Get the first clear course on Bitcoin in RuNet for free, which even your grandmother will understand!

One lesson per day for 6 days.

No water or complex technical information.

Briefly and clearly about what seems complicated.

Are you ready to learn more about Bitcoin than 99% of the world's population?

From this article you will learn which method of withdrawing Bitcoins to Sberbank is the most convenient and which is the most profitable. And the benefit, by the way, is up to 11%.

Below I will tell you about my favorite service for exchanging Bitcoins, as well as how I compared the best rates.

So now I know which service is most profitable to use to sell BTC and in this article I will share this information with you.

Also below you will find step-by-step instructions with videos, with the help of which you can make an exchange quickly and without problems.

Let's get started.

Which exchange method do you choose?

Online exchangers, p2p platforms or exchange. There is plenty to choose from. Next, we will analyze which method will be comfortable and most profitable for you.

Online exchangers

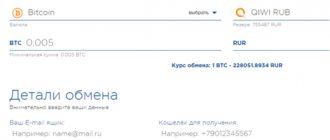

Exchangers can work in different directions. Cryptocurrency can also be exchanged for rubles or withdrawn to a bank card. Almost all exchangers work the same, the only difference is whether they have the necessary exchange directions and rates on the date:

- Selecting source and target currencies;

- Choosing the direction of receiving funds;

- Enter data and confirm your actions.

How long does it take to exchange, for example, Bitcoin through Sberbank online? On average 10-15 minutes. Want to reduce transaction execution time? Then immediately write to support.

Important! Before choosing an exchanger, read the reviews and check the rating of the exchanger. On some forums, exchangers specifically create their own thread where users share their opinions. See reviews on third-party resources. These include the ExNode monitoring site.

Criteria for choosing an exchanger

In the vastness of the RuNet there are hundreds of similar services offering .

All are similar in functionality, but there are a number of criteria that you should pay attention to in order to choose the right option and not end up with scammers:

- Number of supported currency pairs. Top cryptocurrencies are on the list of all exchangers, but it’s a good idea to check.

- Bitcoin rate in a specific exchange service. The rate is approximately equal to the exchange rate, but adjusted for the turnover of currencies within the site. Therefore, exchange rates in different exchangers differ by 1-5%. However, if the rate is implausibly higher than the exchange rate, then it is advisable to avoid such a resource.

- Workload affecting the speed of processing applications.

- Commission fees, discounts for exchanging large amounts, promotional programs.

- Supported payment systems for depositing and withdrawing money (in this particular case, Bitcoin and Sberbank).

- Availability and quality of technical support, speed of responses, competent specialists.

- Clean reputation. A good indicator would be mention of the exchanger in popular online media and presence in BestChange monitoring.

It is advisable to find out how long the site has been operating. Fraudulent projects do not last longer than a few months.

Which exchangers to choose for Bitcoin Sberbank?

On the website you can see a table with exchangers. To make these exchangers in your direction, set the parameters and you will see the list. The first positions in the table are the most advantageous offers.

Exchanger Snowbit

It is easy to use and most transactions do not require verification or registration. The maximum withdrawal time is up to 5 minutes. There is also support on the platform, and they promise to answer customer questions 7 times a week around the clock. In addition to selling Bitcoin, you can also buy Bitcoin through Sberbank online.

Exchanger Obmennik-UZ

Another interesting exchange office is Obmennik-UZ. Here, operations in the Sber Bitcoin card format are carried out manually. Therefore, the waiting time may be slightly longer, but it will still take a little time. Also note that the site administration warns that you should not withdraw BTC less than the minimum withdrawal threshold. You risk that the coins will simply be lost, although the blockchain will show that the funds were sent and received into the account.

Exchanger Chby

But the Chby exchanger works in a certain mode. Sending Bitcoin to Sberbank can take from half an hour to nine hours. But despite the long waiting time, the exchange rate is fixed for the client during this time.

Exchanger AlfaBit

Another exchange office that is respected among users is AlfaBit. It has been on the market for a long time, and has established itself as one of the most reliable exchange points. 24/7 support, working hours without days off or breaks. And AlfaBit meets these criteria.

Most existing exchangers have their own loyalty system and affiliate program. This allows their clients to save on commissions and earn passive income. More details about the offers can be found on the official website.

