Views: 4626

Comments: 0

Cryptocurrency scalping is one of the most common strategies used by traders in financial markets. Scalping (“topping”, “scalping”) involves opening positions multiple times during the day with quick profit taking. This technique is actively used in the currency, stock and futures markets, and with the advent of crypto exchanges it has become widespread in crypto trading.

Main characteristics of scalping strategies for cryptocurrencies

When scalping with cryptocurrencies, a trader manually opens hundreds of positions a day, and their holding period ranges from a few seconds to several tens of minutes. Often, profits are taken after the first price impulse. This type of high-frequency trading requires the player to have good reactions and the ability to make decisions instantly. In this case, the scalper can rely on supply and demand analysis, market reaction to news, technical analysis and intuition. Intraday profit taking requires high volatility of the asset, and the cryptocurrency market meets this criterion. If a currency pair's movement of 1% is considered large in Forex, then a digital coin can rise or fall by 20-30% during the day. Such volatility provides the trader with great opportunities, but the risks also increase.

Basic styles in scalping:

1. Pipsing (from the word “pips” - the minimum possible movement of an asset) is an aggressive high-speed technique with instant profit (loss) fixation. A scalper makes several trades within a minute. 2. Classical method - a transaction is made after an express analysis of the market using graphical tools, mathematical indicators, analysis of the movement of other assets, news monitoring, etc.

Technical Analysis (TA) Vs. Fundamental Analysis (FA)

There are two general approaches to studying cryptocurrency markets:

- Technical Analysis (TA)

- Fundamental Analysis (FA)

Technical analysis (TA) analyzes market price and volume data over time. Using patterns deciphered by reading charts and mathematical indicators, you can get an idea of the future behavior of the market, which will increase the accuracy of entering and exiting a transaction.

Fundamental analysis, on the other hand, involves examining a country, industry, or future earnings prospects based on macroeconomic, industry, and company-specific conditions.

What does a beginner need to know about scalping?

Scalping is one of the riskiest trading styles in financial markets.

High-frequency manual trading is intuitive and has high potential profitability, which is why it is often used by novice traders. However, only a small percentage of them consistently make a profit from scalping cryptocurrencies.

Flaws

The main disadvantages of scalping include:

- High transaction costs in the digital currency market. Commissions on crypto exchanges are much higher than on Forex, stock or derivatives markets. At the same time, the highest commissions are set by the most popular and reliable trading platforms, and the lowest ones are set by new and risky ones.

- High technical risks. Scalping places increased demands on hardware, internet speed and reliability. Many crypto exchanges are malfunctioning. With any technical problem (stock exchange, Internet, power outages), a trader can lose a lot of money.

- Human factor. High-frequency manual trading causes a lot of stress for scalpers. As practice shows, most players are not able to cope with their emotions.

- Large expenditure of time and effort. Unlike more conservative trading styles, scalping requires the trader to constantly be at the trading terminal.

Advantages

An example of the levels of opening and closing transactions when trading using a scalping strategy

But scalping also has significant advantages:

- This technique is an excellent express school for beginners. It allows you to quickly understand market mechanisms, master the main technical indicators for scalping, and develop your own trading style.

- Fast feedback. A conditional high-frequency strategy for a beginner “Beginner” for beginners will give the scalper the necessary statistics in a few days, whereas with position trading it will take several months.

- High potential profitability. On some days with high volatility, you can earn profits amounting to tens or even hundreds of percent.

conclusions

Scalping is a good way to make quick money for a person who knows how to quickly analyze information and charts of digital assets, as well as competently read indicator signals.

However, this type of work is associated with a number of risks. You can increase the safety of trading through regular training and constantly expanding your knowledge base.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action based on information published on this site is taken by the reader solely at his own risk. In our Knowledge Base section, our priority is to provide high quality information. We carefully identify, research and create educational content that is useful to our readers. To maintain these high standards and continue to produce quality content, our partners may compensate us for featuring them in our articles. However, such payments do not in any way affect the processes of creating objective, honest and useful content.

Types of scalping strategies

Scalping strategies vary in terms of how long a trade is held and how they analyze the market.

