Hello, dear friends! Many traders do not fully understand what a spread is in trading, much less understand how it is taken into account in trading. As a result, due to incorrectly set SL receive unnecessary losses, take profit may not work, although in theory it should have worked. And miracles happen with pending orders - either it will be executed when the chart does not reach it, or it will not work, although the candle has clearly reached the required level.

There is no manipulation on the part of the broker . The reason for these phenomena is the spread , and the fact that the order was executed at the wrong price is explained by its incorrect setting. I suggest you don’t make such mistakes again and figure out once and for all what spread is and how to work with it correctly .

Defining the terminology - what is spread

The word spread (from the English spread ) means the difference between the purchase/sale price of an asset. It is also called the difference between Bid and Ask :

- Bid refers to the buyer's price from you. That is, you open sell transactions (short positions) using it.

- Ask – seller price , at which the counterparty will sell you the asset. That is, long positions or buy transactions are opened using Ask.

For a better understanding, let's look at a detailed example:

- Suppose trader No. 1 wants to buy Gazprom shares at a price of 154 rubles. per piece, and this is the maximum among all applications. In the glass, it will take first place among buyers' prices.

- Trader No. 2 wants to sell Gazprom shares at a price of 154.5 rubles. a piece. This is the minimum offer among all, which means his order in the order book will be the leader among sellers or the Ask price.

In our example, the spread would be 154.50 - 154.00 = 0.5 rubles or 50 kopecks . Although the example is described in extremely simple language, an idea of the essence of this phenomenon should already be formed.

Ask and Bid prices

The concept of Ask and Bid prices corresponds to the concept of purchase and sale prices.

Ask and Bid price

The Ask Price is the minimum price at which the seller agrees to sell. And the trader who chooses the Buy operation pays exactly the Ask price. For him, this is the purchase price.

They also write Ask, which translates from English as “to ask”, “to request”. This is the demand price - the amount that the buyer (demand representative) must spend on the product.

The Ask price is always higher.

Bid price is the maximum amount that a buyer is willing to pay for a currency pair. By clicking Sell, we pay this price.

Bid is translated from English as “offer”. Bid price - offer price. The trader, when selling, is the supply side.

The Bid price is always lower.

Spread classification and factors influencing its size

Dividing into groups can be done according to several criteria. Depending on its size , there are:

- Fixed spread . The broker does not allow it to change during the trading session.

- Floating – changes arbitrarily; in theory, the broker does not influence it.

- Fixed with extension - something between the 2 previous options. Most of the time the difference between Bid and Ask is fixed, but sometimes the broker can increase it artificially. This is what some companies do, for example, before news releases in order to cut off those who want to catch news movements.

By type they distinguish:

- The so-called spread “in the order book” - we will work with it further.

- Calendar – typical for stock market instruments. It refers to the difference in prices of derivative instruments for the same asset, but with different expiration dates. An example is buying an oil futures contract with a near-term expiration date and selling it, but with a longer expiration date. A similar service is available, for example, on the MICEX . Many people trade spreads on the stock exchange.

Do not confuse the difference between the Bid and Ask prices with the commission - these are completely different things .

Factors affecting the spread

Among them I will highlight:

- Liquidity . For popular assets with large traded turnover, the difference between prices is minimal. The spread when buying shares is also subject to this law.

- Broker . No one is stopping the company from artificially increasing the difference between the Bid and Ask prices. For example, it could be expanded at night to cut out traders who trade with robotic scalpers for a quiet market.

- Times of Day . Trading activity is distributed unevenly throughout the day. For example, for the EURUSD , most of the daily turnover is gained during the European session and America. At night , when the market is quiet, the spread increases .

- Account type . There are options with a floating spread (down to zero points) and a commission depending on the turnover, and there are options with a fixed spread. The account type is selected taking into account your trading style.

We’ll talk about the difference between Bid and Ask prices in the stock market a little later. There are a number of features in this issue.

Methods of use

Spread is available in any exchange trading tools. Trading highly liquid assets is quite complex and requires a fairly quick reaction. When trading assets that behave less quickly, the spread provides an opportunity for bargaining. There are many assets (for example, bonds) that have a sell price but no buy price. Since the bond meets the reliability criteria, the trader places his purchase price in the “glass” and calmly waits for it to be executed.

This behavior is also applicable if there is a large spread in an asset, then you can bargain and offer the best price by placing an order as Bid or Ask. This way you can “store” funds that are not used, that is, reserve them in applications with attractive prices, so that upon sale the income is practically guaranteed.

