Bitcoin Cash cryptocurrency Bitcoin

Cash cryptocurrency was created as a hard fork of Bitcoin. This happened in the summer of 2022, and this event became one of the most scandalous and memorable in the world of cryptocurrencies, as the community was divided into two camps. The main disagreements concerned the block size - in Bitcoin Cash up to 8 MB versus 1 MB for Bitcoin.

In this article we will tell the whole truth about the reasons for the appearance and technical features of the coin, why it is called the “true Bitcoin” and what role Roger Ver played in the fate of the project. You will also find out what caused the discord in the Bitcoin Cash team and what the current state of affairs is.

- What is Bitcoin Cash

- Technology and features of Bitcoin Cash

- Jesus or Judas? What did Roger Ver do?

- Another split?

- How to buy Bitcoin Cash

- Where to store

- Bitcoin Cash rate and capitalization

- Bitcoin Cash Problems

- Advantages and disadvantages

What is Bitcoin Cash

Anonymity Bitcoin Cash

Bitcoin Cash

– an open source coin. It was created as a result of a hard fork of Bitcoin, as the community was divided, mainly regarding the block size. Promoted by its adherents as the “true Bitcoin”, i.e. First of all, it means that the coin is suitable for use as a means of payment, and also that it is completely decentralized (however, there are nuances here, which are discussed below). Bitcoin Cash moved to a separate blockchain in August 2022. According to the CoinMarketCap rating, it ranks 10th.

Bitcoin has been the main leader among cryptocurrencies for 10 years now and sets the direction for the development of the cryptocurrency market. However, despite its wild popularity, Bitcoin, like everything in this world, turned out to be imperfect.

As a result of an ill-considered move associated with limiting the block size to 1 MB, Bitcoin soon faced a scalability problem. Fans of digital gold passionately discussed possible methods to solve this problem, but could not come to a consensus. As a result of the united work of concerned developers, on August 1, 2022, a new player appeared on the cryptocurrency market, a hard fork of Bitcoin - the Bitcoin Cash cryptocurrency.

A new forked coin was launched in the form of the so-called User Activated Hard Fork (UAHF). Behind the project is a strong team of professionals, which includes the developer of the popular ViaBTC mining pool, Hypo Yang, Bitmain co-founder Jian Wu, as well as one of the most famous crypto investors Roger Ver.

☝️

The official website of Bitcoin Cash defines this coin as an electronic currency available throughout the world, which continues the idea of Bitcoin. Bitcoin Cash is completely decentralized and does not require third parties to confirm or verify transactions.

Bitcoin Cash private keys

According to the developers, the main goal of creating the Bitcoin Cash cryptocurrency is not only to eliminate all the shortcomings that Bitcoin has, but also to increase the value and significance of the coin in the cryptocurrency world.

The entire strategy of the Bitcoin Cash team is aimed at increasing the block size to enable its users to make more transactions with minimal time investment.

☝️

Therefore, the first thing the Bitcoin Cash team brought was to increase the block size to 8 MB to increase the scalability of the blockchain.

In addition, the project team is focused on solving the following problems:

- Significantly increase the number of transactions processed on the network;

- Ensure uninterrupted operation of the system, taking into account scalability;

- Take care to properly protect user data and their transactions.

In most cases, the Bitcoin Cash cryptocurrency is indicated on cryptocurrency exchanges with the ticker BCH, in rare cases there may be other versions - BCC or XBC.

In fact, the developers have created a unique coin that can completely replace Bitcoin. Thousands of investors, small and large companies supported the new project and did everything to increase market coverage. Thus, already in the first year of the project’s existence, the Bitcoin Cash team achieved stunning results and brought the coin into the TOP 10 cryptocurrencies in the world.

Bitcoin Cash Official Website

More information about Bitcoin Cash can be found in the video below:

Bitcoin Cash Cryptocurrency Review

conclusions

A comparison of Bitcoin vs Bitcoin Cash showed that BTC is superior to BCH in terms of investment returns . Despite this, both coins remain among the leaders in the capitalization rating.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action based on information published on this site is taken by the reader solely at his own risk. In our Knowledge Base section, our priority is to provide high quality information. We carefully identify, research and create educational content that is useful to our readers. To maintain these high standards and continue to produce quality content, our partners may compensate us for featuring them in our articles. However, such payments do not in any way affect the processes of creating objective, honest and useful content.

