PEG ratio (English: Price Earnings Growth ratio) - shows the degree of overvaluation or undervaluation of shares. It is one of the varieties of the P/E multiplier, which eliminates its disadvantage in the form of a point estimate of net profit at the current moment or taking the average value over the last year. The PEG multiple adjusts for a company's likely future earnings per share.

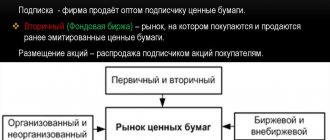

This indicator is used in the value investment strategy, developed by D. Graham and D. Dodd. The essence of which is to find shares of companies that have a high intrinsic value, but are undervalued by the market. Intrinsic value is assessed using the company's fundamental indicators: net profit, revenue, earnings per share, current and quick ratio, return on assets, equity and sales, etc.

Take our proprietary course on choosing stocks on the stock market → training course

As a result, if there are two companies on the market that are similar in terms of fundamentals, but are valued differently in the market, then over time the market restores this difference. This creates investment opportunities for additional profitability.

PEG calculation formula

Option #1. The formula for calculating PEG is as follows:

Where:

P/E is a multiplier presented as the ratio of a company's capitalization to net profit (Earnings).

EGR (English: Earnings Grow Rate) – expected growth in earnings per share (EPS, Earning Per Share).

Read more about the P/E multiplier: → P/E ratio. Formula. Norm. Calculation example.

Option number 2 . Formula for calculating PEG using one of the variations of P/E calculation:

Where:

Price is the market value of a company's shares on the stock market.

EPS – earnings per share.

Option number 3 . Formula for calculating PEG using forecast values of the P/E ratio (Forward P/E):

Where:

CAGR (Compounded Average Growth Rate) – average growth rate.

For example, if a company has a P/E ratio of 10 and a growth rate (net income and earnings per share) of 12%, then the PEG will be 0.8 (PEG = 10/12). It should be noted that the growth rate is taken as a percentage, and not as a fraction of a unit.

It is worth remembering that PER is correct: P/E and expected earnings per share growth rates are linearly dependent. You rarely see linear relationships in the stock market, so I recommend using it only for a short-term period of 1-2 years. Applying it for a long-term period will greatly distort its real value.

Now that we've covered the basics of studying corporate financial statements (the language of business), we need to look at the basic language of investing. P/E, EPS, PEG and other ratios are the main tool used by investors to relate a company's price to the quality of its performance. These quick and dirty estimates can be quite useful to you, as long as you are mindful of their inherent limitations. But before we do any calculations, we must first consider some necessary definitions.

Ratios are the primary tool used by investors to relate a company's price to the quality of its performance.

Earnings per share (EPS) is a company's net income (usually for the 12 preceding months) divided by the number of shares outstanding. EPS comes in two forms - basic and blurred. The base ratio takes into account only the actual number of shares outstanding, while the diluted ratio takes into account the entire possible number of shares, taking into account options and similar instruments currently issued. Diluted EPS is a more "conservative" ratio.

EPS = (Company's Total Net Profit) / (Shares Outstanding)

EPS gives you a quick idea of a company's profitability, but it cannot be used alone.

EPS gives you a quick idea of a company's profitability, but it cannot be used alone without analyzing cash flow and other business performance indicators.

Market capitalization is the market value of a company. It is calculated by multiplying the number of shares outstanding by the current market price per share. For example, if Company XYZ has 10 million shares outstanding and a share costs $25, then Company XYZ's market capitalization is $250 million. As we'll soon discover, this metric not only gives us an idea of the company's size, but can also be used to calculate other company valuation metrics.

Market capitalization = (Share price) x (Number of shares outstanding)

Just as there are three types of profit (gross, operating and net), there are also three types of profitability to determine the degree of profitability of a company.

Gross Margin (Return on Sales) = (Gross Profit) / Revenue

Operating Margin = (Operating Profit) / Revenue

Net Margin = (Net Profit) / Revenue

This ratio is one of the most popular ways to assess the value of a company. It measures the ratio of a company's stock price to earnings per share for the previous four quarters. For example, a company's stock trading at $15 with prior-year earnings of $1 per share would have a P/E ratio of 15.

P/E = (Share Price) / EPS

The P/E ratio gives us a rough idea of the price other investors are paying for a company's shares, relative to that company's underlying earnings.

This ratio gives us a rough idea of the price other investors are paying for a company's shares, relative to that company's underlying earnings. It also acts as a rough measure of whether a company's shares are expensive or cheap. In general, the higher the P/E ratio, the more investors are willing to pay for each dollar of that company's earnings. Stocks with high P/E ratios (mostly those above 30) typically have high growth rates and/or expectations for the company's earnings to grow. Stocks with low P/E ratios (usually below 15) tend to experience slow growth and have more modest future earnings prospects.

