Benefits of Online Charts

Using the proposed chart, a trader can carry out technical analysis of selected instruments. There is the right to choose a priority timeframe and the ability to enlarge the picture in order to improve market perception. With one touch you can set up a candlestick, flow, line chart or traditional Western bars.

We offer a large selection of indicators that allow you to create a complete picture of what is happening and receive confirmation of the technical analysis performed:

- oscillators;

- moving average lines;

- Bollinger Bands;

- instruments by Bill Williams;

- relative strength index.

The changing online forex chart displays information without delay and provides the opportunity to practice different trading strategies. The figures of technical analysis are clearly visible, it is convenient to set power levels, looking for points of contact in history.

Live chart analysis tools

The binary market falls into the category of complex, volatile and sometimes unpredictable financial institutions. Sometimes it seems to traders that the market is floating along its own course, the direction of which defies any explanation and is not even compatible with classic Forex. But that's not true. Well-known world analysts have been developing and implementing various techniques aimed at predicting price movements and determining the future behavior of a trend in options for the second decade. Each implemented methodology is based on a set of determining factors and postulates. It should be noted that a successful approach is one that combines the use of multiple methods.

Professional traders, combining various methods when trading, achieve the following important goal: based on the data of one theory, they find confirmation of the signals of another. Thus, the use of an integrated approach significantly increases the likelihood of correctly predicting the behavior of market conditions.

The category of the most significant and widespread among traders includes the following methods of analysis of both the binary market and Forex:

- fundamental analysis;

- technical analysis;

- candlestick analysis as a separate component of technical analysis;

- Elliott wave principle.

Let's look at each of the above methods in more detail.

Fundamental Analysis

The task of fundamental analysis is to analyze the economic and political situation in countries whose national currency is traded on the platform of a specific binary broker. Fundamental analysis tools allow you to evaluate the possible impact of various economic and political events on a live binary options chart.

Fundamental analysis is based on assessing a set of economic indicators that allow one to analyze trends in the national economies of various states. These indicators are published on a regular basis.

Analysis of economic indicators helps solve problems such as explaining the current movement of exchange rates and predicting their future behavior pattern. For example, when the US market conditions are characterized by a constant increase in consumer prices and employment levels, traders can reasonably draw conclusions about a possible increase in the rate and, accordingly, the dollar exchange rate.

It is on the assessment of such events that the tools of fundamental analysis are built.

Technical analysis

Technical analysis is a direction that is based on the analysis of graphical patterns. Professional traders claim that graphical patterns are the embodiment of the influence of fundamental factors on the foreign exchange market.

When using technical analysis tools, the following nuance must be taken into account:

Absolutely all information flows about the market are concentrated within graphical models. In other words, charts contain complete information about the state of the market. The market has memory, that is, based on events that were observed in the past, it is possible to predict the future behavior pattern of market conditions.

To date, many technical analysis indicators have been developed that help perform such a task as predicting the future movement of option rates.

Candlestick analysis

Candlestick analysis is an integral component of technical analysis. Candlestick analysis tools, when used correctly, provide high accuracy in predicting demand and price behavior. Currently, candlestick analysis is one of the most popular and, therefore, in demand methods used by participants in the foreign exchange market.

The structure of a candle includes a body and a wick. This structure reads as follows:

- The upper limit of the wick acts as the maximum price during trading.

- The lower boundary of the wick represents the price minimum.

- Body boundaries serve as a tool for displaying opening and closing prices.

When there was an increase in quotes on the market, the body of the candle has a white (green) color. In this case, the formation of the opening price should be based on the lower border of the body, and the closing price - on the upper border. If a drop in quotes was recorded, then the body of the candle will be colored black (red). In this situation, it is necessary to use the upper boundary of the body as a reference for the opening price, and the lower one for the closing price. After the highest (lowest) price exceeds the opening (closing) limits, the candlesticks emit long shadows.

The principle, based on the analysis of the formation of Japanese candlesticks, is as follows: a search for a standard model is carried out, a thorough analysis of which ensures the accuracy of predicting further price behavior. As a result of the analysis, both a reversal pattern and a trend continuation pattern can be found.