Technology and features of Bitcoin Cash

BCH technology

Unlike Bitcoin, which uses SegWit technology, Bitcoin Cash cryptocurrency uses SigHash

. Using this algorithm protects the network from the most common problem faced by post-fork cryptocurrencies – replay attakcs.

☝️

Interesting! A replay attack is a data transmission that is maliciously repeated or delayed.

In the context of blockchain technology, a transaction is duplicated from one block to another. For example, Alice sends 5 BCH to Bob, but as a result of the attack, she resends 5 BCH to him, although she did not intend to do so.

The SigHash algorithm recognizes duplicate transactions and invalidates them, thereby providing users with confidence in the security of transactions on the network.

In addition, the Bitcoin Cash cryptocurrency continues to follow the path of increasing the block size, so in May last year the limit was raised from 8 to 32 MB. Today, transfers on the Bitcoin Cash network cost an average of $0.05 – $0.010. At the same time, the transaction processing time on the BCH network is only 2.5 minutes, which is significantly faster than many other cryptocurrencies.

But here it is important to note that the current value of the original Bitcoin is significantly higher, and its blockchain processes tens of times more transactions daily. Therefore, it is difficult to say whether large blocks will be as effective as they are now, given equal conditions.

BCH/USD price history

- Last week

- Last month

- Last year

- Last two years

- Maximum

- Daily

- Weekly

- Monthly

| date | Closing | Change | Change(%) | Opening | Max. | Min. |

| Jan 13, 2022 | 384.30 | 0.65 | 0.17% | 383.65 | 385.35 | 379.15 |

| Jan 12, 2022 | 383.90 | 14.20 | 3.84% | 369.70 | 385.35 | 367.60 |

| Jan 11, 2022 | 369.90 | 6.50 | 1.79% | 363.40 | 374.90 | 361.20 |

| Jan 10, 2022 | 363.40 | -13.60 | -3.61% | 377.00 | 378.30 | 347.35 |

| Jan 9, 2022 | 376.90 | 3.85 | 1.03% | 373.05 | 381.20 | 367.95 |

| Jan 8, 2022 | 372.90 | -13.05 | -3.38% | 385.95 | 391.85 | 361.50 |

| Jan 7, 2022 | 385.90 | -14.00 | -3.50% | 399.90 | 401.80 | 375.20 |

| Jan 6, 2022 | 399.90 | 0.40 | 0.10% | 399.50 | 402.95 | 387.25 |

| Jan 5, 2022 | 399.75 | -27.30 | -6.39% | 427.05 | 432.75 | 390.65 |

| Jan 4, 2022 | 427.10 | -7.85 | -1.80% | 434.95 | 439.85 | 425.25 |

| Jan 3, 2022 | 434.90 | -13.00 | -2.90% | 447.90 | 447.95 | 431.10 |

| Jan 2, 2022 | 447.70 | 3.00 | 0.67% | 444.70 | 452.30 | 441.95 |

| Jan 1, 2022 | 444.55 | 14.55 | 3.38% | 430.00 | 445.80 | 429.95 |

| Dec 31, 2021 | 429.95 | -1.35 | -0.31% | 431.30 | 437.15 | 418.50 |

| Dec 30, 2021 | 431.40 | 1.40 | 0.33% | 430.00 | 437.10 | 422.80 |

| Dec 29, 2021 | 430.00 | -8.75 | -1.99% | 438.75 | 445.60 | 426.40 |

| Dec 28, 2021 | 438.75 | -26.45 | -5.69% | 465.20 | 465.20 | 436.75 |

| Dec 27, 2021 | 465.20 | 13.70 | 3.03% | 451.50 | 475.95 | 446.95 |

| Dec 26, 2021 | 451.50 | -3.70 | -0.81% | 455.20 | 455.30 | 443.85 |

| Dec 25, 2021 | 455.15 | 3.20 | 0.71% | 451.95 | 460.65 | 447.05 |

Last winter was the worst for the cryptocurrency market: prices were minimal, and Bitcoin Cash could be bought for $80. After a slight increase, the price rose to $534, but then fell again, which negatively affected the Bitcoin Cash rate.

Jesus or Judas? What did Roger Ver do?

Roger Ver

Well-known multimillionaire in the crypto community, Roger Ver played an important role in the emergence of the Bitcoin Cash cryptocurrency. It was he who, even before the fork, insisted on increasing the block size in the Bitcoin network. And in 2017, he led important processes during the hard fork and began to actively promote the new cryptocurrency.