The P/E ratio can also be useful in comparing ratios among similar companies to analyze which competitors are valued higher by the market. Additionally, you can compare a company's ratio to the overall market ratio of the S&P 500 or any other appropriate index. This will give you information about the stock's valuation relative to the market.

One useful variation of this ratio is the rate of return, or EPS, divided by the stock price. The rate of return is the inverse of the P/E ratio, so a higher rate of return means a relatively cheaper stock, and a lower rate of return means a more expensive one. It can also be useful to compare the yield to the yield on a 10- or 30-year Treasury note to get a better idea of how expensive or cheap a particular stock is.

Rate of Return = 1 / (P/E Ratio) = EPS / (Share Price)

Another useful variation is the PEG ratio. A high P/E usually means the market expects the company to grow earnings quickly in the future. This means that the company's main profitability potential lies in the future. And this in turn leads to the fact that the market value of the company (which reflects all these future expected profits) is very large in relation to current profits.

The PEG ratio allows you to determine whether the P/E ratio has gone too far in estimating the future. The PEG ratio gives you an idea of how much investors are paying for a company's growth. The PEG ratio is the future P/E ratio divided by the company's expected earnings growth rate over the next five years, as determined by analyst consensus estimates. For example, if a company has a future P/E of 20 with expected annual earnings growth of 10% per year, the PEG ratio for that company will be 2. The higher the PEG ratio, the more relatively expensive the stock is. .

PEG = (Future P/E) / (5 Year EPS Growth Rate)

As with other ratios, PEG should be used with caution. In its calculation, it relies on two analyst assumptions: next year's earnings and the annual earnings growth rate over the next five years, and is thus doubly exposed to overly optimistic and overly pessimistic analyst sentiment. In addition, in the case of projected zero growth, this coefficient loses all significance.

The Price/Sales ratio, or P/S, is defined in a similar way to the P/E ratio, except that the denominator is revenue rather than earnings. Its importance to investors is that it is based on sales volume, a metric that is much more difficult to manipulate and uses far fewer assumptions than profit. Additionally, since sales tend to be more stable than earnings, the P/S ratio can be a good tool for identifying companies that are subject to cyclical fluctuations.

P/S = (Share Price) / (Revenue per Share) = (Market Cap) / (Sales Volume)

When using the P/S ratio, you need to remember that a dollar of profit always has the same value, regardless of how much sales generated it.

When using this ratio, it must be remembered that a dollar of profit always has the same value, regardless of how much sales generated it. This means that one dollar of sales in a company with high profitability is worth more than one dollar of sales in a company with low profitability. This leads to the need to compare companies using this ratio only within one sector or sectors with similar characteristics.

To understand the differences between different sectors of the economy, let's compare a grocery store to a medical equipment manufacturer. Grocery stores typically have markups of no more than a few cents on the dollar, resulting in a P/S ratio of 0.5, one of the lowest of any industry. Stores need huge volumes of sales to generate a dollar of profit, so investors are familiar with large sales volumes in this industry.

At the same time, the profitability of medical equipment manufacturers is much higher. In order to create one dollar of profit, such manufacturers do not need cosmic sales volumes at all. It is not surprising that the P/S ratio of such companies fluctuates around 5.0. Thus, a retailer with a P/S of 2.0 will look extremely overvalued, while a medical device manufacturer with the same P/S will be valued as dirt cheap.

Another common way to value a company is the Price to Book (P/B) ratio, which relates the market value of a company's shares to the book value of equity from the company's most recent balance sheet. Book value can be thought of as what would be left for distribution to shareholders upon liquidation of a company if the company ceased all operations, paid its creditors, and collected what was due from its debtors.

Book Value per Share = (Total Shareholders' Equity) / (Number of Shares Outstanding)

P/B = (Share Price) / (Book Value per Share) = (Market Capitalization / (Total Shareholders' Equity)

Like all other odds, this one has its limitations. For example, book value may not accurately reflect the value of a company, especially if the firm owns a significant amount of intangible assets such as brands, market share, and other market advantages. The lowest values of this ratio are typically found in the most capital-intensive industries, such as utilities and retail, while the highest values are found in drug and consumer goods manufacturers, where the importance of intangible assets is much more important.

The P/B ratio is also related to the return on equity ratio, which is net income divided by shareholders' equity. If you take two identical companies, the one with a higher return on equity will also have a higher P/B value. A high P/B shouldn't necessarily turn off an investor, especially if the company consistently generates a high return on equity.

This coefficient is used much less frequently than those that were covered earlier. It is calculated in a similar way to the P/E ratio, but using operating cash flow as the denominator instead of net income.

