High frequency trading is one of the main methods of algorithmic trading in financial markets. This method involves the use of software that allows you to open and close trading positions almost at lightning speed.

High frequency trading requires a fairly powerful computer and a good connection to the Internet . Any lag or other delay may result in you not fulfilling the conditions of the Forex strategy and incurring a loss.

The history of this method dates back to the late 90s of the last century, when the American Securities Commission SEC gave the green light to the use of electronic Forex trading platforms. Essentially, high frequency trading is a method of scalping the market . Trades were opened for a few seconds.

Over time, of course, the time to hold positions decreased even more. Now it is only a fraction of a second. This is how high-frequency trading differs from other methods of working with financial assets.

Today, the average time for holding positions by such Forex traders is no more than 22 seconds. At the same time, a large number of applications are sent. High-frequency trading is used mainly so that a trader can avoid transferring his positions to the next trading day and still earn quite good money.

High-frequency trading involves opening transactions with a large volume . The targets are usually very small (given that trades are held for a fraction of a second). Sometimes the profit on one trade can be only a few cents. Therefore, large volumes are important here to obtain large profits.

It is worth immediately noting that this trading method carries quite high risks . The fact is that it does not involve the accumulation of positions. High-frequency trading is the process of opening and closing positions within a few seconds, and sometimes even fractions of seconds. Accordingly, there are high risks of losses.

We can say that high-frequency trading is a type of scalping strategy, and quite an aggressive one at that. When opening trades in large volumes, you must understand that if you hold positions for a long time, losses can be colossal.

In principle, HFT trading is a competition exclusively between such scalpers . The profit on one trade will be really insignificant, at least when compared even with those who trade intraday, but without scalping.

HFT trading is especially popular among those who have a faster Internet access channel. Due to this, the trader, firstly, can obtain the necessary information faster than others, and secondly, send an order to open a transaction faster than others.

That is, if you have a weak Internet, which is characterized by lags and other delays, it is better not to engage in this type of trading.

History of HFT creation

You may be interested in: Information and trading platform MetaTrader 4: reviews

HFT is a form of algorithmic trading in finance created in 1998. As of 2009, high-frequency negotiations accounted for 60-73% of all equity trading volume in the United States. In 2012, that number dropped to about 50%. The level of high-frequency trading today ranges from 50% to 70% of financial markets. Companies that operate in the high-frequency trading industry compensate for low margins with incredibly high trading volumes numbering in the millions. Over the past decade, the opportunities and returns from such trading have declined sharply.

HFT uses sophisticated computer programs that predict how markets will perform based on a quantitative method. The algorithm analyzes market data for listing opportunities, observing market parameters and other information in real time. Based on this information, a map is drawn in which the machine determines the appropriate moment to agree on price and quantity. Focusing on the division of orders by time and markets, it selects an investment strategy in limit and market orders; these algorithms are implemented in a very short time.

You may be interested in: How to transfer money to a card from Tele2: methods

The ability to directly enter the markets and place orders on positions, with speed in milliseconds, has led to the rapid growth of this type of transaction in the overall market volume. Experts estimate that high-frequency trading accounts for more than 60% of transactions in the United States, 40% in Europe and 10% in Asia. HFT was first developed in the context of equity markets and in recent years has been expanded to options, futures, ETFS (traded funds exchange) currencies and commodities.

Who uses HFT

Only large structures and funds can afford to maintain software for high-frequency trading and ensure its functionality. For private investors, such instruments are a luxury. All this is caused by the following reasons:

- The need to use huge production capacities.

- The presence of several servers that will be located near the exchange gateways.

- A staff of professional staff in the field of programming is required.

- Huge investment.

All this makes HFT trading inaccessible to the average trader, regardless of his financial capabilities.

Algorithmic trading: terms

Before getting into the HFT topic, there are some terms you need to know that make strategy explanations more accurate:

- An algorithm is an ordered and finite set of operations that allows you to find a solution to a problem.

- A programming language is a formal language designed to describe a set of sequential actions and processes that a computer must follow. This is a practical method by which a person can tell a machine what to do.

- A computer program is a sequence of written instructions for performing a specific task on a computer. This is an algorithm written in a programming language.

- Backtest is the process of optimizing a trading strategy in the past. It allows you to get a first approximation of the possible performance and evaluate whether the operation is as expected.

- Message Server - A computer designed to match purchase orders with sales of a particular asset or market. In the case of FOREX, each liquidity provider has its own servers that provide online trading.

- Co-location - determines how to place the execution server as close as possible to the message server.

- Quantitative analysis is a financial branch of mathematics that, through the prism of theories, physics and statistics, trading strategies, research, analysis, portfolio optimization and diversification, risk management and hedging strategies, produces results.

- Arbitrage is a practice based on exploiting price differences (inefficiencies) between two markets.

What is colocation?

Colocation is the practice of placing a trading server as physically close to the exchange's data center as possible—sometimes in the same premises. All this is done in order to obtain the minimum possible delay in data transfer.

On regular exchanges, each user is exposed to risks associated with data transfer delays. For most people, a couple of milliseconds means nothing, but for a high frequency trader, milliseconds mean everything. One obvious way to gain an advantage is to use the best hardware, and another is to host your own trading processing server as close to the exchange's data center as possible.

In some cases, users literally set up shop in the area immediately adjacent to the desired location, but often the exchanges themselves offer to host private servers in the same premises as their equipment. Clients can even cross-connect directly to the main server, bypassing the need for an Internet connection, greatly reducing transmission delays.

