Your success on the stock exchange will largely depend on the right choice of a Forex broker. The table below contains a list of the best Forex brokers in Russia in 2021-2022 who have the most favorable trading conditions. The rating is based on many characteristics: minimum deposit, maximum leverage, spread analysis, independent assessments and reviews.

| Broker | Open an account | Based | Adjustable | Broker type | Min. deposit | Max. credit leverage | Bonus |

| AlpariReviews: 28 | Open account Demo | 1998 | IFSC, NAFD, FSA, AFD | ECN | 0$ | 1:1000 | |

| RoboForexReviews: 14 | Open an account Demo | 2009 | IFSC | NDD, ECN | 0$ | 1:2000 | +120 |

| AmarketsReviews: 5 | Open an account Demo | 2007 | FSA | NDD, ECN, STP | 100$ | 1:1000 | +15% |

| FxPro Reviews: 13 | Open an account Demo | 2006 | FCA, CySEC | NDD, ECN, STP | 100 $ | 1:500 | — |

| Finam-ForexReviews: 7 | Open an account Demo | 1994 | Central Bank, NAFD | NDD, DMA | 0$ | 1:40 | — |

| NPBFXReviews: 3 | Open an account Demo | 1996 | IFSC | NDD, STP | 10 $ | 1:1000 | +50% |

| InstaForexReviews: 6 | Open an account Demo | 2007 | RAUFR | NDD, ECN | 1$ | 1:1000 | +100% |

| Alpha ForexReviews: 0 | Open an account Demo | 2016 | Central Bank (Russia) | NDD | 0 | 1:40 | |

| FIBO GroupReviews: 1 | Open an account Demo | 1998 | BVIFSC, CNMV | NDD,MM | 0 | 1:500 | — |

Order processing model

It is also possible to select a broker based on its model of working with client transactions and order processing model. Traders prefer to work with ECN brokers, who bring clients’ transactions to the so-called interbank market, where the counterparties to the trader’s transaction are the largest banks, funds and other large participants in the Forex market. And not the broker himself, as happens in “kitchens”, when a trader and broker have a conflict of interest, and the trader’s loss becomes the broker’s income.

For many traders, it is important to be able to use their funds more efficiently through leverage. You can also find out information about what leverage Forex brokers provide to their clients in our comparative table of the best brokers.

Functions and tasks of Forex brokers

The main task of a Forex broker can be called finding a counterparty, and, naturally, placing client orders on the market. They perform many other functions and responsibilities. The main ones:

- training in trading skills and behavior in the market. Paid or free, sometimes even with the provision of your own funds to start activities;

- assessing the profitability of the transaction;

- investment advice;

- trust management, search for a trader, investor;

- studying possible risks and reporting them;

- market analysis and provision of accurate data to the client;

- protection of confidential information and funds from theft.

The more services a forex broker offers, the more reliable it is considered, and therefore many traders and investors want to work with it.

Promotions, bonuses, competitions

If you want to increase the amount of your funds by using the bonuses that brokers give when a trader funds an account, or even if you want to try your hand at trading without depositing your own funds at all, taking advantage of a no deposit bonus, then you can find brokers who provide all this in a special section of our rating.

Also, for each broker, we provide up-to-date information about current and upcoming competitions on real and demo accounts, where everyone can try their hand and test their trading skills, and as a reward receive a real cash reward or even valuable prizes, such as, for example, luxury sports cars .

Saxo Bank

Danish investment bank Saxo Bank, founded in 1992, classifies itself as a leading specialist in financial and regulatory technology, connecting traders, investors and partners with markets for currencies, shares, CFDs, options, futures and other asset classes, accessible from one place. accounts. He specializes in multi-asset trading and investing and providing services to wholesale clients. The company took advantage of technological advances in the late '90s by launching one of the first online trading platforms in 1998.

Saxo Bank is for experienced traders. The company offers a wide range of brokerage services that are aimed at experienced active traders, investors, professionals and institutions. Small account holders will face a number of unusual obstacles, including higher minimum account amounts, varying fees and fewer customer support options. Tiered accounts reduce trading costs and add benefits as capital grows, but most retail traders will struggle to reach higher client levels.

Advantages of the Saxo Bank forex broker:

- Wide range of offers

- Regulated by the Financial Conduct Authority (FCA)

- Industry-leading research

- Superior User Interface

- Offers protection for client accounts

You can register and start cooperation with the Saxo Bank forex broker on the official website - home.saxo

FAQ

How to choose a Forex broker?

To make the right choice, be guided by our rating and position in the ranking. This is influenced by the popularity of the broker, its reliability and feedback from traders.

How to open an account with a broker through ForexGid.Ru?

Choose the one you like and register.

Where can I read reviews of companies from the rating?

For this purpose, our website has a special reviews section where you can read them or leave your own.

Who is a Forex broker?

This is an intermediary through which you can trade on the international Forex market. Upon your order, a trading account is opened and software is provided for performing currency purchase/sale transactions. As a rule, this is MetaTrader4/5. Each broker has its own conditions for the minimum deposit and the leverage provided, as well as its own set of trading tools.

Is it better to choose a broker licensed by the Central Bank or a foreign financial regulator?

Of course, a license and a regulator must be required. The reliability of the broker depends on this, but it does not necessarily have to be a license from the Central Bank. Trading conditions can be much more favorable with companies with foreign regulation and, in fact, they are much more popular than Russian brokers. Many of them have been successfully operating in this market for more than 20 years and there is no doubt about their reliability.

