According to a recent report, the total value of staking rewards for PoS coins (that is, those operating on the basis of the Proof-of-Stake consensus algorithm) will reach $18.9 billion by the end of 2022. Compared to last year, this figure will almost double.

This is largely due to the successful preparations for the launch of Ethereum 2.0, an update to Vitalik Buterin’s blockchain project, which will transfer the network to PoS. But it is also important that today staking is one of the most convenient and effective ways to mine new coins on the crypto market. In light of this, we have compiled for you the most up-to-date selection of the best cryptocurrencies to stake in 2022.

For 2022, the most reliable and profitable platform for staking is the largest crypto exchange Binance. We have prepared a detailed guide on starting staking on this site: How to receive passive income from storing cryptocurrency on the Binance exchange?

Price performance

This is the price performance of Universal Money Instrument (UMI). It shows the percentage gains and losses for each time period.

| October 2022 | +11,31% |

| September 2022 | -62,29% |

| August 2022 | -66,84% |

| July 2022 | -65,71% |

| June 2022 | -54,15% |

| May 2022 | -4,49% |

| April 2022 | +36,07% |

| March 2022 | +11,82% |

| February 2022 | +30,61% |

| January 2022 | +14,55% |

| December 2022 | +0,06% |

| November 2022 | +0,01% |

| October 2022 | +1,96% |

| September 2022 | — |

| August 2022 | — |

| July 2022 | — |

| June 2022 | — |

| May 2022 | — |

| April 2022 | — |

| March 2022 | — |

| February 2022 | — |

| January 2022 | — |

| December 2022 | — |

| November 2022 | — |

| October 2022 | — |

| September 2022 | — |

| August 2022 | — |

| July 2022 | — |

| June 2022 | — |

| May 2022 | — |

Show more

UMI cryptocurrency rate in 2021

UMI course schedule in 2022:

The Yumi exchange rate has generally fallen over the past six months, despite local maximums:

| Year | Month | Cost in US dollars |

| 2020 | October | 0 |

| 2020 | December | 1,01 |

| 2021 | January | 9,18 |

| 2021 | May | 2,55 |

| 2021 | July | 0,54 |

| 2021 | August | 2,16 |

| 2021 | September | 0,0064 |

The reasons for this decline may vary. Some experts accuse the creators of the currency (the Roy-Club company) of deliberate speculation, pointing to too high staff salaries and unproductive expenses such as a party in Dubai, which took place on the anniversary of the currency’s release. The sharp drop in rate occurred after the creator immediately sold coins worth 211 bitcoins.

Important! Cryptocurrency is a very volatile asset and sharp declines occur even among coins that have proven themselves in the market.

UMI cryptocurrency forecast for 2022

Analysts give diametrically opposed forecasts for this currency, but most of them are clearly pessimistic. UMI is currently traded on only two exchanges – Sigen and BTC Alpha. These are small second-tier exchanges. It is not represented on reputable exchanges such as Binance. Some experts believe that this asset is on its last legs.

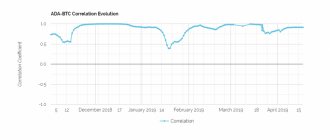

Other experts are not so pessimistic. The table shows the forecast for the exchange rate pegged to Bitcoin:

| UMI growth from average Bitcoin growth per year | UMI price in dollars in 2022 |

| 1% | 0,05623 |

| 2% | 0,05765 |

| 5% | 0,06193 |

| 10% | 0,069054 |

| 20% | 0,0833 |

| 50% | 0,0,12604 |

| 100% | 0,19727 |

This forecast was made using a simple correlation method. But there is very little chance that it will come true. Although everything happens in the world of cryptocurrencies. When the first weirdos bought bitcoins, no one could have imagined that in 2022 the coin would cost $80,000.

The price of a currency is always formed taking into account two factors:

These factors are interrelated. A correctly operating company inspires trust among users, and attracting a large number of users stimulates the company. When false information appeared online that the creator of Ethereum, Vitaly Buterin, had an accident, the rate of this currency fell sharply, and after his minute meeting with Putin at the St. Petersburg Economic Forum, it jumped up. So, although most predictions regarding UMI can be summed up in one phrase: “The patient is more dead than alive,” the last word has not yet been said.

