Stochastic is one of the most popular technical analysis indicators used by traders. The stochastic oscillator was invented by Chicago securities trader George C. Lane.

Stochastic belongs to a group of technical indicators that are calculated using a fixed number of time periods. Moreover, its values fluctuate within a set range around the center line.

Most novice traders do not understand how to correctly interpret stochastic signals in various market conditions. Stochastic behavior changes when the market moves from a trend to a consolidation. If you misinterpret the market environment, the oscillator may show false signals. This is where most new traders fail. They use stochastics regardless of market conditions, and as a result they suffer losses.

Let's understand how the indicator generates its signals, as well as how they can be interpreted and applied correctly in various market conditions.

How does the stochastic indicator work?

Difference between fast and slow stochastic

What is the best way to use the stochastic indicator?

Determining overbought and oversold conditions using stochastics

Trading using stochastic crossover signals

Stochastic indicator and divergence

How else can you use the stochastic indicator?

The Two Biggest Mistakes Traders Make Using Stochastics

How to use stochastics correctly?

How to use stochastics to find the best entry points?

We do not use the stochastic indicator in a sideways market.

Let's sum it up

Set up stochastic

The stochastic indicator has a large number of settings and variations, but only its settings will be considered. So, to start setting up the indicator, you first need to select it in the trading terminal section. The path to it will be as follows: insert – indicators – oscillators. From this menu you will need to select only what you need.

There will be nothing complicated in its settings; you can start with its variables. This is shown in the screenshot below.

Its settings mean the following:

- %K is its period. It is basic and is expressed as a solid line;

- %D is also the indicator period. It appears on the graph as a red dotted line, applied to %K. In simple terms, this is the period of the moving average;

- Slowdown – this parameter refers to the main period %K. He is responsible for smoothing. Increasing the value of the parameter reduces its sensitivity to noise, as a result of which there is less noise. This also allows it to give a smooth response to market changes;

- Low/High and Close/Close are prices, in simple terms. This parameter is responsible only for calculating price highs and lows or the prices at which candles close. The standard setting is Low/High, which is what is most often used;

- MA method – determines the type of moving average, which is associated with %D.

Its main settings are described above. In addition to them, there are also graphic ones, which are responsible for the colors of its stripes and so on. But there is also a parameter called “Levels”. He is responsible for the values that he will take for overbought and oversold zones. The default settings are 80 and 20; they are often left unchanged. Changing them can easily narrow these zones, resulting in a reduction in the number of signals. Or the opposite situation may happen, when there are more signals, but their quality decreases. It all depends on the parameter changes.

How to use stochastics to find the best entry points?

Your understanding of price movement on a chart or interpretation of candlestick patterns may be subjective, but the meaning of an indicator is always objective. If the indicator gives an entry signal, we enter; if there is no signal, we remain outside the market. So if you are one of the traders who are always hesitant about when to enter your trades, this technique is for you.

If the market is in a strong uptrend, enter trades when the indicator line crosses the value of 20. If the market is in a strong downtrend, enter trades when the indicator line crosses the value of 80.

As we know, stochastic measures the acceleration of price movement. So when you see the indicator cross the 20 line, it tells us that there is bullish momentum.

This technique is not a trading strategy; it can only show you possible entry points. It's important to remember this.

How to set up stochastic for 15 minutes

Quite often traders use this indicator for trading on short time periods. For most cases, traders use the default settings, but professionals use trial and error to select the most suitable settings for themselves. Beginners can do exactly the same job, but it is recommended to use a demo account.

The most frequently set parameters of this indicator are: 5, 3, 3. The levels remain unchanged (20, 80), because the author selected their most universal value. This is necessary to obtain optimal signals. With these settings, you only need to use the M15 time period.

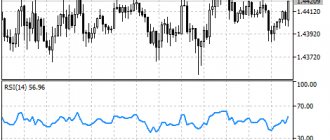

But there is one strategy that involves using the described indicator on the M15 timeframe. To do this, you need to install our indicator in conjunction with RSI. Their settings will be as follows:

- Stochastic – will have parameters 5, 3, 3, and its levels will be 20 and 80. It is installed on M15;

- RSI – for it we set the 14th period and the 50th level. It will be located on the H4 chart.

The purchase of assets using this strategy will occur upon the following signals:

- On the H4 segment, the RSI became above the 50 level;

- On the M15 segment, the stochastic breaks through level 20 from bottom to top, or it begins to grow towards level 80.

Now let's talk about the parameters for sales transactions:

- On the H4 segment, the RSI became below the 50 level;

- On the M15 segment, the stochastic breaks through level 20 from top to bottom, or it begins to fall to level 20.

Setting TP and SL for both situations is the same. The first is 50 points, and the second is 20.

Briefly what we learned

- Stochastic is an oscillator and can predict price movements based on the principles of market waves and impulse movement.

- It is good in flats, but produces a lot of noise during a trend.

- Overbought on the stochastic oscillator can indicate both the completion of the upward movement and the strength of this movement. The same goes for oversold conditions.

- It is better to use the stochastic oscillator in combination with trend indicators.

