Start trading Forex with a trusted broker RoboForex

What does Fear and Greed mean?

Fear and Greed Index was created by CNNMoney analysts in 2022; it is based on market logic and traditional psychology. It is assumed that investor sentiment directly influences future prices.

Conventionally, the emotions of market participants can be divided into three groups: fear, greed and a transitional state between these poles - the syndrome of lost profits (Fear of missing out, or FoMO).

When the price rises, the market crowd is driven by greed, people rush to pour money into the market. FGI index at highs. But at some point, resources run out - demand cannot find adequate supply and the market is forced to turn around.

If the Fear & Greed Index is in the extreme min zone, a serious Bottom is forming in the market. The market falls, investors panic, sell assets at irrationally low prices, which pushes the market further downward with acceleration. The index is actively shifting towards fear.

Please note that this tool is not included in the Forex platforms, but you can watch it on CNN, bitstat top, and also on Alternative.me. The index is usually displayed as a scale from 0 (high fear) to 100 (high greed).

When the value approaches 100, we wait for a correction and need to record the result of purchases. There is no point in opening new trades, as the market should roll back down; for them you need to wait for the balance - the index must be at least in the 50 zone. If the index moves towards zero, the situation is considered favorable for purchases.

The red zone of the range is responsible for Fear, the green zone for Greed. The schedule is published by several companies, but the calculation principle is the same, so there is no serious difference. If you know any other resources where you can watch this kind of information online, please share with us.

The market's attitude towards stocks and cryptocurrencies is most often analyzed. Despite the same interpretations, the composition of the calculation components for stock assets and for cryptocurrencies is still different.

What is VIX?

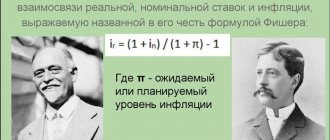

The first index we'd like to start with is the VIX, a stock index that reflects market expectations for future volatility in the US market over the next 30 days. To put it simply, this is a volatility index, more often called the investor fear index. Its values are formed from the prices of monthly options for the S&P500 index.

Let me remind you that the S&P500 includes over 500 of the largest companies by capitalization. The volatility of this index reflects the mood in the American economy.

Essentially, VIX is the volatility of the S&P500 expressed as a percentage.

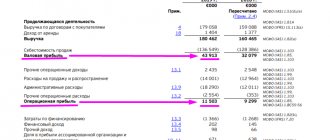

How is FGI calculated in the stock market?

The information content of the indicator is based on the assessment of volatility. The levels of Fear and Greed are determined as a result of the analysis of economic indicators - for the current day, week, week, month, year (52 weeks).

- balance of PUT/CALL options – how far sales lag behind purchases;

- Market Momentum – the position of the current S&P 500 futures price relative to its SMA over the last 125 trading days;

- Stock Price Strength – the number of NYSE shares at max versus the number of shares at min for the current year;

- Stock Price Breadth – a special McClellan index compares the volumes of rising and falling stocks;

- Safe Haven Demand - analysis of the profitability of stocks in comparison with safe assets, for example, US Treasury bonds;

- market volatility - the current value of the VIX CBOE index relative to its SMA for 50 trading days;

- Junk Bond Demand - evaluates the difference between “junk” (high-yield bond) bonds and safe securities of large corporations.

The list of companies for analysis and other data are taken from official exchange sources and the financial press.

What about Russia?

Now most countries have their own fear index, tied to a key index. In Russia, such an index is called RVI and is tied to the RTS index.

It is calculated according to the same scheme as the VIX - the volatility of the underlying index is estimated.

Correlation of RVI and RTS indices

Like the VIX, the RVI index directly correlates with the underlying RTS index and in some cases can also be used as a reference.

FGI Index in Cryptocurrency

Let us remind you: Crypto Fear and Greed Index is a representative of a large family of crypto indices, there are also, for example, The Bull & Bear Index Augmento, WhaleAlert. And this is not an asset that has quotes, but an additional analysis tool. It is used only for the BTC rate, and although it is believed that the entire crypt follows Bitcoin, the influence of the index on other altcoins is minimal.

The behavior of investors in the cryptocurrency market is more emotional, so here the index is more popular and uses the following information:

- average volatility - the current day is compared with data for the last 30 and 90 days, the weight in the overall indicator is 25%;

- global trading volume according to the largest exchanges (25%);

- the activity of the reaction of social networks to information with the Bitcoin hashtag, for example, more messages – an increase in greed (15%);

- opinion polls of relevant groups of at least 2-3 thousand (15%);

- dominance of BTC in relation to other coins on the market (10%);

- analysis of Google Trends search queries (10%).

VIX index values

It is generally accepted that a VIX value below 20 indicates that everything is calm in the market and there is a moderate upward trend. Values above 30 indicate unrest in the market. Above 40-45 - about brewing panic in the market.

The index itself directly correlates with the S&P500 index chart:

Correlation of VIX and S&P500 indices

If we look at the VIX chart throughout its existence, we can see that only twice has it been over 50 points, at the height of the mortgage crisis in 2008 and at the beginning of the pandemic in 2022. And both times this mark was reached near the so-called “bottom”.

What could this mean? That this is one of the very important, and most importantly, leading indicators for purchase. But VIX only works at the moment when the crisis has already begun. In my opinion, it is difficult to predict a collapse in the VIX, because... markets can rise for a very long time.

