Common market concepts

The concept of the market arose quite a long time ago and over time has acquired many varieties.

First of all, the market means the development of national economic relations in the production and distribution of resources that come into use. As a result of these relationships, demand, supply, and their derivative—price—are formed.

The market is an institution that provides communication between existing and potential producers and consumers, with the subsequent conclusion of a trade agreement.

In a broader sense, the market is a system of economic relations based on constant exchange actions between producers of goods (services) and consumers.

The market is not only a place, but also certain relationships between people.

ATTENTION!

As a result, the market is both a place, relationships between people, and people themselves.

Footnotes:

Protection of the rights of consumers of financial services / M. D. Efremova, V. S. Petrishchev, S. A. Rumyantsev, etc. - M.: Infra-M, 2010. - p. 29.

Protection of the rights of consumers of financial services / M. D. Efremova, V. S. Petrishchev, S. A. Rumyantsev, etc. - M.: Infra-M, 2010. - p. 139.

Business journalism / A. V. Afanasyeva, M. V. Blinova, D. A. Borisyak, etc. - M.: MediaMir, 2012. - p. 148.

Business journalism / A. V. Afanasyeva, M. V. Blinova, D. A. Borisyak, etc. - M.: MediaMir, 2012. - p. 148.

Protection of the rights of consumers of financial services / M. D. Efremova, V. S. Petrishchev, S. A. Rumyantsev, etc. - M.: Infra-M, 2010. - p. 86.

Business journalism / A. V. Afanasyeva, M. V. Blinova, D. A. Borisyak, etc. - M.: MediaMir, 2012. - p. 148.

Business journalism / A. V. Afanasyeva, M. V. Blinova, D. A. Borisyak, etc. - M.: MediaMir, 2012. - p. 154.

Business journalism / A. V. Afanasyeva, M. V. Blinova, D. A. Borisyak, etc. - M.: MediaMir, 2012. - p. 154.

Business journalism / A. V. Afanasyeva, M. V. Blinova, D. A. Borisyak, etc. - M.: MediaMir, 2012. - p. 150.

Protection of the rights of consumers of financial services / M. D. Efremova, V. S. Petrishchev, S. A. Rumyantsev, etc. - M.: Infra-M, 2010. - p. 24.

Protection of the rights of consumers of financial services / M. D. Efremova, V. S. Petrishchev, S. A. Rumyantsev, etc. - M.: Infra-M, 2010. - p. 24

Reasons for appearance

There are several reasons for the emergence of a market. Let's consider the main ones:

- Division of labor. With the development of society and the growth of labor productivity, various branches of production appeared. Some categories of people have learned to produce certain types of material goods (resources, goods) or services. This progress has given rise to the need to exchange them for other material goods or services.

- The emergence of different commodity producers. The division of labor caused the emergence of many different manufacturers of goods. They were economically isolated. In other words, they could independently decide what product or service to produce, in what volume and at what cost to sell. From this we can conclude that an important criterion for the development of market relations is the right to private property.

- The emergence of commodity-money relations. The growth in the volume of production of goods forced society to come up with an equivalent for the exchange of national economic consumer products.

- Limited capabilities of an individual subject. Each participant in market relations individually is less effective and limited in creating the material needs of society. Obtaining all the resources required for production is possible only with his participation in relationships with other market entities in the form of exchange, purchase and sale or cooperation.

Lecture test questions:

- Which organizations perform the functions of financial regulators in Russia? List the most famous of them.

- What are the supervisory functions of the Central Bank of the Russian Federation as a mega-regulator of the financial market?

- How are powers to protect the rights of consumers of financial services divided between the Central Bank of the Russian Federation and Rospotrebnadzor?

- What instruments does the Central Bank of the Russian Federation use to implement monetary policy?

- What is the main goal of the monetary policy of the Central Bank of the Russian Federation, starting from 2014?

- What are the advantages of a floating ruble exchange rate over a fixed one?

- What do gold and foreign exchange reserves consist of?

- For what purpose are gold and foreign currency reserves created, and how are they used?

- For what purpose can a journalist use financial regulator databases?

- Why are financial consumers considered economically weak?

Properties of a free market

A free market is a system of economic relations between its participants, characterized by the voluntary exchange of goods, services and money.

The main features of such a market are:

- the leading importance of private property;

- unregulated demand, supply and price of consumer products;

- unlimited access of any manufacturer to market relations;

- competition among manufacturers;

- mobility in the use of material and financial sources in the interests of the manufacturer;

- unrestricted movement of employees.

ATTENTION!

In a free market there is no influence of government agencies on it. The state only establishes legal rules for carrying out market activities.

Government regulation

Government intervention in market relations is used to control economic processes and adapt them to the market environment.

The state regulates:

- distribution of funds received;

- balance of supply to demand.

In the modern world there are two ways of government regulation of the market:

- Indirect influence. Determination of depreciation rates, control of government expenditures, updating of the current tax system. The main strategy is to implement sound monetary and fiscal policies. Using this method, authorities can achieve an optimal supply-demand ratio and reduce the rise in market prices.

- Direct influence. The main mechanism here is legal control of all market relationships. The tools of this method are licensing, holding events in accordance with various programs aimed at supporting manufacturers, and others.

