A gap in trading is of great interest to some traders and is carefully avoided by others. If you look at the chart of any financial instrument, especially if it is traded on the stock markets, then you will most likely notice at least one price gap almost immediately - this is gap

.

Everyone who trades in financial markets should know what a gap is.

, different

types of gaps

and what

opportunities there are for trading gaps

. Let's get started!

What is a gap?

Gap is a term that comes from the English word “gap”, which can literally be translated as “gap”, “space”, “interval”. On a stock chart, the gap is visible as a “hole” between Japanese candlesticks or bars.

In financial jargon, the definition of gap is as follows:

| A gap is an area of the chart in which there has been a sharp upward or downward change in the price of a financial instrument, resulting in a price gap between neighboring quotes. |

Gaps indicate gaps between supply and demand in the market. A gap occurs when supply does not match demand for a particular financial instrument, and vice versa, when demand does not match supply.

On the chart of a financial instrument, a gap represents the intervals between quotes. It is important to remember that you can see price gaps on two types of charts: candlestick charts and bar charts, but gaps are not visible on a line chart because they are plotted only from closing points.

Here is a clear example of a gap on a Japanese candlestick chart and on a line chart:

Source: Admirals, MetaTrader 5, WTI, Daily. Please note that the data presented refers to past performance and is not a reliable indicator of future results.

The nature of the gap is not always known to traders, especially new traders, and this is unfortunate because gaps in markets present a very interesting concept and trading opportunity.

in financial markets.

Learn more about gaps and trading in financial markets in general with Admirals video training course. Get a free course from video lessons

right now by clicking on the banner below! ▼▼▼

Reasons for appearance

Gaps occur for various reasons. Primarily due to the peculiarities of the operation of exchange platforms. On weekends and holidays, after clearing on commodity exchanges, factors are triggered that push the price towards growth or fall. As a result, a gap occurs when opening.

Low asset liquidity

Many identical orders (buy, sell) without counter orders will imbalance supply and demand. The price shifts to achieve balance.

Fundamental Factors

Price jumps with the formation of gaps are caused by economic news, announcement of financial results (if the results did not coincide with expectations), payment of dividends (when registers are closed, the value of shares falls by the amount of dividends), force majeure circumstances (terrorist attacks, natural disasters, significant political events, man-made accidents).

Technical difficulites

Brokers may encounter information holes in the quote stream. But this happens extremely rarely, since cooperation has been established with several liquidity providers.

Gap on the stock exchange: reasons for its occurrence

Gaps are a common occurrence in financial markets and appear on charts primarily for two reasons:

▶️ Opening and closing markets at different quotes

▶️ News release causing markets to move up or down too quickly

Predicting the occurrence of gaps at the opening and closing of markets is much easier than when they arise as a result of economic news.

Example:

➡️ The DAX 40 Index is available for trading from 8:00 to 22:00. When the market opens in the morning, the opening price may not be the same as the closing price at 10:00 p.m. In this case we are talking about a gap at the opening of a new trading session

.

In the foreign exchange market, gaps can also more often occur between the close of Friday evening at 22:00 European time and the market opening on Sunday evening at 23:00 European time.

| ✍ In the foreign exchange market, a gap can form between the closing price on Friday and the opening price on Monday. However, the Forex market operates 24 hours, 5 days a week, making gaps much more predictable. |

However, gaps in the Forex market that occur due to news releases are much more difficult to predict, and sometimes impossible to do. News that has led to major movements in the foreign exchange market in the past:

- Military conflicts, natural disasters and pandemics

- Central bank decisions

- Macroeconomic news, such as reports on GDP, labor market, inflation, etc.

Example:

When the Swiss National Bank abolished the minimum exchange rate of the Swiss franc against the euro of 1.20 in January 2015. This led to the collapse of the currency pair, which went down in history. According to some reports, the EUR/CHF pair lost about 30% of its value in just a few hours.

Source: Admirals, MetaTrader 5, EUR/CHF, Hourly – Data range: from December 23, 2014 to January 9, 2015 as of April 22, 2022 at 12:49. Please note that the data presented refers to past performance and is not a reliable indicator of future results.

