In nature, fractals are usually understood as objects whose individual parts have the same shape as the object as a whole. Without noticing it ourselves, we quite often encounter fractals. Snowflakes, corals, tree crowns, mountain ranges, clouds, pineapples, broccoli - all these natural objects have the properties of fractals. So in my article today we will talk about the corresponding Fractal indicator.

Legendary trader Bill Williams, author of the Alligator, Awesome Oscillator and Accelerator Oscillator indicators, introduced the concept of fractals into trading. In his book “Trading Chaos,” Williams described the market as a natural phenomenon that does not obey the laws of statistics and mathematics. Despite the fact that Williams' theory was harshly criticized by conservative traders, over time, Bill gained a large number of supporters and founded his own school of trading. Today, fractals are a popular tool for technical analysis, and to determine them there is a special MT4 fractal indicator.

What is a fractal indicator?

Let's first understand what fractals are. Fractals can be used:

- To set a stop loss.

- To determine key levels.

- For Fibonacci extension level placements.

- Fractals are an excellent method for determining trends.

To add a fractal indicator to a chart in the MetaTrader platform, click: “Insert” - “Indicators” - “Bill Williams” - “Fractals”.

In nature, fractal patterns are found in crystals, tree branches and snowflakes, to name just a few examples. Fractal patterns are recursive because, regardless of the whole, they are built from many repetitions of the same pattern.

How does this relate to trading? Fractals are based on the mathematical theory of chaos. In chaos theory, price movement is fractal in nature: that is, the market makes the same or similar movements on all time frames. Price patterns appear random, but there is an order to them, which is explained by Elliott Wave Theory.

French mathematician Benoit Mandelbrot was the first person to notice repeating price patterns. His analysis of cotton price movements over a period of more than a century led him to create a trading strategy first mentioned in Bill Williams' famous book, Trading Chaos. It was Williams who first suggested that the market is a chaotic and self-regulating system.

Fractals indicate the tops and bottoms of potential market reversals.

Visually, these are tiny up and down arrows. For a fractal to form, a series of 5 consecutive candles must appear. In this case, the middle candle should be with the highest high or lowest low compared to the two adjacent candles on each side:

Common candles for fractals:

Fractals show momentary price reversals and identify significant points in price movement. However, these patterns cannot be identified as bearish or bullish without taking into account the overall market context.

The Fractal Nature of Financial Markets

Without going into mathematical details, one of the main characteristics of fractals is self-similarity . That is, part of an object has characteristics of the whole.

This feature can also be seen in financial markets. Regardless of the selected timeframe, movements of the same type are formed on the charts of currency pairs, stocks, and commodities. This is a typical manifestation of the trait of self-similarity.

If you examine the wave movement of the charts, you will not see any special differences between M5, H4 or Weekly charts. If you show a trader a chart without a price scale and without specifying time frames, then he is unlikely to distinguish a five-minute chart from a weekly one.

The fractals indicator was used in Bill Williams' fractal theory . As for the theory of fractals, Williams' approach was not unanimously accepted. Some accused him of using a pseudoscientific approach to give his theory extra weight.

Fractals are trending

In an uptrend, we see more and more broken ascending fractals. In a downtrend there will be more downward fractals broken. As the trend progresses, a series of successive breakouts and the appearance of new fractals will be observed. In the event of an unsuccessful fractal breakout, we receive the first signs of sideways price movement.

Failure to successfully break through the previous fractal creates the precondition for consolidation to occur.

Fractal indicator for M1 timeframe

The minute timeframe is used for scalping trading. In this case, traders open 10-20 transactions a day or more, record small profits on them, but due to the large number of orders they receive a completely normal profit.

On the minute timeframe it is quite possible to use a fractal indicator. Moreover, it is better to use a special variety of PBF Scalper Show Me 3Nymous. It works on the same principles, and gives 2 types of signals:

- Blue arrows – buy.

- Yellow arrows – sale.

The indicator is not available in trading programs, so it must be downloaded and installed manually. The settings are left at default. The “Sensitive” option is of greatest importance, i.e. sensitivity. The parameter is responsible for how much the indicator changes under the influence of market noise (of which there is a lot on M1). As the sensitivity increases, there will be many signals, but many of them will be false. If you reduce the sensitivity, there will be fewer arrows, but they will be more accurate.

For example, if "Sensitive" is not sensitive, the arrow does not appear as much as can be seen in the graph. At the same time, the appearance of each signal provides an opportunity to earn money - the trend is really going in the right direction.

Using fractals according to Bill Williams

Dr. Williams called fractals the first dimension of his system of technical analysis. Fractals are essentially short-term support and resistance levels on a price chart, and they are the fundamental building blocks of the alligator trading system.