- The use of technical analysis tools and other data tips above significantly increases the effectiveness of stochastic strategies.

We didn't look at specific strategies. But we did better: we sorted all the information into pieces and now we can create our own trading system. Well, or apply the one described on this site if you are a swing trader. Now answer in the comments:

- How do you like the review – just be honest?!

- Which trend indicator do you prefer to use the stochastic oscillator with?

Thank you for your answers and attention. Happy bidding!

Stochastic parameters for h1

To determine the necessary parameters for an indicator on a certain time period, you need to conduct your own analysis. Because there is no universal value for each time period and currency pair. But for general cases of using this indicator on the h1 segment, we can recommend setting the period 14-21. They are most often used by traders with extensive experience.

But in order to get the maximum profit from trading, you simply need to select the indicator parameters yourself to suit your own trading style.

Most often, stochastic on H1 is used in strategies. Let's consider this use case using an intraday strategy as an example. The indicator described here will play the role of an oscillator, that is, determine the trend. In addition to the time interval H1, D1 will also be used.

Indicator parameters for each time period:

- H1 – 5, 3, 3;

- D1 – 34, 3, 9.

To make purchase transactions using this strategy, you need to see the location of the stochastic above level 20 on the chart. In this case, the main line will be located above the signal line. If the lines intersect, the signal is not taken into account. The position will be opened on the hourly chart when the signal line crosses the main line below level 20. The deal will be closed when the lines cross back above level 80. SL is placed after the previous support level.

The setup for selling this transaction will be opened at the location of the main line below the 80 level, while it will be lower than the signal line. If the lines intersect, the signal is passed. The trigger for selling will be the intersection of two lines above the 80 level. The deal will be closed during the reverse crossing under the 20th level.

Stochastic Strategies

EMA and Stochastic strategy

When trading according to the rules of the Stochastic + EMA strategy, you should never fight the trend. The main goal of the strategy is to act in concert with the currently prevailing trend and find convenient opportunities to join it using the stochastic oscillator.

So, first, let's define the trend:

- If EMA 5 is above EMA 11, uptrend

- If EMA 5 is lower than EMA 11, the downtrend continues

Thus, a buy order should only be opened in an uptrend and when:

- Current values of the stochastic oscillator are near level 20

- The %K line intersects the %D line from below

Example of entering a long position:

We have an entry here in accordance with the conditions described above, the opening price is 1.07902 (excluding spread).

In contrast, a sell order should only be opened in a downtrend and when:

- Current values of the stochastic oscillator are near the 80% level

- The %K line intersects the %D line from above

Example of entering a short position:

The above entry is consistent with the specified conditions, the opening price is 1.10147.

Exit from the market:

The Stochastic + EMA strategy does not use a hard Take Profit level. On the contrary, the stop loss should be:

- Just below the last low in case of buying

- Slightly above the last peak in case of sales

However, if the chart is too many pips away from the above extremes, you should set a Stop Loss order to limit the level of risk:

- Under the previous candle when opening a buy trade

- Above the previous candle when opening a sell trade

We open such a position only if the loss does not exceed our estimated risk per trade (it is advisable not to risk more than 1% - 2% of the deposit)

We close a purchase transaction only if any of the following situations arise:

- The %K line breaks the 80% level

- Line %K intersects line %D

- EMA 5 crosses EMA 11 from top to bottom

Example of closing a long position:

In this case we had the first scenario. The stop loss was at 1.07821 and the position had to be closed at 1.08562.

In contrast, a sell order must be closed when any of the following scenarios occur:

- The %K line breaks the 20% level

- Line %K intersects line %D

- Average EMA 5 crosses average EMA 11 from bottom to top

Example of closing a short position:

In this case we had the first scenario. The stop loss was at 1.10277, and the position had to be closed at a price of 1.09922 (excluding spread).

H1 Stochastic Trend

This strategy is a medium-term one. It can also be considered a swing trading strategy.

The parameters of the Stochastic indicator in this strategy are standard - 5,3,3.

Moreover, to avoid a trade with a low probability of success, we should only enter trades following the trend. To determine the trend, we will use two exponential moving averages (EMA) with periods of 36 and 72. On the hourly chart, they take values corresponding to 36 and 72 hours, that is, 1.5 and 3-day sessions. So we are confident that there is, in fact, a trend. To indicate significant price levels, the Market Profile indicator was used, which represents data for the last week. It creates a price distribution pattern from the last 120 candles.

First you need to determine the trend:

- When the short-term (36-period) moving average is above the long-term (72-period) moving average, then we are dealing with an uptrend.

- On the contrary, when the short-term average is below the long-term average, it should be recognized that the market is in a downward trend.

In the case of an uptrend, the trader should wait for the stochastic line to cross the signal line in the oversold zone, that is, below the level.

When the market is bearish, you need to wait for the intersection of two lines in the overbought zone, that is, above the level of 80.