☝️ This type of gap is caused by a lack of liquidity

On the market. Trading stops for a while, and the new market price can often be very different from the price before the gap occurred.

Such a market gap is very difficult to predict, so it is very important to practice proper risk and capital management, as well as use volatility protection settings.

Remember that you have an excellent opportunity to receive analytics from our experts, which are published almost every trading day, completely FREE!

✅ Articles on Fundamental Analysis and Weekly Market Reviews via LINK.

✅ Articles on Technical analysis of financial markets via LINK.

Follow the latest market news for trading on various instruments in our ➡️ Economic calendar ➡️ via LINK!

Varieties

Trading theory distinguishes 2 main types of gaps:

- attrition gap;

- acceleration gap.

Let's look at each named variety separately.

An exhaustion gap is a gap that is not confirmed by a strong trend in the same direction. Such a price gap is highly likely to close within 1-2 trading sessions.

An acceleration gap is a gap that is confirmed by a strong trend in the same direction. Such a price gap has a fairly low chance of closing within the next few trading sessions.

To identify gaps, in addition to trends, the MACD indicator is used. The specific algorithm will be discussed below in strategies that allow you to make money by trading price gaps.

A special case is a dividend gap. An article on this topic is available here.

Gap in trading: types

Are you wondering if there are different types of gaps in the market? – The answer is positive!

Let's look at the different types of price gaps that can occur in Forex or other financial markets. To create a gap trading strategy, you must first of all have a very good knowledge of the different types of gap.

Simple (or regular) gap

✅ Simple gap

is a price gap that is not very large in size and, as a rule, quickly fills/closes after its occurrence. This is the most common type of gap and can be used as a short-term trading strategy.

Source: Admirals, MetaTrader 5, NZD/USD, Hourly – Data range: February 13, 2022 to March 6, 2022 as of April 22, 2022 at 8:28 p.m. Please note that the data presented refers to past performance and is not a reliable indicator of future results.

In the chart above you can see a simple gap: the price of the NZD/USD currency pair opening below the closing price. Then the price stabilizes and even manages to close the gap on the chart during the day.

But can we know for sure that a gap will happen at the opening of the Forex market? Typically, a gap occurs when important events occur, economic news comes out, or rumors appear during the weekend.

| ✍ If any of the above does happen, you can expect a gap to appear in Forex. In this case, the gap trading strategy is short-term or even intraday - a simple gap in the market closes in just a few candles. |

➡️

The Forex market is

the most liquid market in the world

, so for example, gaps in Forex can be filled faster than gaps in indices. Of course, there may be exceptions to this rule. For example, the DAX40 index (formerly DAX30) is a liquid market where gaps fill frequently.

Advanced tools for analysis and trading are presented in the trading platforms MetaTrader 4 (detailed guide to MetaTrader 4) and MetaTrader 5 (detailed guide to MetaTrader 5).

✅ You can also additionally install our exclusive MetaTrader Supreme Edition plugin for the MT4 and MT5 platforms presented above.

Breakout gap

A breakout gap means that the price gaps through the trading range and then continues to move in the same direction. Due to strong momentum, the price breaks through the boundary of the consolidation range in one of two directions, forming a gap between quotes. A breakout gap can most often be seen after a period of consolidation, and after this breakout gap a new trend is formed in a given financial instrument.

Here is an example of a gap for a breakout of the USD/CAD currency pair:

Source: Admirals, MetaTrader 5, USD/CAD, Daily – Data range: from January 11, 2022 to April 22, 2022 as of April 22, 2022 at 20:46. Please note that the data presented refers to past performance and is not a reliable indicator of future results.

A breakout gap often occurs after a period of consolidation, and after the gap a new trend is formed.

The above USD/CAD chart clearly shows how the price of the currency pair followed a flat (lateral movement) for a long time. Then the price broke through the upper limit of this trading range from the bottom up, which happened through a breakout gap. As a result, the USD/CAD currency pair continued its upward trend.

Gap for continuation (or gap)

In the stock market, the strength of this signal, determined by the gap, can also be confirmed by market volumes (exchange volumes of traded contracts).

