Hundreds of thousands of people from different parts of the world use the global web to earn money. Some see it as an option to generate additional income. While for others, working on the Internet is their main activity. In any case, beginning freelancers are faced with the need to choose a reliable platform on which to store their earnings.

Many network users prefer the Qiwi service, which occupies a leading position in the market due to its convenience and wide functionality. The resource operates successfully not only in Russia, but in other countries around the world. Kiwi occupies a particularly strong position in the post-Soviet space. The issue of anonymous deposit and withdrawal of funds is of constant interest to service clients. After all, people do not always want to disclose financial information. Below we will talk about how to anonymously withdraw money from a Qiwi wallet?

Features of anonymous withdrawal

In Russia, at the legislative level, certain restrictions are established on the withdrawal of funds for users who have not passed identification. Just a few years ago there were no limits. But the restrictive measures, according to the government, were caused by serious reasons. We are talking about the use of payment systems to launder dirty money. To increase transparency in the field of e-commerce, limits were introduced. Large transactions are under the control of financial structures, which can always ask the identified user about the source of his income.

How to withdraw money from a Qiwi wallet anonymously? Beginning freelancers are traditionally interested in this question. After all, no one wants to come to the attention of regulatory authorities and pay taxes. It should be noted that among people working online, only a few can boast of fabulous incomes. While the earnings of most freelancers, as a rule, fully fall within the requirements of the “Anonymous” status. System participants willingly use this option to avoid unnecessary questions from the tax service.

The Qiwi Regulations grant anonymous users certain rights. We’ll talk about how to withdraw money from a Qiwi wallet anonymously later. Now let’s tell you what rights anonymous participants in the system have:

- Carry out operations the amount of which does not exceed 15,000 rubles.

- The volume of monthly transactions cannot exceed 40 thousand rubles.

- Make purchases in an online store operating on the Russian Internet, including using a Qiwi Visa card.

- Pay for services.

- Donate funds to charity.

But the owner of a wallet that has not passed the verification procedure cannot make internal transfers, nor transfer money to a card or account opened on another payment service. How can I withdraw money from Qiwi anonymously to pay for goods purchased on a foreign online platform? Unfortunately, this option is available only to verified clients of the service. A participant in the system must change his status from “Anonymous” to “Standard” and carry out internal conversion of the ruble into the required currency. Qiwi clients have access to such types of currency units as euro, dollar and even Kazakh tenge for exchange.

To change the account type, you need to enter personal data in a special form and provide a scanned copy of your passport. Qiwi clients can receive one of three statuses:

- Anonymous, thanks to which you can make an anonymous transfer in the Qiwi system.

- Standard. The user must undergo simplified identification, which, if desired, can be done online.

- Maximum. Providing this status requires full identification, which is carried out only at the company’s office.

How to open an electronic wallet - instructions for beginners

Registration of a new EC is the simplest process available to every reasonable person. Payment services strive to simplify the wallet creation algorithm as much as possible, but some steps cannot be shortened.

Expert observation: speed and ease of registration are not the main indicators of quality. Electronic money storage must first of all be reliable and convenient. Another important criterion is prevalence.

For example, almost all online stores accept WebMoney and YaD, but the Wallet One (Single Cash Desk) service is not one of those known to everyone, despite all its advantages.

For an active Internet user, the best option is to register with several EPS.

In Qiwi

To register a new Qiwi-wallet, you only need a phone number. In Russia, Qiwi is one of the most popular ECs for paying for services, entertainment and goods.

How to open an account:

- Go to the official website of the company. Learn information about the capabilities and benefits of Qiwi.

- Click on “Create wallet”.

- Enter your phone number.

- Enter the code that will be sent in the SMS message into the appropriate field.

- Create a complex password for authorization.

- Sign in.

Additional options from Qiwi - ordering plastic for offline payments, cashbacks in online stores: at the time of writing - in Nike, AliExpress, Media Markt, Lamoda, etc.

Qiwi has thousands of payment terminals throughout Russia, and the process of creating an account takes on average 1-2 minutes.

More details about this EPS in the video:

On Yandex.Money

The Yandex.Money EPS has been operating in the Russian Federation since 2002 and carries out transactions only in ruble currency.

The procedure for creating an CI is as follows:

- if you already have a mailbox in Yandex, the process is simplified - log in, go to the “Money” section and select “Open wallet”;

- identification occurs by mobile number to which you will be sent an SMS;

- After filling out all the required fields, all you have to do is log in to your account and use all its options.

If you want more opportunities, order a YaD card. It will arrive by mail in 7-14 days.

There are three levels of accounts - Anonymous, Nominal, Identified.

