The easiest way to transfer money from WebMoney to cash is to use the service of direct transfer of funds to a bank account (card). Its only drawback is that this method of withdrawing funds is no different in speed. You will need to fill out a withdrawal application on the official WebMoney website and expect funds to arrive within a few days.

It will be easier to use your bank’s online banking and exchange WebMoney at the current rate (if you are transferring foreign currency). The benefit of a money transfer is the minimum bank commission for withdrawing funds.

How to transfer money from a card to WebMoney

You can top up your WebMoney account not only using a bank debit card, but using the appropriate services. Today, special e-wallet replenishment cards are also available for sale. Cards can be designed both for sending funds to a Russian VMR wallet (in rubles) and to wallets with other title units (VMS, VME, etc.). In addition, today you can transfer cash to WebMoney using terminals. For example, you can top up your wallet from the Qiwi terminal within a matter of minutes - the money goes to WebMoney instantly after the transfer.

Peculiarities of withdrawal in Belarus and Ukraine

Ban in Ukraine

In Ukraine, restrictions regarding the use of the Webmoney system appeared back in 2016, but the Ukrainian version continued to operate. Serious restrictions began in May 2022:

- The SBU blocked system domains and user wallets;

- the state threatens to block funds in wallets, but at the same time acts as a guarantor of their safety;

- conditions are created when the use of WMU in Ukraine is not available.

Important! Users still have the opportunity to use workarounds, but in general the situation is extremely unsightly.

In Belarus, it is impossible to link Webmoney wallets, for example, to Yandex, although such a possibility existed before. Now in this country it is necessary to look for workarounds, that is, exchangers, in order to transfer funds between wallets.

Transfer money from WebMoney to a Sberbank card

If you have a Sberbank of Russia credit card, you can always withdraw money from WebMoney in a short time. You can withdraw money at any time of the day. This service is equally available on weekdays and weekends/holidays. In order to track the receipt of funds, it makes sense to register in the Mobile Bank service from Sberbank or use online banking. As soon as money from WebMoney arrives in your account, you will receive a corresponding SMS message. Please note that for a transfer to a card you will be charged a bank commission in the amount of 4% of the transfer amount. But not less than 50 rubles.

Transaction using WM Keeper WinPro program

Owners of PCs with Windows OS can manage their finances through WinPor. Let's describe how to transfer money to another WebMoney wallet for this category of users:

- We enter the program, find the “Wallets” section.

- Alternately click “Menu” – “Transfer WM” – “To WebMoney wallet”.

- Using the familiar algorithm, fill out the application form.

- After clicking Next, the operation is completed and then a message appears indicating its completion.

How to transfer money from your phone to WebMoney

In order to send money to WebMoney from your phone, you need to use the appropriate services. The service is convenient because you can make a transfer to an electronic wallet even while on the road. The money will arrive on WebMoney instantly. But the disadvantage of replenishing a WebMoney wallet from your phone is the high commission. So this option is only suitable if other replenishment methods are not currently available to you. Or, for some reason, there is too much “extra” money on your phone, and you would like to use it at your own discretion.

Advice from Sravni.ru : Please note that in order to withdraw money to bank cards from a WebMoney wallet, you need to be the owner of a verified formal system certificate. Without such a certificate, translations will not be available to you. In addition, you can only withdraw money from your wallet to accounts that belong to you personally - withdrawals in favor of third parties are not possible.

Conversion

Special attention should be paid to the issue of how to transfer money from WebMoney to WebMoney if the sender's and recipient's accounts have different title units. It is impossible to send funds to an account with a different title symbol. The user must first exchange his existing title units for the electronic currency of the recipient’s wallet, using one of the following options:

- exchange within your WMID at the average exchange rate wm.exchanger.ru;

- place your order or submit a counter order on the same exchange;

- use third-party exchange resources on the Internet;

Let's briefly look at exchanging WebMoney for WebMoney within your profile:

- in the case of Mini, you need to select the wallet that contains the funds for exchange, and use the “Exchange funds” button;

- when using WebPro, inside the “Wallets” section, select the “Exchange WM for WM” tab.

Webmoney services

WebMoney is a whole world. They have a huge number of all kinds of services. For example, through Merchant you can, having received a seller certificate, set up the sale of goods and services to users.