It should be noted that a model indicating a trend reversal only records the completion of the old trend. This suggests that the foreign exchange market situation may be either in a flat or in a trend opposite to the previous direction.

In most cases, candlesticks are plotted on daily charts. This is explained by the fact that candlestick analysis was initially developed and implemented as a tool for assessing this particular time period. The use of candlestick analysis tools is based on assessing the relationship between prices that change within one trading day (session).

Wave analysis

In common parlance, many traders refer to the Elliott wave principle as “wave analysis” or “wave theory.” This theory assumes that the behavior of traders in the market is natural and cyclical. Based on this statement, the price movement model was reflected on the chart in wave format. Elliott's point of view is as follows: all market movement occurs in two volume phases - the phase of activity of the “bulls” and the phase of activity of the “bears”.

The wave principle implies that price movement on the foreign exchange market platform is carried out as follows: five waves move with the trend and three waves move in the opposite direction. The following classification of waves is distinguished:

Impulse waves help create a stable trend (bullish or bearish) and cause market movement. Corrective type waves are characterized by movement against the current trend. This category of waves is also called “pullbacks”.

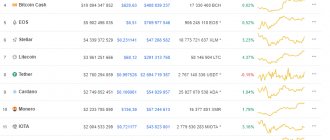

Quotes for all types of assets

A large selection of currency pairs is offered, including major, major, and minor instruments. There are shares of leading companies, the most popular products and world-famous indices. The trader will be able to trade securities of Deutsche Bank, Microsoft, Yandex, Renault. By tracking stock quotes online, you can control open positions through a browser without having access to a trading terminal. Here the user additionally gets access to a general streaming chart with information about the corporation's capitalization, previous closing price and profit.

Stock quotes

Information about the trading history for the entire time after the company entered the market is displayed. Using the provided real-time stock price charts, a trader will be able to carry out not only technical, but also fundamental analysis. The large amount of information offered contributes to the formation of a complete picture in relation to each of the assets.

Identical information is provided on commodity markets that provide access to trade in non-ferrous metals (copper, tin, lead, zinc, aluminum, nickel), precious metals (gold, silver, platinum), energy resources (oil, gas, fuel oil, coal), forest products , and a group of agricultural products of plant and animal origin (meat, dairy products, wheat, sugar, coffee, cocoa, rice, corn, soybeans).

Commodity markets

The online chart contains key information regarding the opening price, closing price, low and high of the candles. Text labels are available, allowing you to leave comments in relation to individual elements. Accurate futures quotes will help track fluctuations in world prices for basic raw materials and will be a good help in stock trading.

The stock market, represented by key domestic and foreign indices, is incredibly popular. Traders will have access to the chart of S&P 500, Nikkei 225, Dow Jones, RTS, DAX.

Stock indices

The user will receive up-to-date information about the current state of affairs and the previous closing price. Information on stock indices will allow you to obtain information about the situation in a specific world economy. Use open index quotes when assessing the current situation and making forecasts.

Users of the site can track changes in the cryptocurrency rate. Bitcoin, popular all over the world, is valued more than the US dollar and is actively being bought by speculators who want to diversify their investments. The real-time cryptocurrency price chart will allow you to evaluate the prospects for investing in this unique trading instrument.

How to analyze live charts?

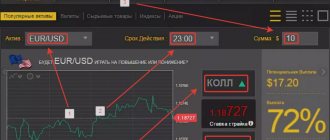

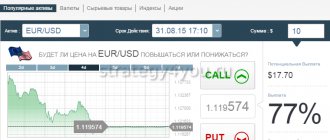

To understand how to analyze binary options charts, we suggest considering several popular types. Below we will briefly describe how to read each of them. People have different ways of thinking, so the situation will be assessed as comfortably as possible when a convenient visualization is chosen. So, how to analyze binary options charts of different types:

- Linear is the simplest graph option. It is represented by lines that connect several points. The resulting curve reflects the value of a given asset at the time of closing. It is generally accepted that this price is the most important indicator. This tool is an excellent way to predict the situation on short-term timeframes.

- Bars are used quite often by traders. They reflect more accurate information than the previous version. It also shows the opening price, upper and lower extremes. Bars will be useful to use at intervals longer than five minutes.