When deciding whether to buy this asset, keep in mind that you could lose your money. But if the same peak as in the graph is repeated, the benefit is obvious.

Source

Have you heard that you can make money on the UMI cryptocurrency, but don’t know what it is or how to start? I'm telling you.

The UMI crypto coin was launched in the summer of 2022. The current yield at the time of writing (March 2022) is just over 30%.

The coin uses PoA (Proof-of-Authority) technology. Transfers are instant and without commission, unlike slow Bitcoin)).

In order to earn money, you need to keep a coin in a special wallet in the “Roy Club” project (more about it later).

Prospects for staking

Mining is gradually losing relevance - this method of extracting new coins is not so effective and requires serious investments and technical knowledge. And although it is still profitable, new blockchain projects based on PoW algorithms are practically no longer launched.

It is cryptocurrencies with staking (mainly based on PoS and its modifications) that are becoming the standard for launching new blockchain projects. For this reason, according to the forecasts of the Ethereum infrastructure company Staked, in 2022, holders of PoS cryptocurrencies will receive rewards worth $18.9 billion, which is almost double compared to last year - $10 billion in 2020.

Among the key reasons for the growth of this sector is the upcoming launch of the updated version of Ethereum 2.0. But outside of Ethereum, there is another driver of staking growth: cryptocurrency exchanges. Today, all top trading platforms offer solutions for staking or connecting staking pools. Thus, even an ordinary cryptocurrency user has access to convenient staking tools.

For 2022, the most reliable and profitable platform for staking is the largest crypto exchange Binance. We have prepared a detailed guide: How to earn passive income from storing cryptocurrency on the Binance exchange?

We are confident that in the coming years the popularity of staking as a passive way to mine new cryptocurrencies will increase significantly.

Step by step. How to buy and what to do to make money on UMI

You need to register on the website https://sigen.pro

Next, click on wallet

Now you need to create a UMI wallet inside the sigen.pro website. You can create 5 of them. To create a wallet click here

You will receive an address like umi.

Now copy and send me your umi wallet number

Buy from 20 UMI on a P2P exchange.

Enter P2P trading. Set up a filter (for example, Russia, bank transfer, ruble) and click buy on the appropriate application. Click on “Create an offer for. " No need. By clicking “Buy”, strictly follow all instructions!

Now you need to register in the Roy Club community.

This is where you need to transfer coins for staking and earnings.

To do this, follow this link https://roy.club/club?ref=UMI103141 or click on the image below.

If you want to be in my structure, then you need to clear your cookies and cache if you have previously followed other links to the swarm club website. Or Open the link in another browser that you rarely use, then you can be sure that you will be in my structure.

On the website, click Registration at the top. Scroll down a little and click “Already have a wallet”

And now you need to link your Yumi wallet to the RoyClub website.

To do this, you need to enter your UMI wallet and a special signature, which must be done on the Sigen.pro website

I think it’s clear with the wallet. And to sign on the Saigen website, under your wallet, click “Signature”

And insert the phrase from the roy-club website there, generate a signature

You paste the resulting phrase on the swarm club website and complete the registration.

When a window like this pops up that transfers you to another leader, then click not to change the referrer or just close the window.

To enter the site you will need to enter your wallet. Without any passwords. Roy Club is an absolutely transparent system.

By the way, if you want, you can log into my account, to do this, enter my wallet umi1z3ke2c99yxrwqx72k65hf4m9cxzpk5kkfz553s3nvelpxs87ajks777l5j

Or you can enter my leader's wallet umi1ycah5l425l0p0zkvn3e7ls9culqky4za8a3gxpfwztkp4dddsaksrjvcqd

Moreover, everything is anonymous. No names or anything. Therefore, everyone can participate in the project, incl. government employees, etc.

Make sure you are in my structure. To do this, click on “Additional data”

It must be so. Make sure it says this (UMI103141) before transferring money.

6. Transfer coins to the swarm club for staking and earning money.

To do this, copy the address of your swarm wallet from the swarm club website.

On the Saigen website, insert the address of the swarm wallet, the amount and make the transfer.

After the transfer, write to me again and I will throw you more UMI coins.

How to participate in staking?

At first glance, classic staking seems like a simple matter: you just need to freeze the coins in your wallet and you can count on a reward. However, in practice, in most coins, things are a little more complicated.