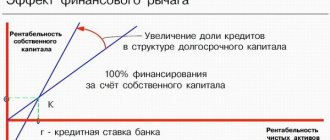

Borrowing as a tool

Savings in any state are a valuable resource that is used to develop the economy of a certain region or state. The money supply, which is savings, is actively used by participants in the public sector, business and representatives of the external economy. How exactly? With the help of loans. Borrowing is the most important macroeconomic tool. Many experts call it industrial fuel. Thanks to loans, many markets and industries are developing.

The role of the financial market in the loan process is undeniable. This sector of the national economy is the most necessary link for obtaining credit funds. The financial market connects representatives of all three economic areas - business, the public sector and representatives of the foreign economic space. Thanks to the financial sector, these areas interact and receive credit funds for this interaction.

Functions

The purpose of the market is determined by the goals it solves.

The following market functions are distinguished:

- Pricing. As a result of interactions between consumers and producers, a price is formed that depends on supply and demand. It includes the benefits of the product and the costs of its manufacture.

- Stimulating. Due to the diversity of market supply, in which more income goes to the market entity offering the most in-demand products and the manufacturer whose production costs are lower compared to competitors, the market motivates participants to regularly seek economic benefits, improve production, minimize costs and wisely use resources .

- Informational. The price of goods contains information that buyers, producers and investors need to carry out efficient economic transactions.

- Distribution. Limited products and sources are distributed through market mechanisms in accordance with the bargaining power of consumers, forming a new redistribution. Under its influence, the consumption of material goods moves to economic segments that are willing to pay a certain price.

- Regulatory. This function lies in the influence of the market on most economic sectors, in particular on production. Constant changes in prices not only reflect the state of affairs, but also adjust business activities.

- Mediation. The market is an intermediary between the producer and the consumer, providing them with the opportunity to take advantage of profitable buying and selling options.

- Social. The success of a market participant consists of a number of skills - entrepreneurship, initiative, communication skills and other subtleties. There is a formation of public demand for such people, which leads to the emergence of conditions for learning such social skills.

- Sanitizing. Under the influence of competition, the market regularly makes a “natural selection” of participants in production activities, clearing itself of ineffective players.

Forms of organization

The market system must have a certain form to ensure the normal flow of the trading process.

The main forms of market existence:

- Exchanges. A popular form of market relations that unites trade participants in accordance with special standards developed on the basis of regulations.

- Auctions. Under this form, a number of consumers are offered to buy the same product, which in turn increases competition among them and increases the price of the product.

- Exhibitions. Here, the increase in demand is carried out through a visual demonstration of the product, during which consumers and sellers interact and have the opportunity to conclude related transactions.

- Trade fairs. A form of trade that is periodically organized to advertise one's own product and sell the maximum volume in a short period of time.

Economic laws of the market

Market relations are subject to the influence of a number of economic laws:

- Law of value.

- Law of supply and demand.

- Law of competition.

ATTENTION!

Price competition takes place in open and closed forms, in the form of discounts and promotional offers.

Law of Value

In accordance with it, the production and exchange of products occurs on the basis of value, that is, determined by socially necessary labor costs.

Law of supply and demand

The essence of this law is that the optimal price level is determined by the influence of supply and demand. With such a balanced price, the desire and willingness of consumers to buy the product and the seller to sell it are similar.

Additionally, there are separate laws:

- Law of demand. If, given the previous conditions, the price of a product rises, then the demand for it decreases.

- Law of supply. If, under the previous conditions, the price of a product rises, then the volume of supply also increases, and, conversely, if the price decreases, then supply also declines.

Law of competition

This law assumes that there is an external force in the market system that forces manufacturers to reduce costs, increase productivity, develop production capacity, and also carry out organizational economic changes.

Investment component

These and other tasks and purposes of the financial market indicate that each state urgently needs to develop its national financial market. We must strive to ensure that it is integrated into the international financial space. This definitely contributes to the influx of investment, which will provide a powerful incentive for the development of the entire economy of a particular region.

Of course, streamlining and regulating the financial market is a daunting task. Trends are constantly changing, new trends and products appear that expand the range of financial instruments. However, there are also conservative, unchanging fundamentals. For example, what remains unchanged is that the foundation of any financial market is numerous savings, both legal entities and individuals.

Market infrastructure

Market infrastructure is a system of institutions, public and private companies that support the efficient operation of market relations.

The infrastructure of three markets is distinguished:

- Commodity. Includes commodity exchanges, wholesale and retail trade organizations, auctions, fairs, intermediary over-the-counter firms.

- Financial. Consists of stock and currency exchanges, insurance companies and funds.

- Labor market. Formation is provided by labor exchanges, employment services and other institutions.

ATTENTION!

The effective functioning of the market must be ensured by advertising, advisory services, as well as control and verification institutions.

Perfect competition

Perfect competition refers to a market condition in which a large number of sellers offer an identical product or service.

In such a market, an individual seller or consumer is unable to influence the price level, since it is formed using the balance of supply and demand.

Characteristics of pure competition:

- a mass of equivalent suppliers and consumers;

- identity and interchangeability of goods and services;

- free access to the market and unlimited exit;

- high mobility of resources that can be instantly redistributed for other purposes;

- equal and full access of all individuals to information: about prices, supply and demand, competitors.

ATTENTION!

If one of the criteria is missing, competition is considered imperfect.

Monopoly

A monopoly market implies the presence of a single supplier selling a certain product, as well as barriers to entry for new producers into the market.

