ROI 120% - is it good or bad? What does this metric affect and what to do after the calculations? How is ROI related to profit and how can you increase it using this metric?

ROI is one of the important marketing indicators along with LTV, CAC and NPS, so many entrepreneurs ask similar questions. Let's look at how ROI helps measure the effectiveness of marketing channels and how to apply it correctly to achieve success. In this article you will find a ready-made template for calculating ROI.

What is ROI

The ROI (Return on Investment) indicator is the rate of return on investment. In simple words - return on investment. This indicator shows how profitable or unprofitable a project or product is.

Investments are understood as contributions directly to the business, that is, expenses for employee salaries, rent of premises, marketing, purchase of raw materials and materials, purchase of software and services necessary for work.

Calculating ROI is necessary when you want to know to what extent the funds invested in a team, project or advertising campaign are returned. This indicator is often used to calculate the payback of different types of advertising: contextual or banner advertising, targeting on social networks, distributing leaflets, advertising in elevators. It is ROI that allows you to know the return on investment.

Example: We are engaged in the production of shampoos and want to find out how effective the costs of an advertising campaign on Facebook were. In this case, calculating ROI will help us: we will find out how much the investment in advertising, along with the expenses on producing shampoos, has paid off.

Why calculate ROI

Return on investment is calculated in order to prevent mistakes that will lead to a waste of money. That is, make an important management decision: whether to continue buying raw materials to produce the product, leave or remove a promotion channel, close the project or stop participating in it.

Calculating ROI will give you a clear idea of the level of performance of your investment. In simple words, this is an opportunity to estimate the percentage of profit that you will receive after investing money.

The indicator is expressed as a percentage for each invested ruble. A high coefficient shows that your project or promotion channel is successful.

Automation of email newsletters

Send chains of trigger messages: welcome, abandoned cart, reactivation, combining email, SMS and web push within one chain.

Set up trigger mailings

ROI, ROMI, ROAS - what are the differences?

ROI is often confused with ROMI, ROMI with ROAS, and vice versa. Let's figure out what the main differences between these indicators are.

ROI (Return on Investment) is the payback ratio or the return on all investments. This indicator helps determine how profitable the entire project is, taking into account all the investments in it. To determine ROI, it is necessary to take into account all the costs of the project and the income from it.

ROMI (Return on Marketing Investment) is an indicator of return on marketing investment. ROMI is most often confused with ROI. If ROI helps determine the return on all investments, then ROMI takes into account only marketing costs: advertising budget, printing, billboard rentals, but does not include the costs of producing the product.

ROAS (Return on Advertising Spend) is the rate of return on advertising costs. ROAS only takes into account marketing expenses for a specific advertising campaign. The main task of the calculation is to find out whether the company makes a profit from the advertising tools used.

Read also:

How to use ROI to evaluate the effectiveness of advertising?

The ROI of marketing and advertising campaigns should be assessed monthly. This will allow you to track effective channels and invest more in them. In the same way, unprofitable channels are identified: we either simply turn them off or change the operating strategy.

Using the examples above, we learned how to calculate the ROI indicator, and now let's look at what actions need to be performed with positive and negative advertising payback values:

- Channels with the highest rates see increased activity. For example, the number of contextual ads increases, display positions in search and advertising networks improve, coverage expands, and more.

- On channels with the lowest ROI values, activity decreases: we reduce the cost of ads, disable ineffective advertising platforms, work with context and key phrases, and adapt to the requests of the target audience.

The assessment of the payback rate is influenced by the percentage of payment to managers or services, seasonality of the product or service, geolocation and other additional factors.

What is a good ROI?

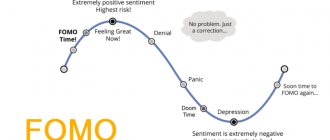

Flower pots rule and the campaign has paid off in spades. But is everything as good as it seems?

ROI is a ratio metric that is not indicative in isolation from the context. Because you can get a big ROI with a small business profit. Without knowing real income and expenses, relying only on ROI, you cannot say that you are getting maximum profit.

