colors

Green: increasing buying pressure. Red: increasing selling pressure.

Add to platform. https://ru.tradingview.com/script/ywEEvEtI-Volume-Trend-Meter/

Pine Editor

This editor is where the magic happens. Tell it what we want to do, then click Add to Chart to see our annotations appear above. Note that things can get messy if we include multiple annotations at once, so be sure to remove them between examples ( right click on the chart to remove indicators ).

As you can see, we already have a couple of lines of code. Let's click Add to Chart to see what happens.

A second chart is added below the original one. The new chart represents the same data. Hover over My Script and click the cross to delete it. Now let's dive into the code.

study (My script)

This first line simply sets up our annotation. This only requires the name you want to call the indicator (in this case My Script), but there are also some additional parameters we can add. One of these is Overlay , which tells TradingView to place the indicator on an existing chart (rather than a new segment). As you can see from our first example, the default is false . Although we won't see it in action right now, overlay = true adds the indicator to an existing chart.

plot (close)

This line is a guide to plotting the closing price of Bitcoin. plot just gives us a line graph, but we can also display candles and bars, and see soon.

Now let's try the following:

// @ version = 4study (My Script, overlay = true) plot (open, color = color.purple)

Once you add this you should see a second diagram (which looks like the original is shifted to the right). Instead, all we've done is plot the opening price, and since the current open days are the close of the previous days, it makes sense that they have an identical shape.

Fine! Let's get rid of the current annotations (remember, we do this by right-clicking and selecting Remove Indicators ). Hover mouse over Bitcoin/BUSD and click the Hide to clear the current chart as well.

Many traders prefer candlestick charts because they give us more information than a simple chart like the one we just made. Let's add them further.

// @ version = 4study (My Script, overlay = true) plotcandle (open, high, low, close)

It's a good start, but due to the lack of colors it's a bit muted. Ideally, we should have red candles when the opening price is greater than the closing price for a given time frame, and green candles when the closing price is greater than the opening price. Ok add a line above the plotcandle() function :

// @ version = 4study (My Script, overlay = true) colors = open = close? color.red: color.greenplotcandle (open, high, low, close)

It looks at each candle and checks to see if the closing price is greater than the closing price. If so, it means that prices have fallen over the period, so the candlestick will be colored red. Otherwise it will turn green. Modify the plotcandle() function to pass this color scheme to:

// @ version = 4study (My Script, overlay = true) colors = open = close? color.red: color.greenplotcandle (open, high, low, close, color = colors)

Remove the current indicators if you haven't already and add this one to the chart. We should now have something similar to a regular candlestick chart.

Beautiful!

Faith Indicator

This indicator compares the demand of buyers with the supply volumes of sellers and calculates which of them prevails. Therefore it only works if the volume is published. Buying demand is assumed to be for a period where a higher high is reached with greater volume. Sellers' supply is determined by a lower minimum combined with higher volume.

The average supply of sellers is subtracted from the demand of buyers, the result is estimated, because a statement like "Belief (strength) during this period was ## percent" does not make sense. We can infer more and less faith, but we cannot represent it in any precise quantity.

This indicator assigns the following ratings: Very high strength is shown as 8. High strength as 6. And so on.

It is represented as a bar graph with blue bars pointing up (meaning faith) and red bars pointing down (meaning distrust).

The background is colored using the Hull Agreement (Hullag) indicator. Hallag identifies price movements into five classes, which are assigned a background color. These are as follows: grade 2: blue, clear upward movement grade 1: green, some upward movement grade 0: gray, neither up nor down grade -1: maroon, some downward movement grade -2: red, clear downward movement.

Using the faith indicator:

The indicator shows the price action/momentum in the form of a background color and the volume action is analyzed as a confidence level in the form of a histogram. Typically, faith is accompanied by rising prices (blue/green background), and distrust is accompanied by lower prices (red/maroon background), but the opposite situations arise, for example, lower prices when the market is fair. This can be explained by the actions of minority sellers who act contrary to market sentiment. You may then decide that this may be an erratic price movement.

If the faith indicator confirms the price movement, you can assume that the movement is meaningful and will continue. Also, if you see faith weakening, you can assume that the movement is coming to an end and the situation will change.

Add to platform. https://ru.tradingview.com/script/ev2TidhJ-Faith-Indicator/

Final Thoughts

In this article, we've covered some basic examples of what you can do with TradingViews Pine Editor. By now you should be confident in making simple annotations on price charts to gain additional information from your own indicators.

We were only interested in a couple of indicators here, but more complex ones can be easily developed by selecting the built-in scripts from New or writing them yourself.

Lack of inspiration? The following articles may give you some ideas for your next project:

- A quick guide to the Parabolic SAR indicator

- A Guide to Mastering the Fibonacci Retracement

- Explanation of leading and lagging indicators

- Explanations for the MACD indicator

Simple VSA

There isn't much discussion about VSA right now, although it is a very good method for analyzing markets.

This indicator attempts to display simple Volume Spread Analysis (VSA) concepts as they appear in real time. These concepts have been borrowed from various VSA experts and applied through this simple script. The code logic is done by me after learning and testing these VSA concepts.

The Simple VSA indicator is not intended to work independently, it is just an auxiliary tool. Trading remains discretionary. It does a good job of recognizing many VSA signals, but of course misses some or shows some false ones. The trader must decide how he will trade around it. To use this indicator, you must know VSA in advance.

Signals are based on: high volume action including tight and wide spreads (orange/blue signals) low volume action such as no supply and no demand (purple signals) price action such as springs, upthrust and two-bar reversal ( red / green) spread of columns in relation to volume and closure, for example, effort to result

Other features: SMA based medium term trend system with level bar colors and color bars for up and down bars

Add to platform. https://ru.tradingview.com/script/xBk0Cv4P-Simple-VSA/

Building moving averages (MA)

We have some basics. Let's move on to our first custom indicator - the exponential moving average or EMA. This is a valuable tool because it allows us to filter out any market noise and smooth out price movements.

The EMA is slightly different from the simple moving average (SMA) in that it gives more weight to the most recent data. It tends to be more responsive to sudden movements and is often used for short-term play (such as day trading).

Simple Moving Average (SMA)

We might as well build an SMA so we can compare them later. Add this line to your script:

plot (sma (close, 10))

This displays the average for the previous ten days. Change the number in parentheses to see how the curve changes with different lengths.

SMA based on the previous ten days.

Exponential Moving Average (EMA)

The EMA will be a little harder to understand, but don't worry. Let's first look at the formula:

EMA = (Close - EMA of previous days) * multiplier - EMA of previous days

So what does this tell us? So, for each day we calculate a new moving average based on the previous one. The multiplier is what determines the last period and is calculated using the following formula:

Multiplier = 2 / (EMA length + 1)

As with simple moving averages, we need to specify what the length of the EMA will be. Syntactically, the EMA construction function is similar to the SMA function. Plot it next to the SMA so you can compare the two:

// @ version = 4study (My Script, overlay = true) plot (sma (close, 10)) plot (ema (close, 10))

You can see a slight difference in the two types of moving averages.

Built-in scripts

So far, we've written our code by hand so you can get a feel for it. But let's introduce something that can save us time, especially if we write more complex scripts and we don't want to do them from scratch.

At the top right of the editor, click New . You will get a drop down menu with all kinds of different technical indicators. Click Exponential Moving Average to see the source code of the EMA indicator.

Go ahead and add this to the chart.

This one is different from ours, you will notice the input() . They are good from a usability point of view as you can click this box

...and easily change some values in the pop-up window by clicking the settings .

Let's add a couple of input() to our next script to demonstrate this.

Volume Profile for the day with support and resistance lines

This indicator shows the volume profile across daily blocks and draws support or resistance lines on the chart created by the previous volume profile block. A support line will be created if in the previous block the VPOC line was closer to the lower price line of that block. This support line will be placed below the VPOC line at a distance equal to the difference between the maximum price of this block and the VPOC price. In the case of a resistance line, similar logic applies. These support and resistance lines are presented because according to the Gaussian bell, VPOC is likely to be in the middle, and these deviations can be used to track support and resistance levels.

In addition, the indicator includes the following functions:

— Change the colors of all drawn lines. — Define the number of day blocks to be displayed. — Determine the resolution when calculating the volume of each candle. — Determine the number of support/resistance lines to be displayed. — Highest and lowest price lines, as well as vpoc line, volume histogram and support and resistance lines. — Whether or not to display the vpoc line and the volume histogram.

The calculations performed by the script are improved if lower time frame candles are used. This indicator has been tested on several markets including cryptocurrency, CFDs, Forex and indices.

Add to platform. https://ru.tradingview.com/script/Nn6PKWp1/

Content

- What technical analysis indicators show Why indicators are needed in binary options Binary options indicators that everyone should know about Hundreds of indicator trading strategies for binary options

- The best and most accurate indicator for binary options Binary options without indicators - reality or fiction? Top 10 best indicators for binary options

- Indicator for binary options SR Pro or Support and Resistance TLB OC

Cumulative Volume Delta

The total delta volume is one of the key analyzes when determining the relationship between volume and price. The application is very easy to understand.

The image below shows how this is calculated:

Add to platform. https://ru.tradingview.com/script/lsDHdn0H-Cumulative-Volume-Delta/

Tradingview Features

To work with TradingView, you do not need to install special extensions on your computer: you can work directly in the browser or install a mobile application (for iOS, for Android). The platform offers a free trial version to get the hang of it, and a more advanced version by subscription. The site has been translated into different languages, including Russian.