Bitcoin Forecast — a plan for changing the exchange rate of Bitcoin for a certain time period, based on technical and fundamental analysis. The sources of such information, as a rule, are analysts, economic experts, cryptocoin developers and other specialists. When creating a forecast, financiers focus on the current Bitcoin exchange rate, the mood of market players, the development of the cryptocurrency sector, the plans of developers and other aspects. Having this information allows investors to invest in Bitcoin with less risk of capital loss.

Subtleties of course formation

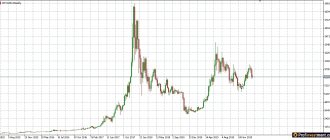

The chart shows the online exchange rate of Bitcoin to the US dollar:

For profitable investments and replenishing a Bitcoin wallet, knowledge of the cryptocurrency exchange rate is not enough. It is important to understand the intricacies of its formation and the aspects that influence the increase and decrease in price. The difference between crypto and fiat money is that it is not tied to the economy or central government. It is an independent digital currency that depends on supply and demand. It is important to take this factor into account when making a forecast and investing money.

The minimum and maximum rates are determined taking into account the trading activity using BTC, the community’s interest in cryptocoins, and people’s faith in it. The more attractive digital money is, and the more profitable it is to use it, the more 1 Bitcoin is worth on the market. The high volatility of crypto coins is due to the poor awareness of many investors. The cryptocurrency community does not know the total number of coins in the hands of major players. If you have a large amount on hand, one or more market “whales” can buy Bitcoin in large quantities and thereby provoke an increase in the rate.

In other words, the cost of Bitcoin and other digital money is based on what crypto market participants are willing to pay.

When analyzing quotes and making forecasts, it is important to take into account the difference between the terms:

- Correction is a gradual decrease or increase in the price of BTC. The average exchange rate changes slightly per month - by 5–10%.

- Draining is a trend in the market that involves the sale of crypto in large quantities. Such actions entail a depreciation of 15–20%. The reasons for the phenomenon are a dump, a ban on the circulation of cryptocurrency, panic in the market, etc.

- Pump is an artificial increase in demand for cryptocoins by introducing positive news or creating a shortage of cryptocoins. The cost increase can reach 20–30%.

- Dump is the reverse process of a pump. In this case, large players collapse the market and depreciate Bitcoin.

Correction is a natural process that occurs after an unreasonable increase in the BTC rate. Many financial market analysts believe that Bitcoin will experience a correction in early 2022 after its rapid growth in 2022. As for the explosive price increase, many attribute the situation to a pump - the creation of an artificial rush. The rise in the Bitcoin rate was fueled by the appearance of BTC futures on US commodity exchanges.

Experienced investors can easily distinguish a leak from a correction or dump. Taking these factors into account makes it easier for them to make a forecast. Market participants realize that after a long decline, as a rule, growth begins. It can be used to generate additional profits.

READ Review of the browser-based NFT game CryptoBlades and SKILL tokens: gameplay, capabilities, features

Expectations of optimists and pessimists

Well-known crypto enthusiasts look to the future with confidence, expecting recovery and growth of the cryptocurrency market. Below are several predictions from significant figures in the crypto industry.

Optimists

First, it’s worth looking at the statements of ardent supporters of the crypto market.

Mike Novogratz's opinion

Mike Novogratz, who headed the investment department at Goldman Sachs and now owns a multi-billion dollar fortune and runs his own Galaxy Digital fund, believes that the stagnation of the crypto market in 2022 has brought more good than harm. According to him, the crypto industry has cleared itself of scammers and crowds of retail investors who easily panic and provoke excessive volatility with their hasty actions.

From the beginning of 2022, representatives of institutional capital will enter the spot crypto market, who have gained a position in Bitcoin on the interbank market and will now move the BTC rate upward. There is no need to wait for a rapid pump, since representatives of the “smart money” are working cautiously, but their actions are still noticeable and will undoubtedly lead to the formation of a sustainable upward trend.

Mike Novogratz, CEO Galaxy Digital

The expert expects that in August 2022 the BTC rate will rise to $8,000, and the year will end above $10 thousand. Reaching maximums at $20 thousand will occur in 2020-2021. Together with BTC, all other cryptocurrencies that are at the top of the CoinMarketCap table of the most capitalized assets will rise in value.