In the crypto market, HitBTC, Gemini and ErisX have such an offer: clients can host their server in the desired location for a period of one year. In this way, many individual traders or entire companies can gain a significant advantage over other market participants.

The nature of the High Frequency Trading system

You may be interested in: Information and trading platform MetaTrader 4: reviews

These systems have absolutely nothing to do with advisors. The algorithms that drive these machines do not follow the main style of the advisor - “if the price crosses down, the moving average goes short.” They use quantitative analysis tools, forecasting systems based on human psychology and behavior, and other methods that most users will probably never know about. The scientists and engineers who develop and code these high-frequency trading algorithms are called quants.

These are the systems that actually make money, with huge opportunities of up to $120,000,000 per day. Therefore, the cost of implementing these systems is certainly high. It is enough to calculate the costs of software development, the salary of quants, the cost of the necessary servers to run the specified software, the construction of data centers, land, energy, colocalization, legal services and much more.

This trading system is called "high frequency" due to the number of transactions it performs every second. Therefore, speed is the most important variable in these systems, the key from which the decision follows. Therefore, the colocalization of servers that calculate the algorithm for high-frequency trading of cryptocurrencies is very important.

This follows from this specific fact: in 2009, Spread Network installed a fiber optic cable in a direct line from Chicago to New Jersey, where the New York Stock Exchange is located, paying $20,000,000 for the work. This network reconstruction reduced the transmission time from 17 to 13 milliseconds.

Example of a trade transaction. A trader wants to buy 100 shares of IBM. There are 600 shares on the BATS market priced at $145.50, and another 400 shares on the Nasdaq market at the same price. When he executes his buy order, the high-frequency machines detect him before the order reaches the market and buy those shares. Then, when the order reaches the market, these machines will already list them for sale at a higher price, so ultimately, the trader will buy 1000 shares at a price of 145.51, and the market makers will receive the difference due to the faster connection and processing speed. For HFT, this operation will be risk-free.

What do you need for scalping?

To become a scalper, you need to register with a broker that allows trading with a minimum time frame, and a device with Internet access. The broker will provide you with access to a trading platform that will allow you to buy or sell financial instruments at high speed. Typically, each trading instrument in the platform has buy and sell buttons, so a trader just needs to click the appropriate button to open or close a position. In markets with good liquidity, order execution may take a fraction of a second.

Suitable Trading Platform

The scalper needs to familiarize himself with the trading platform that the broker offers him. Different brokers offer different platforms, so you should always open a demo account and trade on the platform until you are completely comfortable with it.

With Admiral Markets you can trade on the world's most popular trading platforms MT4 and MT5, including automated trading capabilities.

Highly liquid markets

Scalpers try to trade in the most liquid markets. Additionally, depending on the market, liquidity may be significantly higher at some times than at others, even though Forex operates 24 hours a day.

High quality performance

Traders must be confident that their trades will be executed at the desired price with minimal slippage. Therefore, study your broker's trading conditions well.

Low spreads

As a scalper, you will frequently enter the market and make a large number of trades, with the goal of gaining just a few pips. Therefore, a spread that is too wide will cost you dearly.

Be sure to trade with a broker that offers competitive spreads, such as Admiral Markets.

Several fallback options

Plan B is your insurance in the event of a disaster. When trading, in case of an unforeseen situation, you must have backup options for opening and closing trades. Make sure your Internet connection speed is as fast as possible. Does your broker offer a mobile app that you can quickly open if you have problems using your desktop computer? Is there a phone number where you can quickly contact the broker in case of problems? All this is really important especially when you have an open position and need to quickly close it or make any changes.

Admiral Markets offers a mobile trading app and responsive customer support.

When to scalp and when not to

Remember that scalping is high-speed trading, so it requires a lot of liquidity in the market to execute trades quickly. Scalpers trade only the most liquid instruments and only during times of very good liquidity, such as when the London and New York Stock Exchanges are open.

Don't scalp if for some reason you can't concentrate. Fatigue, colds, etc. will become a hindrance for you. Stop trading if you have suffered a series of losses, give yourself time to rest and regroup. Don't try to take revenge on the market. Scalping can both stimulate you and cause stress and fatigue. You must be sure that you have the qualities necessary to engage in high-speed trading. So keep in mind: scalping is not for everyone.

Opaque platforms and infrastructure

Taking into account the previous example, we need to understand how HFT becomes aware of the order to buy 1000 shares in the market. This is where opaque algorithmic trading platforms appear, which use the same “brokers” and are a room with servers. The payoff is that instead of sending orders to the market, some brokers route them to their opaque HFT platform, which uses speed to buy shares in the market and then sell them for more than the original price to the investor, in just a few milliseconds. In other words, the broker, who theoretically looks after the trader's interests, actually sells him HFT, for which he charges a good fee.

The infrastructure that high frequency markets require is amazing. It is located in data centers, often of financial institutions themselves, next to the offices of exchanges, which are also data centers. Proximity to data centers is extremely important because speed matters in this strategy, and the shorter the distance the signal has to travel, the faster it will reach its destination. This applies to large financial firms that can absorb the cost of buying land and build their own data center with thousands of servers, emergency power systems, private security, astronomical electricity bills and other costs.

You may be interested in: A tax audit is... Definition, procedure, types, requirements, deadlines and rules of conduct

Smaller companies that dedicate themselves to this business prefer to host their servers inside opaque broker platforms or in data centers in the same markets. This is a controversial point since the same brokers and markets "rent" space for HFT to minimize price access time.