Bitcoin rate

The Bitcoin rate is currently: [current_btc_usd_price]

You can see the current Bitcoin exchange rate in dollars above. The Bitcoin rate on our website is updated automatically, so you can see up-to-date information about its real value. The bitcoin exchange rate is measured in dollars. You can calculate the Bitcoin exchange rate in rubles using a calculator - the current dollar exchange rate according to the Central Bank of the Russian Federation is indicated in the upper right corner of our website.

What about the exchange and p2p platform?

P2P platforms attract users because there are no third parties when making a transaction. In addition, there are often profitable offers for the Bitcoin Sberbank exchange position. But there are also risks:

- Unscrupulous “partners” and fraudulent transactions.

- Card blocking due to the transfer of illegal funds.

You can also carry out many transactions through the exchange. For example, buy Bitcoin from Sberbank or any other currency. And often using an exchange can be more convenient than an exchange office. But! The exchange has high commissions. This is due to the fact that such platforms use counterparties - third parties. In addition, exchanges are often hacked.

What do you need to know about withdrawing Bitcoins?

Above we compared transferring digital coins to another wallet with sending a file by email. This analogy is quite appropriate. On the one hand, the transfer of cryptocurrency is simple and convenient. But if you approach the process frivolously, there is a risk of losing money.

Let's return to the analogy with sending a file. By inattention, you can send the wrong picture or document. It is no longer possible to recall a sent file. You also cannot cancel an erroneous transaction. If you indicate the wrong recipient address when withdrawing money from your Bitcoin wallet, you will lose your digital coins. Therefore, before sending funds, it is important to carefully check that the required fields are filled in correctly.

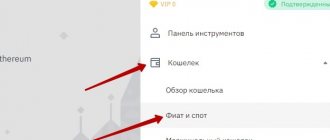

How to choose an exchanger on ExNode

A safe and free service for selecting the best offers - ExNode. Here you can find information, experience of experienced participants and their reviews about the work of this or that exchange office. In a matter of seconds, users will be able to familiarize themselves with the rating table of exchange offices and choose the most favorable rate.

You can withdraw rubles to Bitcoin Sberbank or in the opposite direction in just a few clicks:

- In the fields on the left in the table, select the currency for exchange and the withdrawal direction. For example, you want to withdraw the cue ball to a Sberbank ruble card. Click on the corresponding buttons.

- After completing the first step, the site displays a list of exchangers that support the direction. The exchange rate, the reserve – it’s all in the table.

- Before choosing an exchanger, visit their profile on the website and make sure that the reviews there are positive. You can go to their page in ExNode by clicking on the indicators in the “Reviews” column.

- After you are convinced of the quality and speed of service, go to the exchanger and make a transaction.

Method #3. Telegram bot BTC Banker.

Telegram users can withdraw Bitcoins to a Sberbank card using a bot.

The BTC Banker bot is similar to the Localbitcoins service:

- Private traders. In addition to exchangers, ordinary people are also represented here.

- Internal balance. The seller does not transfer Bitcoins directly to the buyer's account. It first replenishes the internal balance. And during the transaction, his coins are frozen and automatically transferred to the buyer’s account after payment. This protects all parties to the transaction from fraud.

- Verification. Many sellers here undergo verification to confirm their identity. This increases the security of the exchange, since in case of fraud the trader’s identity can be established.

The exchange procedure itself is similar.

How to transfer Bitcoins to a Sberbank card using a Telegram bot (step-by-step plan):

Step 1. Connect to the bot.

First, you need to find a bot on Telegram and connect to it. You can do it like this:

- enter the name of the bot in the Telegram search: BTC_CHANGE_BOT

- follow this link

The bot itself looks like this:

Now click on the bot and click on the “Start” button to connect to it.

All you have to do is agree to the terms of service and you can start the exchange.

Step 2. Select a buyer.

To begin, click on the “Exchange BTC/RUB” button.

Then click on the “Sell” button.

Now, among all the exchange methods, you need to choose Sberbank.

We choose our region so as not to pay a 1% commission for transfers between regions. To do this, scroll through the pages to the right using the buttons located below. The “2/7” button will take us to the second page of seven.

If we have not found our region or the rate of sellers in our region does not suit us, then we choose “Sberbank-other”.

Buyers will then be sorted by the best rate.

What to look for in the table:

- Well. The higher the trader is in the table, the more favorable the exchange rate is for us. So it is advisable to select a buyer from the first page.