In addition to the spread in the “glass”, there is also a calendar spread, which means the difference in the cost of a distant and nearby derivative instrument (usually relative to futures) by expiration date, but for one asset. Such spreads may be a feature of the asset or appear as a result of seasonal demand. For example, the dividend spread of a stock and the corresponding futures. Since futures do not pay dividends, they are often sold at the price of the stock minus dividends.

A calendar spread can appear as a result of inefficiency in the evening session when news hits the financial market that sets the market in motion. Typically, during the evening session, activity is focused on the futures that are closest in terms of execution dates, while the distant ones are often deprived of attention. If the difference in prices has increased, this will allow you to buy a cheap asset and sell an expensive one, receiving the financial difference and carrying out an arbitrage transaction.

Spread in the MT4 trading terminal

We’ve already figured out what a spread is in the Forex market, now let’s move on to practice . When you start the terminal, only one price is displayed - Bid. To activate the display of Ask on the chart , check the corresponding item in the settings. In the example in the figure below, the spread on USDCHF turned out to be 0.7 points for 4-digit quotes.

The spread can also be displayed in the Symbol . In the context menu, just select the appropriate item, and in addition to the Bid and Ask prices for all instruments, the difference between them in points will also be displayed. Just keep in mind that it will be calculated taking into account the bit depth of the quotes.

The contract specification specifies only the spread type . In our case it is floating .

You can also see spread in the window in which the transaction parameters are set. The Bid and Ask prices are shown there , and on the left side of the window they are also shown in the form of a graph .

Since in our example it is floating, it is constantly changing.

Open an account with Exness with low spreads

Trading Features

During trading on the stock exchange, a trader constantly deals with charts of various assets, quotes of exchange instruments, as well as various kinds of technical and fundamental research that are carried out with these assets. The charts show the history of transactions that were made, and the quotes indicate at what cost traders can buy/sell this asset and in what quantity.

Quotes are displayed in special tables, which in stock exchange jargon is called a “order book”. Here they wait for the order of execution of the orders of buyers and sellers, while the purchase price is always lower than the sale price. In the table, asset values are arranged from top to bottom. This means that at the bottom is the lowest purchase price of the asset, and at the top is the highest sale price. If the buyer's price matches the seller's price, a deal is concluded. This is how a two-way impersonal auction works, which is the basis for transactions when trading on the stock exchange.

How to take into account spreads in trading

The difference between the Bid and Ask prices is the broker’s earnings. Regardless of how a trader trades, the company will earn a couple of points on each trade. The site will soon publish a review of quality brokers with low spreads; they are an excellent choice for intensive trading.

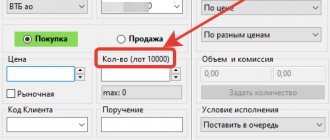

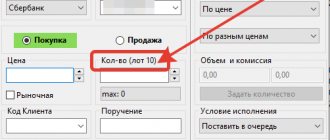

To understand how a broker makes money from traders, let’s figure out at what prices transactions are executed :

- Long positions (to purchase) open by Ask, because of this, already at the moment of opening the transaction is in the red. The broker made money for you the moment you entered the market. The figure below shows that the price has not yet changed, but there is already a loss on the transaction. This happened precisely because of the spread.

- Short positions are opened at Bid , and on them the company takes its income in the form of a spread when the transaction is closed. You buy when leaving the market at a slightly less favorable price.

This must be taken into account when setting a protective spread in take profit and stop loss.

Examples

- A long position is opened, a fixed one is used TR V 20 points. Since entering the market is performed at the Ask price (slightly higher than what you see on the chart), to obtain the profit fixation level from the Bid, we postpone 20 + spread points.

- Pending order Buy Stop will work on Ask, on the chart it will look like a shortfall by the amount of spread to the buy level (if you have not enabled the display of two prices in the settings). Counting position Buy Stop from the price on the chart, do not forget to add the spread to the resulting value. In case of Buy Limit the chart, on the contrary, should go beyond the pending order.

- Example with a sell transaction. The take profit is set to 11 points, but it will only work after the chart (Bid price) drops below the TP on the spread, in our case 1.8 points. As a result, the trader receives 11 points instead of 12.8 points of profit, and 1.8 p. goes to the broker as his earnings for you.

An article about pips and points will be published soon; if you are confused about the bit depth, I recommend that you read it.

To understand this principle, you just need to remember at what prices transactions are executed.