I will present their differences in the table:

| Accounts | Maximum amount on account, in rubles | Limit on cash withdrawal from card |

| Anonymous | 15 000 | 5 000 |

| Nominal | 60 000 | 5 000 |

| Identified | 500 000 | 100 000 |

There are several ways to pass identification: in Yandex.Money offices, in Euroset and Svyaznoy stores, through Sberbank Mobile Bank.

In WebMoney

The oldest EPS in Runet. It is successfully used not only in the Russian Federation, but also in Belarus, Ukraine, and Europe.

Currencies – rubles, hryvnia, dollars, Belarusian rubles, bitcoins, litecoins. The conversion of one unit to another within the service works, but the exchange rate is not always favorable.

Registration in WebMoney is more complicated than in other electronic payment systems and takes longer. This is explained by the developers' concern for customer safety.

Algorithm for creating an EC:

- We go to the registration page in the system (obtaining a WMID identification number), enter the phone number.

- Next, you are taken to a page with a large number of fields for entering personal data. Fill them out thoroughly and honestly, otherwise identification problems may arise in the future.

- You will receive a letter by email, which you need to open and follow further instructions: enter the verification code, confirm your phone number, enter the password that will be sent to you via SMS.

- After registering in the system, the process of creating a wallet follows. Select the appropriate tab and the currency in which you will make transactions.

- To gain access to fund management, you must obtain a certificate of authenticity. This is done by sending passport data to the administration.

Owners of WM wallets have access to several levels of certification - pseudonym certificate, formal, initial, personal. The higher the level, the more opportunities the user has.

For the convenience of users, special client programs called Keeper have been created. They are downloaded to your computer or phone and used for payments and transactions. Activating them, storing keys and transferring them to another computer is a topic for a separate discussion.

Incognito mode with Qiwi Visa Plastic card

This card is a convenient tool for cashing out money. You can also use it to pay by bank transfer both in Russia and abroad. In this case, the amount on the card and virtual wallet is considered the same. Qiwi Visa Plastic has a built-in chip for one-touch payment. Moreover, even an anonymous Qiwi transfer can be made using the innovative Pay Wave technology. The card order is carried out in your personal account. The validity period of this financial instrument is two years.

As for the price of the card, it largely depends on the functionality of the product. If Qiwi Visa Plastic has a chip built in, it will cost an order of magnitude more. The delivery method also affects the cost. Depending on the client’s wishes, the service can send the card by mail or deliver it by courier. Also, at partner outlets, anyone can purchase “plastic” from Qiwi.

The cost varies and directly depends on the chosen tool (whether it is equipped with a chip or not), as well as the delivery option. The product can be sent by postal or courier service, or purchased at a retail partner showroom.

QVP benefits include:

- Free service.

- Make secure purchases in real time.

- Deposit funds through terminals, ATMs, partner offices or Internet banking.

- Anonymous Qiwi transfer at ATMs located anywhere in the world.

- Manage card functions: block, view transaction history and change PIN code.

According to the Qiwi offer, the user has the right to register 5 digital wallets, therefore, it is possible to issue the same number of QVP cards. Thus, if a freelancer earns a large amount, he can divide it into five different accounts, and subsequently withdraw them in parts to Qiwi Visa Plastic. Tax authorities are unlikely to be interested in the minimum turnover of funds in a participant’s wallet or when withdrawing money through an ATM. By the way, when you apply for a Qiwi VisaPlastic card, there are restrictions on cash withdrawals: 5 thousand rubles daily and 40 thousand rubles monthly.

Now it’s clear how to anonymously withdraw money from a Qiwi wallet. The anonymous account type is suitable for beginning freelancers and people with below average income. Cashing out funds in incognito mode exempts the user from paying taxes. However, this does not apply to the commission fee of the payment system when withdrawing cash.

How to keep your identity secret and at the same time expand the limits in your Qiwi wallet? This is difficult to do, but possible. Let's talk about ways to anonymously withdraw funds.

To start using Qiwi wallet, there is no need to provide personal information. All you need is a verified phone number. A plastic card is ordered for the anonymous wallet, which is linked to his account. However, to receive it, you are required to indicate the recipient’s full name, which is subsequently verified by payment system employees. Plus, unidentified wallet owners cannot withdraw more than 5,000 rubles per day and 40,000 per month.

How to withdraw Yumani in cash, without a card

To do this, you can use a virtual card. It has the same functionality as the plastic one. It is allowed to withdraw money from it through contactless payment services (from Apple, Google, Samsung, etc.). You will also need to find a terminal that supports this option (NFC). The commission here is similar to the operation for withdrawing money from a plastic card - 3%, provided that the limit of 10 thousand rubles is exceeded.

There is a list of actions to be completed in order to withdraw money from YuMoney:

- After logging into your account, go to cards and create a virtual card.

- We link the card to Google pay, Apple pay, etc.

- A PIN code is sent to your phone via SMS message.

At the nearest ATM, a telephone (or other device) is applied to the reader. Then enter the PIN code and select the “Get cash without a card” option. After this, you can withdraw the money dispensed from the ATM along with the receipt.

Identification

The system has 3 user statuses: anonymous, standard and maximum. The last two require identification. To obtain “Standard” status, you provide personal data and a photocopy of your passport. In the second case, full identification with personal appearance at one of the Qiwi branches in Russia is required. To complete the procedure, employees will ask to show your passport. After this, you will be able to keep up to 600,000 rubles on your wallet balance and withdraw up to 200,000 rubles at a time and per month.

Full information about limits is in the table:

Desktop wallets

Computer storage for TONCOIN can be installed on all leading operating systems:

- Windows

- MacOS

- Linux

After downloading the appropriate file from the official cryptocurrency website, you can create your own wallet. First of all, you will be asked to write down a Seed phrase consisting of 24 words. You will need it in case you lose access to your computer or forget your password. After this, the system will check whether you have written down the Seed phrase - you will be asked to enter three random words from the available 24. If you successfully complete this step, you will be able to create a password to protect your wallet.

The interface of a desktop wallet is practically no different from a mobile one - you see your balance and buttons for receiving transfers and sending tokens to other users. On the main page (and under the Receive button) you will find your TONCOIN address.

Ways to maintain anonymity when withdrawing funds

No. 1 - Buying a wallet registered to another person

It can be ordered on forums from people who create Qiwi wallets. They sell both empty anonymous wallets linked to a SIM card and accounts identified using a scan of a passport with funds in the account. The problem is that there are scammers among the sellers, so carefully check the reviews about them in the topics.

Keep in mind that even reviews are not a guarantee of protection against losing money, so it is better to withdraw money from the purchased wallet immediately and in small quantities. You should not constantly use it for storage, since an account registered in the name of another person can be restored by him at any time, and you will lose all the money. Another risk is that Qiwi's security system may block your wallet as soon as you use it.

If you nevertheless decide to purchase someone else’s wallet, then for complete anonymity of withdrawal of funds along with your account you will need:

- SIM card in someone else's name;

- Visa Qiwi Wallet plastic card in someone else's name.

The main thing is that the name in the wallet, on the SIM card and the card match, otherwise blocking is possible, as in this case:

Remember: using payment systems and plastic cards of another person is illegal and risky. Next, we’ll look at safer ways to withdraw money.

No. 2 - withdrawal from your Qiwi wallet through exchangers to a card or EPS

Using online exchangers, you can make a transfer to any card or payment system. The scheme is simple: you send rubles to the Qiwi wallet of the exchange service, and it redirects the money to the desired address, and at the same time charges a commission for services. In this case, you are making an indirect transfer, so the recipient of the payment will not know who exactly sent it.

This can be useful if you want to hide the fact that you have electronic money when you send it to your card. Another case: you need to pay a freelancer for work if he does not have a Qiwi wallet and uses Yandex.Money or WebMoney.

In general, situations are different, and you need to be able to choose exchangers, compare rates, and calculate commissions. For some services it is hidden, others completely steal money, so the main criteria for selecting services are popularity and reliability.

Next, you need to enter the card number, holder's full name, and phone number. After this, within 15 minutes you need to transfer money to the specified wallet and click on the green button. As soon as the recipient confirms that the money has arrived, your application will be immediately processed and the money will be sent to the card. Payment processing times depend on the bank that issued it. The transfer can arrive instantly or within 7 days. Please note that the amount of system and bank commissions (in the amount of 200 rubles) is fixed, and the higher the amount, the more profitable the exchange. So, if you exchange 500 Qiwi RUB, the output will be 300, and if you exchange 10,000 Qiwi RUB, you will get 9,800 rubles.

No. 3 - transfer Qiwi to bitcoins

Bitcoin wallets are attractive because all transactions occur anonymously, so they are often used as an intermediate link in withdrawing funds from Qiwi. The method discussed above also allows you to remain incognito, but it is not always safe: law enforcement and tax authorities, in case of any suspicion, have the right to request the exchanger to provide personal data of its clients.

To make the output more secure and anonymous, you should use a different scheme:

Qiwi wallet - exchanger - Bitcoin wallet - exchanger - bank card.

- It is better to use different exchange points, rather than the same one;

- it is worth making translations after a long pause (from several hours to a day);

- It is better to operate with different amounts of money in each link of this chain.

You can use this scheme or not, at your discretion. The more transfers you make from one system to another, the greater the loss on commissions. If the amounts are small, then this is not necessary.

Transferring from Qiwi to Bitcoin is simple. Let's consider, again, using Megachange as an example.

We select the amount and direction of the exchange, and on the next page we enter the address for making the transaction, which we previously received in the Bitcoin wallet. Then we need to transfer the money to the Qiwi wallet specified in the system - and it will process the application as soon as the recipient of the payment confirms that the rubles reached him.

Use of third party resources

Popular methods for withdrawing funds from most virtual payment systems are exchange services. They charge a certain commission and help you transfer money to any card in Russia. Among the popular resources it is worth noting: CourseExpert, SmartWM, BestChange

.

They all work on the same principle. The user selects from where (from the Qiwi wallet) and where he wants to transfer money, for example, to Sberbank or Tinkoff. A list of exchangers appears in front of him that are ready to conduct a transaction for the selected request. The top ones reflect the offers with the minimum transfer fee, respectively the most profitable. As a rule, exchanges take from 2 to 10% of the transaction amount

. Therefore, you should carefully read the terms and conditions. And also, before choosing an exchange, you should read reviews so as not to encounter scammers.

After selecting a suitable resource, fill out the mini-questionnaire:

- Wallet number to be written off and amount;

- Card or phone number paired with the bank card;

- We check the amount that will be written off as interest;

- Fill in your full name and email address;

- We carry out the translation.

Most often, money is sent instantly

. However, a significant disadvantage of this method remains the high commission. Therefore, this method is suitable if others cannot be used.

Summarize

So, to ensure the anonymity of transfers from Qiwi:

- You should not disclose personal information in your wallet.

- You can register it for another person and withdraw money from a Qiwi card, which is also written on it.

- You can withdraw Qiwi using an exchanger to a card, EPS, or exchange it for bitcoins.

The Visa Qiwi Wallet payment system has a lot of obvious advantages when it comes to non-cash transactions. Is it possible to turn electronic units into familiar paper bills? It's time to get acquainted with the methods of withdrawing cash from your wallet and learn how to withdraw money from Qiwi without commission.

The developers of the payment system have provided several ways to withdraw cash from a wallet, because among Qiwi users there are many categories of recipients, and not everyone has access to one or another withdrawal method. How to convert Qiwi rubles to cash? Let's look at the most popular methods and the corresponding fees.

PayPal

In fact, PayPal is the most popular payment system in the world, but it causes a whole lot of inconvenience for Russian users. For a long time, it was impossible to withdraw money from it to your bank card, but you could link it so that when paying for purchases in the system, your card would be debited.

Of course, there is an undoubted advantage, namely the security of payments. If you paid via PayPal and the goods were delivered of poor quality, then it will not be difficult for you to get your money back.

Among other things, some Yandex services cooperate with PayPal. For example, money earned in Yandex Zen or Toloka can be withdrawn not only to Yandex wallet, but also to PayPal.

Despite all its advantages, I don't use it at all. Only a couple of times I bought some plugins and cryptocurrency on foreign sites using this service.

Ways to withdraw money from QIWI

You can withdraw money from your Qiwi wallet to your own or any other bank account. This method is convenient because it is not at all necessary to have a card in this particular bank, but it is available only to Russian citizens. To make a transfer, you need to know the account number and fill out the simple form offered on the website; crediting occurs quite quickly.

Just buy Bitcoin using Qiwi and wait for a good rate to sell.

If you have a Visa, MasterCard, Maestro plastic card, you can withdraw the required amount from Qiwi and then withdraw it in any bank in Russia or through the terminal of this bank.

The Visa payment system allows you to withdraw funds to a plastic card of any bank in the near abroad. To perform this operation, you need to know the number and expiration date. The average duration of the operation is two days.

It is very convenient to receive money from your Qiwi wallet using a Qiwi card. The card and wallet account are single, and you can cash it out at any bank in the country. The number of Qiwi cards is unlimited. The payment system also offers a Qiwi Visa card, which is very convenient for paying for goods in a store, but you can also cash out at an ATM. When withdrawing, the indicated amount arrives quickly, almost instantly.

Withdrawing cash using money transfer systems such as Contact, Unistream, Anelik and PrivatMoney is a fairly reliable method that allows you to safely withdraw large amounts, too. In 1-3 days you can receive your money.

And another way to receive cash from a Qiwi wallet is through private exchangers. The operation takes a minimal amount of time.

To have a more detailed idea of how to withdraw money from a Qiwi wallet, let's look at the step-by-step instructions.

AdvCash

The AdvCash payment system is very popular abroad, but here it is much less common. An undoubted advantage is that internal transfers occur without commission, unlike the same Yandex money, where you will be charged 0.5% for a transfer.

With AdvaCash you can transfer money to any electronic money storage facility, including cryptocurrency. You can also connect various types of currencies here, such as rubles, tenge, hryvnia, etc. Another undoubted advantage is the Russian-language interface, as well as the ability to contact technical support in Russian.

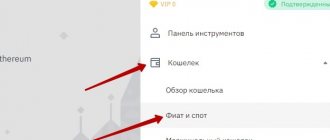

Withdrawal to a bank card

The most convenient way today is to withdraw to a bank card. Plastic card holders of any bank can use it, and cards of Visa, MasterCard and MIR payment systems are accepted. All payment systems have uniform withdrawal limits - no more than 600 thousand rubles per month for residents of the Russian Federation and no more than 150 thousand rubles per week for residents of other countries.

- Log in to your Qiwi account.

- Select the menu item “Withdrawal of money” and look for the sub-item “To a bank card”.

- We fill in the necessary data for the transfer - card number, amount of funds and account to be debited, etc.

- Click “Withdraw to card”.

Fees when making a payment are charged in the amount of 2% + 50 rubles for residents of the Russian Federation and 2% of the payment amount with an additional fee of 100 rubles for residents of other countries. The translation is completed quite quickly - in just a few seconds. In some cases, money arrives within 2 days.

Webmoney

VM has its own problems, which became especially noticeable several years ago, when, in connection with a new government order, the privacy policy was changed with the subsequent lack of access to ruble wallets for non-residents.

However, those who were able to adapt, playing by the new rules, successfully use their virtual VM accounts today, strictly observing the following conditions:

- limits, the size of which directly depends on the certificates - up to 100/400 thousand rubles. per day/month, for formal, up to 400 thousand/1 million for initial, and up to 500 thousand/2 million for personal;

- the ability to withdraw electronic funds to a bank card with a minimum commission of 0.8-2.5% + 40 rubles. for the service (relevant for Sberbank cardholders);

- the need to link card data to a personal passport for client identification.

It is important to remember that any operations within a VM can take up to 3 working days, which is not always acceptable. In addition, due to tightening rules, many users have to use third-party software to withdraw their money to a bank card.

Withdrawal to bank account

One of the reliable and relatively inexpensive ways to receive cash from a Qiwi account is withdrawal to a bank account. To carry out this operation, you must first obtain a debit account at any banking institution (an account for payroll is also suitable), and also prepare payment details. As a rule, the necessary data is specified in the banking service agreement.

- Log in to the QIwi website and in the “Transfer” menu tab, click the “To bank account” button.

- Select the desired bank to send funds.

- Select the required withdrawal type: “Urgent” or “Regular”. In the first case, the bank commission is higher than in the second.

- We fill in the details and other data to make the transfer.

- Click the “Pay” button.

If you choose the usual method of withdrawing cash, it will arrive in your account within three days. However, urgent transfers are not available in all banks.

Brief instructions with screenshots

The commission in this case is 1.6% of the payment amount, but not less than 100 rubles. As a rule, within 15 minutes the money arrives in the account, but sometimes the transfer takes from 2 to 5 days.

Attention! You can cash out no more than 15 thousand rubles in one transaction. The monthly limit is 600 thousand rubles.

How to withdraw Webmoney electronic money

When withdrawing Webmoney there are many nuances: non-obvious rules, commissions. But, if you have mastered the local security systems, then withdrawing funds will seem easy.

First, go to the payment system website and log in. Look for the login link in the upper right corner.

In the window that opens, you need to enter your username and password.

Congratulations, you have entered the site. The VM wallet interface looks something like this:

Now you can withdraw money.

Step 1. Click on the wallet from which you will withdraw funds.

Step 2. Select "Translate". This is what is called withdrawal of funds in the WebMoney system.

Then it all depends on how you want to withdraw your funds.

We withdraw money to a bank card

Step 1: Select "Other Methods" from the drop-down menu.

And then the item “Bank card”.

Step 2: A new tab will open and you will be redirected to the withdrawal page. Enter the amount and card number. Feel free to create a request.

Step 3: You will be redirected to a new page again. All that remains is to enter the verification code and confirm the withdrawal. Click on the “Confirm payment” button.

Withdrawal times and fees depend on the currency.

- For the ruble it is 2-2.5% of the amount and up to 3 days of waiting.

- For the Belarusian ruble - 3.5% and 1-5 days.

- For hryvnia there is no commission. But you will have to act through the exchange. The application will be processed within an hour and you will receive the money.

We withdraw cash using dealers

WebMoney dealers are organizations through which you can withdraw money from the system. This is quite easy to do.