But initially, Ver was simply a fan of Bitcoin and was one of the first who believed in the future of digital money and began investing in Bitcoin back in early 2011. Not only has he invested millions of dollars in various cryptocurrency startups, including Kraken, Ripple, Bitpay, Blockchain.com, Bitcoin.com, etc. He is also the founder of one of the most popular Bitcoin wallets, Blockchain.info, and the Bitcoinstore.com trading platform, where users can purchase various goods for Bitcoin.

Before his deep involvement with cryptocurrencies, Roger Ver was a successful businessman. While still in college, he founded the company MemoryDealers.com, which sold computer components. Ver spent only $1,400 to open the business and within a few years earned his first million from it. The company has been bringing profit to Ver for 10 years now, and his clients already include such major players as Cisco, HP and Vodafone. By the way, MemoryDealers became one of the first companies to accept Bitcoin as payment.

Roger Ver also managed to try his hand at politics, trying to push his beliefs about the freedom of the financial sector from government control and regulation. The experience was unsuccessful and did more harm than good. Wehr was not particularly selective in his statements and made enemies in the US Bureau of Alcohol, Tobacco, Firearms and Explosives. This played a cruel joke on him.

In 2002, a businessman was sentenced to 10 months in prison for selling firecrackers without a license on the online auction site eBay. Ver and hundreds of other users sold firecrackers to farmers to scare animals away from their fields. Usually sellers of such products got by with a simple warning, but in the case of Ver, everything could not be so simple. The management made every effort to get the most out of the young businessman. Initially, he was threatened with 8 years, but as a result, the punishment was reduced.

Businessman Roger Ver

After serving his sentence, Wehr ended his never-begun political career and moved to Japan. Since then, his name has increasingly been associated with various Bitcoin projects.

Roger Ver was so passionate about the idea of unlimited and uncontrolled payments that he poured himself into promoting Bitcoin. He posted billboards about cryptocurrency, held investor meetings, and even gave away free bitcoins so people could experience the benefits of paying with cryptocurrency for themselves.

☝️

Interesting! For his efforts in promoting Bitcoin, Roger Ver was nicknamed Bitcoin Jesus. This nickname was given to the businessman by the head of the Bitcoin Foundation, Peter Wessenes, after he was impressed by Ver’s lecture on Bitcoin to schoolchildren.

As mentioned above, Ver gradually moved from the team of Bitcoin fans to the Bitcoin Cash team. He assured that the Bitcoin Cash cryptocurrency is a continuation of the evolution of Bitcoin; moreover, he inspired the crypto community that this is the real Bitcoin, which was once created by the legendary Satoshi Nakamoto.

To promote his point of view, Roger Ver launched a major PR campaign through the social networks Reddit and Twitter, as well as his own website Bitcoin.com. And in order to emphasize that they were right, at Roger’s suggestion, supporters of Bitcoin Cash began to call the first cryptocurrency Bitcoin Core. This made it more difficult to understand which of the bitcoins was the first and original. First of all, this became a gimmick for newcomers to cryptocurrencies.

To this day, many are angry about why Roger betrayed Bitcoin. According to one version, he simply decided that it was better to be the main representative of Bitcoin Cash than one of the opinion leaders of Bitcoin. The community of the first cryptocurrency did not forgive him for such a change of mood and began to call him Bitcoin Judas, and even threatened with a class action lawsuit if he did not stop calling Bitcoin Cash a real Bitcoin.

Let's sum it up

The value of Bitcoin Cash is growing rapidly. For a short time, the fall does not tickle the nerves even for beginners. Cryptocurrency, separated from Bitcoin, is undoubtedly in demand among specialists, and is already being actively purchased by beginners who do not understand what we are talking about. Everyone wants history with Bitcoin to repeat itself.

Already in August 2022, the rate will rise to 1000 - 1200 dollars. Many factors influence the rise and fall of indicators. This did not stop Bitcoin from becoming such a popular cryptocurrency. You should look into the future, study forecasts and invest your personal money only in projects that have a future.

There is no need to panic if the exchange rate falls. This is how things work with cryptocurrency: the rate rises, then drops sharply, followed by a rapid jump upward. This allows investors to increase their capital many times over.

If you have any questions, please let us know Ask a Question

Another split?

Forks in the blockchain

Since that time, the war between Bitcoin and Bitcoin Cash has subsided, and each side has occupied its own niche in the market. But, apparently, Roger Ver and his team cannot live without scandals. The idyll in their seemingly close-knit team did not last long. And a year after the launch, all the tabloids were full of sensational news about the upcoming Bitcoin Cash hard fork.