- Range of amounts. The minimum and maximum exchange amount is indicated in brackets. Please note that the amount we plan to exchange must fall within this range.

Who will we choose?

As you can see, the first 4 buyers offer a high minimum exchange amount (from 20,000 to 100,000 rubles). If we want to exchange a small amount, then we can stop at the fifth trader (BossmenBTC).

Let's go to his profile.

There is verification, a lot of positive reviews.

Step 3. Replenish your internal balance.

As I already said, the sale of Bitcoins is carried out through the bot’s internal account.

Therefore, first we need to replenish our internal balance. To do this, click on the “Wallet” button in the bot menu.

Then click on the “Deposit” button. After this, our internal wallet number will be displayed.

Now all we have to do is go to our personal wallet and transfer the required amount to the specified address.

Coins will be credited to your balance after the first network confirmation.

Step 4. Make an exchange.

We return to our buyer, whom you selected in the second step.

Click on the “Start Trade” button.

Then we enter the amount we want to change and the card number on which we plan to receive payment.

After this, we need to wait until the buyer transfers money to our Sberbank card.

Once the money is received, click on the “Send coins to buyer” button.

As soon as the Bitcoins are sent to the trader, our transaction can be considered completed.

How to correctly exchange cryptocurrency for rubles. Step-by-step instruction

There are several ways to legally and safely withdraw digital assets such as Bitcoin. We explain the whole process in detail

There are many options for withdrawing cryptocurrency and exchanging it for fiat money. This can be done using exchangers, directly from exchanges, for cash in person and in other ways. We tell you in detail about each of them, about possible risks and commissions and explain whether you need to pay taxes and how to do it.

Exchangers

The most popular way to withdraw cryptocurrency is through exchangers. Special services allow you to sell cryptocurrency and then send money to a bank card, payment system like PayPal and others.

Step by step it looks like this:

- an exchanger is selected;

- the cryptocurrency and the volume to be withdrawn are indicated;

- in response, the exchanger determines the amount received, for example, in rubles, and also indicates the address to which the coins should be sent;

- the user transfers coins to the specified address. In some cases, after this, on the exchanger’s website you need to click the “paid” button. If this is not done, the money will not be transferred;

- when the cryptocurrency arrives at the exchanger’s address, its employees will process the transaction and transfer funds to the user’s account.

Important! When using an exchanger, you need to transfer exactly the number of coins that was agreed upon in the transaction. Otherwise, you may lose funds because the service does not recognize the transfer

The process usually takes about 10-15 minutes, sometimes faster. If more time has passed, you should contact the service’s technical support and find out what the reason for the delay is. There are different reasons. For example:

- The delay may occur due to the congestion of the cryptocurrency network, in such cases transactions are confirmed slowly;

- If there is an error in the data when filling out the application, the cryptocurrency will most likely be irretrievably lost.

The average commission ranges from 1% to 10%, in rare cases it significantly exceeds this value. The fees depend on:

- from the cryptocurrency that the user withdraws;

- from its reserves at the service;

- on withdrawal methods and other factors.

In addition to the commissions of the exchanger itself, part of the fees will be incurred by external payment systems, for example, such as Yandex.money. A fee will then be charged for withdrawing funds to your bank card. This must be taken into account.

There are special aggregators that help users select exchangers. On such services you can filter services by withdrawal methods, prices, customer reviews and other parameters.

It is important to remember that there is always a risk of running into scammers. This could be a phishing site that copies the interface of a real site, or an exchanger that was originally created for the purpose of deception. Therefore, when using an unfamiliar service, you need to be careful; it is advisable to try with a small amount. However, it is also worth considering the fact that attackers can miss a small transaction and freeze a large one.

Exchanges

Another popular way to buy and sell cryptocurrency is through exchanges. Many trading platforms now have the function of direct withdrawal of funds to a bank card. This is convenient and most often safe, but commissions may be higher than those of exchangers.

When cashing out cryptocurrency, the trading platform transfers funds to a third-party service, which then transfers the money to the user. In this case, he immediately pays a double commission, the total amount of which can reach 4-5%. You should always check the withdrawal conditions before taking any action.

When withdrawing cryptocurrency, you should take into account the risk that its rate may rapidly fall. For example, on June 22, the price of Bitcoin fell below $29 thousand for the first time since January of this year. It is safer to withdraw funds in stablecoins - these are cryptocurrencies whose exchange rate is pegged, for example, to the dollar. The most famous of these is the Tether USDT token.