Tom Lee's forecast

Tom Lee from Wall Street, who founded the investment fund Fundstrat, said what awaits Bitcoin in 2022. According to his opinion, the main cryptocurrency will rise to $20 thousand. According to the expert, a fair BTC exchange rate, taking into account the current hashrate and mining costs, is 14 thousand USD.

At the same time, Tom Lee also points out that in 2022 many institutional players entered the market, taking advantage of the “crypto winter” to accumulate volume for purchases. Their actions have so far been invisible, as funds and banks have been buying cryptocurrency on the interbank market, but soon their money will flow little by little into the spot market. And since “a little bit” in the case of institutional capital means “a multimillion-dollar flow,” the recovery and growth of the cryptocurrency market, according to the expert, is only a matter of time.

Statements by Anthony Pompliano

Anthony Pompliano, who founded Morgan Creek, made billions on cryptocurrency and noted that he did not hide his bearishness on BTC and ETH throughout 2022, confirmed that large institutional capital is seriously interested in Bitcoin, considering it as a safe haven asset, and therefore for There is no need to worry about the future of Bitcoin.

According to Pompliano, banks and even individual governments are increasing the volume of Bitcoin, which will soon take the main cryptocurrency to new heights. The expert calls the figure 50 thousand USD as a forecast value, but believes that BTC will be able to reach it only in 2022, since representatives of the “smart money” act carefully and will not allow hysterical purchases, which in 2017 allowed Bitcoin to rise to $20 thousand

Pessimists

Pessimistic forecasts for Bitcoin have one interesting feature - their authors are extremely inconsistent in their conclusions and actions.

Vikram Mansharamani's Bubble Theory

Vikram Mansharamani, a Harvard professor, wrote an entire book about inflating economic bubbles. He also included cryptocurrency among them, openly declaring that BTC is another financial bubble that burst in 2022. Mansharamani's statements are often quoted by skeptics on foreign forums, who ignore several interesting facts:

- in March 2022, Mansharamani, according to him, bought three BTC coins for $1000, which he then sold at the very peak for $19-20 thousand;

- The professor, although he warns about the danger of overvalued assets, at the same time draws attention to the fact that after the burst of the dot-com bubble in the late 90s, Internet technology changed the world, and the companies that survived at that moment, for example, Amazon, were able to turn into multi-billion dollar corporations.

So one of the main skeptics, whose words about the “soap bubble” are often quoted in various public pages, has himself made good money from the growth of Bitcoin, and does not exclude the prospect of further development of individual blockchain projects.

Attacks on BTC by representatives of the banking system

In 2016-2017, cryptocurrency was fiercely criticized by representatives of the traditional monetary system. The most violent attacks were noted from:

- George Soros, who became famous for the fact that his speculative transactions with the pound almost caused the collapse of the UK economy;

- the head of JP Morgan, who promised to fire every employee who talks about or invests in cryptocurrency;

- directors of Goldman Sachs.

Subsequently, it became known that the family of George Soros opened a cryptocurrency exchange platform, Goldman Sachs, through the startup Circle, bought one of the largest US crypto exchanges, Poloniex, and JP Morgan organized its own crypto department and is going to open a marketplace for trading digital assets for representatives of large capital.

Actions of major market players

Volatility in the cryptocurrency network, a sharp decrease and increase in the price of the first cryptocurrency is often caused by a pump and dump. In the first case, it is implied that the exchange rate price is artificially inflated by a player with serious capital. A market participant buys a large volume of sell orders, which provokes the growth of Bitcoin. Inexperienced participants are caught in the “bait” and act in a similar way. As a result, the Bitcoin rate grows, and the pump, when the maximum price is reached, collapses the market. In other words, he sells the assets on hand, which leads to a drop in prices to a minimum level. It makes no sense for him to study forecasts, because he personally or with the help of other “whales” regulates the price and makes money on the difference in rates.

An example is the operation of Roger Ver, who dumped 250,000 BTC in November 2022. As a result, the value of Bitcoin fell by $2,280. The same consequences are caused by the release of a large volume of coins onto the market. In April 2022, large investor Kobayashi traded four thousand BTC daily. As a result, the price dropped.