✅

A continuation gap is formed

when there is a clear price trend

.

Such gaps indicate a long-term trend, so this type of gap trading can be called one of the most reliable

, especially in combination with the Price action strategy.

Source: Admirals, MetaTrader 5, WTI, Daily – Data range: September 28, 2022 to April 22, 2022 as of April 22, 2022 at 20:56. Please note that the data presented refers to past performance and is not a reliable indicator of future results.

In most cases, traders expect that once this type of gap is closed, they will be able to move in the direction of the latest trend. However, this is not always the case.

The WTI CFD chart above clearly shows a gap with a continuation. The price of WTI was already in a downward trend, after which a gap formed and the price fell sharply. What followed was a slight rally, which could have been the opportunity traders were waiting for to open short positions.

Climax gap (gap at the end)

Expiration gaps are most common in stock markets, but they can also be found in the Forex market, although much less frequently. The formation of an expiration gap occurs at the end of the previous trend and signals the last impulse before the price changes its direction.

These gaps can only be traded after you have identified them absolutely accurately. Only then can you trade in the direction of the new trend.

Here is an example of a market gap for the decline of Apple:

Source: Admirals, MetaTrader 5, Apple, Daily - Data range: December 27, 2022 to April 22, 2022 as of April 22, 2022 at 21:02. Please note that the data presented refers to past performance and is not a reliable indicator of future results.

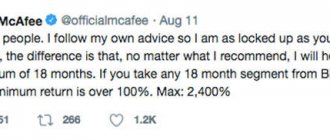

Famous traders about this phenomenon

Price gaps are of interest not only to ordinary speculators. They have long attracted the attention of famous traders and authors of numerous works in the field of technical analysis.

For example, Cornelius Luca in his work “The Application of Technical Analysis in the Global Foreign Exchange Market” made the assumption that a gap is a pattern of trend continuation.

Eric Nyman shared the same opinion in his books “Master Trading. X-Files" and "Small Encyclopedia of Trading". This well-known expert in the field of technical analysis also argued that price gaps lead to trend continuation.

At the same time, such opinions do not at all contradict the possibility of closing the gap. The fact is that the classics usually consider medium-term and even long-term trends. For them, closure is nothing more than a correction.

Finally, Jack Schwager expressed his opinion about such gaps in the chart. Thanks to his work, we today identify all the main types of price gaps listed above in this article. John J. Murphy shares approximately the same opinion. In his book, Technical Analysis of Futures Markets: Theory and Practice, he gives the same classification.

Gap Forex: how to protect yourself from gaps in the market?

Some brokers, such as Admirals, have developed a volatility protection mechanism that can benefit many traders when trading the financial markets, especially when trading in gap conditions.

| ✍Settings volatility protection allow you to cancel pending orders if they are within the gap. |

This can help avoid instant losses that can occur if you have pending orders with a stop loss level when both orders are activated at the same price.

The volatility protection mechanism can play a key role in your trading if you are using weekend trading strategies, for example.

START TRADE

Why does it appear

But why does this gap in the schedule still occur? Everything here is also quite simple. The schedule gap occurs for several reasons:

- Insufficient liquidity in one of the parties, i.e. for example, there is a very large demand for the purchase of an asset and an insignificant demand for sale.

- Trading sessions. For example, cryptocurrency markets operate 24/7, but there are popular exchanges that operate according to the usual schedule for Forex, that is, they rest on weekends. In this connection, since the main market is always working, the price can go significantly higher or lower than the closing price of the usual exchange, and it is for this reason that a gap is formed on Monday.

- Strong fundamental news can also lead to point number 1 and, as a result, the formation of a gap.

This picture shows option number 2. On the left you see the Binance exchange, which operates 24/7, and on the right the CME exchange, which operates on a 5-day schedule.

Gap trading: what does it mean to close a gap, and is it possible to fill it?

| ➡️ A gap is considered filled (or closed) when the price of a financial instrument reaches the price preceding the gap, be it the tail or body of the candle. |

Some traders believe that a market gap fills frequently. However, this does not mean that the closure occurs immediately:

- A gap in the market may close much later, in which case the short-term gap trading strategy may not work well.

