Ethereum is a platform for developing decentralized applications. The first version of the system was presented on July 30, 2015. The emergence of Ethereum was preceded by a large-scale ICO, which managed to collect more than 31 thousand bitcoins, which at that time was equivalent to $18.5 million.

The creation of the Ethereum cryptocurrency was a response to the lack of flexibility of Bitcoin: the lack of programming tools made it difficult to use the blockchain to create applications. The concept of Ethereum was first proposed in 2013 as an extension of the original Bitcoin protocol, but the idea did not find support in the community.

The “fuel” for the operation of the system is a token called “ether”, which is designated by the ticker ETH. As of November 2017, there are 95,743,218 coins in circulation, and the emission of cryptocurrency is not limited.

Official website: https://www.ethereum.org/ Twitter: https://twitter.com/ethereumprojectFB: https://www.facebook.com/ethereumproject

Team

The idea of creating Ethereum belongs to Vitalik Buterin, a Canadian programmer of Russian origin. For several years he was interested in cryptocurrencies and blockchain technology, wrote articles for Bitcoin Magazin and was one of its founders. At the end of 2013, Buterin published the concept of a system for creating decentralized applications, the main point of which was the addition of a scripting language to the Bitcoin protocol. When it became clear that the idea would not be supported by the community, Buterin decided to create his own cryptocurrency.

His partners were Gavin Wood and Jeffrey Wilcke, who were professional C++ and Go developers. The team also included several of Buterin’s colleagues, whose task was to promote the platform and resolve organizational issues. Jeffrey Wilkie still holds a key position at the Ethereum Foundation, a non-profit organization created in 2014 to promote the new cryptocurrency. The main ideological inspirer and face of the project remains Vitalik Buterin.

Despite the decentralized nature of the network, the Ethereum Foundation plays a key role in the development of the platform. This is largely due to the broad functionality of the protocol, which requires constant improvement. According to Buterin, Ethereum is still at the stage of an experimental project that requires constant refinement and adaptation to the real needs of users.

What's wrong with Ethereum

A selection of the best arguments against Ethereum and ETH

To be objective, it is important to look at things critically and take into account different points of view. That's why Bankless founder Ryan Sean Adams asked the crypto community to present all their best arguments against Ethereum and ETH in case he was missing something very important.

Looking ahead, I will say that a fair share of criticism came from Bitcoin maximalists, and their duty is not supposed to understand the intricacies of Ethereum. Therefore, after too superficial but widespread criticisms, I will provide links to materials that explain why the remark is inappropriate or erroneous.

Yes, we know, we know...

The result was something in the spirit of MythBusters, but the fact that Ethereum should become much better than it is now is an indisputable fact and the community understands this.

—

Criticism from the broadcasters

1. There is still no suitable solution for scalability. Each of the existing options offers trade-offs between speed, security, transaction costs, and application compatibility.

Since the most realistic way to improve scalability in the short term is through second-tier solutions that break application compatibility, this is a fair point. To maintain compatibility, development teams of different applications must coordinate and add support for any L2 solution together.

2. The emergence of new popular applications on Ethereum leads to the fact that other useful smaller applications become unusable due to increased commissions. As a result, financial applications have almost completely replaced non-financial applications, which are forced to implement second-tier solutions to make their use meaningful.

Everything is fair. This is true.

3. ETH does not become more valuable with the development of the ecosystem of decentralized applications on Ethereum. There is no point in holding ETH.

The point is to own ETH. Here are a couple of articles on this topic:

- ETH: a new money model

- ETH: Internet Bond

4. Although we have spent a lot of time and money on UX improvements, the majority of Ethereum users are still not very willing to take risks and “try something new.” The DeFi user base consists primarily of wealthy community members rather than average users. This is also due to the high threshold for entry into Ethereum. You need to learn the basics first, such as funding and using a wallet, before moving on to more advanced tactics with DeFi applications.

Judging by a local survey on BanklessRU, this is true.

5. UX is pretty bad in most cases. Of course, it can become better, but my mother will not use it until there is foolproof protection.

There is such a moment, but Ethereum is not even 6 years old, DeFi is only 2 years old... Do you really want to ask a preschooler like an adult?

6. Ethereum will take too long to scale. Competitors will take advantage of this to steal users and developers.

You need to look here. Time will show. But the most difficult element of Eth2 was implementing staking, and it is already working. Then things will go faster.