Signs of monopoly:

- the manufacturer controls the supply of goods solely;

- demand for goods is stable;

- the presence of one supplier, and therefore there is no difference between the concepts of a company and an industry;

- the manufacturer independently sets the price of goods or services;

- restrictions on the entry of new companies into the market;

- a manufacturer can achieve greater income only by increasing sales volume, possible due to lower prices for goods;

- lack of substitutes for the monopoly product.

Monopolistic competition

Monopolistic competition is a market form in which several suppliers compete with each other for sales volume, selling products that are similar in purpose.

A market with monopolistic competition has the following features:

- a large number of independent companies and consumers;

- heterogeneous, differentiated products;

- producers influence the price of their own product;

- entry into the industry is not very limited;

- suppliers and consumers have complete information about market conditions;

- brutal non-price competition provided by advertising, design, service and other subtleties.

Oligopoly

Oligopoly is a form of market in which a few large organizations have power over the production of a product.

The main signs of oligopoly:

- a small number of manufacturing companies (from 2 to 5);

- access of new companies to the market is limited by certain nuances in the form of large start-up capital or existing legislative barriers;

- the actions of manufacturers are similar, since everyone is afraid of making a mistake, which could result in losing part of the market;

- the price level is stable in most cases, since the price struggle is exhausting, and the bankruptcy of competitors is hardly acceptable;

- price war is not in demand, but companies focus on non-price competition.

ATTENTION!

Companies in such a market can pursue two strategies: fight on prices, trying to eliminate competitors, or maintain cooperation by agreeing on price levels.

The concept of gold and foreign exchange (international) reserves

Gold and foreign exchange reserves (GER) are highly liquid government assets represented in the form of gold, foreign currency, government securities (most countries in the world use US Treasury bonds to create gold reserves), special drawing rights (SDR) and a reserve position in the IMF. “Special Drawing Rights (SDRs) are international reserve assets issued by the IMF and held in the account of the Russian Federation in the fund.

The reserve position in the IMF is the sum of positions in the reserve tranche (the foreign exchange component of the Russian Federation’s quota in the Fund) and the country’s claims to the IMF under the New Arrangements to Borrow (NBA).”

Russia's gold and foreign exchange reserves consist of the reserves of the Central Bank and the Government of the Russian Federation under the management of the Ministry of Finance of the Russian Federation. As of 2016, Russia ranked sixth in the world in terms of gold reserves (1.5 thousand tons) after the USA (more than 8 thousand tons), Germany (more than 3 thousand tons), Italy (2.5 thousand tons). t), France (2.3 thousand tons) and China (1.8 thousand tons).

Gold and foreign exchange reserves are a financial reserve left in case a crisis occurs in the state and there are not enough funds to pay off government debt obligations and budget expenses. “They can be used at any time to finance balance of payments deficits, interventions in foreign exchange markets to influence the exchange rate of the national currency, or for other similar purposes.” For example, in Russia gold and foreign currency reserves were actively used to maintain the exchange rate of the national currency during the crises of 2008–2009. and the crisis of 2014–2015.

Types of markets

In the modern world, markets are divided into several segments according to their characteristics.

By type of objects of sale and purchase

This segment includes:

- Resource market. Includes: the labor market, the labor market, the market for natural resources (land, water, mineral deposits and others), the market for artificial means of production - a diverse market for tools and means of labor.

- Consumer. This niche includes: the food market (catering products), the non-food market (clothing, household goods), and the consumer services market (education, healthcare, personal services).

- Financial. Money market (currency, precious metals), market for borrowed sources (temporarily free money lent), insurance market (insurance policies), stock market (securities, shares, bonds), derivatives market (various contracts, futures transactions and options).

- The market for copyright ownership and use. Rental and leasing market, concession contract market.

- Market for activity rights. This includes: the market for licenses for certain types of business activities, the market for intellectual property and its rights, the market for patents, as well as the market for licenses.

- Market of spiritual values. The market for artistic works and their ownership rights, the market for cultural and historical relics.

Geographically

Depending on the location there are:

- Local markets.

- Regional. A market system determined by geographic or administrative regions.

- National. A market system within one country under an identical legal and tax regime.

- International. Markets driven by customs and economic unions.

- World. Global market system of the world economy.

According to the mechanism of interaction between suppliers and consumers

This niche includes the following types of markets:

- Contact. Here the owner, or his representative, an authorized figure independently sells personal consumer goods.

- Agency. Sales of products to the buyer are carried out with the help of intermediaries who bring together suppliers and consumers directly at the stage of concluding an agreement between them. The intermediary is paid a commission for conducting the contract.

- Exchange. In such a market system, the interests of suppliers and consumers are represented by brokers. They carry out transactions in accordance with the instructions of suppliers and consumers. Meanwhile, the key players do not contact each other, since transactions are concluded by persons authorized by them.

By volume of purchase and sale transactions

Depending on the volume of purchases and sales, there are:

- Wholesale markets. Sales of identical products are carried out in large quantities. In this case, the consumer buys products for further resale in smaller quantities.

- Small wholesale. In such markets, unlike wholesale markets, goods are sold in smaller quantities. Consumers most often buy a product for further resale in a retail network and extremely rarely for personal use.

- Retail. Sales of products are carried out individually or in the smallest batches possible. The consumer in most situations is the final recipient of the product.

By type of competition

Based on the level of independence of suppliers and consumers, there are the following market options:

- Competitive. There are many consumers and suppliers, resulting in strong competition.

