A secondary market is a market where already issued securities and financial instruments are traded. It includes both exchanges and the over-the-counter market. An exchange is a formally established stock exchange on which securities are traded and has a specific set of rules for participants.

When trading is done through an exchange, it is supervised by the exchange and thus ensures that all rules and regulations are properly followed. Conversely, the over-the-counter securities market, known as OTC, is a dealer-based securities market that is a decentralized and unorganized market where trading is carried out by telephone, email, etc.

The difference between the stock market and the over-the-counter market is discussed in detail below.

comparison table

| Basics for comparison | Over-the-counter ( OTC) | Exchange |

| Meaning | The over-the-counter or OTC market is a decentralized dealer market in which brokers and dealers transact directly through computer networks and telephone calls. | An exchange is an organized and regulated market where shares are traded between buyers and sellers in a secure, transparent and systematic manner. |

| Market maker | Dealer | The exchange itself |

| Used | Small companies | Well-established companies |

| Physical location | No | Yes |

| Trading hours | 24×7 | Exchange opening hours |

| Stock | Unlisted shares | Shares listed on the stock exchange |

| Transparency | Low | Relatively high |

| Contracts | Individual | Standardized |

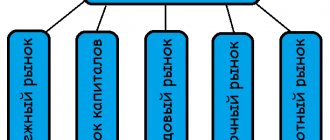

What types of markets are there?

As part of the global financial market, it is customary to distinguish several main segments: stock (including futures), foreign exchange, insurance, investment and capital markets. For the average investor (trader), the first two segments are of interest, while all the others are the domain of professionals. The primary securities traded on the stock market are stocks and bonds. The derivatives market is a place for trading derivative instruments - futures contracts (futures, forwards, options, swaps). In the foreign exchange market, as its name suggests, currency is exchanged.

Definition of OTC

The over-the-counter or OTC market is a decentralized market for unlisted securities that does not have a specific physical location. Firms/individuals involved in trading directly negotiate through a communication network such as telephone lines, emails, computer terminals, etc. Trading in the over-the-counter market is also called over-the-counter trading due to the absence of a formal exchange.

Typically, those companies that do not meet the requirements of a stock exchange to list their shares trade them on the over-the-counter market. Trading occurs between two companies or financial institutions. Financial products such as bonds, derivatives, currencies, etc. are mainly traded on OTC.

This is a dealer market where they buy and sell financial products for their own account, and investors can directly connect with dealers who are interested in selling their stocks or bonds. Or they can talk to brokers, who discover dealers offering the stock at the best price.

Dealers who open the market for a particular security indicate the price at which they intend to buy the stock, called the bid price, and the rate at which they intend to sell the stock, called the ask price. Here, the bid-ask spread refers to the amount remaining between the bid and ask prices, indicating the dealer's markup.

How does trading work on the over-the-counter market?

You can often find out quotes and transfer instructions to a broker only by telephone. To use tools that make it possible to make transactions online, you must pay for the services of the corresponding service (electronic platform).

Due to the absence of an official price for securities, brokers usually announce a smaller transaction amount to buyers/sellers, complete it for a larger amount, and take the difference for themselves. This is a generally accepted practice that you can accept or not - the choice is yours.

Main types of over-the-counter transactions

Basically, two types of transactions are used in practice:

- a delivery forward is an agreement in which one party undertakes to transfer securities no later than the agreed date, and the other party undertakes to pay for them;

- option is an agreement under which the buyer acquires the right, but not the obligation, to buy an asset at a price agreed upon at the time of conclusion of the contract no later than a specified point in the future.

Another type of transaction that exists in the world—settled forward—is not practiced in Russia due to its legal insecurity.

How to access this market

To purchase and sell securities on the OTC market, you need to enter into an agreement with a broker.

The intermediary must have:

- a license from the securities market regulator (for the Russian Federation this is the Bank of Russia);

- accreditation on the trading platform of interest to the investor;

- impeccable reputation and relatively low tariffs.

Exchange definition

Exchange is an exchange market which refers to a centralized and regulated financial market in which securities, commodities, derivatives, etc. of listed companies are bought and sold between stockbrokers and traders.

The prices of securities such as stocks, debentures, corporate bonds, etc. are determined by market forces of supply and demand. Exchange trading can be done at a physical trading location such as premises etc. or on an electronic platform i.e. website.

The exchange has an association of individuals (registered or unregistered), usually called brokers. They were created to regulate trading in securities among the population and companies in general. The exchange sets a number of rules for firms and brokers that engage in securities trading.

Features of the Russian over-the-counter market

During the all-Russian “privatization” of the nineties of the last century, over-the-counter trading of the Central Bank was a mass phenomenon. Employees of enterprises became their shareholders, and enterprising businessmen bought shares from them for little money and resold them at a higher price.

Today, in addition to the RTS Board, securities not traded on the Moscow Exchange can be sold or purchased through its MOEX Board system. Here, each participant has the opportunity to set and view indicative quotes of the Central Bank, as well as make purchase and sale transactions through the Center for Electronic Contracts.

Exchange Features

- Securities trading . The first and foremost function of a stock exchange is to provide a formal platform for trading securities and liquidating them when an investor needs to cash them out at the prevailing market price. Moreover, it gives the investor the opportunity to change his portfolio whenever necessary.