For example, to become a validator in a PoS blockchain, you often need to have a minimum stake. For validators of the Tezos blockchain network, the entry threshold is 10,000 XTZ, or about $69,200. And for validators of Ethereum 2.0 - 32 ETH, or more than $138,400 at the exchange rate on the day the article was published.

Let us remind you: to become a validator, coins must be frozen in your wallet for a certain period of time. In this case, each network sets the freezing period individually. In some cases, this is a couple of days or weeks, but in the case of Ethereum 2.0, we can talk about several years (before the full transition to the PoS consensus algorithm). Also, validators of PoS networks need to synchronize their wallet with the blockchain and ensure that their node is constantly connected to the network. Otherwise, the validator may receive a penalty.

Therefore, many PoS cryptocurrency holders prefer to delegate their coins. Often, the role of large validators is played by crypto exchanges that launch their own nodes in PoS blockchains. Thus, PoS staking services are provided by almost all the top exchanges on the market - Binance, Coinbase, Kraken, Hotbit, KuCoin, Huobi and Bithumb among many others. To participate in staking, users of these trading platforms only need to delegate their cryptocurrencies to them.

There are also many staking pools and SaaS (Staking as a Service) platforms on the market. Participants in these services pool their coins in order to increase the likelihood of being chosen as a validator and receiving a reward. They all work on a similar principle - to participate in staking, you need to register on the service’s website or platform and delegate your PoS coins. In return, you will receive interest in proportion to the size of your stake.

The so-called cold staking is also available on the crypto market. This type of staking is supported by hardware wallets like Ledger or Trezor. To participate in cold staking, you must permanently store your PoS coins in a hardware wallet. As soon as the holder of the coins transfers them to another address, cold staking stops.

But it’s not just cold crypto wallets that offer staking options. For example, the Ethereum-wallet Trust Wallet and the multi-currency crypto-wallet Atomic Wallet are popular solutions among hot cryptocurrency storage facilities that support staking. Read more about the different types of crypto wallets in our material.

Addendum May 27, 2021

I sold most of UMI. Withdrew another 96 thousand rubles. arrived. Why did I sell it and what is my forecast for UMI? Watch in my video.

Also pay attention to other profitable projects.

- EtherConnect. Project from BitConnect. Possibly x1000.

— Symbios Club. up to 22% on liabilities or 33% when purchasing equipment, cars

You can also add to my telegram chat. There you can discuss, ask questions and keep up to date with the news. Or write to VK.

Source

How to create a wallet

You can create a wallet on the official website of the project. No confidential data will be required from the user. You just need to set a “mnemonic” phrase, on the basis of which the MD5 code of the future wallet will be created.

To register, you can also use official mobile applications from the creators of UNI (available for Android, iOS, HarmonyOS from Huawei).

WPLeaks - safe earnings on the Internet! Information leak!

UMI cryptocurrency - is it worth investing your money? Reviews about umi.top

UMI is a fairly new project that positions itself primarily as a universal open source tool. In other words, cryptocurrency. Here we are offered to invest our finances and earn good money from it. Many users know that cryptocurrency is quite a profitable business. However, it is important to understand that there are also very large risks here. But here we are promised that we can safely receive a stable and guaranteed income without risks! Just forgive me how, if we are talking about a coin that is new and no one knows it yet. In fact, all such projects are ordinary garbage. Yes, you will invest money here, but at the end of the day, these tokens will not be worth anything at all. And in fact, you will simply buy candy wrappers for a lot of money. Taking into account the fact that at this stage now, in principle, anyone can create their own cryptocurrency and attract investors to cooperation. Let's look at the project in more detail.

Website: umi.top

Legend about the project

UMI cryptocurrency is instant and free blockchain transfers. Innovative staking allows you to accumulate UMI coins simply by holding them in your wallet. Moreover, this cryptocurrency is going to compete with Bitcoin. But swindlers very often wishful thinking. Therefore, this legend certainly does not inspire any confidence. You can write whatever you want on the site. But where is at least one real confirmation that this is so? Speaking of the site. The site has a lot of different and abstruse words about innovation and blockchain technology. All this is done on purpose. After all, many users do not understand such terms. This is what scammers rely on. There is also a large pile of empty promises and beautiful words on the site. However, as practice shows, promises always remain communications in the practice of swindlers. They are trying to convince us that the coin will be very profitable and that our funds are reliably insured. But there are no significant guarantees for this. Let's start with the fact that cryptocurrency must develop in any case. But for this to be so, it must be supported by something. But it is not known what the UMI cryptocurrency is backed by. In fact, there is such a coin. But what's the point if it's not traded anywhere? This means that in fact its cost will be zero.