- Oligopolistic. In this market system, with many consumers, there are a limited number of sellers. When they collude, they can influence demand and the price level.

- Oligopsonic. There are a limited number of buyers with many sellers.

- Monopoly. There is one seller in the market with many buyers.

- Monopsonistic. There is one buyer and many sellers in the market.

By level of legality

In accordance with this sign there are:

- Official markets. All market transactions are conducted in accordance with clear standards established by government agencies.

- Unofficial (shadow). Transactions are carried out illegally to avoid tax payments.

- Black. Transactions are carried out using illegal or prohibited goods and services.

General concepts about financial instruments

Financial instruments: essence, types Basic financial instruments of the stock market Classification of financial instruments Financial instruments and their role in assessing the investment attractiveness of a company Information support for financial instruments The Ministry of Finance adopted Resolution No. 74 dated December 12, 2018, which approved the National Accounting and Reporting Standard “Financial Instruments” " But not all accountants have a clear understanding of what a financial instrument is. In connection with the adoption of the standard, many questions arose, some of which this article is intended to clarify.

As the capital market developed, new types of financial instruments appeared (forwards, futures and options contracts, swaps, etc.). In modern conditions, the most detailed definition of the concept of “financial instruments” is given in the international accounting standards “Financial Instruments: Disclosure and Presentation of Information”, which came into force on January 1, 1996 (IAS 32). A financial instrument is any contract that simultaneously increases the financial assets of one corporation and the financial liability (equity or debt) of another corporation.

Thus, financial instruments (from the English financial instrument) include:

- cash;

- a contractual right to receive cash or another type of financial asset from another corporation;

- a contractual right to exchange financial instruments with another corporation on potentially favorable terms.

Financial obligations include the following contractual obligations to pay another corporation:

- cash or provide another financial asset;

- exchange a financial instrument with another corporation on potentially unfavorable terms (for example, selling receivables at a discount).

The following type characteristics allow a transaction to be qualified as a financial instrument: the transaction is based on financial assets and liabilities; the operation takes the form of an agreement (contract).

Financial instruments: essence, types

A financial instrument is any contract through which the financial assets of one enterprise and the financial liabilities (debt or equity) of another occur simultaneously.

There are primary financial instruments, represented by cash, types of securities, accounts payable and receivable for current transactions, and secondary, or derivatives. There are 4 types of markets - foreign exchange, futures, money market and stock market. Each of them uses its own financial instruments, i.e. documents that can be sold or transferred to receive money. Securities are traded on the stock market, and they are its main instrument. In essence, these are certain types of obligations with the help of which funds are invested - investing. Stock market instruments can be divided into 2 large subgroups:

- basic instruments (which include bonds and shares, bills, mortgages, bank certificates, in a word, everything that in itself represents the right to a certain price asset). These also include accounts payable and receivable for current operations. For example, a share gives its owner the right to a share in the company, a bill gives the holder the right to receive the amount specified in it, etc.;

- derivative instruments (options, bills, checks, futures, etc.).

Main financial instruments of the stock market

Primary financial instruments include:

- loan agreements;

- loan agreements;

- bank deposit agreements;

- bank account agreements;

- financing agreements for the assignment of monetary claims (factoring);

- financial lease agreements (leasing);

- surety agreements and bank guarantees;

- equity and cash based contracts.

Credits and borrowings are one of the most common financial instruments in the financial market.

When performing transactions, the organization that acts as the lender allocates funds to the borrower. He, in turn, must return them. Bank deposits.

The borrower is the bank, which subsequently, after a certain time, must pay the lender interest for using the amount. A special feature is the fact that a bank deposit agreement must be drawn up in writing.

Leasing operations.

They are very common lately, and this is due to the fact that they are convenient for all parties who take part in the transaction. According to the concluded agreement, the lessor must purchase the equipment or property that the tenant wants to rent. The purchase is made from a third party called the seller. The lessor remains the owner of the property, but despite this, the lessee bears the risk of any losses. As a result of such a transaction, the lessor receives an asset - a long-term investment, and the lease recipient receives an obligation to pay a certain amount for the lease. Leasing operations are regulated by the National Accounting and Reporting Standard “Financial Lease (Leasing)”, approved by Resolution of the Ministry of Finance dated November 30, 2018 No. 73.

The main ones are those securities, the essence of which is property rights to an asset (this can be money, property, goods, resources, etc.). Newcomers to the stock market do not always understand the difference between the main financial instruments of the stock market. These primarily include shares.

Shares are those securities that assign to their owner the fact of participation in the formation of the fund of a joint-stock company, and those that give the owners the right to receive profit from the activities of this company. This instrument is widely represented both in the Belarusian and global markets. Shares are classified as low-liquidity (i.e., difficult to convert into money), but highly profitable instruments. A share is an investment instrument; the invested funds can only be returned if you sell the existing securities.

Shares provide an opportunity to receive income, but the amount of this income is not known in advance and is not even guaranteed. What it will be is determined by the joint stock company that issued the shares; it is based on the income received by the company for the year. Income from shares depends on how exactly the enterprise (joint stock company) operated. If a profit is made at the end of the year, the shareholder will receive income. If there was no profit, then the shareholder will receive nothing. A joint stock company can grow or shrink, investors will invest or bypass the company - the share price will change accordingly. To receive a constant and high income from stocks, you need to constantly monitor changes in the market and news on the stock exchange, sell and buy these securities.