Liquidity comes first

What is liquidity? This is the ability of a product to sell and buy well.

Let's take an example from life:

Which car do you think will be more liquid on the secondary market, Hyundai Solaris or Porsche Cayenne? Answer: Solaris. Let's look at the process of selling both cars through the eyes of the seller. There are more Korean cars on the market than German ones. The price of a Hyundai is much lower, which means there will be an order of magnitude more buyers for this brand. In other words, if you had both brands and decided to sell them, then it would be easier for you to find a buyer for Solaris at the right price. Cayenne will be sold for a long time at the price you need. And to sell it faster, you will have to greatly reduce the price, which will be unprofitable.

Now let's look at the same example, but through the eyes of the buyer. Let's say you have 500,000 rubles. for a used Solaris for his wife and 2 million rubles. for a used Caen for your loved one. There will be 100 Solaris at this price, of which it will be easier for you to choose a car that is not damaged and technically sound. But there will be about 20 Caen at this price, but upon closer examination, many of them will disappear, since they will either be broken, or repairs will require considerable investment, in other words, it will be much more difficult to find an unkilled Caen.

In the Forex market, the equivalent of Solaris is the euro/dollar pair. Every 3rd trader in the world (37%) trades this asset. This means that it has high liquidity and brings regular income to the broker. Therefore, the spread here is minimal.

Unlike the USD/ZAR pair, which in Forex is the equivalent of Caen (dollar/South African rand). Have you heard of the rand before? Now imagine how often they buy it, even if the name of the currency doesn’t tell you anything. It is clear why the spread here is 80–250 points (taking into account the low exchange rate, this is $60–190 with a volume of 1 lot). However, liquidity depends not only on the type of asset! (Fig.4)

Enlarge image

Influential factors include time of day, holidays and news releases. Let's remember the Swiss franc, which collapsed during the New Year holidays! And let's talk about how the spread changes in different periods.

Types of currency pairs depending on the spread

The difference between Bid and Ask prices is not constant. There is no standard that would set restrictions on this parameter. As a result, we observe differences even for the same instrument. For example, during the day on EURUSD , Alpari’s demo account spread reaches 0.5-0.6 points, while Forex4You’s spread for the same pair reaches 2 points on the Classic .

Despite this, the following classification :

- Currency pairs on Forex with a small spread . This includes majors and those crosses for which there are no problems with liquidity, that is, a fairly large volume is traded. Spreads on them are calculated in a few points.

- Instruments with average difference between Bid and Ask . Here I include those pairs for which the difference between the Bid and Ask is already noticeable, reaching 10-15 points. You can still trade with them, but entry points need to be selected more carefully.

- Assets with a large spread . This applies to all exotic currency pairs. There is almost zero activity of traders on them, hence the gigantic spread.

The large spread is one of the reasons why I do not recommend trading exotic currency pairs for beginners. At the start, it is advisable to limit yourself to majors ; at most, include a couple of crosses . You can practice on a demo or a small real deposit. Previously, a post was published about where it is profitable to open a cent account - you can deposit only $5-20 and practice working with real money.

Open a cent account in Exness

On myfxbook you can track statistics for different brokers. Data changes in real time.

How is it different from margarine?

Both products are obtained from vegetable fats, but margarine contains only vegetable fatty acids, while “spread” contains both natural and milk fats.

Margarine does not have the same restrictions on the content of trans fats (trans isomers) as butter substitutes, so it causes more harm to the cardiovascular system. For example, margarine can contain up to 20% of these unsaturated fats, while spreads can contain only 2%.

Scientific fact: natural trans fats are found in meat and dairy products and there is little harm from them. The health hazard is mainly posed by artificial trans isomers: they are formed during the curing process of liquid oils, for which nitrous acid is used.

Stock market spread

Despite the fact that the work here is carried out with company shares and other instruments, the essence of the spread does not change , it is still the difference between the best price of the seller and the buyer. Let me briefly go over the features of the stock market.

This is where the concept of the so-called calendar spread . We discussed in more detail above in the paragraph with classification (futures for one asset with different expiration dates).

As for the factors influencing the spread in the stock market, they are approximately the same as in Forex:

- Crisis phenomena in the country's economy or unexpected news regarding a company lead to the dumping of relevant securities. As a result, the spread widens.

- Expected news , the results of which establish a bullish or bearish trend .

If this indicator grows too much, the exchange may stop trading.