- Setting the price . The stock market is one of the best examples of perfect competition due to the presence of many buyers and sellers in the market. Since the market is transparent, all the necessary information is available, so there is active bidding and thus the price is determined.

- Fundraising . The stock exchange is common for companies and governments to raise funds in the market by offering securities for sale to the general public.

- Savings mobilization . People invest their savings in the stock market to get good returns and earn money from their investments. In this way, the savings of the people are mobilized and channeled by the stock exchanges, investing their money in various sectors that generate high returns.

- Trading of used securities . Only those securities that were previously issued by companies through a public offering on the primary market are traded on the exchange.

Exchange Securities Market

An exchange securities market or stock exchange is an organized securities market in which trading is carried out strictly according to established rules and schedules during the exchange session. Only securities of reliable issuers are listed on the stock exchange. The criteria for listing are the size of the company's net income, the value of assets and the size of issued shares.

The main objectives of the stock exchange are to create the necessary conditions for trading and services, in return for which trading participants pay commissions, annual fees, and also pay a listing fee.

The functions of the stock exchange are:

- Organization of public trading using certified equipment and with the help of highly qualified exchange employees;

- Development and implementation of exchange contracts;

- Regulation of securities quotes;

- Exchange arbitration (resolution of conflicts of interest and disputes arising during exchange trading);

- Insurance of trade participants against sharp price surges and hedging;

- Guaranteed execution of transactions.

Currently, there are more than 200 exchanges in the world, the largest of which are: New York, Tokyo, London, Shanghai, Hong Kong, Frankfurt.

The first stock exchange, which still exists, was opened in 1602 in Amsterdam, where trading was carried out not only in various goods, but also in securities, and the trading technique in both cases was the same. Admission to the exchange was free, and anyone could participate in trading. For a long time, only shares of the United East India Company, Dutch government bonds and bonds of the administrations of the country's largest cities were traded on the stock exchange. In the middle of the 18th century. 44 types of securities were already listed on the Amsterdam Stock Exchange.

Key Difference Between Stock and Over-the-Counter Markets

The difference between the exchange and the OTC market can be clearly seen for the following reasons:

- Exchange refers to a trading exchange, which can be an organization or institution that hosts a market where shares of listed companies are traded between buyers and sellers. On the other hand, an over-the-counter market is a decentralized market in which buyers search for sellers and, conversely, communicate with each other through a computer network or telephone.

- In the over-the-counter market, dealers play the role of market makers as they specify the price at which securities and other financial instruments are bought and sold between participants. Conversely, in the case of an exchange, the stock exchange is the market maker since prices are determined by the forces of supply and demand.

- Companies that do not comply with exchange rules and regulations often trade their securities on the over-the-counter market, usually small companies. In contrast, large businesses usually list and trade their shares through an exchange.

- One of the main differences between the two is that the trade is physically present, while the method of open protest is used. In contrast, OTC has no physical location, everything works over the phone or computer.

- Trading on the stock exchange is carried out only during business hours. In contrast, the over-the-counter market trades around the clock.

- In terms of transparency, the over-the-counter market is not as transparent as an exchange, where participants have complete information and knowledge about the securities being traded.

- In case of exchange, only standardized products are considered in terms of quality and quantity, while in case of OTC, contracts are customized as per the requirement.

- Due to short-term imbalances between supply and demand, there is no mechanism in the over-the-counter market to stop sharp highs or lows in security prices. However, in an exchange, these price imbalances are adjusted by stopping trading of specific stocks on the exchange, allowing additional participants to restore market equilibrium.

Advantages and disadvantages

Advantages of transactions with assets on the over-the-counter market:

- the widest scope for investment activities, primarily with access to the securities of a huge number of companies;

- the opportunity to purchase securities with the highest dividend yield;

- additional profitability of acquired assets associated with the growth of the market itself.

Disadvantages of this type of trading:

- extremely low liquidity of assets;

- the greed of brokers and the associated high costs for investors;

- limited availability of analysis tools for asset acquirers.

Advantages and Disadvantages of OTC Stock Market and Stock Exchange

Let's start by listing the advantages of the exchange:

- fraud protection;

- fairer prices;

- more opportunities for short-term trading, trading;

- high liquidity of assets;

- papers from more or less proven companies.

Among the disadvantages of the exchange:

- broker and exchange commissions;

- Due to listing, truly worthwhile startups may not be included in the list of traded shares.

And now to the advantages of over-the-counter trading:

- you can find shares that are not on the stock exchange;

- the price is negotiable, you can negotiate to an acceptable price;

- there is a chance to find a startup that will quickly increase in value.

And to the cons:

- high risk of fraud;

- risk of overpayment;

- low liquidity.

Why do you need a broker to trade on the stock exchange?

Federal Law No. 39-FZ of April 22, 1996 allows only legal entities with the appropriate license to participate in auctions. Everyone else needs an intermediary, that is, a broker, to conduct transactions on the stock exchange.

A specialized company will open you a brokerage or individual investment account (IIS) and provide access to tools with which you can place orders for the sale and purchase of securities.

Usually they offer to install a mobile application for this, but there are also companies that are slower than others to master the achievements of technological progress. Therefore, be sure to evaluate how comfortable you are with using the services of a broker when you choose one.

What else to pay attention to