P/CF = (Share Price) / (Operating Cash Flow per Share)

Cash flow is less susceptible to accounting tricks than profit because it reflects real money rather than paper values. This ratio can be useful when analyzing firms in industries such as utilities or cable communications, where cash flows may significantly exceed profits. It can also be used if many one-time write-offs have led to the P/E ratio becoming negative.

As mentioned, there are two ways to make money from buying stocks: capital gains, when shares rise in value, and dividend payments. Dividends are payments made by companies directly to their shareholders.

Dividend yield has been an important measure of company valuation for many years. The dividend yield is equal to the company's annual dividends divided by the price of one share. If a company paid out $2 for the year when the share price is $100, its dividend yield is 2%. If the share price falls to $50, its dividend yield will increase to 4%. All other things being equal, the dividend yield falls when the share price rises.

Dividend Yield = (Annual Dividend per Share) / (Share Price)

After many years of focusing solely on share price growth, dividends are again starting to become the focus of investors' attention.

Stocks with high dividend yields usually belong to mature companies with little potential for dramatic growth. The economic reasons are that companies cannot find suitable investments in their industry and therefore prefer to pay out the money they earn directly to shareholders. These stocks typically include utilities, but can also be found in growth industries such as the pharmaceutical industry.

After many years of focusing solely on share price growth, dividends are again starting to become the focus of investors' attention. One of the reasons is the recent change in the US tax system, which lowered the tax on dividends.

Companies with the best high dividend yield stocks also have consistently positive cash flows, healthy balance sheets, and relatively stable businesses. In addition, it is also worth paying attention to the history of dividend payments in each specific company over the past, say, 50 years.

We've looked at how many of the common analytical ratios are calculated. But in addition to the calculation formulas, it is necessary to understand the nature of the financial indicators that underlie these formulas, as well as the potential limitations of the use of certain coefficients. Good news: with long-term investing, the values of these coefficients move to the background.

Similar articles:

- Financial Ratios and Economic Moats Determining whether a company has the economic moat we discussed...

- Investment declaration: what is it and why is it needed? Large organizations create them to house their pension funds. Financial…

- Analysis of financial statements. Financial ratios. In the previous three sections we looked at the three main financial statements….

- How to calculate the value of a company. DCF model In the previous section, we looked at how to calculate the value of a company with...

Regulatory PEG value

There is no single normative meaning. The higher the value of this indicator, the less investment-attractive the company is (more overvalued by the market). Peter Lynch suggested focusing on a value of 1. If the PEG is in the range from zero to one, then the company can be considered for investment. The table shows the optimal multiplier values ↓

| Meaning | Investment attractiveness |

| PEG < 0 | The company has negative net income. The criterion cannot adequately assess its potential |

| 0 < 1 | An undervalued company is investment-attractive for investors |

| 3 > PEG > 1 | Optimal company assessment |

| PEG > 3 | The company is not attractive to investors because it is highly overbought |

Limitations of PEG use

Let's consider the main restrictions imposed on the use of the PEG multiplier.

- The time duration of the profit growth forecast is not taken into account. For example, calculating PEG for 5 years and 10 years will produce different, non-comparable values.

- Lack of consideration of company risks. P/E has the same disadvantage.

- Simplification of the linear relationship between P/E dynamics and the profit growth rate.

- Dividend payments are not taken into account. The ratio can skew the estimate if the company pays large dividends but does not have a high rate of earnings growth.

Notes for use

- The PEG ratio is especially important for valuing high-growth companies and is applied rather cautiously to stocks with slow growth rates;

- It should be taken into account that young companies are characterized by explosive multiple growth in the first years of development. As a rule, one day this growth may come to naught and this must be taken into account in forecasts;

- Large Russian companies with the largest capitalization are mostly mature businesses. In addition, the Russian stock market has a pronounced tendency to invest in high-dividend stocks. And therefore, companies with low dividend payments are often not of particular interest to private investors. They may be undeservedly underestimated for a long time. But still, I would formulate the main idea of this paragraph as follows: the expected net profit must always be summed up with the expected dividends;

- A negative PEG value is meaningless to interpret;

PEG modification. Multiplier PEGY

One of the modifications of the coefficient is the PEGY indicator, the calculation formula for which is as follows:

Dividend yield – dividend yield.

For example , a company has a P/E of 15, an earnings per share growth rate of 8% and dividend payments of 5% per annum, then:

PEGY = 15/(5+8) = 1.25

At the next stage, we compare PEGY values with the industry average. If the industry average is 1.1, then the company is overvalued.

The logic behind this indicator

It cannot be said that PEG Ratio is widespread in the Russian-speaking segment. I mean that not all analytical Internet portals that periodically publish information on various issuers pay due attention to this ratio.