Market profile is a tool that allows you to observe price ranges in which price is consolidating. They are marked by the so-called “bell”, which we can observe by the shape of the instrument. At the bottom of one “bell,” which is a common price distribution interval, we can indicate support, and at the top, resistance. These spaces will be needed to place stop loss orders. For an uptrend and a buy signal, SL is below support, and in a downtrend and a sell signal, it should be above resistance.

Exit from the market:

In the case of the above strategy, we do not limit profits with artificial take profits, but simply set ourselves the goal of quickly closing positions when the market makes a strong movement against the trend.

We use a trailing stop loss, which we move according to the support (resistance) levels received in the market profile. The stop loss is always below local support or above local resistance.

When a resistance break occurs, in the case of an uptrend, the last local break becomes the place below which the SL should be. A similar situation appears in the case of a downtrend, except that the stop loss is updated at the moment the support is broken.

For this strategy, it is not recommended to risk more than 1%-2% of the deposit per trade.

EMA pyramiding strategy - Stoch

Pyramiding is an approach designed to increase the likelihood of success and maximize profits at a time when we are dealing with a strong movement in a given direction. According to the Pareto principle, there will always be fewer successful transactions. So why not make the most of the move to make as much money as possible?

The next strategy is based on searching for an opportunity to join the trend at the moment the correction ends. Accordingly, this strategy uses two exponential averages (EMA) with periods of 48 and 96 and a stochastic oscillator.

Timeframe: M30

Stochastic settings are standard: (5,3,3)

Trend definition (1):

The trader determines the prevailing trend based on two exponential averages.

- If EMA96 is below EMA 48, and both are below the price, then the trend is upward and you need to look for an opportunity to open a buy transaction

- If EMA48 < EMA96 and both of them are above the price, the trend is downward and you need to look for an opportunity to open a sell transaction

Stochastic as an oscillator is designed to inform the trader at what point to open a position to increase the likelihood of success.

The signal to enter the market occurs when the slow stochastic crosses the signal line in the overbought (80-100) or oversold (0-20) zone, depending on the specific trend on the M30.

At the moment the signal appears, the trader must enter a trade at the moment when the high of the last candle on M30 is broken (in the case of a buy signal in an uptrend) or the minimum (in the case of a sell signal in a downtrend).

The stop loss is below/above the local minimum/high.

If the conditions for determining the trend (1) are met and new signals from the stochastic appear, you need to open new trades along the trend. In this case, at the moment when a new transaction is opened, it is necessary to move the stop loss of the previous transaction to the level of opening a new one. In this way, the trader protects his capital by maximizing the potential of a given transaction.

Example of how the strategy works:

Exit from the market:

This strategy does not use Take Profit orders. The advantage of this strategy is to increase the potential of a given trade by pyramiding, quickly cutting losses the moment the price closes at the stop loss (SL).

Do not risk more than 1%-3% of your deposit per trade.

Setting up oscillator stochastic on the m1 chart

The settings of this indicator are selected individually by each trader. This is done on a demo account through trial and error. All professional traders use indicators with their own settings, which they arrived at this way. There are no universal parameters. But most often for the M1 timeframe, stochastic is used with parameters 14, 3, the slowdown is set to 3, and the levels remain standard (20, 80).

In addition, the indicator is widely used for binary options trading. Its settings are almost no different from the version of the indicator for the Forex market. The most optimal setup option for using the indicator on binary options is as follows:

- Period %K – 21;

- Period %D – 9;

- Slowdown – 9.

To start trading using the strategy you need to:

- The chart of the asset on which trading will take place should be converted to a one-minute scale;

- Install the indicator with the above settings;

- Transactions will be concluded only when the indicator lines cross in the zone above or below.

When performing actions using this trading system, it is possible to open only one transaction every 30 minutes. It is recommended to use only Put options for trading. Since the bearish trend proceeds faster than the bullish one.

But if a major price collapse begins, it will pass quite quickly. This time will be enough for him to move the required distance during a purchase on the M1 chart. In this case, noise, which often interferes with accurate signals, will be much less annoying.

The above chart clearly shows that four trades were closed in profit. Here it is necessary to pay attention to the fact that the stochastic indicator did not go into the overbought or oversold zone. If such a situation occurred, it would be worth buying the CALL option, but the risk would be higher.

Trading using stochastic crossover signals

The second most used stochastic signal is the crossover signal, which occurs when the %K line crosses the %D line and generates a buy signal. On the other hand, when the %K line crosses the %D line, a sell signal is generated.

These stochastic crossover signals are quite reliable in a range-bound market, but these signals tend to become much less reliable when the market is in a strong trend. However, you can still rely on stochastic crossover signals as a trend continuation signal and to open additional positions.

In the figure, the trading instrument is in an uptrend, and the stochastic has generated a cross buy signal. This indicated that the uptrend was likely to continue and the market continued to rise. Likewise, if you see a crossover sell signal during a downtrend, you can also rely on that signal as supporting evidence that the downtrend is likely to continue.

This type of trend continuation signal tends to be reliable during trending markets. However, you should exercise caution and apply additional filters before trading against the trend using the stochastic crossover signal.

Setting up stochastic for 5 minutes

On a five-minute time period, stochastic is used with standard values, since they are perfectly selected by the author of the indicator. Using this timeframe is quite risky, because the risks of receiving false signals are high. To reduce the risk, it is recommended to trade from 4 to 6 am Moscow time. It would be best to use currency pairs with high volatility, for example, EUR/USD.

There are no recommendations for deposits. There can be at least 10 dollars in the account, at least a thousand. Each transaction that closes in profit brings in approximately 10 percent of the deposit, which is already quite good.

Traders who trade binary options also do not ignore this excellent indicator. It is often used in ready-made trading systems, where it acts as an auxiliary tool.

Let's consider its application using the example of one of the more popular strategies. It is often used by traders due to its simplicity and accuracy. It is configured for options on the 5 minute chart.

Indicators used:

- Heiken Ashi candles;

- Exponential moving average in the 7th period;

- RSI in the 3rd period and established overbought and oversold zones of 80 and 20;

- Stochastic with periods of 6, 3, 3 and overbought and oversold zones of 70 and 30.

The European and American sessions are used for trading. Any assets except shares are suitable for trading; they must be selected carefully. Trading will take place short-term, that is, only 5 minutes.

To open you need to follow this algorithm:

It’s worth starting by looking at the minute chart. Transactions for the CALL option will occur according to these rules:

- The moving average will pass through the body of the candle. There is one additional condition - the color of the candle must change to green from red;

- The RSI will break through its level of 50 from bottom to top and continue moving in this direction. This indicates that an upward trend is prevailing;

- Stochastic, located in the oversold zone, will cross and the lines will go up.

Transactions for the Put option will be made according to the opposite rules:

- The EMA will pass through the body of the candle. In this case, the candle will change color to red from green;

- RSI will break through level 50 from top to bottom;

- Stochastic will cross in the overbought zone, and the lines themselves will head down.

There is also nothing complicated in using the indicator for options. Any trader can do this.

Description of the Stochastic indicator

This indicator was developed in 1950; experienced trader George Lane worked on its creation.

Despite the fact that the stochastic oscillator is similar in its characteristics to other indicators, it has many features:

It is best to use this oscillator on the Forex, stock or derivatives markets.- Trading instruments can be: any currency pairs, futures, stocks, fixed contracts, etc.

- The tool is suitable for different timeframes (minute m1, hourly, daily and even weekly).

- Experienced traders call the recommended settings Stochastic parameters from 5-3-3 to 21-3-3.

The operating principle of such a tool is based on the ability to analyze market speed. There is a formula thanks to which Stochastic determines closing prices in a set range over a given number of days (there is a minimum and a maximum).

Stochastic is always located at the bottom of the screen under the chart and consists of 2 curved lines:

- line %K - is the main fast line, represented on the graph by a solid line;

- line %D is called the moving average and is marked on the chart as a dotted line.

These lines move in a horizontal corridor. The lower limit here is 0%, the upper limit is 100%.

The entire indicator field can be divided into 3 zones:

- the oversold zone refers to a field located in the range of 0-20%;

- the neutral zone includes space from 20 to 80%;

- The upper part of the chart from 80 to 100% entered the overbought zone.

Strategy example: EMA 50 (13 and 4) + Stochastic

Stochastic settings for h1.

The use of stochastic on the hourly timeframe usually occurs on the following parameters: 5, 3, 3. However, its levels remain standard, that is, 20 and 80. This is the most effective option for this timeframe.

In the “Two Stochastics” strategy, this indicator performs excellently. But it has some differences in settings, since the foreign exchange market and options are different things.

To start trading binary options using this strategy, you need to open two stochastic indicators. There is no need to install it separately, since it is already built into the terminal. The first should have settings of 21, 9, 9, and the second - 9, 3, 3. This will allow you to find the balance of the sensitivity of the indicators. The first one will react to each change slowly, and the second one will react quickly. Stochastic number one is needed to filter false fluctuations that will come from the second one.

There is a recommendation that states that options should only be traded on timeframes close to the expiration time. For example, when using an expiration date of two hours, the timeframe should be H1.

Transactions to buy a Put option are made according to one rule - if both indicators are in the overbought zone, then you need to buy it. When they are in the oversold zone, “CALL” is bought. When a signal arrives, it is possible to open trades on it until the opposite one appears. This will result in several open profitable positions.

Let's sum it up

When used correctly, the stochastic indicator can help you better assess price movements in both trends and consolidations. For example, the indicator is capable of generating reliable buy or sell signals during a range-bound market, as well as signaling hidden divergences in a trending market.

Although the crossover signal does not work very well as a reversal signal during a strong uptrend, it can be quite reliable as a reversal signal with regular divergence.

Stochastic setting for timeframe d1

The stochastic indicator on the d1 time frame is usually used in ready-made trading systems. Let's take a closer look at one of them.

The strategy is based on the momentum of multiple time frames. Trading using it occurs strictly in the direction of movement of a larger time period. The transaction will be executed only after the smaller of the time intervals has reversed in the direction of the older one. The conditions are the same for sales and purchase transactions.

This indicator is plotted on the chart in quantities of 2 or more. Their location will be clearly visible in the screenshot below.

The first indicator is responsible for H1, the second for H4, and the last for D1.

In addition, this indicator with this timeframe is widely used in binary options. In addition to it, two more indicators are installed: MACD and two RSI.

Their parameters will be as follows:

- Stochastic oscillator – will have parameters 8, 3, 3. This will allow you to receive timely information about trends and the location of the asset used relative to the overbought and oversold zones;

- Two RSI lines, the first of which will have a period of 13, and the second - 3. They predict the nearest trend trend, as well as the strength with which the impulse in the direction of the trend will occur;

- The MACD indicator will have parameters 12, 26, 9. It is necessary to filter the received signals. If the histogram of this indicator is located above the signal line, then it will be necessary to consider only signals for long positions. When it is located under the signal line, signals for making transactions on short positions will be considered.

To make transactions to purchase a CALL option you must:

- The MACD histogram will be located higher than the signal line of the oscillator indicator;

- The Stochastic chart will display two lines going up, the main one should cross the signal line from bottom to top and move into the overbought zone;

- In the RSI window, the line in the 3rd period will cross the line of the 13th period from bottom to top, and then rise above the 70 level.

[stochastic-dlya-d1-primer-2] Signals to buy a Put option will be opposite:

- MACD will be located below the signal line;

- The main stochastic band will cross the signal line from top to bottom and move into the overbought zone;

- The RSI in the 3rd period will fall below the RSI in the 13th period, and then go beyond the 30th level.

This strategy is universal in terms of choosing options for trading. But the best option remains the standard set.

Application area

In binary options and forex, this oscillator can provide the following information.

- Signals when the maximum and minimum prices have been reached.

- Indicates the direction of the price indicator and the indicator itself.

- It can be used to track the rise or fall in the value of an asset.

One of the classic examples of using Stochastic RSI is the following situation. During the period of several tamframes, the asset grows in price (or rapidly becomes cheaper), but then the price movement slows down. At this moment, the oscillator gives a slowdown signal, which may indicate an imminent trend change. This point on the chart is called impulse or momentum.

Ideal stochastic settings on n1

In order to choose the ideal settings for yourself, you need to use a demo account and a moving average calculator. For each time period it is worth calculating your own parameters. This is necessary to accurately determine the extreme zones of each moving line.

You can consider the indicator settings for h1 using the example of a good strategy, which also includes RSI.

The RSI indicator is used in it with a 14th period, the overbought and oversold levels are unchanged. Stochastic is set with parameters 8, 3, 3. The first indicator listed is set on the H4 time period. It is necessary to clearly determine the place of entry into the market. The opening of the transaction itself will take place on the hourly chart.

For the strategy to work, you first need to mark a candle on the H4 chart, following the formation of which the RSI will leave the overbought zone in a situation for selling, or from the oversold zone in a situation for buying. Now it is necessary to consider only the hourly period of time.

The deal will be opened only after the RSI indicator leaves the overbought or oversold zone, as described above. When it leaves the first zone, the signal line should be under the main one, that is, the red line will be above the green one. In the case of the second zone, the red line will be located under the green one.

Using the example of the chart above, you can see that the stochastic indicator left the overbought zone at the moment the signal candle closed on h4. This is also indicated by the h1 time period. Based on this, the pair could be sold immediately.

SL in this strategy is set at a distance of 35 points, but if we look at the above figure, we can see that when opening an order during a trend reversal or correction, it would be more appropriate to place SL behind the local minimum point.

History of Stochastic

The Stochastic Oscillator was developed back in the 1950s, so it's very old and has a beard. It was created by the famous economist George Lane. The main idea that underlies it is the measurement of the so-called “momentum” - how much the price of an asset changes.

Typically, a change in momentum is followed by a change in price, which creates a great trading opportunity.

Momentum is the difference between the current price and the price that was a certain number of periods ago.

Lane gave several interviews in which he noted that Stochastic primarily reflects price changes. Imagine a rocket rocketing upward. Before she can turn around, she needs to slow down, right? This is how momentum always changes before the price itself changes.

Formula

You don’t need to know this formula at all, because on a live chart, Stochastic, like any other indicators, is calculated automatically. But it won’t hurt to take a look at it for a general understanding.

Stochastic has only 2 lines, let's call them %K and %D. They are calculated like this:

(Current Closing Price - Lowest Price) / (Highest Price - Lowest Price) * 100 = %K Line 3 Day Simple Moving Average (SMA) of %K = %D Line

Stochastic settings for h4

To configure the indicator more correctly for a given period of time, you should first install it on a chart with standard parameters. At the very beginning, you don’t even need to use levels to determine overbought or oversold.

Then you should use a demo account, the deposit on it is virtual, so there is no risk of losing money. Now you will have to use a calculator that can calculate the extreme zones of moving averages. Each time frame will have its own optimal values. It is also necessary to be able to distinguish between the types of signals given by the indicator. The best of them is the intersection of lines, which provides a lot of useful information for making trades. Most often, this indicator gives signals faster than the oscillators used in conjunction with it, this significantly increases the chances of a successful transaction.