Step 1: To find a dealer near you, select “find locations near you” from the drop-down menu.

Step 2. You will be redirected to the search page. Don't be intimidated by the impressive list. Not all dealers issue money: some accept funds and credit them to the account. Here is a general list of organizations that work with WebMoney.

Now you need to filter out unsuitable dealers. To do this, select your region. If it is not in the list, click on the item “all regions of Russia”. Or “...Ukraine”, “...Belarus”.

Step 3. After selecting the region, a list of settlements will open indicating dealers.

Again, not everyone is suitable. You need ones that work for output or I/O. Look for the following icons on the page:

| This is how the output points are designated. They only work to issue money. | This is what the exchanger icon looks like. They not only issue, but also accept cash and credit it to your WM account. |

Click on these icons one by one and check the results. A list of dealers willing to give you money will appear below.

Not all cities have dealers and exchangers.

Step 4. Click on the organization to find out the address and contacts.

You can receive money on the spot. I recommend contacting the dealer before going to their office. It is also worth clarifying the size of the withdrawal fee so that the lost money does not become an unpleasant surprise for you.

Transfer money to a bank account

Step 1. Select “To Bank Account” from the drop-down menu.

Step 2. Fill out the fields. Indicate your contacts and the amount to be received. In the “Insurance premium” field, enter a number that is at least 2% of the amount of money you are withdrawing. For example, for 1000 - this is at least 20 rubles.

Quote from the WebMoney website Insurance premiums ensure the safety of transaction participants

Step 3. Enter your account details and the recipient bank itself.

To ensure that your money is not lost along the way, carefully check the information you entered. Click on the “Submit Application” button.

Funds will arrive within 1 business day. The commission will be 1.8-2%.

We withdraw funds by postal order

The method is available only to residents of Russia. Transfer fee - 2%. The timing is also unpleasantly surprising: the money arrives within 7 days.

Step 1. Select “Other methods” from the drop-down menu.

Step 2. In the expanded list, find the “Postal Transfer” item.

Step 3. The system will open a new page. The fields will be filled in automatically. Check if everything is correct. All that remains is to select the currency (WMR or WMP), indicate the transfer amount and create a withdrawal request.

You can receive money from the cashier-operator at the post office. By the transfer number that will be sent to your phone or e-mail.

Withdrawing money without commissions to a QIWI Visa Plastic card

To withdraw money to a QIWI VISA card, you must first order it, as described on this page. There is no need to withdraw money to the card, because... they are already there. You have a single account for your QIWI VISA card and your QIWI wallet. You can withdraw cash from a QIWI card at any ATM of any bank.

A Qiwi Visa plastic card is one of the most convenient tools for withdrawing cash from a payment system account. At the moment, Visa Qiwi Wallet users have three types of bank cards to choose from, from the simplest to the premium product. There is a fee for issuing the card, which also serves as an annual service fee. The cheapest thing for wallet owners is the regular Qiwi Visa, its cost today is 149 rubles.

A special feature of the cards is a single balance with the Qiwi wallet. In addition, plastic has additional advantages.

Advantages of Qiwi Visa cards

- you don’t need to go to the bank to issue a card;

- no need to pay for annual service (except for the Priority card);

- no commission is charged for replenishment and non-cash payments;

- You can pay contactless (except for a regular Qiwi card).

Unfortunately, it will not be possible to withdraw money from Qiwi plastic and avoid commissions. You can use the card at any ATM, but for the transaction, 2% of the withdrawal amount and an additional 50 rubles will be withheld from the account.

Good to know! In the “Bank cards” tab you can find detailed information about the conditions for ordering cards and tariffs for their services.

How to register

Registration in Jeton Wallet does not require much effort and is available to all users - all you need is Internet access and any device. If you plan to register via phone, the mobile application can be downloaded from the AppStore or Google Play.

Below we present step-by-step instructions for registering a Jeton Wallet wallet.

1. To get started, go to the official Jeton Wallet website and click on the “Register” button in the upper right corner.

2. In the form that opens, select the country code and enter your phone number. Next, add a valid email, create a password, enter your first and last name, then your date of birth. Click “Register”.

*Be sure to provide up-to-date personal information so that your account can be verified without any problems.

3. An SMS notification with a confirmation code will be sent to the phone number you specified. It must be entered into the appropriate window on the website or mobile application.

We emphasize that in the future, every time you log into your account, the system will necessarily request a code on your phone. The user will not be able to enter the Jeton wallet without a code.

4. At the next stage, when you have already entered the code from your phone, a window will open where you will need to indicate your address information - country, registration address, city, postal code. Agree to the Terms of Use and Privacy Policy, then click “Go to Wallet”.

