Hello! In this article I will tell you how to create an electronic wallet.

Electronic money is a method of paying for goods and services via the Internet. You can buy things, pay for services and transfer money to someone without leaving your home. Electronic wallets have been ensuring the functioning of online commerce for more than 10 years, and now it is difficult to imagine how you can do without them. In this article we will figure out how to create and use electronic wallets and which one is better.

What is an electronic wallet

Electronic wallets are a place where you store electronic money for payments on the Internet. This is your virtual wallet, but it has many more functions.

With it you can:

- Buy goods in online stores.

- Make money transfers.

- Pay for cellular communication and Internet services.

- Make purchases in online games, etc.

And all this can be done in a few clicks without leaving home. With the advent of bank cards, electronic wallets have become less necessary, because with the help of applications, plastic cards perform the same functions.

But there are some categories of people who need electronic wallets without fail:

- For those who constantly buy something in online stores.

- Freelancers to get paid.

- Owners of online stores and any sellers on the Internet.

- Owners of websites, blogs, groups on social networks and similar projects.

- Players at bookmakers.

- For active gamers.

If you fall into one of these categories, it’s high time to think about how to get an electronic wallet.

Most active Internet users have a need for an electronic wallet. But despite the fact that bank cards have practically replaced them, opening an electronic wallet is much easier, and it takes a couple of minutes.

Every user can create an electronic wallet for free.

Without e-wallets, all commerce that exists on the Internet would not exist. Electronic transfers, payments for advertising, for projects, for remote work - all this passed and passes through electronic wallets.

The Western e-wallet PayPal is generally linked to a bank card. Calculations within the system are instant. Most large players, even at industrial auctions, prefer to pay for multimillion-dollar contracts using this payment system.

Despite the fact that the creators of cryptocurrency set out to completely change the system of global payments, wallets are still actively used around the world. So there is no need to think that they will gradually become obsolete, turning into something useless.

Now let's move on to the questions of how to make an electronic wallet in the three most popular payment systems: Yandex.Money, Qiwi and Webmoney.

Replenishment - possible options

After the card for the electronic wallet in Sberbank has been created, you can carry out transfer operations. To do this, it is possible to deposit cash in the following ways:

- Bank cash desk. The operator needs to announce the number of the registered payment instrument, deposit the amount and present your passport.

- Terminal. In the menu you need to follow the path: Payments and transfers – Electronic money – Wallet replenishment. Next, write down its details and enter the banknotes into the device.

Registered users are offered several transfer methods.

It is also permissible to deposit a balance via Internet banking or an ATM by transferring from a card or account using a non-cash method. At an ATM, the transaction follows instructions identical to those for the terminal. The difference is the method of transferring money. In this case, the money will be debited from the card that is inserted into the device.

Now all your discounts are always at hand - on your mobile phone

Sberbank Online

In Sberbank Online, an electronic wallet is replenished according to the following instructions:

- Login to your Account.

- Go to the Payments and transfers subsection.

- Select the Electronic Wallets tab. Go to Yandex Money.

- Enter the number of your payment instrument and the transaction amount in the payment fields.

- Select the card from which to debit.

- Select a confirmation method: request a key via SMS.

- Enter numbers.

One of the replenishment options is to use a remote customer service system

. After completing the replenishment, the client is asked to save the payment as a template. This will subsequently speed up the transfer procedure. You will no longer need to re-enter the necessary details and select a card.

If the client regularly uses online payments, you can set up automatic replenishment of the virtual account. It is convenient to do this from a salary card, setting the amount and frequency. In this case, once a month (or another established period) funds will be transferred from it to the virtual card. It has one more advantage - if the money is not spent, interest is charged on the balance, i.e. they work like a deposit. The rate is small, and, of course, you won’t be able to get significantly rich with a virtual card, but many clients note such a pleasant bonus as an advantage.

Poisoning bank data has never been easier

How to create Yandex.Wallet

Yandex.Money is the most popular payment system in Russia. It is quite convenient, has worked stably for 15 years and makes it possible to transfer funds in a few clicks.

You can create a Yandex.Money e-wallet in 6 steps:

- Registering mail on Yandex.