Full list of webmoney services.

Through the Webmoney debt service, you can provide loans to other users at your own interest and earn money from it. Well, and collect debts yourself, of course)

There is also a credit exchange. Plus, there is a separate obligation exchange where debt obligations (unrepaid loans) are sold.

Don't get into the lending business if you have absolutely no experience in it. It's not as simple as you think.

Naturally, through Webmoney you can top up mobile phones and pay for a bunch of services, from Steam to housing and communal services.

Through the Escrow.WebMoney service, you can use WebMoney as a guarantor for your transaction, which is popular when paying for orders to freelancers.

There is no point in describing all the services; there are a lot of them. WebMoney is a whole world around which a lot of diverse businesses are built.

Here's another important point. Webmoney takes companies that use them very seriously and is known for blocking wallets at the slightest suspicion. Let's say, when Webmoney blocked the wallet of the notorious Forex Trend, for those who understood it was a 100% signal that the company was finished. That’s what happened in the end; those who didn’t listen to this greatly regretted it. So they can be regarded as another indicator of the reliability of a particular office.

Some black offices try to get around this and accept Webmoney to a personal wallet, the number of which is provided by the manager. Do not do that!

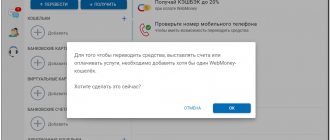

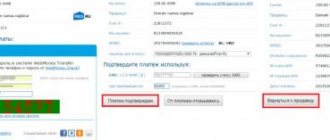

Payment for WebMoney must be made strictly through their official merchant (the browser will have the address https://merchant.webmoney.ru ), which will look like this:

At the slightest suspicion, you can always contact Webmoney arbitration and complain about the owner of any wallet.

Transfer via terminal

The use of the system's own terminals is not available in all Russian cities. You can find out about the location of the terminal in a specific city on the map on the WebMoney website. ru. As a rule, they are installed in large shopping centers or in stationary service points of system participants. If there is a device in the city, then you can use it according to the same principle as a regular bank terminal.

The user needs to find the top-up option in the menu. Next, enter the wallet number with the appropriate prefix. To transfer to a WMR wallet, indicate the prefix R, then enter the number. To prevent users from making erroneous transfers, the system indicates the WMID and the details of its owner. After entering the number, cash is deposited. Here you should pay attention to one-time and daily restrictions. If the limit is exceeded, the system will refuse to complete the transaction.

The transaction is completed after clicking on the confirm button. Deposited funds are automatically converted into title units in a 1/1 ratio. If a transfer is made to a WMZ wallet, the amount calculated at the current rate will be credited to the account. Funds arrive instantly. There is no transaction fee.

Authentication Center

Authentication consists of sending a color copy of two pages of your passport (photo page and registration page) to the WebMoney authentication center. To do this, log in to the system. Go to the Certificate tab→Passport control panel→Your documents. Submit a color copy of your passport.

Verification of your submitted data will take no more than a day.

After checking the data, the system will send you a confirmation email.

What will you need to send a transfer?

In order to be able to transfer amounts from the WM virtual wallet to a card, you need:

- Obtain a certificate of at least the Formal level. To do this, you need to send scanned copies of your identity card (pages with photograph and registration) to the system administration.

- Find out the details of the issuer. They can be found in Internet banking.

Expert opinion

Alexander Ivanovich

Financial expert

Important: A formal certificate can be obtained free of charge after verification of the submitted data. A personal certificate requires payment.

Get a formal WebMoney certificate

A formal WebMoney passport can be obtained if you fill in all your passport data in your account on the Passport tab→Passport Control Panel→Your personal data. There are no difficulties here. It is important to fill in the correct data and after checking from 10 minutes to 3 hours, the system will confirm by email that you have received a formal certificate.

Note: In addition to the formal certificate, there are higher levels of certificate: personal and initial. To withdraw WebMoney money, a formal certificate is enough, but you need to go through an authentication center.

How to perform a reverse transfer (YuMoney to WMR)

Today you can transfer funds to WebMoney only by phone number. Therefore, use the fast payment system. In this service, such transfers are made from a wallet to an account in a third-party payment system. In this case, it is necessary to take into account several nuances:

- Transfers via SBP are only available from an identified wallet.