This time, Roger Ver launched a dirty war against Craig Wright, who became famous in the Bitcoin community with claims that he is the true creator of Bitcoin - Satoshi Nakamoto.

Disagreements between the two developers arose amid a discussion of the future development of the Bitcoin Cash cryptocurrency and the possibility of the coin complying with Satoshi’s precepts. Their opinions were radically opposite, so a fork was inevitable.

In November 2022, Bitcoin Cash was split into two cryptocurrencies: Bitcoin ABC (the original Bitcoin Cash) and Bitcoin SV (Satoshi's Vision), a version of Bitcoin Cash with a block size of 128 MB. Following the split, Bitcoin ABC became the dominant chain and kept the ticker BCH as it had more hash power and more nodes on the network.

After the hard fork, users held their breath and watched with interest the development of events. In one corner of the ring was Roger Ver with support from Bitmain, Binance and Coinbase, and in the other was Craig Wright teaming with nChain, CoinGeek, CalvinAyre and Bitcoin.org. This was the most scandalous hard fork, which was accompanied by mutual threats, insults, lawsuits and attempts to take over the enemy’s network.

Roger Ver and Craig Wright

// Source: hashtelegraph.com

As a result, Bitcoin SV did not receive the expected support from the crypto community. Most crypto market participants are wary of both Wright himself and his project. However, Wright does not give up and considers his project to be a real Bitcoin, corresponding to Satoshi’s idea.

It is worth noting that not everyone supports the development strategy of both projects. According to Microsoft, increasing the block is a direct road to centralization, and therefore a greater vulnerability of the network.

You will learn more about the hard fork of the Bitcoin Cash cryptocurrency from the video below:

Hard fork Bitcoin Cash

Bitcoin cash rate forecasts

- Prime XBT gives bch a forecast that BCH will reach approximately $1,100 by 2025.

- Digital Coin Price is more optimistic, giving bitcoin cash a forecast that BCH could surpass the $2,500 mark by 2025.

- Investor Wallet is not so confident about the prospects for cryptocurrency. They indicate that the price of BCH will remain relatively static, at around $540 in 2025.

- Forecast Long are even less optimistic. They forecast for Bitcoin Cash that the price of BCH will fall by 2025 and will be around the $350 mark.

As you can see, the forecasts regarding the price prospects for Bitcoin Cash seem somewhat ambiguous.

How to buy Bitcoin Cash

Buying Bitcoin Cash

To further increase the reach of the Bitcoin Cash cryptocurrency, the development team made a bold decision even at the launch stage. Potential users received a unique bonus - everyone who had Bitcoin in their accounts as of August 1, 2022 received the equivalent amount of Bitcoin Cash absolutely free.

This was an unprecedented decision that helped not only gain investor loyalty, but also bring Bitcoin Cash into the TOP 10 cryptocurrencies within the first weeks of its existence.

As for the classic way to get Bitcoin Cash - buying through exchanges, there were some problems with this in the first few months. Popular exchanges and wallets did not want to recognize the Bitcoin Cash cryptocurrency, thereby blocking the further development of the coin. At the moment this problem has disappeared. Bitcoin Cash appears on the most popular cryptocurrency exchanges, including Binance, Kraken, Exmo, etc.

List of exchanges for purchasing BTC

// Source: bitcoincash.org

Also, Bitcoin Cash, like most other cryptocurrencies, can be mined. In order to mine Bitcoin Cash, we advise you to choose one of two effective options: join a mining pool or use cloud mining.

In addition to those mentioned above, the official Bitcoin Cash website offers additional ways to receive coins. Here are some of them:

- Using a Bitcoin Cash faucet with which you can get a small amount of BTC for completing simple tasks;

- Buy coins at a specialized Bitcoin ATM;

- Use services like LocalBitcoinCash to buy coins in person from a local seller.

You can learn more about ways to receive BTC on the official website of the cryptocurrency.

Is a clone promising?

Does Bitcoin Cash have a future in 2022? Of course, the rate of this crypt will rise to a high level. What changes can we expect from VSS? Let's start from the situation with Ether, and everything becomes clear. A cue ball clone will help solve a lot of problems that arose with the original. Of course, the developer does not advertise such nuances, but experts suggest that we are talking about low speed, large commissions and complicated one-time payments. What is the reason for such guesses? With the fact that the clone has more advantageous positions in these moments. But the main reason is theft, which can no longer be predicted and stopped. The blockchain system has its holes. In this regard, new cryptocurrencies began to be developed on other “engines”.

