Top businesses

The opportunity to earn passive income always seems like a good idea, but during a pandemic it becomes especially relevant. How to create sources of passive income? Let's look at it in the article.

Passive income is a type of income that requires a minimal investment of time and effort. But it’s worth immediately dispelling the main misconception: passive income does not mean that you need to sit and wait for your account to be replenished without doing anything. Almost every type of passive income requires some work and investment, especially at the start. After that, it will generate income without requiring your activity.

In this article we will look at 12 ideas for passive income. There will be no offers to purchase securities, cryptocurrency or trade on the stock exchange. All ideas are available for implementation, they are suitable for beginning entrepreneurs and do not require specific knowledge.

1. Car as a source of passive income

You can rent out your car to taxi services or rental cars. But you should understand that you won’t be able to simply give away the car and wait for income. We'll have to control everything. First, you will need to understand the legal side of the issue. Secondly, select the right tenant (private individuals, transport companies, local taxi companies, aggregators) and determine the terms of cooperation with them. Thirdly, it is worth drawing up a plan for the income and expenses of the project in advance to determine how beneficial it is in your particular case.

As a rule, in a city with a population of over a million, a leased car can bring in 1-1.5 thousand rubles per day, and 30-40 thousand rubles per month. But you should take into account the wear and tear of the car, possible repairs, maintenance costs, insurance, etc.

This idea is suitable for those who are well versed in the intricacies of taxi companies and transport companies.

So, in theory, this is a highly profitable business, but, as practice shows, the process is very risky and troublesome. For example, to reduce the risk, you can rent out a car not as a taxi, but for personal use - companies often rent cars for their employees. Or choose another way to make passive income from a car.

A simpler and safer option is to use the car as an advertising medium. All you need to do is place an advertisement on your car. To find clients, you can contact advertising agencies, place an ad on Avito, or look at specialized services like Wrapify and Carvertise.

The amount of income will depend on the advertising space: the larger it is, the higher the income. For example, you can place a large banner on a truck - thanks to such advertising you can earn about 10 thousand rubles per month. A lightbox placed on the roof of a car brings in 3-6 thousand rubles per month.

What kind of income can be called passive

The understanding of what passive income is was revealed to me by the parable about the plumbing from Robert Kiyosaki’s book “The Cash Flow Quadrant”. Since then, all I have been doing is creating such streams of money in my life.

Passive income is income that does not depend on daily activities. Such income includes interest on deposits, dividends, rental payments, affiliate commissions, advertising fees, royalties from sales of intellectual property and patents.

And active income is the payment you receive when performing some action or from selling your services.

There are hundreds of ways to earn money passively. Let me tell you in more detail using specific examples.

What is income

Concept of types of income

Income

is money or other material resources that the state, company or individual receives as a result of any activity over a certain period of time. Some economists define income as the money a company or individual can spend without harming its economic condition.

In economics, income means the sum of all funds that came into a company over a certain period. A similar concept is profit, which is calculated by subtracting costs from income.

☝️

Read the full article: Net profit: how to calculate, formula, examples

To generate income you need to have resources. Among the most common are the following:

- Professional knowledge and skills;

- Capital;

- Earth.

There is no single classification of income; types of income are determined depending on factors. Below you will find a detailed description of the most common types of income.

Save money in a bank deposit

I created my first source of passive income when I was still working as an installer and receiving a salary of 20,000 rubles. I just started saving a small part of my active monthly earnings for a deposit in the bank. So I began to receive money every month, in the form of interest from my savings.

Complete information about current strategies that have already brought millions of passive income to investors

Then this source seemed ridiculous and cheap, devoured by frightening inflation, but now it has turned into capital of several million, which brings tens of thousands of rubles monthly and is reinvested in more profitable instruments. The money started working.

I recommend you read my article about the power of compound interest. You will learn how money can increase tenfold over time and turn into huge capital.

If, from today, you start putting aside 1,000 rubles each month at an interest rate of 7%, then:

| Time | Your investments | Total savings | Monthly passive income |

| After 5 years | 59 000 | 72 020,73 | 425,65 |

| After 10 years | 119 000 | 174 133,24 | 1 029,14 |

| In 20 years | 239 000 | 524 198,61 | 3 098,05 |

| After 40 years | 479 000 | 2 643 313,04 | 15 622,16 |

I think everyone can save 1,000 rubles a month and invest it in capital accumulation, even with a small salary and during a crisis. In the future, you will be able to invest part of the accumulated funds in more profitable areas at a higher interest rate.