- The telecom operator number refers to Russian service providers.

- The recipient of the payment must also have a telephone number registered in the Russian Federation and an open account in the Web Money system.

Important! When transferring from YuMoney to Web Money, you need to know in which bank the recipient has a bank card linked to the wallet on the World Bank.

The transfer procedure is available subject to the above conditions. There are no commissions for such a transaction. For one transfer, as well as within 24 hours, you can transfer a maximum of 3,500 rubles. The monthly limit is 100 thousand rubles. The translation is performed as follows:

- Go to the YuMoney mobile application.

- Select the Catalog tab.

- In the list of sections, find “Translate” and click on it.

- Select “By phone number, SBP”.

- Enter the phone number of the person you are sending the transfer to.

- In the list you will see a complete list of banks that support the fast payment system, and select the bank where the recipient has an account.

- Enter the payment amount.

- Confirm with the payment code from the message.

Transactions via mobile application

To use the WebMoney mobile application to transfer funds from one wallet to another, you need to download and install it. This is not difficult to do - the whole process takes a few minutes, and working with this Keeper is very simple.

After you install the WebMoney application, log into it and follow the instructions:

- At the very bottom of the page, find the “translate” command.

- In the window that appears, select “to wallet”.

- Indicate the number of the recipient to whom you are going to transfer money.

- Enter the amount without taking into account the service commission.

- Write a note - a message to the recipient, more than 5 characters long.

- Select the type of transfer - depending on the desired level of security.

- Click "ok".

- To pay for the created payment order, confirm the operation in any convenient way.

This completes the operation to withdraw funds from one WebMoney to another. Whatever Keeper you decide to use, all procedures are very simple, understandable and take a minimum of time. But, if you want to make a transfer without a commission, then this will not be possible - you will have to pay the standard service fee.

WM card (plastic and virtual) – where to open it, what benefits it gives

As mentioned earlier, WebMoney offers us the opportunity to make a card, both virtual and plastic. Now we will look at what the main differences are.

In the meantime, I want to show you sites where you can earn money and then withdraw it to WebMoney and more. In my experience, these are the best resources on the RuNet.

| Where can I make money right now |

| ✔Vktarget - a service for performing simple actions on social networks |

| ✔Advego is a content exchange, you can earn money by writing texts and comments |

| ✔Kwork – a freelance services store, place your services and receive orders |

| ✔Etkht - copywriting exchange, earning money from texts (writing, translations, editing) |

| ✔Qcomment – exchange of comments and social promotion |

| ✔Profitcentr – multifunctional task service |

| ✔Vkserfing – making money on social networks |

Let's start with the virtual option.

- To activate the card you will need 50 rubles.

- Card servicing fee – 0 rubles.

- There is no cash withdrawal.

- It is impossible to make a transfer from one card to another.

- There is a limit on funds for replenishment. Each operation to transfer funds to the card will write off up to 20% for each deposit.

What is known about the plastic card.

- Valid for 3 years.

- As the account certification level increases, the commission for depositing funds decreases.

- There is a daily limit on withdrawals from ATMs.

- Card maintenance fees are charged only if the card is not used for a month.

Using a virtual card is a good option, which helps you pay online with a card, just like a bank card.

Withdrawal through the exchange

If you do not want to withdraw money through a bank, you can cash out funds through the exchanger.money exchange. This method allows you to transfer money to the Qiwi, Yandex.Money and PayPal systems. To use the exchange, follow the instructions:

- Go to the exchange website.

- Select the currency: ruble, dollar or euro.

- Select a translation system.

- Filter the options by the “rate,%” column.

- Determine the most profitable option and click on this line.

The system will open a new window for you, which will contain all the information about the transaction. Carefully study all the data and click “submit a counter-application” if the conditions suit you.

What if the money doesn't come?

Despite the established deadlines, in the vast majority of cases, funds are credited to the card within the first 5 minutes. Occasionally they are delayed for a day and very rarely go within the established 5 days. There is no need to worry during this period.

If 5 days have passed and the amount has not been received, you should contact WebMoney support. Before writing, review the notifications in your personal account. In case of problems or impossibility of completing a transaction, the service notifies the user.