Jeton Wallet verification

Immediately after registering a Jeton wallet, the user must go through the account verification process. You will be able to fully use the account only after this condition is met.

The account verification process is a mandatory step for a financial institution and is known as Know your customer (KYC). This is a unique tool in the fight against money laundering, which also reduces potential risks for the financial companies themselves. Failure to comply with obligations to the regulator to collect and store data from their clients threatens companies with fines and even loss of license.

Identification of the Token wallet user is carried out in two stages - identity confirmation and address confirmation.

Documents for Jeton Wallet verification:

1. At the first stage, the identity of the account owner is verified using a passport, driver's license or ID card of your choice.

2. At the second stage, the address is checked. You must send a utility bill, a document with your residential/registration address, or a bank statement (your choice).

The documents must be:

- no older than 3 months;

- signed and sealed by the issuing institution.

The account verification process takes about a day.

Withdrawing money through exchangers

Taking into account the conditions of the methods described above for withdrawing cash from Qiwi, many are wondering how to withdraw money from Qiwi without any commissions and is it possible? Those who want to save money on fees often try to find alternative ways to withdraw money from Qiwi online. These include exchangers - special services that offer to exchange electronic tokens of various payment systems for real currencies of different countries.

- We select a suitable exchanger through BestChange monitoring - reliable and with a favorable exchange rate. To correctly assess the security of an exchange office, it is recommended to study reviews about the resource and check the duration of its operation.

- We go to the exchanger’s website and go through the registration process.

- We are looking for the right direction for the exchange, filling out the necessary details - recipient’s full name, bank card details. Attention! The card PIN code is strictly confidential information; exchange offices have no right to require this detail.

- Confirm the operation with the “Exchange” button. The transfer should be completed within 5-10 minutes. Delays may be due to the bank’s insufficient efficiency; in this case, the operation may take up to 2-3 days.

Reliable and profitable exchanger

It is worth noting that exchange offices do offer profitable commissions for users, but such methods always leave a risk of running into scammers. The Qiwi payment system does not classify exchangers as recommended withdrawal methods!

Trust Wallet - wallet for work and staking

In addition to the main function - safe storage of coins, quick sending in case of a transaction, it can be used to receive funds on a passive basis. The multi-currency wallet differs from the others in the ability to create a backup copy of assets. This feature greatly simplifies management and control. Having figured out what cryptocurrency is needed for, you can find out that most often it is used to make a profit on the difference in exchange rate - on stock exchanges or in exchangers. This application shows very productive work with them, which is emphasized in many reviews.

Withdrawal from Qiwi through money transfer systems

The opportunity to withdraw electronic currency into real money using the Contact money transfer system might seem most attractive, if not for one nuance. A 0% commission is only possible if money is sent in rubles and received in another currency. But in this case, a certain amount of funds may be lost due to conversion at the internal Qiwi Visa Wallet rate.

In other cases, fees are 2% of the transfer amount, plus an additional 50 rubles will be charged. You should not look for an operator offering more favorable conditions - the tariffs for this operation are the same for all popular money transfer systems, including Western Union and Unistream. However, one cannot fail to note the obvious advantages of withdrawing cash using this method.

Advantages of translation systems

- there is no need to open a bank account or issue a card;

- Cash issuance is carried out with only a passport and transfer number;

- You can get money almost instantly.

By clicking on the “Withdrawal” tab, select the “Through a money transfer system” method. If you want to see all systems, click the “Show all” button. "

The following systems are available:

- Transfer to a Mastercard or Maestro card;

- Transfer via CONTACT;

- Transfer to MIR card;

- Transfer to Visa card;

- Transfer to Visa and Mastercard cards of Kazakhstan banks;

- UnionPay MoneyExpress;

- TBC Bank Account;

- Rapid-Lukoil map;

- Post office;

- American Express;

- To a bank account abroad;

- Transfer to Visa and Mastercard cards abroad;

- Express Pay;

- YUNISTREAM;

- Transfer to Visa card;

- Transfer to a Mastercard or Maestro card;

- Western Union;

- Transfer to Georgia;

- Diners Club International;

- Transfers to European IBAN accounts;

- Electronic wallet ELSOM (KZT); To a bank account in Georgia.

Details about each of these methods can be found upon request through the search on our website.

- We choose a transfer system, taking into account the commission. In Unistream, Contact and Western Union it is 2.5%, in Anelik - 2%, but not less than 50 rubles.

- Fill in all the fields on the page of the selected system that opens and click “Pay.”

Wallet replenishment

How to top up Jeton Wallet is one of the main questions that worries users of the electronic system. For these purposes, you can use the method most convenient for you from the ones described below.