Conservative scalping strategy

Here, a trader can wait a long time for the optimal entry point into the market, and the position is held from one to several tens of minutes. For the conservative Intraday strategy, various technical analysis tools are used: support and resistance lines, moving averages, graphic patterns, mathematical indicators and oscillators.

Moderate scalping strategy

A scalper makes several dozen trades within an hour, and the position holding time may not exceed a minute. There is little time left for market analysis; you have to rely more on reaction and intuition. The trader monitors supply and demand, the market’s reaction to news, and the dynamics of the behavior of guides.

Aggressive scalping strategy

In this case, the position is closed instantly a few seconds after opening. Such strategies on cryptocurrencies involve taking a profit of several points. Due to high commissions on crypto exchanges, their use is not recommended.

Key assumptions of technical analysis

- Price Action includes all public and non-public information (including forecasts, expectations and sentiment)

- Prices move according to trends or stable patterns

- History repeats itself

When investing in cryptocurrency over a longer period of time and without any leverage, the timing of entering or exiting a position is less important. However, a trader who buys and sells several times a week or day will often use leverage to achieve the desired return. This leverage comes with significant risk, especially when trades are not timed. Technical analysis helps with this timing and helps ensure entry and exit accuracy.

Money management

Risk management in scalping is even more important than in other trading styles. The golden rule of trading says that first of all it is necessary to preserve trading capital, and only then think about increasing it. A deal is never opened for the entire deposit, but only for its pre-calculated part. To limit losses, stop orders are always placed on a transaction. Limits are determined not only for each transaction, but also for the trading period (day, week, month). If the set value is reached, trading stops. For example, a scalper's capital management system for trading BTC USD may include: risk per transaction - 1-2% of the deposit, daily limit - 5% of the deposit, maximum drawdown for the month - 15% of the trading account.

Trend indicators

Trading with a strong directional price movement (trend) is considered the most profitable option for any financial asset, including cryptocurrencies. The only problem is how to find the moment of the beginning and, most importantly, the end of the trend.

The first way is to plot trend lines on a chart based on at least three local maximums/minimums. The figure shows an example of an uptrend, when each next max/min is higher than the previous one. The lower line will be support, the upper line will be resistance, for a downward trend they change places. We immediately see the problem - most of the trend has already been passed, and the best entry points too. If you do this after the third extremum, you can get into a reversal and get a loss instead of a profit. Especially if these are binary options with a fixed expiration.

moving averages ( MA) were developed , which, by smoothing out the “market noise,” show the true direction of the trend and the moment the reversal begins. You can trade in two ways:

- by MA movement. Above the average the most accurate signals are to buy (BUY), below the average to sell (SELL).

- on reversals at the moment of intersection of averages with different periods.

All trading terminals include basic MA smoothing algorithms (see figure), there are many modifications that need to be carefully tested before using them in trading.

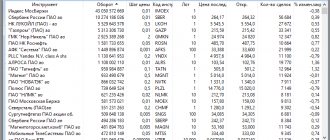

An example of trading using a scalping strategy on a cryptocurrency exchange

Let's give an example of a conservative counter-trend scalping strategy on a cryptocurrency exchange. At the first stage, you need to select a coin that is included in the TOP-100 by capitalization, according to the following criteria: a fall over the last 7 trading days of more than 20%, while the dynamics over the last day and last hour should be positive, but not exceed 5%. To implement such filtering, there are special programs on specialized resources.

We study the charts of suitable cryptocurrencies. The optimal choice would be a coin that has hit a strong support level and is about to reverse. To confirm a possible correction, the MACD indicator is used. If all conditions are met, the currency is purchased. Take profit (automatic profit fixation) is set at 10% of the entry point, stop loss (automatic loss fixation) is set below the support level.

How is scalp trading different from day trading?

In the past, we have discussed another short-term cryptocurrency trading strategy called day trading. Compared to long-term trading, day trading requires the trader to focus on small price movements. So the question arises: how is scalp trading different from day trading?

If we have to point out one significant difference between day trading and scalp trading, it would be the time frame.

While both day trading and scalp trading fall under the broader concept of day trading occurring within a single day, many retail traders rely heavily on short-term price action, measured in minutes and seconds, to make profits. This is where scalping trading is preferable to day trading.

Main mistakes when using scalping

Scalpers make the same mistakes as position traders, but they cost more. The most common mistakes:

- “Sitting out” losses. The trader does not close a losing trade on time in the hope that it will become profitable. This is the most common mistake among beginners. In scalping there is not always time to set stop losses, and the ability to quickly close a position manually is the key to success. Failure to record losses most often leads to the destruction of an account.

- Averaging. An aggravation of a previous mistake when a trader adds another to a losing position. On the one hand, this shortens the path to the break-even point, and on the other hand, it increases risks, since continued movement leads to a double loss. The construction of such a pyramid leads to a rapid loss of deposit.

- Tilt. This term is used to describe a stressful state when a trader loses control over himself and begins to make frequent chaotic transactions that were not provided for by the trading strategy. Scalpers often find themselves on tilt, having received losses and trying to quickly win back.

- Early profit taking. Although scalping involves quickly taking profits, only powerful movements provide greater profits.

- Failure to comply with the capital management system. Using high leverage or incorrectly calculating position size can throw a scalper out of the game.

- Trading with other people's money. Due to high risks, scalping using client funds is not recommended.

Should I start scalp trading?

It completely depends on what trading style suits you. Some traders don't like to leave open positions while they sleep, so they choose short-term strategies. Day traders and other short-term traders may fall into this category.

On the other hand, long-term traders like to develop solutions over a longer period of time and do not mind having positions open for several months. They can simply set their entries, profit targets and stop losses, and monitor the trade from time to time. Swing traders may fall into this category.

So, if you want to decide whether you want to take scalp trades, you need to figure out which trading style suits you best. Additionally, you will need to find a trading strategy that suits your personality and risk profile so that you can implement it consistently and profitably.

Naturally, you can try a few strategies and see what works and what doesn't. Paper trading on the Binance Futures testnet can be a great way to test them out. This way, you can test scalping strategies without risking real funds.

Should you use scalping in cryptocurrency trading?

A topic such as scalping on crypto exchanges requires a careful approach. This style of trading allows you to quickly understand the principles of pricing in the market, master the technique of placing orders, etc. The main thing is not to scalp large sums at once. It is optimal to allocate a small part of your trading capital to this strategy, and use more conservative trading styles to manage the main part. Scalping is not for everyone. It requires high reaction speed and great psychological stability. Some players who started with scalping move on to algorithmic trading based on their experience. Most often, success is achieved by traders who combine various methods and techniques, adapting them to the market situation.

Price channels

The price never moves linearly, otherwise there would be no support/resistance lines from the borders that can be worked on during pullbacks and corrections. To eliminate the need for manual construction, channel indicators were developed that can be used during sideways movement (flat) if the channel width is from 20-30 points. Let's look at examples:

- Bollinger Bands ( BB, Bollinger Bands), Keltner Channel (Keltner channels). Popular indicators based on dynamic channels: three Moving Averages, the distance between the extreme ones changes together with volatility. We trade rebounds from borders and breakdowns of the middle line (filtering false BB signals according to Keltner).

- “hard” (fixed) Doncian Channel (Donchian channel) and standard Envelopes . Here volatility is not taken into account: Donchian lines are based on local highs/lows, the Envelopes width is set in the settings and does not change as the trend progresses.

The last example shown is the multi-frame channel indicator MAChannel_Close (not included in the basic set of terminals); an additional panel is displayed where you can see data for other time periods. Thus, you can quickly assess the situation without switching from the working timeframe.

Oscillators

All "canalizers" use MA as a basis for calculations. To compensate for their lag and filter out false signals, any strategy should use indicators of the onset of market overbought/oversold.

Let's see how this works using the example of the Stochastic oscillator: when it is above the 80 level, it means that the ability of buyers to further increase the price is running out (overbought), a downward reversal begins until the moment when buyers can no longer buy back the asset at an ever lower price (oversold below level 20) and the cycle repeats.

Technical oscillators using histograms (see figure) work on a similar principle, although visually they look different. Breaking the zero level confirms a new trend, a reversal of the histogram from the maximum values indicates the onset of overbought/oversold.