Most of the methods that I will talk about next require financial investment, so if you want to create one, then start saving money.

Vending

Vending is suitable for those who want to make maximum profit with a minimum of effort. Starting such a business is quite simple and quick, with a starting capital of 100 thousand rubles. With this money you buy a vending machine for a specific product, install it in a crowded place and start earning money. Your participation in the business is minimal: it is enough to come 2-3 times a week to replenish goods or consumables and collect the proceeds.

The most popular vending machines brew coffee and dispense snacks. But today the vending format is relevant for a wide variety of goods and services. A vending machine for jewelry, lenses, flowers, accessories for smartphones, a vending machine for printing photos from social networks and photo booths - all this can be classified as a vending business. Guides to starting a business using a variety of vending machines can be found here. And here is a selection of 90 unusual vending machines.

The essence of this format is the possibility of a quick start with small investments and minimal participation in the business.

Rent out your property

A room, apartment, house, garage or just a piece of land can be rented out for long-term rent and receive passive income in the form of rent. Many people dream of buying a couple of apartments, renting them out and doing nothing. Only this requires funds.

There are many options for purchasing real estate and generating income from its rental. You also need to learn this, study the market where you are going to buy real estate, know the legislation, look for ways to save on repairs and maintenance.

31.12.2019

5 634

Where to invest a million rubles: available tools, strategies and investment rules

Hello, friends! If you have a question about where to invest a million...

When I was a student and studying at a college in another city, my sister and I rented a room from a woman about 50 years old. She lived in a 3-room apartment and simply rented out one of the rooms to us for several thousand rubles. Why not? At a minimum, she covered utility bills for the same apartment.

If you don’t have the means to purchase real estate for rent, you can borrow money from the bank, rich relatives, friends, or work harder and earn money. Buy real estate, rent it out and pay off the debt from the rent received. Essentially, you get by without investing.

Last year I had my first experience buying an apartment. True, we bought it for personal use and cost optimization. Previously, we had to pay rent of 20–30 thousand per month. Now only utilities are 3 – 4 thousand + property tax once a year. It turns out that expenses were reduced by 15–25 thousand rubles.

On the blog you can read a series of articles about investing in real estate, where I use a real example to talk about all the methods and nuances of creating such a source of passive income.

Buying websites with income

Recently, a source of passive income such as purchasing a ready-made website has become popular. There are unprofitable and profitable projects, so sites are constantly selling and buying.

Where can I buy a website? There are various services that allow you to buy or sell a website and ensure the security of transactions. The services act as an intermediary and receive their percentage of the transaction. Exchanges where you can buy a site:

- Telderi is the largest Russian exchange. It is an auction of websites and domain names;

- Flippa is a foreign exchange. On it you can very often buy a website with a company, i.e. ready-made business;

- Bitus is a private exchange of Internet projects.

- PR-CY.ru – the service conducts auctions for the sale of websites and does not take a commission, so all risks remain with you. But for 5% of the transaction amount, the service provides guarantor services.

As a rule, the price of a website is calculated based on the return on investment of the project. But it all depends on the monetization method: sites with passive income are more expensive.

Thus, purchasing a website is a profitable investment that can quickly pay for itself and generate profit. The main thing in this matter is to be able to correctly analyze offers and buy promising sites.

Learn to invest money

If you already have savings or free money, then start investing it. There are many investment instruments that generate passive income in the form of dividends and growth in asset value:

- securities,

- currency,

- precious metals,

- real estate,

- cryptocurrency,

- business and startups,

- information sites, etc.

Especially for beginners who don’t know where to start, I’ve put together a whole guide to investing. Start studying this topic and take your first steps.

Determine the life cycle point

You may be single or married with no children and two incomes. Or maybe your wife is planning to leave her job to have a child. Or you have very little left until retirement. This information will help in calculating the required level of passive income.

Let's say you want to invest in real estate to make money on rent. Will your current budget support your mortgage costs? What will you do if you can’t find tenants: will you be able to cope with your regular expenses? Will you be able to repay your home loan early?

Create and automate your business

In most cases, a business is an active income, since you have to work yourself to develop and maintain it. Sometimes it's even worse than regular office work.

But what prevents you from turning an ordinary business into passive income by automating all processes and assembling a good team. I know many entrepreneurs who own a business and are not involved in it. So to speak, they retired from business, transferring all tasks to managers, while keeping most of the profit for themselves.

More than 100 cool lessons, tests and exercises for brain development

Start developing

Get creative

Singers, musicians, photographers, artists, writers, videographers, filmmakers all end up making passive income from selling their products.

