The international Forex currency market is open to everyone.

To start trading on it, it is enough to study the basic concepts. However, the desire to immediately master everything in practice often becomes the cause of banal mistakes that lead to the loss of the deposit. To become a high-class exchange player, you must first learn the basics of Forex and only then put this knowledge into practice, constantly improving and comprehending all the secrets of this global currency market.

Forex strategies for beginners

The best Forex strategies for beginners are implemented within a systematic approach.

The main principle is not to break the established rules. An untimely closed or missed transaction often causes the loss of a large amount of funds. Everyone experiences temptation when trading currencies. Experienced traders and beginners alike face this problem all the time. The market constantly tempts the human psyche with various offers and options. The only way to avoid making a mistake (losing funds) is to strictly follow the rules and recommendations of the chosen strategy. Contents Hide

- Forex strategies for beginners

- Forex trading for beginners

- Forex lessons for beginners

- Forex - how to start earning money

- Forex Basics

- Psychology of Forex Trading

- Plan and statistics. Forex market for beginners

- Qualities of a novice trader

- First practical steps

Trading programs, criteria for choosing a trading terminal: review of the top 5 popular Forex platforms

Choosing a trading platform is considered one of the key points when deciding to trade Forex. Here it is important not to give in to advertising calls, but to determine for yourself, based on your situation, what functionality will be necessary and sufficient.

The most significant criteria are the following:

- speed and productivity;

- functionality;

- convenience and intuitiveness of the interface;

- security of information storage;

- compatibility of the platform with operating systems (to be able to work on more than one device).

Platform 1: Meta Trader 4 (MT4)

One of the most popular platforms among traders, developed on the basis of its predecessor MT3.

Users highly value:

- reliable security system;

- extensive analytical functionality;

- flexibility of settings;

- presence of automatic mode;

- the ability to program in MQL4 (create: indicators, advisors (robots, experts), scripts), adapting the functionality to your needs.

The platform can even be installed on mobile devices.

Introductory video about the terminal:

You can download the MetaTrader 4 trading terminal from these brokers that we have tested: Broker-1, Broker-2, Broker-3, Broker 4

Platform 2: Meta Trader 5 (MT5)

An updated version of MT4 with a new design and even greater functionality for analyzing the market situation.

The platform provides access not only to the Forex market, but also to the futures exchange, stock exchanges, forwards market and options. It works much faster than its previous version, which allows you to increase the accuracy of forecasts and increase the trader’s profit.

Platform 3: Ninja Trader (NT)

American development, recognized as a reference all over the world. Easy to use, provides ample opportunities for market analytics, and has a high level of performance. Manual and automatic trading modes are available.

Platform 4: Zulutrade

On-line system using free Forex signals provided by traders all over the world.

Zulutrade is an interesting system consisting of 2 categories of participants:

- traders-signal providers;

- users who have trusted any signal providers and entrusted them with copying transactions to their own account.

Platform 5: Mirror Trader

The principle of operation is mirror trading on Forex and is similar to Zulutrade. Here, too, signals from traders using various trading strategies are monitored.

The platform offers manual, automatic and semi-automatic control options.

Forex trading for beginners

All Forex trading for beginners comes down to finding answers to questions such as: “When will the price start to rise or fall?”, “When is it more profitable to buy or sell a currency?” and the like. This part of the work is considered the most difficult. Typically, one or more methods are used to find solutions. All of them are combined into a whole science - this is “Technical Analysis”. The developed methods boil down to analyzing the quote chart by calculating the values of individual indicators. To obtain the most accurate forecast results, Technical analysis is combined with Fundamental analysis (macroeconomic indicators).

How to open a demo account with Gerchik & Co: brief instructions

To open a demo account, you must first register with Gerchik & Co. After registration, you will have a “Personal Account”, in which you can open a training trading account. To do this, go to the “Accounts” section, which is located on the left side of your online account.

Select the “Open demo account” tab and select the account type from the drop-down list: Demo Zero, Demo Mini or Demo Standard. In addition, you will need to choose a trading platform - MT4 or MT5.

Once you have created a demo account, you can start trading. The optimal training time for a demo is within a month. This time is usually enough to study the terminal structure and hone your strategy, after which you can move on to making money on the real market.

Register with Gerchik & Co right now

Forex lessons for beginners

Each potential trader can take two paths. The first is to use free Forex lessons for beginners. The second is to purchase a paid course from a popular trainer. Each option has its own advantages and disadvantages. The information you need to take your first successful steps as a currency trader is guaranteed to be freely available.

It makes sense to invest in training after gaining some experience and developing practical skills. By this point, you will have a clear understanding of what course is worth paying for. You will also understand why this needs to be done now, and not in a year.