But there are also values that experienced traders recommend using. They should not go out of the range of 5-9, because otherwise there will be a huge number of false signals, or the signals will be very late.

Stochastic settings for m15

Each trader will select the necessary settings for this indicator independently. This is necessary because there are no optimal values for each trader’s trading style. There are only some recommendations that do not have to be followed. Experienced market participants selected the optimal indicator parameters for each time period; for M15 they will be in the range of values from 8 to 13. This was identified by selecting values.

It is worth remembering that too large values can only worsen the situation in a given period of time, and too small ones too. The selection must be made independently.

The stochastic indicator is perfectly used in the “RSI + Stochastic” strategy. In it, the indicator described is used on a 15-minute time period. It is recommended to trade on it using the EUR/JPY currency pair.

The two indicators used will have the following settings:

- The RSI indicator is used in the 14th period; you still need to select an additional level of 50. It is set to H4;

- Stochastic will work with parameters 5, 3, 3, overbought and oversold levels will remain 20 and 80, that is, standard.

First, you need to conduct a market analysis on the two time periods used. The first interval to assess the situation will be H4, because it is on it that the RSI is installed, giving a signal to sell or buy. Next, we move on to M15, where we need to find a similar signal for confirmation. If it is, then you can open a deal depending on the signals received.

To carry out purchase transactions, you first need to study segment H4. If the RSI rises above the 50 level, this will be a buy signal. Now we turn our attention to M15. Stochastic must break through level 20 from bottom to top, or begin active growth towards level 80. In this case, a long position transaction can be opened.

To open trades for sale, first of all we also pay attention to H4, and then to M15. The first time period should show the RSI indicator, which has dropped below level 50. In the second interval, the stochastic will cross the 80 level from top to bottom, or it will begin to fall to the 20 level. A short position can be opened if these conditions are met.

For both situations, TP and SL are set fixedly, that is, at a distance of 50 and 20 points.

Stochastic oscillator - what is it? What is it for?

Stochastic (stochastic oscillator) is an indicator that is based on moving averages and has a relative evaluation function, that is, it has a smoothing component. Stochastic is designed to determine reversals; it is perfectly used in sideways and trending situations, that is, it can be called a universal tool for technical analysis.

To make it more informative, the stochastic is combined with other indicators, for example, MACD or Bollinger, as well as with graphical and candlestick analysis. You can also often see a stochastic window on charts with wave markings, since the signal of divergence and convergence is quite relevant not only for the usual search for a reversal, but also for determining some phases of wave structures.

The creator of the indicator, George Lane, paid attention to how the current bar closes in relation to the previous ones. As you know, sharp fluctuations are possible by the end of the candle period. That is, during the formation process it can take almost any shape, but at the very end, literally in a few minutes, completely change it. That is, there was, for example, a confident falling candle, with small shadows and a large body, which quickly turns into a Hammer reversal figure. This is why, by the way, it is recommended to open trades only at the opening of a new bar of the working period. This method of work allows you to work with up-to-date data, eliminating the possibility of an unsuccessful login due to haste.

So, the stochastic indicator works on a simple principle: a numerical assessment of the price level at which the current bar closes is carried out in comparison with the levels of previous bars. That is, in fact, we just look, there is a sequential closing lower and lower, that is, a bearish trend is developing, or sequentially higher and higher, that is, a bullish trend. This approach allows you to assess the real situation, because candles may have long shadows, but a trend closure does not occur. These are usually signs of a flat or reversal.

To better understand the algorithm, you need to look at the value of each of the lines, which we will analyze in the stochastic settings section. There are many modernized versions of the indicator, but they do not always bring anything useful, so it is better to use a simple version.

I also recommend reading:

Alligator indicator - how to use? Settings and application in trading

Often, the creators of some mathematical methods of market analysis become famous, and their creations become classics of trading. One of […]

How to set up stochastics for precise entry

The easiest way to analyze the indicator settings is from the very first stage - installing it on the price chart. Select the “insert” item, then “Indicators” and then “Oscillators”, the name of the required indicator will already be visible there.

As soon as the indicator is installed, an additional window with its settings will open. At the very beginning they remain standard. It is best to start using it with them and without changing anything. You can, of course, choose line colors and the like, this will not affect its operation in any way.

You must select the exact login parameters yourself. It will be necessary to use a virtual account on which experiments with the settings will be carried out. For each time period, it is necessary to determine your own values.

In the case of binary options, the indicator settings will also not be complicated. The options window has two tabs: style and arguments. “Style”—responsible for changing the parameters for displaying lines on the chart. In addition, there is an opportunity to change the location of overbought and oversold levels. All trading using the stochastic indicator will be based on these levels. In other words, entry signals will appear only after the moving averages cross one of the levels.

The “Arguments” section is responsible for selecting the general period of the indicator and individual periods for each line. It is recommended to trade with standard settings first to gain experience. Then you can gradually change the values for your own convenience.

How to set up stochastic

Before you start setting up the indicator, you need to install it on the trading terminal. The easiest way to do this is by selecting the “List of Indicators” tab, it is located at the top. From the window that opens, all you have to do is select the desired indicator.