The presence of a spread – dependence or necessity

Trading on the Forex currency markets can often be accompanied by a number of conditions of brokerage centers. This list of conditions determines how profitable the transactions that will soon be

will conclude. The amount of profit received is affected by margin trading, the volume of each trading operation and a list of some other factors. However, among the services that a broker can provide, there are some details that can affect the condition and position of deposits in the most negative way. And here we are not talking about any low-quality services provided; in this context, they mean payment for brokers’ services. First of all, this is what is called the spread and commission for rolling over positions. Let us consider the history and purposes of application of the above concepts.

For the first time, the concept of a spread arose and became widely used virtually simultaneously with the beginning of the provision of various types of services in the field of Internet trading in the Forex market. Brokers, who are essentially intermediaries between currency exchanges and market participants, have a full justified right to receive their share of the profit for the services provided to them. This type of profit is often the spread. This is a kind of commission, which is deducted from the trading activities of each of the traders. At the same time, the commission fee for concluding a transaction is often withdrawn regardless of its actual profitability. Before the order can enter into profitable positions, brokerage companies withdraw their share of the profits.

Most often, the amount of remuneration that a broker receives depends on a number of parameters, among which you can find the type of currency pairs or cross. In addition, the width or size of the spread is also influenced by the direction of the company’s internal financial policy. It is for this reason that the broker most often chooses something that is closely related to the consideration of the spread size. Most often, the spread volume is a small percentage of the completed transaction. Moreover, each currency pair often uses its own individual commission size. For most brokers, its size can range from 2-9 points according to the main currency pairs. In some cases, which may be related to the individual characteristics of certain nationalities or religious beliefs of the trader, the broker may provide the opportunity to trade without a spread. However, this proposal often fails to reflect the promised reality. Despite the fact that there is formally no spread, brokerage centers charge fixed commissions for open transactions. In fact, there is no difference, because they differ only in the wording.

Is it possible to reduce the spread?

You will not directly influence its value in any way. But it is possible to organize trading in such a way that the spread is not critical. I recommend:

- For high-intensity trading, choose accounts with a floating spread from 0 points .

- Work only on majors.

- Limit trading time to European and American sessions.

- Take advantage of the spread return program ( rebate ) if the broker offers it.

As for how to calculate the spread, you don’t have to do any calculations. Look at the trading conditions on the broker's website, and also track its changes through the terminal during the day and you will have an idea of its average value.

Ensuring the profitability of the transaction

Any trader should focus on changes in the spread. The greatest performance will be achieved when the maximum market conditions are fully taken into account. The success of a trading strategy is based on the effective assessment of market odds and the financial terms of the trading transaction. It is necessary to analyze the likelihood of any risks and estimate the volume of the transaction.

In order not to lose, you need to do a comprehensive analysis and clearly understand the essence of the spread. Since its size can change, you need to use a flexible trading strategy. This will help you adapt to the peculiarities of the market.

Video on the topic:

Brokers with minimum spread

You can read a detailed review of each of the three companies on the website. I will limit myself to a brief description of trading conditions.

Exness

Let's start with this company.

- Leverage from 1:2 to infinity, it is tied to the size of the trader’s capital.

- For Classic and ECN, the minimum deposit is $2000 and $300, respectively.

- The spread on EURUSD is 0.3-0.7 points.

- An account can be opened in 22 currencies , including crypto .

- Work with CFD on crypto .

I note that the spread indeed one of the lowest in the industry for majors . In terms of crosses - at the level of other brokers.

Open an account with Exness with low spreads

FxPro

The next broker in my personal top.

- Leverage in the range 1:1-1:500 .

- The account is opened in one of 8 currencies .

- The spread depends on the trading platform; in MT4 it is on average 1.45 points, and in cTrader it is 0.45 points. In majors it is slightly inferior to Exness, in crosses it is approximately at the same level.

- cTrader $ 1 million traded.

- You can work with currency pairs, CFDs, futures, energy market instruments, and commodities. CFDs available for shares American, English, German And French companies. The average spread is small, for example, for Apple it is equal to $0.69.

- There are no deposit restrictions . The site mentions a recommended capital of $500 and $1000 for MT4 and cTrader, respectively. But this is only advice for observing the MM. If you open an account too small, then even the minimum volume can reset it to zero. An article was recently published about what a lot is, where this issue is discussed in more detail.

Open an account with FxPro

J2T

Just2Trade closes the list ( for the stock market there is almost no alternative ):

- Deposit from $200 , with this amount you get access to all trading platforms in the world.

- Leverage up to 1:50.

- You can work with shares of ETF funds .