When making long-term Bitcoin forecasts, it is important to remember that the creator (Satoshi Nakamoto) has more than 1,000,000 BTC in his hands. If digital coins are dumped, the cryptocurrency market will collapse. This is possible if the developer of the first virtual currency suddenly decides to convert Bitcoin into fiat money and buy an island in the Pacific Ocean.

Scientists' opinions on the future of crypto?

Bitcoin seems to be the most researched cryptocurrency. Many scientists have tried to understand its nature. Analyzing their work can be useful in predicting the price of the first crypt because the researchers were able to formulate some of the fundamental factors that shape the coin's pricing system.

Peetz & Mall

Scientists D. Petz and J. Moll, in their article “Why Bitcoin is not a currency, but a speculative asset,” published in September 2017, argued that the market flagship does not have a reasonable price. They wrote that the coin has reached the bubble levels, which is a must. However, they did not discount the possibility that the BTC bubble could get even bigger in the medium term. As we see, unfortunately, or fortunately, scientists have put forward a completely reasonable theory.

Eric Budish

Eric Budish of the Chicago Booth School of Business suggested that Bitcoin would be subject to a 51% attack if it gained high economic value, that is, if it became an asset similar to gold. According to him, there are certain economic limitations to BTC achieving such a role. This is an interesting thought. However, BTC is unlikely to be that easy to hack.

Jochen Mobert (Deutsche Bank Research)

Jochen Mobert wrote a great article on crypto. In it, he expressed the idea that forecasters make many erroneous analogies and assumptions. More time is needed to make forecasting more informed. Additionally, it will take several more years for blockchain technology to spread. The scientist raises questions regarding the fact that Bitcoin may well be replaced by a new, more advanced cryptocurrency, or its current competitors.

Features of the technology

Bitcoin is the first cryptocurrency, so over time, many shortcomings have been discovered in it. When forecasting, it is important to remember the main “gaps” of Bitcoin - low throughput, small block size (about 1 MB), delays in transactions, the presence of conditional anonymity, and so on. Despite the efforts of the developers, these problems have not yet been resolved. Unlike other cryptocurrencies, Bitcoin has a high commission, which pushes many users and investors away from BTC.

For comparison, as of December 6, 2022, the average commission for Bitcoin is 38 cents, ETH is 8 cents, XRP is 0.07 cents, BTC is 0.23 cents. With that said, it is clear that Bitcoin's fees are higher than those of its competitors. That is why, when studying forecasts, it is important to take into account not only the opinions of experts, but also the plans of developers to eliminate the problems discussed above. If nothing is done, users will switch to more profitable cryptocurrencies. As a result, the value of Bitcoin will fall.

The legislative framework

The price of Bitcoin is directly dependent on the success of the cryptocurrency in the domestic markets of large countries. Analysts, economists, financial market experts and even developers of digital coins talk about this. Recognition of Bitcoin at the legislative level leads to an increase in its value. For example, the legalization of BTC in Japan at the level of fiat money became a powerful impetus for the growth of its value. At the same time, bans from China, South Korea and a number of other countries have a negative impact on the development of the cryptocurrency market.

The list of countries that support Bitcoin is constantly evolving. But this is not enough. For a positive outlook, Bitcoin needs universal recognition. The more countries recognize the cryptocurrency, the more stable the rate of the virtual coin will be, and the higher the price of Bitcoin will be in the future.

Possible applications

Every year Bitcoin becomes more and more important and in demand as a currency. With its help, you can pay for education, buy a car, purchase basic goods, go on a trip and solve other problems. The number of points accepting Bitcoin is increasing every day. The largest concentration of stores is located in the EU countries, Japan, the USA and a number of other countries. To confirm this fact, just go to coinmap.org, where information about retail outlets that accept Bitcoins is provided in a convenient form.

If you zoom in on the image, you can easily see the following picture (for example, for Moscow).

The map shows that in the Russian capital there are about 40 points that accept cryptocurrency, and this number is only growing.

The emergence of competitors

Bitcoin is not the only cryptocurrency. The number of digital coins traded on exchange platforms is in the hundreds. Many of the coins have better parameters and great prospects when compared to BTC. When researching or making forecasts, it is important to consider market competition and the potential of digital coins. Today, XRP, ETH, Stellar and other digital money are looking at the back of Bitcoin. Bitcoin SV is gaining momentum and, as of December 7, was among the TOP 5 cryptocurrencies by capitalization. Until recently, no one knew about this coin, but today it has overtaken many top coins.

