Volumes is the easiest technical indicator for a trader to understand. It reflects the real volume (turnover) of trading by the number of shares, futures, currencies or options bought and sold over a selected period of time.

How can an ordinary currency speculator take advantage of the advantages of this tool in Forex trading (and are there any at all?), what you should pay close attention to, the strengths and weaknesses of the indicator - let's figure it out.

Indicator characteristics

Platform : Any Currency pairs : any Time frame : any Trading time : around the clock Recommended brokers : Alpari, RoboForex, NPBFX

In the Forex market, Volumes counts the number of ticks - triggered orders of traders without taking into account the volume of purchases or sales. They are reflected most correctly only on ECN accounts that carry out direct transactions with liquidity providers and clients of other brokers on the unified interbank platform.

Volume is an important addition to price action for understanding the “strength” of a trend and the level of liquidity at the current moment of the session. This explains why the indicator is included in the standard technical analysis tools of almost all trading platforms.

Where to get information from?

In MetaTrader4, in the standard set of indicators, the situation with volumes is deplorable; only 4 algorithms are available, and even those allow you to work only with tick data. In addition to MT4, you can work with this information through other terminals.

For example, ATAS has the opportunity to work with a footprint. , cluster analysis of a graph is well implemented in the terminal . The only downside is that the demo is available for a limited time. After it expires, you will have to register your training account again.

For QUIK there are good indicators of horizontal/vertical volumes. on sb-professional.com , however, their terminal is now paid . Among the terminals I would also like to mention NinjaTrader and ToS .

You can also view data on futures volumes here . True, working with information is not particularly convenient, and a time delay .

Cluster Delta was freely available , but since 2013 they have become paid . Moreover, the indicators themselves can be downloaded, but they will only work if you top up your account on clusterdelta.com , otherwise access to the information will be prohibited.

I liked the developments of the Delta Cluster because the trader received everything he needed to work using VSA. There are regular and horizontal volumes, and delta volumes. In principle, if a trader constantly uses VSA in his work, then he can pay for access, but for beginners it is better to experiment in the same MT4. You should not count on the Delta Cluster indicators being hacked. The fact is that access to information from the site . A hacked indicator simply will not have access to it.

If you have just started getting acquainted with volumes, then you can limit yourself to free tools for MT4 or other trading terminals. I will also provide a table with the conditions of major brokers.

| Company | Just2trade | United Traders | BKS | Tinkoff investments |

| Minimum deposit | From $100 | $300 | from 50,000 rub. | Unlimited, you can even buy 1 share, they recommend starting from RUB 30,000. |

| Commission per cycle (buy + sell trade) | 0.006 USD per share (min. 1.5 USD), 0.25 USD for each application. that is, per lap – $3.50 | “Beginner” tariff – $0.02 per share Average $4 per round | At the “Investor” tariff – 0.1% of the transaction amount, at the “Trader” tariff it is reduced to 0.015% | 0.3% for the “Investor” tariff |

| Additional charges | The ROX platform will cost at least $39/month. (for the American market), for an additional $34.50 they connect Canada/TSE, Level II On the over-the-counter market, the additional fee is 0.75% of the transaction volume (minimum $30), in the case of dividends - 3% from the issuer (minimum $3) | On the Day Trader tariff, they charge $60/month for the Aurora platform, free on other plans | If the account has less than 30,000 rubles - 300 rubles/month. for access to QUIK and 200 rub./month. for access to the mobile version of QUIK, | — |

| Account maintenance cost | $5/€5/350 rub. reduced by the amount of the commission paid | — | 0 RUR/ month on the “Investor” tariff. On other tariffs, funds are debited only if there was activity on the account this month | Free for the "Investor" tariff |

| Leverage | for Forex Up to 1 to 500 for stocks up to 1 to 20 (day) to 1 to 5 (night) | 1 to 20 on the Day Trader tariff, this is the maximum leverage (daily) | Calculated for each share, within the range of 1 to 2 – 1 to 5 | Calculated for different instruments, the calculation is linked to the risk rate |

| Margin call | -90% | Standard -30% of the deposit, in technical terms. support can be set -80% | Calculated based on the risk for each security | Depends on the asset |

| Trading terminals | MetaTrader5, ROX | Aurora, Sterling Trader, Fusion, Laser Trader, Volfix.Net, Pair Trader | My broker, QUIK, WebQUIK, mobile QUIK, MetaTrader5 | The purchase of shares is implemented like an online store, professional software is not used |

| Available markets for trading | Forex, American, European and other stock markets, cryptocurrency | American and other stock markets, more than 10,000 assets in total, cryptocurrency | Foreign exchange, stock, commodity markets, there is access to foreign exchanges | American and Russian stock markets |

| License | CySEC | Lightweight license from the Central Bank of the Russian Federation | TSB RF | TSB RF |

| Open an account | Open an account | Open an account | Open an account |

Description of the indicator operation

The Volumes indicator does not contain complex formulas - it is a tick counter for a specific period of time equal to the selected timeframe. Ticks are displayed in real time in the form of a cumulative histogram that changes as new transactions appear on the market.

As soon as the candle closes, a new bar appears on the chart, colored in one of two colors, which has nothing to do with the price change:

- The histogram below the previous value is colored red;

- The histogram above the previous value is colored green.

conclusions

Volumes are important in trading; they can be used both as the basis of a trading strategy and as one of the additional filters (for example, assessing the truth of a level breakout). I do not urge you to abandon your own trading methods and immediately start trading only on the basis of VSA, but it is worth taking a closer look at this method of market analysis .