7. The Ethereum community is ready to make compromises on decentralization in order to gain new opportunities. Nodes that are completely dependent on the Infura infrastructure, Maker accepts centralized stablecoins as collateral for issuing DAI, smart contracts are completely under the control of developers, etc.

One of the most accurate and thoughtful comments.

Other concerns:

- the community in the future may make an erroneous decision regarding monetary policy under the influence of emotions, trends, or during a crisis;

- Too much regulation could stifle innovation in DeFi;

- hacking a large contract, such as the Eth2 deposit contract.

Anything can happen. Ethereum, ETH, DeFi - these are all risky and those who get involved with this should understand this.

Criticism from Bitcoiners

1. Does not scale, most of the ETH was mined in the premine, blockchain rollback after The DAO hack, breeding ground for scam ICOs.

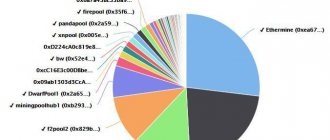

Firstly, most of the ETH was not mined at the premine. Here is a chart of the initial ETH distribution.

Red area - public sale, yellow - how much has been mined, blue - Ethereum Foundation - a non-profit organization to support the development of the Ethereum ecosystem

Most of it was sold at a crowdsale. Now compare with the distribution of tokens by other L1 networks.

You might as well blame Satoshi for the BTC premine.

As for everything else, man is stuck in the past. When was the last time you heard about an ICO?

2. Network effects simply work on Ethereum. There are technical solutions that can do everything the same, only better. ETH was simply first.

What should have sounded like criticism actually revealed the main advantage of Ethereum and Bitcoin. It’s doubly strange that a Bitcoiner said this. Instead of Ethereum, you can substitute Bitcoin in his words and they will not lose their meaning. Bitcoin and Ethereum beat out their competitors primarily due to the network effect.

Investment portfolio of crypto money

3. Ethereum's monetary policy and security model are subjective and unknown.

They may be unknown to Bitcoiners, but it will not be difficult for everyone else to know that Ethereum’s monetary policy is aimed at reducing the emission of ETH to the minimum amount necessary to ensure the security of the network.

Ethereum Monetary Policy Is Underestimated

4. Second-tier solutions are the only real way to scale

At the moment - yes. But the same can be said about Bitcoin, with the exception that no one works on or uses them on Bitcoin. There is currently only $40 million worth of BTC in the Lightning Network, while tokenized BTC on Ethereum is now valued at $5.6 billion, which is 140 times more. Moreover, large applications are gradually starting to move to L2 on Ethereum. For example, derivatives exchange Synthetix has begun the transition to Optimistic Rollups.

5. It becomes obvious that any application can be built on BTC using Shadowchain and DLC.

Nobody cares about DLC and Shadowchain. Most applications are built on Ethereum.

6. BTC is the undisputed leader in value and security.

Now yes, but this just proves once again how undervalued ETH is. An explanation of this thesis can be found in the note about Bitcoin dominance.

Instead of output

We know that Ethereum and DeFi are not flawless and have a number of problems. But the most talented people in the industry are working to solve them. There are incomparably more of them than in any other competing network. Bankless is betting that they will solve them over time. And when this becomes a fact, it turns out that the three-digit price for ether was incredibly profitable. You may agree with this or not. The final decision will still be up to the market.

If you have arguments against Ethereum that were not mentioned in the post, write them in the comments. Perhaps I'm missing something important.

Not financial advice. This blog is for educational purposes only. It does not provide investment advice or encourage the purchase or sale of assets or other financial transactions. Do your own research.

Technical features

The Ethereum platform is based on the use of smart contracts - code fragments that allow you to create decentralized applications in a way familiar to a programmer. The Solidity scripting language is in many ways similar to JavaScript, which is popular among developers, and allows the use of variables, loops, conditional branches and other constructs suitable for solving any problems that arise. Computers connected to the Ethereum network are a distributed virtual machine that can execute code written in smart contracts. The developer just needs to write a program and upload it to the blockchain, after which its execution will begin on remote nodes.

Smart contracts allow you to implement a large number of solutions based on blockchain technology:

- new digital assets and cryptocurrencies;

- fundraising (crowdfunding and ICO);

- user identification services;

- confirmation of the authenticity of files and documents;

- electronic voting and data accounting systems;

- decentralized asset exchanges.

