olegas Jan 5, 2022 / 1181 Views

This term first appeared in 1917, but not in rebellious Russia (after all, our country is primarily associated with this year), but in the bourgeois United States of America. Like many other American innovations in the financial sector (see, for example, the depositary receipt), the repurchase agreement, repo, appeared with the goal of saving more money.

The fact is that in April 1917, the United States entered the First World War (before that they remained neutral). This led to a significant increase in taxes, which was one of the reasons why older forms of lending became less popular. Then the US Federal Reserve introduced the concept of repo transactions. Through these transactions, he lent to other American banks. Well, then repo transactions, as they say, went to the people.

We can say that a repo transaction is essentially a form of lending

The essence of a repo transaction is that one party sells to the other party certain material assets (mainly the object of the transaction is securities). But he doesn’t sell it just like that, but with the condition of buying them back after an agreed time, at an agreed price. In this case, the seller's goal is to get the amount of money he needs, and the buyer's goal is to return his money with interest at the end of the transaction (this percentage is taken into account in the buyback amount). In this case, the buyer, as it were, lends money with minimal risk for himself, because at the time of the transaction, he owns the seller’s property. And if, after the period specified in the repurchase agreement, the seller does not fulfill his obligations and does not buy back his property, then the buyer himself can sell it, thereby returning his money.

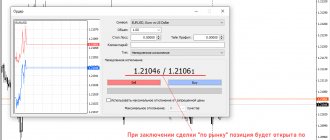

Examples of repo transactions

For one person, a REPO is an opportunity to increase profit/loss on a price change; for another, it is an opportunity to earn a fixed percentage on your money, like on a deposit, but with a temporary transfer of securities. There are two motives: placement of free liquidity (ruble/currency/securities, if they are in demand) at a fixed percentage or speculation with leverage.

The main method of short-term placement of funds by financial institutions is repos with a central clearing house. The exchange bank National Clearing Center (NCC) acts as the Central Counterparty. To place funds, a company needs to submit an application to its broker for this type of operation.

The REPO operation is a risk-free and high-tech instrument: maturity is one day (“overnight”), rates are close to the key rates of the Bank of Russia. These transactions represent an alternative to placing funds in bank accounts on demand.

Let’s say one person has free rubles, another sees prospects for Sberbank shares to grow by 10% in the near future. And instead of buying shares with his own thousand left over from his salary and earning 100 rubles, he decided to buy Sberbank shares for 2 thousand and earn 200 rubles. And so he buys for his thousand and opens a margin position for one thousand. Thus, taking the so-called leverage one to one. And he borrows money at interest from a person who has a free thousand, secured by his Sberbank shares using a repo transaction. (I sold my shares today, bought them back a week later, and the difference between the purchase price and the sale price differs by the percentage per annum for the week of the loan. More precisely, this is not a loan or a collateral transaction, these are different things). Simply put, a repo transaction is like borrowing shares.

Differences from a swap contract

A swap contract is an agreement under which a financial instrument is sold with the simultaneous acceptance of an obligation to repurchase it after a certain period at an agreed price. At first glance, the repurchase agreement contains the same conditions. However, there are some differences:

- The prices in the repurchase agreement are fixed. In a swap contract, prices can change (swap transactions are most often carried out using a floating interest rate). And it is not a fact that the swap will be positive, because the result can be influenced by many factors (exchange rates, the size of the Central Bank key rate, etc.).

- Unlike a swap, repo transactions with securities are a type of lending. The difference between the sale price of the asset and the redemption price is the lender's profit, that is, interest on the loan.

- When conducting swap transactions, there is no exchange of assets, but simply the difference between the price fixed in the contract and the market value of the asset at the time of settlement is paid.

Increasing profitability on the Fix Inc. portfolio due to a repo transaction

This is the purchase of a bond of some reputable company, perhaps an oil and gas company, say, for three years. After three years, the bonds are redeemed and the invested amount is returned. Once a quarter the company pays a coupon, let’s say a fixed one - 8.5% per annum. The yield to maturity is higher due to the reinvestment of the coupon, and on the market money costs 5% per annum, with expenses and commissions of no more than six.

By pledging bonds at five and buying more with this money, the buyer will receive an additional income of 2.5-3% per annum if rates do not rise and a very reliable company does not default. By doing this, the buyer increases the risks, for which he receives additional rewards.

Classification of repo transactions

According to the methods of execution of a repo transaction there are:

- Direct (implying the need for a buyback);

- Reverse (obliging to reverse sale of collateral securities in the future).

They are also:

- One-day (the entire operation cycle occurs within 24 hours);

- “Overnight” (two parts of the full transaction cycle are separated by one night);

- Active (when the deal is not closed and only the first part is completed);

- Open (the terms when the transaction must be completed are not defined);

- Exchange (the transaction is concluded with the participation of the exchange, acting as an arbitrator and a guarantor of compliance by the parties with all obligations);

- Over-the-counter (transactions are concluded outside the exchange);

- Tripartite (execution of all clauses of the contract is controlled by a third party);

- Transactions with the Central Bank of the Russian Federation (Central Bank of the Russian Federation);

- True (registration of the transaction is possible only upon signing the general agreement).

Essential terms of the repurchase agreement

The main terms of the agreement are the requirements for securities:

- type (for example, shares or bonds), as well as securities issued in cash or non-cash forms;

- type (for example, blue-chip or second-tier stocks);

- quantity.

Depending on the terms of the transaction, which were listed above, the agreement must reflect the repo rate. This is a certain percentage that the lender will receive after the sale of securities in the second part of the transaction.

For example, under the terms of part 1 of the transaction, shares were purchased for RUB 375,000. ($5,000 or 145,000 UAH). The second part of the agreement provides for the repurchase of these securities for 412,500 rubles. ($5,500 or 159,500 UAH). In this case, the rate will be 10% (500/5000*100).

Market participants who are short-sellers use securities transactions that are the opposite of repo transactions: the reverse sale is carried out at a reduced rate. In calculating liquidity, it is necessary to make a choice between securities (transactions using borrowed securities) and repo (transactions using borrowed funds). In general, when the market situation is calm, repo transactions are used more often, and depots are more relevant during periods of economic turmoil: a trader sells securities in order to purchase them cheaper in a short period of time.

Object and form of the agreement

The object of the agreement is the subject of the pledge. These may be securities of the following types:

- shares and bonds of Russian and foreign issuers;

- investment shares;

- clearing certificates of participation.

The agreement is drawn up in a number of copies equal to the number of parties to the transaction, one copy for each party.

Subject composition

The subjects of the contract are the seller and the buyer. If one of the parties to the agreement is an individual, then the other party can only be a legal entity that is a broker, dealer, credit institution or professional participant in the securities market.

The legislation does not provide for repo transactions with securities between two individuals, except in cases where a broker acts on behalf of the individual.

Rights and obligations of the parties

Rights and obligations of the seller

- The seller undertakes to transfer to the buyer securities free of obligations to third parties.

- In the event of a significant change in price, the contract may provide for the payment of a compensation contribution. This point is relevant for long-term repo transactions or for short-term transactions in securities that are characterized by high volatility.

- If during the validity of the agreement the securities transferred under the first part of the transaction were converted into others, then the transfer of other securities to the buyer may be provided. However, this condition must be stated in the contract.

Rights and obligations of the buyer

- The buyer undertakes to transfer to the seller in the second part of the transaction securities not encumbered with obligations to third parties.

- The agreement may provide for a ban on transactions with the subject of the agreement during the validity period. This limit must be recorded in the buyer's repo account.

- In case of price changes, compensation payments to the seller may also be provided.

- Obligations under the contract may be fulfilled by the buyer ahead of schedule if this condition is specified in the contract.

Master agreements for repurchase transactions

There is a master agreement containing the conditions established by the self-regulatory organization NFA (National Stock Association) for concluding repurchase agreements. This document applies to the entire securities market.

The Master Agreement must comply with the Sample Terms, which are mandatory:

- Procedure for concluding repurchase agreements.

- Essential terms of the agreement.

- Procedure for fulfilling obligations.

- Legal status of counterparties.

- Mechanism for resolving disputes under the contract.

- Carrying out upper and lower revaluation.

Among the international agreements on repo transactions, the following should be noted:

- General Master Repurchase Agreement;

- Global Master Repurchase Agreement.

Execution of the repurchase agreement

Proper fulfillment of the terms of the agreement occurs at the time the buyer, defined in the second part of the agreement, receives securities in documentary form or at the time they are credited to a securities account or an entry is made in the register of securities owners.

Obligations can be fulfilled through netting, as well as with the help of authorized persons (broker, depository or clearing organization).

Early execution

The legislation provides for the possibility of early execution of the contract in the event of force majeure or failure or improper fulfillment of obligations of one of the parties to the other party or third parties.

Risks of repo transactions

There can only be a risk if one of the parties to the relationship violates the terms of the contract. For example, if shares rise in price, then the buyer can sell them profitably himself, without returning the securities back to the seller, with whom the transaction was concluded at the price established in the contract.

When concluding repo transactions with the Moscow Exchange, which is carried out through a broker, there is no risk, because the Moscow Exchange is a fairly reliable and liquid counterparty, and has high ratings for these indicators.

Advantages and disadvantages

Pros:

- More favorable conditions than when applying for a bank loan;

- Fast processing of transactions and payments for them;

- Transactions are not subject to VAT;

- The risks for the buyer are quite low, since the shares remain in his possession if the seller refuses to fulfill the second part of the transaction.

Minuses:

- A repo transaction is a short-term transaction. The period for which REPO transactions are concluded should not exceed one year; it can be extended by the new version of Art. 282 of the Tax Code of the Russian Federation is not provided for;

- If the economic situation changes, one of the parties may lose interest in fulfilling the second part of the transaction.

Why are repo transactions needed?

“Repo transactions are needed to fund long-type margin positions in different currencies and to open short positions as such. Currently, almost all repo transactions are completed on the exchange through a central counterparty. In this case, all risks for the execution of the first and second parts are assumed by the Moscow Exchange. That is, the client bears the risks only on the exchange,” - Vyacheslav Antsupov, Head of the Department of Operations in the Money and Foreign Exchange Markets.

We hope this article helped you learn more about repo transactions, showed you the risks that can arise, and also told you about the pros and cons of such transactions. Our company is an active participant in this market and organizes repo transactions for you on the Moscow Exchange.

The importance of REPO for the monetary policy of the state

Separately, I would like to dwell on the importance of the repo operation as an instrument for regulating the state’s monetary policy. In this case, the parties to the agreement are the Bank of Russia and commercial banks. The purpose of a repurchase transaction is to provide liquidity or collect excess liquidity in the financial market.

If there is a liquidity shortage in the economy, the Bank of Russia uses repo auctions for a period of 1 week. When there is an excess money supply, such auctions are not held. In both cases, the Central Bank reserves the right to:

- “fine-tuning” auctions for a period of 1 to 6 days;

- long-term auctions;

- permanent operations.

The Central Bank uses buybacks not only as a monetary policy tool, but also to implement other functions. For example, in 2014–2017, he bought securities from banks for foreign currency to provide credit institutions with dollar liquidity. At that time, access to it was difficult.

The Central Bank conducts its operations on the Moscow and St. Petersburg stock exchanges, as well as using the Bloomberg information system. The bank does not allow all assets to participate in a repo operation. Only those included in the Lombard list. Information on assets accepted as collateral is updated daily. Find it at this link.

By the way, for those investors who buy bonds of individual issuers for their investment portfolio, I recommend that you also check these lists. They include the most reliable securities that have passed the strict selection of the Central Bank.