- There is a single account ( MMA ).

- In addition to stocks, you can work with the Forex , crypto , futures , and options .

- Commission depends on turnover. For example, when working on GLOBEX/EUREX it varies from $1.5 per trade to $1 with a turnover of over a thousand shares per month.

Details are given for each trading platform. This broker is ideal for traders starting to work in the stock market. The entry threshold is small , and you can trade on literally any platform in the world.

Open an account for the US market on just2trade

Nutritional value and chemical composition of the product

100 g of spread contains 495 kcal, so it should not be consumed uncontrollably, in unlimited quantities - this can lead to a significant increase in body weight.

The ratio of proteins, fats and carbohydrates in grams: 0.1/53/0.1 per 100 g of product [3]. Nutrient content

| Vitamin A | 819 mcg |

| Beta carotene | 0.61 mg |

| Vitamin B1 | 0.01 mg |

| Vitamin B2 | 0.03 mg |

| Vitamin B4 | 12.4 mg |

| Vitamin B6 | 0.01 mg |

| Vitamin B9 | 1 mcg |

| Vitamin B12 | 0.07 mcg |

| Vitamin C | 0.1 mg |

| Vitamin E | 7.8 mg |

| Vitamin K | 93 mcg |

| Vitamin PP | 0.02 mg |

| Potassium | 30 mg |

| Calcium | 21 mg |

| Magnesium | 2 mg |

| Sodium | 994 mg |

| Phosphorus | 16 mg |

| Omega-3 fatty acids | 23.2 g |

Summary

The main thing you should take away from my article is:

- The broker will receive his profit on any transaction.

- The spread can be minimized by wisely choosing a company, account type, and currency pair. But reducing it to zero will not work . If it nevertheless decreases to near-zero values, then the broker will still receive his due from the commission.

Messages periodically appear on the network that there was a negative spread , but in most cases this is explained by a software malfunction. This can happen on a demo account with a very large amount of virtual deposit. In theory, this can also happen on a real account, when large-volume limit orders remain on one ECN platform, but on another they have already been sorted and the price has changed. But they are sorted out in a few ticks, and it is almost impossible to catch such a moment.

If you are just starting to trade, limit yourself to the majors and do not chase the number of transactions . In this case, the influence of the spread on the result will be reduced to a statistical error, and the profit will depend solely on your trading skills.

Surely you still have some questions after reading the material. They can and should be asked in the comments - I will be happy to answer them. And don’t forget to subscribe to my blog, you are guaranteed not to miss the release of new materials. With this, I bid you farewell for a moment. See you soon and good luck in your trading!

If you find an error in the text, please select a piece of text and press Ctrl+Enter. Thanks for helping my blog get better!

Satisfying needs

Naturally, for many, withdrawing funds from an account will not seem like a completely fair action. However, in such cases it is worth thinking about one interesting detail. If no one pays commissions to intermediaries, then who will provide this kind of service? Because to ensure the full functioning of brokerage companies, considerable funds are needed to maintain equipment in good condition, pay taxes and the provision of additional services, just like salaries to employees.

If you pay attention to the corporate websites of brokers, it becomes clear that in addition to the terminal itself, they provide the opportunity to use informative materials and resources, but they also require special training, which costs money, since it is also necessary to pay for the work of the specialists who prepare these materials.

In addition, broker websites may have economic calendars and detailed analytics on technical, wave and fundamental analyses. All this requires considerable costs. The spread is the most significant among several sources of income for brokerage centers. If you exclude it from the system, then the very fact of currency trading will become impossible.

Many brokerage centers provide opportunities for novice traders to develop. In order to provide them with such an opportunity to assert themselves in the immediate environment of traders, brokers can organize a wide variety of Forex tournaments and competitions with very real monetary rewards. What can we say about already experienced traders, who are often also forced to take part in tournaments of this kind so that investors can see the results of their achievements. Funds for rewards in such competitions are also taken from the money that was received from the spread. Similarly, the spread plays a positive role in each of the bonus or no deposit accounts. This service is provided for those who have decided to change brokers and intend to test trading terminals. Naturally, this can be done from a demo account, but during the testing period you should not miss the opportunity to make a profit. In addition, a no deposit account serves as a good alternative.

In addition, a bonus account has always been convenient for those who, being only at the initial stage of trading, are still afraid to invest their own funds. In this aspect of the problem, the bonus account serves as an excellent incentive. However, this would not be possible if there were no spread. Because all the costs described above are compensated from this brokerage commission.