The era of solo mining is long gone. The ratio of computing power and network complexity does not allow receiving a reward for signing a block. Today, the only way to mine cryptocurrency is to join together in mining pools. However, many miners fail when choosing a pool due to a lack of understanding of the operating principles, specifics, differences and other features of mining pools.

In this article we will look at everything related to mining pools: from their differences to choosing the best servers for specific cryptocurrencies.

Definition of mining pool

A mining pool is a kind of server whose main task is to divide computing tasks into many subtasks. The latter are distributed among all participants who are connected to the pool. Initially, mining existed on processors; their computing power was enough for independent cryptocurrency mining.

As the complexity of the network grew from attracting new participants, the sphere of “coin” mining moved to video cards. Mining on processors is a thing of the past due to minimal profitability (and later, complete lack of profit).

Subsequently, the process of increasing mining complexity led to the fact that without combining capacities, miners could no longer mine cryptocurrency. It is important to consider that a mining pool is not a completely collective mining operation with an even distribution. It is rather a division of tasks, where each participant makes a profit, depending on the effort (power) invested.

Is it more profitable to mine alone or in a community?

Cryptocurrency mining in Mining Pool has the following advantages:

- reducing the time required to search for a cryptographic signature;

- distribution of profits among all participants;

- you can be a user of the resource even with very simple equipment;

- making a profit immediately after connecting to the resource.

It is definitely much easier to mine cryptocurrency by registering on a server than doing it alone. Due to the increasing complexity of mining, it is almost impossible to obtain rewards on your own. Even with heavy-duty, cutting-edge equipment, the process of finding a new unit can take more than a year. At the same time, the cost of electricity and the purchase of necessary parts for mining is not always justified.

Principle of operation

The contribution is assessed by the concept of a “share” (from English share), which is part of the computational hash function for signing a block. The server's task includes not only distributing tasks, but also checking their validity. When the “share” meets the complexity values required for signing a block, the operation is confirmed.

The reward received by the pool is distributed to all miners, depending on the number of valid “shares” transferred (depending on the method of reward in a particular pool). Moreover, who signed the “share” block has no influence on the final distribution of the reward.

Each such server is a full-fledged business that “lives” on commissions collected from users. Mining pools may underestimate overall computing performance to obtain additional profit from “unaccounted power” (the so-called “hidden commission”), but such servers instantly end up in negative ratings and blacklists, losing all participants.

In technical terms, the design of a mining pool cannot be called complex. It is a dedicated server that distributes tasks. Moreover, the pool does not require complex configuration (if there are already ready-made templates). However, the key aspect is to attract participants, which is based on:

- Powerful advertising.

- Reputation of the mining pool.

- Security.

- Favorable conditions for participants (low commission and other privileges).

You should also remember about the “51% rule”, which is a direct threat to centralization and allows you to attack any cryptocurrency. Once this point is reached, the pool should potentially announce its liquidation unless the collection of high capacities serves specific purposes.

Types of mining and methods of reward

In the field of cryptocurrency mining, there are three mining methods:

- Solo.

- Collective (in Pool).

- Cloudy.

The latter stands out noticeably from the rest, since it does not require equipment; it is often classified as an investment rather than a “digging”. Solo mining is almost completely a thing of the past. This is due to the growing complexity of networks and the demand for digital money mining.

New “coins” rely on solo mining, but as they develop and attract participants, “loners” will quickly be replaced. An example is mining Pirl coin solo without a pool. Therefore, collective mining, with the pooling of capacities, is the only way to compete in the field of cryptocurrency mining.

One of the key factors when choosing a server is the reward method that is used on a particular resource. It can affect your bottom line and can either increase or decrease your earning potential. There are more than 20 payment methods, although PPS and PPLNS are considered the most popular and widespread. The simplest PROP method is becoming less and less popular, gradually becoming a thing of the past.

PPS or Pay Per Share - for participants this type of reward is considered the most promising. When a block is found, each participant receives income for each “ball” sent. The amount is calculated for the user based on the reward divided by the network complexity. Despite the fact that this distribution principle is the most profitable for miners, it is riskier for pool owners, which usually leads to higher commissions.

PPLNS - Pay Per Last N Shares - the method is considered one of the most profitable and does not include payments for each “share”. Accruals are made not for searching for a block, but for so-called “shifts”, which represent certain time intervals. The method is in many ways similar to PROP, but differs in a “slow start” when calculating rewards.

That is, the calculated power indicator will increase to the maximum gradually (only after reaching the peak value will payments be full). But even if you are disconnected from the mining pool, payments will occur until the estimated capacity drops to zero.

In addition to the three above methods of remuneration, there are the following types:

| Solo | CPPSRB | PPSW |

| PPS+ | Geometric | POT |

| SMPPS | DGM | BPM |

| ESMPPS | FPPS | Eligius |

| Puddinpop | HBPPS | Triplemining |

| RSMPPS | RBPPS | Score |

Independent pool statistics

To find out more detailed information about existing cryptocurrency mining pools, the user can use independent sources. At the moment there are two reliable resources:

- Blockchain.info – provides an assessment of the distribution of hashes between available resources;

- BTC.com. – provides information where you can find out the history for each service.

Note! There are a lot of fraudulent projects on the Internet, and when studying pools you need to pay attention to the server rating and how long it has been running. The longer a pool exists, the more reliable it is, since HYIPs, as a rule, do not exist for more than a year. Reading user reviews will help you save valuable resources such as time and money. You can read opinions using the platforms: bitcointalk.org and forum.bits.media.

How to choose a good mining pool?

Choosing a mining pool for beginners can be a daunting task, especially with the huge variety of servers available. First of all, the pool must be financially profitable; this is the primary and only important criterion. The following parameters will help you choose the most profitable, safe and stable option.

Hashrate

The power of a particular pool directly affects its potential for finding new blocks, and therefore the income of participants. It is for this reason that the resources created among the first are the most popular.

Any new servers, despite their features, cannot attract as many participants, which means they will lose in power and efficiency in searching for blocks.

Commission amount

This criterion cannot be called decisive, but it also contributes to the income received from mining. Before choosing a server, make at least a superficial comparison of different pools in terms of commission size. In the long term, this may affect your earnings.

It is not recommended to chase minimum commissions; most often this is an illogical approach from the point of view of security and quality of service, but you should not choose resources with large commissions either. This is financially unprofitable.

Reward system

An important indicator that needs to be correlated with your own capacities in order to extract the most favorable conditions. For example, with proportional profit sharing, in the case of low capacity, the level of income will be unusually low due to the insignificant contribution.

Therefore, the choice of a reward system will be important if it meets the conditions (for ASICs, farms or large centers it is different and selected individually).

Location

An important parameter. In this regard, there is an opinion that it is best to choose servers that are located as close as possible to the equipment. This will ensure a stable connection and minimal ping.

The immediate geographical location is of secondary importance. To select the best connection, use the "ping" command with the server address.

What is blockchain

For most cryptocurrencies to work, it is necessary to create a chain of blocks - blockchain. Each new block contains transactions that have appeared on the network since the creation of the previous block. We like to compare blockchain to a ledger. Each new block is a page of the book on which transactions are recorded.

How to create a new block, that is, turn the page of the ledger? To create a new block, miners solve a mathematical problem. Important point: this task is based on the information contained in the previous block. This feature is not accidental, because in this way the blocks form a continuous chain - a blockchain, in which all blocks are connected to each other. Accordingly, hackers or other bad people cannot remove or replace a block in the chain.

Why remove or replace the block? For example, block number 324670 included an important transaction in which you transferred Vasya $10 in bitcoins, and Vasya gave you his Zhiguli in return. If you subsequently delete block 324670, then the transaction with the transfer to Vasya will be lost. This means that you will have both money and Vasya’s Zhiguli, who will now only cry. In accordance with the basic principle of the blockchain, it is not possible to remove a block. This is the main principle of its work.

TOP 3 pools for Ethereum

Let's look at the top of the largest and most famous pools that make it possible to effectively mine Ether.

SparkPool

The undisputed leader, which ranks 1st in terms of power for Ethereum (33% of the daily power). Supports the production of 6 “coins”, including the quite rare Beam and Grin. Reward system – PPS+ (combines the advantages of PPLNS and PPS). For all “coins” the withdrawal commission is 1%.

- pool hashrate – 56.35 TH/s;

- accrual schemes – PPS+;

- minimum payout amount – 0.1 ETH;

- pool commission – 1%;

- number of cryptocurrencies – 6.

Official website: https://www.sparkpool.com

Ethermine

One of the largest pools, the second most powerful among all servers (21% of the total hashrate per day). The number of participants exceeds 220 thousand people. It also allows you to mine “coins” without registration. The only significant disadvantage can be considered an additional commission of 0.001 ETH, which is charged when withdrawing less than 1 ETH.

- pool hashrate – 38.7 TH/s;

- accrual schemes – PPLNS;

- minimum payout amount – 0.1 ETH;

- pool commission – 1%;

- number of cryptocurrencies – 6.

Official website: https://ethermine.org

Nanopool

One of the largest resources for mining ether, as well as Zcash and several other “coins”. Supports PPLNS reward system. Ranks 4th in power among all servers for ETH (7.5% of the total hashrate). Also considered one of the best RVN mining pools.

- pool hashrate – 13.7 TH/s;

- accrual schemes – PPLNS;

- minimum payout amount – 0.5 ETH;

- pool commission – 1%;

- number of cryptocurrencies – 7.

Official website: https://nanopool.org

Top 8 cryptocurrency mining pools in 2022

List of top 8 cryptocurrency mining pools in the CIS. The pools listed below are general purpose and focus on mining as many cryptocurrencies as possible. The main vector of development of such pools is scaling by expanding the number of POW coins mined.

| Pool | Website | Commission | Coins |

| EMCD | https://pool.emcd.io/ | 0% | BTC, BCHN, BSV, LTC, DASH, ETH, ETC |

| Minergate | https://minergate.com/ | PPS - 1.5%, PPLNS - 1% | XMR, GRIN, BTC, ETH, LTC, ETC, BTG, ZEC, EOS, TRX, ICX |

| Zpool | https://zpool.ca/ | 0.45% | Every POW coin |

| F2Pool | https://www.f2pool.com/ | From 3 to 5% | BTC, BCHN, BSV, LTC, ETH, ETC, GRIN, DASH, XMR, DCR, XFR |

| AntPool | https://v3.antpool.com/ | 2.5% | BTC, BCH, LTC, ETH, ZEC, DASH, XMC, BTM |

| Poolin | https://www.poolin.com/ | 2.5% | BTC, ETH, ZEC, ZEN, LTC, DCR, DASH, CKB, BCH, BSV, HNS |

| ViaBTC | https://www.viabtc.com/ | 2% | BTC, BCH, BHA, BSC, FCH, LTC, ETH, ETC, ZEC, ZEN, DASH, XMR, CKB, LBC |

| SlushPool | https://slushpool.com/ | 2% | BTC, ZEC |

EMCD. Owned by EMCD Tech, it occupies a prominent position in the CIS and Eastern Europe. Offers miners firmware for ASICs and systems for remotely monitoring the status of ASIC farms. Miners receive rewards using the FPPS+ system, and the pool itself operates without commission payments. Instead, a Donation of 0.5% is used here. In this way, the pool tries to win the attention of newcomers to the industry who do not understand mining.

Minergate is a solid sized pool. Once the mecca of mobile mining. After updating the rules of the Play Market and App Store, the application was modernized to track the performance of its own farm on the pool. They offer to withdraw the mined cryptocurrency to an exchange wallet or your own. The commission amount is 1.5%. Beginners are offered to use their own miner.

Mininggrirentals is a site that offers to rent computers or entire farms for cryptocurrency mining. Operating since 2014. The fee is for one hour of using computing power. Farms and mining PCs get their own pages with analytics, where you can find out if the farm is cheating on hashrate, trying to lure you in with a high number and a low price. Statistics on farms are open; the resulting power is used for any mining pool.

Zpool . Poole is from America. The cryptocurrency mined here is converted into Bitcoin upon withdrawal. Because of this, there is a partial loss on conversion. The minimum withdrawal is 0.05 BTC. Beginners with weak cards will need to wait a long time for this threshold. Commission 0.45%. As of 2022, the pool produces 185 coins using 57 algorithms. The list of supported coins is quite exotic. For example, you can find DeepOnion, Dinero, Cream and StakeCube here. On the page with coins there is a link to social networks and Github of each project, where you can take a closer look at the mined curiosity. Those who like to hunt for rarities will like it here.

BitClub Network . The creators of the pool tried to sell their shares in the company, but [were sued for fraud]. There is nothing more to say about the bullet.

F2Pool (Discus fish) is a mining service that, in addition to cryptocurrency mining, is engaged in the dissemination of news and innovations in the field of staking. According to various estimates, it holds from one fifth to one sixth of the total hashrate of the Bitcoin network. Payment system: PPS. Money that is not withdrawn within 90 hours after mining is transferred to the maintenance of the pool.

Poolin . Multi-cryptocurrency mining pool. Provides statistics on mined cryptocurrencies, including network difficulty, pool hashrate, number of active liners and daily profit. By default, profitability is indicated in approximate values. The largest share of laners in the pool mines BTC, but other currencies are also present. The company's main offices are located in China and have a representative office in Europe. Poolin founders: Kevin Pan (Baidu, Dangdang.com, Bitoll.com) and Terry Lee (Baidu, Bitmain, BTC.com). The main nationality of the pool team is Chinese.

ViaBTC . Pool founder: Haipo Yang, a graduate of China Polytechnic University. Before that, he led the ZeusMiner development team and was a developer at Tencent Weibo (Chinese Twitter). Launched ViaBTC in 2016.

The pool provides cloud and regular mining services. Cloud mining is offered for two cryptocurrencies: BTC and ETH. Computing power is purchased under a contract with a fixed hashrate. At the time of writing, one Ethereum megahash costs $25.

Additional services: hedge services and borrowing money secured by cryptocurrency. For those wishing to invest large capital, the pool offers to rent mining farms with capacities from 12 to 400 Megawatts. The farms offered for rent are powered by energy from geothermal and hydroelectric power plants. Due to the low price of electricity, farms are offered for rent from 3 cents per kilowatt-hour of operation.

SlushPool . The first Bitcoin mining pool in history. As of the first quarter of 2022, the total number of working farms on the pool is 148 thousand. All work of the pool is aimed at mining Bitcoin. Only recently ZEC was connected, which acts as an alternative currency for airliners. The pool policy clearly states that you should not count on supporting cryptocurrencies other than BTC and ZEC.

TOP 3 pools for Monero

Among the pools that are very popular in Monero mining are the following servers.

mineXMR

One of the main pools for Monero mining, with a share of the total network hashrate of 34%. It is considered one of the very first servers for Monero, which was launched in 2014. Reward system – PPLNS, fixed commission – 1%.

- pool hashrate – 413 MH/s;

- accrual schemes – PPLNS;

- minimum payout amount – 0.004 XMR;

- pool commission – 1%.

Official website: https://minexmr.com

supportXMR

The peculiarity of this pool is that it supports mining exclusively Monero. It also stands out with the lowest commission among all major servers - 0.6%. It also occupies a leading position in terms of uptime, the value reaches 100%.

- pool hashrate – 350 MH/s;

- accrual schemes – PPLNS;

- minimum payout amount – 0.1 XMR;

- pool commission – 0.6%.

Official website: https://www.supportxmr.com

MinerGate

A popular cloud mining service, which is also one of the leaders for Monero and Bytecoin. Supports up to 11 popular coins, including Etc, Bitcoin Gold and others. Withdrawal commission – 1%.

- pool hashrate – 9.1 MH/s;

- accrual schemes – PPS, PPLNS;

- minimum payout amount – 0.01 XMR;

- pool commission – 1%.

Official website: https://minergate.com/xmr-mining-pool

Main types

Mining pools are different and may differ from each other according to a number of criteria:

- The presence of a centralized server or its absence;

- Type of cryptocurrency mined;

- The presence or absence of a commission for withdrawing earned funds;

- Requirements imposed by the mining pool on the computing power of participants to connect to the general mining process;

- Method of payment of remuneration.