The alligator trading system is quite a complex system as it uses several different indicators combined with some rules for entering the market, scaling positions and has clearly defined rules about when to exit the market.

The beauty of this system is that once you learn how to use indicators in combination with chaos theory, scanning the markets and correctly understanding the current trend or lack thereof will become child's play for you.

According to Bill Williams' trading system, fractals should be filtered using the alligator indicator.

- When the fractal appears above the level of the alligator's teeth, purchases should be considered.

- When the fractal appears below the level of the alligator's teeth, sales should be considered.

Such signal fractals will remain valid until the entry order is triggered or until a new fractal is formed. Then the position must be changed according to the new fractal. Successive fractals that occur in the same direction as those formed after the first order can be used to add to an open position.

Installation and configuration of the indicator

The Fractals indicator is installed on the chart according to the standard scheme, like other technical tools of the MetaTrader 4 platform. The easiest way to do this is through the “Indicators” button in the top menu of the terminal.

The tool's settings are minimal: you can only select the color and size of the fractal icon, as well as timeframes on which it will not be displayed.

Once the indicator is installed on the chart and configured, you can start trading CFDs.

Alligator indicator - the key to using fractals

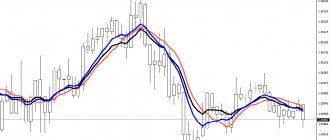

The alligator indicator consists of three moving averages:

- The blue line is called the alligator's jaw, which is a 13 period moving average of the average price (High + Low / 2), and it is shifted 8 candles into the future.

- The red line is called the alligator's teeth and is an 8 period moving average of the average price (High + Low / 2) and it is shifted 5 candles into the future.

- The green line is called the alligator lips, which is a 5-period moving average of the average price (High + Low / 2), and it is shifted 2 candles into the future.

When the three moving averages expand and move upward, it signals a bullish market. On the other hand, when moving averages expand and move down, it signals a bearish market. Everything is very simple.

Statistically, most markets stay in a range about 70% of the time and only trend about 30% of the time. Since the alligator trading system is basically a trend following system, the distinctive feature of the alligator indicator is that it can easily determine whether the market is trending or trading in a consolidation within well-defined support and resistance levels.

When the alligator moving averages contract, it signals a sideways market and according to the rules of the system, you should stay out of the market and wait for the next trend to emerge.

The alligator trading system has several other indicators, such as the Awesome Oscillator and Accelerator Oscillator, which are used to scale positions after the system generates its first signal. However, to get the first signal, you need to have a good understanding of how the fractal indicator works.

Therefore, once you have identified a trending market based on the alligator signal, you need to first look for fractals to enter the trade.

Modeling

Modeling means testing the indicator on historical data using Excel and ForexTester. Since we were unable to test the indicator automatically over a longer period of time, testing was carried out manually.

Quotes were provided by Forexite. Pair – EUR/USD, timeframe – Daily (testing period 2 years – from 01/01/2015 to 07/31/2016). Commission (spread, slippage, swap) were taken based on real tick history. Deposit – 1,000 USD, transaction volume – 0.02 lot.

As a trading strategy, a technique from the books of B. Williams was chosen.

Rules for entering a position:

— a buy order is placed 1 tick higher from the previous valid buy fractal (above the red Alligator line) provided that all 3 Alligator lines diverge upward (the Alligator is not sleeping);

— a sell order is placed 1 tick lower from the previous valid sell fractal (below the red line of the Alligator) provided that all 3 lines of the Alligator diverge downwards (the Alligator is not sleeping);

— adding is carried out if the remaining orders are in profit;

— according to the risk management rule, the maximum number of open transactions is no more than 4.

Rules for closing orders:

— all buy orders are closed if the closing price (Close) occurs below the red Alligator line (Alligator teeth or balance line);

— all sell orders are closed if the closing price (Close) occurs above the red Alligator line (Alligator teeth or balance line).

Test results report:

Test result: the strategy for breaking out a fractal after the Alligator comes out of hibernation turned out to be unprofitable. Even trend periods could not improve the result. All profits in trends were eaten up by deep pullbacks. Quite a lot of transactions took place on false breakouts, despite the fact that there were only 35 transactions over 2 years. But it is worth noting that during trend periods, the increase in profit occurred quite well, so the disadvantage of this strategy, to a greater extent, is the rules for closing positions, and not discoveries.

How to trade using the fractal indicator?

According to the alligator trading system, just because an up or down fractal is formed does not mean it is a valid signal. You must interpret the fractal in relation to the alligator indicator and pay attention to the alligator's teeth.

If the top fractal is above the alligator's teeth, only then can it be considered valid. In contrast, if the down fractal forms below the alligator's teeth, you can consider it valid. However, keep in mind that any up fractal that formed below the alligator's teeth is invalid and vice versa.

Once you find a fractal that is above or below the alligator's teeth, wait until the alligator begins to open its jaw, which happens when the three moving averages begin to expand.

If the alligator indicator is signaling an uptrend, place a Buy Stop order slightly above the fractal up in the direction of the trend. Likewise, if the alligator indicator is signaling a downtrend, place a Sell Stop order slightly below the down fractal.

Description of using the Fractals indicator in trading

In the classic version proposed by Bill Williams, the Fractals indicator should be used in conjunction with another “brainchild” of Bill – the Alligator. Many consider the “duet” of these indicators to be a separate strategy for binary options, based on breakthroughs of important price levels. You can use any timeframe (the higher the better), expiration should be set at the closing time of the breakout candle. For more comfortable work, I can recommend setting up alerts in the MT4 terminal (by email or SMS). You can add the Accumulation/Distribution indicator as a filter. Another example of a breakout strategy can be found here.

Signals for binary options on call:

- An alligator goes hunting for a bull. Sequence of lines from top to bottom: green, red, blue;

- A rising candle breaks the level of the previous fractal upward.

Signals for binary options on put:

- An alligator goes hunting for a bear. Sequence of lines from top to bottom: blue, red, green;

- A downward candle breaks the level of the previous fractal downwards.

In a fight with the "Alligator"

Alligator is one of the technical analysis indicators, also developed by Bill William. It is presented on the chart in the form of three moving averages with different settings for periods and shifts.

Instrument settings window, view on a chart in MT4.

The help of this indicator is as follows: if the price lies:

- above the Alligator's jaws, then the upward trend is likely to continue;

- below the jaws of the Alligator, then the downward trend is likely to continue.

This tool filters well the false signals that the fractal indicator often sends.

Life cycle of the Alligator

- Sleep period – all Alligator curves intersect on the graph.

- Awakening – the longer the “predator” sleeps, the hungrier it wakes up. In Forex, this period is called “price consolidation.”

- Food – the indicator curves move away from each other, expanding the moving channel, which absorbs the candles of the dominant trend in the market. This is the time to actively open positions.

- Sleep - having satisfied its hunger, the Alligator falls into hibernation again, its curves come closer, overlap each other, intertwine with each other. This is the time to take profits on previously opened transactions.

In technical terms, this is a method of trading “on the breakout of a price trading range” after a long period of consolidation.

Rules for working with Fractals and Alligator

Using these two tools in practice requires adhering to certain rules:

1) Entry into the market should be sought only when fractal patterns are formed outside the “Alligator’s Teeth”:

- Buy entry when the fractal is formed above the Alligator’s teeth;

- Entry by Sell – when the formation of a fractal is fixed below its teeth.

2) The formed fractal lying outside the “mouth of the reptile” should be perceived as an actual trading signal:

- until it closes;

- or until a new trading signal is generated by the fractal indicator.

Clear and understandable entry signals for the trader are provided by the Sniper trading system, the most popular trading strategy, the advantages of which have already been appreciated by many traders. Forex Academy offers you to study the Sniper system for free to become an even more successful trader:

Fractal Lines indicator without redrawing

This is another fractal tool without redrawing. But it forms not only arrows, but also horizontal levels of green and red. With their help, you can navigate when entering the market and closing a transaction:

- red arrow – the asset is being sold;

- green arrow – the asset is being bought;

- rebound from the support level (the price went up) – buy;

- rebound from the resistance level (the price went down) – sell;

- level breakdown – entry in the corresponding direction.

Attention! This indicator is equipped with an alert. When the arrow appears, it gives a sound signal. The alert can be enabled or disabled through the “Properties” menu (right-click and go to the desired window).

Summarize

- The Fractals indicator generates a large number of patterns of different types, sizes and colors when using multi-indicators. At first glance, entry points look good, especially in history, but in reality they require experience to understand and newbies need to be especially careful.

- Indicator data should not be the determining factor for decision making. They should complete the entry point confirmation, not start it.

- A few words about automatic advisors, the description of which contains a mention of “fractality”. With all due respect to their authors, it is difficult to imagine how it is possible to develop an algorithm that replaces visual analysis of the correctness of the resulting model and especially its position relative to candlestick patterns and other instruments. It’s good if an advisor that includes such a “Fractal indicator” misses signals or is not decisive, otherwise losses cannot be avoided.