As soon as these actions are completed, an additional indicator window with settings will open. There are three main parameters:

- The %K period is the main one, as mentioned above. It is responsible for how quickly the indicator will react to market changes. The higher the value, the smoother the oscillator moves;

- Period %D – it controls only the dotted line. Here, by analogy with the first point, the higher the value, the smoother the moving line will move. The value will be calculated based on %K;

- Slowdown – it is necessary only to control the indicator’s reaction to sudden price changes. As its value increases, the two lines will move more smoothly.

How to use Stochastic

The stochastic oscillator consists of two lines, which are displayed on a scale from 0 to 100.

- The first line, also known as %K, displays the current closing price in relation to the price range you selected.

- The second line (%D) is a regular simple moving average (SMA), calculated based on the %K line.

Stochastic parameters can be changed as you wish. But we'll talk about this a little later.

Still not clear what's what? Not surprising - it's a theory, and it's pretty boring. Now get it out of your head - we're moving on to practice.

Setting up stochastics for a minute chart

The indicator settings for its use on minute time periods are most often selected manually. But this configuration option is suitable only for those who have at least some experience in using the indicator and can navigate its signals. Beginners can easily use the values that have already been selected by traders with extensive trading experience. Most often, these values do not go beyond the range of 8-13. Their use has already been verified by more than one person, therefore there is a guarantee of receiving stable high-quality signals, but there is still a possibility of an unsuccessful transaction.

Stochastic oscillator setting for daily charts

The creator of this indicator himself gave recommendations for its use on daily charts in the period from 5 to 9. The most important setting point is the first parameter, because it is responsible for the number of bars that will be used for calculations. The remaining parameters are responsible only for the degree of smoothing of both lines.

To select the most effective indicator period, it is necessary to independently select its values. You should first try to trade at each value, and then change it to the next one. Only in this way can you achieve optimal values for yourself. It is worth knowing that each time period and currency pair will have its own combination of values.

Calculation formula

Principle. The stochastic formula is designed to show the percentage ratio of the closing price of the current candle to the trading range for a certain period. Calculation example: the current candle closes at $49. Over the last 5 candles (period 5), the maximum is at $50 and the minimum is at $40. Therefore, the closing level is now at 90% of the entire trading range for 5 candles. This level is stochastic and will be displayed on its scale.

The formula for calculating the stochastic indicator itself is as follows:

%К = (Current closing price – N minimum) / (N maximum – N minimum) *100%, where N is the period or number of bars taken into account.

%D = 100 * ((K1 + K2 + … + K n) / n) or simply SMA for n periods %K.

Interpretation. It is known that when a stock begins an upward wave, the candles close near their highs and rise up, as if on steps. At this time, the stochastic lines rise towards 100%. As soon as demand from the bulls falls, the candles close near the middle of their ranges. The indicator shows curves rounding at the top (overbought zone). And when the supply from the bears exceeds the demand from the buyers, the candles close down and the stochastic oscillator moves towards 0%.

Optimal settings for stochastic

Each time period used has its own settings options. They also depend on the currency pair used. For general cases, there are already parameters selected by experienced traders: time periods up to M30 - the period from 9 to 13, H1 - 14-21, from H4 and above - 5-9.

But ideally, you will use your own values, which will be selected exactly for your trading style. This will help you get maximum profit from every trade. At the same time, the reaction of the lines to price changes will be optimal for you, which also increases the chances of positive transactions.

Do not forget that divergence and determination of overbought and oversold territories require the use of different parameters.

You can also experiment with overbought and oversold levels. By default, they are set to 20 and 80. For example, when trading during the Asian session in a stable market situation using the scalping method, you can use the “fast stochastic”, the settings of which will be: 7, 3, 1, and levels 30 and 70.

Recommendations for working with strategy

When working with this system, you can use a number of techniques to increase efficiency:

- Pay attention to the position of the line and histogram of the MACD oscillator. For example, the histogram is above the zero line, but it has already crossed the line from top to bottom, and the histogram is decreasing. This indicates a likely market reversal.

The Stochastic and MACD strategy gives a signal about a change in the upward trend.

- Ignore histogram values close to the zero line. Remember the procedure for calculating a histogram - this is the difference between two moving averages; if its value is close to zero, this indicates that the MAs are located close to each other and there is no trend.

A near-zero value of the histogram corresponds to a flat in the market.

- Take into account divergences on both indicators. Although the MACD and Stochastic strategy does not speak about them, it is a powerful signal. If a divergence has formed on the MACD on H4, this indicates that the trend is slowing down, and either a correction or a change in direction of movement is possible.

An example of divergence on the MACD – it would be better to refrain from buying in this example.

In the MA and Stochastic strategy, you can use an additional filter in the form of a heavy MA . If the price is located above it, we give priority to purchases, if below the MA, we give priority to sales.

An example of using a filter in the form of EMA200.

In the screenshot above, EMA200 helped filter out the flat area, where the MACD histogram had already gone below the zero line, but for now it is better to refrain from selling. The Stochastic and MACD strategy will give fewer signals, but the number of losing trades will also decrease.