- Go to the “Money” section.

- Select “Open Wallet”.

- Fill in all the data in the fields.

- We confirm the phone number via SMS.

- We get money.

After you open your Yandex.Money wallet, only basic transfers will be available to you, such as replenishing your phone, Internet, and paying for housing and communal services.

Yandex.Wallet has several levels:

- Anonymous - no need to confirm anything. Available immediately after opening the Yandex.Money e-wallet. You can store up to 15,000 rubles, payment limits are 15,000 rubles. Payments are available only in Russia. You cannot transfer funds to a bank card or transfer funds to other wallets without a direct request. You can withdraw funds only through exchangers.

- Personalized - you can store up to 60,000 rubles in your wallet. Limits on payments - 60,000 rubles. You can transfer to bank cards and other wallets. In order to receive a personalized wallet, you just need to send a copy of your passport to the service.

- Identified - you can store 500,000 rubles in your wallet. The limit on payments is 250,000 rubles from a wallet and 100,000 rubles from a card. It is possible to transfer to a card, wallets, bank account and direct cash transfers through the Western Union system.

Identification can be obtained in different ways. The simplest ones are Euroset and Svyaznoy communication shops. Come there, bring your passport, fill out a form and pay 50 rubles. After this, you receive a confirmation and an identified wallet.

If you have such an opportunity, I recommend getting identification immediately after you create a Yandex.Money wallet. This will save you from unnecessary hassles regarding limiting money transfers and withdrawing money. Each level opens up additional opportunities, which once again suggests that you need to confirm your account as quickly as possible.

Yandex makes it possible to transfer funds to a card starting from 100 rubles. But the service commission is huge: 3% + 45 rubles. When transferring 500 rubles - 60 rubles, when transferring 1,000 rubles - 75 rubles, when transferring 5,000 rubles - 195 rubles.

When transferring from wallet to wallet, no commission is charged. When paying for purchases on the Internet, the amount of the commission will depend on the service with which Yandex works.

You can top up Yandex.Money in the following ways:

- Through any payment terminals.

- Using bank cards.

- From your mobile phone balance.

- Using other electronic wallets.

- Bank transaction.

- Via Russian Post, CONTACT, Unistream.

Yandex.Money wallets can be linked to Webmoney and Qiwi. This will allow you to make transfers within these systems without using exchangers.

In the original Yandex.Money system, it is not possible to make payments in dollars and euros. But it is possible to create a virtual card that will act as a dollar wallet and use it to pay for purchases in foreign stores.

A few words about the security of Yandex Wallet. You have two options for confirming transactions:

- Using a permanent password.

- One-time passwords.

When registering, you will be given the opportunity to create a permanent password. Approach this issue wisely. You need to choose a complex password that cannot be hacked. It is desirable that it consist of letters, numbers and symbols of different case.

Don't forget your password. When I created the wallet, I didn’t notice and automatically entered one of my permanent passwords into the form on the site. Then I tried for a very long time to restore the wallet and change the password, but after all the conversations with technical support I had to remember it myself.

If you try to access your wallet from another device, even if you know the password, you will be asked to confirm via SMS. Therefore, it is best to immediately change the password to a one-time password. As soon as you change your password to a one-time password using your mobile phone, you will start receiving SMS with codes to confirm transactions. You will also receive 25 one-time codes, with which you can confirm transactions if you do not have access to a mobile phone. Print out the password sheet and carry it with you.

In Yandex.Money, you don’t always need to confirm transfers. As soon as you make 1 - 2 identical transfers, subsequent ones can already be made without SMS. For example, I have been transferring money to a Sberbank card for a long time without password confirmation.

From personal experience I can say that transfers to a Sberbank card via Yandex.Money arrive almost instantly. Within 2-3 minutes I receive a notification that my account has been replenished.

Yandex.Map

Yandex has released its own plastic card for non-cash payments in real life. Card balance = amount of money in your account. The card supports contactless payment, looks stylish and is practical to use. Price - 200 rubles for 3 years of use.

You can order a Yandex.Card directly from your wallet account. It will arrive by mail within 5 - 7 days after the wallet is identified.