Online banking

Please note that this method of replenishing your wallet by bank transfer is not supported in all countries. To find out if you can deposit via online banking, simply log into your wallet and check if there is a way to fund your bank account.

If it is available, click on the appropriate tab, after which the system will redirect you to a page with a list of available banks. Enter your bank details and deposit amount. Transfer to the account is carried out instantly and without delay.

Bank card

Top-up by credit or debit card is available worldwide*. However, it is important to know that:

- Only Visa and Mastercard cards are supported;

- There is a fee for currency conversion;

- the Jeton Wallet user must be the owner of the bank card with which he replenishes the account.

You can also top up your Jeton Wallet wallet with a Trastra Visa card.

*At the time of writing, replenishing your account with a bank card is temporarily disabled.

Prepaid Jeton Card

You can top up your wallet using a Jeton prepaid card. These are Jeton digital vouchers that are used all over the world in many online stores.

To top up your wallet using a Jeton Card, you must first purchase it. Select a relevant site that sells e-gift cards, prepaid cards, game cards and subscriptions online. Select your Jeton card and place your order using your preferred payment method.

1. To fund your account using Jeton Card, go to the deposit section, then select the “Deposit Money” option.

2. Select the “JetonCash” method - “Continue”.

3. Enter the deposit amount and click “Continue”.

4. In the next window, enter your voucher number, expiration date and security code. Click Finish.

5. Once the transfer is successful, your payment will be confirmed.

Commissions for withdrawal of money

The fee for withdrawing a certain amount from an electronic wallet will differ in each case, so this point must be taken into account. When withdrawing to a plastic card, the commission will be 2% and 20 rubles for Russians and 2% plus 40 rubles for citizens in other countries. There is also a limit on the withdrawal of funds in the amount of no more than 600,000 rubles per month. When making a transfer to a bank account, each bank charges its own commission percentage.

To withdraw funds through an ATM of any bank, the commission will be 2% plus 50 rubles. When withdrawing funds using money transfers, you will have to pay from 2 to 2.5%. Today, it is not possible to withdraw funds from a Qiwi wallet without any commission; by the way, when cashing out through exchangers, it is less significant.

Trust Wallet Token: what is it?

TWT is a utility coin used exclusively within the application.

Allows you to stimulate crypto wallet users to increase their awareness. It provides the following features:

- Get a discount to buy cryptocurrency or DEX service.

- Get access to collectible tokens.

- Take part in the decision to add new digital coins and functionality.

- Conduct a review or promotion of DApps to support developers. This enables further adoption of Web0 for smartphones.

- Provide affiliate and bonus rewards. However, it can be converted into BNB or Ether, and also used to pay commissions.

- Increasing user reputation.

Digital coins are transferred or exchanged between network participants. They are used in any wallet supported by the Binance blockchain according to the BEP2 cryptocurrency standard. However, it has not yet been listed on exchanges.

Trust Wallet instructions - withdrawal of money, replenishment.

subscribe

How to Import Your Wallet into Trust Wallet [in 20 Seconds!] Find out exactly how to import a Trust Wallet crypto wallet - in less than 20 seconds

subscribe

Now you can:

- Store all your favorite cryptocurrency;

- Use the store and purchase NFTs;

- Connect to decentralized applications;

- Buy cryptocurrency with a credit card;

- Check schedules and prices.

Let's sum it up

Perhaps the tempting offers of various services for withdrawing funds from electronic wallets offer truly profitable commissions that allow users to save their personal savings.

Nevertheless, withdrawing money from Qiwi through your personal account on the payment system website offers one undeniable advantage - security. Check out more ways to cash out from your Qiwi wallet.

If a Visa Qiwi Wallet member is interested in the safety of his own funds, he should use only recommended methods.

How to top up?

To receive funds, click the “Receive” button. A QR code will appear here that needs to be sent to the user. You can also simply copy the wallet address and top it up.

Here you can use the payment request function. The application will make a publicly available link indicating the receiving address. The user can also deposit a specific amount. The link is not only passed on to other network members, but also published on social networks and instant messengers.

Crypto wallet TrustWallet / Installation, Transfers and Exchanges, Staking, DEX and DApps, Wallet Connect

subscribe

Web wallet

The online wallet for working with TONCOIN tokens is located at tonwallet.me. On the main page of the site, you can create a new wallet, import the created one (to do this you will need to enter the Seed phrase) or connect the Ledger hardware wallet.

The principle of creating a web wallet is no different from creating mobile or desktop storage: you also write down a 24-word Seed phrase, come up with a password, confirm it - and you can work with the wallet. On the wallet page you will see your current balance, buttons for receiving and sending cryptocurrency, your address and other useful information.