Interest from miners

The popularity of Bitcoin is largely due to the interest of miners - network participants who use computing equipment to mine virtual coins. Obtaining BTC in this way was profitable until 2022, but due to the increase in complexity, the use of GPU farms has lost its effectiveness. ASICs also bring less profit. The devices provide high hashrate, but you have to pay about $1000 for them (per unit). As of December 7, 2018, the average payback period is 12–14 months. It is important to take into account changes in price and complexity in the forecast, so the cost recovery period may vary.

An additional pressure factor is a decrease in the remaining number of coins. Miners have already mined 17.4 million BTC. There are only 3.6 million left. According to experts, they will be received before 2140. It is worth taking into account the reduction in miners’ remuneration. As of December 2022, the premium is 12.5 Bitcoins per block. In 2022, the parameter will be halved again - to 6.25 BTC. Already today there is a noticeable trend of switching to other virtual coins, for example, Zcash, XMR and others.

READ User reviews about Bitcoin

Negative forecast for 2022: investor opinions

Not all crypto investors are optimistic. Bitcoin critics still call it a bubble and focus on the lack of a legal framework. States are in no hurry to recognize virtual assets. The Chinese authorities most often speak negatively about Bitcoin, having repeatedly stated that cryptocurrency negatively affects the country’s economy and interferes with GDP growth.

Mike McGlone's opinion

Some experts express the opinion that Bitcoin is outdated, and there are coins that are more promising in terms of technology, for example, ethereum, eos, ripple. Mike McGlone, an analyst at Bloomberg Intelligence, believes that Bitcoin has not yet reached its bottom, and new lows are just around the corner: BTC may update them in 2022.

Brian Kelly, founder of the investment company BKCM, said that this year there is no hope for approval of Bitcoin exchange-traded funds (ETFs) by American regulators, so the price of BTC, even for a short period of time, will drop to $1,500, that is, by more than 50 %.

Brian Kelly's opinion

The ratio of optimists and pessimists among analysts is approximately 50/50. In addition, they quite often change their opinion depending on the release of fundamental news that can turn the market 180 degrees.

Additional factors

There are a number of other aspects taken into account when making forecasts and analyzing the price of cryptocurrency:

- Psychology of market participants. The price of Bitcoin depends on sentiment in the cryptocurrency space. Expert statements, opinions of developers and analysts.

- Reliability and safety. The key role is played by the security of Bitcoin from hacking and theft by criminals. Regular news about the “fall” of exchange platforms and the theft of coins from user wallets negatively affects the value of BTC.

- Encryption algorithm. The BTC cryptocurrency runs on SHA-256. At the time of development, the creator had no other alternative, and he was forced to use this protocol. Today, when creating cryptocurrencies, newer and more advanced developments are used, for example, X11 or Scrypt. According to preliminary calculations, this algorithm will soon lose its relevance.

- Level of comfort of use and availability of cryptocurrency. The more options for purchasing BTC, the higher the number of users. As a result, the exchange rate price also increases.

The factors mentioned are sufficient to understand the principles, analyze the value and make forecasts of digital money.

How much will Bitcoin cost in 5 years and forecast for 2025

How much will Bitcoin be worth in five years (2024)? According to the Walletinvestor website, its price in 2023-2024 will be around $32,000. However, this forecast was made based on machine analysis, the algorithms of which were developed by the site team. As far as we know, it does not take into account fundamental factors such as the launch of the BAKKT platform, etc.

Other forecasts:

- $330,000 in 2022 (Bobby Lee);

- $96,000 by 2023 (Satis Group analysts);

- over $9,000 in 2025 (Digitalcoinprice).

Initial Bitcoin dynamics

The Bitcoin cryptocurrency has existed for about 10 years, and during this period its value has undergone significant changes. For example, in 2010, the price of 1 Bitcoin was already $0.96. In February 2011, the price of BTC increased to $17. In 2012, it increased to $600–700, and already in 2013 it exceeded the $1,000 mark. In subsequent years, the growth trend continued. The biggest jump took place in 2022, when at the beginning of January the Bitcoin rate was $1,000, and by December it had risen to $20,000. During that period, bold predictions were made about future growth.