Ethereum uses classic Proof-of-Work as a consensus mechanism: the authenticity of transactions is confirmed by the computing power of the network. As a result, cryptocurrency mining becomes available. However, not everything is so simple: the release of a new version of the protocol, code-named Serenity, is planned for 2022, which will begin the gradual transition of Ethereum to the Proof-of-Stake algorithm. In the list of advantages of switching to PoS, developers name the following factors:

- eliminating potential problems with system scaling;

- increasing job stability;

- energy efficiency.

From 2022, the share of blocks created using PoW will gradually decrease. Miners will have to accept new rules for mining ether or switch to other cryptocurrencies.

By what indicators is Ethereum catching up with Bitcoin?

The Bitcoin (BTC) network is ahead of Ethereum (ETH) in most key indicators: capitalization, trading volumes, mining profitability, number of active wallets, transactions, network hashrate. But this gap is gradually closing, and sometimes Ethereum even gets ahead. For example, in the spring, ETH miners earned more than BTC miners, and the Ethereum blockchain periodically takes the lead in the number of processed transactions.

On the day of the release of Article 1, the BTC costs $47,059, its capitalization is $873 billion. The price of 1 ETH is $3,108, capitalization is $359 billion. The difference in capitalization is 2.4 times. However, it decreases over time. For example, at the beginning of 2022 the difference was 23 times, in January 2018 - 2.7, in January 2022 - 9.36, at the beginning of this year - 6.75.

The daily trading volume with BTC is $35.7 billion, and with ETH - $18.8 billion. But at the same time, the number of ETH transactions has increased by more than 50% since the beginning of the year, while in the Bitcoin network, on the contrary, it has decreased.

Currently, the market share of VTS is 44%, ETH is 18.1%. Since the beginning of the year, Bitcoin dominance has decreased by 32%, while the share of ETH has increased by only 5.5%.

Graphs of shares of military-technical cooperation and ETH in the market. Most of the time, PTS is the clear leader. Only in June 2022, the share of VTS dropped to 37.9%, and the share of ETN rose to 33.2%.

What is gas?

Executing someone else's code creates a significant load on the nodes that support the network. To stimulate their activity, the concept of “gas” was introduced - payment for performing standard tasks. For example, adding numbers costs 3 gas, and multiplying costs 5 gas. A typical transfer of cryptocurrency to another user also requires the use of a small amount of fuel. Thus, the amount of gas required to perform an operation directly depends on its complexity.

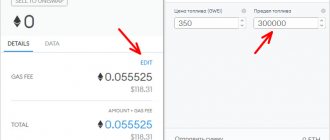

But where does the gas come from if the main coin in the system is ether? It's simple: if the amount of gas to perform an operation is a fixed value, then the user sets its cost independently. In fact, it is the gas price that is analogous to the commission in the Bitcoin system, which affects the priority of transaction processing. The higher the gas price set by the user, the faster the desired operation will be completed.

For example, the cost of transferring cryptocurrency to another address is always 21,000 gas. The user can specify different gas prices, expressed in ethers, or more precisely in gwei, which corresponds to 0.000000001 ETH. With a gas price of 4 gwei, the cost of the transfer will be 0.00008 ETH, and it is this amount that will be debited from the user’s wallet as a commission. In practice, to change the cost of gas in the official Mist wallet, a convenient slider is used, so the user does not need to independently calculate the cost of the transfer.

Advantages and disadvantages of the system

Ethereum is the only fully functional platform for creating decentralized applications. Competing solutions such as Lisk or Stratis are currently in their early stages and cannot be used to solve practical problems. Due to the lack of alternatives, Ethereum has become the most popular tool for developing smart contracts.

The most popular application for Ethereum is the creation of new assets, most of which are distributed among users as a result of ICOs. The explosive growth of this type of crowdfunding contributed to the rise in popularity of Ethereum: within two years, the value of the cryptocurrency increased several hundredfold. However, some fundraising campaigns are hidden behind fraudulent schemes, which contributes to increased uncertainty in the cryptocurrency market and can negatively impact the long-term reputation of the platform.