To prevent losses due to a sharp drop in the exchange rate, there is a function to freeze it. Some services, when concluding a transaction, allow you to temporarily fix the price at which the cryptocurrency will be sold. Typically for 15 minutes. However, this option may incur additional fees.

other methods

You can also cash out cryptocurrency using cryptomats - this is an analogue of ATMs. Each of them has its own digital address. The user can transfer funds to it and thus cash out Bitcoin and several other popular coins.

However, crypto ATMs have their drawbacks:

- High commissions, often exceeding 5%;

- Low prevalence. According to cryptocoinmap.ru, there are only 7 of them in Moscow;

- Risk of using a fraudulent device.

Another risky way to exchange cryptocurrency is through cash transactions. For example, during a meeting, transfer digital assets and receive money. It is important that such operations can only be carried out with people you know well and trust. Otherwise, there is a risk of not only losing money, but also putting your life in danger.

There are many ways to cheat. A partner can pay at the wrong rate, lose money when receiving cryptocurrency, appropriate it for himself, citing a technical error, or simply rob it.

A safe way to make a deal with another person without intermediaries is through p2p platforms. The most popular of them is LocalBitcoins. The service guarantees that its clients will not deceive each other.

The main disadvantages of withdrawing funds through LocalBitcoins:

- The price is indicated without the commission that the bank or system will charge for the transfer;

- Due to the low popularity of p2p services, there are fewer offers for sale or purchase on them.

Another non-standard way to exchange cryptocurrency for fiat is through Telegram bots. They allow you to buy and sell Bitcoin and other coins, as well as store them in a wallet linked to your Telegram account.

This option is extremely risky. The user entrusts his money to a complete stranger, with whom he almost certainly will not be able to contact if something goes wrong.

Taxes

Transactions with cryptocurrency are not always, but can generate income. In this regard, the user must pay tax on transactions performed. Its value is 13%, said Yuri Brisov, a member of the Commission on Legal Support of the Digital Economy of the Moscow Branch of the Russian Bar Association.

“Individuals pay income tax. The tax on the sale of property in Russia is 13%. The citizen must deduct from the amount in rubles received as a result of “cashing out” the cryptocurrency, the amount in rubles that he spent on purchasing the cryptocurrency. You should pay 13% of the difference received,” the expert said.

He added that printouts from wallets confirming the generation of income should be attached to the personal income tax form-3 submitted to the tax office. However, there is no such requirement, and the declaration can be submitted simply by indicating the amount of income. Income of individuals from the sale of cryptocurrency minus the costs of its purchase is subject to personal income tax at a rate of 13%.

“To pay tax, you need to submit a tax return in form 3-NDFL to the tax authority at your place of registration in person, by mail, through the MFC or in your personal account on the website of the Federal Tax Service of Russia, and pay personal income tax. Tax authorities may conduct a desk audit of the declaration and request additional documents and explanations. The income tax return for 2022 had to be submitted by April 30; when filing it now, a fine will be charged, and it will increase with each month of delay. But you can still pay the tax on such a declaration painlessly if you do it before July 15,” explained Dmitry Kirillov, senior lawyer in the tax practice of Bryan Cave Leighton Paisner (Russia) LLP, teacher at Moscow Digital School.

Cashing out cryptocurrency in parts and blocking bank cards

Brisov explained that when cashing out cryptocurrency, you should not divide it into small amounts. This will not prevent the bank from checking the transaction if it considers it suspicious. Moreover, dividing one payment into several small ones in international practice is perceived as unfair practice and always raises questions from the monitoring service. Therefore, any “cunning” schemes can bring the wrath of not only the bank, but also law enforcement agencies, upon their perpetrator.

“Experienced participants in crypto-circulation know that banks have “flags” set for certain amounts, so they are often advised to “split” payments into amounts of up to 50 or 30 thousand rubles. The law does not provide for such restrictions on amounts and banks can check any suspicious transaction even for 1 ruble... It is not recommended to engage in “fragmentation”, you just need to indicate the legal basis for the transfer, save transaction confirmations and pay the tax on time. Thus, under the current legislation, cryptocurrency activities should not cause problems,” Brisov shared.