While most market gaps are subsequently filled, there are some gaps that do not eventually close. Most often, continuation gaps remain unfilled .

✅ In order to trade on financial markets for a long time and consistently, the main areas of an investor’s investments should be his knowledge and skills!

Let's sum it up

Gaps can be powerful tools for a trader. They provide additional structural factors to the current levels on the chart, which increases our chances of making a profit.

Remember the following points when using gaps:

- Large, obvious gaps will most likely lead to a change in market direction.

- Gaps that occur in higher time frames are larger than those that occur in lower time frames.

- An unfilled gap is one that remains unfilled for more than five trading days.

- When using gaps as an additional structural factor at key levels, remember that the levels must already be confirmed.

Next time you look at your charts, be sure to take note of any gaps. They may provide you with additional trading opportunities.

Trading on gaps

Many traders wonder what strategy to trade on gaps

worth choosing. In this part of the article we will give several recommendations that may be useful when trading in gap conditions in financial markets.

Considering the fact that a gap usually closes completely, a bearish gap in a bull market can be a very good opportunity to buy an asset.

, whose price fell just before the gap filled to generate some profit. With gap trading this way, you can profit on the first reversal of the gap.

This hypothesis is also confirmed from a technical point of view. The stock market often closes the gap and tests previous levels

before starting to move in the form of a sustainable trend (or continue the previous one).

| ⚠️ However, you need to be careful: the gap does not always close during the same trading session! |

Thus, a simple bearish gap may represent an opportunity to buy shares at a better price. As we saw above, gaps can be of different types, and they are useful to trade if you have identified their type and why they occurred.

Let's remember their types:

✅ Simple (or regular) gap

✅ Breakout gap

✅ Continuation gap (for breakaway)

✅ Climax gap

Of all the types of gaps, only two pose a risk for sellers:

- Simple gap

- Continuation gap

Determination rules

Before examining the topic: how to make money on gaps, you should learn how to correctly identify such price gaps. Many traders and even stock analysts have difficulty with this. And if you incorrectly determine the appearance of a gap, then the trading decision made on such a false basis will also become erroneous.

Remember 2 rules.

1. The presence of a gap is checked exclusively on the daily chart (D). Doing this on hourly, 30-minute or other timeframes is fundamentally wrong.

2. When determining a gap, it is the body of the candle of the previous trading session that matters. You shouldn't focus on shadows.

How to trade a gap and what to choose: swing trading, scalping or day trading?

Many traders wonder what type of trading is most suitable for gap trading. Some traders with small trading accounts and high leverage avoid swing trading and long-term trading, particularly due to gaps.

Traders who use low leverage and engage in long-term trading use the gap as a tool for analyzing charts and confirming market sentiment.

You can combine swing trading or day trading with gaps, but scalping will be a little more difficult (but still possible) due to higher market spreads around the gap and lack of liquidity. The difference between a winning and losing trader with a trading strategy also lies in money management, a good trading strategy and trading psychology.

How to use it as an investor

A long-term investor can use a gap only if he knows the mechanism well.

Let's consider a simple situation. An investor opens a short position before the record date, knowing that the share price will fall before the dividend cutoff. He sells securities at a high price, hopes to buy them cheaper the next day and make money on the difference. But the latter just won’t work. The investor will pay an income tax of 13%, and the broker will withdraw an amount from his account in the amount of upcoming dividends for the current owner of the securities.

Investment educational program

A short position or short position is borrowing shares from a broker to sell them at the current price and then buy them cheaper. The basis of such a transaction is the expectation of a fall in quotes. The broker does not give away his shares; he does not have them. He takes them from another investor, so he is obliged to return them.

Some investors try to make money on the desire of others to receive dividends. If large payouts are announced, the shares begin to rise due to sharply increased demand. Owners of securities can sell their assets at this inflated price, and then, if they wish, buy it cheaper if they intend to keep them in their investment portfolio.

The latest example is the frenzy for Lenzoloto shares, the price of which rose by more than 80% in the week after the announcement of record dividends. If you don’t know how or don’t want to look at a company’s financial statements, then listen to experts who do this regularly. Everyone unanimously asserts that Lenzoloto does not have long to live.