About us: Admiral Markets

Admiral Markets is a global, award-winning, regulated Forex and CFD broker offering trading in over 8,000 financial instruments on the most popular trading platforms in the world: MetaTrader 4 and MetaTrader 5. Start trading today!

This material does not contain, and should not be construed as containing, investment advice, recommendations or an offer or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future trading as circumstances may change over time. Before making any investment decisions, you should seek the advice of independent financial experts to ensure you understand the risks.

Advantages and Disadvantages of Trading

According to the above, the image of HFT in public debate is very negative, especially in the media, and more broadly it is perceived as an emanation of cold finance, dehumanization with harmful social consequences. In this context, it is often difficult to talk rationally about a subject that is traditionally based on financial passion and sensationalism, whether in the political or media sphere.

In certain circumstances, HFT may have implications for the stability of financial markets. Apart from the purely technical aspects associated with high-frequency trading strategies on low-volatility securities, the main risk at the global level is systemic risk and system instability. For some HFTs, a necessary requirement for adapting to the market ecosystem is innovation, which increases the risk of financial crisis.

Three main reasons for the volatility of high-frequency trading in Russia:

In this debate about the benefits and harms of high-frequency trading HFT, there are enough fans of this type of global trading with their own arguments:

Term, features, strategies

In 2011, hackers hacked Fox News's Twitter account and published news on behalf of the newspaper about the assassination of US President Barack Obama.

As a result, the Dow Jones index fell by almost 400 points and the HFT companies that were the first to use this news were able to earn millions of dollars. Article navigation

- Features of high-frequency trading

- History of appearance

- Who uses HFT

- High Frequency Trading Strategies

- Statistical arbitrage

- News arbitrage

- Market making

- Arbitration of delays

- Definition of liquidity

- Spread speculation

- Criticism of the technique

Since its inception, the stock market has attracted many traders and investors who have strived to create effective trading strategies and techniques. In the last two decades, high-frequency trading (HFT), the essence of which is to conduct transactions in nanoseconds, has gained enormous popularity.

The financial industry is against it

The financial industry opposes such regulation, arguing that the consequences would be counterproductive. Indeed, too much regulation equates to less exchange and circulation of credit, mechanically increases the cost of the latter, ultimately making access to capital more expensive for businesses, and has negative consequences for the labor market, goods and services.

Therefore, several countries want to officially regulate and even ban HFT. However, any purely national regulation will only impact a small area since, for example, HFT for securities in that country may be done on platforms located outside of that country. A purely national law will have the same weakness as any territorial law in the face of free capital that can be distributed and exchanged throughout the world. A country willing to unilaterally implement such regulation will lose. At the same time, other countries will benefit doubly from its weakening.

The only viable option in the short to medium term is legislation at the regional level. In this context, it can be adopted by Europe if it makes significant progress in this direction, then countries outside Europe, the United Kingdom and the United States will benefit.

About starting work, costs and prospects

Typically, people who come to the field of algorithmic trading are looking for something new and want to get away from simple investments and trading “with their hands.” The more they immerse themselves in the industry, the more they realize that it is highly fragmented and involves different types of strategies.

For example, I was interested in making money with minimal risks, so I was creating mechanical trading systems (MTS) based on following trends.

However, I quickly realized that in the market there are not only pronounced market movements, using which you can make money, but also periods of calm, “sideways” - when prices move up and down with a small amplitude. During such periods, trend strategies show poor results, and an account drawdown is possible, so I quickly switched to arbitrage strategies, which is what I still do today.

The entry threshold in this area depends on the segment. Trend strategies are usually easy to implement and do not require a lot of capital, so the amount of investment can be quite small - 100,000 rubles is enough. If you need to create something more high-tech and complex, then developing a competitive product will not be easy.

For example, our foundation has been doing approximately the same thing for 10 years; the code of our robots is measured in many hundreds of thousands of lines. To start from scratch and reach the level of a company like ours will require a significant investment of time and resources.

In our business, a popular phrase from Alice Through the Looking Glass is “To just stand still, you have to run as fast as you can.” This is also why the main expense item for us is the salaries of financial engineers and developers. The competition is very high, so you have to constantly think about improving your strategies so as not to be left behind.

Characteristics of Trading Tables

The agents using such trades are proprietary trading table firms at investment banks and hedge funds that are able to generate large volumes of transactions in short periods of time based on these strategies.

Companies involved in high-frequency trading have:

How does HFT trading work?

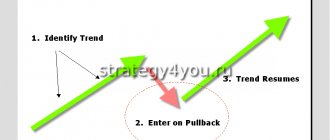

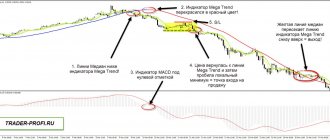

High frequency trading is carried out according to the following principle. Transactions are opened after you send an order to buy or sell . Submitted applications are visible to us in the form of feeds. It is important to understand that high frequency Forex trading is only possible if the HFT engine is tuned at all levels.

How can you reduce the delay time? To achieve this, HFT servers are usually located close to the exchange gateway . Naturally, feeds should come with as little lag as possible.

To make high-frequency trading on the Forex exchange available, specialists have developed a special FPGA system. This engine allows you to relieve the central processor.