Project overview

Why shouldn't you invest your money in UMI Cryptocurrency? In fact, this coin is ordinary garbage. Here we are promised a profit increase of 40 percent. But in what way? This profit will simply be tritely depicted. Simply put, admins can draw you anything they want. After all, in fact, they pay for ordinary air. Users believe in the admin’s promises and buy coins for real money. In addition, here we are promised a very generous affiliate program. That is, you will still be used as free labor. Which will simply invite new trusting users and these people will also invest their finances. After which the project will simply disappear or declare itself bankrupt. And since he is anonymous, it will be almost impossible to get your money back. Here are all the facts of fraud in person. For example, contact information. These are just three email boxes where no one will answer you. Quite solid for a project that was going to compete with Bitcoin.

Reviews

The project has just appeared online. But this did not stop him from gaining a large number of negative reviews. Users accuse the project of fraudulent activities and the fact that the coin is worth nothing on the exchange. There are already first victims who believed and invested their money.

Conclusion

UMI cryptocurrency is not even close to Bitcoin. It is not traded on the stock exchange and has no weight. Simply put, you are investing money in air that will not bring you profit. The profit of 40 percent is deliberately created by scammers. To attract more naive users. Be extremely careful and avoid such offers on the Internet. Always check not only reviews about the project, but also the availability of complete legal information.

Source

Best Cryptocurrencies for Staking

There are more than 100 cryptocurrencies on the crypto market, the holders of which can participate in staking. We have selected for you the most popular projects whose coins bring the greatest rewards during staking.

Ethereum 2.0

Despite the fact that the full transition of Ethereum to the PoS algorithm may take from one and a half to two years, ETH has already become one of the most popular coins for staking.

Ethereum 2.0 phase zero was launched on December 1, 2022. To do this, 16,384 validators had to deposit a minimum stake of 32 ETH and start working on the Beacon Chain, a new blockchain that exists in parallel with Ethereum 1.0. It is thanks to the launch of Beacon Chain that ETH staking is already available in Ethereum 2.0.

Ethereum 2.0 staking is now available on Binance.

As of May 10, 133,327 validators are responsible for maintaining Ethereum 2.0, with a total stake of 4,421,858 ETH:

? The # of NEW VALIDATORS has significantly accelerated since May 4th https://t.co/AdIA9sUViV

137,917 with 4,421,858 ETH deposited. (17B @ 3,882 USD, 3.8% of ETH supply)

Active Validators: 133,327 Queue: 4,590 Daily new validators (7d avg): ~1456 [email protected] #Ethereum

— The # of ETH2 Validators are: (@eth2validators) May 9, 2021

“The number of new validators has increased significantly since May 4th. Currently, 137,917 validators have deposited 4,421,858 ETH (17 billion at $3,882, 3.8% of total ETH supply). Active validators: 133,327. Queue: 4,590. Number of new validators per day: ~1456.”

ETH is the second largest cryptocurrency by capitalization, which has already updated its price highs several times this year. Over the past 12 months, the price of ETH has increased 13 times, and since the beginning of the year - 5.5 times, from $746 in January to $4,279 today. And it is likely that ETH will continue its upward bullish trend.

Now ETH staking brings up to 7.15% of new coins per year. But as the number of frozen ETH in staking increases, this figure will decrease - at the start, validators received 21.6% of new coins per year. However, it must be taken into account that if ETH continues its bullish trend, then the real benefit from staking will be much higher.

To become a validator in Ethereum 2.0, you need to freeze a minimum of 32 ETH - more than $138,400 at the time of publication. Therefore, the easiest way to stake these coins is through exchanges, such as Binance. Also on Coinbase, since mid-April, a limited number of users began staking ETH with a yield of up to 6% of new coins per year.