If you sell as much product as possible and make the maximum profit (we do not take into account price increases), then it is time to optimize your channels as much as possible and increase your ROI. If not, you first need to reach this maximum point, that is, invest in expanding the sales market. Accordingly, spend more money on advertising and slightly reduce ROI.

Let's take the situation as an example.

We have two campaigns. The product is the same - for example, the same cups. In the first case, the ROI is much higher - 105%. It would seem that this campaign is more successful. But thanks to the second campaign, more units of goods were sold and the profit was almost twice as large.

Let’s assume that the maximum flower pots you can produce at your current capacity per month is 50. But you won’t be able to sell that many, and the goods will remain in the warehouse. You can invest in advertising more and more until you sell those 50 pots, provided the ROI is > 100% and the campaigns are not unprofitable. Once you've reached this maximum, you can optimize your ad spend and increase your ROI.

Errors when calculating ROI

1. The business attribution model is not taken into account. For example, a business has a short transaction cycle: the user lands on the website - studies the product - leaves a request - buys. In this case, the value of the sale can always be given to one channel - from which the user came to the site in order to immediately make a purchase.

But if the business has a long transaction cycle, before the purchase the user comes to the site several times from different advertisements, the value of the conversion must be distributed among several channels.

The attribution model you choose will help you understand how important the user touch was for each traffic channel.

We told you in the blog: how and which attribution model to choose for a business.

2. The average duration of the transaction cycle is not taken into account. In some areas of business, customers spend a long time thinking about making a purchase. You can go to a restaurant’s website and order a pizza in a few minutes, but buying a car takes time to think it over and choose the best option.

A user may first go to a website from an advertisement in October, but only buy an expensive product in early March. If you calculate the ROI of channels outside the transaction cycle, you may decide that advertising did not pay off. In fact, it could bring money to the business, just not in the same month that the marketer launched the ad.

3. Additional costs are not taken into account: for example, payment for the work of a contractor or a commission for an advertising platform. As a result, the business sees an incorrect profit figure in the report; in fact, it is lower.

Roistat's end-to-end analytics can take into account additional advertising costs. To do this, in the end-to-end analytics report, for example, for all traffic channels you need to add the following metrics: “expenses for contractors” and “ROI taking into account additional expenses.” The additional expense will need to be filled regularly.

4. Revenues are distributed incorrectly between advertising campaigns. It can be difficult to track how many sales each ad generates. For example, a user saw an ad in Yandex.Direct, went to the site, but did not find the necessary information and left the page. The next time the user went directly - he simply entered the name of the site in the address bar - and left a request. The sales manager, of course, tried to find out which ad out of 10 that had been set up brought in a new lead. But the user could no longer remember.

As a result, to calculate ROI, a marketer has to figure out where to add a sale or calculate the total ROI for a traffic channel.

Roistat's end-to-end analytics can track advertising effectiveness down to the ad or keyword. If a keyword isn't even generating bids, you can remove it from your settings so that your ad campaign will attract more customers overall.

For example, the keys “can for bulk products”, “set of jars for food”, “can for bulk products buy” and “bread basket buy” do not generate sales - you can disable advertising for them

When to calculate ROI?

You need to understand that ROI is a metric that directly indicates action. Such metrics are also called actionable metrics. There are metrics that you can look at and be happy or, on the contrary, be upset, but they do not show what exactly is wrong and what needs to be changed (for example, churn rate or the number of subscribers). Actionable metrics show exactly what needs to be changed.

ROI is not a conversion formula; it is not calculated in the background. ROI is calculated when some management decision needs to be made. For example, if you need to choose whether to purchase equipment or raw materials, remove or leave an advertising channel, kill the loyalty program or give it the right to exist.

When calculating, you need to take a period of time when nothing has changed globally in the advertising campaign, method of distribution or production.

Read also:

When ROI Doesn't Work

ROI is not a universal tool and there are a huge number of cases in which calculating the investment ratio is simply pointless. There are quite a lot of such options, we will list the main ones.

When selling goods or services, where the client does not make a decision instantly. This especially applies to the purchase of a car, apartment, large household appliances, and expensive goods. The client weighs the pros and cons when making such an important purchase for quite a long time. He can click on the ad and make a purchase in a week or month. Accordingly, ROI will vary depending on the study period.