On H1 there is little sense in a heavy EMA - moving averages with a large period are used only to identify the market state , but not to receive accurate signals (the lag is too large).

Correct setting of the stochastic indicator

The indicator is installed by default in the MT4 trading terminal, so there is no need to search for and install it. You just need to open the panel of available indicators and select the one you need there. The standard indicator settings are shown in the screenshot below.

The graph displays two lines:

- The %K period is the dominant line of the indicator, depicted as a solid line;

- Period %D is an auxiliary line of the oscillator, expressed as a dotted line.

To correctly interpret this chart, you should definitely use additional levels that will indicate overbought and oversold zones. Most often they are 20 and 80.

When using the indicator in options trading, its settings will be slightly different from the settings for the Forex market. Experienced traders in practice were able to identify two main settings, one of which carries a greater percentage of risk. The first setting is as follows: %K – 9, %D – 3, and the slowdown is also 3. This configuration makes it possible to open a larger number of transactions, but the quality will be significantly lower. The second configuration gives more accurate entry signals, the indicators will be as follows: 21, 9, 9.

A smooth stochastic requires a detailed consideration. Since it is the best for trading low-volatile currency bonds. It also allows you to receive excellent quality signals during night trading. Since the market changes more slowly, and its signals manage to arrive on time.

But it’s still worth remembering that there are no universal parameters for every situation; this has already been mentioned several times in the article. The market is constantly changing. That is why, when working with an expiration time of less than 30 minutes, it is worth setting up the indicator before starting trading. The setup will be done experimentally. The ideal configuration is one in which the indicator with its highs and lows will closely replicate the highs and lows of the price chart.

The most optimal strategy for this situation would be “Two Stochastics”; it has already been discussed in this article. If you are going to use only one given indicator, then the conditions should be as follows:

- The work will take place in minute time periods;

- In addition to it, a second indicator will be used, for example, Bollinger lines. This combination has proven itself to be excellent;

- Trading will take place on a system without Price Action indicators, or using Fibonacci levels; stochastic will be needed only to filter out false fluctuations.

To work in other cases, it is recommended to use the above-mentioned “Two Stochastics” strategy. This will allow you to reach the optimal level of received signals.

We do not use the stochastic indicator in a sideways market.

If you have already read any articles, books or taken courses on trading, they all say that it is best to use the stochastic indicator in a sideways market. Because you can expect a short entry point when the indicator indicates overbought.

The indicator accurately shows us the boundaries of the trading range. But do we really need this? After all, even without an indicator everything looks quite obvious. We buy at the support level, sell at the resistance level. And we get exactly the same results.

It turns out that stochastics do not have to be used in trading ranges. It just clutters up the schedule.

Stochastic in the main chart window

This indicator is often located in the lower window of the price chart. But there is another variation of it, when it is located on the main price chart in the required channel. His presence in this place does not change his work.

This option is configured in exactly the same way as the usual stochastic. Filtered signals can also be used in the standard version - divergence, change of direction of the main line and intersection of its levels.

How to add Stochastic to MetaTrader

If you are working on the MetaTrader platform (MT4 or MT5), you already have it in your terminal. To display the graph on the screen:

- go to the “Insert” menu;

- select "Indicators";

- In the "Oscillators" drop-down menu, find "Stochastic oscillator".

Stochastic built on a lower timeframe

The use of stochastics on lower time frames is no longer new. Its creator himself used it on 3-minute bars while trading futures with the S and P 500 index.

It is quite possible to use it at lower time intervals. You just have to select values that will be comfortable to work with. There is simply no middle ground, otherwise the market will simply collapse. Most often, the indicator is configured for time frames up to M30 in the range 8-13. But the overbought and oversold levels remain unchanged.

Stochastic signal line parameter

The signal line of this indicator is the Moving Average. Its period is calculated using the formula given below.

The line is necessary in order to receive signals when the signal line itself crosses the main one. If this line enters the overbought or oversold zone, then a reversal of the market trend is likely to occur.

This indicator has proven itself to be excellent. It is used by a huge number of traders from all over the world, from beginners to professionals. The thing is that it is very easy to use and brings good income to those who are not too lazy to fully understand it. Anyone can study it thoroughly and select the necessary settings to get good profits from trading, regardless of time periods.

Difference between fast and slow stochastic

When stochastic was first invented, it was calculated using the formula we discussed above. However, the original stochastic formula seemed too simple for some stock and commodity traders, so they applied an additional three-period moving average to further slow down the indicator's reaction.

You can see in the figure that there is a Slowdown input field that shows a value of 3. This value is an additional moving average applied to the stochastic oscillator. This allows you to make it a little less sensitive to price changes, which improves the quality of the stochastic oscillator signals.

When you use an additional moving average to slow down the original stochastic formula, the stochastic is called slow. By default, the MetaTrader 4 trading platform displays a slow stochastic based on an additional 3-period moving average. According to the original formula, stochastic is called fast.

To calculate fast stochastics using MetaTrader 4 and other charting software, you need to set the slowdown value to 1.