- Japanese candlesticks are similar to bars in many ways. At the same time, they are easy to interpret, which is what attracts many. The trader only needs to look at the screen to determine the situation. Red candles indicate a bearish trend, while green candles indicate a bullish trend. The longer they are, the longer and stronger the trend.

Understanding the analysis methodology, a trader can make a reliable forecast and place suitable orders. At the same time, you should not rely on your instincts - rely solely on accurate calculations and your own knowledge in the field of trading. Not forgetting about analytical tools.

Glossary

- The Forex market provides access to interbank liquidity and makes it possible to speculate with currency pairs. Minor, major, exotic and major instruments are offered with different levels of volatility. Trading is carried out around the clock with varying degrees of activity for individual pairs, tied to the opening hours of the Asian, Pacific, American, and European sessions.

- Shares are corporate securities that reflect the company’s capitalization and are issued to attract mass investment. Shareholders receive dividends.

- Indices are an indicator of the market condition of shares, calculated based on a basket of the most liquid securities. Thanks to indices, it is possible to get a holistic picture of the market and the current economic cycle.

- Futures are contracts that bind parties to an obligation to sell or purchase an asset at a set price within a specified period. Compliance with the terms of the contract is monitored by the exchange.

- Cryptocurrency is a reliable and fast payment system created on the basis of modern technologies and uncontrolled by national governments.

What do you need to know to fully analyze the chart?

Unlike Forex, the binary market is much easier to study. Working with them is available even to those who do not have a special economic education and are engaged in trading for the first time. At the same time, the risks are completely controlled. It is unrealistic to lose an amount exceeding your own contribution. However, not everyone who tries their hand at this can make money on options. Let's figure out how to win trades and predict price movements.

Before analyzing the binary options market, you will need to become familiar with some important concepts. And the most important is the live schedule.

The graphical display of asset prices consists of several parameters that should be taken into account when considering the market situation. Having studied each of them, it will be possible to proceed to drawing up a full-fledged forecast. It is worth paying attention to the following details:

- Visualization is a method of graphically displaying the price movement of a binary pair. It can be of several types. There are only 4 main ones: lines, Japanese candles, borders, American bars. There are even less common options that are used only by professionals: Renko (no time reference), Heiken Ashi, tic-tac-toe. The last chart is considered the most difficult to understand and is used only in the most exceptional situations. A beginner can look at several options and choose the most comfortable one. Each chart has its own advantages and disadvantages, in connection with which you can create your own strategy.

- A trend is a price direction. It can be downward (bearish) or upward (bullish). Depending on the direction of the main trend, the trader will have to place orders to increase or decrease the price of the asset. There are a lot of indicators and techniques to determine the trend. Experienced traders say that it is worth speculating during periods of stable trends. However, the problem is that they operate only 30% of the time, while flats take up the entire rest of the period.

- A flat is a moment when the market is in uncertainty. Price fluctuations are quite sharp, unpredictable and not global. The ratio of sellers and buyers is approximately equal, there is no significant overbought or oversold of the asset. It is also called a side corridor. At the same time, the price forms its own extreme points, in connection with which certain bets can be made.

- Support/resistance levels - they are recommended to be drawn in situations with lateral movement. One of the lines is located below the price and seems to support it from further falling. The second is located at the top and creates resistance that does not allow the quote to rise. Thus, a corridor appears that allows you to predict the situation. Once prices reach these levels, they often reverse. The reason for this is a psychological factor - many traders simply merge transactions in the hope of a partial refund from the binary broker.

- Reversals are very dangerous for trading. The main enemy of a trader has always been greed, so most players try to hold onto losing positions even after the price direction changes. Even the strongest trends sooner or later reverse. This happens for the reason that value-driving investors at some point leave the market and fix their income. At this time, the opposing side becomes dominant and reverses the trend.

A trader needs to familiarize himself in detail with basic knowledge about the market, because all highly profitable strategies are built on it.

arcsin through arccos, arctg and arcctg; arccos through arcsin, arctg and arcctg, etc.