With a large difference in the amount of transactions, ROI is also difficult to take into account. If we take the example of selling a car, then calculating the coefficient of investment in advertising is very difficult; a one-time sale of one expensive car can break all calculations.

Summarizing all of the above: calculating the payback ratio is certainly an interesting tool, but you need to understand how to use it and in what situations . If you do everything correctly, then you can properly configure and regulate your advertising campaign without any problems.

How to calculate ROI: in Excel or online?

When calculating the ROI coefficient, there is a possibility of getting confused or not taking into account important indicators. In order not to miss anything and spend a minimum of time on calculations, there are several ways to calculate ROI automatically: using excel tables or special calculation services.

Checkroi allows you to calculate not only ROI, but also other marketing indicators.

Ciox is a standard calculator with all the necessary variables.

You can use a table in Excel and store all previous calculations there. Download a ready-made template for calculating ROI in Excel and other useful materials from the Carrot quest team in our library.

How to increase ROI

There are different methods to complete the task. Let's look at four ways to increase the indicator, each of them has its own characteristics.

- Reduced costs. The company will need to spend less money on advertising, as well as on cost analysis and performance monitoring. You need to find where you can save money, but you should approach this wisely. It is quite possible that you will still have to pay for some things, since they are the ones that generate income. A serious cost analysis will be required; in this case, it is advisable to contact a professional crisis manager.

- Increasing income. To achieve this, you can expand the list of services, as well as find new markets. Any options that are relevant for a specific field of activity are suitable. The main thing is that the company can increase its income.

- Changing the methodology for allocating costs for a specific project. It will be necessary to check how correct the economic analytics is. Perhaps the managers made some mistake. If possible, you should distribute expenses differently between projects and products. You can also adjust the expense allocation keys. Let's say the distribution of money per department depending on the number of employees.

- Strengthening analytics. For example, using end-to-end analytics or hiring a qualified specialist. Analysis of ongoing activities plays an important role in business development. The more thoroughly the analytics is carried out, the more steps become known that need to be taken for its development.

Methods for increasing ROI are varied and multifaceted. There are many different ways to positively influence this indicator. In our guide you will find 10 tips, some of which may be useful for increasing your profits.

To summarize, the return on investment is definitely worth considering. If a company understands whether the money spent is being returned, it will be able to adjust its marketing strategy and make it more effective and profitable. Otherwise, the business will continue to spend money on things that do not pay off. It is also important to consider whether there is a possibility that the investment will still bring profit in the future, or whether this option is unlikely.

The difference between ROI and DRR

DRR is the share of advertising costs or CRR (Cost Revenue Ratio). DRR is similar to ROAS and shows the ratio of advertising costs to advertising revenue. Calculating the formula helps determine what percentage of the income received is the cost of spending on an advertising campaign.

Formula for calculating DRR:

ARR = Advertising Cost/Advertising Profit * 100%

Let's return to the mugs. We spent 5,740 on advertising cups, and earned 6,400 from it (8 mugs for 800 rubles).

DRR cups: 5740 / 6400 * 100% = 89.6%

This means that we spend 89.6% of our cup revenue on advertising.

The DRR indicator, in contrast to ROI, allows you to determine the share of advertising expenses from the revenue from them. Using this indicator, we can also draw conclusions about the profitability of a project or advertising campaign. The DRR should not be higher than 100%, otherwise the advertising company will be considered unprofitable.

Example of ROI calculation

Let's look at it using a live example. Let’s say an online store created campaigns in Direct and AdWords and advertised the sale of its goods in a local newspaper. Clients who came from Direct bought for 9,700 rubles, from AdWords for 8,600 rubles, from the newspaper – 5,000 rubles. But we paid 2,780 rubles for campaigns in Direct, 2,530 rubles for AdWords, and an ad in the newspaper cost 4,000 rubles.

| Campaign Income | Campaign expenses | ROI | |

| Direct | 9700 | 2780 | 249% |

| AdWords | 8600 | 2530 | 240% |

| Announcement | 5000 | 4000 | 25% |

From this we can see that Direct is more profitable than AdWords, and an ad in a newspaper is ineffective . Every 1000 rubles invested in Direct is returned and brings in an additional 2490 rubles. In the same way, various advertising campaigns for one product or service are calculated. After which appropriate conclusions about the advertising campaign are drawn.