How to trade gap with leverage? What deposit is required?

Gap trading is not necessarily a trading strategy for beginners. Why?

- During a gap, market liquidity is lower.

- A gap in the stock market can be very significant (for example, on the DAX40 - formerly DAX30 - a gap of 300 points was recorded).

| ☝️ Thus, gap trading requires knowledge in money management and risk management (trading risk management). The trader must understand that the gap movement can be very large (for example, it can be as large as 300 pips) and the trader must prepare to be able to support such market movement. |

One solution to this problem is to reduce the effective leverage of the trading account. There are two solutions to reduce leverage:

- Open smaller market positions

- Deposit more funds into your trading account

Gap trading is interesting for traders who choose volatile instruments. However, it is always a good idea to test your gap trading strategy on a demo account before you start trading on a live account.

✅ You also have the opportunity to conduct chart and indicator analysis and invest in various trading instruments using our MetaTrader 5 trading platform. To download it for free, click on the banner below ▼▼▼

Price gaps and risks

Some traders believe that gap trading is a safe bet, especially in the Forex markets. For beginners, gaps are shocking. Either they force you to temporarily stop trading, or they lead to serious drawdowns.

When using gap strategies, you need to consider the following risks:

- false gap (unconfirmed on the charts of several trusted brokers);

- incorrectly defined gap type, leading to an erroneously opened position;

- haste (after fixing the gap, it is advisable to wait 3–4 hours). Due to an erroneous order, you can lose a large amount;

- excessive volatility of the selected instrument;

- Be wary of the proprietary, supposedly win-win gap strategies that have flooded the Internet.

It is advisable to learn to control risks. Before trading for money, try to find a gap on the charts, take a closer look at the price behavior after its formation. It is worth remembering that after the gap closes, the market can move in any direction.

Profitability on gaps rarely exceeds 5% at the end of the month, and you have to risk a significant part of your capital.

About us: Admiral Markets

Admiral Markets is a global, award-winning, regulated Forex and CFD broker offering trading in over 8,000 financial instruments on the most popular trading platforms in the world: MetaTrader 4 and MetaTrader 5. Start trading today!

This material does not contain, and should not be construed as containing, investment advice, recommendations or an offer or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future trading as circumstances may change over time. Before making any investment decisions, you should seek the advice of independent financial experts to ensure you understand the risks.

Why gaps tend to close

Price gaps in all financial markets always close, the only difference is the time it takes to fill (for some assets this will take months or years).

Read more: List of 36 films and TV series about the stock exchange and traders that you might not know about!

The mechanism is quite simple - the price tends to a state of equilibrium. If we talk about the situation in trading, after a significant change in quotes, there is a high probability of limit orders being triggered, traders manually closing positions in order to fix profits, or entering the market against the movement in the hope of a reversal.

As a result, in most cases, after a gap, there is a movement in the opposite direction, which often ends with filling in the coming trading periods.

At the same time, if the strength of the formed or developing trend is great, the trend persists, and filling occurs much later.

In banks

The bank uses gap analysis. It is based on determining the distribution of assets, the number of liabilities, and operating efficiency. It is used to identify the main parameters in the bank and its financial condition.

A gap is the gap between assets and liabilities. It can be positive, negative or zero. It all depends on which parameter prevails in the bank.

A positive gap indicates that the company has more assets. It is an indicator of the good financial condition of the institution and the correct development strategy.

Zero – the indicators are equal. You should think about the need to change management methods and work strategies.

Negative – there are more liabilities. It indicates a significant number of obligations that the institution has difficulty meeting.

Gap analysis is a complex area. There are many terms and concepts in it that cannot be simplified. Therefore, there is no point in going deeper into this area.

Types

There are several varieties:

- a normal gap, observed against the backdrop of low trading volume, indicates little interest on the part of traders;

- when the level is broken, there is a significant increase in value with an increase in trading volume;

- acceleration gap usually indicates an increase in interest on the part of players, in most cases the increasing trend continues;

- An exhaustion gap occurs with significant trading volume and indicates a change in trend.