From the formulas for the connection between trigonometric and inverse trigonometric functions, discussed in the previous paragraph, it is possible to obtain formulas expressing one of the arc functions through other arc functions, for example, expressing the arc sine of one number, through the arc cosine, arc tangent and arc tangent of another number. Let's list them.

Using these formulas, you can replace arcsine with arccosine, arctangent and arccotangent, respectively:

Here are the formulas expressing arccosine through arcsine, arctangent and arccotangent:

The arctangent formulas through arcsine, arccosine and arccotangent are as follows:

Finally, here are a series of formulas with arc tangent:

You can prove all the written formulas based on the definitions of arcsine, arccosine, arctangent and arccotangent of a number, as well as the formulas from the previous paragraph.

For example, let us prove that . It is known that with the indicated a represents the angle (number) from minus pi in half to pi in half. Moreover, according to the formula for the sine of the arctangent, we have . Therefore, at −1 is the arcsine of the number a by definition, that is, .

By analogy, you can prove the remaining formulas presented in this paragraph of the article.

To conclude this paragraph, we will show an example of using the resulting formulas. For example, let's calculate with their help what the sine of the arc cotangent minus the root of three is equal to. Turning to a formula of the form , expressing the arc cotangent through the arc sine, at we have .

In this example, we could calculate the required value directly: . Obviously we got the same result.

It is clear that to calculate the required value, we could have done it differently, using a formula expressing the sine through the cotangent of the form . Then the solution would look like this: . Or it was possible to immediately apply the formula for the sine of arc cotangent of the form: .

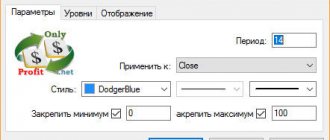

Set of indicators

This is one of the main features of online live charting for binary options. Usually in online terminals the choice is limited to 10-20 standard indicators (moving averages, a pair of oscillators, Bollinger bands). In Trading View, the number of indicators is in the dozens.

For convenience, all indicators are divided into 5 categories:

- Built-ins – standard, time-tested indicators. These are algorithms built-in by developers, among them there are standard (Stochastic, relative strength index, moving averages) and custom ones;

- Candlestick Pattern s – a new category, this includes tools that make it easier to find candlestick patterns on the chart;

- Public Library is the most interesting section; all indicators created by traders themselves flock here. In addition to the name, the number of likes is displayed opposite each of the algorithms; you can evaluate the popularity of the indicator in the trading environment;

- My Scripts – trader’s scripts; algorithms created by the trader himself are saved here;

- Volume Profile – volume indicators that require Pro status to work.

There is no need to study the entire list of indicators. In the search bar, you can start typing its name and the search will automatically return a list of tools whose names match the entered query.

I also recommend reading:

Exchange binary options - what are they? What is the difference from betting BOs?

When it comes to binary options, the first association that arises is standard BO brokers, providing BOs for dozens of types […]

Arcsine, arcsin

Definition and notation

Arcsine ( y = arcsin x ) is the inverse function of sine ( x = sin y ). It has a domain of definition –1 ≤ x ≤ 1 and a set of values –π/2 ≤ y ≤ π/2. sin(arcsin x) = x ; arcsin(sin x) = x . Arcsine is sometimes denoted as follows: .

Graph of arcsine function

Graph of the function y = arcsin x

The arcsine graph is obtained from the sine graph if the abscissa and ordinate axes are swapped. To eliminate ambiguity, the range of values is limited to the interval over which the function is monotonic. This definition is called the principal value of the arcsine.

Properties - extrema, increase, decrease

The functions arcsine and arccosine are continuous in their domain of definition (see proof of continuity). The main properties of arcsine and arccosine are presented in the table.

| y = arcsin x | y = arccos x | |

| Scope and continuity | – 1 ≤ x ≤ 1 | – 1 ≤ x ≤ 1 |

| Range of values | ||

| Ascending, descending | monotonically increases | monotonically decreases |

| Highs | ||

| Minimums | ||

| Zeros, y = 0 | x = 0 | x = 1 |

| Y-axis intersection points, x = 0 | y = 0 | y = π/ 2 |

Recommended brokers for trading forex and stock exchange rates

In the Masterforex-V Forex Academy broker rating, more than 300 brokerage companies are divided into 3 leagues:

- Major league of proven and recommended brokerage companies for working in financial markets : 1. Nord FX, 2. Dukascopy Bank SA, 3. FXPro, 4. Interactive Brokers, 5. Alpari (Alpari), 6. Swissquote Bank SA, 7. OANDA ( Oanda), 8. FXCM, 9. Saxo Bank (Saxo Bank), 10.FOREX.com, 11. FIBO Group, 12. Fort Financial Services (FortFS), 13. Finam (Finam).