This coefficient cut can be carried out each time after changing the campaign. This way, it’s easy to get a complete picture of what actions and changes affect what . This allows you to maximize the optimization of advertising and marketing campaigns carried out by the company in a short time.

I calculated the ROI. What's next?

If we are talking about paid advertising, adjust advertising campaigns, disable ineffective ones, reduce or increase the advertising budget in order to expand the sales market without ineffective costs.

If we are talking about other expenses, analyze what can be used to increase efficiency or, conversely, what else is worth spending on.

Experiment. Test new ideas. Launch new campaigns. Correct your course as soon as you see that you are moving in the wrong direction.

The main value of ROI is that timely calculation of this formula allows you to make cheap mistakes. So make mistakes to learn and find the right path.

Read also:

How to automate ROI calculations

The end-to-end analytics service Roistat collects data from advertising channels, website, call tracking and combines it with data from CRM. In the Roistat summary report, the company will see how much money was spent on advertising, how many website visits, applications and sales were received from it.

In Roistat, ROI is calculated automatically. In the Analytics service, you can analyze the effectiveness of traffic channels, including tracking indicators for Yandex.Direct, Google Ads, VKontakte, email newsletters and other channels.

Example of a Roistat end-to-end analytics report

The most frequently asked questions - let's summarize

What is ROI? ROI is the return on investment or, in other words, the return on investment in a business. Calculating ROI is necessary when we need to know the profitability of a project or evaluate the effectiveness of a team. Expenses for employee salaries, renting premises, purchasing raw materials, purchasing software and subscribing to services necessary for work are all business investments that need to be taken into account in the calculations.

How to calculate ROI? If we calculate ROI for an advertising campaign or project, we take income only from these projects. Expenses include the costs directly for the project/campaign whose payback you want to calculate. If we calculate the profitability of a marketing campaign, that is, ROMI, then we only include the costs of this campaign - for example, printing and billboard rentals - but do not include the costs of producing the product.

The calculation results are expressed as percentages.

ROI calculation formula

Calculation examples

Let's look at how ROI is calculated using specific examples.

Investing in the stock market

In investment activities, return on investment is one of the indicators by which the effectiveness of an investment in a particular instrument is assessed. Under no circumstances should you make a decision to buy or sell assets based on these calculations alone. ROI is considered in conjunction with other important indicators.

The formula must take into account not only the money that the investor invested in the purchase of a particular security, but also the costs that he incurred during his ownership of it. For example, broker commissions, taxes.

Income on a stock includes the excess of the purchase price over the current value of the security and dividends paid for the analyzed period. The yield on a bond is the excess of the current market value of the security over the par value, plus the coupons received.

The simplified calculation formula looks like this:

ROI = (Net Income from Investment - Initial Investment) / Initial Investment * 100%

Net income = Asset value as of the current date – Costs (commissions, taxes) + Dividends, Coupons

Example. We bought a share for 250 rubles. Over the year, its price has increased by 30 rubles. Costs during the ownership period amounted to roughly 10 rubles. At the end of the year, dividends were received in the amount of 15 rubles. per share.

ROI = ((280 – 10 + 15) – 250) / 250 * 100% = 14%

Let's say that over the year the share price has decreased by 30 rubles. Then the profitability will be negative. Our investment turned out to be unprofitable.

ROI = ((220 – 10 + 15) – 250) / 250 * 100% = -10%

For a long-term investor, this calculation should not become a signal to sell the stock and invest in more profitable instruments. A feature of the stock market is its volatility, i.e. constant price fluctuations up and down. But in the long term it always grows. Therefore, a decrease in profitability over one year does not mean anything. You need to conduct a fundamental analysis and understand how promising this stock is for you.