Centralized and decentralized pools

Decentralized Mining Pools

Most mining pools today are centralized. Centralized pools are a server whose operation is coordinated by an operator.

Each of the participants puts their computing power at the disposal of the pool, which, combining them, works to find the nonce value in order to close the block and receive a reward. If successful, the operator divides the profit between all participants according to one of the schemes, which will be described below.

☝️

In this system, the whole pool, and not an individual participant, is perceived by the blockchain as a separate node (node).

A huge disadvantage of centralized mining pools is their greater vulnerability to DDoS attacks. For example, in July 2017, one of the largest Chinese Bitcoin pools, F2Pool, was attacked by hackers.

In addition, with the existence of huge pools (for example, BTC.com or Antpool, which are actually a project of the Chinese giant manufacturer of ASIC miners), the risk of a 51% attack increases, which was described in detail in a paper by Satoshi Nakamoto. Now the share of BTC.com is a little more than 16% of the total hashrate of the Bitcoin network and this pool does not yet threaten the security of the network, however, the history of mining already knows the case of a very likely 51% attack from one Bitcoin pool.

Attack 51%

In 2014, the most popular pool at that time, Ghash.io, came close to a critical indicator, and according to some online news portals, on June 13, 2014, it even controlled 51% of all capacities within a few hours. Miners sounded the alarm and began to suspend mining en masse and leave the pool. Fortunately for the Bitcoin community, Ghash.io stated that it has no plans to take over the Bitcoin network and has stopped accepting new miners to stabilize the situation. At the moment, only a cryptocurrency exchanger operates at ghash.io.

There are also other examples: DeepBit, which controlled 49% of the hashrate in 2011, and BTC Guild with 40%. In all cases, the situation was resolved without the use of any force majeure measures.

Decentralized mining pools have emerged as a counterweight to centralized ones. The main advantage of such associations is that they follow the main principle of blockchain - decentralization. In this system, independent miners simply band together to increase the chances of finding a block. Each miner is a separate node participating in the mining process.

Among the decentralized mining pools it is worth mentioning the following: P2Pool, BitPenny, Eligius.

Below is a comparative table of centralized and decentralized mining pools:

Comparison table of decentralized and centralized pools

Merge mining

Cryptocurrency mining

Some pools allow the possibility of merge mining, or simultaneous mining of several cryptocurrencies at once. They work according to the following principle: in the process of selecting a random nonce number, which is necessary to close a Bitcoin block, mining devices generate billions of these numbers. Those nonce that are not useful for signing a block in the Bitcoin network are used to sign blocks of other cryptocurrencies, mainly forks of Bitcoin, for example, Namecoin, Devcoin, IxCoin, I0Coin.

☝️

Reusing non-Bitcoin nonces gives miners an additional profit of 1-2% of their total earnings.

However, not all pools provide this option, so when choosing a service you should pay attention to this parameter. For example, such an option is available on Antpool, BTC.com, MinerGate.

Multi-coin pools and multipools

Multi-coin pools are services where you can mine cryptocurrency that is profitable at a certain moment. These must be coins with the same encryption algorithm, for example, Bitcoin and its forks, which are based on the SHA256 algorithm. In this case, the mined funds go to one account, from which the miner manually or automatically distributes the currencies to their wallets.

☝️

It is worth noting that the miner makes all switches between currencies manually, so it is very important to have up-to-date data on the price and popularity of a particular cryptocurrency.

To switch, you just need to select the desired TCP port in the mining equipment software settings.

Multi-coin pools have replaced multi-coin pools

. They differ from multi-coin ones only in that all switching occurs automatically - the pool itself selects the most profitable coin for mining at a certain moment, taking into account such indicators as the price and popularity of the cryptocurrency on the exchange, network complexity and many other factors. The most popular multipools for Bitcoin mining: NiceHash, Zpool, Multipool.

List of other popular servers

Many popular pools support several cryptocurrencies, and large multipools even allow you to mine more than 10 “coins”. Giants such as NiceHash work with all algorithms: from the popular Scrypt and SHA-256, to less popular ones, like DGB on Qubit.