Features of different strategies

There are different types of HFT strategies, each with its own signature features, usually these are:

The market making strategy continuously issues competitive limit buy and sell orders, thereby providing liquidity to the market, and its average profit is determined by the bid/ask spread, which, along with introducing liquidity, provides its advantage as fast transactions are less affected by price movements.

In strategies called liquidity detection, HFT algorithms try to identify benefits from the actions of other large operators, for example, by adding multiple data points from different exchanges and looking for characteristic patterns in variables such as order depth. The purpose of this tactic is to capitalize on price fluctuations created by other traders so that they can buy, just before large orders are executed, from other traders.

Market manipulation strategies. These methods used by high frequency operators are not so clean, create problems in the market and, in a sense, are illegal. They disguise offers by preventing other market participants from revealing commercial intentions.

You may be interested in: Signs of authenticity of banknotes: how to distinguish a counterfeit bill from a real one

Common algorithms:

High Frequency Trading: A Guide from the Flash Boys

Translator's note: Previously, in our blog on Habré, we looked at the various stages of developing trading systems (there are also online courses on the topic), and even described the development of an event-driven backtest module in Python. Today we present to your attention a short guide to high-frequency trading from Brad Katsuyama, the famous quant and hero of the best-selling book Flash Boys: A Wall Street Revolt by Michael Lewis (we published an adaptation of this work on our blog).

In an episode of Wall Street Week, Brad Katsuyama talked about high-frequency trading (HFT) and market structure, and we reviewed the topic of HFT trading and financial regulation from the point of view of the order execution process on the exchange. The video is available at the link.

What is High Frequency Trading (HFT)?

Essentially, high-frequency trading (HFT) is the conduct of electronic trading at very high speed.

Although HFT traders are often criticized, only certain types of HFT trading create chaos in the modern financial market. The line between algorithmic trading, electronic market making and harmful HFT trading is quite blurred, and high-frequency trading often refers to electronic trading. In fact, the phenomenon of HFT trading in itself is neither good nor bad, but the devil is in the details. To clearly understand the possibilities of HFT trading, it is worth taking a closer look at some types of market activities.

What is algorithmic/systemic trading?

- Algorithmic/systemic trading is the general name for the process of using programmable systems that use a specific mathematical model to automatically execute trades. A person creates a program on a computer for a specific financial strategy based on a given criterion and controls the developed system from this computer.

- HFT trading is a type of algorithmic trading, but not all algorithmic trading can be considered high-frequency.

What is manual/discretionary trading?

Manual/discretionary trading is a general name for a set of subjective decisions made by a person, usually based on a number of subjective criteria.

A manual trader can be a small investor who makes one trade per month, an intraday trader who makes several hundred trades a day, or a large organization that trades large blocks of shares at various periods of time. In 2011, the Commodity Futures Trading Commission (CFTC) admitted that it was not “attempting to define” high-frequency trading. Instead, she proposed “seven key signs of HFT trading”:

- Using systems that implement extremely fast order placement, cancellation and modification in less than 5 milliseconds or with virtually minimal latency.

- The use of computer programs or algorithms to automate the decision-making process, during which the placement, execution, direction and execution of orders are determined by the system and do not require human intervention in the case of each individual order or transaction.

- Using colocation services co-location - placement of foreign servers near the exchange], direct access to the market or a dedicated data transmission channel offered by exchanges and other organizations in order to reduce network and other delays.

- Very short time frame for opening and closing a position.

- High daily turnover of the securities portfolio and/or a high proportion of submitted orders in relation to the number of transactions carried out [English. order-to-trade ratio].

- Placing a large number of orders that are canceled immediately or within a few milliseconds.

- Ending the trading day in a position as close as possible to zero. flat position] (without holding large unhedged positions overnight).

How the stock market works

The stock market was created so that companies could access government investment and thus attract financing to increase their growth rate.

Stock exchanges were supposed to be a place where ordinary buyers and sellers would come together and enter into transactions with each other in an established manner. However, after the emergence of various intermediaries, the stock market was divided into a large number of segments, and its structure became much more complex. Currently, trading in the United States is conducted by 11 public stock exchanges, about 50 alternative trading systems (ATS), also called “hidden pools,” and about 200 internalizers (usually broker-dealers who can sell/buy securities by acting on your own or someone else's behalf). The largest public exchanges are the New York Stock Exchange (NYSE) and NASDAQ. Public exchanges are subject to significant regulatory influence, while ATS systems, typically controlled by large banks and financial institutions, face less government influence.

When you place an order in your online brokerage account, that order may be transmitted to a specific exchange or ATS system. After placing your order, you almost immediately receive confirmation that the transaction has been completed, but you will not be able to see through whose hands your order managed to pass in a few milliseconds.

Thoroughly Researched HFT Strategies

Shortly after the May 2010 Flash Crash, the Securities and Exchange Commission attempted to gather more information about the different types of HFT strategies that were adversely affecting the market.

Passive market making

- Passive market making generally involves placing buy (bid) and sell (ask) orders (limit orders) in order to provide liquidity in the market. Players, buying at the bid and selling at the ask, profit from the commission for adding liquidity, which is paid in accordance with the maker-taker model of the exchange.

- Regulators are concerned about the quality of liquidity that passive HFT market making supposedly provides. Incorrect incentives in the maker-taker model lead to layering. Layering – market manipulation by artificially shifting quotes for buying and selling securities] and a high level of early failures (at least 90%).

Arbitration

- Arbitrage strategies are aimed at making a profit based on the difference in prices for identical assets that are traded on different trading platforms. Arbitrage will always be present in financial markets, but it should not be based on the desire to win speed and gain access to exchanges in related markets before others.