Real Estate Investments

Until now, the most effective financial tool among Russians for preserving and increasing their funds is considered to be the purchase of real estate. There are several options for such an investment:

- Investment of money during the construction stage. After the house is put into operation, its price increases, and the investor makes money on this difference if he sells the asset.

- Purchasing an object and renting it out. In this case, sometimes not your own money is used, but borrowed money (mortgage).

- Purchasing shares of so-called REITs. There are a lot of them on the foreign market, including index funds (ETFs), which include several dozen REITs. In Russia, the St. Petersburg Exchange gives investors the opportunity to buy some REITs.

In all of the above cases, it is necessary to calculate performance indicators so as not to receive a return below the interest rate on a deposit in a commercial bank. If this happens, then investments in real estate will take several decades to pay off and will turn out to be ineffective investments. One of the indicators can be ROI.

Calculation formula:

ROI = (Revenue – Cost) / Initial Investment * 100%

Example. We decided to buy a new one-room studio apartment in a small regional town with a mortgage. The seller's price is 1.2 million rubles. The down payment was 10%, i.e. 120 thousand rubles. We are given a loan for 10 years at 9% per annum. Let's use a mortgage calculator and calculate the monthly payment. It is equal to 13,681 rubles. The average rent for such an apartment in this city is 15,000 rubles. Let's calculate profitability.

ROI = (15,000 – 13,681) * 12 / 120,000 * 100% = 13.19%

The investment is quite profitable, given the low deposit rates in the fall of 2022. But there are a few BUTs:

- The calculation is made taking into account the full occupancy of the apartment during the entire loan term. And this only happens if the apartment is located in a popular area with developed infrastructure, near office centers, educational institutions, for example. Therefore, an analysis of the attractiveness of the housing chosen for investment should be carried out at the very beginning.

- Repair costs are not taken into account: initial ones after purchase from a contractor and ongoing ones when changing occupants. Tenants are different. Sometimes the costs of bringing an apartment into a habitable state can be very high.

- The costs of furniture and equipment with household appliances are not taken into account, if such, of course, are needed.

Evaluating Marketing Strategies

In marketing, ROI is often called ROMI, where the letter M stands for marketing. The calculation of the indicator is especially widespread in Internet marketing, when it is necessary to evaluate the effectiveness of:

- using a specific advertising channel (Yandex Direct, Google Adwords);

- promotion of individual goods and services or categories of goods (for example, products for children, products for pregnant women);

- email newsletters with the company’s commercial offer.

Calculation formula:

ROMI = (Revenue – Expenses) / Amount of investment in a specific marketing activity * 100%

Revenue is income from the sale of goods and services that the company received as a result of implementing the analyzed marketing strategy (for example, only through advertising in Yandex.Direct). Expenses are the cost of producing goods and services.

Example. The online store sells holiday sets (baskets) with different contents (sweets, cosmetics, flowers). An advertising campaign has been created for each set. Profitability calculations were carried out for each channel. The following results were obtained for Yandex.Direct for the month:

| Product | Sales income | Cost price | Number of applications as a result of advertising | Advertising cost | ROMI |

| Candies | 800 | 650 | 30 | 2 500 | 180 % |

| Cosmetics | 1 200 | 1 000 | 35 | 3 000 | 233,33 % |

| Flowers | 1 250 | 950 | 20 | 2 800 | 214,29 % |

It is obvious that the effectiveness of advertising a basket of cosmetics is higher, despite the highest promotion costs. Calculations are made similarly for other advertising channels. As a result, ineffective ones are identified and decisions are made to improve profitability.

ROI can be used to evaluate not only online strategies, but also conventional marketing efforts. For example:

- sending catalogs by mail;

- calling clients;

- holding an action;

- development of customer loyalty programs, etc.

It is not appropriate to conduct a performance assessment in all cases. Sometimes this simply cannot be done. For example, how to evaluate street advertising? Or purchasing expensive goods (apartment, car, large household appliances)? In the latter case, people spend a long time looking at the website, exhibition samples in the showroom, catalogue, advertising in the media, etc. And only then make a purchase. But it is not possible to identify the channel that led to it.