- 2nd league of popular but dubious companies with a large number of complaints from traders Masterforex-V - 1 Forex Club 2 RoboForex 3 InstaForex 4 Forex4you 5 eToro 6 TeleTrade (Teletrade) 7 MaxiMarkets (Maximarkets) 8 EXNESS (Exness) 9 Alpha Forex 10 DF Markets 11 NPBFX (Nefteprombank) 12 AMarkets 13 FreshForex (Fresh Forex) 14 Grand Capital (Grand Capital) 15 BCS Forex (BCS Forex) 16 Larson&Holz 17 Market index 18 Weltrade 19 Forex Optimum Group Limited 20 ForexTime 21 Forex Trading 22 World Forex 23 Key to Markets 24 LiteForex 25 FXOpen 26 FinmaxFX 27 Pepperstone 28 MTrading 29 Tickmill 30 GKFX 31 IC Markets 32 PROFIT Group 33 XTrade 34 XM.com 35 X-Trade Brokers 36 Admiral Markets 37 IG Markets 38 StreamForex 39 ForexStart 40 E-Xun Asia Company Limited 42 Captrader 43 Real Trade 45 Ironfx 46 Easy-Forex 47 Kalita Financ E (Kalita Finance) 48 Activtrades 49 Turboforex 50 HotForex 51 IFC Markets 52 HY Capital Markets

- 3rd (minor league) of the Masterforex-V rating: dubious and little-known forex brokers: - 1 ForexMart 2 EverFX 3 JustForex 4 vtb forex 5 Real-Forex 6 FXCH 7 FX Primus 8 Corsa Capital 9 Vantage FX 10 AAAFX 11 GAINSY 12 FXDD 13 AGEA 14 PaxForex 15 Hotspot FX 16 ETX Capital 17 NSFX 18 TenkoFX 19 BMFN 20 FXall 21 GDMFX 22 ORBEX 23 vPE Bank 24 UFXMarkets 25 ICM Capital 26 Land-FX 27 FXFlat 28 Forex ee 29 Sucden Financial 30 Tallinex 31 FinFX 32 ATC BROKERS 33 Deltastock 34 Blackwell Global 35 Varengold Bank 36 FXCC 37 OneTrade 38 AccentForex 39 Squared Financial 40 Forex EuroClub 41 Finotec 42 Windsor Brokers 43 Renesource Capital 44 London FX 45 Nordhill Capital 46 FxGlory 47 Yadix 48 Hantec Markets 49 GCI Financial Ltd 50 FBS Markets Inc. 51 NetoTrade 52 NTFX 53 TFI FX 54 YA-HI.com 55 GO MARKETS 56 Synergy FX 57 STRATO Markets 58 xCFD 59 AvaFX 60 Tradeview Forex 61 Cornèr Trader 62 FXGM 63 FXPremax 64 Profiforex 65 WH SelfInvest 66 FXTSwiss 67 RBC Forex 68 Royal Forex 69 STO 70 VINSON FINANCIAL.

Sincerely, wiki Masterforex-V, free (school) and professional training courses Masterforex-V for working on Forex, stock, futures, commodity and cryptocurrency exchanges.

Sine from arccosine, tangent from arcsine and others like them

In practice, formulas that establish the relationship between trigonometric functions and arc functions are very useful. For example, you may need to calculate the sine of the arc cosine of a certain number, or the tangent of the arc sine. Let us write down a list of formulas that allow us to solve such problems, then we will show examples of their application and provide proofs of these formulas.

Here are some examples of using the written formulas. For example, let's calculate the cosine of the arctangent of the root of five. The corresponding formula looks like this:

Arccosine, arccos

Definition and notation

Arc cosine ( y = arccos x ) is the inverse function of cosine ( x = cos y ).