Efim Kazantsev, Ph.D., expert at Moscow Digital School, added that the bank can block funds if a cryptocurrency cash-out operation seems suspicious to it. This is provided for by Federal Law 115-FZ “On combating the legalization (laundering) of proceeds from crime and the financing of terrorism.”

Briefly

There are at least six ways to withdraw cryptocurrency. The most popular way is through exchangers. Aggregators will help you choose a service with the most favorable rate and provide the opportunity to work with a huge number of payment systems. But there is a risk of using the services of scammers and losing money.

The most convenient way to withdraw funds is through exchanges. However, not all trading platforms have this option. Plus, an additional fee may be charged for withdrawing cryptocurrency if the transaction occurs through third-party services.

According to the law, a citizen of the Russian Federation must pay tax when cashing out cryptocurrency. Gray schemes, for example, evading this by splitting the withdrawal amount into parts, can lead to blocking of the card. Such transactions are recognized by banks as suspicious.

— How to buy cryptocurrency profitably and safely. Instructions for a beginner

— How to start trading cryptocurrency. Instructions for a beginner

— How to choose an exchange for trading cryptocurrency. Instructions for a beginner

You will find more news about cryptocurrencies in our telegram channel RBC-Crypto.

Buy Bitcoins from a Sberbank card online - profitable, around the clock

- Manual. On such sites, the operation is completely carried out by the operator: he issues the details, controls the payment and transfers the coins to the recipient’s wallet. Due to the human factor and overload, manual exchangers that conduct transactions quickly and work 24/7 are almost impossible to find. Typically, exchanges on manual platforms are carried out only during specified opening hours; sometimes you have to wait for your turn.

- Automatic. The complete opposite of manual ones: the transaction is carried out mechanically by the platform, operators do not participate in it in any way and are only involved in technical support. On such sites you can exchange money at any time and faster than on the other two types of platforms.

- Semi-automatic. The transaction is carried out by the platform, but is controlled by the operator: he transfers the transaction from one stage to another. Faster than manual ones, but slower than automatic ones, there are restrictions on operating time.

Step 2 . Set up your account. Enable two-factor authentication in the “Profile Settings” block. Select "Enter SMS code", enter the number and click "Check". Confirm to activate the feature.

Possible withdrawal methods

As you know, Sberbank does not work with cryptocurrencies. You can open an account in rubles, dollars or euros, but not in bitcoins. Actually, all other banks operating in Russia adhere to the same policy. Cryptocurrency exists in a semi-legal regime in our country. Therefore, it is impossible to withdraw it directly to an account in any bank and then store it there.

The entire procedure for withdrawing bitcoins from a BTC wallet comes down to exchanging them for a real currency convenient for the user, which is subsequently credited to a bank account. You can do this in the following ways:

- through online exchangers;

- using cryptocurrency exchanges;

- via the WebMoney system.

Let's consider each of the options in more detail.

Features of Blockchain

Virtual money requires interaction with online systems such as, for example, Blockchain.

In addition, for further use of these funds, you need to know how to withdraw bitcoins from the Blockchain to a Sberbank card or somewhere else through a virtual exchanger. Blockchain is a huge database of virtual Bitcoin wallets. It was created in 2011 and operates on the principle of general use. It does not have a centralized management apparatus. The purpose of this system is to protect its users from financial fraud and fraud. In addition, users themselves begin to bear some financial responsibility for their actions with virtual currency. In Blockchain, there is a system of transactions that are automatically verified by it and entered into the network of registries.

Blockchain is a transparent financial system that guarantees the receipt of money into user accounts. At the same time, confidential information of the partners conducting the transaction is completely classified.

In addition, it is pleasant to work with the service, because the transaction speed is high, there is a transfer notification system, clear functionality, quick registration, minimal commission, password generation for each authorized login, as well as clear and detailed statistics on the operations performed.

How to buy Bitcoin through Sberbank?

Bitcoin is exchanged, bought and discussed. This topic is more relevant than ever, even considering the fact that such coins do not have a physical shell. You can't hold them in your hands, but you can get good financial benefits for them online. BTC can be mined, but it is often time-consuming and expensive. Or you can buy it using a Sberbank card for rubles or other currency. There are other ways to purchase. More details about them or how to become a crypto holder:

· From the seller. This is the fastest way, as well as the most risky. Thus, it is easy to fall for a person who will make, to put it mildly, an unfair deal. Therefore, if you prefer this method, it is better to do it through friends or trusted acquaintances. You don't want to lose your savings, do you?