Moreover, due to the fact that ETH withdrawal will be available only after a complete transition to PoS, exchanges issue users secondary tokens tied to ETH. For example, Binance issues tokens with the ticker BETH. But Kraken does not offer such an option at all: users will be able to withdraw coins from ETH 2.0 after a complete network update.

UMI

UMI is the leader in our ranking in terms of staking rewards. This universal payment blockchain platform allows you to make instant transfers around the world without commissions.

Already, the developers of this blockchain network have managed to achieve a speed of 4,369 transactions per second, and in the test network - up to 65,535. At the same time, UMI will potentially be able to process up to 1 million transactions per second. Also technically, UMI is a powerful blockchain platform capable of creating and executing smart contracts of any complexity.

The UMI cryptocurrency was launched in June 2022. Since then, the number of addresses in the network has exceeded 450,000. In total, 148 million UMI have been issued during this time, 130 million of which (87%) are staking.

Cryptocurrency staking is available to any user; the UMI team has made this process extremely simple and understandable. To stake a coin, you don’t need to launch nodes, synchronize wallets with the blockchain, or deal with technical difficulties. You just need to create a UMI wallet and join one of the staking pools: ROY Club or ISP Club. Participation in the ROY Club allows you to create up to 32% of new coins per month , and in the future - up to 40%. As for ISP Club, this pool brings in 24% of new UMIs per month. Thus, staking UMI in pools brings the highest percentage of new coins on the crypto market.

The UMI blockchain is built on a modernized Proof-of-Authority (PoA) algorithm, and a special smart contract is responsible for staking. It is the smart contract that ensures that all staking conditions are met, it allows you to join the staking pool and credits new coins directly to the wallet.

Thanks to the smart contract, UMI staking has unique qualities:

- There is no need to freeze UMI; they can be withdrawn and sold at any time.

- Interest is accrued 24/7 , not once a day or only once a month.

- UMI remains in the user's wallet. They do not need to be transferred to the validator, they do not leave the wallet, and new coins appear directly in it. This way, only the user has access to his UMI, even while staking;

- The UMI rate is supported by liquidity in Bitcoin. The UMI team placed 365 BTC ($20.7 million) in the order book to buy the UMI cryptocurrency at a rate of $0.95. This “wall” protects the coin’s rate from decline, preventing it from falling below the specified value even during periods of large or mass sales.

Moreover, UMI recently entered the DeFi market. So, on May 6, the ISP Club staking pool team tokenized the coin and added it to the most popular decentralized crypto exchange, Uniswap.

However, the team does not stop there - it has big plans for the future: for example, adding support for offline transactions, launching a line of various decentralized applications (dApps) and decentralized exchanges (DEX).

Cardano

Cardano is a decentralized ecosystem that is often predicted to replace Ethereum.

The project has been under development since 2015 under the leadership of mathematician and co-founder of Ethereum Charles Hoskinson. Until 2022, the project team worked on the launch of the Cardano mainnet and its native ADA coin. And in June last year, the long-awaited launch of the Shelley update took place, which activated the Delegated Proof-of-Stake (dPoS) consensus algorithm and the possibility of ADA staking at 4-5% per annum. The activation of this update became one of the main drivers of growth in the value of ADA last year - the coin has grown by 430% in 2022.

In March of this year, the project activated the next stage of network development - the Goguen update. After its final implementation, users will be able to create their own tokens, launch smart contracts, decentralized applications (dApps) and DeFi protocols. In total, Cardano will go through five stages of development, which you can read about in our recent review of the project.

Successful activation of updates had a positive impact on the price of ADA. Over the past 12 months, the price of the coin has increased 27 times, and since the beginning of 2022 - 7.5 times. Currently, ADA ranks 6th in terms of capitalization in the CoinMarketCap rating, which is $55.4 billion. Most experts are confident that ADA will remain bullish in the medium term. And some analysts even believe that the coin will increase in price by 10–20 times by the end of next year.

ADA has excellent prospects for continued growth. There are two more major updates ahead that will make Cardano a completely decentralized environment, as it will completely transfer the management of the project into the hands of the community. Moreover, these updates could make Cardano a more advanced blockchain than Ethereum from a technical perspective.