I will end my review here, I hope it was useful for you. Subscribe to my blog updates, this is not the last topic that I would like to discuss with you. See you in touch!

If you find an error in the text, please select a piece of text and press Ctrl+Enter. Thanks for helping my blog get better!

Using the indicator in trading

Volumes is an information indicator that is never used separately, only as part of strategies as an additional filter.

The current level of volumes is a fairly variable value, depending on many factors: seasonality, day of the week, time of day, etc. Traders sometimes add a long-period moving average to a histogram to give a relative estimate of trading turnover.

Market theory and practice make volume growth a prerequisite for a trend. Trading turnover below average values will help the trader predict a flat or the end of a trend. In the first case, low volume indicators will save the trader from “in the saw” transactions, allowing him to enter at the moment the trend continues. In the second case, they will work as a filter, stopping purchases at the top of the trend.

Consecutive red histograms on a rising or falling trend reveal exchange rate manipulation by market makers who continue to artificially maintain directional movement. Volumes gives a signal to refrain from new transactions, ignoring entry points for the trading system until correction occurs.

On a daily chart, three declining volume bars in a row may indicate a high probability of a three-bar pattern correction candle appearing. It is determined by connecting the opening price of the first candle, which led to the formation of the red histogram bar, with the closing price of the third candle.

Abnormally high volumes of the Volumes indicator are another sign of a possible end to the trend. They occur at the end of a global movement, when large players invest very heavily in reversing long-term trends.

A sharp increase in the Volumes histogram often occurs during local trends, but does not necessarily lead to a reversal. After a short correction and flat, the movement may continue in the same direction, but the trader will receive a signal that allows him to protect the current profit or open a countertrend trade.

On-Balance Volume (OBV)

Trading volume is a valuable indicator in itself, and OBV allows you to extract even more data.

This indicator measures the cumulative selling/buying pressure by adding volume on days of upward price movements and subtracting volume on days of falling prices. Ideally, volume confirms trends. A rising price usually goes along with a growing trading volume, and vice versa, the volume decreases when it falls.

In the chart below, Netflix shares are rising, as is trading volume. And since OBV did not fall below the trend line, this is a good indicator that the price will continue to rise, especially after small declines.

Read reviews, market analytics and investment ideas on the ITI Capital Telegram channel

Description of settings

The Volumes indicator is located in the “Volumes” section, the “Indicators” option, the “Insert” menu of the Metatrader 4 trading platform. The settings window does not contain numerical parameters, only the selection of the thickness and color of the histogram bars.

On the Levels tab, a trader can set specific markers to indicate abnormal historical values. As shown above, they can indicate global reversal points for long-term trends in a currency pair.

Basic Concepts

In relation to financial markets, the term “volume” includes the total number of contracts for a trading asset (currency, stock, futures, option, derivative) per unit of time of a trading session or day. Two types of data are used:

- exchange (real, “clean”) . Both the number of transactions and their monetary volume, opening/closing levels are visible.

- Teak . Only the number of transactions per unit of time.

A volume indicator that works with stock data gives better results, since the trader can assess the real market interest in specific levels and price zones, but as we will show later, it is possible to trade profitably using a tick histogram.

Displaying market volumes on a price chart.

You should not attach much weight to exact numbers, especially in Forex. The dynamics of activity changes are more valuable, and you need to look at how they relate to other tools and patterns. First of all, we pay attention to:

- histogram column size : small, medium, large. We analyze at least 10-15 past periods;

- transaction information. For example, open interest in derivatives such as currency futures. You can see not only the levels where there are the most contracts, but also who currently dominates the market: market makers, small players, speculators or hedgers.

Thus, the volume indicator for MT4, first of all, looks for various “ abnormal ” situations that have a significant impact on the market: entry and exit of “smart” money, changes in the balance between buyers/sellers, determination of the truth of breakouts of levels.

Convergence and divergence

Another parameter that requires attention and can influence the final decision to open a position is the convergence or divergence of the price and indicator readings. Convergence or divergence, in stock exchange parlance.

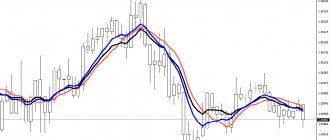

The figure below shows a pronounced divergence, when an increase in quotes for some time is not confirmed by a corresponding increase in the number of trading operations. This clearly characterizes the trend as weak or weakening; the trading strategy in this case involves closing existing positions and searching for better opportunities to enter; it is possible to work with an alert to signal the stock player about the occurrence of the conditions he expects to enter the market. Or hold, but with strict stop losses set for previous candles. In this case, if preconditions for a reversal appear, it will be possible to maintain the previously obtained profit.

Features of using technical tools

All free Forex trading volume indicators for MT4/MT5/Quik and other terminals can be divided into two large groups based on their usage features and construction methods:

1) Those that repeat the price chart with different degrees of smoothing

- Accumulation Distribution or A/D indicator - indicator-Accumulation_Distribution-MT4;

- OBV - .

2) Oscillators that display information in the format of a chart of changes in market sentiment (Klinger indicator, Chaikin oscillator - you can download it from the link)

Regardless of the group and type of instrument, the rules and features of their work are almost the same.

Operating principles of indicators:

- When volumes decrease, we can talk about a decrease in the interest of participants in a currency instrument, which often leads to price consolidation or a quick change in trend direction.

- An increase indicates an increase in interest in the asset, the likelihood of a trend continuation or a sharp change in trend direction.

- When values slowly decline, the price may fluctuate greatly due to the fact that major participants have already left the market and the actions of small traders have a greater influence on the situation than usual.

- The appearance of indicator peaks indicates the likelihood of a trend reversal.