The Yandex.Money bank card has its drawback - it is unprofitable to withdraw cash. For each payment you pay 3% and a minimum of 100 rubles per withdrawal. That is, the minimum you need to withdraw is 3,000 rubles, and then the commission will be 3%. But in comparison with the same Sberbank, where there is no commission for withdrawals at all, this is inconvenient.

In all other respects, Yandex.Card is an excellent addition to an electronic wallet. Using an electronic card, you can make purchases on the Internet, and use plastic to pay in stores. A large number of promotions when paying for goods using the Yandex payment system allows you to receive additional bonuses.

To be frank, it's just an addition to an e-wallet. Few bonuses, cashback and no % on the balance make such a card uncompetitive.

Registration and identification

The algorithm for creating a Sberbank electronic wallet is quite simple:

- you need to register your mail on the Yandex service, i.e. create an account;

- follow the link https://money.yandex.ru/new;

- click Open wallet;

- indicate the phone number from +7 and confirm the identification of the device in the system with the code from SMS;

- complete the registration of the Sberbank e-wallet by pressing the appropriate key and proceed to linking the card;

- Enter the number of your existing Sberbank card and click Link.

Immediately after this, you can proceed to replenishing your account and making payments. To view the payment number, you need to click on the designation of the amount in your wallet in the top menu on the right. The drop-down menu will contain the necessary information.

You can create a wallet not only to use the services of the service for transferring funds, but also to receive them

The conditions for using the Sberbank electronic wallet are introduced for several categories of users. The limits and functionality of the account depend on the client’s status:

- Anonymous - issued immediately after registration, the client can pay 15 thousand rubles at a time throughout Russia, but cannot send transfers;

- Personalized - issued after checking the completion of the online form, the payment limit is increased to 60 thousand rubles and the geography is expanded - you can pay all over the world, transfers to cards and other wallets are allowed;

- Identified - issued after checking passport data, the payment limit is increased to 250 thousand rubles from a wallet and up to 100 thousand rubles from a card, any transfers are allowed.

To increase the level of identification, you need to go to the Settings – Status – Change status tab and follow the assistant’s instructions.

How to create a Qiwi e-wallet

Qiwi is an international payment system that is very popular in Russia. Before its active use, Yandex.Money was the leading electronic payment system. Many terminals in every city of the Russian Federation, convenient functionality and simple registration make this wallet very convenient for almost any user.

There are three ways to make a Qiwi wallet:

- Using the terminal.

- On the official site.

- According to the message from SMS.

The easiest option is to register on the website.

To open a Qiwi e-wallet, you need:

- Go to the official website Qiwi.com.

- Click on the “Create wallet” button.

- Enter your phone number.

- Enter the code that will be sent to your phone.

- Create a complex password.

The registration procedure using the terminal is the same, only you need to go to the Qiwi terminal, select creating a wallet and also go through the registration procedure.

Qiwi also has 3 categories of wallets:

- Anonymous - access immediately after opening the Qiwi e-wallet. The balance on the balance is 15,000 rubles. Payments - up to 40,000 rubles per month. Cash withdrawal via card - up to 5,000 rubles per day and 20,000 rubles per month.

- Basic. The balance on the balance is 60,000 rubles per month. Transfers and payments - up to 200,000 rubles per month. Cash withdrawal from the card is 5,000 rubles per day and 40,000 rubles per month.

- Maximum. Up to 600,000 rubles on your wallet balance. The maximum amount of one transaction is 500,000 rubles. Withdrawal from cards - 100,000 rubles per day and 200,000 rubles per month.

To receive the main wallet, you will need to go through a simplified identification process. You need to send the following information to the company:

- Full name of the wallet owner.

- Passport details.

- Date of birth.

- SNILS and INN.

After completing the simplified identification procedure, you receive a main wallet and the ability to transfer funds to bank cards.

Foreign citizens will be required to go through the basic identification procedure in person. You must have a passport of a foreign citizen and its notarized translated copy.

To complete full registration, all you need to do is come to the Euroset salon with your passport. Our staff will help you fill out all the information and get maximum confirmation.