Shares are divided into categories depending on the privileges that their owners receive with their help. Preferred shares make it possible to fix part of the property if for some reason the owner declares himself bankrupt. That is, if the company goes bankrupt, the money invested will be returned. Shares are an equity instrument (in this context, an investment in another company), so treasury shares, as well as interests in a joint venture or subsidiary, are excluded from this definition.

Thus, a financial instrument represents a link between the assets or rights of a company, on the one hand, and the liabilities or equity instruments of another company, on the other.

Another category of securities is bonds. They confirm that their owner gave money to the one who issued the bonds, and the one who issued the bonds is obliged to pay this money within the agreed period, and the owner will receive a pre-agreed income. A bond is an instrument for immediate income; it is valid only for a certain period. The income of the bond owner is known initially; it is calculated based on the par value of the security. This is a fixed value (which is the main difference from a stock). A bond also differs from a bank deposit in that it can be sold; it is a tradable instrument. Bond prices also change, although not as dramatically as stocks.

There are significantly fewer bonds on the Belarusian market than on foreign markets, but in terms of the volume of transactions, it is bonds that occupy a leading position (due to government securities). Bonds have their own classification. They may vary:

- by issuer (the one who issued them) - be state, municipal, corporate;

- by type of income - there are discount (without fixed income), coupon (with fixed income) and with a floating interest rate;

- if possible, exchange - there are convertible and non-convertible.

Another completely separate financial instrument of the stock market is commodity assets, i.e.

real goods (gold, cotton, oil, grain, etc.), but purchase them on the stock exchange as a financial asset. This is due to the fact that the cost of these goods is growing all the time, so such a purchase saves money and protects them from inflation and depreciation. And in order not to store goods at home, stock investors came up with settlement contracts - options and futures, i.e. secondary (or derivative) financial instruments, which will be discussed below. A security is a document drawn up in the prescribed form, indicating the ownership of its owner for a certain amount of money or specific property values. Securities are rights to resources that are separated from their basis and have their own material form (for example, in the form of a paper certificate, account entries). They must meet such fundamental requirements as negotiability; availability; regulation and recognition by the state; liquidity; risk; performance obligations.

If securities have a price asset underlying them, they are called derivatives. Receivable and payable financial debt. It is necessary to distinguish between receivables and payables, for which settlement will be made in cash or securities (financial instrument), and debt, for which settlement will be made in goods (not a financial instrument). A financial instrument also does not include accounts receivable and payable to tax and other authorities.

Secondary financial instruments arose as a result of the transformation of traditional financial relations associated with the acquisition of property rights, as well as partly loan and credit operations.

A derivative financial instrument, derivative (English derivative) is an agreement (contract) under which the parties receive the right or undertake an obligation to perform certain actions in relation to the underlying asset (which can be the primary financial instrument). Usually the opportunity to buy, sell, provide, or receive some goods or securities is provided. Unlike a direct purchase/sale agreement, a derivative financial instrument is formal and standardized, initially providing for the opportunity for at least one of the parties to freely sell this contract, i.e. is one of the securities options. The price of a derivative and its pattern of change are usually closely related to the price of the underlying asset, but are not necessarily the same.

At its core, a derivative financial instrument is an agreement between two parties whereby they undertake an obligation or acquire the right to transfer a specified asset or sum of money on or before a specified date at an agreed upon price. Typically, the purpose of purchasing a derivative is not to physically obtain the underlying asset, but to hedge price or currency risk over time or to obtain speculative profit from changes in the price of the underlying asset. The final financial result for each party to the transaction can be either positive or negative.

Modern instruments appeared because most market participants had a desire for speculative transactions. Speculation is an investment in risky assets that, if possible, will allow for large amounts of profit.

A distinctive feature of derivative financial instruments is that the total number of obligations under them is not related to the total number of the underlying asset traded on the market. Issuers of derivatives are not necessarily the owners of the underlying asset. For example, the total number of CFD contracts (CFD is a contract for difference in prices concluded between a buyer and a seller through a broker) for shares of a certain company can be several times greater than the number of issued shares. Buyers and sellers of CFD contracts are not initially focused on the delivery of real shares; they are only interested in the difference in price that arises for these shares over a period of time specified in the contract or under specified conditions.

A derivative financial instrument has the following characteristics:

- its value changes following changes in the price of the underlying asset (interest rate, price of a commodity or security, exchange rate, index of prices or rates, credit rating or credit index, other variable);

- to acquire it, small initial costs are sufficient compared to other instruments, the prices of which react in a similar way to changes in market conditions;

- settlements on it are carried out in the future.

The following types of derivative financial instruments are known.

Hedging is a way to compensate for possible losses from the occurrence of certain financial risks; insurance of the price of goods against risk. Every scheme that involves financial management allows you to minimize risks, and it has the right to be called hedging. A forward contract, in essence, is an agreement for the purchase and sale of a commodity or financial instrument with an obligation to deliver and settle in the future. The contract has its own standards depending on the quantity and quality of the goods that are the main object of the transaction. That is, according to the concluded agreement, the seller has an obligation to deliver a certain amount of goods within a certain period of time. A futures contract (futures) is a type of securities aimed at profiting from price changes. They represent one of the types of forward, and this type is widespread, especially on financial exchanges, and information about these data is published in the special press. This type of transaction has the main purpose of speculation, and futures are a special contract. Futures have become most popular in trading agricultural products, as well as in trading transactions in metals and other products.