The main problem of Ethereum remains the influence of the human factor: errors in writing smart contracts can lead to losses amounting to tens of millions of dollars. In June 2016, funds from The DAO project were stolen for a total of more than $60 million. The theft was made possible due to a bug in The DAO's code, which was discovered by an unknown hacker. To return the stolen funds, a network hard fork was carried out, after which an alternative chain called Ethereum Classic was formed.

In 2022, users of the Parity online wallet experienced two shocks at once. In July, attackers stole more than 153,000 ETH from user accounts, which corresponded to an amount of $30 million. To hack, hackers used a bug in the code of one of the smart contracts. A few months later, many Parity users again encountered serious problems. This time, due to another error in the smart contract, tokens worth more than $150 million were frozen.

The high vulnerability of smart contracts is a serious concern for the crypto community. According to many experts, protocol developers should reconsider their approach to system security and tighten the rules for writing code. At the moment, the stability of the smart contract depends solely on the professionalism of the developer and his ability to provide for non-standard cases of program behavior.

Why doesn't Ethereum threaten Bitcoin's status?

Despite all the technical advantages of Ethereum and the potential of its use, its future leadership is not at all guaranteed.

- Firstly, some of Bitcoin’s problems, due to which they predict it will hopelessly lag behind Ether, can be solved. For example, we have already written that Bitcoin mining can be environmentally friendly - most of the coin’s production can be converted to using energy from renewable sources. The use of second-layer solutions, primarily the Lightning Network, can also solve the problems of slow and expensive transactions.

- Secondly, Ethereum is not the only technically advanced project on which DeFi smart contracts are based. There are dozens of strong alternatives on the market, such as Cardano, Solana and Polkadot.

- Thirdly, the value of Bitcoin is not in its technology - it has long been perceived as a digital analogue of gold. The asset has every chance of becoming a generally accepted form of accumulation and preservation of wealth. And for these purposes, transaction speed is not important. Trust and security are much more important. In this regard, Bitcoin has no equal in the crypto market.

Most likely, in the coming years, the speed of development and price growth of ETH will be higher than that of military-technical cooperation. Perhaps Ether will overtake the first cryptocurrency in terms of capitalization, and maybe also in price and market share. But even this will not deprive Bitcoin of its status as digital gold.

Ethereum is much more technologically advanced than Bitcoin and is the basis for a huge ecosystem. But it does not compete directly with Bitcoin. And if Ether overtakes Bitcoin by some indicators, this does not mean that oblivion awaits the first cryptocurrency.

Dmitry Machikhin, partner at GMT Legal, noted that even as a means of payment, ether does not have any special advantages over Bitcoin:

“There are a lot of shortcomings, for example, inaccuracies in emission, premine, the possibility of changing the basic protocol, etc.”

The expert believes that Bitcoin can lose its leader status only if a project appears on the market that can copy the main properties of BTC and will be better than it in them. But so far there is nothing similar on the market.

“Ether may overtake Bitcoin in market capitalization, but this will not have a long-term impact on the market. Bitcoin is the strongest brand in the crypto market, and depriving it of its pioneering and absolute leader status is like trying to replace the Earth’s core. At least in the next few decades ,” says Dmitry Machikhin.

Sergey Khitrov, founder and CEO of Listing.Help, believes that ETH will not be able to take the place of BTC, since these projects face completely different tasks. But in the event of serious changes in the market, ETN may well overtake BTC in capitalization. For example, this could be facilitated by the transition of Ether to state 2.0 or tightening regulation of Bitcoin.

Sergey Khitrov noted that in order for ETH (or any other project) to take first place in capitalization and overtake BTC, a combination of a number of factors will be required:

- network stability and security;

- speed and low cost of transactions;

- breadth of cryptocurrency use; recognition from government regulators;

- demand from large institutional companies;

- Widely recognized by private investors.

But now no cryptocurrency project has such a combination of factors. Therefore, in the near future, BTC will retain its place as the leader among cryptocurrencies in terms of capitalization.

In the debate over Ether's prospects of becoming a market leader for investors, there is a practical takeaway: don't bet everything on one asset.

How to create an Ethereum wallet

Despite the availability of online wallets for working with Ethereum, the most secure way to store this cryptocurrency remains the official Mist wallet, which is installed on the user’s computer. Before downloading it, you should take care in advance of having free space on your hard drive: for its work, the program downloads the full version of the blockchain with a capacity of more than 140 gigabytes. You also need to be prepared for the fact that the initial synchronization process will take up to several days.