- Statistical arbitrage involves profiting from price differences between correlated securities or markets. This type of arbitration uses mathematical modeling methods and can be used on any time period.

- Arbitration of delays latency arbitrage] is the use of modern technologies in order to gain an advantage in speed. Latency refers to the time that passes from the moment a signal is sent to the moment it is received. When discussing the differences between harmful and harmless types of HFT trading, statistical arbitrage is often confused with delay arbitrage.

Structural Strategies

- Structural strategies tend to focus solely on exploiting vulnerabilities in the market structure and obtaining the necessary market data before others. To do this, you need to place your servers close enough to the exchange or gain direct access to its information. With access to the latest quote data, companies can make money by executing orders if they find players who receive information more slowly.

Directional Strategies

- The goal of directional strategies is to make a profit by predicting the directional movement of securities prices. This differs from the three previous types of strategies by taking on unhedged risks.

- Using a directional waiting strategy, the player tries to detect large orders that can affect the price and place his order before them. Thus, he can use these large orders as “free options” (exit points) in the event that the price of the security does not move in the expected direction.

- When using the strategy of "igniting momentum" [Eng. momentum ignition] a company places a group of orders in an attempt to “ignite” a sharp price movement in a certain direction. The essence of the principle, called “spoofing,” is the manipulation of algorithms and manual traders who are forced to trade aggressively. In addition, when using this strategy, the player can cause further price movement due to the set stop losses. Spoofing is considered an illegal strategy but is difficult to detect and prove.

What are the regulations of the national market system?

The National Market System Regulations (Reg NMS) are a set of rules and regulations adopted in 2005 by the US Securities and Exchange Commission and effective in 2007.

They aim to modernize U.S. exchanges by establishing market fairness in pricing, the way quotes are displayed, and the provision of access to market data. The following are the main rules of Reg NMS:

- Best Order Execution Rule: This ensures investors that their securities orders will be executed at the best price on any exchange. The rule is designed to protect investors by eliminating shortcomings in traditional trading rules that allow unprofitable execution of orders, especially in the case of limit orders. Although this rule was designed with a noble purpose, its unintended consequences negatively affected the structure of the market.

- Access Rule: The consequence of this rule was the emergence of a system called "Securities Data Processor" [eng. Securities Information Processor, SIP], the principle of which is to collect information on quotes on all public exchanges and issue the best bid/ask quote (NBBO) for each security. Data is transferred from all data centers of exchange platforms to one central processor, which then issues a universal spread. Regulators introduced this rule to address the negative consequences of the growing fragmentation of public exchanges, but instead it only increased their fragmentation and provoked an increase in trading in dark pools.

Unintended consequences of introducing a favorable order execution rule

An organization that is looking to execute a large order will likely do so in a dark pool so as not to reveal its intentions until the trade is concluded.

The spread of a stock consists of the highest bid (order to sell) and the lowest ask (order to buy). If you place a market order to buy 200 shares, you will be matched with a sell order at the lowest price (assuming the order size is at least 200 shares), and your order will be filled at that price. But what if you want to buy 1,000 or 10,000 shares? As the size of the application increases, more problems arise. Let's say you want to buy 1,000 shares, but the lowest bid on the "home market" is for only 100 shares. Let's say the price per share in this sell order is $10.10, an additional 1,000 shares are put up for sale at a slightly higher price of $10.11 per share, and then an offer is made to purchase 900 shares at a price of $10.15 per share.

If you place a market order for 1,000 shares, it must first be filled at the “best price”: in our case, 100 shares at $10.10. Immediately after your order is executed, the exchange on which it was executed issues a confirmation of the transaction for 100 shares at $10.10. You can then hope that 900 of the 1,000 shares selling for $10.11 will be added to the rest of your order. However, things are often a little different.

Once confirmation appears in the market to buy 100 shares at $10.10, the computer can reject the offer to sell 1,000 shares at $10.11, and your order will automatically accept the next "best" offer to sell 900 shares at $10.15. The average price of your trade will be $10,145. The problem in this case is that you cannot accept the offer at $10.11 after buying the shares at $10.10 without first signaling your intention to the market.

For a small individual investor, the difference in price may not be critical, but for large organizations such as pension and mutual funds [English]. mutual funds], which hold the money of most of the US population, a regular increase in the average transaction price over time can lead to significant financial losses.

How hidden pools came to be

It is believed that hidden pools have become even more important as a result of economic incentives that arose due to imperfect legislation.

Dark pools emerged in the 1980s as large investment organizations tried to find a way to trade with each other without paying commissions and remaining hidden from the public eye. They wanted to be able to buy and sell large blocks of shares without disclosing their plans to public exchanges, thus making better deals. In 1998, the Securities and Exchange Commission laid the foundation for today's market structure with the enactment of the Alternative Trading Systems (Reg ATS) regulation, and then introduced a series of additional regulations for the National Market System (Reg NMS) in 2007.

Growth of trading in hidden pools

More transparent public exchanges are usually classified as "white markets", while less transparent alternative trading systems and dark pools are usually classified as "dark markets".