Swap is an agreement between two entities regarding the exchange of obligations or assets in order to improve their structure, reduce risks and costs. That is, the transaction implies payment of a fixed percentage on a certain date. There are several types of swaps, but the most common are currency swaps. In general, lending can be carried out according to a variety of schemes. In such conditions, it is possible to combine the efforts of several service clients. This will reduce the costs of each client and at the same time experience significant savings from various transactions. In order to simplify the calculation and analysis procedure, an operation such as an interest rate swap was invented. Its essence is to transfer the difference in interest rates. This amount is not sent from one hand to another, but is a kind of base for calculating interest. As a rule, interest is calculated once a year or even more often.

An option is one of the types of futures; however, unlike futures and forward contracts, options do not require the sale or purchase of the underlying asset, which, under unfavorable conditions, can lead to direct or indirect losses for one of the parties. Options can be very different - on stocks, on currencies and even on futures. They are developing the idea of futures and due to this they have gained momentum in popularity. With such instruments you can suffer big losses, but also get high profits. An option sometimes gives the right to buy, in which case it is called a call option, and if it gives the right to sell, it is called a put option. There is also the concept of “option price,” which refers to the amount given by the buyer to the seller. There is also such a thing as the “strike price” - the price of the underlying asset at which the owner can sell the asset. It should be noted that the option has a peculiarity: the buyer does not buy assets, but the right to purchase them. Based on their expiration dates, options are divided into:

- European – the contract allows you to buy or sell assets for only one day;

- American – you can have surgery any day.

REPO transactions are an agreement to borrow securities against a certain guarantee of funds or funds against securities (sometimes called a securities repurchase agreement). This is a kind of agreement that securities will be borrowed against a guarantee. A direct repo transaction involves the sale of a package of documents, and an obligation is created on the party that sells to buy these securities back at a certain price. A direct repo operation has as its main goal to attract the necessary amount of finance and placement of those resources that are temporarily free. From an economic point of view, the situation is obvious, because in the process of its completion, one party receives money, and the second, in turn, can make up for the lack of securities.

Classification of financial instruments

Financial instruments by type of asset can be divided into:

- currency;

- interest;

- with a fixed income;

- with floating income;

- price

Foreign exchange financial instruments arise in the process of exchanging one currency for another.

In particular, these include instruments such as currency pairs on Forex, which involve the delivery of one currency for another currency at a certain rate. Interest-bearing financial instruments provide their owner with a certain income at a fixed or floating interest rate. These include, for example, bank deposits and coupon bonds.

Price-based financial instruments provide their owner with income in the form of an increase in their market value. These include stocks, precious metals, etc. Financial instruments by market type are divided into:

- credit financial instruments;

- FOREX market instruments;

- exchange-traded financial instruments;

- insurance market instruments;

- instruments of the precious metals market.

A credit financial instrument involves a contract between two parties, according to which one of the parties receives a loan and assumes obligations to repay it with agreed interest, and the second party (the one who issued the loan) receives the right to the repaid amount and interest.

Credit financial instruments include, for example, bank cards. Instruments of the international foreign exchange market FOREX are contracts concluded for the purpose of exchanging one foreign currency for another. Exchange-traded financial instruments or stock market instruments represent the entire variety of securities traded on the stock exchange. These include stocks, futures, options, depositary receipts, etc.

Instruments of the insurance services market include all contracts concluded between two parties in such a way that one of the parties undertakes to compensate for all losses arising from various types of force majeure, and the other party receives the right to this compensation. An example of an instrument of this kind is a regular insurance policy.

Instruments of the precious metals market are used mainly for the formation of reserves and represent gold, platinum, and silver in their pure form. The peculiarity of this kind of tools is their irrelevance, i.e. one of the parties receives an asset in the form of a precious metal, and the second party does not assume any obligations.

Financial instruments by circulation period are divided into:

- short-term financial instruments;

- long-term financial instruments.

Short-term financial instruments include those whose maturity does not exceed one year.

Long-term instruments are those whose circulation period is one year or more (including perpetual instruments). Financial instruments according to the type of obligations arising are divided into:

- debt;

- equity

Debt financial instruments include those financial instruments that oblige one of the parties to pay the other party a certain amount of money (this obligation may be accompanied by a number of conditions, such as the payment period, interest, etc.).

Equity financial instruments are those that give their owner the right to a certain share in the issuing company (which issued the financial instruments). These include shares, investment certificates, etc.

Financial instruments according to risk level are divided into:

- relatively risk-free;

- low risk;

- with an average level of risk;

- with a high level of risk;

- with an extremely high level of risk.

Short-term government bonds can be called risk-free financial instruments.

These also include hard currency or precious metals for short investment periods. Low-risk financial instruments include deposits in reliable banks that are not subject to the state deposit insurance program, checks and bills issued by large banks. Investments in this kind of financial instruments are classified as conservative. The medium risk group includes, for example, shares. The risk for such financial instruments is within the market average. A high level of risk is typical, for example, for shares of companies belonging to the so-called. second echelon. The risk of such financial instruments exceeds the market average, and investments in them are already classified as aggressive.

Finally, an extremely high level of risk is characteristic, for example, of shares acquired in various types of venture funds. Investors purchasing third-tier shares also take on the same level of risk.