Where to store

Storing BCH

There is a huge variety of wallets that support BCH. They can be desktop, paper, mobile or hardware.

The most common hardware wallets among users are Ledger and Trezor. These are very popular wallets designed to provide maximum security for storing Bitcoins. They are designed as flash drives that allow connection to a PC. Their only drawback is the price.

A good alternative would be the official Bitcoin wallet. Moreover, you can store both regular bitcoins and its fork on this wallet. One of the disadvantages is that it is often attacked by hackers.

Mobile wallets for iOS and Android

A complete list of wallets that support BCH can be found here.

How to invest in cryptocurrency

There are many noteworthy digital asset exchanges on the market. Against the backdrop of attempts by the Russian authorities to impose taxes on members of the crypto community and organize tracking of their transactions, anonymous trading platforms have become the most attractive option.

An example of a popular crypto exchange that allows you to maintain confidentiality is StormGain . On the platform you can anonymously buy cryptocurrency, including for rubles. StormGain is distinguished by low commissions, a high level of security and a simple interface.

Screenshot from StormGain website

Don't forget to pick up the 25 USDT bonus for replenishing your deposit from the anonymous crypto exchange StormGain before the promotion ends! You can get it from the link >>>>

Bitcoin Cash rate and capitalization

Capitalization of Bitcoin Cash

The division of Bitcoin Cash and the scandals around the coin resulted in big losses for everyone. While big guys are playing war games, ordinary users are suffering the most. Compared to the hard fork that created Bitcoin Cash in 2022, when the price of Bitcoin remained virtually unchanged, the Bitcoin Cash hard fork significantly undermined the price of the coin. Even if you add up the post-fork price of BCH and BSV, their total value is significantly lower than the price of BCH before the hard fork.

According to the Coin Dance portal, miners of both teams now receive only 25% of the profit that they could receive from Bitcoin mining. This will be felt most by large mining pools such as Roger Ver's Bitcoin.com, which has diverted hashing power from Bitcoin mining to Bitcoin Cash mining in order to gain a dominant position in the "clash of the titans."

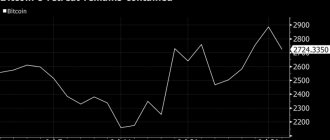

It is worth noting that when choosing a cryptocurrency for investment, you should pay attention not only to the current state of affairs, but also to the history of exchange rate changes. Below is a graph of BCH exchange rate dynamics.

Change in Bitcoin Cash rate since launch

// Source: coinmarketcap.com

There is an opinion that at the initial stages BCH could be bought for pennies, but this is not so. From the first days of launch, the price of the coin remained around $500, and after a few weeks of existence, the price of BCH on exchanges exceeded $1,000.

It is important to note that in addition to various external and internal factors, the price of the Bitcoin Cash cryptocurrency directly depends on the cost of Bitcoin. Thus, against the background of the growth of its “parent”, on December 20, 2022, the maximum price of BCH was recorded – $4355.

Further on the chart you can observe a gradual decrease in the value of the crypto asset. The absolute minimum price of BCH was recorded a month after the hard fork, on December 20, 2022. At that time, BCH could be purchased at a price of about $75 per coin.

☝️

At the time of writing, Bitcoin Cash is trading at $251.26 with a capitalization of $4.62 billion and ranks 5th on CoinMarketCap. You can track the Bitcoin Cash rate in real time.

Expert advice

It is no longer possible to keep up with cryptocurrency. By exchanging money for new items, you can end up with an empty wallet. In order not to waste all your capital, you should not spend more than 30% of the total amount in your personal wallet. By increasing the exchange rate, this will help you stay in the black.

It is possible that the new crypt will disappear as quickly as it appeared. But with Bitcoin Cash, things are different. The sharpest jump did not bring the rate below 350 USD. e. This deserves respect, which is why the clone began to be valued.

Bitcoin Cash Problems

Bitcoin Cash Scandals

2019 turned out to be quite a difficult year for the Bitcoin Cash cryptocurrency. As the hash war with Craig Wright continues, the network has often been at the center of discussion due to technical errors and various accusations.

Since the beginning of 2022, the community has renewed pressure on Bitcoin Cash, accusing the network of centralization. According to the CoinDance portal, the BTC.top mining pool controlled 50.2% of the BCH network hashrate, which caused a wave of negativity and concern in the crypto community. And in May, a new record was recorded for BTC.top. The mining pool received 53.47% of the BCH hashrate, which would be enough to launch a “51% attack.”