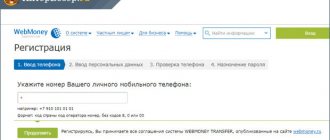

In addition to the number of cryptocurrencies, pools are often classified according to requirements and operating conditions, where the main place is occupied by the registration process. For some servers it is mandatory, while others allow access without registration.

With registration

Some servers require registration of participants as a mandatory step for mining cryptocurrencies. The largest servers include:

- Bitfury;

- NiceHash (supports almost all known coins, from the largest to specialized ones, like Zcoin and others);

- Mining pool hub;

- Aikapool (one of the largest Dogecoin mining servers).

Without registering

In the list of mining pools without the need for participants to register, the most popular are:

- ETHpool/Ethermine;

- NanoPool;

- Baikalmine (allows you to mine several rare “coins”, like CLO).

Login to the official 2Miners website

☝️

Official website of the 2Miners pool

To get acquainted with the site, go to the official 2Miners website. Here we have some good news - you don’t need to register to work with the site. All information is immediately available to the user.

The 2Miners start page has a laconic and pleasant design.

In the first window, the user sees the total hashrate of the pools in the context of various mining algorithms, as well as brief operating conditions and achievements of the site.

There is a toolbar at the top of the main page. Here you can select the desired interface language, read the FAQ section and training materials, there is a search bar for a miner by address, and there is also a quick access button to select a mining pool. This block will also be available when scrolling down the page.

Home page 2Miners

How to join the pool?

The joining process depends on the server itself, so some conditions may differ (for example, for the POS algorithm). However, the basic steps are almost always the same. After the first attempt to join, this process will no longer be difficult. Let's look at all the stages using the popular Slush pool as an example.

- Purchase equipment for mining “coins” (for BTC these are ASICs, other types of mining are irrelevant for this cryptocurrency).

- Go to the Slush Pool website and create an account.

- Download the miner and configure it. The following parameters must be entered in the configuration: pool URL, ID (user and worker name), password.

- Registering a wallet in your account to which payments will be made.

However, always research the connection methods for the cryptocurrencies you choose. For example, for an ETP mining pool, select the closest server and enter its address in the miner configuration.

Basic information about the 2Miners pool

Information about 2Miners

- Mining is available on 10 algorithms: Ethash; Equihash; Equihash 125.4; Equihash 144.5; Equihash 192.7; CryptoNightR; MTP; Cuckoo; X16Rv2; BeamHash;

- Supports 19 cryptocurrencies, including Ethereum, Ethereum Classic, Zcoin, Bitcoin Gold, Grin, Monero, Zcash, Pirl, Callisto, etc.;

- Rewards are awarded every two hours;

- Shared pools and SOLO pools for large miners;

- Possibility of mining on rented equipment;

- Full block reward, including fees for all transactions;

- Open statistics for each pool;

- Low ping – from 0 ms for Russia and from 47 ms for other countries;

- Russian-language interface and support;

- Notifications about new blocks and the status of workers both by e-mail and Telegram.

2Miners review

Calculation of profit from mining

Calculators are used to calculate profits. Their number is in the hundreds, so choosing the right service for counting will not be a problem. Many servers have their own calculators, which can be found on the company's website.

To calculate potential profit, you need to:

- Open Explorer or any other browser and go to the selected calculator.

- Select the desired “coin” (ETH, NRG, etc.).

- Enter the hashrate for a specific algorithm (or hardware, if the calculator supports such an option) into the line.

- Fill in the line with the energy consumption of the equipment.

- Select a time period.

- Set the correct network complexity values (not all calculators update this indicator in real time).

Among the most famous and reputable services, miners most often use Whattomine.com.

Common problems

The main problems that may arise when mining cryptocurrencies include:

- Connection instability and loss of connection (also constant reconnections).

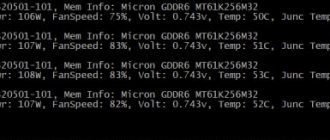

- Reduced hashrate when installing new drivers (can also occur when using older versions).

- Incorrect miner setup (the main problems arise precisely when setting up the bat file).

- Overheating of equipment (refers to technical problems).

- Release of a new version of the miner and reduction of the maximum hashrate.