According to AdaStat, there are already over 515,813 participants in ADA staking, who delegate 23 billion coins. Thus, ADA is the leader among other projects in terms of the volume of coins in staking, because about 73% of all issued coins are locked in it.

To start staking ADA, you need to join an existing staking pool or start your own (however, this option is only recommended for advanced users). There are currently 2,471 pools operating in the network and their number is constantly increasing. At the same time, you can join the pool through the project’s native wallets - Daedalus and Yoroi. Every 20 days, Cardano automatically issues ADA staking rewards. At the same time, coins are not frozen during staking.

Today, ADA staking brings in about 7.24% of new coins per year, but in fact, users usually “earn” much more due to the significant increase in the rate. But as new staking pools are connected, this figure will decrease.

Polkadot

Polkadot (DOT) is a decentralized blockchain protocol that allows you to launch and connect blockchains into a single network. Thus, Polkadot is a unique decentralized environment where different blockchain networks can interact with each other. According to the team's plans, Polkadot will become the basis for the future version of the decentralized Internet, Web 3.0.

The project’s native cryptocurrency, DOT, entered the crypto market in August 2022. Since then, its value has increased from $2.72 to $40.15 - almost 15 times. At the same time, the coin’s capitalization already exceeds $38.3 billion, which puts it in 9th place in the CoinMarketCap ranking.

The minimum stake for a validator is 10,000 DOT, or $401,500 on the day the article was published. Therefore, mostly large pools or crypto exchanges become Polkadot validators. To start staking, you need to join one of the providers of this type of service. For example, DOT staking is available on the Binance crypto exchange.

As for the amount of the award, it varies depending on the duration of the DOT freeze. Staking will yield 13.15% of new coins per year if the coins are frozen for 30 days. But this figure can increase to 22% if the freezing period is 90 days.

Polkadot also has an experimental network called Kusama, which has actually become an independent project. Its KSM token ranks 47th in terms of capitalization, and its staking yield is about 13.8% of new coins per year.

Binance Coin

Binance Coin (BNB) is the native coin of the largest crypto exchange Binance, as well as the Binance Chain (BC) and Binance Smart Chain (BSC) blockchain networks.

Binance Chain is the blockchain of the decentralized crypto exchange Binance DEX, whose users can directly trade cryptocurrencies with each other. And Binance Smart Chain is a blockchain network for dApps and smart contracts developers. BNB is the native coin of both networks. In Binance Chain, the coin is used to pay fees on Binance DEX, in BSC it is used to deploy smart contracts, cause, staking and token exchange.

Since the launch of trading, BNB has been able to soar to third place in terms of capitalization in the CoinMarketCap ranking. Now the coin’s capitalization is $101.5 billion, and its value has risen to a record $659 per coin. Among the key reasons for the BNB rally is the transition of users of DeFi projects from Ethereum to BSC.

Binance Smart Chain runs on a unique hybrid Proof-of-Staked Authority (PoSA) algorithm using Proof-of-Stake and Proof-of-Authority. Its peculiarity is that validators do not receive a reward for freezing BNB, but earn only through commissions. To avoid inflation, Binance quarterly “burns”—that is, permanently removes from circulation—some BNB coins.

To become a BSC validator, you need to freeze a minimum of 10,000 BNB - $659,000. Running a validator node will generate 23.16% of new BNB per year. For delegates, this figure is lower - 18.39% of coins per year. However, there is no minimum entry threshold for delegates to participate in staking. Moreover, the lock-in period for BNB during staking is only 7 days, and rewards are paid out daily.

The most convenient way to stake BNB is through the Binance crypto exchange. To do this, you need to create an account on the trading platform, buy BNB and delegate your coins to validators; this is done in a few clicks. Read more about staking or Binance here.

Solana

Solana is a platform for running decentralized applications (dApps) and smart contracts.

The project was founded in 2022. At the same time, the key feature of Solana is that this blockchain network works on both PoS and its own Proof-of-History (PoH) consensus algorithm. The essence of this algorithm comes down to the fact that different network nodes work independently of each other, but at a given time they all must synchronize with each other. As a result, transaction processing speed in Solana can reach 191,000 operations per second. And if you believe the developers, this is far from the limit for the network.