The situation described above is one of the main reasons why trading in “shadow markets” is developing, carried out, in particular, by large investment organizations. In 2005, even before the regulation of the national market system came into force, dark pools accounted for 3-5% of the market volume. Today this figure is 15-18% and continues to grow. Approximately 40% of all transaction volume passes through the enterprise trading reporting system. Trade Reporting Facility, TRF]. It covers all “over-the-counter trading”, including the activities of alternative trading systems, trading in the “upper tier” market. upstairs trading] (when exchange traders directly negotiate with each other and enter into large transactions) and retail order flow. In addition, according to Tabb Group estimates, 54% of the derivatives market is accounted for by high-frequency trading.

Why? In simple terms, large institutions can trade anonymously in dark pools and not report the closure of a large position. The development of shadow trade has had a negative impact on the natural pricing process. Broker-dealers and major investment banks, given the impact of new regulations, rushed to set up several dark pools to lure order flow from large institutions.

Now, instead of becoming a meeting place for ordinary buyers and sellers - as stock exchanges were originally supposed to be - for some institutions they have become the last chance for liquidity. Even though 60% of trading is still done in white markets, exchanges are causing a lot of problems due to the orders being driven into the maker-taker commission system (and its inverse, taker-maker model). And while public exchanges are a source of stable liquidity today, the reality is that their activity and reliability are gradually declining.

Unintended consequences of securities data processing

Among other things, the National Market System Regulations provide for the creation of a Securities Information Processor (SIP), which is a regulation that allows arbitrage strategies to be implemented.

These strategies are one of the main topics that concern opponents of HFT trading. SIP is a centralized processor to which all exchanges send their market data with the goal of creating a universal "internal market" for every security listed on the exchange. There are two SIP processors: one that handles securities listed on NASDAQ and hosted on its technology platforms, and one that handles securities of the New York Stock Exchange and other entities that trade on the NYSE's technology platforms. In short, all 11 public exchanges are connected via cable to SIP processors, which, in turn, collect the data received, analyze it and issue the best quotes (NBBO) for securities.

The process of transferring market data from the exchange to SIP processors takes a fraction of a second. So, if we take into account the fact that the signal is transmitted at different speeds depending on how close to the exchange its clients’ servers are located, then there is a slight lag compared to the “direct data stream”.

What does direct data flow mean? Every exchange has a live data feed that provides quote data to those who “subscribe” to it faster than others. The closer you are to the exchange server (or use a microwave connection), the faster you will receive and transmit this data. When it comes to latency, you must understand that we live in a world where a few milliseconds or even microseconds can make a difference.

HFT firms are willing to shell out a decent amount of money to place their servers next to the servers of exchanges. This way they can receive data faster than from a slower SIP processor. The exchange engine, which brings together buy and sell orders, was once located on the trading floor of the New York Stock Exchange, and a separate specialist worked with it. Today, such engines are placed in large rooms along with exchange servers.

Proponents of HFT trading argue that anyone can get direct access to the exchange and install their own servers next to it, but in reality this is done by reputable companies that have the funds to develop and implement HFT strategies on a large scale. The services of hosting servers near the exchange bring it good profit, if we remember that the exchange is primarily a commercial organization. HFT companies pay tens of millions of dollars to install their servers in the exchange building: the demand for services providing space, communication, speed and bandwidth is quite high.

As a result, HFT firms receive data faster due to direct access to the exchange, while the rest of the market follows the quotes transmitted by the slower SIP processor. This allows HFT firms to use latency arbitrage to get ahead of other orders and thus make money on a large number of trades. Formally, such a strategy differs from “playing ahead” [eng. front-running] and is rather a loophole resulting from conflicts of interest and differences in incentive mechanisms.

Layering and order cancellation

If you look at the current state of the US stock market, it appears to be the most liquid financial market in history, but it has some serious flaws.

Advocates of HFT trading believe that the stock market is in a state that is most favorable to the average individual investor. Spreads have narrowed and trade volumes have increased, leading to better order execution and lower commission fees. At first glance, this situation should suit relatively small individual investors who do not enter into large transactions on an ongoing basis.

However, the biggest beneficiaries of the ravages of delay-based HFT arbitrage are large organizations that profit from large transactions. Revenue from high-frequency trading is distributed throughout the market, but most of it is concentrated in the hands of a few HFT firms.

We've previously discussed the method by which aggressive HFT firms employ delay arbitrage strategies so that they can manipulate the order book, preventing market participants from executing their orders at the best average price. Although this is just one possible scenario, the market is indeed flooded with orders that no one ever intended to fill: they rather serve as bait to attract other market players and take their money.

When proponents of HFT trading talk about the merits of fast automated trading, they overlook the fact that most liquidity is just an illusion. It often happens that we see the minimum spread of any stock, but the size of the order on the domestic market can be so small that no trader will execute it. When a trader places a small market order, all other larger orders outside the domestic market immediately disappear, and the trader realizes that he will not be able to enter into such a trade. Bank of England chief economist Andy Haldane once said: “High-frequency trading adds liquidity in the wet season and takes it away in the dry season.” transl.].

Maker-taker model

With the development of shadow trading, commercial exchanges have to maintain the flow of orders from which they receive their income.

Colocation services and surcharges make up a significant portion of their profits, but exchanges are forced to maintain steady order flow to remain competitive. To lure order flow into dark pools—which can usually make a better offer—exchanges resort to controversial practices called order flow fees. Its essence is that exchanges and wholesalers pay each individual broker-dealer for routing his order along a specific route. To compensate for the order flow sent, the exchange pays the broker-dealer a limit order fee for each share. This compensation is usually a fraction of a penny per share (0.002 or 0.003 cents), but if we are talking about several million shares, the total amount is quite impressive.