Distribution of hashate between mining pools within the BCH network

// Source: bitcoinexchangeguide.com

This is not the first time that accusations of centralization have hit the Bitcoin Cash cryptocurrency.

Previously, Roger Ver had already received a “slap in the face” from the developers of the BitPico mining pool, who conducted a stress test of the network and found that 98% of all Bitcoin Cash nodes are connected to only one server. Also a little earlier, well-known cryptography expert Nick Szabo publicly called the Bitcoin fork team “centralized virtuals,” after information appeared on the network that more than 2/3 of the network operates in the Amazon and Alibaba cloud.

Distribution of Bitcoin ABC (Bitcoin Cash) nodes

// Source: bitcoinist.com

At the same time, the Bitcoin Cash team continues to assure its users of its decentralization. But only in words. It's no secret that centralization is unsafe and can lead to network hacking and its complete destruction. In addition, it is not at all surprising that Roger Ver and his team avoid discussing this issue in every possible way, since confirming the centralization of Bitcoin Cash would mean that the coin has moved away from its main goal - to be a true Bitcoin, which, in turn, implies complete decentralization and more no compromises.

At the same time, after the planned network update on May 15, 2022, BCH experienced a problem, as a result of which miners mined empty blocks for some time, and the network itself was temporarily divided into two chains. Subsequently, all BCH transactions were blocked on many exchanges until the issue was resolved. According to the BitMex report, approximately 3,392 BCH were spent to restore the network and roll back erroneous transactions.

By the way, in April 2022, one of the Bitcoin Core developers, Corey Fields, already warned the Bitcoin Cash team about the presence of a critical error in the transaction signature confirmation code, which could lead to the division of the network into 2 chains and blocking of all transactions with the coin. At that time, the error was fixed, but why was the network exposed to this vulnerability again?

During the same hard fork, another problem arose. At the time of the network fork, an unknown attacking user tried to appropriate coins that had previously been blocked.

As it turned out, during the hard fork in 2022, when Bitcoin Cash was separated from Bitcoin, a number of coins were created that were mistakenly transferred to remote addresses. To solve the error, the developers blocked these tools and made them inaccessible to users. However, the latest hard fork removed the blocking of coins and allowed an unknown miner to appropriate them.

Notification of an error

// Source: twitter.com

The dominant pools BTC.com and BTC.top helped solve the situation. As it turned out, they were preparing to restore these coins in order to give them to their rightful owners, and when they saw that an unknown person was trying to appropriate the coins, they carried out a “51% attack” to cancel his transaction.

Although the intentions of the two companies seem good, their actions have subjected the network to severe censorship. In addition, it is still unknown whether BTC.com and BTC.top really decided to try on the role of Robin Hood and give away the coins, or whether they were simply preparing to appropriate them, and the alleged thief prevented them from doing so.

All of these facts negatively affect the reputation of the cryptocurrency and require response from the project leaders, which in turn will increase investor confidence in the Bitcoin Cash cryptocurrency. Otherwise, BCH may be at risk.

Market Sentiment:

Will rise Will fall

50%

50%

You voted for the price to fall. You voted for the price increase.

Try trading BCH/USD?

Start trading

Open demo

The second important difference is the difficulty of mining. Due to the large block size of BCH, it will require more computing power to mine, which in turn means more cost. On the other hand, this same feature gives miners much more options when it comes to receiving transaction fees. However, perhaps the most significant difference between blockchains is the huge price imbalance. To attract miners to the network, the BCH network difficulty must be lower than that of BTC.

Pros and cons

A blockchain schism always causes public outcry. Some begin to actively support the new cryptocurrency, while others, on the contrary, vehemently speak out against it. The authority of each party in the crypto market and in the global community as a whole plays a big role. You should also compare their words and actions.

First we will talk about opponents. The most furious in this case was the director of financial affairs of the Bitmex exchange. He said that the exchange is not going to support money that appears out of nowhere. Perhaps he is right, because during the split, everyone who had Bitcoin in their account received the same amount of Bitcoin Cash.

The site team also stated that BCH is not able to provide the proper level of transaction protection, therefore it will not be included in the list of trading pairs of the exchange. But the question arises: how then was it possible to avoid double spending, delays and repeated transactions between the BTC and BCH blockchain? By the way, in 2022, Bitmex traded Bitcoin Cash futures.