Financial instruments (assets) are one of the new economic concepts that came to Belarus from the West during the formation of the foundations of a market economy. There are different interpretations of the concept of “financial instrument”.

In the most simplified approach, there are 3 types of financial instruments:

- cash in the cash register, on settlement and foreign currency accounts of the organization;

- credit instruments (bonds, loans, deposits);

- methods of participation in the authorized capital of a corporation (shares, shares).

Financial instruments and their role in assessing the investment attractiveness of a company

Any operation with a financial instrument - issue, purchase, sale, exchange - is inevitably associated with a change in the composition and structure of sections of the balance sheets of its participants.

Therefore, the impact of such transactions on the idea of the financial condition of the company is manifested in various aspects. On the one hand, financial assets and instruments are an object of investment and speculation; on the other hand, any financial instrument is an asset that sometimes occupies a very significant place in the company’s balance sheet. In addition, some financial instruments, such as options, carry the potential for large outflows of cash, cash equivalents or other assets, which, under certain market conditions, may materialize and lead to at least losses, sometimes significant ones. Any financial asset on the balance sheet can, on the one hand, mean a source of current (regular) and capitalized income (for example, shares of a third-party issuer owned by the company and shown in the assets of its balance sheet can generate income in the form of dividends, as well as deferred income income from an increase in the exchange rate price), and on the other hand, potentially incur a loss (for example, in the event of a collapse in the price of securities of a third-party issuer, when the current price falls below the cost at which these securities were previously purchased).

As for financial liabilities, for example, attracting large amounts of borrowed capital in the form of a bond issue or a bank loan means increasing the company’s financial risk and, under certain circumstances, can lead to a deterioration in its position in the capital market and complicate relations with counterparties.

Since data on financial assets, liabilities, and instruments are reflected in companies’ balance sheets, it is no coincidence that in recent years the problem of transparency of public reporting and its accessibility to investors, creditors, and counterparties has been actively discussed. Transparency means, firstly, a reliable and fair presentation in the reporting of all assets and liabilities of the company and, secondly, the presence in the reporting of data, including analytical transcripts, notes and explanations, sufficient to form an objective picture of the financial condition of the company. The concept of reliability and integrity, in turn, presupposes a correct assessment of all reporting items. Publicity of reporting means its availability to all interested parties; in addition, national specificity in the interpretation of this concept is also possible.

Information support for financial instruments

Information support for the use of financial instruments in the market is the following types of information:

- regulatory – legislative and regulatory acts governing the issue and circulation of securities;

- accounting - Statement of financial results (profit (loss) per share), Statement of changes in capital (dividends, increase in authorized capital due to additional issue of shares, etc.);

- statistical – the volume of long-term, short-term and other financial investments;

- analytical – analytical reviews and assessments of financial analysts, information officially published by the National Bank and other bodies.

The following indicators are used to evaluate financial instruments:

- dividends;

- volume of transactions on the stock exchange;

- characteristics of transactions;

- urgency;

- securities rates, etc.

Ida Arsentieva , auditor

Examples of markets

There are many types of markets, but their characteristic features make it possible to group them into separate groups based on economic purpose and spatial characteristics.

Foreign exchange

The foreign exchange market is a system of economic relationships between banks, as well as banks and their clients regarding the acquisition and sale of foreign currency.

The main responsibilities of the foreign exchange market are:

- ensuring international circulation of products and services;

- formation of the exchange rate under the influence of supply and demand;

- regulation of monetary relations;

- protection of economic participants from currency risks and speculative agreements.

ATTENTION!

The foreign exchange market exists on the foreign exchange exchange, as well as in the interbank foreign exchange system, in which banking institutions interact without the participation of the exchange.

Financial

The financial market is a complex of economic relationships between participants in agreements regarding the purchase and sale of financial instruments and services.

Main functions:

- ensuring fruitful relationships between banking institutions and depositors;

- regulation of borrowed resources and financial risks;

- organization of the necessary capital balance;

- searching for fresh sources of financing;

- conducting currency transactions;

- work with securities transactions;

- control of investment activities.

Commodity

The commodity market is an area in which connections are formed regarding the purchase and sale of goods, and there are also certain economic activities associated with the sale of products.

The main functions of the market are:

- pricing;

- information content;

- regulation;

- sanitization.

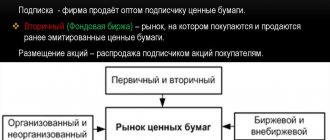

Stocks and bods market

The securities market includes economic relationships between market participants regarding the production and turnover of securities.

Main functions of the market:

- A commercial. It consists of generating income from local transactions.

- Price Provides a procedure for the formation of market prices, as well as their regular movement.

- Informational. Organizes and provides subjects with market information about retail facilities.

- Regulatory. Determines trading rules, the sequence of resolving disputes between entities and sets priorities.

The specific functions of the securities market are:

- redistribution;

- insurance of price and monetary losses.

The redistribution function can be divided into three subfunctions:

- Distribution of monetary resources among industries and areas of market activity.

- Transfer of savings, in particular of the population, from unproductive to productive form.

- Financing the budget deficit of government agencies on a non-inflationary basis, excluding the release of additional money into circulation.

Labor market

The labor market implies a complex of social relations related to employment and the supply of labor or their purchase and sale.