Mist may not be the most convenient wallet for Ethereum. However, regular attacks on online wallets show that only an official client is able to provide a sufficient level of reliability and security.

To download Mist, just click the corresponding button on the main page of the official website.

When you first launch the program, you will be prompted to select a network to work with. Click “Use the main network”.

The next step is to import your existing Ethereum wallet. For new users, this item is not relevant and must be skipped using the “Skip” button.

The next step is also optional: the program will offer to top up your wallet with bitcoins using the ShapeShift service. In any case, it is preferable to replenish the wallet after synchronizing the blockchain, so click “Next”.

In the next window you need to set a password to access your wallet. Important: it is impossible to recover a forgotten password! After setting the password, the program will issue a reminder about the need for backup. We'll come back to this later, but for now just click OK. The blockchain will begin downloading, which usually takes from several hours to 2-3 days. Wallet functions will be unavailable until synchronization is complete. You can view the download status in the status bar.

If at any point the synchronization process freezes, try restarting your computer.

After synchronization is completed, the main program window will open. First of all, you need to save a backup copy of your wallet using the menu Accounts - Backup - Accounts.

To find out your address for receiving ether, click on the account name in the main window of the program.

To send funds, use the “Send” button in the top navigation bar. In most cases, it is enough to enter the recipient's address and the transfer amount, leaving the remaining parameters as default.

How to buy Ethereum

Thanks to the growing popularity of Ethereum, a large number of options for purchasing it have appeared. Typically, purchasing ETH tokens comes down to four different methods.

- Use of virtual exchangers that accept bank cards and popular payment systems. One of the easiest ways to buy. The current list of exchange offices and reviews of their work can be found on the website bestchange.ru.

- Buy with Bitcoin using the built-in features of the Mist wallet. Practice shows that using this service can lead to problems in receiving ether, and it is better to refrain from using it.

- Buying with bitcoins on cryptocurrency exchanges. The best option for those who already have bitcoin.

- Purchasing with fiat money on cryptocurrency exchanges. A good way to purchase large amounts of ether.

How soon can Ethereum overtake Bitcoin?

Ethereum's versatility has attracted the attention of prominent financiers and investors, who view the coin as an investment opportunity and the most likely competitor to Bitcoin.

A number of experts believe that Ethereum will one day, and perhaps within the next few years, overtake BTC in terms of capitalization and use cases. For example, John Wu, president of Ava Labs, the developer of Avalanche, Dan Morehead, founder of the large cryptocurrency investment fund Pantera Capital, Mike Novogratz, founder and CEO of the crypto investment company Galaxy Digital, Nathan Cox, chief investment officer of the Two Prime crypto fund, Mark Cuban, think so. Billionaire investor, Charles Hoskinson, founder of Cardano and co-founder of Ethereum.

A May report from investment bank Goldman Sachs said:

“Ethereum is the cryptocurrency with the highest real use potential... and the most popular smart contract application development platform.”

Given the importance of real-world use cases in determining the true value of a project, investment bank experts believe that ETH has every chance to replace BTC as the main digital asset. They believe that Bitcoin's current leadership is based only on first-mover advantages and could easily be lost. The most likely candidate for the role of the new leader is Ethereum.

For ETH to catch up with BTC in capitalization, its price must rise to $8,000. But with such a bull market, Bitcoin is unlikely to stand still, therefore, in order to confidently overtake Bitcoin, Ether needs to gain a foothold at the level of $10,000 to $20,000. Experts predict that the coin will price of $4,000 - $5,000 by the end of the year, and up to $10,000 - $20,000 over the coming years. There is even a point of view that ETH could reach $100,000 by 2025.

On which exchanges is Ethereum traded?

You can purchase ETH tokens for rubles or dollars on the following exchanges:

- YoBit

- cex.io

- Exmo

- Livecoin

- Bitfinex

- Bitstamp

- Kraken

The last three exchanges require complex verification, which requires the provision of scanned copies of documents containing information about the user’s identity and residential address. However, it is these sites that have the greatest liquidity, which can be important when purchasing large amounts of ether or actively trading against the dollar.

Trading Ethereum against bitcoin and other cryptocurrencies, in addition to the listed exchanges, is available on the following trading platforms:

- Bittrex

- Poloniex

- Huobi

- HitBTC

- Liqui

- Cryptopia