It has a domain of definition –1 ≤ x ≤ 1 and a set of values 0 ≤ y ≤ π. cos(arccos x) = x ; arccos(cos x) = x . Arccosine is sometimes denoted as follows: .

Graph of arc cosine function

Graph of the function y = arccos x

The arccosine graph is obtained from the cosine graph if the abscissa and ordinate axes are swapped. To eliminate ambiguity, the range of values is limited to the interval over which the function is monotonic. This definition is called the principal value of the arc cosine.

Some other formulas

The basic formulas of trigonometry and the formulas for arcsine sine, arccosine cosine, arctangent tangent and arccotangent cotangent allow us to derive a number of formulas with arcsin, arccos, arctg and arcctg, not yet mentioned in this article. But we note that they are already quite specific, and they have to be used far from often. Moreover, it is more convenient to derive such formulas each time rather than memorize them.

For example, let's take the half angle formula. If we add the condition that the value of the angle alpha belongs to the segment from zero to pi, then the equality will be true. Under the specified condition, the angle alpha can be replaced by the arccosine of the number a, which will give us a formula of the form, from which we can obtain the following formula expressing the arccosine through the arcsine:.

Using other trigonometric formulas, a number of other relationships can be found between arcsin, arccos, arctan and arcctg.

In conclusion of this point, I would like to say that it is not so much these specific formulas themselves that connect arcsin, arccos, arctg and arcctg that are of practical use, but rather the ability to perform the transformations used in deriving these formulas. The theme is continued by the theory section of transformation of expressions with arcsine, arccosine, arctangent and arccotangent

.

Online dollar rate charts and forecasts Masterforex-V

- Dollar index chart,

- EUR USD chart (euro dollar);

- GBP USD chart (pound dollar exchange rate);

- USD JPY (dollar to yen chart);

- USD CHF (dollar to Swiss franc chart);

- USD CAD (US dollar / Canadian dollar);

- NZD USD (New Zealand dollar to US dollar);

- AUD USD (Australian dollar to US dollar);

- USD SEK (dollar to Swedish krona);

- USD NOK (dollar to Norwegian krone);

- USD CNY (dollar Chinese yuan);

- USD UAH (dollar to Ukrainian hryvnia);

- USD BYN (dollar to Belarusian ruble);

- USD SGD (dollar to Singapore dollar);

- USD HKD (dollar to Hong Kong dollar);

- USD ZAR (dollar to South African rand);

- USD ILS (dollar to Israeli shekel);

- USD PLN (dollar to Polish zloty);

- USD TRY (dollar to Turkish lira);

- USD MXN (dollar to Mexican peso);

- USD THB (dollar to Thai baht);

- USD INR (dollar to Israeli shekel);

- USD CZK (dollar to Czech crown);

- USD BAM (dollar to Bosnia and Herzegovina convertible mark chart);

- USD RSD (US dollar to Serbian dinar);

- USD HTG (dollar to Haitian gourde chart);

- USD HNL (dollar to Honduran lempira);

- USD AZN (dollar to Azerbaijani manat);

- USD CUP (dollar to Cuban peso chart);

- USD NIO (dollar to Nicaraguan Cordoba);

- USD SYP (dollar to Syrian pound);

- USD IQD (dollar to Iraqi dinar chart);

- USD LKR (dollar/Sri Lankan rupee chart);

- USD WST (dollar / Samoan tala);

- USD LYD (dollar/Libyan dinar chart);

- USD MAD (dollar / Moroccan dirham);

- USD XAF (dollar/Central African franc chart);

Table of arcsines and arccosines

This table presents the values of arcsines and arccosines, in degrees and radians, for certain values of the argument.

| x | arcsin x | arccos x | ||

| hail | glad. | hail | glad. | |

| – 1 | – 90° | – | 180° | π |

| – | – 60° | – | 150° | |

| – | – 45° | – | 135° | |

| – | – 30° | – | 120° | |

| 0° | 90° | |||

| 30° | 60° | |||

| 45° | 45° | |||

| 60° | 30° | |||

| 1 | 90° | 0° |