This may be due to the fact that PEG differs from the main financial multiples, such as P/E, E/P, EV/EBITDA and others, in that it is calculated based not only on data from financial statements, but also on certain subjective categories.

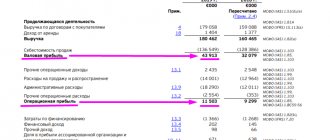

Let me explain: in the report we can see data on private equity, profit per 1 share, look at the share price on the stock exchange and calculate the same P/E ourselves. We can also see the growth rate, but there is one “but” - this growth was in the past and whether it will continue in the future is not known. However, looking at the average profit a company has generated in the past gives us more insight into its future prospects.

Advantages and Disadvantages of PEG

(+) Accounting for future profit growth . Ability to forecast profits and adjust for growth.

(-) Subjectivity of forecast estimates . Analysts may forecast future earnings growth either too pessimistically or on the contrary optimistically.

(-) Lack of accounting for financial risks (disadvantage is similar to P/E). Various companies may have underestimated P/E values due to large net profit values, which are created through borrowing, the so-called financial leverage. Therefore, when comparing companies, it is necessary not only to calculate PEG, but also to compare the financial strength of the companies.

(-) Possibility of manipulation . Net profit can be “adjusted” because Various costs, contributions, etc. may not be taken into account. In this regard, the P/S ratio is more reliable, which refers to the amount of sales revenue (see → P/S in simple words. Formula. Norm. Calculation example)

(-) Cannot be used when the profit value is negative . Net profit in some periods may be negative, and the calculation of the indicator will not be correct.

What does the P/E multiple show?

P/E ratio (Price/Net Income, Price/Earnings Ratio, Price/Net Profit) - shows how many years, at the current annual profit, the investor’s investment in the company will pay off. Thus, P/E helps the investor to make a comparative assessment of the company's investment attractiveness.

One of the main advantages of the P/E multiple is that it reacts quickly to changes in stock price and provides a way to compare companies during sharp downturns and expansions. However, the companies being compared may not be the same in terms of market capitalization, revenue or assets.

Remember that you need to evaluate P/E ratios relative to the country and industry - compare the value with the industry average. A P/E ratio>20 most likely indicates that the company is overvalued by the market, and a P/E in the region of 10 indicates that the valuation is fair. At the same time, investors should be careful with a low P/E value. Especially when analyzing cyclical companies. A low P/E for a cyclical company often warns that the best is behind it.

So, if an investor is considering two competing companies, in theory he should include the stock with the lowest multiple in the portfolio, and also look at the industry average P/E. A company's ratio that exceeds the industry average will indicate that the company is overvalued; below that, it will indicate that it is undervalued. Typically, investors compare company multiples to each other in a stock screener.

Using PEG to Find Undervalued Stocks

Let's consider a practical example of searching for undervalued shares on the American stock market. To do this, we will use the Finviz.com service. Go to the “Screener” tab → “Fundamental indicators” → “PEG” → set the filter to less than 1. The companies shown have minimum indicator values. The figure below shows all the sequential stages ↓

Step-by-step instructions for selecting company shares based on the PEG criterion in the Finviz service

For a more correct use of the PEG indicator, it is also necessary to assess the company's financial stability and bankruptcy risk. To do this, we will need to evaluate such ratios as: current liquidity (current ratio), quick liquidity (quick ratio), autonomy ratio, Debt/Eq.

The second service for evaluation is FinBox . io

In order to find an investment-attractive company, you need to go to the “Screener” section → specify the filter for PEG (more than 0 and less than 1). We will also add accounting for financial risk using the Altman coefficient (read more in the article → “Altman model. Z-score. Estimation of the probability of bankruptcy”). The standard value for financially stable companies is Z-score > 2.9. We install such a filter to filter out high-risk companies. As a result of such an express assessment, we find companies that are undervalued by the market (PEG), and at the same time have high financial reliability (Z-score).

Step-by-Step Guide to Finding Undervalued Stocks by PEG Ratio

One of the advantages of this service is the ability to include or remove promotions from different regions (America, Canada and Mexico, UK, Europe, Asia, Brazil, Africa)

conclusions

The PEG ratio is one of the varieties of the P/E indicator, solving one of its shortcomings: the precision of the assessment, due to the forecasting of future profits. The indicator allows you to compare the investment attractiveness of different companies based on their undervaluation. In addition to its calculation, it is necessary to take into account the company’s financial risk and evaluate other ratios: current, quick liquidity, Altman’s Z-score, etc. It is difficult to calculate this indicator for domestic companies, because they have a negative earnings growth rate.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |