EBITDA is a multiplier widely used in financial analysis of management and accounting data. It shows how much a company earned before taxes, interest on loans and depreciation. In simple words, EBITDA is the so-called “dirty profit”, i.e. the amount of money from which mandatory payments not directly related to the issuer’s main activities should be deducted.

Today we will analyze the formula for calculating EBITDA based on financial statements compiled in accordance with Russian and international standards. You will also learn how this parameter is used by investors and where you can find its value by issuer. And, of course, we will calculate EBITDA using real examples.

What is EBITDA

EBITDA stands for Earnings Before Interest, Taxes, Depreciation and Amortization. That is, this is net profit increased by the above components.

Interest on loans, taxes and depreciation are parameters that do not directly affect operating activities. They are needed to calculate net profit, but for a more detailed analysis you should understand how much income the company receives from its core activities.

Why calculate EBITDA

First of all, the EBITDA indicator determines the degree of dependence of the company on borrowed funds. Let's say an investor is considering two businesses that have approximately the same amount of revenue. But one company has debt on loans, the second does not. Thus, investing in a debt-ridden company automatically increases the risk of the investment. After all, loan payments are paid before income to shareholders.

On the other hand, when the first company pays off its loan debt, it should overtake its competitor, since the second company achieved such results at its own expense, without the use of financial leverage.

As for taxes, with the same amount of taxable profit, the calculation is influenced by benefits (if any), the location of the issuer, and the composition of expenses. The fact is that not all costs can be taken into account when determining the tax base. Some payments are made from net profit. Agree, this is important for an investor.

What is the meaning of the indicator

EBITDA calculation is necessary for a detailed profitability analysis. With its help you can find out:

- whether the company has debts to banks;

- whether the issuer enjoys tax benefits;

- whether net profit is spent on anything other than paying dividends;

- what is the amount of depreciation charges?

Depreciation is usually an indirect expense. In other words, its size does not affect the results of production activities. However, this amount shows the degree of wear and tear of the equipment. For capital-intensive industries, the amount of wear and tear is of no small importance - if the equipment is outdated, it means that the time will soon come to update it. And, consequently, costs will increase and profits will decrease.

What does the EV/EBITDA ratio show?

Next, it is advisable to introduce the concept of EV and the EV/EBITDA ratio.

EV stands for Enterprise value, or company value. It can be defined as the sum of the capitalization of an enterprise and its debts. Investors need this valuation metric to compare different companies.

The EV/EBITDA ratio shows the company's value based on EBITDA. To calculate it, the following formula is used:

EV/EBITDA = (Capitalization + Long-term liabilities + Short-term liabilities) / Earnings excluding taxes, interest and depreciation.

The billing period is one year.

This indicator is used to compare companies with each other. With its help, investors can understand how much a company is undervalued or overvalued by the market.

However, it is important to take into account the industry in which the company being assessed operates. Developing industries are characterized by a higher rate. EV/EBITDA for more traditional industries will be lower. The factor of the country of origin of the company also influences the value of the indicator. Thus, the opposite situation is typical for developing economies, since traditional industries can develop at a faster pace than high-tech ones.

These factors should be taken into account when calculating the indicator.

How to calculate EBITDA

If you only have reports at hand, which are submitted to the tax authorities and presented on the company’s website, then it is impossible to calculate EBITDA. For calculations, you will need additional data, namely a breakdown of costs.

Of the costs, only one line is required - depreciation.

Sometimes the Ebitda value can be found on the company website. If there is no data, the calculation is performed independently.

Formula for calculating EBITDA on balance sheet

The general formula looks like this:

\[ EBITDA = Net\ profit + Interest\ payable – Interest \ receivable + Tax \ on \ profit + Accrued \ depreciation. \]

Now let’s look at the features of calculating the indicator based on balance sheet data drawn up in accordance with Russian and international standards.

Formula

- Component One EBITDA - see Lesson 25.

- Component 2 Net Debt

Net debt = short-term debt + long-term debt − cash and cash equivalents

Net debt = short-term debt + long-term debt − cash and cash equivalents

Net debt can be called an indicator of a company's financial independence. The lower the net debt, the lower the obligations to creditors. The prevalence of short-term liabilities increases the risk of financial instability, while long-term liabilities reduces it.

Calculation of EBITDA according to IFRS

Before giving an example, it is necessary to highlight two important conditions:

- Interest is taken into account both paid and received. The first quantity is included in the formula with a plus sign, the second – with a minus sign;

- In reporting prepared in accordance with IFRS, interest is accounted for in the lines “Financial income” and “Financial expenses”, and tax is recorded in the line “Income (expense) for income tax”. The fact is that the tax can be paid or refunded (if the company overpaid or expenses exceed income).

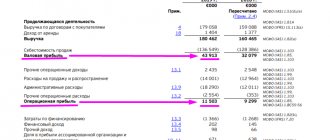

Let's calculate EBITDA on the balance sheet for 2022.

EBITDA = 123208 + 47252 – 4938 + 30279 + 118633 = 314434 million rubles.

As you can see, depreciation charges amount to a fairly significant amount. This once again emphasizes how important EBITDA is for companies with depreciable assets on their balance sheet.

Calculation of EBITDA according to RAS

Now let’s calculate the multiplier on a balance sheet drawn up in accordance with Russian accounting standards, using the same formula.

The information we need is contained in the income statement (Form 2). Let's take . Additionally, only the amount of depreciation deductions will be required. We will calculate it using the data contained in the notes to the financial statements.

Depreciation = (4438692 – 3402267) + (1962 – 665) = 1037722 thousand rubles.

EBITDA = 5845874 + 1215651 + 545860 – 31534 + 1037722 = 8613573 thousand rubles.

Real example Intel Corp #INTC

1. EBITDA #INTC for the financial year ending December 2022 is equal to:

EBITDA = Net Income + Taxes + Interest + Depreciation + Amortization = $20,899 + $4179 + ($1400) + ($10,482 + $1757) = $35,917

2. Net Debt #INTC for the financial year ending December 2020 is:

Net debt = short-term debt + long-term debt − cash and cash equivalents = $2504 + $33,897 + ($1400) − ($5865 + $2292 + $15,738) = $12,506

3. Net Debt/EBITDA #INTC for the financial year ending December 2022 is equal to:

Net debt/EBITDA = $12,506 / $35,917 = 0.35

Intel has a reasonable net debt to earnings ratio. Net Debt/Ebitda Intel Corp. at 0.35 lower than its peers in the Semiconductor industry group (average 1.03).

4. To compare Net Debt/EBITDA of peer companies from the Semiconductors sector, similar in capitalization:

- Broadcom #AVGO - 3.03;

- Nvidia #NVDA - 0.67.

Open an account and start trading CFDs on shares of successful companies

Where to find ready-made data

For foreign issuers, there is no need to independently calculate the ebitda indicator. There are several sites where you can find the multiplier value by year.

For example, on the website morningstar.com, just enter the ticker symbol of the company you are interested in in the search bar, then go to the Operating Performance section.

Another example of a site is finbox.io. Here you can compare the Ebitda multiplier values for several companies over a certain period of time.

Why does a private investor need EBITDA?

In simple words, ebitda allows you to evaluate the following parameters:

- the efficiency of the enterprise in comparison with competitors;

- the degree of tax burden within this industry;

- what share of expenses is made up of non-cash costs (depreciation);

- degree of depreciation of fixed assets;

- operating profit of the business.

Next, we will analyze investment indicators calculated on the basis of EBITDA, which will be useful to the investor for a more detailed analysis.

Interpretation

1. Low Net Debt/EBITDA is traditionally considered preferable: the company does not have excess debt and is assumed to be able to repay its debt obligations. 2. Net Debt/EBITDA is high - the company is heavily burdened with debt. Such conditions will lower its credit rating, so investors will need higher yields to compensate for the increased risk of default. 3. If Net Debt/EBITDA exceeds 3.5x, you should be careful and conduct a thorough analysis. Net Debt/EBITDA above 5x is considered a red flag that raises concerns among rating agencies and investors. Too much debt can lead to difficulties in meeting obligations. For these companies, attracting additional loans will become a serious problem. 4. The ratio is modified significantly by industry since each varies greatly in terms of average capital requirements. This means that the coefficient can be correctly used for comparison with “colleagues” within the same industry/sector. If you observe a debt level above the industry average, you should be puzzled. 5. If Net Debt/EBITDA is negative, the business can (not necessarily) be considered unstable - there is no debt and there is no prospect of expansion or projected development of production capacity through external financing. 6. To ensure the company's ability to repay its debt obligations, loan agreements typically specify covenants that dictate the range within which Net Debt/EBITDA should fall.

Investment performance based on EBITDA

Let's look at several coefficients based on the multiplier we are considering.

- EBITDA margin (EBITDA margin). The formula for this indicator is:

\[ EBITDA \ margin=EBITDA/VP, where \]

\(VP \) – gross profit (revenue minus the cost of goods). The indicator is expressed as a percentage and shows the profitability received from the main activity.

- EV/EBITDA ratio, where

EV – enterprise value taking into account debt;

\[ EV = Cap + SC, where: \]

\( Cap \) – market capitalization;

\( KZ \) – accounts payable.

Market capitalization is the value of common and preferred shares. Accounts payable include long-term and short-term loans, as well as current debts to suppliers and other counterparties.

This coefficient is needed to calculate the payback period of investments. For example, a value of 5 indicates that the investment will pay off in 5 periods (periods are usually expressed in years). For comparison, companies in the same industry should be considered.

- The Debt/EBITDA ratio shows the degree of dependence of the company on creditors. Debt is the same short-term and long-term loans. The standard for this indicator is less than 4. If this value is exceeded, the company is considered to be in debt.

History of the indicator in economics

EBITDA was originally used to measure a company's ability to service its obligations. To do this, the values of this indicator were compared for individual companies from the same industry, on the basis of which the amount of interest payments that would be used to pay off the debt was calculated. From this point of view, the company was seen as an asset that could be sold at an attractive price.

At the same time, we can note some nuances of calculating this indicator using this method. It was necessary to summarize the items that could be used to pay off the debt. At the same time, the cost of paying taxes could be taken as an additional basis for calculating debts, provided that all the company’s net profit was directed to the same purpose, and the business turned into an unprofitable one. As a result, the company ceased operations. But the creditors benefited. This indicator was readily used in the 80s of the last century.

EBITDA modifications

Modifications are applied depending on the industry and the specifics of the enterprise’s activities.

- EBIT is the same as EBITDA, but excluding depreciation. In simple terms, this is earnings before taxes and interest. The multiplier is used to compare issuers from different industries, because when calculating it, the capital intensity factor is excluded. EBIT can be calculated in three ways:

- \[ EBIT = EBITDA – Depreciation; \]

- \[ EBIT = PE + R&D + Percentage, where: \]

\( PE \) – net profit; \( NPR \) – income tax; \( Percent \) – percentage;

- \[ EBIT = V – OR, where: \]

\( V \) – sales volume; \( OR \) – operating expenses;

- EBITA. This indicator takes into account depreciation, but only for intangible assets. Used in knowledge-intensive industries;

- EBITDAR is EBITDA plus rental costs. Used by companies leasing large areas;

- EBITDAX. This multiplier is used only in mining companies. It excludes exploration costs from EBITDA.

Summary

Net Debt/EBITDA is great for benchmarking within a single segment. But we must take into account that any company is on its own path in the life cycle of its industry, which will affect the cost of capital, adjusted for many external factors: expected future growth, competitiveness, pricing policy in the market and much more.

⇐ How to make money on stocks. Lesson 27. EV/EBITDA How to make money on stocks: articles from a financial analyst ⇒

Comparative characteristics of EBITDA, EBIT, operating profit, adjusted EBITDA

Let's summarize all the indicators in the table.

| Name of the animator | Parameters involved in the calculation | |||||

| Net profit | Tax | Interest | Depreciation | Rental costs | Other indicators | |

| EBITDA | + | + | + | + | — | — |

| EBIT | + | + | + | — | — | — |

| Operating profit | + | + | + | + | + | + |

| Adjusted EBITDA | + | + | + | + | — | + |

Operating profit is the gross profit of an enterprise excluding non-operating income and expenses.

In simple words, this is sales revenue minus the cost of goods and expenses related to core activities. This figure does not take into account investment income and expenses. Adjusted EBITDA is a multiple that excludes certain items as appropriate. For example, assets were revalued. This value can be added to EBITDA with a plus sign in order to eliminate distortions. In other words, adjusted Ebitda removes the results of non-recurring transactions that can affect the value of the multiplier and make it incomparable with the results of competitors.

Pros and cons of EBITDA

Among the advantages of the multiplier, the following should be noted:

- the indicator does not take into account subjective factors (tax benefits, depreciation method, capital structure, interest rates on loans);

- suitable for assessing return on investment;

- allows you to assess the degree of debt of the enterprise.

Flaws:

- does not take into account capital costs;

- does not take into account changes in working capital (for example, an increase in accounts receivable, which may be overdue);

- in some cases, an overestimated value of the indicator may be an obstacle to obtaining a loan.

EBITDA Case Study

Let's compare two companies of the same sector with the same amount of net profit and calculate EBITDA based on the initial data:

| Indicator (in thousand rubles) | Company A | Company B |

| Net profit | 9000 | 9000 |

| Tax | 2250 | 2250 |

| Interest | 500 | 350 |

| Depreciation | 200 | 600 |

| EBITDA | 11950 | 12200 |

What conclusions should an investor draw?

- Company A has smaller assets based on depreciation. This means that you need to study the balance sheet for the amount of fixed assets. If the company is large, an explanation is usually attached to the balance sheet, which contains detailed information about the structure of assets and accrued depreciation.

- Company A pays higher interest. This may indicate a low credit rating (the bank has set a high interest rate).

Thus, if we analyze only the Ebitda value, Company B shows more attractive results. The next step is to calculate return on sales (ROS) and return on assets (ROA). In addition, it is necessary to calculate EBITDA on the balance sheet for the previous period in order to analyze changes in the indicator over time.