What else to read on the topic:

- We consider LTV: what is special about this metric and why everyone needs to follow it

- CAC: how to calculate the cost of attracting a client

- NPS index: how to evaluate customer loyalty

- ROMI formula: what is the difference from ROI and how to calculate it

- Where and why users leave: how to calculate Churn Rate and start working with it

- Stop the war: how to combine marketing with sales and double your revenue - the experience of the Carrot quest team

You are reading the blog of Carrot quest - a service for increasing business revenue by communicating with clients in digital channels and reducing the transaction cycle

Connect Carrot quest 14 days free

Why do you need ROI in marketing?

“All marketers love and consider it their duty to consider ROI” - no. There is no clear opinion among professionals regarding this indicator.

Proponents of calculating return on investment believe that the indicator is important for determining strategy and makes it possible to evaluate the benefits of all advertising investments. Opponents appeal to the subjectivity of the indicator: the person who calculates ROI tries to highlight his usefulness, and due to the flexible form of calculating the indicator, this can be easily done.

We consider ourselves to be proponents of ROI. Firstly, understanding the percentage of return on investment allows you to control marketing and forecast the budget, and secondly, the entire process of calculating return on investment can be automated to significantly save time and reduce the human factor to a minimum.

In order not to be unfounded, we will talk about options for calculating ROI and share our experience in automating these calculations.

Formula for calculating ROIC ratio

ROIC is an indicator that reflects a company's past performance and is expressed as the ratio of a company's net operating income to the average annual amount of total invested capital. For potential investors, ROIC is important because it determines the return on investment before making business financing decisions. The formula for calculating the indicator is as follows: ROIC = ((net profit + interest * (1 - tax rate)) / (long-term loans + equity)) * 100%

Or:

ROIC = (EBIT* (1 – tax rate) / (long-term loans + equity)) * 100%

To clarify: net operating income is considered less adjusted taxes (NOPLAT). By total invested capital we mean the average annual amount of equity capital and long-term loans invested in the main activities of the company.

Invested capital in total is current assets in core activities, net fixed assets and other net assets (less non-interest bearing liabilities). When calculating ROIC, you should use data from annual or quarterly earnings reports.

How to use the received data?

Now you know how ROI is calculated and you can calculate this indicator for your business. But what to do next with this data? How to use new information for development?

For example, you can evaluate the effectiveness of advertising tools. This way you will understand which channel is worth investing more of your budget into. To calculate ROI, you just need to know the revenue received from each customer acquisition channel and your expenses. The table shows that Yandex.Direct’s ROI is 4.3 times higher than Google Adwords, so it makes sense to redistribute the advertising budget.

ROI calculation formula

The easiest way to calculate ROI is using the following formula:

ROI = ((Revenue − Costs) / Costs) x 100%,

where income is all the profit that the company earned over a selected period of time, costs are investments and investments.

That is, you first need to calculate the profit, then divide it by the total amount of investment and calculate the percentage coefficient.

It’s easy to evaluate the result:

- the indicator is less than 100%, then something needs to be changed - the business is suffering losses;

- ROI is 100%, then the state of affairs suggests that income is equal to expenses, which means there are no resources for development and scaling;

- if the ROI formula helped calculate a value over 100%, then the business is effective, sales are growing, and the chosen strategy is correct.

Where to calculate ROI: programs and services

In order not to waste time manually calculating the required coefficient, you can use programs and services. The easiest way is to enter the desired formula in Excel, but there are online services where this can be done in literally 10 seconds.

Moneymakerfactory

A simple online resource where you just need to enter profit and expenses, and the built-in calculator will give the correct value.

Ciox

This calculator knows how to calculate the ROI of an advertising campaign. There are more indicators here that can affect efficiency, meaning the final result will be more accurate.

CoMagic

The service for comprehensive analytics of marketing tasks will also help you calculate ROI. Moreover, the analysis will be more accurate, since it takes into account additional characteristics.

Roistat

Another useful service to help a marketer or business owner. Helps track the effectiveness of advertising campaigns and tells you how to calculate ROI. The service is paid, there is a 14-day trial period.