One variant of this scheme is used when sending order flow by large organizations: this model is called maker-taker. Not long ago, it caused real anger among opponents of HFT trading. Under this model, you are considered the “maker” of liquidity when you place buy and sell orders (limit orders) on the exchange and receive rewards immediately after the other party accepts the order you placed. At the same time, you become a “taker” of liquidity when you accept buy or sell orders (market orders or aggressive limit orders) and effectively pay a penalty for doing so. Over the past few years, the rewards have increased markedly as each exchange competes for its piece of the shrinking pie of the order flow still flowing through the white markets.

The introduction of fees for order flows and the very fact of using the maker-taker model are far from the real purpose of financial markets, which is to create a platform that brings together buyers and sellers in an established order and favors natural pricing, which is the result of the law of supply and demand. If the situation had not been distorted by perverse incentives that contributed to the development of shadow markets, the introduction of rewards would have been unnecessary.

Conclusions and the future of high frequency trading

If Michael Lewis somewhat embellished the current state of the stock market by calling it "technologically advanced" in his book Flash Boys, then at least he has started a very important discussion for the entire financial industry about whether financial markets are moving in the right direction. .

The rapid arms race has led to oversaturation and consolidation of the HFT industry. Large fish eat smaller ones; Today, only the fastest HFT companies with the most resources survive. Any HFT strategy can be customized, which means that if one HFT company learns about another’s strategy, it can develop a high-speed algorithm based on it and gain an advantage. If the pie of potential profit from delay arbitrage is still large, many players in the HFT industry will get smaller pieces as time goes on.

To restore fairness to the financial market, we need to improve its regulation and seize opportunities for free trade. New investor-oriented exchanges will help level out the market situation. Regulations should always be kept as simple and effective as possible in order to meet the original purpose of the stock market, which is to become a place where buyers and sellers are matched in an orderly manner. The wrong motivation has led to the emergence of entire groups of intermediaries, which does not correspond to our ultimate goal of transacting in a free market.

Online trading courses

Creating automated trading systems is a great skill for traders of any level. You can create full-fledged systems that trade without constant control. And effectively test your new ideas. As a trader, save time and money by learning to code yourself. And even if you outsource coding, it’s better to communicate if you know the basics of the process.

It is important to choose the right trading courses. When choosing, the following factors are taken into account:

If a future trader is new to programming, MQL4 is an excellent choice, where you can take a basic programming course in any Python or C# language.

MetaTrader 4 (MT4) is the most popular charting platform among retail Forex traders with a scripting language - MQL4. The main advantage of MQL4 is a huge amount of resources for trading on Forex. You can find strategies used in MQL4 on forums like ForexFactory.

There are quite a few online courses on this strategy on the Internet, with several basic and common strategies, including crossovers and fractals. This gives a beginner enough knowledge to learn advanced trading strategies.

Another course, “Black Algo Trading: Create Your Own Trading Robot,” is a high-quality product and is the most comprehensive for MQL4. Notably, it covers optimization techniques that other courses skip and is comprehensive for any beginner.

The teacher, Kirill Eremenko, has many popular courses with rave reviews from users. Course “Create your first FOREX robot!” is one of them. This is a basic practical course that introduces high-frequency trading programs in MQL4. It is aimed at absolute beginners and starts with learning how to install the MetaTrader 4 software.

Content

- What is high frequency trading?

- High frequency trading: how does it work?

- High Frequency Trading: Benefits and Criticisms

- High frequency trading: what are the risks?

- High frequency trading: a little history

- High Frequency Trading: Regulation

- High frequency trading: how to become an HFT trader?

- High Frequency Trading: Is It Suitable for the Individual Trader?

- High Frequency Trading: Scalping as an Alternative

- How does scalping work?

- What do you need for scalping?

- High frequency trading: differences from automated trading

- Conclusion

- Continue your Forex education

- About us: Admiral Markets

Moscow Exchange

Young traders think that the largest Russian stock exchange holding company trades exclusively on the stock market, which is certainly wrong. It has many markets, such as derivatives, innovation, investment and others. These markets differ not only in the types of trading assets, but also in the way sales are organized, which indicates the versatility of the MB.

Last year, the CBR analyzed trading on the Moscow Exchange of HFT participants and their impact on the work of the CBR. It was carried out by specialists from the Department for Combating Unfair Practices. The need for this topic is explained by the growing importance of HFT in Russian markets. According to the Central Bank, HFT participants account for a significant part of the transactions of the Russian MB, which is comparable with data from developed financial markets. In total, 486 reputable HFT accounts officially operate on the MB markets. Bank experts divided HFT participants into four categories depending on the volume of work on MB:

- Directional;

- Maker;

- Taker;

- Mixed.

According to the results, HFT firms actively participate in the work of the IB, which allows online trading dealers to quote rates in a very wide range and confirms the positive effect of HFT operations on market liquidity. In addition, the transaction costs of HFT participants carrying out currency purchase/sale operations will decrease. This level of instant liquidity increases the prestige of the foreign exchange market, according to CBR experts.

Experts record the diversity of trading activity on the Moscow Exchange, which has the ability to influence market characteristics. These are real algorithmic trading systems of financial markets. There are systems responsible for absorbing or introducing liquidity in very short periods of time, which embody the figure of the “beholder”, which ultimately causes the price to move.