Trading in the project’s internal cryptocurrency, SOL, started in April 2020, and within a year the value of the coin increased 60 times - from $0.77 to $46.9. SOL currently ranks 17th in terms of capitalization in the CoinMarketCap ranking.

SOL staking is available to any network user through a native or third-party crypto wallet. For example, SOL staking is supported by popular hardware crypto wallets Ledger Nano. At the same time, to participate in staking, you must create a special staking account, which differs from the wallet address. Alternatively, you can submit your SOL to one of 607 validators, each of which offers a different reward amount.

The current average reward for staking SOL is 10.63% of new coins per year. However, the indicator may be higher when staking coins through exchanges. For example, Binance offers so-called fixed SOL staking, in which the reward amount depends on the freeze period and the maximum stake limit.

Avalanche

Avalanche (AVAX) is a decentralized platform for launching and exchanging tokens, smart contracts, dApps and DeFi applications. The main goal of the developers is to provide the crypto market with a space where users can seamlessly exchange tokens and coins from different blockchains.

The Avalanche mainnet launched in September 2022. The project is being developed by AVA Labds, one of the founders of which was the creator of Bitcoin NG, Emin Gun Sirer. Along with the launch of the Avalanche mainnet, the native AVAX coin was also launched, which is used as the base unit of account for paying for activities on the network (such as launching dApps or deploying smart contracts). Avalanche validator rewards are also paid in AVAX.

Since the start of trading, the price of AVAX has increased 8 times - from $5 to $40.90. And at its peak in February, the price of the coin reached $53. At the same time, Avalanche also integrates a burning mechanism that removes AVAX spent on paying commissions for transactions on the network from circulation.

It is worth noting that the entry threshold for validators is quite high - from 2,000 AVAX, which at the current rate is about $81,800. For delegates there is also a minimum stake size - 25 AVAX ($1,022). At the same time, during staking, coins are frozen for a minimum of 2 weeks, and a maximum of a year. The network charges a 2% commission for delegation.

AVAX can be staked through the native web wallet Avalanche Wallet. Currently, network validators receive 5.38% of new coins per year, and delegates receive 5.1%. But on exchanges, staking AVAX can be even more profitable. For example, staking 30 AVAX on Binance for 15 days will yield 32.79% new coins per year.

Algorand

Algorand (ALGO) is a decentralized payment platform launched in June 2022. Behind the development of this blockchain platform is the famous cryptographer, Turing Award winner and professor at the Massachusetts Institute of Technology (MIT) Silvio Micali.

The Algorand network is designed to work with the financial sector and banking institutions. Therefore, it was based on technologies that ensure high speed of transaction processing, security of all network participants and decentralization. In this way, Micali’s team tried to solve the so-called blockchain scalability trilemma, in which developers of modern blockchains are forced to make compromises and sacrifice speed, security or decentralization to better optimize the network. Among the key competitive advantages of Algorand is high speed, up to 1,000 transactions per second.

Algorand uses a modified version of PoS - the Pure Proof-of-Stake (PPoS) consensus algorithm. This means that the network has validators that run full nodes and verify transactions, but there are no delegates - any user who holds at least 1 ALGO in the native Algorand Wallet or in one of the wallets that supports this coin can participate in staking:

At the start of trading, the ALGO coin cost $2.15, but now its price has dropped to $1.40. Staking ALGO brings from 5% to 10% of new coins per year depending on the platform used for staking - a native wallet, or a third-party wallet, or a crypto exchange.

ALGO coin is available on all major exchanges, including Binance, Coinbase, Kraken, OKEx, Huobi and BitMEX among others. Also, ALGO staking does not require freezing coins in the wallet - they can be withdrawn from staking and sold at any time.

Terra

Terra (LUNA) is a decentralized payment protocol with algorithmic stablecoins pegged to fiat currencies. The main network of the project will be launched in 2022. The goal of Terra developers is to offer the crypto market a unique ecosystem for the development of decentralized finance (DeFi).

This ecosystem features two coins: Terra stablecoins based on fiat currencies and LUNA, a coin that acts as a stabilizer for Terra. Thus, the main goal of LUNA is to protect the ecosystem from the high volatility of the Terra price.