You can spend time writing a book or song and receive royalties from its sales for the rest of your life.

Photographers and artists can make money by selling their images by posting them on stock photo sites. I myself have bought photos and graphics for my projects more than once. The cost of one image can reach several tens of thousands of rubles.

Video and audio tracks are sold in the same way on similar sites.

Develop your personal brand (name)

In English there is a word “influence”, which means “to influence”. From him the concept of “influencers” was formed - people whose opinions matter to a certain audience.

These are bloggers, experts in their niche, famous personalities who have created their name. By having people watch them (followers), they can earn passive income from the content they produce through advertising and recommendations.

In 2015, when I switched to remote work, I immediately began to promote my personal brand on the Internet and be active on social networks. I understood that this was profitable and could bring good passive income in the future.

Literally a few months later I found products that I began to recommend on my pages and receive commissions from sales. Here is a screenshot of my first income from blogging.

After some time, I stopped advertising these products, but surprisingly, the income from them is still coming in. Since all my posts remain, my subscribers continue to find and read them.

Trust management

Trust management is the most favorable option for passive income. A PAMM account gives the investor up to 120% per year. A PAMM account is an account where investors invest their finances, and the broker is responsible for the technical part of distributing income and expenses.

In this way, the risks of losing money are reduced if an exchange participant does not have experience in trading. It's good to have several managers. This diversifies the portfolio. The longer the accounts are open, the higher the profitability will be.

Indices and funds

If you look at stock charts for indices, you can see that their profits are not as high as we would like. But it is always there. ETF funds are packages with shares of several companies, from 10 to 30 pieces in one package in equal parts. The packages are entirely dependent on the fund's index (such as the Dow Jones). Therefore, when you purchase one share of an ETF, you purchase the entire package.

In America and Europe, funds are popular because of their security. The risks here are minimal. And buying and selling can be done at any time if the exchange is working.

Forex transactions

With this option, the income will come from the work of an outsider. In other words, there are professionals in Forex who carry out buying and selling transactions. You look at their work and connect with them. When a trader opens a trade, you have a copy of it open. That is, your money remains with you.

This is what the trader's page looks like.

The only thing is that you need to pay a commission for copying a transaction - up to $30 monthly. Although such a fee is considered profitable, with a moderate investment. Because traders can take up to 50% of the proceeds from a transaction from PAMM accounts. Here the fee is fixed. And many traders help to make sufficient profits over a long period of time.

Own business

An option with the prospect of a good income. Since it is possible to take control of all investments. This is not an active business where you need to do half the work yourself. An excellent option would be to buy a ready-made, established business with staff and management. Or consider options with Internet ideas, creating services or applications. You hire a team, they create an application or service that subsequently brings a stable income. This includes services for verification, analytics, statistics, etc.

Record videos on YouTube

With absolutely no investment, you can create passive income using YouTube. It pays video creators for the opportunity to show ads to viewers while watching.

Your videos can be watched by thousands of people 24 hours a day, and you will earn income from it even while you sleep.

Here’s an example of one of my “Knowledge Base” channels. We publish educational screencasts on it. Let's look at monetization analytics.

Passive income from videos on the channel is 40 - 50 dollars (2,500 - 3,200 rubles) per month. Naturally, the more videos and views there are, the higher the earnings.

Create an information site

Essentially, the site is the same as YouTube, only instead of videos you publish articles. Like the one you are currently reading.

Users find an article in a search, go to the site, read and sometimes click on an advertisement. The user received a solution to his problem, and the webmaster did not waste his time. Everyone is happy.

I have already talked more than once about ways to make money on the site and how it brings passive income around the clock.

Investments are minimal. To launch a website you will need less than 1,000 rubles. My course “How to create your own information website” will help you with this. Then all that remains is to regularly update it with articles. In a year or two it will begin to generate good profits.

Bank deposits

Despite everything, bank deposits remain the most popular financial instrument.

This is the base where everyone starts. It is clear that it is difficult to directly “earn money” on a deposit in Russia today, but you can at least save money from the influence of inflation. With the help of recommendation services like Banki.ru and Sravni.ru, you can find good deposit options with a yield of 6.5% to 9%. At the same time, according to the Central Bank’s forecasts, in 2022 inflation should not exceed 5.2%. There are also opinions that these forecasts are inaccurate due to a very liberal approach to collecting statistics, and real inflation may exceed 10% - but even in this case, a good deposit will at least help reduce the damage.

Screenshot: Banki.ru

The advantage of this option is high reliability, deposits up to 1.4 million rubles are insured by the state, and so far there have been no cases where depositors would not have had their money returned after a bank went bankrupt.

Develop a useful service or program

I have to use dozens of paid services, different programs and applications on my phone every day. Every month I pay a subscription fee for them. Surely you, too, have paid at least once for similar tools that help solve some problems.

Passive income consists of the fact that the developer, having created such a service, sells monthly access to it.

Or it could even be completely free, but contain ads. Here's an example of the LightShot screenshot program that I and millions of people use every day. It's free, but when you upload a screenshot to the cloud, it appears with ads. I think developers make good money this way.

Get involved in affiliate programs

Now affiliate programs bring me passive income of 200,000 rubles per month. I started doing them only 4 years ago.

There is a separate section on the blog in which I told everything about them: what they are, what types exist, how and how much you can earn from them. And in the Knowledge Base you will find a whole course “How to make money on affiliate programs.”

I built a source of income on affiliate programs completely without investments. When they started to make a profit, I began to invest part of the money in paid promotion tools.

The essence of building passive income is that you either create endless traffic for an affiliate product, or bring clients through affiliate programs to those services that require constant payment from the client. You bring a client once and every time he pays for the services of any service, you receive your commission.

Sources of passive income: 15 ideas for a quick and easy start in 2022

Simple ways to generate passive income

As mentioned above, to create a source of passive income you need starting capital

. In some cases, you can get by with just a temporary investment, but even here you will need minimal savings, such as purchasing a domain and hosting when starting your own blog, or high-quality professional photos when creating your own blog.

This section describes sources of passive income that are available to users of any level of investment knowledge, as they are less risky and easier to start.

☝️

However, remember that even if you choose one of the simple methods below, before investing money, you need to study the information in detail and assess the possible risks.

Bonds

Generating passive income with bonds

Bond

is a debt security in which the issuer undertakes to return the borrowed money and interest on it within a specified period. Both companies and the state can issue bonds, but the latter are considered more reliable.

Bonds are the choice of conservative investors and are one of the lowest risk instruments. When choosing, you need to pay attention to two important factors:

- Net profit;

- The share of equity in assets (the best indicator is considered above 50%)

.

You can earn about 6% per annum on bonds by purchasing government debt securities, and 15-20% on high-yield bonds. For investment you will need at least 1,000 rubles, but you won’t be able to earn much with such starting capital.

☝️

Read the full article: Bonds as a type of investment

Real estate

Earning passive income from real estate

The real estate market is a popular source of creating passive income, which even now, in the era of mass virtualization, has not lost its relevance. There is room to expand here, because this area is not new and there are a sufficient number of ways to make money in it.

☝️

The only negative is the high entry threshold, it is at least 1.5 million rubles when purchasing real estate.

Ways to make real estate a source of passive income:

- Short-term and long-term rental of an apartment

makes sense only in big cities, otherwise supply will exceed demand, and the price will have to be significantly reduced to find tenants. The minimum required amount is 1.5 million rubles, but it greatly depends on the city. You can rent an apartment long-term through Avito, short-term - through Avito, Booking or AirBnb. The yield is about 5-7% for long-term rentals and about 10% for short-term rentals; - Leasing commercial real estate

- there is already a higher entry threshold, which is at least 5 million rubles, but in general you need to focus on 10 million rubles. However, you can earn above 10% (a good result). 10% is an average figure, but if the profitability is below 10%, then such a business is considered unprofitable; - Real estate abroad

can provide a yield of 20% per annum (average value 10-15%), but this business is associated with certain difficulties. In particular, both rental and resale (if you buy an apartment at the foundation pit stage) will have to be carried out through intermediaries. The entry threshold is from 2.5 million rubles; - Creating a hostel

- you can buy a spacious apartment on the ground floor, divide it into rooms and rent it out through Booking or AirBnb. If you don’t want to spend personal time communicating with guests and organizing arrival and departure, you can hire a management company. The required starting capital is from 10 million, and the profitability can reach up to 15-16% per year; - Apart-hotel room

- you can purchase a separate hotel room and rent it out through the hotel management company. The entry threshold is 2.5 million rubles, income is about 15% per annum. However, this method has one very serious drawback, which is that if the hotel’s rating on Booking or another service falls, then the income will also fall, and it will be very difficult to sell such real estate, because no one wants an unprofitable business; - New buildings at the foundation pit stage

- the purchase of a future apartment for the purpose of subsequent resale. Entry starts from 1.5 million rubles, and you can earn about 30-50% one-time; - Sublease of real estate

- the essence is to rent a premises for a long period (the price is more favorable than when renting for a couple of months), after which individual rooms are rented out. This can be either commercial or residential real estate. The entry threshold is about 200,000 rubles, and the income is about 15% per annum. However, keep in mind that responsibility to the owner of the apartment falls not on the subtenants, but on the tenant, so the choice of tenants must be taken very seriously.

Bank deposit

Passive income on a bank deposit

Bank deposit

- a standard and time-tested source of passive income. All banks offer to put money on deposit and receive income in the form of interest. Most banks offer deposits in both rubles and dollars. For ruble deposits, the annual rate usually does not exceed 7%, and the minimum initial amount is 1,000 rubles. On dollar deposits, on average, you can earn 2% per annum with a minimum deposit of $100.

Despite the fact that a bank deposit is one of the easiest ways to earn passive income, there is a big drawback that in the event of bankruptcy, the bank has the right not to return deposits and earned interest.

☝️

Also, given the current situation with the crisis and rapidly growing inflation, bank deposits are not the best source of passive income. Moreover, some banks introduce negative rates, this is when the client must pay the bank for storing funds on deposit.

Mutual funds

Mutual investment funds as a source of passive income

Mutual investment fund (UIF)

) is an association of investors without creating a legal entity, in which each participant owns a certain share of the fund’s property. Management is carried out by a management company - an accredited stock market investor.

The company charges a commission for managing the fund, which usually ranges from 2% to 5, which is quite a lot.

For example, with a difference in commission of only 2.5%, about 58% of the mutual fund’s income is “eaten up” in 20 years.

In addition, profitability is highly dependent on the choice of the management company in which securities to invest.

Own website or blog

Passive income on your own blog

Earning money on websites is one of the very first ways to generate passive income since the time when the Internet became a mass product. There are several ways to make money, but each of them will require either investing money or a lot of personal time.

In the first case, we are talking about buying an already promoted website on a certain topic or starting a website from scratch with the involvement of professional authors, who, naturally, will have to pay for the content, as well as an SEO optimizer, which will attract traffic to the site. The average entry fee into such a business is 100,000 rubles, and the profitability is up to 65% per year.

In the second case, you can save money if you are well versed in a certain topic and know how to clearly and competently express your thoughts in writing. In addition, you will have to gain knowledge in the field of SEO optimization if you are not willing to pay a specialist. However, keep in mind that promoting a website created by the efforts of one person, with proper organization, can take from several months to several years.

There are two ways to monetize websites:

- Search advertising by Google and Yandex. Passive income comes from impressions, clicks and leads. Payment is calculated daily and can range from 5,000 to 300,000 rubles per month. In most cases, one person owns 10 websites, each of which brings in about 30,000 rubles per month;

- Direct advertisers - at the initial stage, while the site is not yet particularly popular, you will also have to search for advertisers in a certain field. Earnings vary depending on the area and specific case, so it is impossible to give specific figures.

There is another way to make money on sites. To do this, you create a landing page on a specific topic, for example, that your company allegedly creates custom fireplaces. Next, you optimize the site and attract traffic to it. True, it’s worth saying here that promoting a landing page organically is very difficult, if not impossible, so there will be additional costs for contextual or targeted advertising.

After attracting leads, you need to find a company that provides these services and agree to rent out the landing page. Both monthly payment and payment for each lead are possible. On average, you can earn about 20,000 rubles per month this way.

YouTube channel

Passive income on YouTube

YouTube is an open platform, and everyone can present their creativity and earn real money from it. If you have acting talent and are knowledgeable about a particular topic, starting a YouTube channel can be a good source of earning passive income. True, before this you will have to actively work on promoting the channel.

There are three ways to make money on YouTube:

- Google AdSense Affiliate Program;

- Direct advertising from companies and brands;

- Donations from subscribers and sponsorship.

In 2022, in order to monetize your YouTube channel, you need to achieve certain results:

- More than 1,000 people must be subscribed to the channel;

- Watching time must be at least 4,000 hours within the last year.

- As for the amount of income, it very much depends on the subject of the channel and the content produced.

For each 1 owner receives from $20 to $50.

And as already mentioned, you can additionally earn money through direct advertising or donations.

Personal brand on Instagram

Creating a personal brand on Instagram

With the advent of Instagram, a new way to earn passive income has appeared - creating a personal brand and cooperation with companies and brands. However, here, as in the case of a YouTube channel, you will first have to work on promotion and reputation. And this will require funds and a lot of personal time.

How much you can earn in this way is a very difficult question, because it depends, not least of all, on luck, which companies will pay attention to you. But in general, the prices are approximately the following in 2022 (the price is indicated for one advertising campaign):

- 4,000 - 10,000 subscribers - 500–1,000 rubles;

- 20,000 - 13,000 subscribers - 2,000 - 5,000 rubles;

- 50,000 – 100,000 subscribers – 10,000–30,000 rubles.

☝️

Interesting fact! Dwayne Johnson, before signing a contract to star in a new film, takes an additional $1 million for advertising it on his Instagram account.

There is also data on advertising on Instagram of famous personalities of Russian show business:

- Olga Buzova’s one advertising campaign costs 250,000 - 300,000 rubles;

- Sergei Shnurov has 1.5 million rubles.

Works of art

Passive income from a work of art

If you have well-developed creative abilities, you can provide yourself (and in case of phenomenal success, also your children and grandchildren) with passive income by creating a work of art. It could be a book, a song, a painting, etc.

For example, if you wrote a book, you can publish it on the Internet and earn income from each download by users. You can also try to contact a real publishing house and receive passive income from the sale of copies. However, there is a risk of being rejected due to high competition among authors.

In the case of a song, everything is even simpler, since the video clip can be posted on YouTube, ensure good promotion and, if the result is good, receive payment for views and receive orders for performances. You can also upload your songs to iTunes, Spotify and similar platforms.

Patent for technology or device

Passive income from patents

One of the oldest sources of passive income, which however is available to few, is receiving income from the use of patented technology by manufacturers. If you do not have a sufficient budget for the development or presentation of technology, funds can be raised through crowdfunding.

Courses

The second name for this activity is information business. If you are an expert in a certain field, develop a course or webinar and earn passive income from downloads. Webinars can be conducted via YouTube or Zoom. And the well-known educational platform Udemy is suitable for selling courses.

Earnings from referrals

How to earn passive income from referrals

Referrals

— these are users who followed your link within a specific program. The bottom line is that the more a referral uses the service (the greater his turnover), the more you earn. Referral programs are offered by stores, cryptocurrency exchanges, sites for making money on the Internet, etc.

You can attract referrals by placing referral links on various resources: websites, blogs, social networks, through email newsletters and instant messengers.

Earnings range on average from 1% to 50% of the amount spent/earned by the referral.

This method does not require investment of money, but you will have to spend a lot of time to make it a truly profitable source of passive income.

Purchasing an existing business

Passive income from a ready-made business

Everything is simple here - you need to find profitable offers for the sale of an already established business, conduct a thorough audit of it to identify all the shortcomings, remove bottlenecks and receive income from work.

☝️

However, you need to be very careful when buying, since usually no one will sell a successful and profitable business.

To make business income truly passive, you need to transfer control to a responsible person, but this should only be done at the stage when. In addition, you should very carefully choose the person to whom you are going to delegate your responsibilities. But remember, transferring control to a trusted person is always a risk.

In addition, according to a recent study, companies run by founders, rather than hired executives, earn more.

Renting out equipment or transport

Passive income from renting out equipment

This method brings good passive income and requires minimal activity. As a rule, the cost of short-term rental is quite high, so the costs of equipment or transport will pay off very quickly. However, on the other hand, you need to be prepared for the fact that tenants can damage or even completely render the property unusable.

You can rent out different types of equipment: commercial, industrial, production, construction tools.

If renting a vehicle is of greater interest to you, then you can start by renting bicycles, scooters or modern electric modes of transport. The initial capital in this case will be significantly lower than for organizing car rental. However, this type of activity is only suitable for large cities where transport rental is a popular service.

Advertising on LED screens

Passive income from LED screens

An LED screen can become a source of stable passive income.

☝️

However, first you need to find a profitable advertising space and agree on a lease with the owner - exactly where the LED screen is located ensures 60% of success.

You also need to find clients, preferably for long-term rentals.

The initial investment is from 1 million rubles, which will pay off within one to two years.

You can earn up to 50% of your investment monthly with constant screen operation. 1,000 seconds of broadcast (100 impressions/day for 10 seconds) costs approximately 25,000-30,000 rubles per month. When the screen operates 18 hours a day, the maximum number of impressions will be 550-860.

For example, if you enter into a long-term lease with five companies, then you can earn 150,000 rubles per month, with 10 - already 250,000 rubles, excluding expenses. If you organize your work competently and take a responsible approach to finding clients, then you can earn 750,000 - 900,000 rubles per month.

Earning money on stocks

Passive income from photo stocks

You can use this source of passive income if you create a database of images (photos or illustrations) and upload them to special sites (microstocks). Some sites also allow you to upload videos and 3D models. Payment is charged for each download, and the site takes a portion of the earnings in the amount of 40-80%. You can also sell image rights. in this case, you can earn more, but the picture will no longer be able to generate passive income.

The amount of earnings depends very much on the site, specific works, the author’s ability to “feel the trend” and profile rating. On average, you can earn the following amounts per month from stocks:

- 100-500 works - $50-100

- 500-800 works – $200-1000

- More than 800 works - $1000-5000.

The most popular and largest microstocks:

- Shutterstock;

- Stock Adobe;

- DepositPhotos;

- DreamsTime.

10 more ways to earn passive income are described in the video below:

10 ways to make passive money

Try network marketing

The method is similar to working with affiliate programs, only you are constantly dependent on some company and their product.

I was engaged in network business even before I came to the Internet. I know how it works and what it is. You can build passive income on it if you find people who will figure and sell for you.

This method is paid, since in most online companies you have to pay to enter the business. You will have to buy a product in order to generate passive income for everyone who succeeded before you.

Honestly, this type of income is not for everyone; you need to become a real leader-activist in order to assemble a good team and constantly motivate it to action.

You can try it, I learned a certain amount from it. As a rule, a good school of sales and personal growth has been built there.

How to get high passive income: the most profitable ways in 2022

Risky ways of obtaining passive income

The methods of obtaining passive income described above were simple and relatively risk-free, i.e. they are theoretically suitable for anyone.

Below we will describe sources of passive income that require knowledge of the stock market and how financial instruments work. In addition, these methods involve high risk, so diversification of investments is mandatory in this case.

Stock

How to invest in stocks to earn passive income

Stocks

- This is one of the most popular and profitable ways to generate passive income, but it is also the most risky. To start making money on securities, you need to at least master the basics of technical analysis and study how the stock market works. To start working with shares, you need to open a brokerage account.

On average, stocks earn 20% per year.

There are two ways to earn income in the stock market:

- Dividends

- the average income is only 3% per annum, but you don’t need to do anything; - Participation in trading

- here you can earn the above-mentioned 20% per year, and with active daily trading with an understanding of the processes, much more, however, in this case, passive income turns into active.

The most risk-free stocks that are suitable for beginners - “blue chips”

(securities of well-known companies) - they provide a stable, relatively small income. You can earn significantly more by investing in undervalued stocks, but this method is more suitable for advanced users, as it involves a higher risk.

☝️

Read the full article: Stocks: how to buy them and how to make money on them

REIT

Passive income from

real estate investment trusts (REIT)

are real estate funds on the American stock market. on which you can invest through brokers. They can be hired from both American and Russian specialists, but if you choose the latter, the choice will be very small.

REITs engage in a variety of real estate transactions, including construction, buying and selling, and leasing. Those. When you invest in a REIT, you are investing in a real estate business.

☝️

These funds direct 90% of their profits to dividend payments, so you can earn here on average up to 75% per annum.

However, there is one drawback to this type of passive income: in times of crisis, REIT quotes fall in the same way as stocks. That is why we included this method of passive income in the section for experienced users.

Trust management

Passive income on trust management

Trust management

- This is a very simple way to organize passive income, but it is very risky in the sense that finding a professional and responsible trader is not an easy task.

The only plus is that you don’t need to waste your time at all, since trading is completely handled by a hired specialist. However, he has more advantages than you, since in the case of successful trading he receives a profit, and in the case of unsuccessful trading, all losses fall only on you.

Therefore, you need to approach the choice of a trader as responsibly as possible. To do this, you need to pay attention to three important points:

- Checking the brokerage report - the ratio of successful and failed transactions;

- Account monitoring;

- Only you should have access to depositing and withdrawing money; the trader will only have enough rights to conduct trading operations.

Cryptocurrencies

Passive income on cryptocurrencies

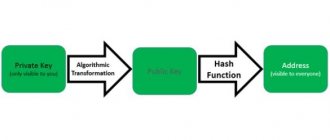

Cryptocurrencies

is a new financial instrument, so by default it has an increased risk. Bitcoin and alcoins provide very wide opportunities for earning money. The cryptosphere can offer the following ways of income:

- Trading - Unlike stocks or REITs, you don't need a broker to trade cryptocurrencies. All transactions take place on cryptocurrency exchanges, where anyone can register. However, trading takes time;

- Mining is the extraction of cryptocurrencies using powerful computing equipment. The most popular cryptocurrency for mining is Bitcoin, but creating such a mining farm requires serious investments;

- Staking - participation in the network as a validator to confirm transactions. No special equipment is required, but investments are required to purchase a deposit for staking;

- Participation in IEO means buying a coin at the pre-sale on the exchange, after which it can be sold at a much higher price;

- Creating your own cryptocurrency will require serious investments in the development of truly unique technology, promotion and marketing of the coin, as well as legal issues related to regulators.

It is difficult to determine the specific profitability that can be obtained on cryptocurrencies, since this area is still very young and each of the methods described above has its own characteristics and nuances.

ETF

Passive income on ETF

ETF(Exchange Traded Fund)

- another way to receive passive income in the stock market, which is a ready-made set of shares, gold, bonds and other assets. There are also ETFs that represent entire sectors of the economy, such as information technology, medicine, energy, etc.

On the Russian stock market, the choice is limited to only 40 ETFs, since this instrument appeared only in 2013. Features high commissions for providers. However, the entry threshold is from 1,000 rubles, and passive income ranges from 5% to 45% per annum.

In the American stock market, the choice of ETFs is much wider - there are about 2,000 of them. Commissions are much lower than for Russian ETFs. Entry into the tool is only $50 and you can earn from 5% to 50% per year.

Sell your knowledge

If you are an expert in a certain field, you can package your experience (knowledge) and sell it. For example, create a training course, write a book, make short instructions or checklists. In another way it is called “Infobusiness” - information business.

You can create educational materials on any topic, even in gardening, vegetable gardening, cooking and others. You just need to find something that will be interesting and useful to people.

I recently started selling my knowledge, but the income from this is already approaching a million rubles.

In the Knowledge Base you can find my courses on remote work, website creation, affiliate programs and others.

IIS accounts

Another good option “for dummies” who have some money, but do not have the knowledge and skills to invest it wisely.

An individual investment account is an attempt by the state to increase the financial literacy of the population and attract private investors to the stock exchange. It works like this: When you use the account, you can get two types of benefits. The first of them is a tax deduction (13%). To receive it, you need to deposit money into an IIS and also have official, taxable (NDFL) income. For example, if you deposit 400 thousand rubles into an IIS, then the maximum you can return as a deduction is 52 thousand - for this you will need a salary of 33 thousand per month.

There is only one drawback here - according to the rules, the money must remain in the IIS account for three years; you can withdraw it earlier, but then the deductions will have to be returned.

The second type of benefit when using IIS is exemption from income tax from transactions on the stock exchange. This allows you to combine the IIS with the previous point and buy OFZ funds with the deposited funds. This way you can receive your 7%+ interest and also take a deduction. In this case, you don’t need to make any special moves - open an account with a broker, buy OFZ and fill out an application for a deduction.

Learn financial literacy

This method, in theory, should be put first on the list.

Study finance and everything related to it. Look for ways to save, save and grow money. Study the laws, follow the latest developments in the field of finance.

A simple example. About 7-8 years ago, banks began actively introducing such a bonus for clients as “Interest on the balance” - the accrual of interest on the money that was simply lying on the card. I was already following the banks then and immediately changed the bank. I abandoned the predatory Sberbank and switched to Tinkoff.

Now, in my opinion, Sberbank still does not have such a function; people pay the bank for its services, and not vice versa. It turns out that banks pay me, I receive passive income in the form of interest on the balance, interest on deposits, cashback and other bonuses.

In addition, by studying finance, you can receive money from various benefits, government programs, reduce your taxes, and so on. There are a lot of things people don’t know and, thanks to their financial illiteracy, they lose money.

Ideas that require minimal investment

Rent a room

If you live alone in a two- or three-room apartment, then you have a very profitable tool for passive income. Firstly, renting out a room will allow you to share the costs of housing and communal services with the tenant. Secondly, every month you will receive an amount that is enough to survive in the absence of other sources of income.

Of course, living with a stranger in your own apartment is a process for the strong in spirit. But perhaps you are just such a person and this method suits you.

Monetize your hobby

If you have a passion that brings tangible results, you can start selling the fruits of your labor. Let’s say you are a talented carpenter and have already given stools to everyone you know, or you like to embroider, but don’t know what to do with the finished canvases. You are passionate about the process, and therefore there are more and more finished products, and it is not clear what to do with them.

Create profile pages on social networks, accounts on popular trading platforms, for example Etsy, Crafts Fair. There will definitely be someone who will appreciate your talent. But remember: as soon as you start making things specifically for sale, passive income will turn into active income.

Try it