So manual trading or automated trading? Or maybe copying trades?

It all depends on your perseverance, balance, free time and desire to be involved in the process.

- Manual trading. Requires accuracy, concentration and time. Advantages: your complete control over transactions, monitoring the market situation, the ability to plan. For manual trading, you should read Forex analytics and forecasts.

- Automated trading using advisors or robots. Up to a quarter of transactions are made in this mode, and Forex beginners love it very much. Profitability is difficult to assess; it is influenced by quite a few factors. The time savings compared to the manual method are very large. It does not provide complete control over transactions, but this is not a serious problem if you work with small volumes.

- Copying transactions. The functionality of the terminal allows you to automatically repeat transactions of other traders. Many of them provide access to their operations for free or for a small fee. Pros – you can choose successful traders while minimizing your own risks. Disadvantages - everything is relative in the foreign exchange market, including the trading result for accounts with certain parameters and the volatility of the situation as a whole.

You can combine manual and automated trading by monitoring advisors and adjusting their activities.

If you are most attracted to the possibility of copying signals, maybe it makes sense for you to become not a Forex trader, but an investor?

Forex - how to start earning money

How to start making money on Forex if you have not dealt with currency before? Very simple. The main thing is to understand the essence of what is happening so that new knowledge is put on the right basis. Imagine that you have a box of chocolate. Now it costs 1000 rubles. There are two ways to make money on this product. Option one is to wait until the price rises to 1200 and sell the chocolate. The difference between the purchase and sale prices (200 rubles) is the trader’s profit.

The second option is to sell a box of chocolate for 1000 rubles. In this case, you must be sure that the product will fall in price, say, to 800 rubles. If the forecast comes true, you will be able to buy the box back at a lower price. Profit is also formed due to the difference in selling and purchasing prices.

Where to trade? Which broker do you recommend?

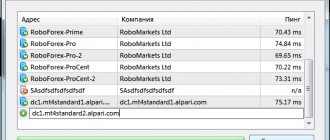

The question that is asked most often. Unfortunately, there are a lot of scams among Forex brokers. Therefore, choosing a reliable broker is very important. Personally, my main trading accounts are with Alpari. The company is old and reliable (providing services since 1998), with a good reputation. There are no problems with output, they work correctly.

Also, using our broker selection service, you can choose the company that is right for you.

When choosing a broker, it is important to carefully consider the following criteria:

- Reputation and quality of work (order execution, slippage)

- Terms of trade (the lower the costs, the more you earn)

- Support (it is important that you can answer any questions you have, especially at the initial stage)

- Software (possibility of using the application on the phone)

- Security (important, conditions for depositing and withdrawing funds, identity verification procedure)

I would advise starting with an amount of at least $100, otherwise you may simply not have enough funds in your account if there is a small drawdown, without which trading is impossible.

Forex Basics

The basis of Forex is the principle of formation of the price of a specific currency. The very concept of “currency price” for a selected pair, for example, euro/dollar, means the number of dollars for which one euro will be sold. For example, a price of 2 means that for one euro they give 2 dollars. In a Forex currency pair (euro/dollar or any other), the first currency is always evaluated. In fact, if the price has dropped to 1.5, for our pair this means that the euro has fallen in price and is now worth one and a half dollars. If the price rises to 2.5, this means that the euro has become more expensive and is now worth two and a half dollars. Remember - when working with currency pairs on Forex, all operations are carried out with the first currency.

Basic Forex terms for beginners

Some words in trading are unknown to a beginner. But, once you understand what support and resistance, trend and some other things are, you will no longer be confused in these terms.

Trend - what is it?

Forex prices are constantly moving, except on weekends. As a result, a graph is formed - a curved line. When displaying prices, it tends to maintain a certain direction for a long time - up or down. When the chart is directed upwards, it is customary to say that the trend is uptrend . If it is directed downward, then they say that the trend is downtrend .

More precise formulations sound like this:

- If each successive top and bottom is higher than the previous one, this is an uptrend.

- If each successive top and bottom is lower than the previous one, this is a downtrend.

Also, an upper trend can be called an upward or “bullish” trend - this is a kind of trading jargon that formed on Wall Street long before the advent of Forex.

The downtrend , in turn, is called downtrend or “bearish” .

There is also the concept of “price corridor” . Most often it refers to a market condition such as flat or range . This is a situation in the market when the price does not have a specific direction and rushes up and down. In this case, the movement can be either sluggish and weak, or very strong.

Flat and range are types of sideways trend. Their peculiarity is that the price does not have a pronounced upward or downward direction. This trend can also be called horizontal .

There is no clear division between the concepts of “flat” and “range”. But most often:

- the first is used for very slight price fluctuations, a sleepy market;

- the second is when the scope is very large.