How it works? The algorithm built into the blockchain is responsible for controlling the supply and demand of the Terra coin, the value of which must be kept at 1 SDR (Special Drawing Rights). SDR is an international reserve asset created by the IMF in 1969, the value of which is determined by the exchange rate of the US dollar (41.73%), euro (30.93%), Chinese yuan (10.92%), Japanese yen (8.33%) and British pound sterling (8.09%). ).

If the price of Terra falls below the target rate of 1 SDR, then the protocol automatically buys 1 Terra coin and sells LUNA for an amount of 1 SDR. Conversely, if the price of Terra rises above 1 SDR, then the protocol sells 1 Terra coin, buying back LUNA worth 1 SDR.

The Terra ecosystem currently offers stablecoins pegged to the US dollar (Terra USD), the South Korean won (Terra KRT), the Mongolian tugrik (Terra MNT) and the IMF basket of currencies (Terra SDR).

As for staking, the LUNA coin participates in it. Until the beginning of this year, the price of LUNA remained virtually unchanged and was in the range from $0.15 to $0.5. But since the beginning of 2022, the price has increased 26 times - to $17.39. This LUNA rally is caused by several factors:

- increasing the emission of the dollar stablecoin Terra USD,

- launch of TerraBridge technology, which allows transactions between the Terra, Ethereum and Binance Smart Chain blockchains,

- as well as investments in the project amounting to $25 million from the famous investor and head of Galaxy Digital Mike Novogratz.

Currently, LUNA staking brings in about 10.65% of new coins per year. To stake, just download the Terra Station application or use its web version, which offers the option of delegating coins between several validators. There is no minimum steak size.

LUNA staking is also supported by trading platforms such as Binance, Bithumb, Coinone, Huobi Global and BKEX.

UMI cryptocurrency. Reviews

The UMI cryptocurrency (Universal Monetary Instrument, Russian: Universal Money Instrument) is one of the new completely useless cryptocurrencies, the creators and advertisers of which offer up to 40% profit on staking monthly.

Over the past couple of months, the popularity of the UMI cryptocurrency has been growing and over 10 thousand people a month are already looking for reviews about it (only in Yandex). Therefore, our independent review of the UMI cryptocurrency will be useful to many people.

UMI cryptocurrency exchange rate to Bitcoin

Actually, this is where I can end my review of the UMI cryptocurrency, since I have outlined the main points. But let's go back a little to history. A couple of years ago, the first MLM cryptocurrency PRIZM began to grow. The ROY club grew and developed along with her. Then I managed to attract many networkers and even I bought PRIZM for about $100. There was a high probability that the project would be stabilized and it would be possible to earn money on PRIZM for at least a year.

And so it happened that the Prism course began to collapse quite quickly and did so quite sharply. The organizers of the Roy Club actively promoted it. Then I managed to make good money. So there are the same chances of earning money on UMI.

To further develop the community, a new cryptocurrency UMI was released. If UMI growth is rapid, then investors will make good money. Actually, this happens in any hype project.

Main technical features of UMI

At the launch of this cryptocurrency network, 18 million tokens were created, distributed among the creators, as well as the initial technical support team. All subsequent coins are created through staking. That is, their number is growing exponentially, which is why in the future there will be a systematic decrease in the cost of each token.

Each block holds 65,536 transactions. A new block is generated automatically when a sufficient number of transfers have been accumulated (approximately once per second). The wallet format is Bech32 (with the UMI prefix). The hash of all transactions is publicly available, and due to the open source code, obtaining details for each operation is not difficult.

In summary, UMI is a truly unique token. Its main advantage is the automatic accrual of rewards without the need to engage in mining. And this is complemented by the absence of any commissions on all transactions. And all transfers are carried out instantly, since new blocks are formed almost every second. It is also worth noting that when launching UMI, the developers did not use ICO. That is, the popularization of cryptocurrency occurs solely due to the interest of potential investors.

Is it worth buying UMI cryptocurrency now?

It is important to note that while the popularity and exchange rate of cryptocurrency against the dollar is growing, you can buy it and try to earn several tens of percent. In a couple of years, when investor activity decreases, it is quite possible that the UMI rate will begin to fall, although if the club manages to maintain popularity, then the UMI rate may continue to rise.

Here you should act as in other high-risk investments - invest not the last of your money and do it carefully.

This concludes the review about the UMI cryptocurrency, follow the development of the project with us!

Source