High frequency trading on the stock exchange

High-frequency trading accounts for more than 70% of all orders on US stock exchanges, more than 50% of transactions on the Russian stock market, 40% on the European and 10% on the Asian. To provide the speed necessary for HFT, the exchange must have servers with co-location capabilities, that is, the trader’s server must be located in the same data center or cloud as the exchange server.

Traders are increasingly relying on electronics and automation, and this is happening across all markets. Market makers and arbitrage traders trade more efficiently, which impacts pricing, price discovery and liquidity. There are fewer arbitrage windows and they close faster, indicating a more efficient and mature market.

Matt Trudeau, CSO ErisX

Many argue that high frequency HFT trading makes the market volatile. Others call it a liquidity locomotive. So which side of the Force is HFT on, the dark side or the light side?

The May 6, 2010 crash led thousands of people to believe that high-frequency traders were manipulating the financial market. The situation is clearly reflected in the graph:

That day, the US stock market experienced a brief crash, during which the capitalization of companies such as Procter & Gamble and General Electric fell by billions of dollars. The SEC and CFTC report states that one of the reasons was the large number of sell orders generated by HFT robots. The collapse began when investment fund Waddel & Reed Financial sold $4.1 billion worth of futures in one trade. And high-frequency traders, according to the report, “quickly exacerbated the effect of this sale.”

However, a number of other organizations, in particular the Chicago Mercantile Exchange (CME), insisted that HFT robots and traders had nothing to do with it - and on the contrary, they helped stabilize the situation and minimize the scale of the decline.

Since 2009, the effectiveness of high-frequency algorithmic trading in traditional markets has gradually declined. By 2012, the total profit in the high frequency trading market fell 4 times from $5 billion to $1.25 billion. Since HFT robots derived their main profit from high volatility, its decline led to the fact that in 2016 most HFT companies ceased their activities . HFT was originally designed to work in the stock markets, but was later used to trade options, futures, currencies and commodities.

Decrease in volatility since 2009 in stock markets (VIX volatility index):

Today, many HFT companies and traders are gradually moving to the cryptocurrency market, because, firstly, it is much more volatile than traditional markets, which makes it possible to earn money, and secondly, cryptocurrency exchanges need HFT companies as liquidity providers . The fact is that in traditional markets, liquidity is maintained by market makers and at the moment when it becomes unprofitable to close liquidity holes at their own expense, they attract HFT companies or use high-frequency trading themselves. Simply put, the cryptocurrency market is a new earning opportunity for traders and companies using high-frequency algorithmic trading.

Prospects for high-frequency trading

In this trading, market makers and major players use algorithms and data to make money by placing huge volumes of orders and earning small margins. But today it is even smaller, and the opportunities for such businesses have shrunk: income in global markets last year was about 86% lower than a decade ago at the peak of high-frequency trading. With pressure on the sector continuing, high-frequency traders are trying to advocate for tougher operating conditions.

There are many reasons why this practice's revenue has declined over the past decade. In a nutshell: increased competition, higher costs and low volatility all played a role. Vikas Shah, an investment banker at Rosenblatt Securities, told the Financial Times that high-frequency traders have two raw materials they need to perform effectively: volume and volatility. The algorithm boils down to a zero-sum game based on how fast current technology can be. Once they reach the same speed, the benefits of high frequency trading will disappear.

As is obvious, this is a very large and interesting topic, and the secrecy that surrounds it is quite justified - whoever has the goose that lays the golden eggs will not want to share it.

Source

High frequency trading is gaining popularity in the market

HFT is an extremely efficient way to trade, which is why it is so popular in the financial markets. Institutional investors spend billions of dollars annually developing and implementing high-frequency strategies. HFT is conquering new markets - including the crypto market - and is increasingly being covered in the media. Regular traders can only accept the presence of HFT and, if possible, avoid the pitfalls of high-frequency traders.

On our blog, we often post articles that help novice traders improve their efficiency and recognize a trap in time. If you are already involved or want to get involved in algorithmic high-frequency trading, do not forget that we have our own tier-4 data center in Luxembourg with colocation capabilities.

Does HFT benefit the market?

In general, the activities of algorithmic traders are useful in that they generate additional liquidity in the market - this is also recognized by the Bank of Russia. This means that all investors, even those who do not use robots, have more opportunities to earn money. However, during periods of sharp market movements, the activity of algorithmic traders can increase the negative consequences. Alteus strategies primarily create liquidity rather than take it away.

Thus, in 2012, the American market experienced an instant collapse of 20%, provoked by a trading robot. Later, already in 2018, experts associated market declines around the world with the work of trading algorithms. Then, within a few days, the markets could collapse repeatedly - as happened, for example, with the American Dow Jones. On February 5 it collapsed by 4.6%, and on February 8 it lost another 4.15%. In such situations, it is not the high-frequency traders who bear the greatest losses.

At the same time, market self-regulation helps ensure that only robots do not work in it. Everything is developing in a circle: increasing liquidity and efficiency of the market also leads to an increase in the number of algorithmic traders, which reduces the profitability of their operations.

At the same time, costs (for example, on technology and equipment) continue to grow, which means that soon working in the Low latency trading niche will become unprofitable for many traders. As a result, there will be fewer of them, and market inefficiencies will again arise that can be exploited, which will again lead to the development of this segment. It is very difficult not to fly out of the market at the next turn; for this you need to work very hard and look for new niches.

For example, as competition becomes increasingly fierce, and at the same time the volatility of financial markets decreases, the following trend has emerged: algorithmic strategies are beginning to be actively used in cryptocurrencies, where volatility is still in order.