In fact, within such a sideways trend there may be several successive upper or lower small price channels.

The price corridor on the chart barely exceeds 100 points in places with the largest range, but generally fluctuates between 40-50 points. This movement is usually called a flat.

The price corridor on the chart exceeds 200 points. The movement does not have a clear direction up or down - it is constantly changing. This situation on the market can also be called a sideways trend, but hardly a flat. Some experts use the term “range” for this movement.

The width of the range should be looked at by the number of points, since the visual picture may change depending on the current range of prices as a whole at the moment.

During a flat, when the price range is very small, you cannot trade. The likely benefits are low and the risks are high.

Often you can come across another name for a trend - trend . Both terms can be used without any loss of meaning.

Support and resistance levels

When peaks or troughs are connected to each other, straight lines are obtained on the chart.

- The lower ones, passing under the trend , are called support levels .

- Upper ones, passing above the trend - resistance levels .

These concepts apply to any single trend. If the trend has changed direction, then resistance can become support, and vice versa.

- In an uptrend, breaking through the support level indicates a possible reversal, and the resistance level indicates a likely strengthening of the trend.

- In a downtrend, the signals have the opposite meaning. A breakthrough of the support level is a likely strengthening of the trend, and a resistance level is a possible reversal.

One of the most important rules of trading is: “Trades should only be opened in the direction of the trend.”

Psychology of Forex Trading

The psychology of Forex trading helps a trader fight his main enemies. They all live in our head. Greed is danger number 1. Everything here is good in moderation. If a trader is too greedy, he misses a lot of opportunities to make money. Profitable transactions remain, but their number and volumes are gradually decreasing. When greed takes over, the number of unnecessarily risky trades increases sharply. The result of uncontrolled behavior is partial loss of the deposit or complete ruin. The best way to overcome greed and other emotions is to learn to control and suppress them.

Let's say I want to invest. What's next?

There is a wonderful service for PAMM accounts. You can read what it is here.

The rating of PAMM account managers is available at

https://gobymylink.com/ru/invest/pamm/

PAMM account is an account management system through which both traders and investors can make profits. Investors trust their funds to be managed by experienced and successful traders by investing in PAMM accounts. Traders, using the capital of interested investors, make profitable transactions, increasing investor capital and receiving management fees.

You do not need to trade Forex yourself - you constantly monitor the work of the manager and can withdraw your funds at any time.

In addition, every month we publish an “Investor Digest”, where we monitor the most interesting projects for investment.

Plan and statistics. Forex market for beginners

A trading plan and statistics on the Forex market for beginners help market participants improve the process of working on the exchange. Many traders do not analyze what is happening on the market and do it completely in vain. Write down the emotions that overcome you when closing each deal. Draw conclusions. Why did the situation develop in one way or another? Only this approach will allow you to give an objective assessment of the market situation and your actions. Record everything that happens in great detail. This will allow you to draw the right conclusions and achieve impressive results.

Forex trading market users

In the Forex structure, there are some “big guys” (these are the Central Banks of various states, as well as commercial private banks), there are also “smaller players” (these are various funds, for example, pension funds), and there are those called “retail” (these are various organizations involved in the export and import of goods, commercial investors, and it should be mentioned, and the traders themselves involved in the purchase and sale of currency).

Can traders really change market conditions? Yes, of course, but not directly, but through various intermediaries:

- If we are engaged in the purchase and sale of currency, when we need to go to another country, then commercial banks provide assistance to us.

- If we have plans to make money on the retail exchange rate, then we need to go to a Forex broker. But it will not be possible to purchase currency for personal use, because only currency trading takes place there, but its exchange takes place.

Qualities of a novice trader

The main quality of a novice trader is the right emotional attitude. Be prepared for a lot of studying in the first months. Really a lot. At the beginning of your journey, you need to read professional literature, practice on a demo account, and study the rules of money management. In the first 6-12 months you should not count on good profits. It's really not easy, but the effort will definitely pay off. You will start receiving a monthly amount equivalent to the average salary in your city in 2-4 months. The first serious victories will come later, but they will definitely happen.

Stages of growth at the beginning of a trading career

There are many tips on how to trade better. But it is much more important to do the right things.

First stage: choosing a broker

There are many criteria for choosing the right broker. One of the most important is the presence of a license. You also need to pay attention to the trading conditions: what is the minimum lot, is the spread too high, are there all the instruments you are going to trade.

You can choose a broker from our section Top Brokers - 2017. The most worthy, in our opinion, companies are presented there, the integrity of which we have personally verified.