Ilyushin Sergey / author of the article

Expert and editor-in-chief of the Forex Guide website. Graduated from YarSU named after. P. G. Demidov, majoring in economics in 2007. I have been investing in the stock market and IPOs since 2016. Practicing trader in the Forex market. Experience 5 years.

The most important parameters for choosing the best Forex broker

To choose the best forex broker that best suits your requirements, you need to analyze all services together, pay attention to customer reviews, and look at ratings. The greater the number of traders a company has, the higher the trust in it and its level of reliability.

Fraudsters usually cannot stay in the market for more than two or three years. If a company has been operating on the market for more than ten years, then you can trust it with your money. Those who conduct their activities unprofessionally also close quickly. Such companies usually accumulate a lot of negative reviews; few people trust them. They are simply forced to close. Many companies order reviews to be written. But they can be distinguished from the truthful ones. Experienced traders write their comments on the forums; they will quickly notice the absurdity of the reviews and write their unbiased opinion.

Some people prefer a Russian forex broker, others like the activities of a foreign one. Many reliable companies are usually registered in large cities. The wide geographical location of representative offices indicates the seriousness of the organization and the fact that it is trusted throughout the world.

Before concluding an agreement with a company, you must study it carefully. It is important to pay attention to the client agreement. If something is unclear, do not hesitate to ask questions. You can contact customer support and at the same time check how quickly and efficiently it works.

Trading conditions of a brokerage company are the most important parameter. Before making a choice, you need to study the number of assets. If a broker only trades a pair of euros and dollars, then this is very bad. Experienced traders advise analyzing the order execution model. Many of them prefer to trust their funds to ECN (STP) brokers.

This is due to the fact that such companies withdraw money through interbank trading. The interests of the trader are very important to them because they earn commissions from transactions. You should not trust funds to DDE companies; it is important for them that the client’s deposit is exhausted, since this is their profit. These are the companies that are called kitchens.

An important parameter that experienced traders advise paying attention to when choosing a Forex broker will be spreads and commissions. These indicators are important for those who seek to make quick transactions. Pay attention to how narrow or wide the spread indicator is.

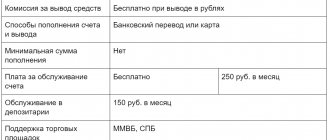

It is important to consider what payment systems the company uses. And also how quickly you can get money. Many people make deposits in bitcoins and withdraw funds to a bank card or some other electronic system. For many, it is also important what is the minimum amount to start trading, investing, and what is the size of the deposit.

You still need to start trading even with the most reliable company offering the best conditions on a demo account. This way you can protect yourself from losing money. Experienced traders advise switching to a real account only after the client is convinced of the quality of service and the profitability of his own strategy and trading system. Basing your choice on a reliable rating of Forex brokers, taking into account the advice of experienced traders, you will be able to make the right choice and start earning money.

What does a license from the Central Bank of the Russian Federation provide?

The legislator claims that for the client, cooperation with brokers/dealers who are residents of the Russian Federation is protection of the deposit and a guarantee of money back if the dealer suddenly gets screwed. Compensation will be taken from the compensation fund.

Advantages and Disadvantages of Licensed Forex Dealers

You can expect the following benefits from working with a legal dealer:

- Protecting the interests of the client. The requirements for obtaining a license are so strict that potential scammers simply cannot pass them.

- Qualified support. Without certificates 1.0 and 4.0 and work experience in financial institutions of at least 2 years, they will not hire you.

- Transparent accounting and tax reporting. For each profitable transaction, an income tax of 13% is charged from Russians, 30% from non-residents. The dealer sends reports to the tax office. That is, the trader only needs to file a tax return.

The obvious disadvantage is the high entry threshold. No cent accounts, and to open a deposit you need not a hundred or three hundred, but a thousand greenbacks.

How are clients of Russian forex dealers protected?

Theoretically, a licensed dealer is subject to the decisions of the SRO of which he is a member. A self-regulatory organization carries out inspections and makes decisions. Therefore, if a trader believes that he has been disadvantaged in some way, he can complain to the SRO.

If his decision seemed unfair, it can be appealed directly to the Central Bank of the Russian Federation. If there are a lot of complaints, the dealer could easily be deprived of his license.

But this, of course, is in theory. Thus, the government encourages brokers not to be greedy and to resolve conflicts without resorting to government agencies. In addition, traders' money is placed in separate accounts registered specifically for trading. The dealer himself does not have access to them.

What is the difference between a broker and a cryptocurrency exchange?

Let's figure out how a cryptocurrency broker and an exchange differ fundamentally.

Brokerage services are more suitable for trading large volumes of currencies. There are several reasons for this, including security and high liquidity. After depositing funds, various trading opportunities open up for you, depending on which broker you contacted - leverage, etc. On the other hand, the exchange offers a simpler procedure using the order book of the trading pair associated with the deposited asset, be it cryptocurrency or fiat. Thus, the exchange brings together buyers and sellers, for which it charges a commission.

It is worth noting that in spot trading on an exchange, physical delivery of the asset being exchanged takes place, while in the case of broker-assisted margin trading, the underlying asset is traded without physical delivery.

The difference between an exchange and a broker can also be considered using the example of the target audience. The services of cryptocurrency exchanges are mainly used by hodlers who are interested in long-term or medium-term investments. Such clients, for example, buy a specific cryptocurrency and wait for its value to increase, or simply buy certain digital coins and then transfer them for secure storage to their hardware wallet.

Brokers are usually approached by speculative investors who use the services provided by brokers, such as margin trading. They make various types of trades with the ability to use available technical analysis tools. Such clients seek to obtain short-term or medium-term profit, and the broker acts as an intermediary who helps to obtain it.