Among the well-known projects that actively support cryptocurrency are the mining pools AntPool and ViaBTC. The first actively popularized the altcoin, directing a considerable amount of his hashrate to it. And Hypo Yang, the CEO of the latter, according to some sources, participated in the development of the fork.

Bitcoin forecast for 2022

Bitcoin exchange rate forecast

Most of the bitcoin exchange rate forecasts for 2022 voiced by analysts and bloggers could be divided into two directions.

At the end of the section, we will summarize which of the cryptanalysts was closest to the real price of Bitcoin at the end of 2019.

Optimistic forecast

The rise from $3,200 to $14,000 in 2022 was seen by many as preparation for a more global bullrun, which in theory would have been driven by the launch of the Bakkt platform and the approval of the Bitcoin ETF by the US Securities and Exchange Commission.

But in the end, everything turned out somewhat differently: the first event did not bring the expected upward push in the exchange rate, and the second was once again postponed, which was accompanied by a significant decline in the price of Bitcoin.

☝️

We recommend reading: Bakkt: a rocket to fly to the moon or a Bitcoin killer

However, there was no reason to panic, since a correction is a completely natural event after an increase of 4.5 times, and many people made forecasts for Bitcoin, drawing a bright future for it, and the very near future.

For example, technical analyst Alessio Rastani allowed the exchange rate to decline up to $7,000, after which he expected the implementation of the “wild card”

— a sharp rebound followed by an assault on the 2022 ATH and, if successful, reaching $39,000.

Chris from the MMCrypto YouTube channel had a similar opinion, arguing that $14,000 is not the peak of the new Tuzemoon, and, therefore, it is too early to expect a complete market reversal to the side of the bears. For more information about these forecasts, watch our video message to everyone who is still waiting for the opportunity to buy Bitcoin at $3,000:

Prediction: Will Bitcoin reach $3000?

Also, the renewal of highs by the end of 2022 was predicted by the famous financial analyst Max Kaiser - in his opinion, the breaking of the $10,000 mark opened the way for Bitcoin to $28,000, where it may go after the correction is completed.

The head of the crypto bank Galaxy Digital, Mike Novogratz, gave slightly different figures - he was confident that already in the fourth quarter of 2019, the Bitcoin rate would reach $20,000 due to the entry of investment banks into the game. Moreover, after this the bullish rally will not end, and the price of the main cryptocurrency will begin a confident movement towards the $40,000 mark.

Andy Chung, chief operating officer of the OKEx crypto exchange, gave a similar forecast for Bitcoin, expecting an influx of institutional investors into the market in the very near future.

And YouTube blogger Sunny Decree even saw the $90,000 mark on the chart by the end of 2022. He came to this conclusion by making the assumption that the growth of 2017 was an analogue of the preparatory stage of 2013, after which a real bullish rally followed.

YouTube blogger Sunny Decree

As for the autumn correction, Sunny believed that a drawdown of 40% was a completely normal phenomenon, behind which lies the additional accumulation of positions by the market maker before the next breakthrough.

In addition, he argued that for a trend to reverse downward, a price peak must be reached that exceeds the previous ATH, which has not yet happened. And the correction that occurred after exiting the triangle, which was considered by many as a bullish figure, is a standard deceptive maneuver to unload extra “passengers” before continuing the upward movement.

A less optimistic forecast for Bitcoin was given by Crypto Zombie, which looked at a fractal on the chart that had previously led to a significant increase in the rate. At the same time, he did not specify what numbers he was talking about, and did not guarantee that everything would go according to a similar scenario. What made him doubtful was the almost formed bearish flag on the chart, which increased the likelihood of the continuation of the downward movement.

The details of this two-pronged forecast can be seen in our video on making decisions based on Bitcoin behavior:

What will the Bitcoin rate be?

It also provides examples of non-standard market indicators from the Crypto Daily channel, confirming the possibility of a new bullish rally starting soon. In particular, we are talking about the growth of capitalization of the stablecoin Tether (USDT), as well as an increase in the number of “whale” wallets (with 1000 or more BTC in the account).

Well, now that 2020 has already arrived, we can draw conclusions which of the above analysts managed to predict the movement of the Bitcoin rate until the end of last year.

Let's start with the overly optimistic blogger Sunny Decree

- in 2019, he did not wait for Bitcoin to reach $90,000. Financial analyst

Max Kaiser

, who predicted Bitcoin would overcome the $14,000 mark and then double its price, was also wrong.