Since the beginning of 2022, the price of Bitcoin has gone down, and in November it reached the level of mid-2022. Despite this drawback, expert forecasts are mostly positive. Many analysts are confident that Bitcoin will eventually regain its position and grow.

Bitcoin Price Prediction 2022

When the cost of the main crypt approached the 20 thousand USD mark, everyone said that the conquest of peaks would continue. Someone was beating his chest with his fists, convincing everyone that he would soon sell his cue ball for 100 thousand USD. And someone even planned to dine on their own reproductive organ if the “impossible” happens and Bitcoin does not reach $1 million in the next 2 years.

The jump in the price of leading coins on Coinmarketcap in December 2022 - January 2022 did not have sufficient market justification. Today, Bitcoin pricing is not as speculative as it used to be. This means that price growth will slow down significantly. However, periodic declines and long-term flats will be followed by growth.

In mid-October 2022, Fidelity Investments, one of the world's largest asset management companies, announced the creation of a division specializing in providing crypto services to institutional investors. The exact launch date for Fidelity Digital Assets is now known. This should happen in the first half of 2019. Such an event has the potential to become a powerful driver of market growth during 2022.

Fidelity Investments provides investment and custody services to 13,000 advisory firms and brokers. The new Fidelity Digital Assets division will provide a cryptocurrency trading platform, advisory services and physical custody of crypto assets.

2019 may finally bring BACCT to the market. BAKKT is a platform that will allow users and institutional investors to buy, sell and store digital assets in a global ecosystem. This project has many famous partners, including Microsoft Technology Corporation and the international coffee chain Starbucks. The launch of the platform has already been postponed several times. As of January 2022, the platform continues to build a staff of crypto and blockchain specialists. The launch of BAKKT should shake up the market. The launch is expected to take place this summer. But let’s not make a wish, so as not to jinx it.

The community and investors have been waiting for the adoption of Bitcoin ETF in February 2019. However, the main application of CBOE and VanEck was withdrawn due to the shutdown in the United States. The application was later resubmitted, but now a decision may have to wait more than six months.

Where to watch current courses

To analyze the Bitcoin market and create forecasts for today, a week, a month or several years, it is important to have information about the current price of Bitcoin. To obtain information of interest, you can use the following sites:

- Binance.com is a cryptocurrency exchange with a large selection of currency pairs, accurate information on the cost of digital money, articles and forecasts. The platform has been operating since 2022, but despite its short period of activity, it is in demand among market players. The advantages of the platform include low fees (0.1%), ease of registration, no commissions for depositing virtual coins, and a convenient and simple interface.

Register on Binance

- Exmo.me is a platform that has been operating since 2013. Its peculiarity is a wide selection of currency pairs, a high transaction fee (from 0.2% or more), the ability to replenish your wallet in one of the many ways with a small commission, fast withdrawals and reliable support service.

Register on the Exmo exchange

- Livecoin.net is a platform that allows you to top up your wallet using a bank card from Sberbank or another financial institution with a small commission. Additional advantages of the service are a small transaction fee (from 0.1 to 0.2 percent), a wide selection of trading pairs, and accurate Bitcoin rates.

- Yobit.io is a Russian-language platform with a user-friendly interface, the ability to trade a large selection of pairs and low commissions. The service provides accurate rates of cryptocurrencies relative to fiat money, provides instant withdrawal of money, and has a 24-hour support service.

Registration on the YoBit.Net exchange

Some exchanges provide information about Bitcoin, a forecast for the week, month and long periods.

Bitcoin price in 10 years and forecast for 2030

We believe that cryptocurrency is the future of economic relations. The only question is when this future will become a reality. We think BTC will literally become digital gold. It is unlikely that it will be used as an everyday means of payment, at least due to the fact that people will not spend an asset that could significantly increase in value. This role will be played by other cryptos such as Litecoin, Dash or, more likely, stablecoins. Since the supply of Bitcoins is limited, their price will rise and, in our opinion, could reach $100k.

The Winklevoss brothers believe that in the 30s of the 21st century, the capitalization of Bitcoin will reach 7-8 trillion. US dollars. To be more precise, according to Tyler, digital gold should catch up with physical gold. If this happens, the cost of the cue ball should be $300,000. But we consider such an indicator unlikely even in such a distant future. What, then, should the capitalization of the market as a whole be? 15-20 trillion. US dollars? No, it's some kind of nonsense.