· Earn money by mining. Another way to get a coin. This method takes the longest, but its reliability is high. What does income depend on? It depends on how powerful the source of electricity is, on the power and amount of equipment. The latter requires a lot of attention. The equipment should not overheat, but it tends to do so. Therefore, the best option would be to acquire a special room. By the way, this will not be cheap. Especially if you are planning to build a real crypto farm.

· Crypto exchanger. This method is more popular than the above. It’s easy to buy Bitcoin for rubles or other currencies here. We will talk in more detail below.

If we are talking about Sberbank, then we should take into account that it will not be possible to buy a bank account directly. Therefore, the best option is to seek help from special services that sell crypto. Of course, you will have to pay a commission, but you can be glad that there are many such organizations. Therefore, from a variety of options, you can choose the most profitable rate. Do this using the EXNODE monitoring site, where the ranking table is constantly updated according to course size.

Important! Exchangers that come under the platform’s monitoring strive to be among the top ten. And this is influenced by user reviews, course and other factors. Therefore, the administration of exchange offices is worried about the reputation of the service.

Exchange bitcoins on a cryptocurrency exchange

Cryptocurrency exchanges are online platforms where you can make exchange transactions with cryptocurrency and other digital assets. On crypto exchanges with fiat, you can exchange bitcoins for rubles, dollars, euros, hryvnias and other payment systems.

List of reliable exchanges for exchange:

- Binance.

- EXMO.

- LocalBitcoins.

- Livecoin.

- Currency

Best services

The easiest way to understand the abundance of exchangers is to use the bestchange.ru portal. This site provides its users with a list of the best exchange services. All existing features, weaknesses and strengths of the best resources are described here. Any option proposed here is trustworthy and verified by the mass of cryptocurrency owners.

It’s also worth taking a closer look at the xchange.is portal.

Today this is one of the most reliable btc services and deserves the trust of customers. Being an official partner of many international payment platforms and banks, it is able to offer the user the most favorable conditions. Thus, the commission for exchanging funds here is only 1%.

Exchanges

By withdrawing Bitcoin through exchanges, users have the opportunity to play on the course. In addition, the exchange rate on exchanges is often more favorable than what exchangers offer. Withdrawal of funds is carried out in several stages - cryptocurrency is converted into rubles; the converted amount is automatically withdrawn to the card.

It is possible to become a player on the cryptocurrency exchange after the user passes not only registration, but also verification. The transaction is carried out when the account is replenished using the received exchange details. So, for example, rubles are transferred to the ruble account of the exchange, dollars - to the dollar account. Funds are stored on the exchange until the user decides to conduct a financial transaction.

What is the risk for clients? Firstly, as soon as the first electronic payment systems appeared, malware also appeared. Now they are perfectly adapted to the cryptocurrency world.

Hacker attacks are another reason not to store funds on the exchange. Bankruptcy and closure of exchanges are not uncommon. This is done completely unexpectedly for the client. Therefore, many in such cases simply did not have time to withdraw money to the card. In addition, there are no guarantees for damages.

About the commission

Commission payments take up a significant portion of the total amount, and they vary depending on the chosen method. So, exchangers can ask for up to 15% of the transaction amount, but it all depends on the site’s rating and the speed with which it deposits money. Cryptocurrency exchanges provide services for a commission that rarely exceeds 2%, but it is most profitable, from the point of view of overpayment, to use WebMoney, the average commission is 0.8%. True, this is compensated by the not entirely favorable rate, which is usually lower than at other exchange offices.

How to use Blockchain: instructions for beginners

"Blockchain", or BlockChain, is the most popular external BTC wallet. He is a reliable intermediary when transferring from a Bitcoin account to real currency. Before you can withdraw bitcoins to your card, you must transfer them to your BlockChain account. After this, select the option of transferring cryptocurrency to a Sberbank card account.

Before using BlockChain, you need to register in the system. When using an external wallet, login is carried out using a login and password. The protection is a code sent to the account owner’s phone.

Users can feel free to use BlockChain as an external Bitcoin wallet. The system allows you to install 2-level protection when logging into the system. This allows you to block access to these scammers who have already entered your account after learning the primary password. Security options include a mobile phone or a free smartphone app.