There are two main responsibilities of the labor market:

- Social. It involves ensuring an optimal level of earnings and well-being of the population, as well as high-quality reproduction of the production capabilities of employees.

- Economic. It implies the rational involvement, distribution, regulation and use of labor force.

Special legal status and powers of the Bank of Russia as a supervisory authority and issuing center

The Central Bank of the Russian Federation (Bank of Russia), as a mega-regulator of the financial market, carries out state regulation and supervision over the activities of credit and non-credit financial institutions, insurance companies, microfinance organizations (MFOs), pawnshops, professional participants in the securities market (brokers, dealers, depositories, trustees, registrars, organizers of exchange trading, clearing organizations), formation and investment of pension savings, credit history bureaus, insurance actuaries, auditors, collectors, rating agencies, credit cooperation enterprises, forex dealers.

The Central Bank of the Russian Federation makes a decision on state registration of credit organizations, issues licenses to credit organizations to carry out banking operations, suspends their validity and revokes them. Also, the Central Bank of the Russian Federation licenses and maintains state registers of securities and commodity market entities, professional participants in the securities market, and makes decisions on state registration of non-state pension funds (NPFs). The status, objectives, functions and powers of the Central Bank of the Russian Federation are determined by Article 75 of the Constitution of the Russian Federation, the federal law “On the Central Bank of the Russian Federation (Bank of Russia)” and other federal laws.

“Thus, it acts as a special public legal institution that has the exclusive right to issue money and organize money circulation, including in the field of monetary policy.”

In accordance with Article 3 of the Federal Law “On the Central Bank of the Russian Federation (Bank of Russia)”, the goals of the Central Bank’s activities are: protecting and ensuring the stability of the ruble; development and strengthening of the banking system of the Russian Federation; ensuring stability and development of the national payment system; development of the financial market of the Russian Federation; ensuring stability of the financial market of the Russian Federation.

“The volume of money in circulation is one of the key instruments of state economic policy. An excess money supply can lead to an unacceptably high level of inflation, and an insufficient one can lead to a non-payment crisis in the country, giving rise to money surrogates and a decline in economic growth. That is why the issuing function of the central bank is one of the most important.”

The Central Bank of the Russian Federation, in cooperation with the Government of the Russian Federation, develops and implements a unified state monetary policy.

At the same time, the Central Bank of the Russian Federation exercises its powers independently of other federal government bodies, government bodies of the constituent entities of the Russian Federation and local government bodies. In its activities, the Central Bank of the Russian Federation is accountable to the State Duma of the Russian Federation, which appoints and dismisses the chairman and members of the board of directors of the Central Bank of the Russian Federation. “In terms of its level in the government system, the Bank of Russia is comparable to the Government of the Russian Federation. Although it largely performs government functions, it is not an executive body. The Chairman of the Bank of Russia is appointed by the State Duma on the proposal of the President of the Russian Federation. The Bank of Russia is endowed with independence, is independent of the Government and is not subordinate to anyone.”

Although the Central Bank of the Russian Federation is not a government body, its powers include the application of state coercive measures. In particular, the Central Bank of the Russian Federation can limit, suspend and terminate the activities of financial organizations if they violate established rules and regulations.

Imperfections

The results of the continued progress of economic activity in terms of conducting research on the pros and cons of the market system can be reduced to two conclusions:

- The market system is capable of solving major economic problems, although not always in an ideal way.

- The market system is fundamentally incapable of solving problems that are important to society.

Understanding this took a lot of work and was not at all easy. But the results of scientific research have proven:

- the market system is capable of further development and efficient functioning can be achieved;

- planning is not able to solve the main difficulties and over a long period of time leads to worse results than the use of market instruments.

In other words, the market absolutely should not be removed from the accounts and sent to the archives. It can continue to be effectively used for the benefit of society - you just need to learn how to compensate for its imperfections and minimize the consequences generated by such errors.

ATTENTION!

Market weaknesses are the inability of the market mechanism to solve a number of economic problems.

The causes of market imperfections in real life are conditions that sometimes cannot be met.

The most common among them:

- suppliers and consumers should not influence the establishment of price levels to a greater extent than other subjects of market relations (but a monopoly form of power is sometimes found in the market);

- The existence of conspiracies among sellers and consumers to ensure more comfortable terms of transactions than could be achieved within the framework of perfect competition (but in real conditions these agreements occur quite often);

- all participants in the market system must be equally provided with information about the market situation (who, what, where, when and at what price sells);

- all expenses associated with the transaction must be reimbursed exclusively by the subjects, and they must also be provided with all the benefits from it;

- government agencies or public enterprises are prohibited from interfering in market activities for political or religious reasons.

If compliance with these ideal market conditions is violated, then market mechanisms begin to function with errors. This leads the state to economic difficulties and creates the need for government intervention in economic activities. Thus, a mixed economic system is formed.

In a mixed economic system, government authorities take on certain tasks:

- eliminating the consequences of market imperfections;

- regulation of the imbalance of income and wealth through their partial redistribution.

The imperfections of the market system are reflected in the following:

- in the possibility of monopoly;

- in the problems of formation of commercial public goods;

- in organizing externalities or external costs;

- in the emergence of socially unacceptable differences in the amount of income of society.

ATTENTION!

The imperfection of the market lies in the fact that in reality it is not always possible to adhere to all the conditions prescribed in theory that allow market mechanisms to effectively eliminate the main economic problems of the population.