You can top up your Qiwi wallet in several ways:

- Through the Qiwi payment terminal (no commission from 500 rubles, up to 500 - 3%).

- Bank transaction.

- From the balance of another wallet.

- From mobile (commission from 7.5 to 12%).

- By bank card (no commission from 3,000 rubles).

You can transfer money from your wallet:

- By money transfer to a card.

- To another wallet.

- Get cash through Qiwi cards.

- Receive cash through postal transfers.

In order to transfer money from one account to another, it is enough for only the sender to have a wallet. The recipient will receive an SMS to their phone number confirming the receipt of money. To receive them, just create a Qiwi e-wallet in a few clicks.

Security is also at the highest level. Internal protection on the site, which will not allow attackers to make money transfers, even after receiving the password. Confirmation of transactions is carried out via SMS. Sometimes the system may crash, about once every few months, but problems are resolved quickly, within a few hours.

Qiwi card

Qiwi, by analogy with Yandex, has issued its own plastic cards. But they have many more options. They even have their own installment card. The minimum option is 150 rubles for 2 years. The commission for withdrawals from ATMs is the same everywhere - 2% + 50 rubles. For withdrawal of 1,000 rubles you will pay 70 rubles.

There is even a special name card for gamers with a nickname and a unique game design.

By analogy with Yandex, Qiwi cards are simply an addition to your account. They do not have any special advantages over bank plastic.

How to top up your wallet if you don’t have cash?

Choose one of the ways to improve your financial condition. Remotely, manually - how to replenish your wallet is up to you.

Use:

- bank transfer;

- MFO loan;

- electronic loan;

- transfer between accounts;

- payment/remuneration for services or goods.

Pros:

- Service is simple and transparent.

- Verification through a single verification center.

- Low commission.

- International payments online.

- Opportunity for growth.

Remember, access keys can be sent to your mobile phone or email.

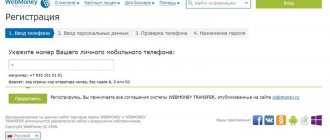

How to create a Webmoney electronic wallet

Webmoney is a global payment system. Until the recent scandal with the Central Banks, it was in one of the leading positions in Russia, but after that it began to actively lose clients due to failures in transfers to bank cards. Now it is not as popular as Yandex.Money or Qiwi.

Making a WebMoney wallet is more difficult. You will need:

- Go to the official Webmoney website.

- Click on the “Registration” button.

- Fill in the phone number.

- Confirm it.

- Enter a huge amount of information about yourself (it is better to enter it correctly or there will be problems with identification in the future).

- Confirm your email by following the links.

- Select currency and account.

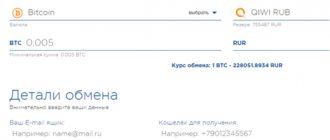

For each currency in the Webmoney electronic wallet you need to create a separate account. There may be several of them inside one wallet, so don’t worry. Webmoney even has bitcoins, which can be exchanged at the current rate for any of the available currencies.

Just opening a Webmoney e-wallet is not enough. To access transactions, you must issue a Certificate of Authenticity. To do this, you need to send your passport data and a scan of the passport itself. Verification usually takes from 1 to 3 days. But if the scans or photographs are of poor quality, you will have to resend.

You can top up your Webmoney wallet:

- Cash.

- From a bank account.

- Electronic money.

- Through terminals.

- Direct money transfers.

You can withdraw money via Webmoney:

- Cash.

- Transfer to a bank card.

- Transfer to a bank account.

- Electronic money (link Qiwi or Yandex wallet).

- Direct money transfer.

Webmoney has a very convenient functionality: an internal loan exchange. This is a place where users give short-term loans to each other. It is very difficult to earn money, but with a good wallet status you can get a small loan.

It is worth understanding that you will have to pay much more, even in comparison with loans from microfinance organizations. Do not use this functionality unless absolutely necessary.

Security in WebMoney is also at a high level. Attackers will not be able to access your funds, even if they manage to hack your account. Confirming transactions via SMS is quite convenient.