How to Use FGI for Regular Trades

Classic market psychology believes that the market always moves against the crowd, that is, according to the theses of the famous Buffett, one must be careful when everyone is “greedy” and take risks (“greedy”) when most are afraid to trade. Hence the conclusion:

- Fear > need to sell > increase in supply > decrease in price

- Greed > need to buy > high demand > rising prices

In fact, it turns out that the index only shows the “market” past and will always lag, especially in the cryptocurrency market. By the time he informs you about the new “fear,” social networks will already be panicking with all their might, the major players will have time to dump all their volumes, and you will only have time to jump into such a market at the very end, and this is very dangerous.

It is assumed that:

- if the market falls and assets become cheaper, then the index will show “fear”, and we are recommended to buy.

- if the market is overbought (“overheated”) and requires correction, the index will shift towards “greed” - it is recommended to sell, or even better, to stay out of the market.

In real time, the index can be interpreted as an independent volatility indicator:

- less than 20% – weak, the market is optimistic;

- 20−40% - standard, risk appetite decreases;

- 40-60% – average, fears of a market collapse are growing;

- more than 40% - panic in the market.

Become a trader with market leader broker RoboForex

Why does the VIX work?

Why does VIX work and why is this instrument a good choice? Everything is actually simple here.

When some significant events occur in a country or in the world, it is logical to assume that this will somehow affect the economy. These could be some political events, such as presidential elections. It could be a massive pandemic, like we had in 2022 and is still going on.

In such cases, investors always strive to save their money, reduce costs or protect assets from possible risks. And there are 3 options: if there is a risk of assets falling in price, then they either sell them and go completely into cash, or do nothing with them, or hedge them.

You can hedge either by opening short transactions (short) or by purchasing options to reduce the value of assets. Those. bet that the value of assets will decrease through the purchase of appropriate options. In short, options are contracts that allow you to buy or sell an asset at a predetermined price at a predetermined time.

Thus, if, for example, you have a bunch of shares from the S&P500 index and you are expecting a strong correction in this index in the next month, you can buy options that will cover your probable minus from the correction. At the same time, you do not need to sell the assets themselves from the portfolio. This is the meaning of hedging.

In the Russian Federation, options are not so popular due to the fact that the threshold for entry into this instrument is quite high, but in America everyone trades options from the cradle. This is why the VIX reacts very quickly to changes in market sentiment.

However, it is important to understand that if an index shows volatility of 30%, this does not mean that such volatility will actually occur. This suggests that market participants expect it this way. Here it would be appropriate to recall the saying “Fear has big eyes.”

Thus, VIX shows the state of the market, its direction and mood. The higher the index, the higher the fear among investors. And the more they will sell or hedge their assets. The lower, the calmer. There is a saying on Wall Street about this: “If the VIX is high, it's time to buy. When the VIX is low, look out below!” (if the VIX has risen, it’s time to buy, if it has fallen, you need to wait).

And what is the result?

To be honest, the analysis of this indicator does not provide any guarantee or clear algorithm of actions, especially for novice traders. It simply organizes some fundamental information. “Extreme fear” does not even mean a medium-term bearish trend, it is only a short-term and rather unstable signal. Modern Forex speculators generally believe that it is necessary to act against the classical recommendations: sell on the green index (“greed”), and buy on the red (“fear”). If, of course, you have time to enter the market.

The Fear and Greed Index is an interesting, but quite tricky indicator; it cannot be used as a regular strategy tool. Market sentiment will still need to be confirmed using traditional methods, but before you buy, you can use FGI as an additional filter for market noise. At the same time, check how your personal emotional state corresponds to the market one.

Is it worth building a long-term strategy on the fear&greed index?

The “extreme greed” level for the fear&greed index relatively accurately predicts a correction, and the “extreme fear” level can be considered a reliable buy signal. This is the main advantage of the index. However, I don't think it's critical for a long-term investor to monitor it regularly. We must remember that this is not a fundamental indicator, but a technical one.

I also recommend reading:

What is portfolio rebalancing and why is it so important?

Portfolio rebalancing: when is it needed and how to do it

In addition, the average size of corrections that occurred after the fear and greed index crossed the critical level is 8.7%. This is a standard drawdown that happens regularly in the market. I believe that it should not worry long-term investors.

The index can be useful if you keep a large cache of cash in anticipation of market failures like those that occurred in March 2020 or at least in October. In this case, the fear&greed index can give a signal that the time has come to enter. Or, on the contrary, it will show that now is not the best time to invest a large amount, and a correction is possible in the near future.

But even in this case, you cannot rely on only one tool. If you are looking for the optimal entry point, you should take into account the news background associated with the companies you have chosen and the indicators of other indicators. You need to take into account whether the asset you want to buy is classified as a "safe" asset. If so, then at the moment of maximum fear it may be overbought.

Another disadvantage of the fear&greed index is that its minimum value does not guarantee the growth of all securities. Even if it helps to guess the bottom of the market, this does not mean that all purchased securities will begin to grow. You should choose companies based on fundamental assessments, and not focus only on what is cheapest.

And don't forget that the fear and greed index is calculated taking into account the performance of the American stock market. This factor greatly affects Russian assets. Our stock exchange may have its own corrections and upswings due to internal reasons, the political situation or external sanctions. There is no complete analogue of this indicator, calculated on the basis of Russian quotations. This is why fear&greed index deserves attention.

I also recommend reading:

Test answers for non-qualified investors starting October 1, 2021.

Answers to tests for unqualified investors: learning and investing