Mike Novogratz called slightly lower numbers

, however, his expectation of $20,000 per 1 BTC by the end of 2022 also did not come true.

Crypto Zombie

forecast into account, since he did not name specific numbers and hinted at the development of a fractal with an upward movement, without excluding a possible drawdown.

Alessio Rastani turned out to be closest to the real state of affairs

: as he expected, in the fall of 2019 the price of Bitcoin dropped to almost $7,000 and then a “wild card” was realized - an unexpected sharp jump up by $3,000 within two days. True, after this there was no predicted assault on the level of $14,000, much less $39,000, the downtrend continued and the rate dropped to $6,500. Thus, only the first half of Rastani’s forecast came true, which in general is not so bad, given the absolute failures of the rest of the Bitcoins -optimists.

Pessimistic forecast

Pessimistic price forecast

Bitcoin has already repeatedly experienced so-called price bubbles, accompanied by panicked cries of the crowd in the “everything is lost” style, but each time after that a new one happened. This means that there is still a chance of seeing a Bitcoin rate of $50,000, $100,000 or even $200,000.

But there is also bad news - for example, after the rapid rise of 2013, the market took about 2 years to transition to a new stable growth phase, which ended in December 2017. That is, almost 4 years passed between the tops of these cycles on the Bitcoin chart.

Now, not even three years have passed since the end of the last bull run. This means that before the start of a new rally, there may well be another 1-2 years, which Bitcoin will spend in a wide-range flat, and maybe even in a downward trend with updated loys.

Bears in the market

In October 2019, only the bearish figures looming on the Bitcoin chart hinted at the fact that there would be no native moon in the near future, but they could be “helped” at any moment by fundamental reasons such as a ban in some country or another robbery by hackers of a large exchange exchange cryptocurrencies Many feared that the panicking crowd would help push the price down and, before we knew it, we would be exploring a “new bottom.”

In addition, the “bull run” of 2022 could well be a full-fledged market mini-cycle, the result of which, as always, should be “shaking out weak hands” and lowering the rate to levels convenient for the market maker to accumulate Bitcoin before the next breakthrough. If we draw an analogy with the last cycle, then the last three months of 2019 we were in approximately the same state as in December 2018, that is, in the stage of accumulation at the local bottom.

It was assumed that these would be levels around $8,000, or lower levels of $7,000-$7,200, which Tony Weiss and Alessio Rastani pointed to, expecting that there could be a reversal from there, after which Bitcoin would finally go to storm new ATHs.

And if the rebound did not follow, panic sales could well have occurred, which would have brought Bitcoin to the level of $5,000, and maybe even $4,000. We discussed this option in our next video from six months ago:

Bitcoin price forecast: Where is the local bottom

Even the eternal optimist Sunny Decree pointed out the possibility of such a scenario. In his opinion, the rate could easily go to $6,000 or lower, since there was an unclosed gap in Bitcoin futures at this level. But he did not consider this circumstance as a threat to the cryptocurrency market, still expecting the beginning of a sustainable upward trend in the medium to long term.

Legendary trader Peter Brant was more pessimistic, suggesting that the inability of the bulls to keep Bitcoin above $10,000 indicates the possibility of a deeper correction up to 80% of the 2022 high (from $14,000), the movement towards which can well be considered as a growth cycle.

Also worth paying attention to was the opinion of American investor Tyler Jenks, according to which Bitcoin needs to correct well, even to the same $3,000, in order to ensure healthy growth in the future. In parallel with this, Bitcoin was supposed to gain market dominance of about 90%. Otherwise, we, of course, could go to the moon without the mentioned drawdowns and quite reach the level of $30,000–$50,000.

But this will happen without the entry of new investors into the market and the growth of general acceptance of cryptocurrencies, after which a real collapse will occur with the search for the deepest bottom within 5 or even 10 years.

We cannot yet evaluate such a long-term prediction, but the descent to $3,000 predicted by Jencks has not yet materialized. As well as Peter Brunt's 80% correction.

Rastani and Weiss were also not entirely right - the rebound from $7,300 that occurred at the end of October fits well into their forecasts, but until the end of 2019 there was neither an ATH update nor panic sales to $4,000 - 5,000.

The most accurate guess was Sunny Decree

about a decline to $6,000 before continuing to grow - in December, Bitcoin found a local bottom around the $6,400 level.

☝️

We recommend: Earning money on cryptocurrency: 11 ways without and with investments