Yandex money

The second most popular payment virtual system. It stores money only in the equivalent of Russian rubles. You can transfer funds from your account in other currencies at the current exchange rate. You can also order the issuance of a personal card with a free cash withdrawal limit. This card can be used all over the world. When paying with plastic in another currency, rubles are converted at the current rate.

After registration in the system, an anonymous wallet is activated with a transaction limit of up to 15 thousand rubles. To be able to transfer/receive larger amounts, you must provide personal documents to the Yandex representative office and thus confirm your identity.

Withdrawal of funds is available to a Yandex.Money card or bank card, current account, or through a money transfer system with the deduction of a commission of 3% of the amount. Free funds are withdrawn only to the Yandex.Money card. You can top up your wallet in the system using the same methods, as well as using terminals.

An additional method of withdrawing funds

It is not always possible to cash out funds transferred to certain wallets. Sometimes you need money right now, but there is no way to go through the confirmation procedure. For such cases there are exchangers. These are companies that, for a commission, provide the opportunity to transfer funds from one payment system to another.

Exchangers charge a small fee for transfers. In order to choose a suitable exchanger, just go to bestchanges.org. This is a huge collection of all exchangers. You can select “From” and “Where” you want to transfer money. Websites, commissions and minimum restrictions on transactions will tell you.

This is a current way to receive money from electronic wallets for residents of Ukraine. Ukrainians have many difficulties making transfers through the Webmoney and Yandex Money systems, since most opened these wallets for settlements with customers as freelancers.

I myself have used exchangers several times, and I can say that they work quite honestly. They charge a small commission and send money almost instantly.

PayPal

International money transfer system. Convenient for paying for purchases abroad. You can link a plastic bank card in MasterCard, Visa, Discover format from almost any bank in the world to your PayPal wallet. For registration, the user has two account options: personal and corporate. The first is used for personal purposes, the second is created for business. The login in the system is your email address.

You can top up your PayPal wallet through official representative offices of the system in your country or city, as well as using a bank transfer from a card. Money is withdrawn to a personal card issued by any bank.

Which e-wallet is better to choose?

Now let's compare the main indicators of electronic wallets presented in the article. I will give a rating on a five-point scale based on my personal experience and opinion:

- Convenience - how convenient the functionality is for a new user.

- Security - how secure your money is.

- Commission - how much the service requires for its operations (the lower the number, the more the wallet will require).

- Features - functionality that is available after you have registered an electronic wallet.

| Yandex | Kiwi | WebMoney | |

| Convenience | 5 | 5 | 3 |

| Security | 5 | 5 | 5 |

| Commissions | 4 | 5 | 5 |

| Possibilities | 5 | 4 | 5 |

Do not forget that Webmoney and Yandex wallets are practically inaccessible for residents of Ukraine. WebMoney is simply blocked on the territory of the state. And although Yandex.Money is available, in order to go through the confirmation procedure, you will have to go to the company’s office in Kyiv, Simferopol or Odessa.

In my opinion, the most convenient of all wallets is Yandex.Money. It is ideal for residents of the Russian Federation. Simple functionality, many possibilities, including for doing business. The only drawback is the fees for transfers to bank cards. Qiwi and WebMoney have a lower figure.

Summarizing. Yandex is the best wallet for those who want simplicity, convenience, opportunities and are willing to overpay slightly. If you want to save money, your option is the Qiwi e-wallet.

Advantages of using electronic money

- Access to your wallet from anywhere in the world. Electronic systems are not tied to a specific country and can be used by citizens of different countries.

- Free wallet creation, no commission for its maintenance. You can not use your wallet or remember about it once a year, and the system will not charge any fees.

- All wallet management processes are performed online. To create, identify, replenish and withdraw, you do not need to visit the office.

- Instant crediting of funds upon withdrawal or transfer to another wallet. Any day, including weekends and holidays.

- Possibility of payment for goods and services to residents of different countries.

- Minimum commission for transfers and withdrawals.

- High level of security, absolute confidentiality of personal data.

Compared to banks, electronic money has clear advantages. For example, when paying online, you do not need to enter personal data, as is done with bank cards. When paying with electronic currency, you just need to enter your wallet number and mobile operator confirmation code.