Stage two: training to use the platform

If your broker does not provide instructions on how to install and download the terminal, as well as how to work with it, you can find out about this in detail on our website. For example, in this article. It is important to learn many little things right away: such as one-click trading, working with indicators, news and analysis tools, and some others.

Today, one of the best companies that provides maximum knowledge and information to its clients is Alpari.

Download Metatrader 4 from the official website:

Third stage: learning to trade

Training should be not just a set of knowledge, but also its mandatory application in practice. But the idea that you need to study Forex for years before you start trading is completely wrong.

2-3 hours of training a day is enough, including practice, and in a couple of months you will have a good understanding of the basics. This is enough to get started. Also in the future you will need to supplement your knowledge and improve it.

Stage four: opening and funding a real account

At the learning stage, it is better to use only a demo account. Next you will need to open the real one.

A big misconception is the idea that you need to top up your account with the amount of the minimum deposit. Sometimes such a decision can be a failure. It is best to base your stop loss on the level you plan to set. Correct capital distribution implies that it should not exceed 2% of the total deposit.

This means that if you plan to set an average stop loss of, for example, 50 pips, and the pip in your trades will be equal to $1, then $50 should equal two percent of the total deposit. Then you need to top up your account with $2,500.

There are other rules of money management that must be followed. But this is one of the most reliable for calculating the deposit amount.

Fifth stage: choosing a strategy

The strategy must meet the main requirement: the total number of profitable transactions is greater than unprofitable ones, and in general it brings profit. With the right choice, further success depends entirely on you.

You can find a good strategy on our website. We offer a considerable number of options, regardless of which instrument or timeframe you choose.

First practical steps

The first practical steps in Forex begin with responsibility for the result. Only you are responsible for the profits made and losses incurred. The market, friends, family, loved ones, and even an experienced trader-mentor have nothing to do with it. Determine your main strategic goals and start moving towards them. Break your mission into intermediate tasks. Set adequate deadlines for their completion. Move towards your goal and constantly analyze what is happening. Don't rush to make a million or open more positions. It is better to place one transaction per day, but understand the true reasons for what is happening.

Terminology

Up to this point, the article has already discussed in detail the concepts of “broker”, “spread”, “leverage”, “ASK”, “BID”, “lot”. This section describes other basic Forex terms that were not found in the previous paragraphs:

- Contract for Difference (CFD). A type of asset in which there is no actual sale or purchase of the object, but the essence of the transaction is the price movement. For example, when trading oil futures, the trader does not actually purchase oil, but makes money on increases or decreases in price. It turns out that the object of the transaction is the price movement, and not a specific product.

- Margin. The amount of collateral for a transaction is proportional to the leverage. For example, to secure a position of 1 lot with a leverage of 1:100, you only need 1% of the total transaction volume ($1000) as collateral.

- Margin Call/Stop Out. Automatic closing of client positions at a loss if there is not enough money on the balance to provide margin on orders.

- Paragraph. A unit of measurement for chart movement. Depending on the quotation, the item will be the fourth or fifth sign of value (last). For example, if the price was 18.00000 and became 18.00001, then it increased by 1 point.

- Swap. The operation of transferring a position to the next day. By law, exchange organizations must complete the current transaction and immediately open a similar one. At this moment, an interest rate is charged to the account of the owner of the money (as on a deposit), equal to the difference between the rates of central banks of the main currencies of the transaction.

- Trend. Directional movement of the graph. It can be “bullish” (growing) or “bearish” (falling).

- Flat. A chart state in which the price movement occurs within a horizontal corridor (there is no pronounced trend).

| Name of the term | What means | How is it designated? |

| Margin | The amount of collateral required by the broker to perform leveraged transactions | As a percentage of the amount, for example, 5-25% |

| Margin Call/Stop Out | The maximum drawdown percentage at which the position will be closed | As a percentage, for example 50-70% |

| Swap | Commission for transferring a transaction to the next day. It can be positive and negative | Number, with 4-5 decimal places. For example -2,000 or 4,000 |

Books for the novice trader

For those who are planning to get serious about trading. We recommend reading specialized literature. The direction of financial markets has developed greatly. Many good books have appeared. I'll try to choose the best ones:

- The Way of the Turtles (Face Kurtis);

- How to play and win on the stock exchange (Alexander Elder);

- Long-Term Secrets of Short-Term Trading (Larry Williams);

Related posts:

- Foreign exchange market, participants, nuances of trading - a detailed overview

- How to make money on the stock exchange - step-by-step instructions

- Trading sessions and their schedule - what are they?

- How to choose a broker for the stock exchange - what...

- How to trade stock indices on Forex

- Technical or fundamental analysis - what...

- PAMM - how it works and how to choose the right one

- Review of Forex brokers 2022 - list of reliable and proven ones